Will the fire at the UST city gate bring disaster to the stablecoin industry?

Today, the UST crash has basically come to an end. The flower of the algorithmic stable currency that used to be aloof in the past is now almost nothing. According to the latest data, the price of UST is only less than $0.100, while its parent chain Terra governance token LUNA is $0.000179, close to zero.

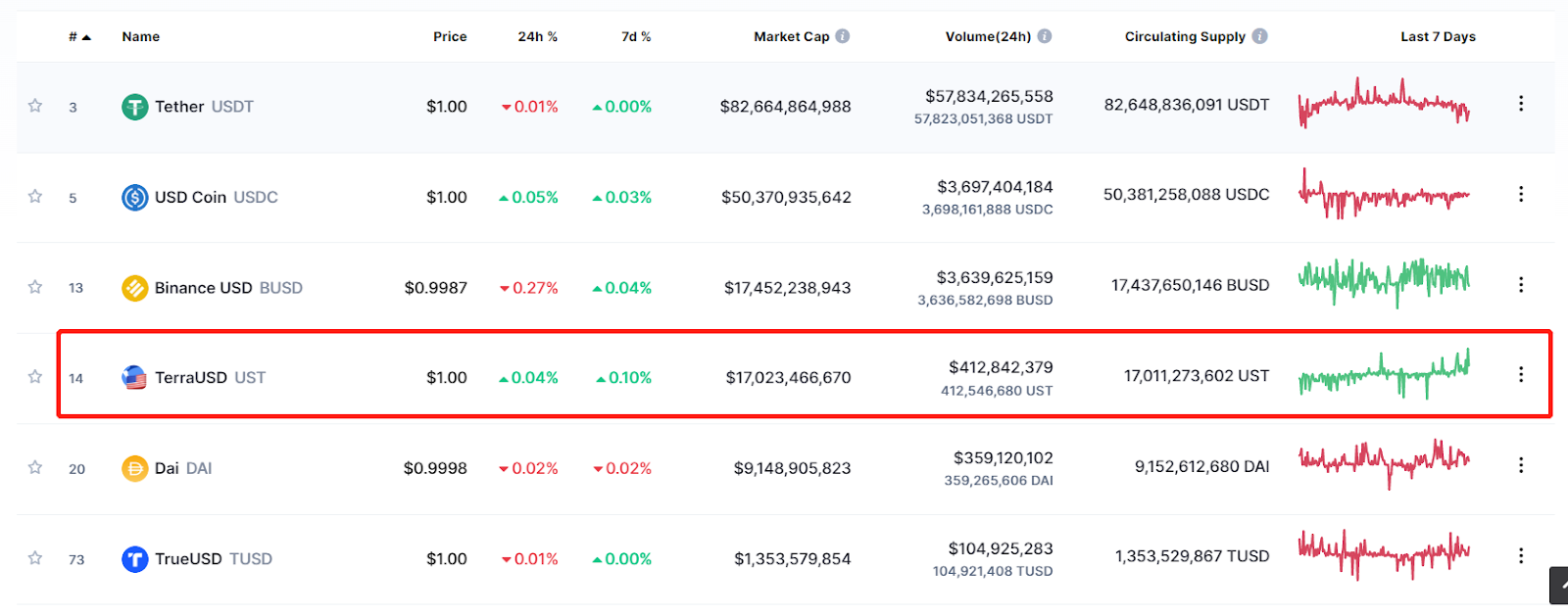

image description

secondary title

Broad Classification of Algorithmic Stablecoins

There are many currencies in the stablecoin market, and the more popular classification method is to divide stablecoins into three types. The first is the fiat-backed stablecoin, which guarantees the value of the stablecoin by anchoring a relatively stable fiat currency. The mainstream legal currency anchored here is the US dollar, as well as other legal currencies such as the euro, Japanese yen, and renminbi. The second category is over-collateralized stablecoins, which are mainly over-collateralized by using mainstream currencies such as BTC and ETH as underlying assets. The third category is algorithmic stablecoins that maintain value by binding a set of ecological algorithmic arbitrage mechanisms.

secondary title

Why Algorithmic Stablecoins Are Unstable

Before discussing this issue, we must first clarify the so-called "stability" of stablecoins. What is its source? Stability itself is a relative concept. As long as the fluctuation relative to the anchor object (or more appropriately called the frame of reference) exceeds a controllable interval, it can be called unstable. In other words, the source of stablecoin stability lies in whether the anchored object is a ready-made legal currency or a set of ecological environment in the encrypted world?

image description

(The tragic fall of LUNA is still shocking today)

secondary title

How to judge who is really stable?

So, how to judge whether a stablecoin is really stable?

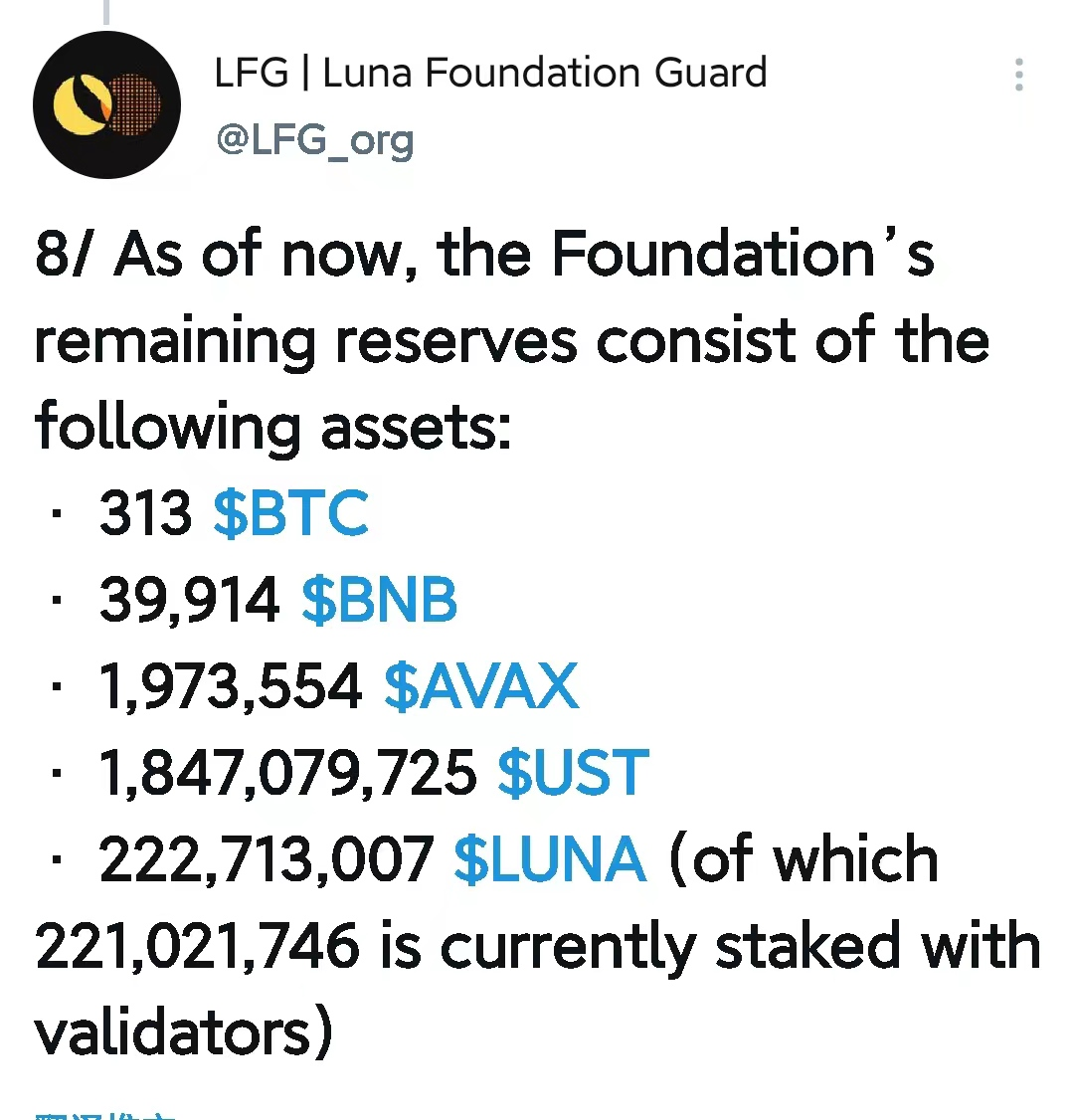

image description

(Data source: LFG official Twitter, release time: May 17, 2022)

And if it is a dollar-collateralized stablecoin, there is almost no doubt about the vitality of the dollar. For this type of stable currency, it is also important to consider the characteristics of security, transparency, and ease of use.

In terms of security, compared with UST, TUSD shows a strong degree of professionalism in the way of keeping US dollar reserves. When TUSD is purchased by users, the operation team will not touch any investment funds. This fundamentally eliminates the situation where a large amount of assets like UST is unknown. In addition, TUSD has become the world's first stablecoin to launch 24-hour real-time proof on the chain, which can ensure the realization of 100% US dollar reserves. In contrast, other similar stablecoins such as USDT have problems such as unknown reserves, and have been criticized by the market for this (of course it has improved now), while USDC only "guarantees" its own openness and transparency by issuing monthly audit reports. It is clear at a glance whether the credibility of the two is higher or lower when the audit is carried out.

Finally, based on the above discussion, we make two predictions: The first is that although the UST anchor drag event does not mean that the market will deny the value of Suan stable. In the future, Suanwen will still get the support of its fans anchoring the encryption ecology. The second is that the US dollar stable currency will be recognized by more investors in a long time. A stable currency with a complete audit mechanism like TUSD will undoubtedly meet the needs of the market more.