Bankless: Welcome to the market stage where fundamentals matter, how to seize opportunities?

Compilation of the original text: Dongxun

Original author:David Hoffman

Compilation of the original text: Dongxun

The collapse of the Terra ecosystem left a panicked aftermath across the industry.

The rapid destruction of capital on such a scale will leave visible scars for the next decade.

Don't make the algorithm stable。

As we assess the damage caused by this event, investor interest has shifted from high-growth assets to safe-haven assets.

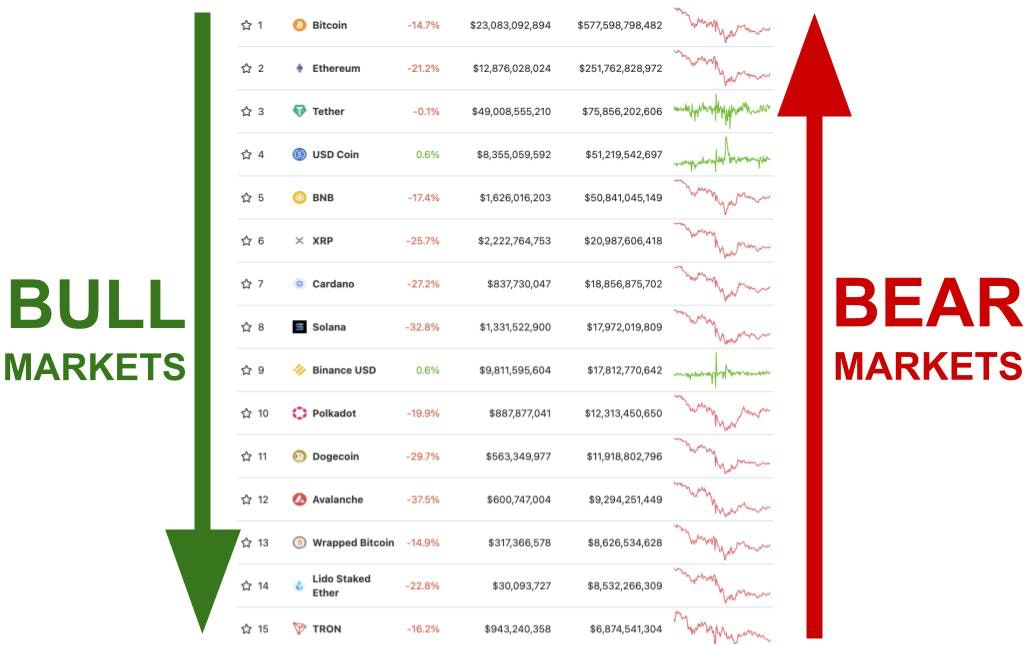

We can see changes within the cryptocurrency industry as people are fleeing in the direction of market capitalization, and we can see that in traditional markets, bonds are becoming attractive again.

The sharp decline in the market has forced investors to reassess their financial situation in order to prepare for a bear market. As the fundamentals of the market shift from pricing growth to pricing fundamentals, investments that once promised growth opportunities have become liabilities.

Markets will continue to shift into conservative long-term positions until the blow from the Fed's rate hikes is over.

Welcome to a market phase where fundamentals matter.

ETH and BTC

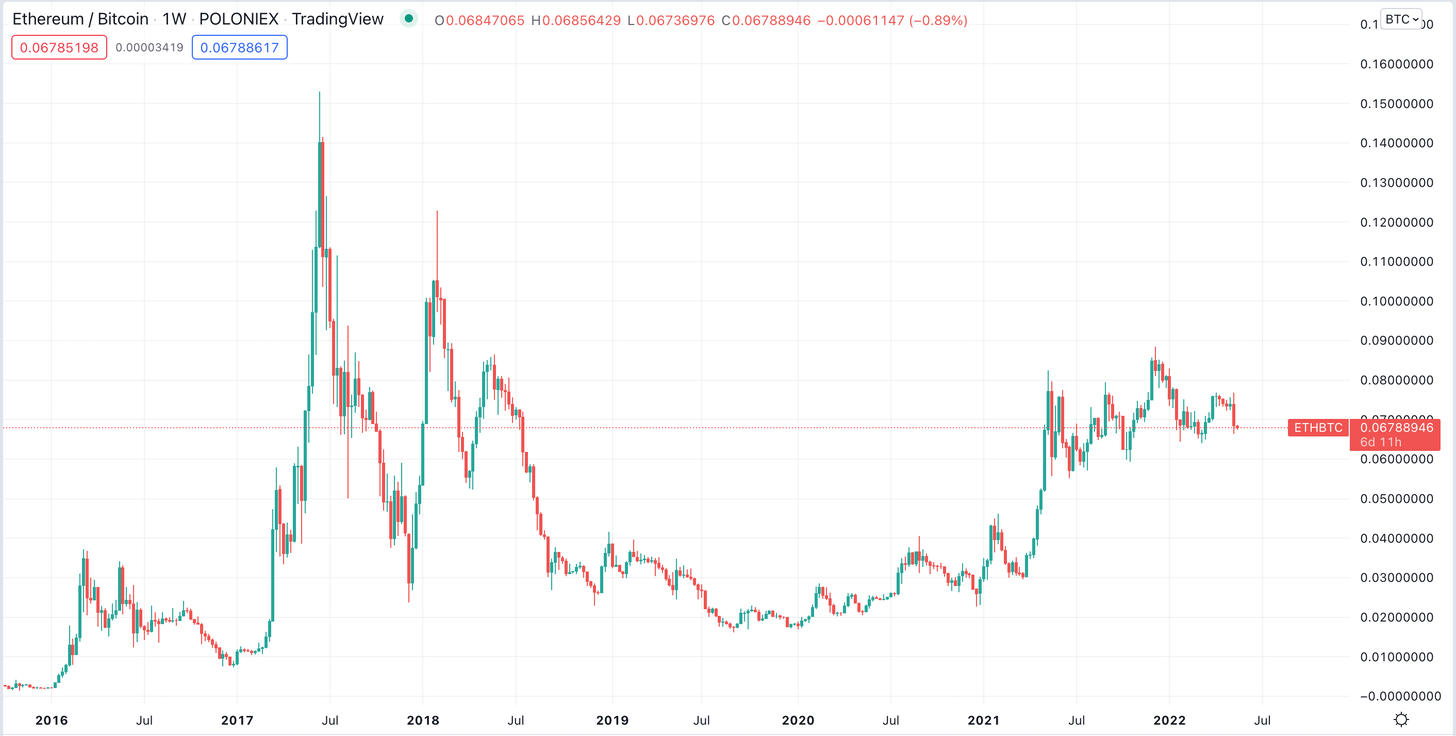

During the last bull run, Ethereum’s fundamentals improved strongly.

Since EIP1559 went live on August 5, ETH has earned $4.7 billion in transaction fee revenue. EIP1559 is a mechanism to capture bull market excess funds and store them in ETH in case block space revenues drop.

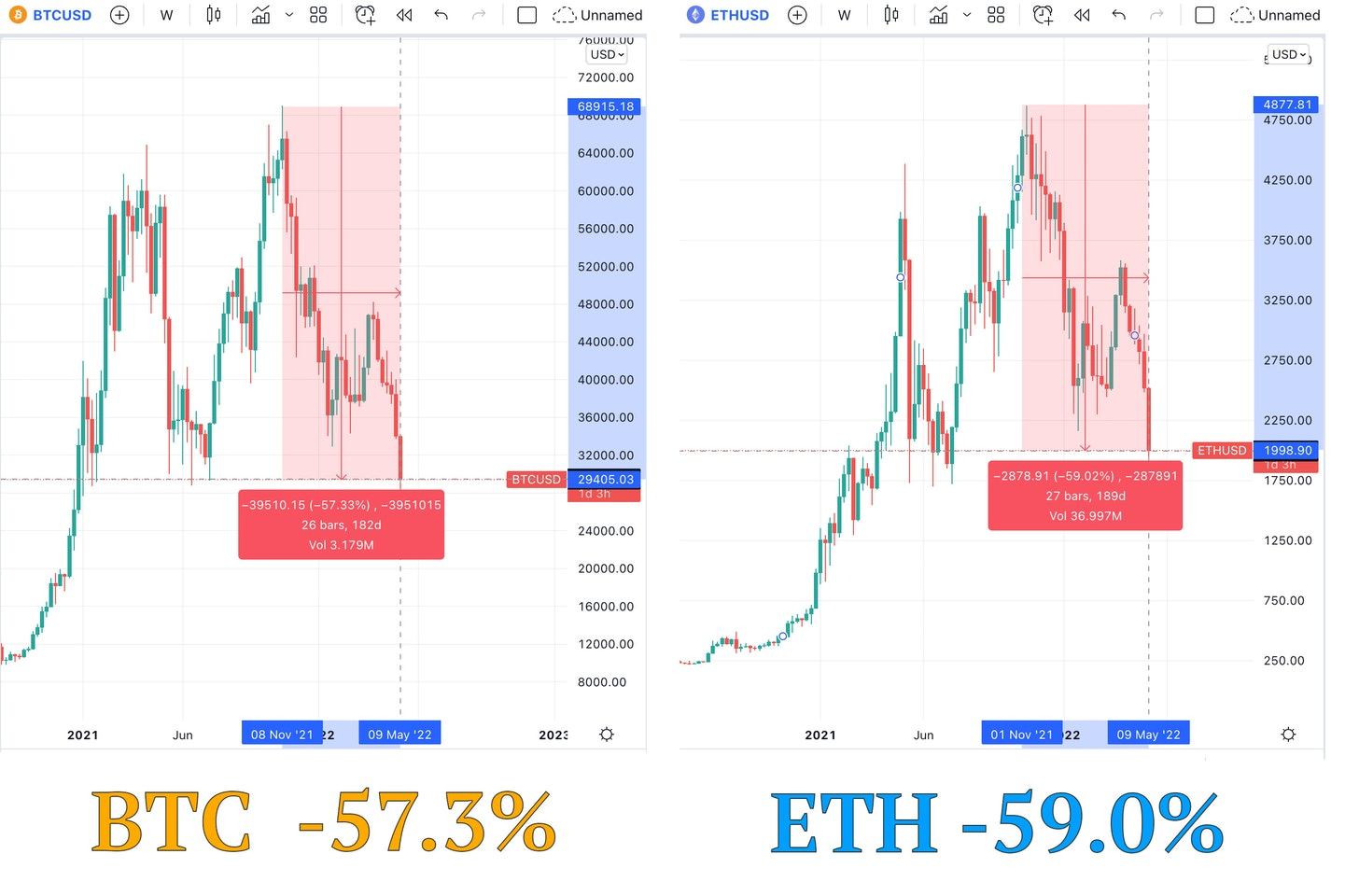

During the 2018-2020 bear market, BTC fell 85%, while Ethereum fell 95%.

During this cycle, they fell by roughly the same amount:

The improved performance of ETH relative to BTC may be due to the improving fundamentals of Ethereum.

It should be emphasized that,Fundamentals matter.

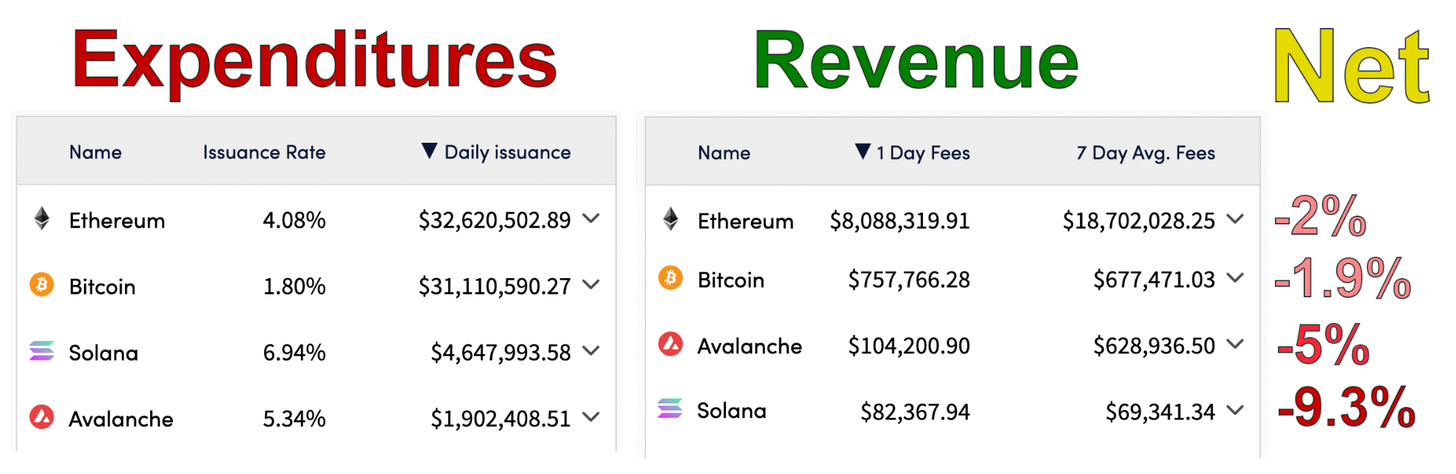

At the same time, the high-circulation, low-revenue Alt L1 also saw a severe decline:

Don't let the percentages fool you, the difference between a drop of 60% and 80% is a whopping 50%. For example, Fantom is down 2x as much as Solana is down from ATH, and AVAX is down 54% compared to ETH.

The newer L1s were expected to be hit harder entering their first bear markets; ETH and BTC have been through bear markets before and have built investor resilience over the years.

However, there are two things about these special L1s that previous bear market survivors did not have: an oversupply of block space, leading to overinflated L1 assets, and an unlocked supply for investors.

Not included here: Investor Unlock (BTC and ETH do not). Additionally, the combined ETH flipped from -2% to +2%.

These Alt L1s will have to carry the burden of high issuance and investor unlocking throughout the bear market. And for those who adapt and survive the bear wash-cycle: I will be bullish.

Security and Scale

The rotation of markets from risk-on to risk-down can be reframed as “prioritizing size” to “prioritizing safety.” A similar structural pattern comes into play here.

What works is based on safety.

What is breaking down is based on scale.

One type of investment (those in markets that can scale to meet demand) does well in bull markets, and the other (those that have established a sustainable economic foundation) does well in bear markets.

DAI and UST

Terra crashes due to too many USTs. Anchor's unsustainable subsidy growth and non-discretionary UST minting created insurmountable liabilities when Terra stopped.

It turns out that the value stored in LUNA is not enough to cover the bill.

MakerDAO's strategy is the polar opposite of Terra's design. Terra's strategy is to flood the market to subsidize adoption. In contrast, the supply of DAI is designed to lag market demand.

New DAI will only be minted when the market creates long-term sustainable demand for the stablecoin. This prevents overproduction of DAI and frees MKR from burdening unnecessary DAI supply. Therefore, MakerDAO is an efficient credit machine that maximizes returns and risks.

Terra prioritized growth over security, and it capsized. And MakerDAO prioritizes security over growth and thus has a strong foundation of decentralized stablecoins.

Ethereum and Solana

The same trade-off between scalability and security exists between Ethereum and Solana.

Solana floods the market with block space supply, bringing instability to the blockchain itself. Without fees, Solana is vulnerable to spam attacks and must resort to censorship to prevent chain disruption.

Solana block space supply inherently exceeds demand, which is its business model. As a result, its foundation often becomes unstable, unable to support the activities that take place on it.

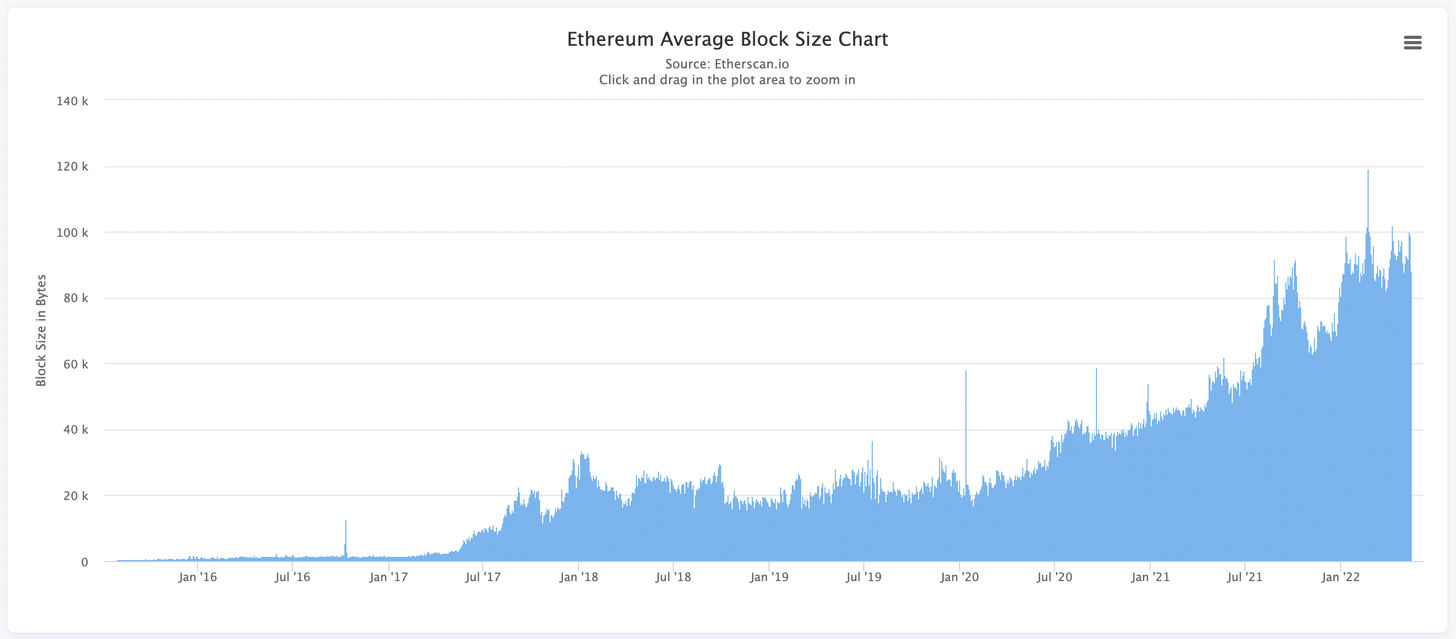

image description

Ethereum L1 scale growth since genesis

Additionally, limiting L1 block space creates an economic opportunity for L2 to capture this demand. L2 will not destabilize Ethereum L1, they can increase the efficiency of block space by several orders of magnitude.

unsustainable design

These are design patterns for Alt L1s, and they don't play well in a bear market. Alt l1 Oversupplies the market with cheap products to reduce competition and drive growth. But when the market sees users and capital outflows, this cheap product turns from an asset into a liability.

Selling a product for $0 is no longer competitive. But it used to be crazy.

DAOs, too

DAOs need to realize that "free million dollars in national debt" in a bull market is not a sustainable paradigm.

The bottom line matters, and DAOs need to think about it to survive the crypto winter. In order to do this, DAOs need to abandon this exclusion of structure and hierarchy.

The name DAO has done damage to the industry. It doesn't describe exactly what those organizations are. What you think of as DAOs are actually DOs:digital organization。

For DOs, fundamentals matter. Structures and processes need to be established. Resources need to be used wisely.

For example, Gitcoin is leaning towardNew Leadership Culture and Structural Conservatism。

DAOs need to take an honest look at their funds, P&L, and org charts to see if anything isn't right.

basic opportunity

It is normal that the next adoption cycle will be more risk-averse than previous cycles. The biggest risk-takers are getting into the cryptocurrency market long before the real fundamentals emerge.

Each new cycle produces new fundamentals and a stronger case for cryptocurrencies to be a sound investment, gradually winning over investors with higher and higher standards.

Before the next "fundamentals don't matter" frenzy happens, we'll need to build a "fundamentals matter" market cycle.

This is the next cycle of opportunity in crypto: can you identify undervalued fundamentals with high potential for the next growth season?

Here's why I'm bullish on the fundamentals of L2s.

L2 chains don't have to pay for security, which makes them economically sound to begin with.

L2 provides a fundamental answer to Ethereum's scaling problem while providing cheap surface area for entrepreneurs and builders.

L2s can be measured using the tried and tested DCF valuation model, providing assurance to investors looking for true fundamentals to base their investments on.

If you haven't found a job in crypto yet... check out L2s and their app.

golden age of construction

There is a golden age of construction ahead of us. With the bull market noise gone, builders can finally focus and get back to real, long-term sustainability.

The fuel of a bull market is built during a bear market.

In 2018, DeFi became active. MakerDAO, Uniswap, Compound, Aave, Synthetix, OpenSea — these were all developed when Ethereum’s customer base felt like a few thousand people.

In this bear market, we have a new paradigm of millions of users and cheap fees, directly connected to the core hotspot of the Ethereum economy.

There is still a lot to build.

And what builds over the next two years will be the fundamentals that generate the next bull market.

Make sure you stick with it and observe what you build so you can grasp information asymmetry when the time comes more favorable position, while those with poor information are at a relatively disadvantaged position).

Therefore, you can have alpha.