跟随Crypto各领域聪明钱寻找Alpha全攻略

本文来自 Nansen,由 Odaily 星球日报译者 Katie 辜编译。

加密市场投资者总有各种方法找到财富密码。可能是在 Crypto 领域工作,认识投资大佬,加入含金量高的 Alpha 电报群,或者是探索链上数据,并抢先在 Token 上线前得到第一手消息。

加密市场投资者总有各种方法找到财富密码。可能是在 Crypto 领域工作,认识投资大佬,加入含金量高的 Alpha 电报群,或者是探索链上数据,并抢先在 Token 上线前得到第一手消息。

这其中,有一招百试不爽——从不说谎的链上数据。在 Nansen 的“探索”板块中,我们致力于分析“聪明的钱”地址,这些地址涵盖了 Crypto 各领域,对找到 Alpha 十分具备参考性。

流动性提供者和质押先行者(First Mover LP & Staking)

流动性提供先行者——基于一定规模的流动性池数量的前 200 个地址,这些流动性池也排名靠前。

质押先行者——基于一定规模的质押池数量的前 200 个地址,这些质押池也排名靠前。

通常可以捕捉到两类地址:

24 小时保持活跃的玩家,总是潜伏在 Twitter 和 Discord 上,时刻准备进入下一个质押池;

项目支持者(如投资者、巨鲸),希望提高种子流动性,帮助项目获得吸引力。

在币圈有三种致富方式:做第一个行动者、比别人更聪明,或割韭菜。在这里,我们推荐做行动派。

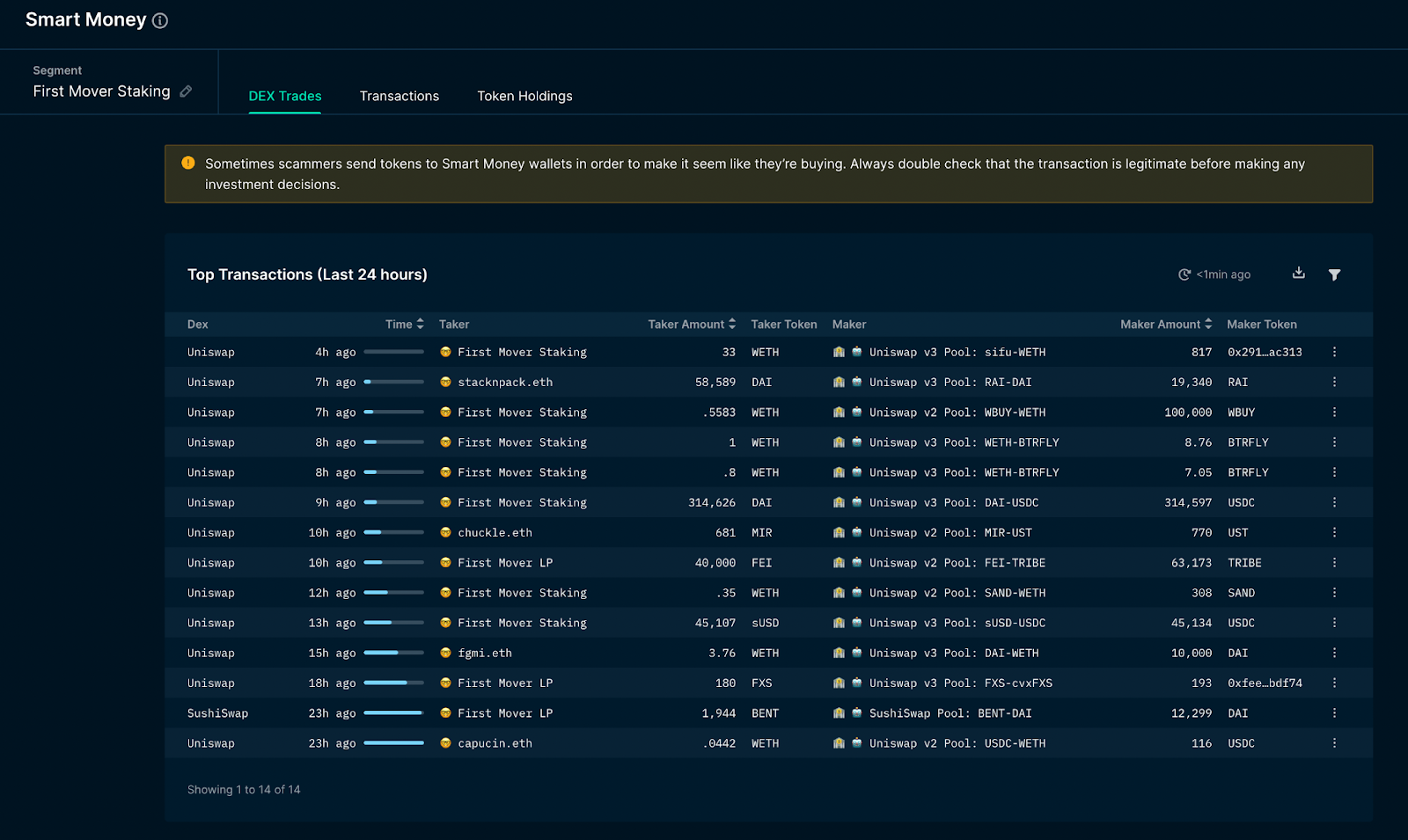

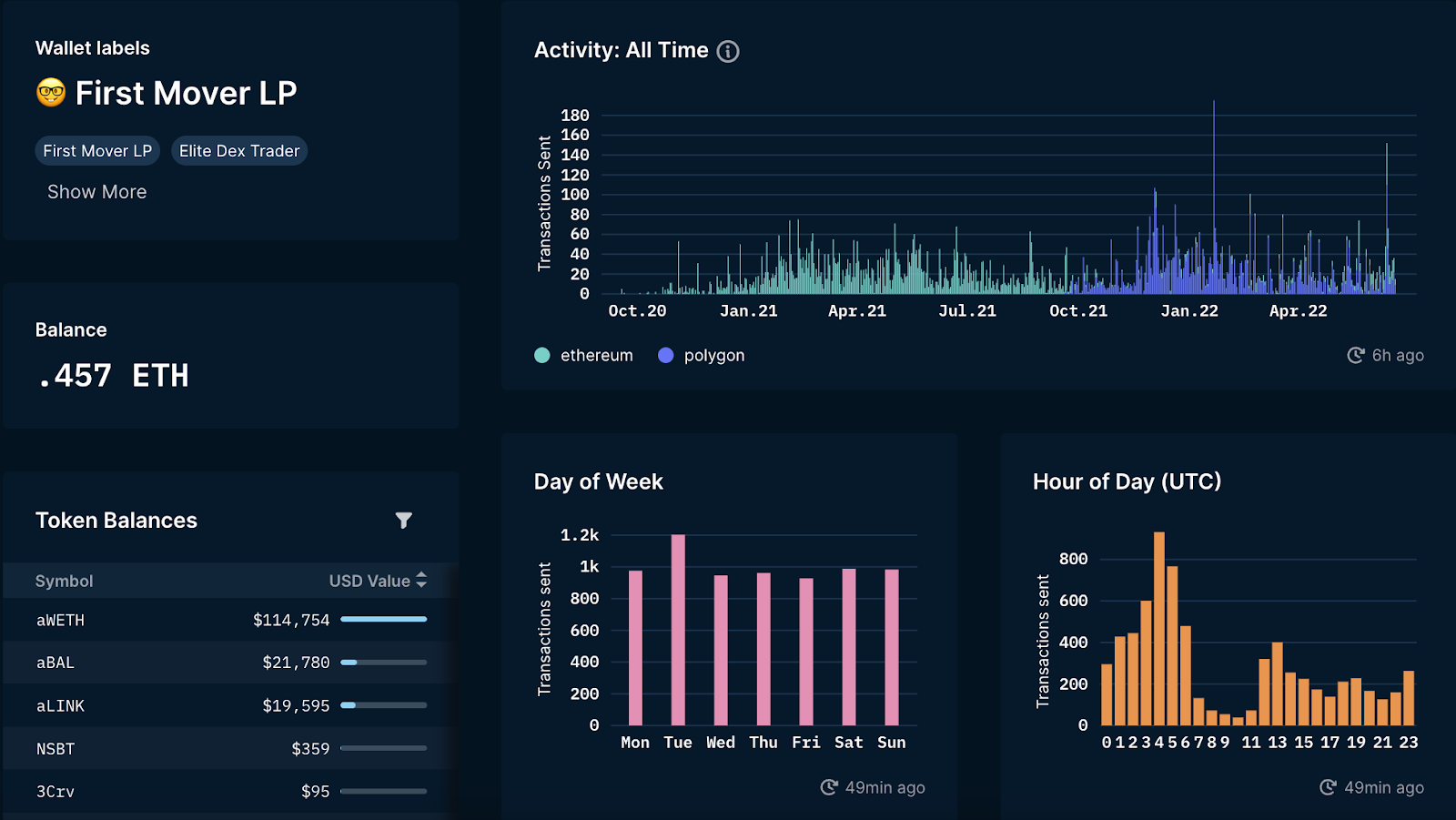

一个研究方法是查看我们的 Smart Money 数据仪表板和过滤器的 First Mover LP和 Staking,可以获得在过去24 小时内一直活跃的地址列表。接下来,使用钱包分析器研究这些地址,并为那些在你的时区内活跃的地址生成智能警报。

来源:Nansen智能理财数据仪表盘(对质押先行者和LP进行筛选)

来源:LP先行者的Nansen钱包分析器

基金和私售投资者

基金——投资和管理加密货币的实体。

私人销售投资者——在大量不同的代币上从投资者分销商地址收到至少 10 万美元的地址,展示了投资者行为的链上证据。

这里涉及的范围稍微大一些,包括顾问、天使投资人,以及可能不是基金但从事资产配置工作的实体(如媒体公司、咨询公司等)。

除了简单地跟随这些地址交易之外,了解他们当前的投资组合、分配明细以及他们使用的协议等信息将非常有用。

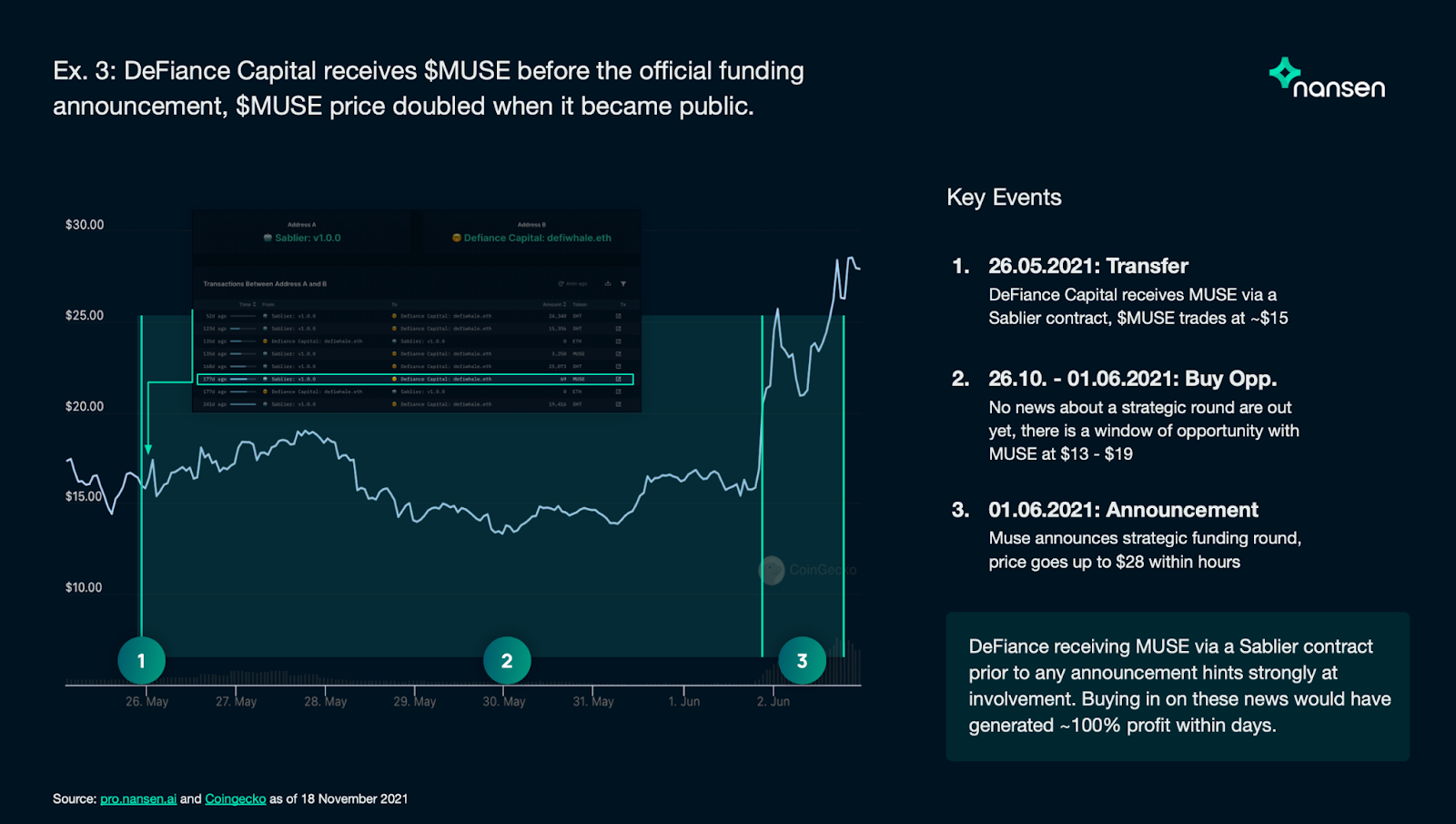

更复杂的挖掘方法是追踪流入和流出的资金。举例:

在公开发行之前,如果有人观察到代币流入到 Defiance Capital 地址,那么就可以在链上发现 Muse DAO 和 Defiance Capital 之间的战略融资交易。

来源:Nansen《2021 Crypto产业状况报告》

更聪明的流动性提供者(LP)

聪明的流动性提供者——在 Uniswap 或 Sushiswap 上做流动性提供者和流动性矿工,赚了 10 万美元以上。利润计算不包括短暂损失。

更聪明的流动性提供者——在任何 Uniswap V2 类型的 DEX 上,以利润和 ROI (投资回报率)计算的前 1% 的流动性提供者和流动性矿工。利润计算包括暂时性损失。

与流动性提供先行者类似,这些玩家也在关注流动性供应。然而,关键的区别在于,我们使用实现利润作为衡量标准,而不是交易速度。

在 DeFi 中,短暂的损失经常被吹捧为“沉默的杀手”。一个人需要走在交易曲线前面,才能跑赢“短暂亏损”,因此被贴上了这样的标签。除了研究执行类似的 LP 规定之外,这些地址可能是复杂的加密原生地址,值得探索它们来获得财富密码。

空投专业户

空投专业户——在多次空投中收到大量代币的地址(空投的价值基于分发开始后 30 天的平均值)。

通过 Nansen 数据,我们发现收到大量空投的地址。有这个标签的地址通常可分为两类——撒大网抓鱼或与一个精心策划的协议列表交互。第二类的地址应该重点关注。

必须深入挖掘并查看这些地址的交易历史,然后再列出几个值得关注的地址。以下是一些有相当多交互的著名项目的例子:

Aztecl

Nomadl

xPollinate

我们不了解这些例子的空投潜力,也不评论这些协议本身的质量。参考上面的列表,可以作为你开始你的 Alpha 探索之旅的第一步。

聪明的 NFT 交易者

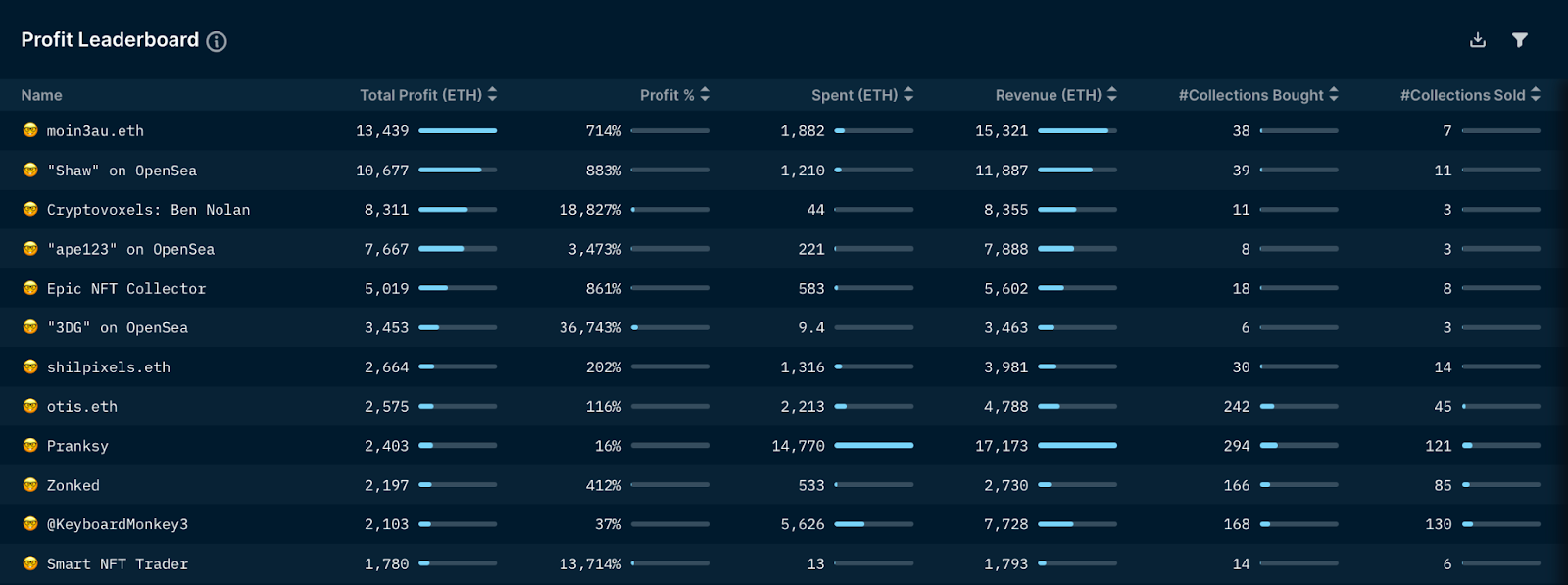

聪明的 NFT 交易者——NFT 销售实现利润的前 100 名地址和基于我们内部交易员评分指标的前 100 名地址。

正如这个术语所暗示的那样——这些地址擅长于 NFT 交易。无论是将 NFT 从 0.1 ETH 翻倍到 1 ETH,还是从 30 ETH 翻倍到 60 ETH,我们都对每个 NFT 交易员的实现利润进行了排名,包括绝对利润和相对利润。此外,我们只考虑已经翻倍超过一定数量的 NFT 系列的交易者,避免任何偶然性翻倍的交易者(如仅通过一次收藏就发财的玩家)。

很明显,这是一种会被复制交易的地址类型。你可以看看我们的 NFT Paradise 盈利排行榜,从中找到值得关注的例子。

来源:Nansen的NFTParadise盈利排行榜仪表盘

聪明的 NFT Hodler

聪明的 NFT Hodler——根据他们当前 NFT 投资组合的估计利润排名前 100 位的地址,以及根据我们的内部持有者评分指标排名前 100 位的地址。

我们转而关注未实现利润。有多少地址坐拥大量账面利润,但仍持有 NFT,这部分集中在未售出的地址。

方法是在 Nansen 的 NFT Paradise 上查看聪明的钱标签,看看从聪明的钱地址最近的交易,看看他们在做什么。甚至可以专门筛选 Smart NFT holder 标签和你正在看的活动类型(买卖和 mint),从更大视角看交易。如果你看到一些 Smart NFT Hodler 在销售一个特定的 NFT 系列,这是一个潜在的“退出”信号,反之亦然。

来源:Nansen的NFT Paradise聪明的钱仪表盘

聪明的 NFT 早期采用者

聪明的 NFT早。期采用者——前 100 位在指定日期之前投资了选定的蓝筹项目,并且仍然持有该项目的 NFT 的地址。

相当多的蓝筹项目通常都有一个“Alpha”渠道或代币 Discord 频道。观察钱包可能有助于我们了解这个群体的关注方向。

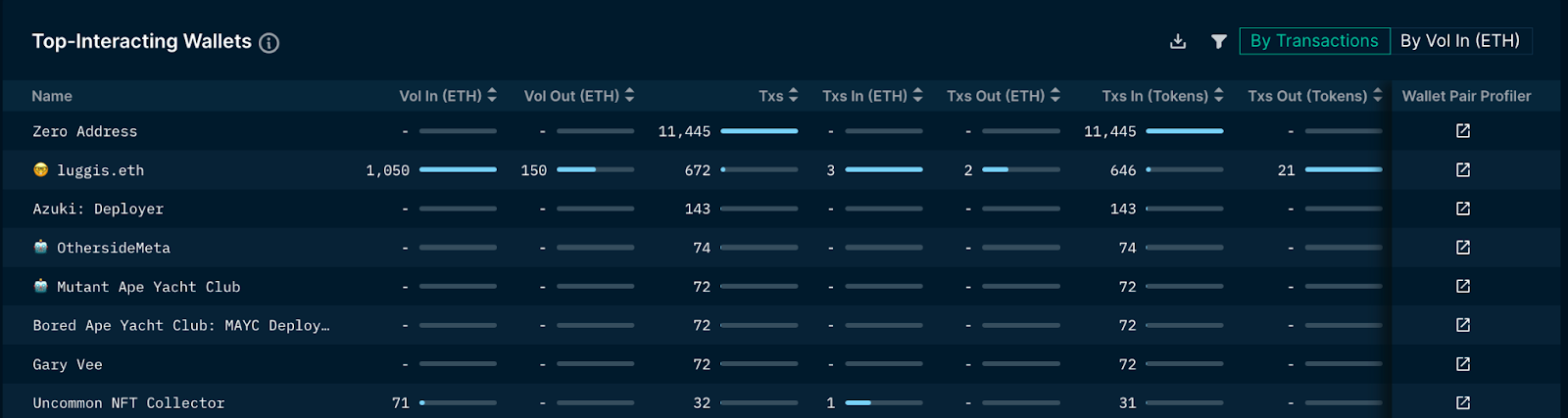

“如果他们把所有猿猴 NFT 放在一个资金库,聪明的钱标签就不准确了吗?”这是有可能的,我们需要再仔细分析。通常,交易员的冷热钱包之间会有联系。人们可以在 Nansen 的 Wallet Profiler 上观察交易对手的表格,找到一些线索。

以下的 Vault Wallet 的示例图:

聪明的 NFT Mint 玩家

聪明的 NFT Mint 玩家——前 100 个地址在过去 60 天内通过多次收藏至少实现 5 倍以上利润。

Mint 很困难,特别是在最近 NFT 项目激增的情况下。如何决定要 Mint 什么?追踪这些地址也许能找到有趣的 Mint。

注意:

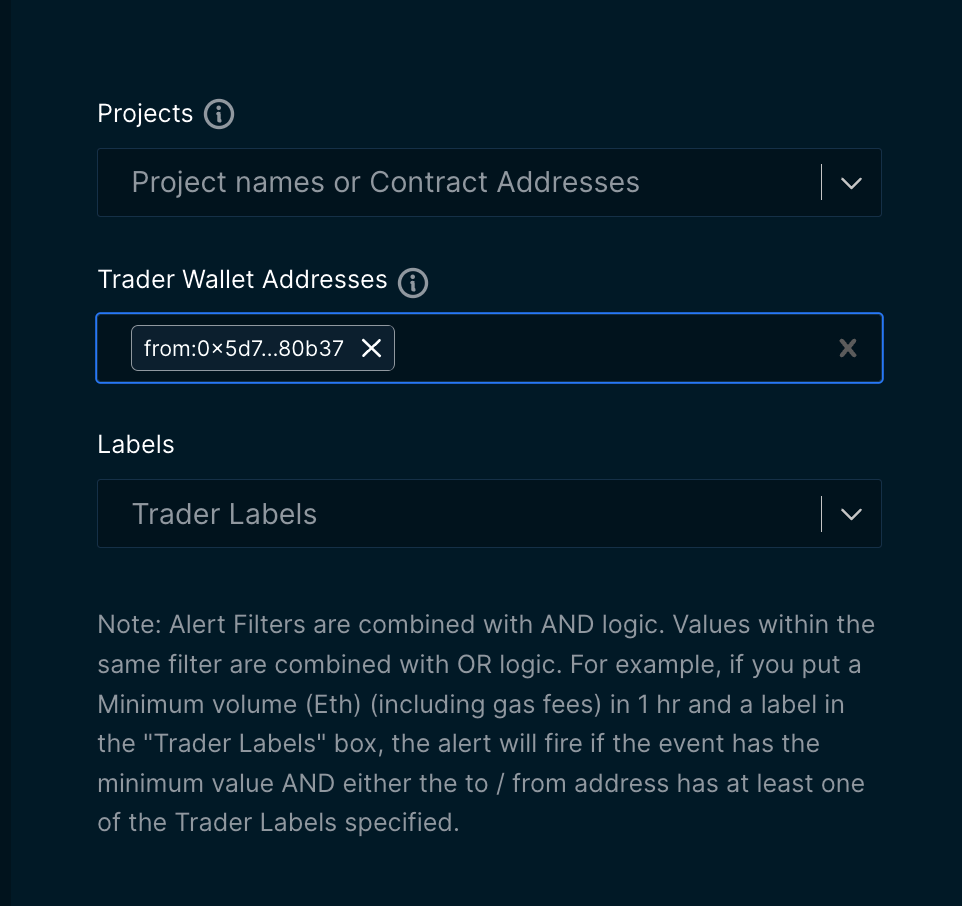

在地址前面添加一个“from: ”,使其变成“from:0x.... ”,而不是只输入地址,可以过滤由该地址发起的交易。这大大减少了出现的骗局代币的数量。

总结

只有知道谁是交易背后的交易者,才能知道链上正在发生的交易。通过利用 Nansen “聪明的钱”标签,可以帮助我们做出更明智的投资决策,并当财富密码出现在链上时立即识别,抓住机会。

相关阅读: