Babel Finance: A comparative study on the performance of the stock market and Bitcoin before and after the Fed raised interest rates

Original author: Yuanming Qiu (Research Analyst at Babel Finance) & Robbie Liu (Head of Research at Babel Finance)

Original source: Babel Research

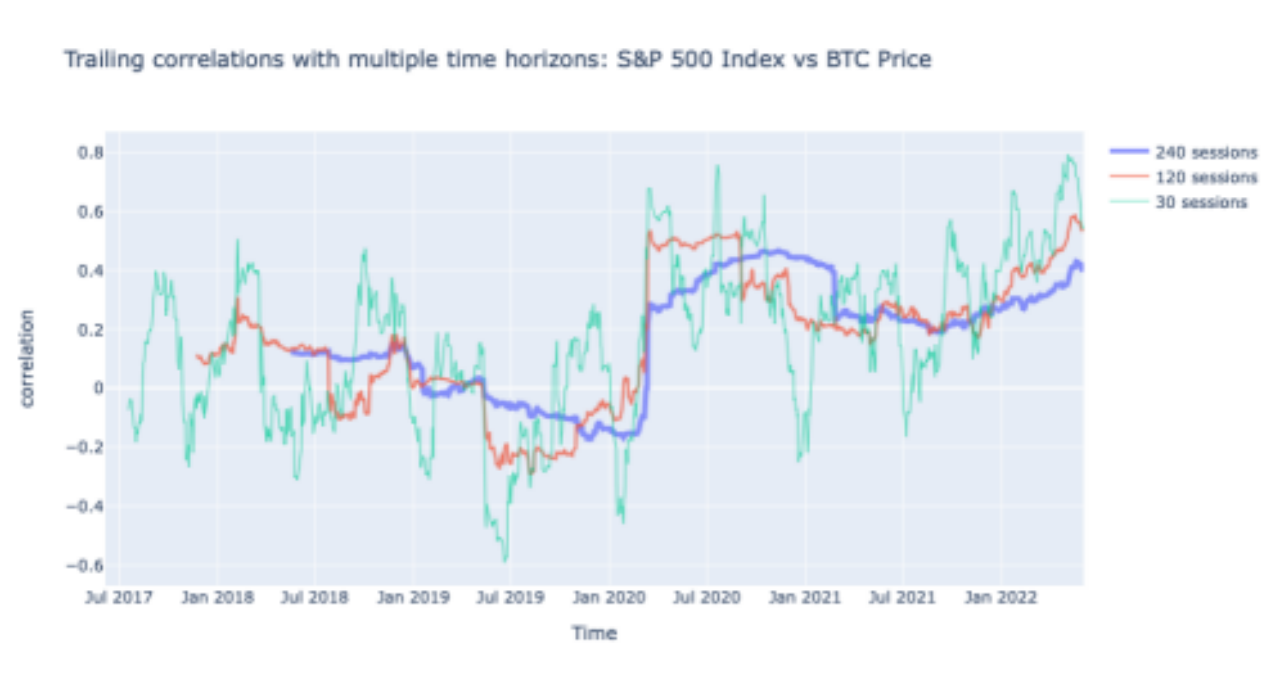

We have witnessed the incredible growth of the crypto market during the epidemic, and we have also observed a strong correlation between cryptocurrencies and traditional risk assets. Since May 2020, the correlation between Bitcoin's movements and S&P 500 volatility has been high at the 120-day and 240-day levels. And on a shorter scale, Bitcoin's 30-day correlation with the S&P 500 reached nearly 0.8 on May 6, 2022, the highest level since July 2017.

With U.S. inflation hitting a 40-year high of 8.6% in May due to lockdowns, rising energy prices and broader price pressures, the Fed signaled strong intentions to tighten monetary policy in its recent news conference. In his most hawkish speech yet in May 2022, Fed Chair Jerome Powell said: "What we need to see is a clear and convincing decline in inflation, and we'll keep going until See that."

image description

image description

Multi-Timeframe Tracking Correlation Between S&P 500 Index and Bitcoin Price

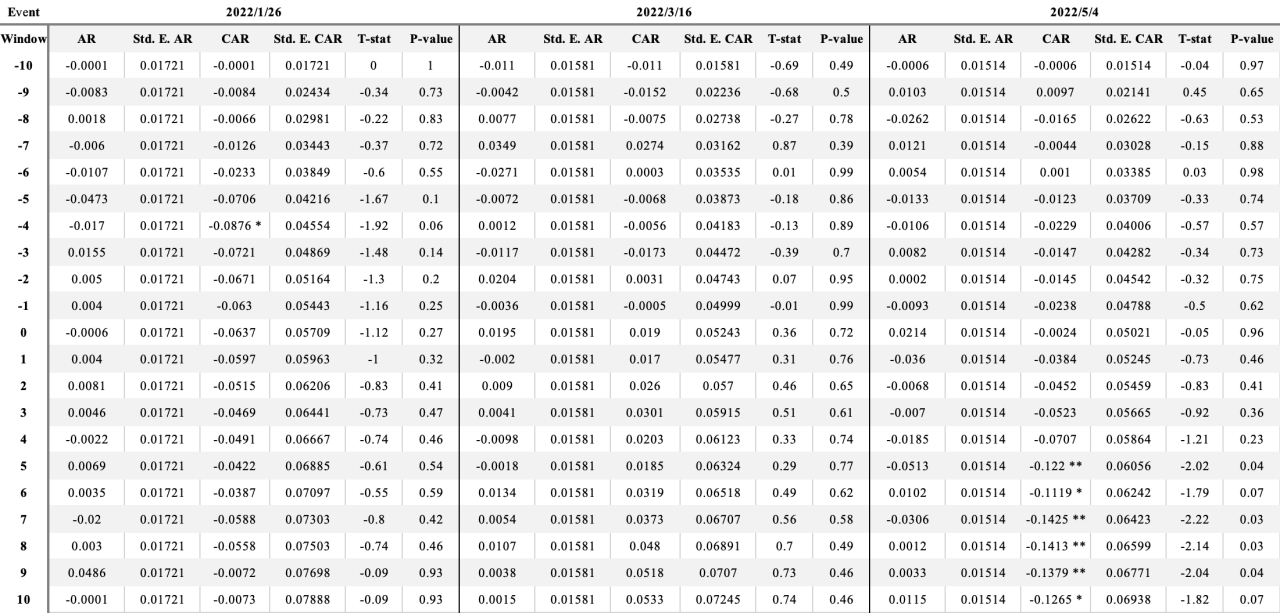

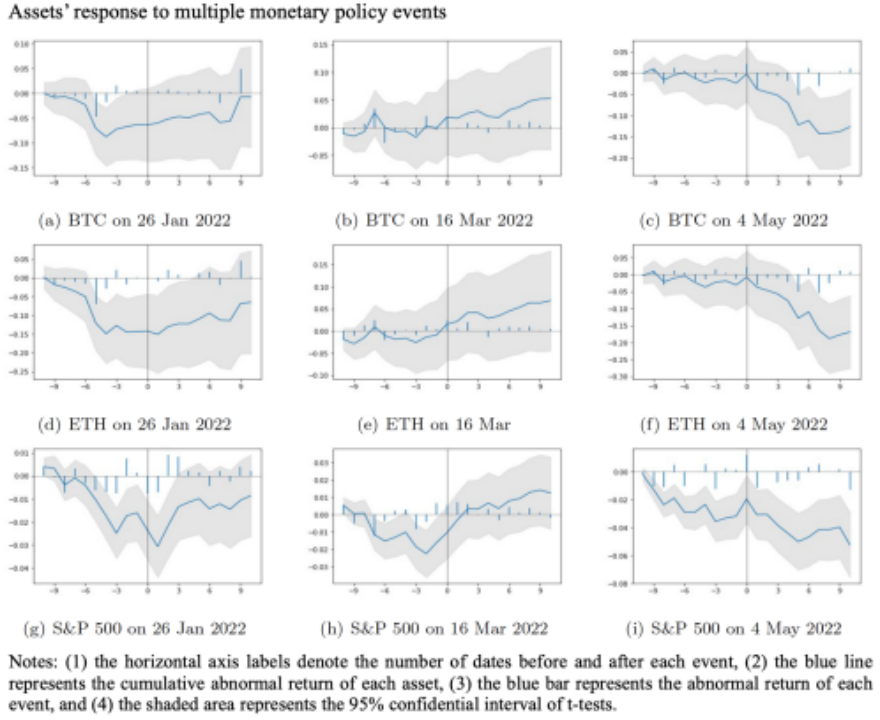

We analyze the reactions of the U.S. stock market (as measured by the S&P 500 Index) and two of the most representative cryptocurrencies (Bitcoin and Ethereum) to recent U.S. monetary policy tightening events. In order to observe and quantify the response of each asset to various monetary policy adjustment events, we adopt the most classic event research model: constant mean model (constant mean model), the estimation window (estimation window) is set to 250 days, and the event window (event window) is set to 21 days (10 days before and after the event).

Regarding the selection of monetary policy adjustment events, we base our selection on two criteria: whether key monetary policy decisions are made on that day, and whether investor attention, as measured by the Google Search Index, peaks on that day. Based on this, a total of three events were selected for this study, namely:

1) May 4, 2022 - The Fed raises interest rates by 50 basis points, keywords"rate hike "Google's search index peaked;

2) March 16, 2022 - 25 basis points Fed rate hike, keywords" rate hike "Google's search index peaked;

3) January 26, 2022 - First FOMC meeting of the year, keywords" Federal Reserve "Google's search index peaked.

According to our model, both the S&P 500 and both cryptocurrencies were impacted by the Federal Reserve’s announcement of a 50 basis point rate hike on May 4. It is worth noting that,The S&P 500 has seen a statistically significant sell-off pattern in the ten days leading up to May 4, 2022, continuing until the end of the rate hike event window. However, Bitcoin and Ethereum did not follow the same sell-off pattern. The two cryptocurrencies only came under a lot of selling pressure after the exact date of the rate hike.

For the event of a 25 basis point rate hike on March 16, 2022, only the S&P 500 witnessed a statistically significant profit loss prior to the event. Neither Bitcoin nor Ethereum has seen a statistically significant profit loss.

For the first FOMC meeting of the year on January 26, 2022, both the S&P 500 and Ethereum experienced statistically significant loss of profit in the (-5, 1) event window, while Bitcoin presented ahead of the event Considerable recovering ability - given that this event is a scheduled FOMC meeting, we use here"resilience"image description

image description

In general,

In general,Bitcoin’s historical performance over three given rate-hike event windows shows that the No. 1 cryptocurrency, Bitcoin, is better able to moderate the impact of monetary policy tightening events than the S&P 500 and Ethereum.A reasonable explanation is that a considerable number of investors have always had confidence in Bitcoin's value storage properties and the narrative of hedging inflation. Even if the prices of other risky assets plummet, they will choose to hold Bitcoin for a long time.

Bitcoin’s on-chain statistics cross-validate this conclusion. Addresses labeled as “small shrimp” (<1 BTC) and “big whales” (>10,000 BTC, excluding exchanges and miners) have been actively trading since the price dropped into the $25,000-$32,000 range. Accumulate bitcoins. According to data from Glassnode, this build-up has been happening over the past two months while Bitcoin is running at a low price.

What can we expect from now on? As U.S. inflation continues to accelerate, the Fed will step up its pace of cooling the economy, regardless of whether Powell announces a 50 or 75 basis point hike after Wednesday's meeting. Some analysts are looking for signs that Bitcoin has bottomed out. Our analysis does not answer whether "buy the current dip" is a good bet, although the 30-day level correlation between Bitcoin and the S&P 500 has shown signs of declining, it is not sure whether the correlation between the two is will recover and how. In fact, our research shows that,Despite experiencing massive market capitalization growth and showing contemporaneous volatility with other risky assets, Bitcoin’s store-of-value attributes remain.In a recent research article, Fidelity Digital Assets states that “in the event of an economic hard landing, we think Bitcoin will respond positively.” As always, Bitcoin's long-term narrative won't be easily derailed by another price crash. Bitcoin "true believers" will still stick to their original intentions.

Appendix: Cumulative abnormal returns calculated based on the constant mean model and the daily Bitcoin price data before and after the three monetary policy regulation events on 2022/5/4, 2022/3/16 and 2022/1/26