Weekly Editors' Picks Weekly Editors' Picks (0618-0624)

"Weekly Editor's Picks" is a "functional" column of Odaily.On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Now, come and read with us:

Now, come and read with us:

Investment and Entrepreneurship

Investment and Entrepreneurship

Interpretation of the encryption market trend from nine indicators: 8.35 million BTC is at a loss, and many indicators have fallen to historical lows

Using the past to learn from the present, the comparison of the three market downturns.

The conclusion is: the current "bubble" of BTC prices has been squeezed out to a large extent, but compared with the previous two market downturns in history, the current price is compared to the fair value provided by the transaction and the actual value provided by the mining industry. There is still room for continued pressure; the current market is the same as the previous two downturns in history, with rapidly increasing loss chips, further shrinking profit-loss chip ratios, higher short-term investment returns, and low market reserve risk. This shows that the market game may intensify, but the return on investment is attractive at this time; compared with the previous two historical downturns, users on the chain during the current period are more active; funds during the current period are also more active Not only the frequency of changing hands is higher, but the turnover rate is also higher.

Binary Research: Enlightenment from the plunge, exploring the financial attribute cycle of encrypted assets

The decline in the stock market this time may go out of a three-stage pattern: caused by the panic over inflation, the rise in U.S. bond interest rates kills valuations, and the economic recession kills fundamentals. The third stage has not really come, because the liquidity premium of US stocks in the past ten years has been very high, and the real value return has not yet been realized, and the liquidity risk and credit risk have not been fully released.

How to correctly view the bear market? What will be the new narrative driving the next wave?

Some more subjective predictions, including: the next cycle should be about improving token economics, enabling tokens to serve as a more direct form of value-added for a given protocol, such as transferring tokens to reflect the value capture of the network; Arbitrum, it is expected that L2 will continue to capture more transaction volume for non-gaming business over time; talent becomes a brand moat; optimistic about Nouns, etc.

Follow Crypto's smart money in various fields to find Alpha's full strategy

Nansen's "smart money" label usage is explained in detail. These "smart money" include: liquidity providers and pledge pioneers, funds and private equity investors, LPs, airdrop professional accounts, NFT traders, Holders, adopters and Mint players.

Coinshares Research: Does Tether Pose Systemic Risk to the Cryptocurrency Market?USDT is not financially backed by cash (or cash equivalents) 1:1, but more like 0.85:1. A closer look at cash and cash equivalents shows that just over half is allocated to US Treasuries and about 30% is allocated to commercial paper (CP) and CDs. The remaining 16% was allocated to money market funds (about 10%), cash and bank deposits (about 6%), non-U.S. Treasury bills (about 0.4%), and reverse repos (0.15%), and the remaining 14.36% No further clarification was provided in the audit.》。

NFT

USDC is chasing USDT fiercely, and the stablecoin market pattern is quietly changing

Foresight Ventures: Decentralized NFT Trading Protocol Will Beat OpenSea

After Uniswap acquired Genie, the industry has a lot of imagination about NFT transaction aggregators.This article believes that if NFT exchanges want to break through, they must take the vertical track and the wealth effect. NFT tools such as aggregators have become an inflection point that changes the competitive landscape. A possible breaking solution for NFT trading: a truly decentralized NFT trading protocol, enabling each market traffic front-end, whether it is an exchange, a tool platform or even a project party, to become an exchange by itself, and then share the pending orders of each subject, In this way, they together form the front end of this decentralized trading ecosystem, so that every order can have an equal opportunity to be seen and purchased.》

It is also recommended to predict the NFT market from another angle: "

Multicoin partner: The next stop of the NFT trading market is community-led

GameFi

Nansen: How do you view the market prospects of NFT?

The author bluntly said that it will be difficult for many NFT series to return to the original price. NFT is driven by FOMO, so it is difficult to make it burst again. If you want to buy NFTs that are in a value depression, find those teams that have capital, vision, and strong beliefs to survive this bear market. The author is optimistic about the teams of Yuga, Proof, World of Women, CloneX (Nike), and Doodles, and believes that they have capital and innovation to promote their long-term development.

In-depth analysis of the merits and demerits of chain game development: Play to Earn or Play to Ponzi?

The externality of pension is reflected in that its essence is insurance, not investment appreciation. The externality of Bitcoin is reflected in the absolute freedom and open environment, people's undisputed ownership of property, and absolute trust in the consensus within the system.

Web 3.0

secondary title

Understanding Web3 data track unicorns, breakers and future stars in one article

An overview of the ecological landscape of Web3 decentralized storage

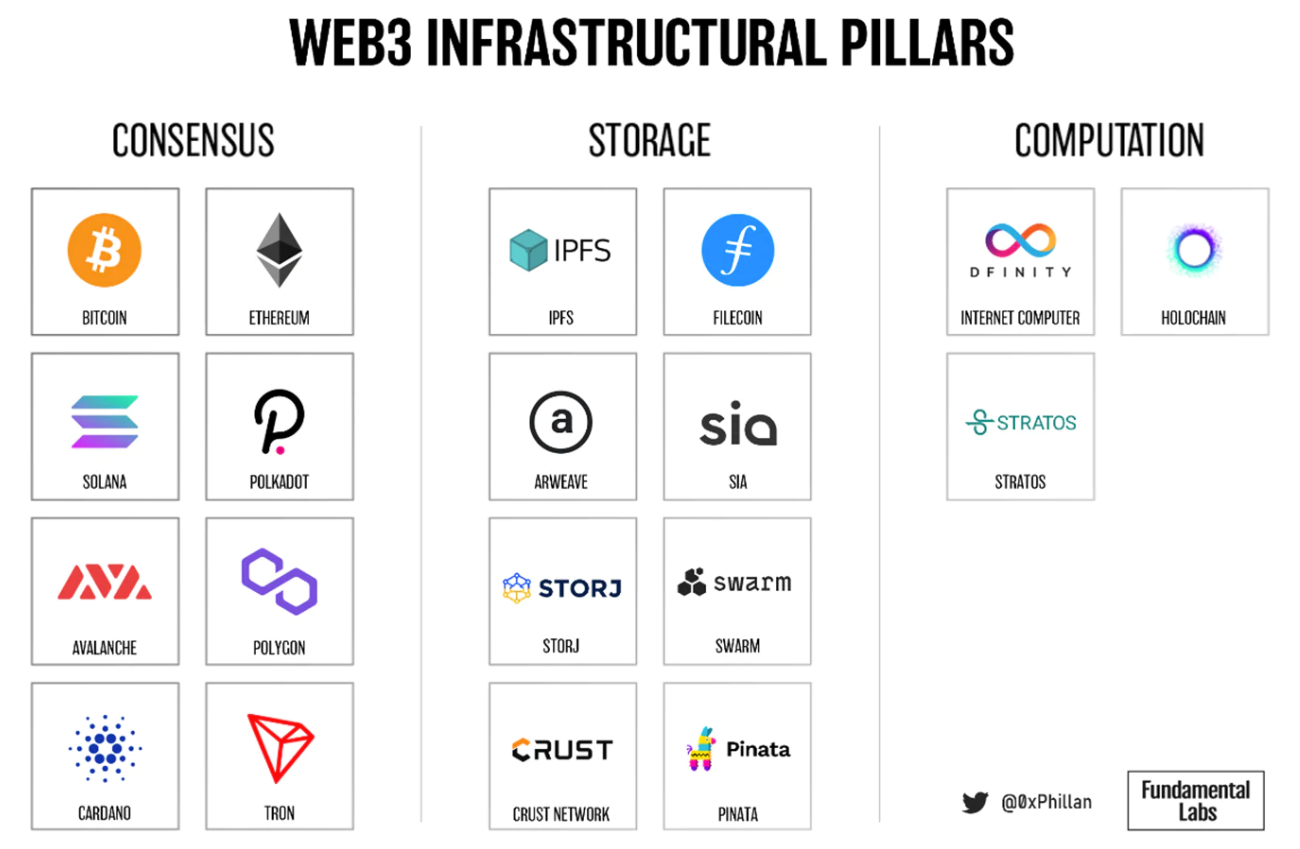

image description

Three pillars of Web3 infrastructure: consensus, storage, computing

The article first formulates the comparison dimension, then compares each project horizontally, and finally discovers the suitable use cases for each project, as follows.

It is very suitable for users who have just entered the Crypto world and want to choose a wallet. The article covers 10 wallets in four categories: browser extensions (MetaMask, Coinbase Wallet, GameStop Wallet, Rabby, Math Wallet), browsers with built-in wallets (Brave, Opera), "any browser" wallet services (WalletConnect, Portis), a browser-compatible desktop wallet (Frame).

Ethereum and scaling

Ethereum and scaling

Messari: After the merger of Ethereum, where will the miners go?

The merger of Ethereum will force the $19 billion proof-of-work mining practitioners to find another way. Most existing Ethereum miners cannot find POW mining coins with equivalent economic benefits in the market. The total market cap of GPU-minable tokens excluding ETH is $4.1 billion, or roughly 2% of ETH’s market cap. ETH mining income accounts for 97% of the daily income of GPU miners. Most of the GPU miners will be resold on the secondary market. Miners willing to invest time and money will be able to transition to high-performance data center operators or node providers for the Web3 hashrate protocol — both markets are growing rapidly. Miners can contribute GPU computing power to Web3 protocols such as Render Network, Livepeer and Akash.

Compared with traditional service providers who only provide node operations, liquid staking service providers provide staking users with more liquid and composable options than ordinary node operators. For the public chain, the existence of infrastructure service providers enhances the security of the entire public chain network. For ETH holders, staking is the best way to preserve and increase the value of their rights. However, while staking brings convenience, there are also various risks in terms of security and governance, such as the liquidity risk caused by tokens being locked in a high-volatility market, and tokens that may suffer after nodes are slashed or attacked Loss, and risk of node centralization. If you want to participate in staking, you must carefully study its expected annual rate of return and service fee rate, and avoid DeFi risk transmission and coupling losses.

Safety

Safety

Wallet phishing websites emerge in endlessly, and the production cost is very low, and a process-oriented and professional industrial chain has been formed. Scammers usually directly use some tools to copy well-known wallet project websites to trick users into entering private key mnemonics or induce users to authorize.

We recommend that you always verify the URL of the website you are using before attempting to download or enter it. At the same time, do not click on unknown links, and try to download through official webpages or official media platforms to avoid being phished.

Policy and Macro Impact

In-depth discussion of the macro market situation behind the Fed's 75 basis point interest rate hike

The Fed manages market economic expectations. Consumer confidence is low. Of the core components of the current market (food prices, gas prices, housing costs, jobs), only the labor market is doing okay. Consumers also influence the development of companies through different channels. In the stock market, people feel that they are spending less because they earn less; in the housing market: higher mortgage rates make it difficult to buy a house; in the crypto market: with 3AC and Celsius insolvent, the end of the dominoes will be Caused a massive earthquake.

In-depth interpretation of the latest bipartisan encryption regulation bill in the United States

secondary title

hot spots of the week

In the past week,hot spots of the weekIn the past week,FTX, Deribit and BitMEX Liquidate Three Arrows Capital Positions, the Wall Street Journal saidThree Arrows is considering asset sales for bailout, OTC platform under Three Arrows Capital due to ""Promotion of GBTC arbitrage transactions, whereabouts of user funds are unknown"Questioned,Voyager Digital's exposure to Three Arrows Capital is about $655 million, the recoverable amount cannot be assessed yet,Reduced daily withdrawal limit to $10,000,, the Voyager subsidiary will receive,Alameda $200 million and 15,000 BTC revolving line of creditBlockFi secures $250 million credit line from FTXBabel Finance responds to liquidity pressure: Will actively fulfill the legal responsibilities to customers,Solend Governance FarceTrigger the "DeFi Moral Paradox",GBTC negative premium extended to 33.71%, a record low,Stablecoin MIM drops to $0.94, its issuerAbracadabra says treasury has enough assets to cover bad debts, the specific repayment plan and loan agreement will be announcedCelsiusMaple Says Funding Pool May Have Liquidity Issues, Lenders may not be able to withdraw funds,$10 million in DAI has been repaid to Compound Finance, cross-chain bridge between Harmony and ETHHorizon under attack, with a loss of approximately US$100 million, Ronin Network will

Restart Ronin Bridgeand return all user funds;In addition, in terms of policy and macro markets, Federal Reserve Chairman Powell said that it is appropriate to continue raising interest rates,Fed firmly pledges to bring inflation back to 2%,, planned for the next few yearsSupervision of stable currency and digital financial market

perspectives and voices,Do KwonThe time has come;Kyber NetworkSays there's a difference between failure and fraud, confident in rebuilding Terra,

Institutions, large companies and top projects,: The potential bankruptcy of Sanjian Capital may affect Kyber’s finances, but the fund pool can still support Kyber’s development for many years;Institutions, large companies and top projects,BinanceVC firm 1confirmationLaunched a $100 million NFT fund with a 10-year cycle,zkSync Releases V2 Update Details

NFT and GameFi fields,: Add functions such as "account abstraction" and communication between L1 and L2;NFT and GameFi fields,CryptoPunksWith "Editor's Picks of the Week" series

With "Editor's Picks of the Week" seriesPortal。

See you next time~