A comprehensive analysis of the current status and future prospects of the DeFi mortgage lending ecosystem

Original Author: Jack & 0xlol

first level titleJackand0xlol。

Memo on low-collateralized lending in DeFi

Humans have been involved in lending and borrowing since ancient times. The earliest examples date back to 2000 BC in Mesopotamia, when farmers borrowed seeds and animals to create agricultural yields. This social dynamic creates more complex issues of trust and risk, but it is undeniable that it also provides a qualitative leap in economic growth. Those with wealth found a new mechanism to earn yield on their assets, while those without wealth gained the ability to borrow money, generating their own wealth. This method seems simple, but it is really a stroke of magic!

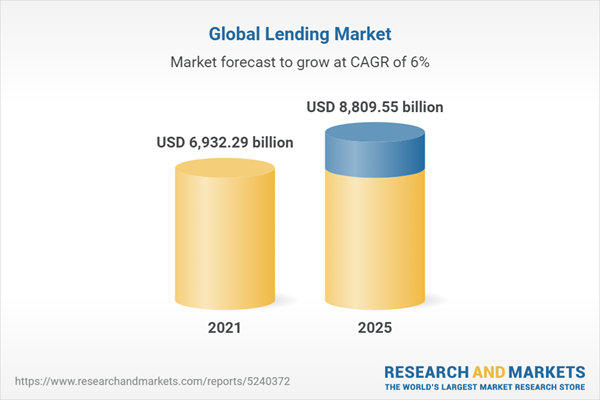

A cornerstone of entrepreneurship and creativity, leverage allows individuals to take risks in developing new products and services. In fact, based on the interest income of all private and public institutions, the modern global lending market is currently worth between $7-8 trillion (not including the value of outstanding loans).

Forecasts for the global lending market. Source: Research & Markets

The value of the global lending market in 2021 and an estimate to 2025 based on a CAGR of 6%. 2021: USD 6,932.29 billion, 2025: USD 8,809.5 billion.

image description

Source: Statista

The histogram shows the forecasted value of Global Peer-to-Peer Lending from 2021 to 2025. 2012: $1.2 billion, 2013: $3.5 billion, 2014: $9 billion, 2015: $64 billion, 2025: $1 trillion

first level title

TradFi or DeFi?

While traditional financial (TradFi) systems have rich credit scores, KYC (know your customer) documentation, and legal protections for recovering funds, they have various problems. For example, even with laws preventing racial discrimination in the lending process, a 2019 study of 2 million U.S. traditional mortgage loan applications found that black applicants were less likely to apply than economically comparable white applicants. Loans are 80% more likely to be rejected, mostly due to biased algorithms (Forbes). DeFi presents an opportunity in some cases to reduce identity-based discrimination in the lending market by relying entirely on smart contracts and on-chain identities.

The problems in the lending market don't stop there. Putting your money in a traditional bank means you have no custody of your assets. There are already numerous examples of governments and banks using these assets to bail out 'friendly crooks'. After the mortgage crisis of 2008, some major banks were bailed out by the US government, ultimately passing the burden on to taxpayers.

The DeFi lending market presents an era of new possibilities where only those who choose to deposit liquidity into the protocol can be held accountable for poor management of funds, rather than big government pushing the tax burden on those who never participated in bad business practices People, such as those selling subprime loans. DeFi presents a new opportunity for liquidity providers (LPs) and protocol token holders to participate in governance. In TradFi, if you keep your money in the bank, you earn single-digit annual interest, and you have no say in who the bank lends or borrows from. But DeFi lets lenders have a say in who they lend their money to, a true form of financial sovereignty!

secondary title

The beginnings of DeFi lending

Decentralized lending starts with the simplest form: over-collateralized lending. Many popular platforms such as AAVE, Compound, and Maker play this role, with users depositing their crypto holdings as collateral to borrow an amount below the value of their deposit. Taking DAI on AAVE as an example, its maximum loan-to-value (LTV) ratio is 77%, which means that for every $100 deposited on DAI, users can borrow up to $77 in assets.

Low-collateralized loans, on the other hand, can be partially secured or completely unsecured. In a partially-collateralized lending system, an individual deposits $25 and borrows $100 worth of assets, while in an unsecured lending system, an individual can borrow $100 with no collateral at all. Under-collateralized loans are also known as unsecured loans, while over-collateralized loans are often referred to as secured loans.

At the time of writing, the total value locked (TVL) of the entire DeFi market is about $174 billion, and the lending money market encapsulates a TVL of $36 billion. However, less than 5% of that $50 billion came from the Uniform Lending Agreement. We analyze the fundamental and technical aspects of seven such agreements. The risk assessment module and lending mechanism are among the few differentiating factors. Also, it should be noted that in this post we do not consider flash loans (aka "single block liquidity") as low-collateralized lending.

Before diving into the details, let's first try to understand the different purposes of these protocols:

Maple Finance, TrueFi, and Clearpool: Low-collateral lending protocols for institutional borrowers.

DebtDAO: A revolving line of credit (for future revenue) for growth-stage DAOs and protocols. Provides a new way for DAOs and protocols to raise funds without diluting or releasing native tokens.

Goldfinch Finance: Provides real-world businesses with low-collateralized loans in exchange for fiat currency.

Gearbox: Offers 0% funding rate and up to 4x leverage for protocols on the whitelist.

secondary title

Risk Assessment Method

Clearly, risk is our primary concern when dealing with under-collateralized lending in an anonymous and trustless financial space. No one wants to lend money to a random Twitter Anonymous in the hope of getting paid back from them, rather than letting them spend and splurge with a wad of cash. So what actually stops someone from stealing all the borrowed funds in real life instead of on-chain? Well, it is very likely that banks and other lending institutions know of your whereabouts, they can affect your credit score and can cause a lot of social and financial trouble for the dishonest person.

image description

Analysis of different risk assessment methods

A comparative analysis of different risk assessment methods used in lending agreements under collateral. These methods include: pool delegation, community voting, third-party risk assessment, and smart contracts.

secondary title

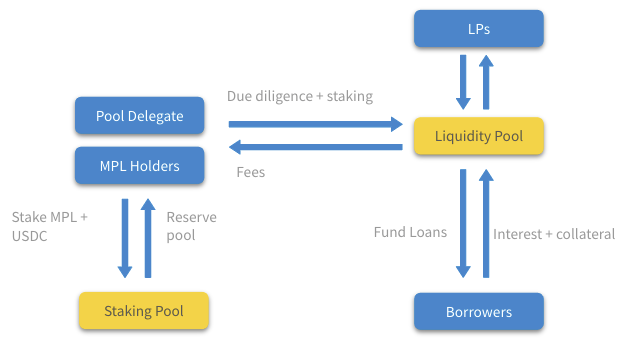

Pool delegation: Maple Finance, DebtDAO (not released yet)

Maple Finance and DebtDAO rely on professional credit analysts who evaluate and approve lending as collateral with their native governance tokens ($MPL and $DEBT). However, Maple Finance allows pool principals to negotiate lending terms with borrowers, such as interest rates, maturity dates, and collateral ratios. DebtDAO risk analysts simply approve or deny lending requests given to them, the process is non-negotiable. These pool delegators are rewarded for their work, and they earn a portion of the interest from borrowers.

The Engine of Maple Finance

Maple Finance's credit approval system, which relies on pool principals staking MPL to approve borrowers' loan requests.

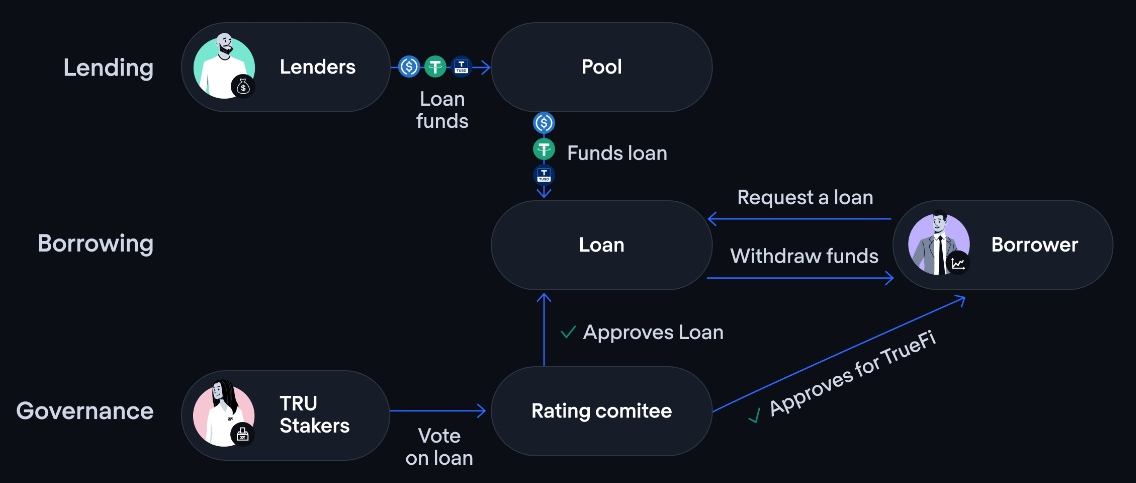

Community Vote: TrueFi

Likewise, TrueFi needs to stake its native token $TRU in order to approve lending requests, but instead of relying on a pool of delegators to fulfill this role, it distributes the risk assessment across all stakers. Each loan request requires at least an 80% approval rate to open a deposit in the lending pool. Like DebtDAO, the community simply votes for or against lending proposals. The terms are proposed by the borrower and there is no negotiation stage throughout the process. 10% of the interest generated by the protocol will be paid to stakers of $stkTRU as a reward for approving the obligation to borrow.

TrueFi's Engine

TrueFi’s credit approval system, which relies on community-managed voting by Tru stakers to approve borrower requests.

Third party external organizations: Clearpool, Goldfinch

Clearpool Finance requires institutions on the whitelist to pledge at least $500,000 in CPOOl to be eligible for credit evaluation. This sets the protocol apart by requiring institutions to stake governance tokens instead of using credit risk analysts. It takes the amount pledged as a sign of good faith by the institution that outsourcing credit analysis to a third-party partner, X-Margin, is worthwhile. When the pledge is approved, the institution’s lending pool is ready to accept funds.

Goldfinch also requires companies to pledge their native token $GFI, but not strictly a nominal amount, but must pledge $GFI equivalent to 2 times the audit fee. Goldfinch then outsources credit checks for financial statements and legality of identity to its third-party partners: Persona or Parallel Markets. If the whole process goes well, each business will receive a unique identity (UID) non-transferable NFT that links to its designated wallet to avoid Sybil attacks. After whitelist approval, borrowers must meet the 20% threshold in the first-loss capital pool. Then, 6 of 9 randomly selected auditors (individuals who hold GFI dollars for auditor voting rights) need to approve the loan in order for the borrower to receive funds.

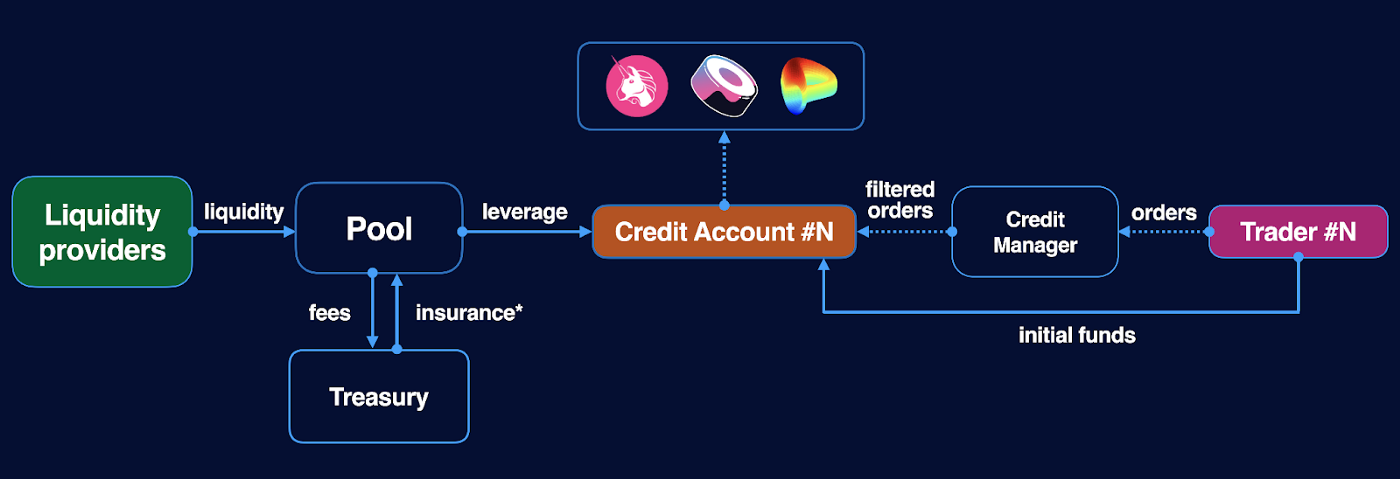

Predetermined Smart Contracts: Gearbox

Gearbox is a completely permissionless protocol relying on its credit account. They are pre-programmed smart contracts for each pool type, binding lenders and borrowers together, curated by what are known as credit managers. Its credit accounts hold both collateral deposited by users and funds borrowed. Borrowed funds can only be used on whitelisted protocols and/or exchanged for specially allowed tokens to avoid extreme volatility. Since the funds deposited by users can be liquidated by smart contracts at a determined level of risk, the protocol does not require credit evaluation of users.

The Engine of the Gearbox Protocol

Credit accounts on the Gearbox protocol, as pre-determined smart contracts, allow borrowers to borrow and lend permissionlessly.

While Gearbox may seem like an interesting protocol, it's not really a form of low-collateral lending that enables lending for everyday activities like auto lending and mortgage lending that TradFi is currently killing.

Off-chain integration: Teller

Teller has its own category because it is not the same as other lending protocols. Teller creates stand-alone products for specific use cases, and once a proposed borrower passes Teller's proprietary credit risk algorithm, it becomes a marketplace platform connecting borrowers and lenders. In fact, USDC.homes on Polygon rely on Teller's credit assessment before funding loans from TrueFi. Teller's algorithmic credit risk protocol privately and securely computes credit and banking data off-chain, generates personal loan terms for users, and routes them on-chain. Its inputs include the collateral provided, the risk premium, the loan and bank balance, the loan and monthly net income, and the loan and monthly income.

First Loss Capital (First-Loss Capital)

While the risk assessment model provides an initial wall of protection for borrowers in low-collateralization lending agreements, the "first line of defense" system provides liquidity providers with Provides additional protection against loan defaults.

Stakers as First Losses: Maple Finance, TrueFi, Goldfinch

Maple Finance requires pool principals to pledge 8-12% of the pool loan balance in MPL and USDC at a one-to-one ratio. In this way, the protocol aligns the incentives of pool delegators with liquidity providers. In addition, in the event of default, these funds can be easily liquidated in the name of USDC. Anyone other than pool delegators can join the reserve pool, further strengthening the protocol's first line of defense to earn 1/10 of the pool's interest fees and $MPL reward share. Likewise, Goldfinch relies on assessing the borrower's backers as a first line of defense. Supporters deposit their funds in the "junior pool" to obtain higher nominal interest rates, because they can receive 20% interest through ordinary liquidity providers in the "advanced pool" to take on additional risks.

TrueFi relies on participants who pledge $stkTRU to obtain voting rights, the issuance of $TRU, and protocol fees as the first line of defense. In the event of a default, up to 10% of $stkTRU may be liquidated to repay the loan. Importantly, there is a cooldown period for staking $stkTRU, meaning it cannot be withdrawn immediately and users must wait until the cooldown period is over.

Goldfinch has a premium pool and a junior pool.

Insurance pool as first loss: Clearpool

In each block, if the borrower defaults, a certain percentage of equity in each pool will be transferred to the insurance pool as a claim pool for liquidity providers. The current governance vote sets this at 5% of the interest earned by the pool.

Spigot Function: DebtDAO

image description

Analysis of Various First Loss Capital Methods

Comparison chart showing the pros and cons of the three main first loss capital methods implemented by mortgage lending protocols; Pledge, Insurance Pool, and Spigot Funciton. The evaluation is based on whether the method aligns with the incentives of liquidity providers, allows instant repayment, provides the possibility of getting back 100% of the investment forever, and whether the method is automatically executed by smart contracts.

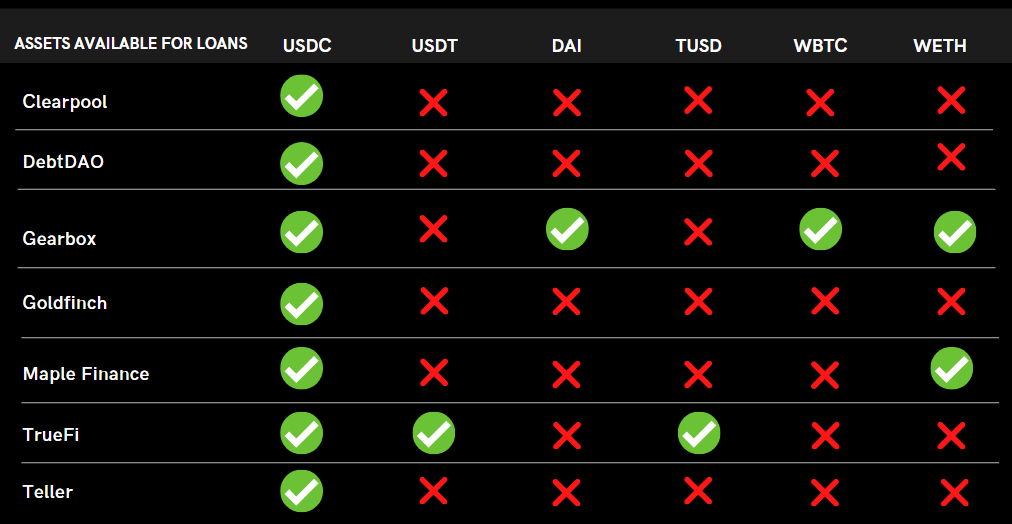

Types of Tokens Available for Lending and Pool Risk

In addition to risk assessment methods, the type of tokens offered for lending is an important factor in differentiating low-collateral lending protocols. While individuals can use UniSwap to swap borrowed assets for preferred assets not offered by the lending protocol, users may wish to avoid exposure to slippage, transaction fees, and increased smart contract risk. Given that USDC is considered the safest stablecoin in the DeFi ecosystem, each of the aforementioned protocols offers the popular and reliable USDC. TrueFi offers USDT, BUSD, and TUSD in addition to USDC, while Maple offers USDC and WETH. Gearbox has the most variety, offering DAI, USDC, WETH, and WBTC for lending and lending due to their ability to limit funds to whitelisted protocols only.

Analysis of different assets that can be used as loans on different protocols

The comparison chart shows the available assets for lending provided by the lending agreement under collateralization. Available assets include: USDC, USDT, TUSD, WBTC and WETH.

Another additional feature of the low-collateralization lending protocol is to provide multiple lending pools for the same asset. A huge advantage of having multiple pools for the same asset is the ability to provide liquidity providers with pools with different levels of risk. Maple Finance, Clearpool, and Goldfinch offer multiple pools per asset type based on named borrowers, while TrueFi, DebtDAO, and Gearbox offer only one pool per asset type. For example, on Maple Finance, users can deposit USDC into the Maven 11 Capital pool with an 11.3% annual interest rate, or the Alameda Research pool with an annual interest rate of 10.5%, the difference in annual interest rate is due to the estimated risk difference determined for each institution Caused.

Potential limitations of low-collateralized lending in DeFi

While all of these protocols are exciting and driving the DeFi space as a whole, it’s worth discussing some potential downsides to the status quo of low-collateralized lending here. Most importantly, scalability is a core tenet of the growth potential of such lending platforms. While the pool manager concept works well for protocols like Maple Finance, these protocols only succeed because they are limited to institutional borrowers. If these protocols plan to scale up to allow the general public to participate, the bandwidth required by pool delegators will be far greater than the time available to them to vet and evaluate borrowers. TrueFi has a similar scalability issue, the protocol requires every lending request to be voted by $TRUE stakers, and if it was limited to institutional investors, it wouldn't have to worry about that. While both protocols lack the potential for massive scaling, Maple's approach of using pool delegators is superior to TrueFi's community voting mechanism simply because it allows for more educated decision-making. In reality, community voters with distributed responsibility don't pay the same attention to detail as one person responsible for a pool.

On-chain 'algorithm-determined' credit scoring would be easier to scale to the masses if it could get rid of institutional borrowers, but currently it is relatively weak to scale due to limited availability of on-chain data. Additionally, on-chain credit scoring can be vulnerable to Sybil attacks if it cannot be tied to a single real-world identity. In the context of low-collateralized lending on the chain, a random individual can slowly build up good credit through an account in order to eventually obtain a large loan without a repayment plan. They can flush and repeat the process through multiple wallet addresses. One way to avoid this is to link a wallet to a person by implementing KYC requirements. However, for security and personal reasons, an individual often has multiple wallets in which his assets are distributed, so the concept of "KYC connected to a single wallet" is somewhat limiting and inefficient.

Also, individuals may not want their KYC details kept on-chain (even if the information is encrypted) for privacy reasons. Following this line of thinking, off-chain credit scoring based on traditional finance not only goes against the spirit of DeFi, but also introduces the risk of keeping KYC documents and personal information in a risky off-chain system.

an optimistic future

image description

Total borrowing from various low-collateralization lending agreements

The histogram shows each protocol's share of the overall DeFi mortgage lending market, based on total lending originations as of April 5, 2022. TrueFi: $1.4B, Maple Finance: $1.26B, Goldfinch: $115M, Clearpool: $41.7M, Gearbox: $6M

Clearpool faces an uphill battle against the two aforementioned protocols, but the protocol may see some growth by offering variable rates instead of the fixed rates of Maple and TrueFi.

image description

Currency price performance of various on-chain mortgage lending agreements, source: Delphi Digital

As DeFi continues to proliferate into the mainstream, the integration of on-chain credit scoring with KYC requirements or Teller’s off-chain credit scoring for retail investors will drive the migration of personal lending from off-chain rigged ecosystems to fair on-chain protocols. The off-chain credit consolidation system is relatively scalable, and existing institutions seem open to it, as Teller has had strong partnerships so far. We expect to see people accepting loans on-chain in 1-2 years without even realizing Teller is the backend infrastructure.

Along with credit assessment, legal protections will also be key to building trust between lenders and borrowers. TrueFi currently has legal agreements with their institutional borrowers that grant them the right to enforce their loans and, if necessary, recover any liquidated damages. If this framework is applied to personal lending and signed on-chain through protocols such as EthSign, it can further boost confidence in retail low-collateralized lending.

While on-chain low-collateralization lending is still new, its rapid rise and current success has established a solid foundation in this space. It opens the door for similar protocols looking to enter DeFi. One can expect this concept to expand further to an untapped consumer base. Every innovation in this space brings us one step closer to DeFi disrupting TradFi. Maybe one day, the insurgents will storm the Bastille prison in Paris (a symbol of the absolute rule of the French monarchy over its subjects)!

The author of this article is a DeFi research analyst at Polygon.0xlolInterests include research on the attention economy, derivatives, and Ethereum scaling solutions. andJackThe interest lies in accelerating the adoption of DeFi and NFT in a sustainable way.