Looking back on the encryption "Lehman moment": Besides Terra, what other affected projects?

Written by: Poplar

In the "UST unanchor" crash, the market value of tens of billions of Terra ecology evaporated within a few days, which brought a devastating blow to Terra's own ecology, proving that there is no myth of "too big to fail" in the encryption market.

As far as the entire encryption world is concerned, this crisis, which can be called the "Lehman moment" of encryption, has also spawned a series of secondary disasters. Let's take stock of those related projects that have been seriously affected outside of Terra.

Stablecoins Suffer Confidence Shock

Against the backdrop of bear voices being faintly heard, UST’s thunderstorm also brought the market’s confidence in stablecoins almost to a freezing point, and stablecoins seemed no longer stable.

Centralized stable currency such as USDT

Beginning on May 11, USDT, which has been hearing thunderstorms for several years, was the first to face the impact of decoupling:

From May 11 to noon on May 12, the price of USDT broke away from the $1 peg, reaching a low of $0.9565, before recovering within 36 hours, eventually recovering to $0.998.

During this period, other major stablecoins USDC, BUSD and DAI experienced a premium of 1% to 2%, while Tether announced that it was still open for redemption on May 12, when the decoupling pressure was at its worst, and a redemption worth $2 billion Already in progress, alleviating market concerns.

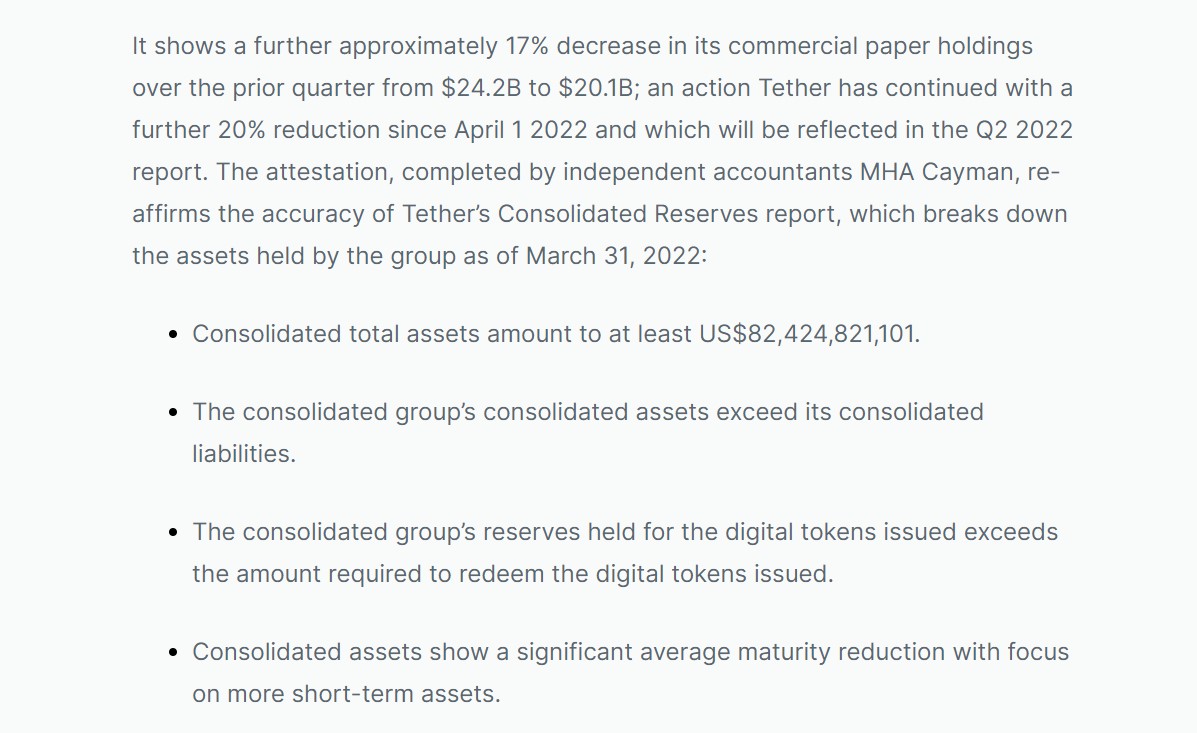

Then on May 19, Tether released its first-quarter audit report. As of March 31, 2022, Tether's comprehensive total assets are at least more than 82.4 billion US dollars, and comprehensive assets exceed comprehensive liabilities, further stabilizing market confidence.

However, the total circulating supply of USDT has dropped by US$10 billion in the past 14 days. According to CoinGecko data, the total circulating supply of USDT was US$73.3 billion and USDC was US$53.2 billion at the time of publication.

Decentralized stablecoins such as USDX

On May 13, Kava Network's native decentralized stablecoin USDX was unanchored, and the price once plummeted to as low as $0.55. The main reason is that part of the collateral of USDX is UST, and it is also a blockchain network of the Cosmos ecosystem. Kava There are also risks in the application of Terra asset mortgages such as UST.

Then on May 14th, Kava decided to remove all Terra risk assets from the agreement, and all UST was also removed from Kava.

But as of the time of writing, according to CoinGecko data, USDX is about $0.83, and has not yet fully recovered its anchor.

The Curve ecosystem is in crisis

Curve locks up $8 billion

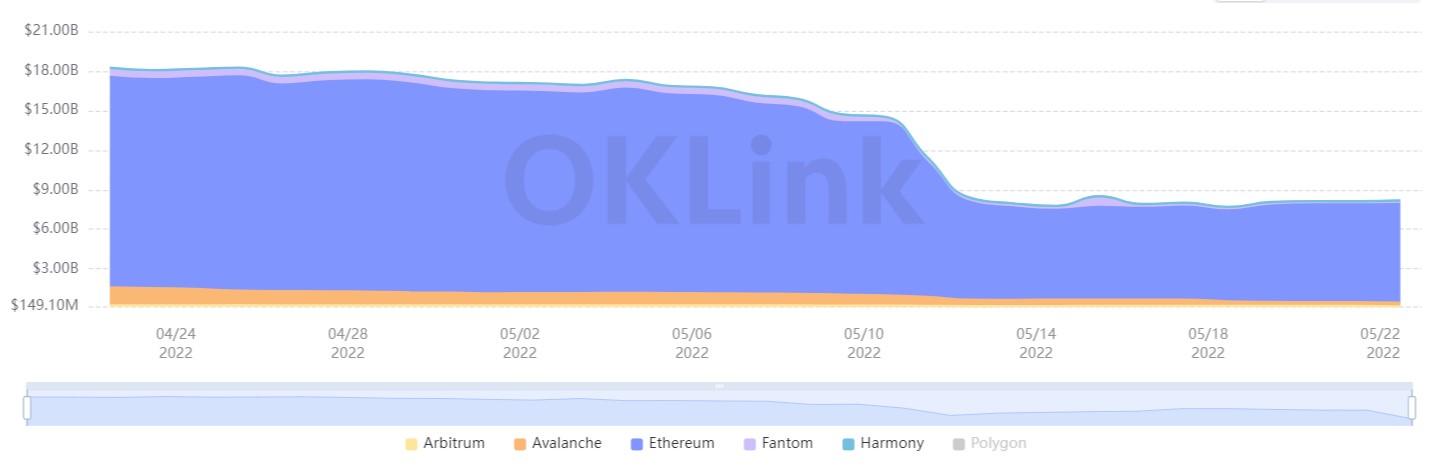

According to the data of Okey Cloud Chain Master, since May 8, the total lock-up volume of Curve's entire network has dropped sharply from 17 billion US dollars to 8.4 billion US dollars within half a month, a drop of more than 8 billion US dollars, a drop of more than 50%.

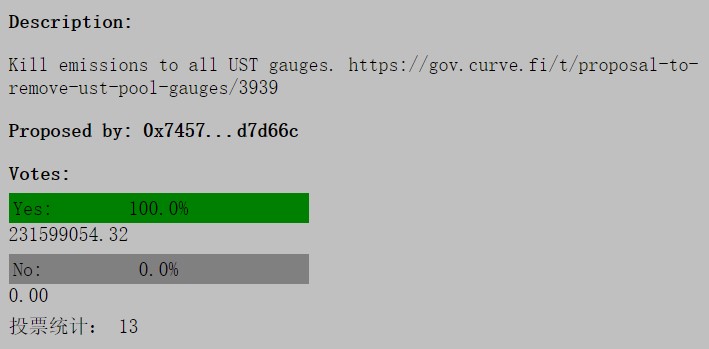

In addition, the Curve community issued a proposal vote, suggesting that the UST pool be removed from Gauges and no longer provide liquidity incentives to it. This is to prevent high slippage when adding liquidity and the uneven distribution of some users through the liquidity pool profit etc.

At the time of writing, the vote was 100% in favor.

ETH/stETH pool continues to tilt

A fire broke out at the gate of the city, which affected the fish in the pond. Following the deviation of the USDT Curve pool, in the context of market turmoil, the ETH/stETH exchange ratio also deviated from its 1:1 peg and gradually increased. ETH2 users on the chain actively exchanged back to ETH. As of the time of publication, the stETH flow in the ETH/stETH pool Sex accounted for 71%.

On May 13, Lido Finance announced that it will deploy a new stETH/WETH liquidity pool to improve the link between the two, and provide 1 million LDO rewards. It is recommended that the deposit ratio of stETH and WETH in the new pool be 13:1.

DeFi protocol losses such as "oracle machine attack"

When the market prices of LUNA and others were fierce, some users arbitraged against oracle machine loopholes such as untimely price feeds, resulting in heavy losses for a number of DeFi protocols such as lending and DEX.

Venus loses $14.2 million

At around 09:20 on May 12, Chainlink’s price feedback for LUNA reached the price floor and was suspended by it at a price of $0.107, while Venus’ LUNA market continued to operate, but the spot price continued to fall, and 4 hours later the spot price was about At $0.01 the team finds a problem and suspends the protocol.

However, some users here have borrowed through "oracle attack", resulting in a shortfall of about 14.2 million U.S. dollars in capital losses, and then the Venus Venture Fund, which has a balance of 15 million U.S. dollars, plans to make up for all the gaps. In addition, Venus also negotiated with the BNB Accelerator Fund. Provide Venus with an instant loan to cover liquidity (if required due to any shortage).

Drift Protocol loses $10.4 million

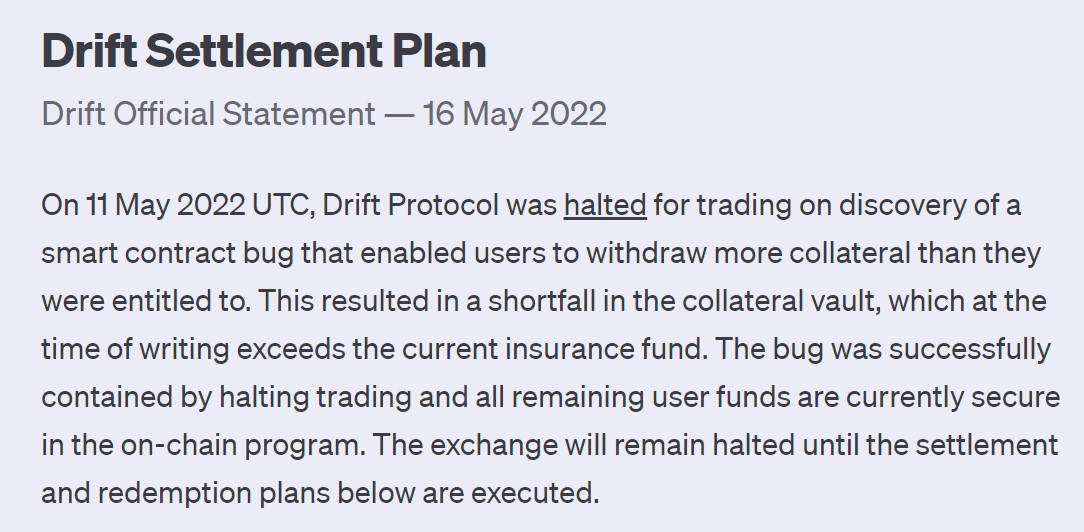

On May 12, affected by the sharp fluctuations in the price of LUNA, users of Drift Protocol, the Solana ecological perpetual contract agreement, were able to withdraw more collateral than they were entitled to from the collateral pool and vault, resulting in a loss of 10.4 million US dollars, The agreement was then terminated to avoid further losses.

On May 17th, Drift Protocol announced the settlement and redemption plan. It plans to settle all previous open positions at 19:37 UTC time on May 12th (trading suspension time) before the protocol is re-launched. The settlement method is based on The treatment of unrealized gains and losses on the user's account balance and open positions determines the total amount of collateral that the user can redeem.

InsurAce pays $15 million claim

In addition to the "oracle machine attack", the insurance agreement that previously supported anchoring insurance for UST is also facing claims. On May 14, the DeFi insurance protocol InsurAce released the UST decoupling report and launched the user claim procedure. Insurance holders who meet the corresponding standards are eligible to file a claim:

Hold UST or any UST liquidity derivative token (such as aUST) in their wallet or account with any custody service (such as CEX, asset management provider, etc.) when purchasing the policy;

Hold an active UST De-peg policy at the time the decoupling event is triggered;

Hold UST or any UST liquidity derivative token (such as aUST) when the decoupling event is triggered;

It is estimated that InsurAce is expected to pay approximately $15 million for this claimable event.

Stablegains loses $42 million in client funds

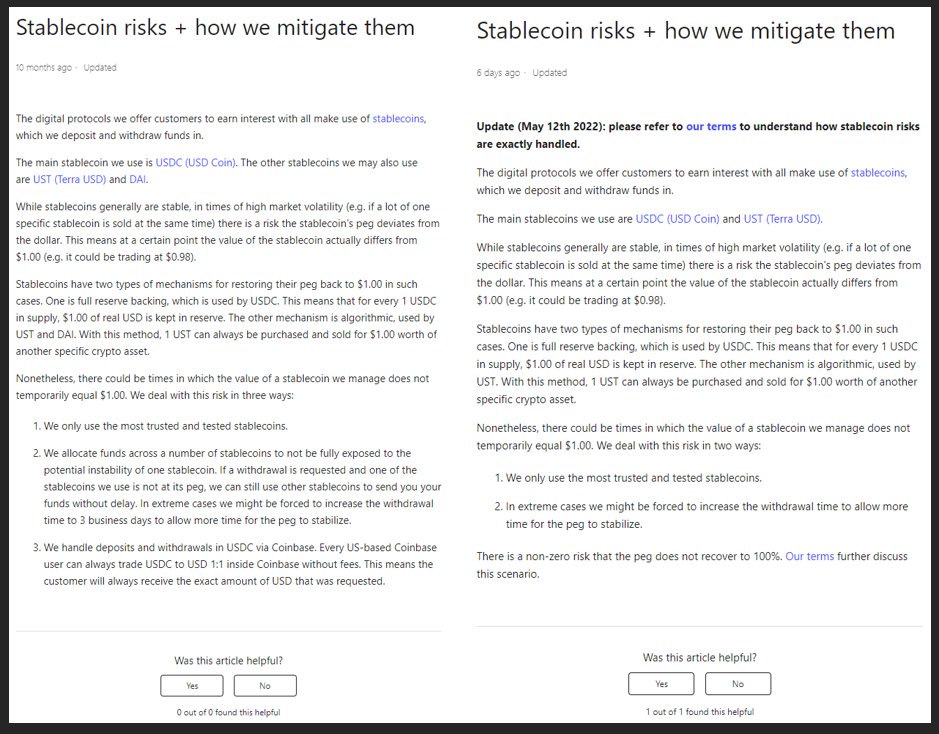

On May 19, some netizens broke the news that the income agreement Stablegains invested customers' USDC and USD into Anchor without prior disclosure, and lost 4,878 customers with a total of about 42 million US dollars in funds, and may not be able to repay.

Stablegains has changed the denomination in its app from USD to UST and also changed its terms and conditions. According to screenshots, law firm Erickson Kramer Osborne has sent a letter to Stablegains on behalf of its clients.

Investment institutions suffer heavy losses

Among the investment institutions participating in the Terra ecology, there is no shortage of top escapers like Pantera Capital who "turned an investment of 1.7 million into a profit of 170 million U.S. dollars", but there are also a considerable number of investment institutions that "profit and loss come from the same source", and all gains and losses are returned to one place.

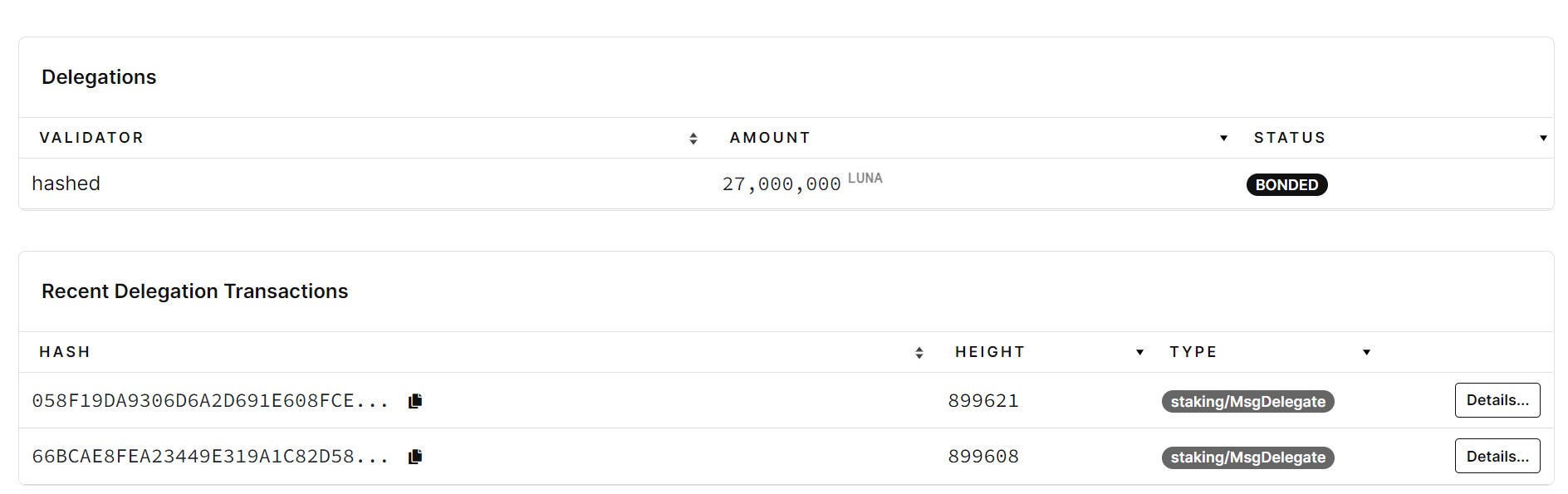

Hashed may lose more than $5 billion

According to CoinDesk, the South Korean venture capital firm Hashed said after the LUNA crash that the company’s financial situation was good, but according to data on the chain, the company pledged more than 27 million LUNAs on the Columbus 3 main network and 100 million LUNAs on the Columbus 4 main network. 9.7 million LUNAs, and 13.2 million LUNAs are pledged on the current Columbus 5 mainnet.

Using price data prior to UST unanchoring, Hashed's losses totaled more than $5 billion.

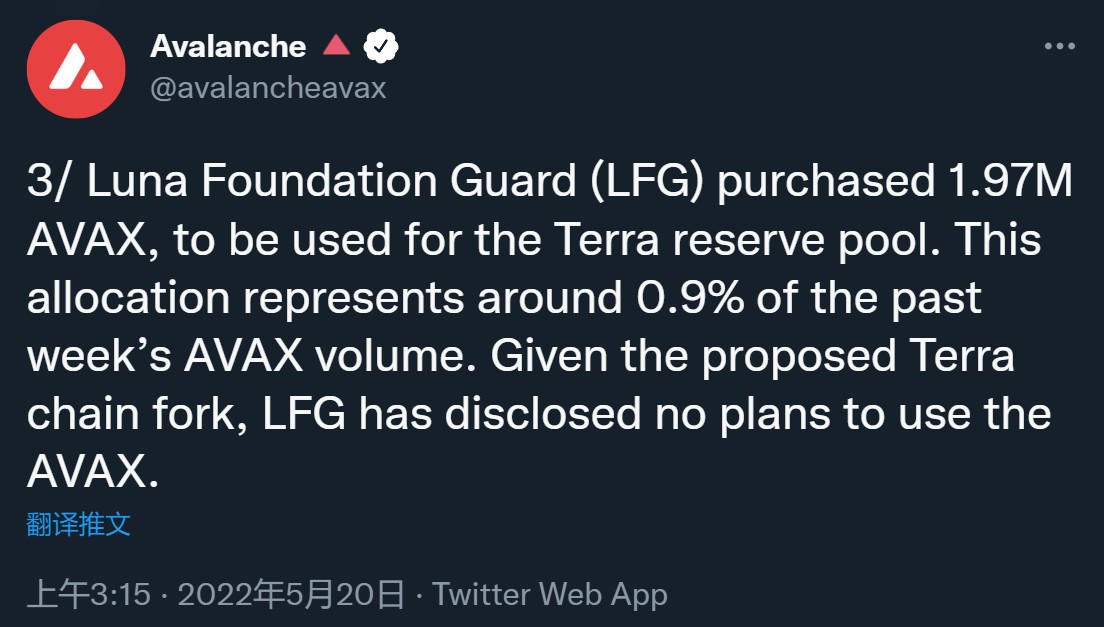

Avalanche loses about $60 million

On May 22, Emin Gün Sirer, CEO of Ava Labs and founder of Avalanche, revealed in an interview with Forbes that Avalanche lost a total of about $60 million in the UST crash.

Before the Avalanche Foundation and Terraform Labs reached a cooperation, Luna Foundation Guard (LFG) purchased AVAX worth 100 million US dollars (1.09 million AVAX) to increase its UST reserves, part of which AVAX was "paid" in UST and LUNA.

Jump Crypto may lose hundreds of millions of dollars

On May 16, Igor Igamberdiev, director of data research at The Block, said that Jump Crypto had previously attempted to stabilize the peg between UST and the U.S. dollar, and added more than $682.5 million in other U.S. dollar stablecoin liquidity to the liquidity pool on Curve. The currency has withdrawn the liquidity of nearly 600 million UST.

Afterwards, Jump Crypto began to mint UST into LUNA for arbitrage from around 6:00 on May 10th, Beijing time. On May 12th, Jump Crypto completed the transaction on the Terra chain, minting 640 million USTs into 221 million LUNAs and commissioned to 5 validators.

But even though the capital used by Jump Crypto was approximately equal to the size of the entire UST pool, it still failed to prevent its decline, and lost at least hundreds of millions of dollars in this incident.

Delphi-related investments have "completely lost"

《The Terra ecology of building ups and downs, Delphi Digital's "Terra gamble" reflection"In the article, Delphi stated that he participated in LFG financing in February 2022, Delphi Ventures invested 10 million US dollars, and did not sell any LUNA during the Terra crisis; according to the current LUNA price, this fund has been completely lost.

In addition, Delphi Ventures purchased a small amount of LUNA tokens (accounting for 0.5% of the net asset value) in the secondary market in the first quarter of 2021; Accounting for about 13% of Delphi Ventures' net assets, these assets are currently in a state of huge floating losses.

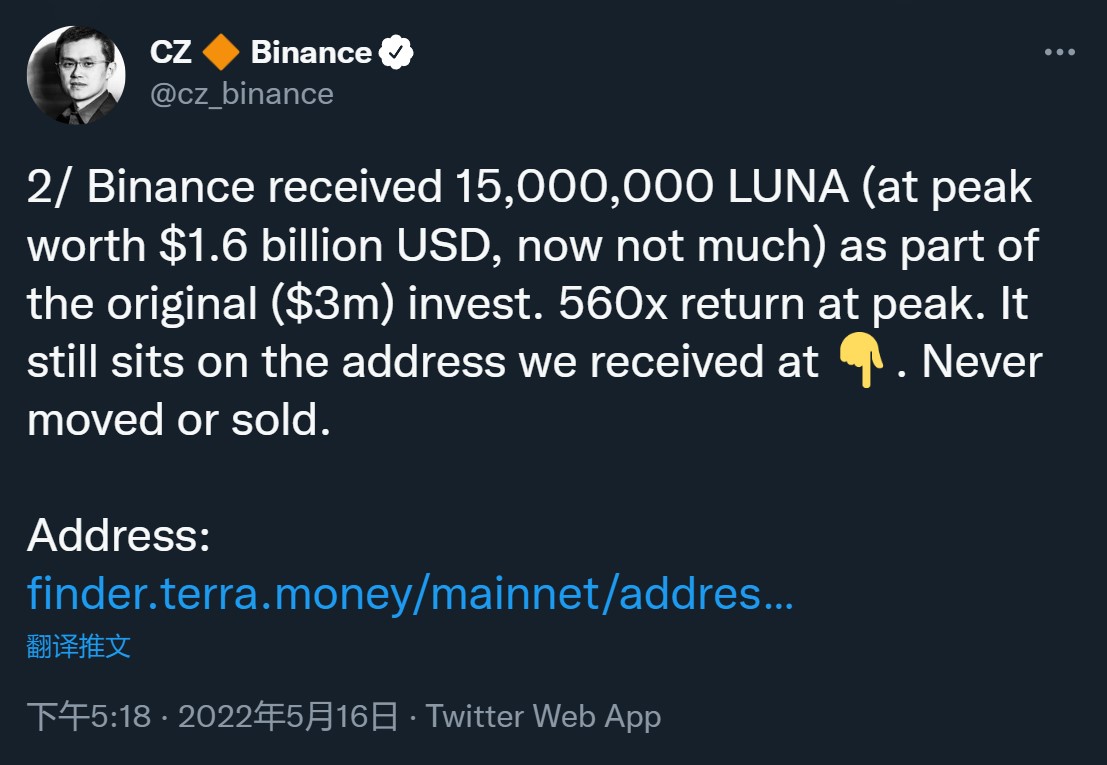

Binance's $1.6 billion investment returns to zero

On May 16, Binance founder Zhao Changpeng stated that Binance Labs only invested $3 million in Terra in 2018 and did not participate in subsequent financing. UST appeared after Binance Labs invested, so Binance does not hold UST.

Binance received a return of 15 million LUNA from its $3 million investment in Terra, and also obtained 12 million UST through pledge, with a peak value of $1.6 billion, but never moved or sold the above assets.

No matter how the follow-up reconstruction process of Terra proceeds, UST and LUNA are destined to become historical terms in the encryption industry, and both the Terra ecology and the encryption industry have endured an unprecedented round of confidence and systematic tests.

When the giant whale falls, all things live. BNB Chain and Polygon have also extended olive branches to the builders and funds of the Terra ecology, "As the legacy of the Terra ecology, how to provide a new wave of seed players and possibilities for the industry", perhaps after the secondary disaster of this round of crisis , one of the biggest industry propositions we face.