Author: William M. Peaster

Original source: Bankless

Compilation of the original text: The Way of DeFi

Author: William M. Peaster

Original source: Bankless

Compilation of the original text: The Way of DeFi

Derivatives are essential in the hyperscale, decades-long battle between TradFi and DeFi.

That's because assets and stocks are just the tip of the iceberg. It is derivatives that provide depth to the entire global financial system.

Of all the Web3 projects dealing with derivatives, Synthetix has long been a pioneer of synthetic assets, taking the lead.

So, how to get the most out of it.

Image credit: Logan Craig

Your Guide to the Synthetix Ecosystem

image description

Among the most proven and pioneering projects in the DeFi space, Synthetix has developed a derivatives infrastructure that is currently at the center of an ecosystem of decentralized applications such as Kwenta, Lyra, and others.

Skills: Intermediate

This Bankless strategy will show you how to operate the Synthetix ecosystem.

Goal: Browse the top Synthetix ecosystem projects

Skills: Intermediate

Effort: 1 hour

ROI: Upgrading Your DeFi Skill TreeSynthetixSynthetix Ecosystem Guide

Introduction to Synthetix

In 2018,sUSDSpecifically, Synthetix is a derivatives liquidity protocol that powers the creation of "Synths" (or synthetic assets) that can be made in a decentralized and permissionless manner trade.

Synthetics allow traders to profit from asset exposure without directly owning the underlying asset. Currently, some of Synthetix's most popular synths are its fx synths, such as

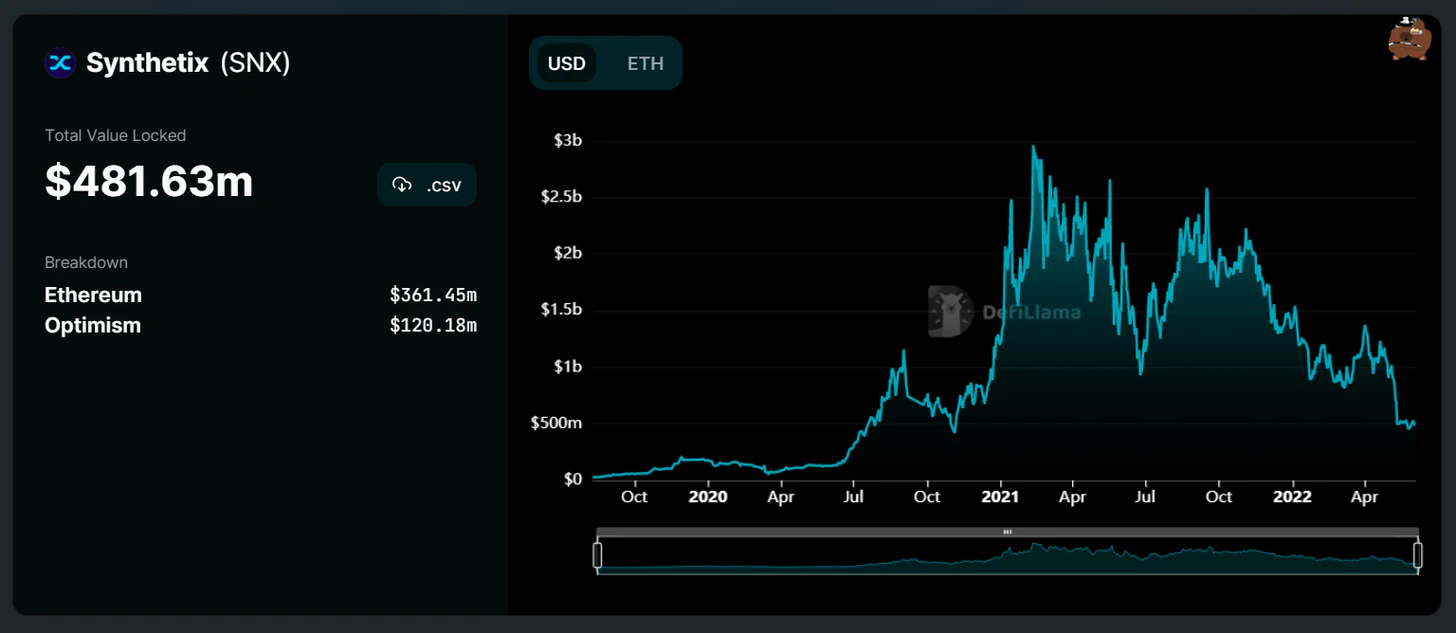

and sEUR.image descriptionImage via DeFi LlamaIn addition, Synthetix is also a pioneer in DeFi, because of its popularity in 2019First yield farming

Known for, and in 2021 will be

First Adopters of Optimism

One of the leading DeFi projects in the world, the second-layer (L2) scaling solution.

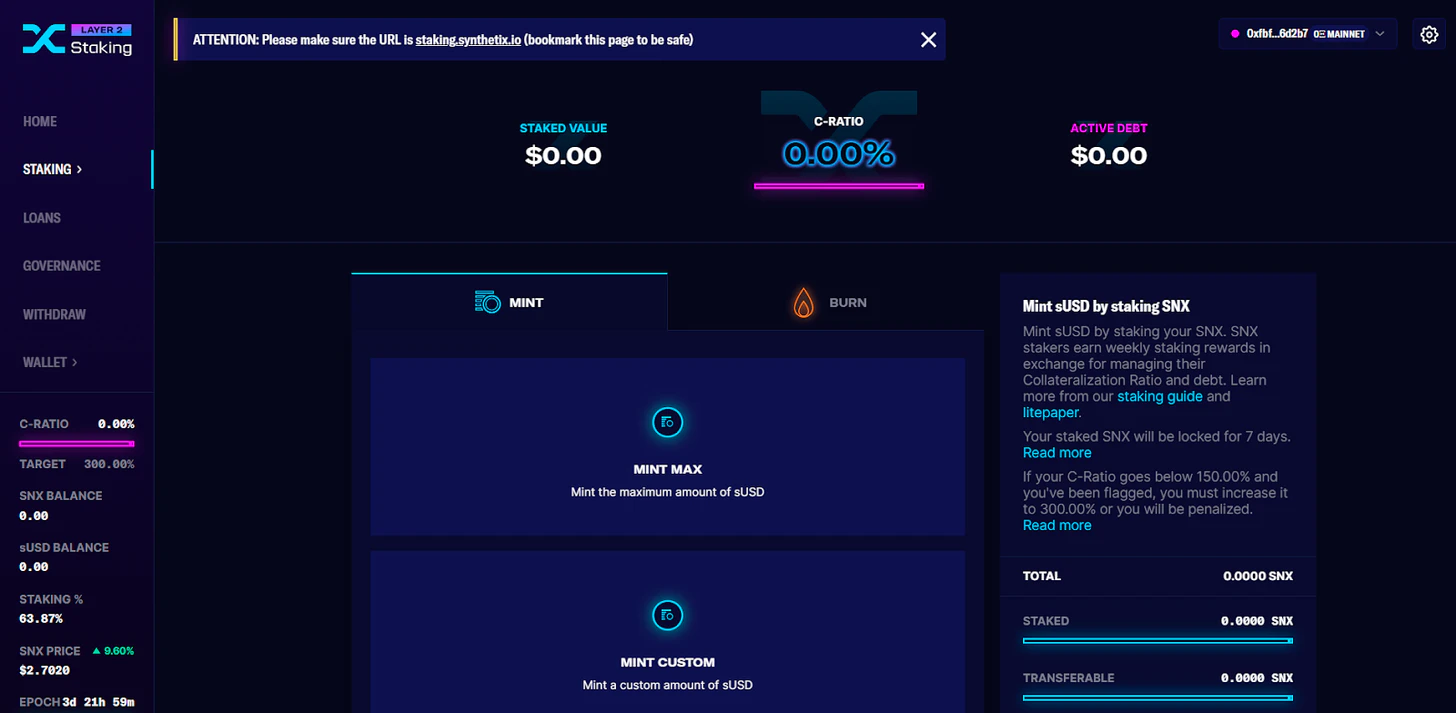

The Synthetix community has also nurtured multiple additional DeFi protocols so far, and the Synthetix ecosystem already has a few dapps in its orbit.Using Synthetix 101A foundational element of Synthetix is SNX staking, which is used to underwrite derivatives agreements and create deep liquidity for synthetix.

In terms of Total Value Locked (TVL), Synthetix is currently the

biggest deal

, in large part because the project migrated its SNX staking and sUSD minting operations to Optimism early in the L2 lifecycle.Notably, SNX stakers not only earn inflationary SNX rewards, but they also earn a cut of sUSD fees generated by protocols working on top of Synthetix such as Kwenta and Lyra.The basic steps of SNX staking are as follows:1. Get SNX, SNX can be obtained directly on Optimism (for examplevia Uniswap

), or from Ethereum (e.g. via

Optimism Bridging

) for bridging.

3. Connect a wallet and connect to the Optimism networkstaking.synthetix.io/earn/claim4. Click the "Staking" button on the sidebar, then click the "Mint & Burn" button

Kwenta:Synthetix DEX

Kwenta5. Click the "Mint Max" button and confirm the transaction in the wallet

Staking rewards are calculated and then announced every Wednesday. Positions with a slightly higher L2 collateralization rate (C-Ratio) of the protocol (300%) will receive the most rewards, which can be achieved by

receive. Claimed SNX will be escrowed, i.e. non-transferable, for a period of one year.is the primary decentralized exchange (DEX) in the Synthetix ecosystem, designed to facilitate zero-slippage synthetic trading.Interestingly, Kwenta does not rely on an order book or liquidity pool model. Instead, the DEX employs a peer-to-peer (P2C) system in which synthetics are traded against smart contracts fed by Chainlink prices. Also, Kwenta only allows the trading of synthetics, so no other cryptocurrencies can be used here.

In September 2021, Synthetix deprecated sAAPL and sAMZN etc. on Ethereum

sUSD

sEUR

sETH

sBTC

sLINK

sSOL

sAVAX

sMATIC

sAAVE

sUNI

Synthetic assets with low trading volume

, paving the way for subsequent re-listing on Optimism L2.

L2 synthetic assets available to Kwenta as of June 2022 include:kwenta.io/exchange

https://app. such as 1inch

)get

3. enter

4. Connect a wallet and connect to the Optimism network

Lyra5. Select the "From" composition, the amount to trade and the "Into" composition

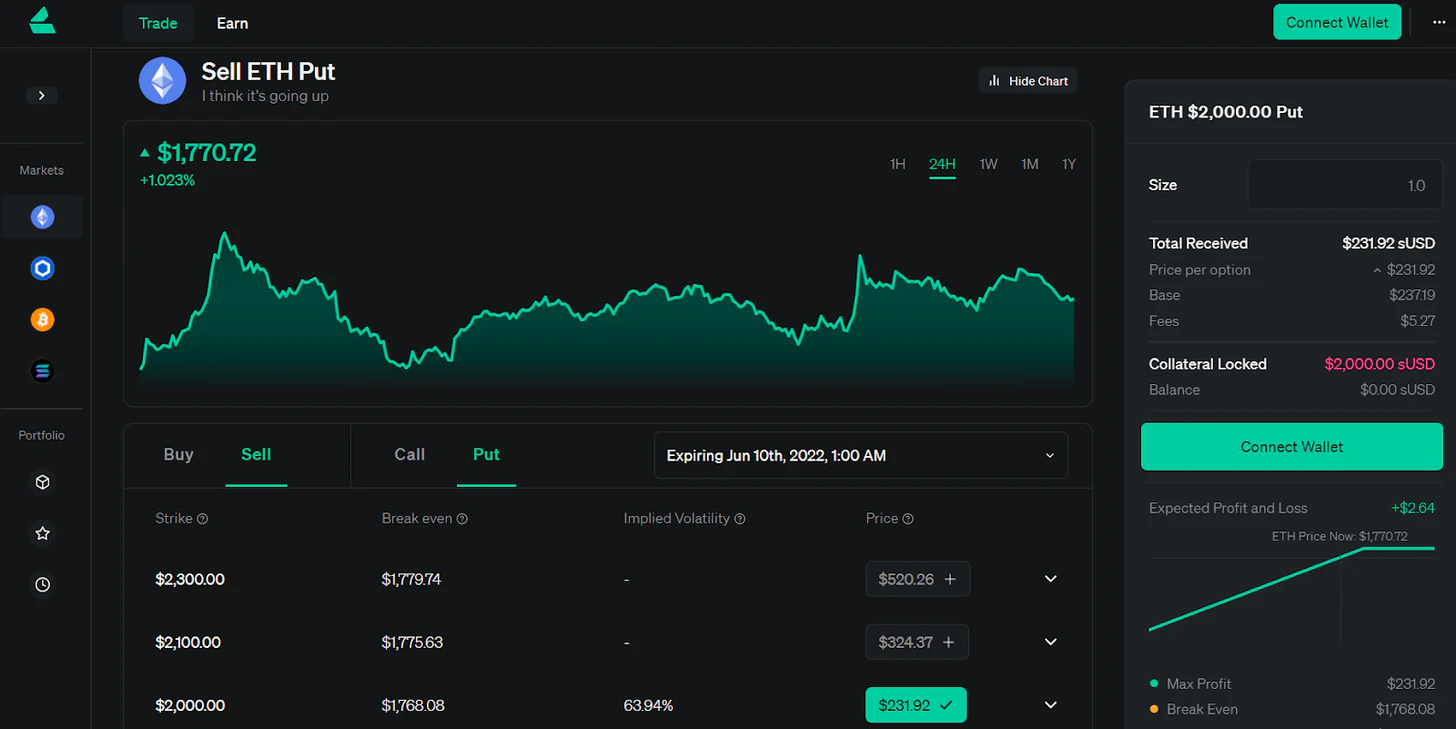

6. Click the "Submit Order" button to confirm the transaction in the walletLyra: Options Powered by Synthetixis a decentralized options trading protocol powered by a dedicated Automated Market Maker (AMM) system.

Notably, Lyra uses Synthetix's sUSD stablecoin as its exclusive quote asset, so traders use sUSD to open long positions or close short positions. Lyra also uses Synthetix as a base asset for its market

long-short exposure(i.e. delta hedging) one-stop agreement.》。

It’s worth noting that Lyra uses Synthetix’s sUSD stablecoin as its exclusive quote asset, so traders need to pay fees to open long positions or close short positions using sUSD. Lyra also uses Synthetix as a one-stop protocol for long-short exposure of its market underlying assets, i.e. delta hedging.

A complete primer on trading options with Lyra can be found in the

Lyra Options Guideapp.lyra.finance

The basic steps are as follows:

1. Get sUSD (or other synths like sBTC if selling call options exclusively)

2. enter

3. Connect wallet and connect to Optimism network

4. Select a market (ETH, BTC, LINK and SOL are currently available)

5. Select the due date

6. Choose from Buy or Sell options

7. Select "Call" or "Put"

Thales8. Choose a strike priceThales: Binary Options Centerof.

is a decentralized binary options protocol, which was created by a group of Synthetix community members in 2020

Synthetix spin-offof.Binary options have only two possible payouts if held to expiration: a predetermined profit or nothing. Thales relies on Synthetix's sUSD stablecoin: 1. to mint its binary options token; 2. as the platform's unit of account.

Thales is now completely independent, but the project is running a three-year Merkle airdrop system that will provide 35% of the THALES token supply to

2., to keep the Thales and Synthetix communities closely integrated.

3.The main usage of Thales is as follows:

4.Create a binary options market

Trading Long and Short Binary Options

exercising binary optionsTHALES pledgeAelin: Decentralized Fundraising ProtocolLast year, Synthetix founder Kain Warwick used his own:

SPAC (Special Purpose Acquisition Company)joke in reply to a tweet by Mariano Conti, which led to Warwick responding with something likeLayout of SPAC in the way of Ethereum

Members of the Synthetix community contributed it as a development

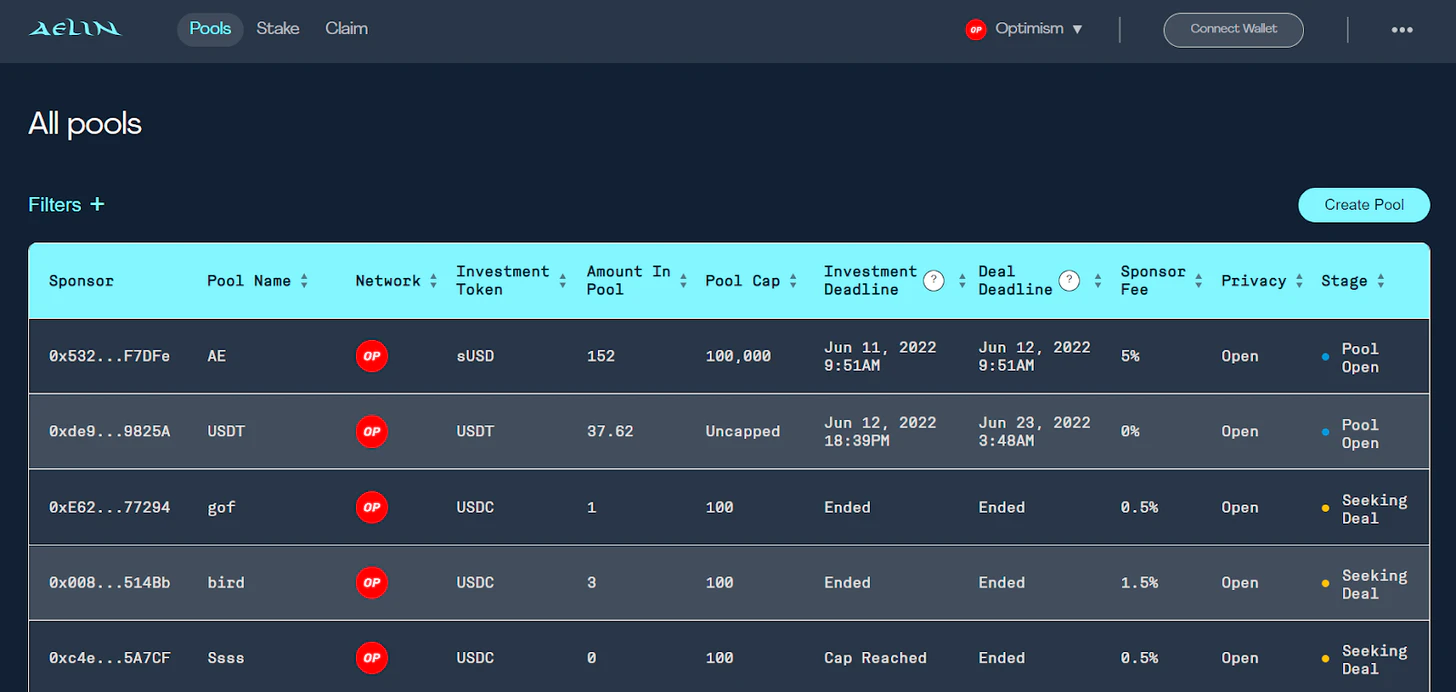

Aelin protocol

Inspired by , the protocol launched earlier this year on Ethereum and Optimism.

3.The main ways of using Aelin are as follows:

Summarize

create pool

create transactionSynthetix's early migration to Optimism paved the way for an ecosystem that has come alive in recent months thanks to Optimism's fast and cheap transactions.