What is the Crypto Greed Fear Index

Original author:supraoracles

Original author:

Original title: "What is the Crypto Fear and Greed Index?"

Recommended reason:

Recommended reason:

The cryptocurrency greed and panic index can observe the investment sentiment of the market, and is an important reference index for the macro analysis of the currency circle. This article analyzes in detail the composition of the greed and panic index, its usage method and application limitations.

Investors can use a cryptocurrency’s greed-fear index to determine when to buy an asset.Alternative.meThe main cryptocurrency sentiment index created. The index is designed to measure general market sentiment towards crypto assets. The index began measuring investor sentiment on February 1, 2018.

image description

The Cryptocurrency Greed and Fear Index is measured on a scale of 0-100, with lower scores representing fear and higher scores representing greed. A score of 0-24 represents "extreme fear," meaning investors are selling heavily and exiting the market. A score of 25-49 represents "fear," which means a significant number of investors are selling while market interest remains low. A score of 50-74 represents "greed", which means a lot of buying is taking place, causing prices to rise. A score of 75-100 represents "extreme greed" and indicates that the market is very hot and the market "bubble" may soon burst.

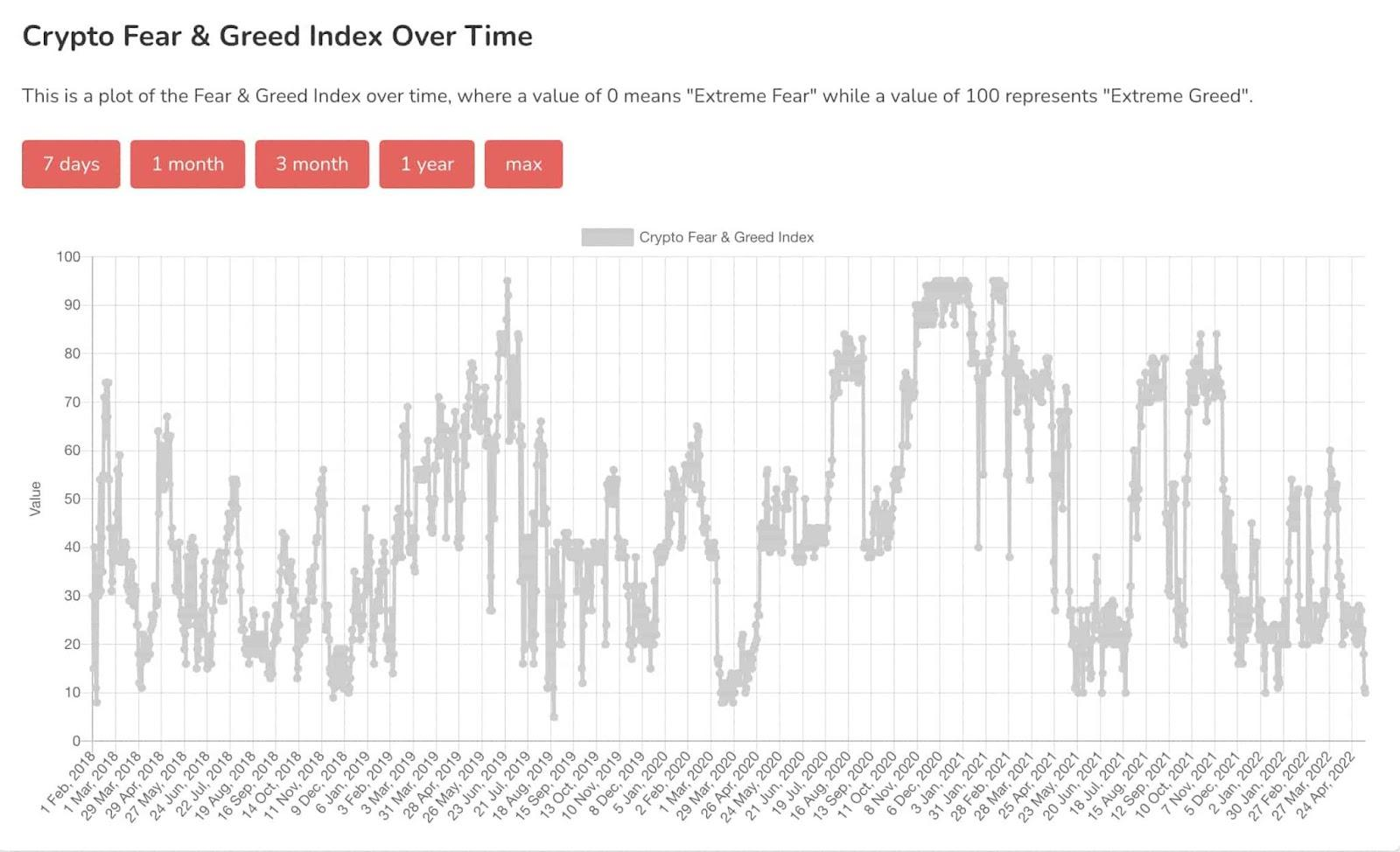

image description

Image source: alternative.me

As of early May 2022, the index has reached a resistance level of "10," or "extreme fear." As mentioned earlier, "extreme fear" usually means that prices are falling sharply and investors are exiting the crypto market, while "extreme greed" is usually associated with surging prices and new investors entering the market.

The Crypto Greed and Fear Index could be a valuable tool for both long- and short-term crypto investors. In times of panic, investors may want to build their crypto asset positions at a lower cost, while others are afraid to enter the market. Likewise, during times of greed, investors may wish to hold off on buying new crypto assets and even sell some of their cryptocurrencies while prices are still high. However, it should be noted that the index focuses primarily on Bitcoin and less on other cryptoassets, which may make it less accurate and useful than expected.

How to Calculate the Cryptocurrency Greed and Fear Index?

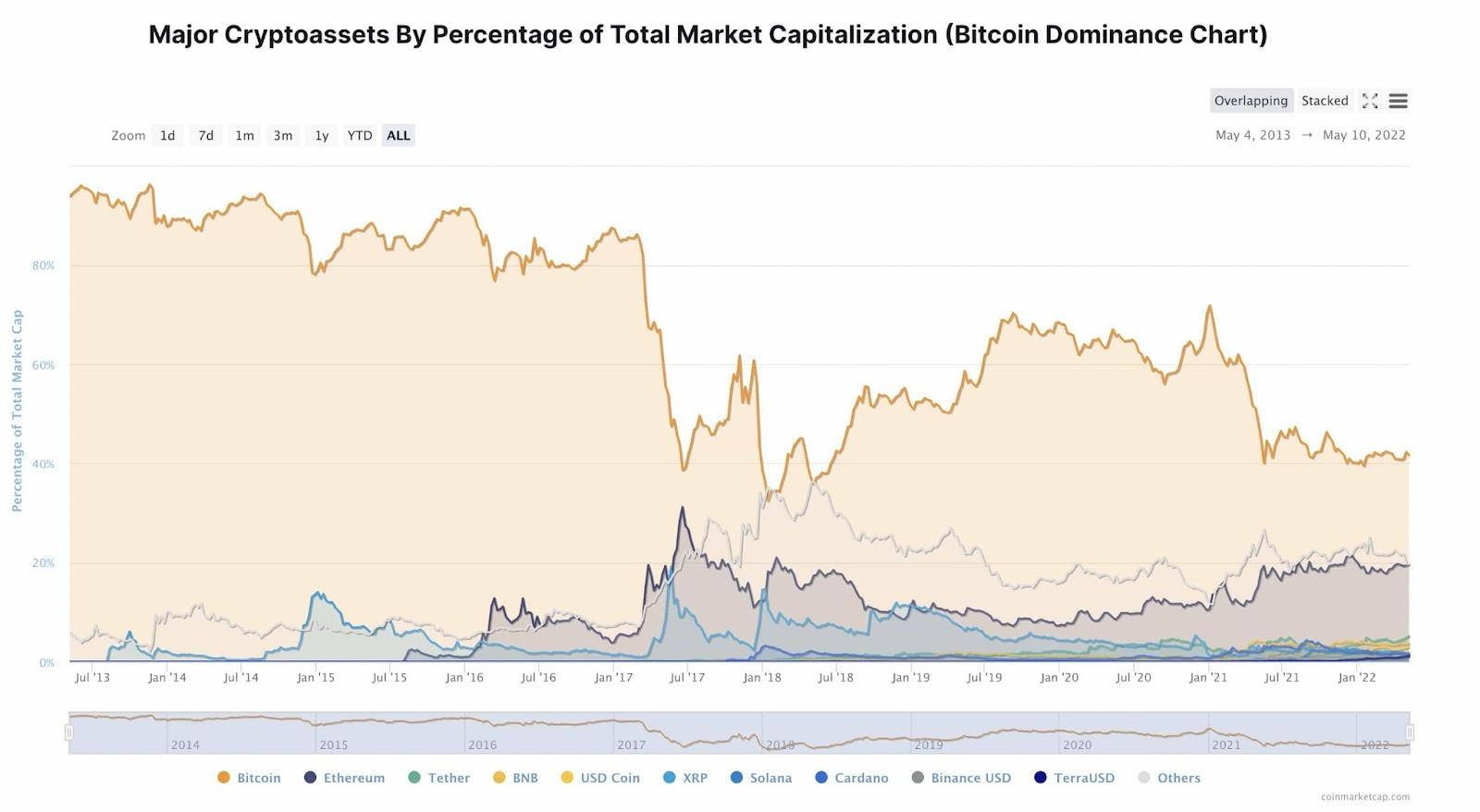

image description

Image source: alternative.me

Alternative.meBitcoin Dominance chart, representing one of several weighting factors used to calculate the Cryptocurrency Greed Fear Index.

The Crypto Greed Fear Index is calculated using six main factors, each weighted by perceived importance. These factors include:

Market Momentum and Volume (25%): Current trading volume and market momentum are some of the most important factors considered by the Crypto Greed & Fear Index. The calculation of the index compares the current daily volume and momentum with the 30-day and 90-day averages. Larger selling volumes and negative daily market movements indicate significant selling pressure, thus increasing panic. In contrast, large buying volumes and repeated positive market moves point to heightened greed.

Volatility (25%): Volatility is another important factor. The more volatile a crypto asset is, the more fearful investors may be, leading to a lower score on the index. As with market momentum and volume, volatility and value declines (maximum drawdowns) are compared to 30-day and 90-day averages.

Trend (10%): The Crypto Greed Fear Index also measures the volume of searches for cryptocurrencies on Google, with higher search volume generally leading to greater potential greed and thus a higher index score. Like other indicator factors, this search volume study focuses on Bitcoin and weights search terms based on perceived importance and volume. However, not all searches are weighted equally (and not all searches have a positive impact on the index score), with negative searches like "bitcoin market manipulation" and "bitcoin crash" pointing to greater fear in the market.

Dominance (10%): Dominance looks at the Bitcoin market capitalization as a percentage of the market capitalization of all cryptocurrencies. It is generally believed that Bitcoin's increased dominance (increased market share) represents a scarier market, as investors may view Bitcoin as a cryptocurrency "safe haven." In contrast, the index sees increased altcoin investment as a more rapacious market, with more speculators willing to invest in lesser-known assets in hopes of reaping big returns. However, this approach may not be a particularly prominent factor in the current market, as Bitcoin's current market share in early May 2022 (41.66%, priced around $31,500) is currently lower than Bitcoin's in November 2021 A market share of around 43% at a height of $69,000. This suggests that investors are not actually flocking to Bitcoin as a "safe haven" during times of market fear. This could be attributed to the growth of ETH and stablecoins like Tether (USDT), as well as the strength of other altcoins like Binance Coin (BNB). So instead of just counting Bitcoin, a possibly better measure of dominance might consider the dominance of the top 3-4 assets (or even the top 10 assets) and compare the market cap of these combined assets to the rest of the market .Alternative.meSurvey (15%): Although this part of the calculation has been suspended, until recently,Strawpoll.comstill utilize its sister site

Social Media (15%): The Crypto Greed Fear Index utilizes text processing algorithms to parse crypto-related market keywords on Bitcoin and Twitter. The algorithm collects and counts posts with cryptocurrency-related hashtags and measures the velocity of crypto-related posts and the amount of engagement on posts over a specific time period. A higher interaction rate typically responds to more market greed, while a lower interaction rate may indicate more dire market behavior. As with other index measurements on this list, the focus and weighting of social media behavior is more on Bitcoin than on other cryptocurrencies. The index's creators are currently experimenting with adding Reddit sentiment analysis using a similar text-processing algorithm, which may be added to the index's social media calculations in the coming weeks or months.

first level title

Cryptocurrency Greed and Fear Index Usage Limits

As useful as the Greed & Fear Index is, it doesn't tell investors anything about market timing, nor does it claim to make any valid predictions about the future. So even if the market is extremely greedy, it is still possible for the price to rise further and stay there. Likewise, even if the market is in extreme panic, prices could fall further and remain depressed for an unknown period of time.

Additionally, the Crypto Greed Fear Index doesn’t pay much attention to ETH, the second-largest asset in the crypto space. The ETH/BTC ratio may be another important indicator of market movements that investors may be interested in. It could be argued that the ETH/BTC ratio is just another measure of Bitcoin’s market dominance, but since ETH has a large market cap, it might be useful to include it in the calculations. The index also does not focus on any particularly high-growth sectors of the crypto market, such as stablecoins and their associated governance tokens, or the relative market capitalization or profits generated by various DeFi protocols.

It should also be noted that the index does not take Bitcoin halving into account either. This is generally a bullish factor due to less excess supply (meaning lower bitcoin inflation). However, the Bitcoin halving could become more pessimistic as more traders expect Bitcoin to temporarily rise (and later fall), meaning the message has already been baked into the market and therefore has less impact.

Overall, the Crypto Greed & Fear Index is just one tool investors should consider using when deciding when to buy cryptocurrencies, along with various fundamental analysis indicators. One method that some long-term investors have historically preferred to buy cryptocurrencies is Dollar Cost Averaging (DCA), where equal or near-equal amounts of cryptocurrencies are purchased over long periods of time at pre-defined intervals (e.g. once a month), Whether the market is greed or fear. This way, investors buy at low prices and at high prices, which usually makes them pay mid-range (not too cheap, not too expensive).

Regardless of the strategy, investing in cryptocurrencies is always risky, and investors and traders should always be prepared to lose whatever they put into it.

first level title

Cryptocurrency Greed and Fear Index iOS App and APIAlternative.meIn addition to the online index,Alternative.meWith proper credit, the widget API can be used for commercial purposes.

first level title

Other Interesting Bitcoin and Cryptocurrency Charts and Indexes

In addition to the Crypto Fear and Greed Index and traditional price charts, there are various other indices that crypto investors and traders may be interested in checking out. Some of the most interesting include:

DeFi Pulse Index: Created by DeFi information aggregator DeFi Pulse, the DeFi Pulse Index is a market capitalization-weighted index that tracks the performance of DeFi assets across the market.

Bitcoin Profitable Days Chart: This chart shows profitable and unprofitable days for holding Bitcoin.

Bitcoin Stock to Flow Model: This graph measures the number of Bitcoins in circulation compared to the number of Bitcoins mined (per year), and compares this ratio to Bitcoin's price.

CoinDesk Large Cap Index: The CoinDesk Large Cap Index (DLCX) tracks a basket of large-cap cryptocurrencies with a market-cap-weighted index covering at least 70% of the digital asset market capitalization.

CoinDesk Smart Contract Platforms Select Ex ETH Index: No (SCPXX) tracks the market cap-weighted performance of the largest and most liquid Eterheum-compatible smart contract platforms (primarily layer 2).Lookintobitcoin.comApart from

Conclusion: The Crypto Greed Fear Index Is A Powerful Indicator But Has Significant Limitations

Translator's note:

Translator's note:

The Crypto Fear and Greed Index is an excellent benchmark for crypto traders, investors and market analysts. However, it also has its limitations, such as its focus on Bitcoin, to the detriment of other crypto assets, including ETH and stablecoins.

So, as mentioned earlier, the index, while useful, should be just one of many data points used to track the cryptocurrency market and should not be relied upon heavily to make investment or trading decisions.

Follow us:

Follow us:

Our Twitter: @Forest_VenturesH.Forest

Our mirrors: