Understand a16z "2022 Encryption Industry Status Report" in 5 minutes

This article comes froma16zcrypto, by Daren Matsuoka, Eddy Lazzarin, Chris Dixon, Robert Hackett

Odaily Translator |

Odaily Translator |

In order to let everyone understand the main content of this report faster and more clearly, we have extracted five summary points, and you only need 5 minutes to fully understand what this report says. Next, let Mr. Odaily (ID: o-daily) take a look with everyone (there are easter eggs at the end of the article).

secondary title

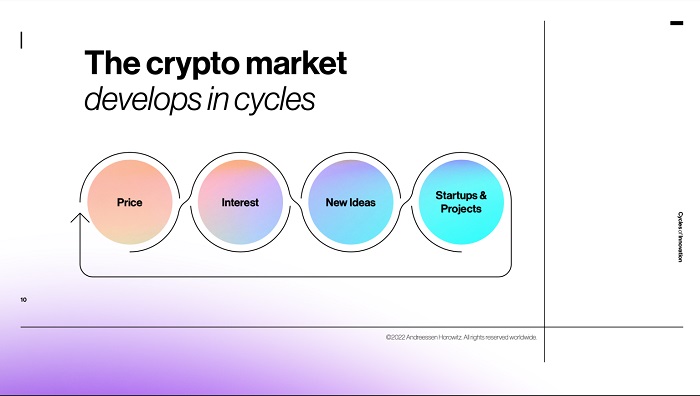

Key takeaway #1: We are in the middle of the fourth "price innovation" cycle

Any market is cyclical, and Crypto is no exception. The progress made by the BUIDLers during dark times will eventually reignite optimism in the market when the dust settles.The cryptocurrency market has been pretty sluggish lately, as we may now be entering the middle of a fourth “price-innovation” cycle. While price is often a lagging indicator of market performance, in cryptocurrencies it is a leading indicator.Price is the hook, and the numbers (often hikes and high yields) drive interest, which then drives ideas and activity, which in turn drives innovation.

You know, anyone who swore off technology and the internet after the dot-com bust in the early 2000s missed out on the best opportunities of the decade: cloud computing, social networking, online video streaming, smartphones, and more.

secondary title

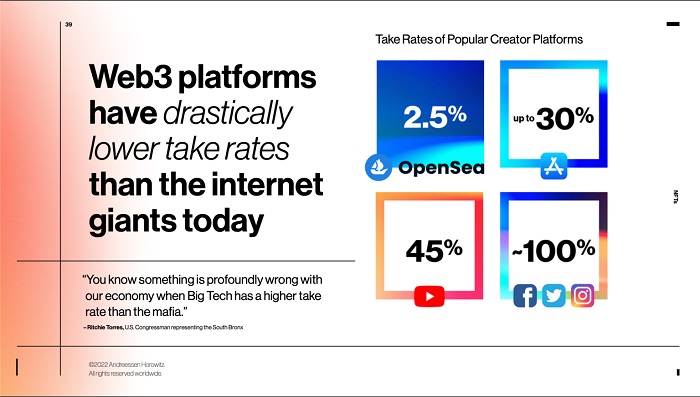

Key takeaway #2: Web3 is much better than Web2 for creators

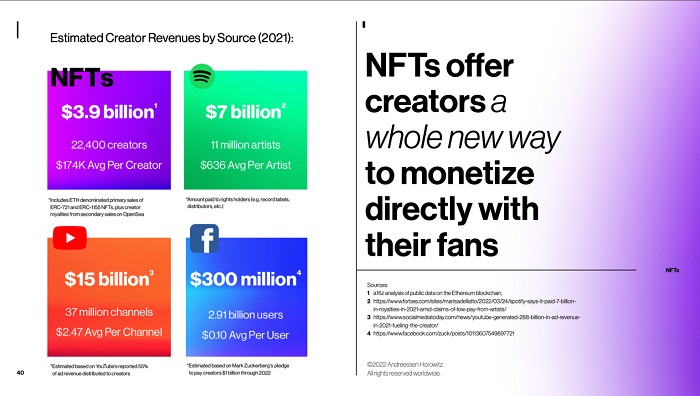

The acquisition rate of Web2 giants is high, and Web3 platforms offer fairer economic terms, for example, Meta has a user acceptance rate close to 100% on Facebook and Instagram, while NFT market OpenSea has this indicator of only 2.5%. But as U.S. Congressman Ritchie Torres said, "When the take-up rate of Big Tech is higher than that of the Mafia, you know there is something seriously wrong with our economy."

In 2021, based on the primary sales of Ethereum NFT, plus the royalties paid to creators by OpenSea secondary sales, creators will earn a total of 3.9 billion U.S. dollars, while Meta’s fee to designated creators is only 1 billion U.S. dollars. Only the former about a quarter of that.

In a word, Web3 may seem small but it is powerful.

secondary title

Key takeaway #3: Encryption is having real-world impact

The current state of the financial system has disappointed many, with more than 1.7 billion people unbanked according to the World Bank, and demand for decentralized finance (DeFi) and digital dollars (USD-based stablecoins) has exploded over the past few years. Increase.

On the other hand, cryptocurrencies are also addressing other broken markets such as:

Flowcarbon is improving the carbon credit market with a more transparent and traceable blockchain.

Helium is a "grassroots" wireless network that is challenging entrenched telecom giants.

Spruce empowers people to control their identities, rather than ceding that power to display intermediaries like Google and Meta that profit from people's information through data mining business models.

More than that, DAOs are demonstrating how strangers can economically coordinate and cooperate to achieve goals, and NFTs grant people virtual property rights over profile pictures, artwork, music, in-game items, access passes, virtual world land, and other digital goods. Token incentives enable newcomers to bypass the "cold start" problem and jump-start network effects.It is no exaggeration to say that we may have only scratched the surface of this field right now.

secondary title

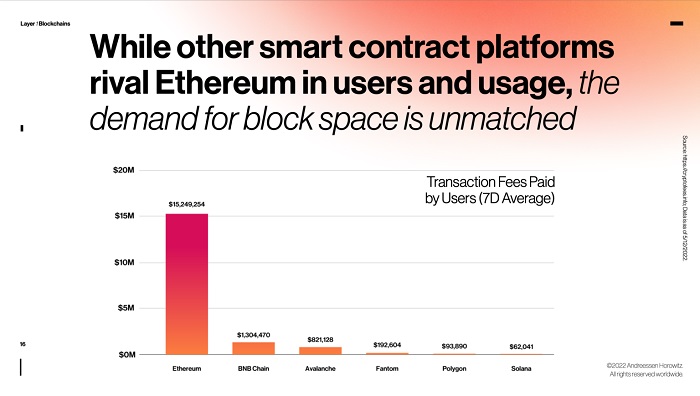

Key takeaway #4: Ethereum, the leader, is facing competition

Ethereum is dominating the Web3 conversation, but there are now many other blockchains making adjustments to it, such as Solana, Polygon, BNB Chain, Avalanche, and Fantom to name a few.

In terms of developer interest, Ethereum has the most developers with nearly 4,000 monthly active developers. This is followed by Solana (nearly 1,000) and Bitcoin (around 500).

Blockchain is a hot product of the new wave of computing, like personal computers and broadband in the 90s and 2000s, and mobile phones in the past decade. There is a lot of room for innovation, and I believe there will be multiple winners in the future.

secondary title

Key takeaway #5: We are still in the early days of the crypto industry

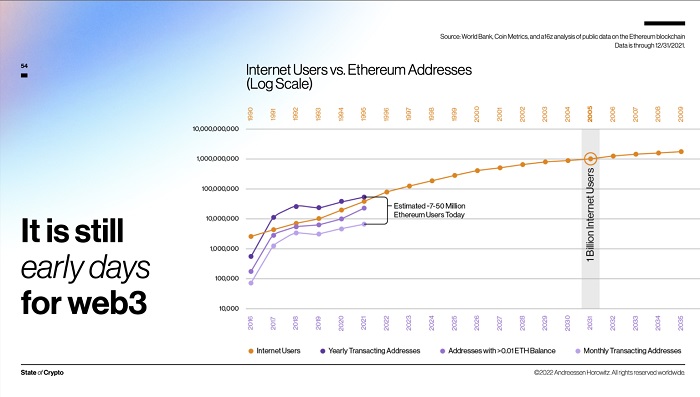

While it is difficult to know the exact number of Web3 users, it is possible to infer the size of the movement. Based on various on-chain metrics, it is estimated that there are currently between 7 million and 50 million active Ethereum users worldwide.

As far as the development stage is concerned, compared with the early commercial Internet, we are roughly equivalent to around 1995. By 2005, Internet users hit 1 billion—2005, by the way, is also when future giants like Facebook and YouTube began to take shape.

Likewise, if the trend lines continue as depicted, web3 could reach 1 billion users by 2031 (exact numbers are difficult to estimate).

That said, we are still in the early days of the crypto industry and there is still a lot of work to be done.

(Easter egg: If you want to study the full text of this report, please click hereLink。)