Talk about algorithmic stable currency after UST falls into a death spiral

TerraUSD (UST), which was once the third largest stable currency in the world, has collapsed rapidly in recent days. This incident not only stirred up the currency circle, but also attracted the attention of US Treasury Secretary Yellen. During a hearing on May 10, Yellen emphasized the need for a regulatory framework for stablecoins. The current regulatory framework "does not provide a consistent and comprehensive standard for the risks of stablecoins," she said. Moreover, Yellen also specifically mentioned the sharp unanchoring of UST. Due to the collapse of UST, the development of stablecoins has received great attention from the market and has been questioned a lot. What is a stablecoin and what is an algorithmic stablecoin? Why did LUNA and UST crash?

With these questions in mind, let's start with the development of stablecoins.secondary title

1. Fiat-backed stablecoins

Due to regulatory policies in some regions, the exchange cannot provide users in the region with the service of "purchasing cryptocurrencies directly with fiat currency", thus promoting the development of the first generation of stablecoins - fiat currency-collateralized stablecoins.

The main features of fiat currency-collateralized stablecoins are that fiat currency is used as the underlying asset, and the centralized institution acts as the acceptor, and the centralized institution has the responsibility of rigid payment. Among them, USDT, USDC and BUSD are the main representatives.

USDT

USDT is a USD-pegged stablecoin launched by Tether. Like other cryptocurrencies, USDT is built on the blockchain and can currently be minted and traded on multiple public chains such as Ethereum, Tron, Solana, Algorand, EOS, Omni, and Avalanche.

image description

Graphics: IOBC Capital

image description

Source: Tether official website

According to the disclosure of the reserve report on December 31, 2021, Tether's reserves are not all cash, but include cash and bank deposits, treasury bills, commercial paper and certificates of deposit, money market funds, reverse repurchase notes, corporate Bonds, funds, precious metals, secured loans, other investments, etc.

USDC

USDC is a fully collateralized US dollar-pegged stablecoin issued by Circle, which is strongly supported by Coinbase. Grant Thornton will publish a public report every month to disclose the financial status of USDC issued by Circle.

Circle is invested by institutions such as Goldman Sachs Group, IDG, CICC, Everbright, Baidu, Bitmain, and CreditEase Industrial Fund. It has payment licenses from states in the United States except Hawaii, the United Kingdom, and the European Union, as well as New York State Bitlicense. It is a global license in the encryption asset industry. The company with the largest number has compliant channels for USD, GBP, and EUR to enter and exit encrypted assets.

BUSD

image description

Data source: The Block

secondary title

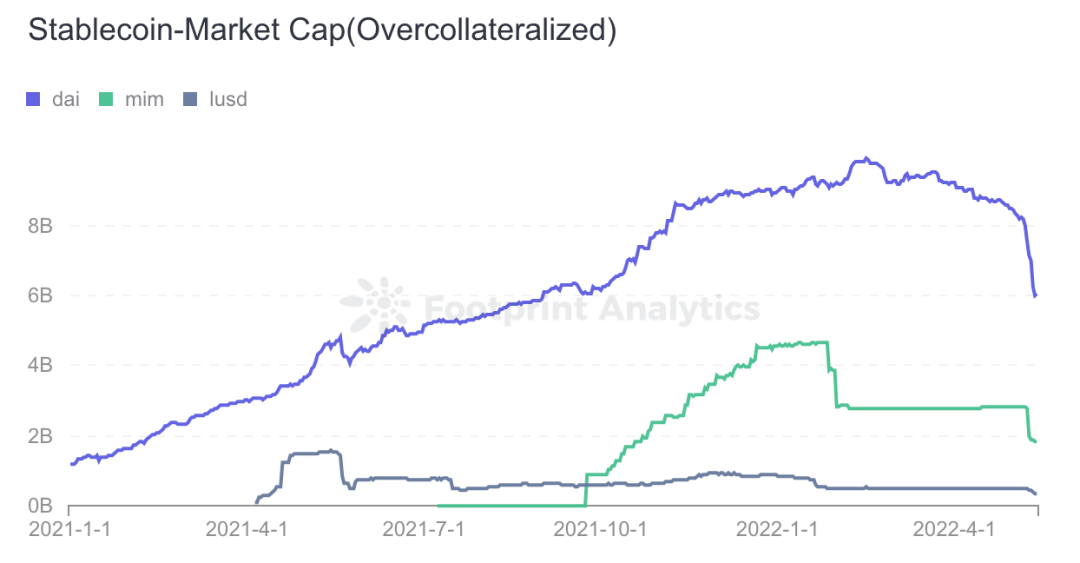

2. Over-collateralized stablecoins

The main feature of the over-collateralized stablecoin is that the mainstream currency (ETH, BTC, etc.) is over-collateralized as the underlying asset. Over-collateralized stablecoins are mainly represented by MakerDAO's DAI.

Over-collateralized stablecoins, as the name suggests: the value of collateralized assets > the value of minted stablecoins. For example: pledge $100 worth of ETH, only 70 DAI can be minted. When it falls below the minimum pledge rate, it will be required to cover the position. If the position is not covered and falls below the liquidation line, it will be liquidated and liquidated, and a liquidation penalty will be incurred.

image description

Data source: Footprint Analytics

secondary title

3. Algorithmic stablecoins

Whether it is a fiat-backed stablecoin or an over-collateralized stablecoin, each has its own shortcomings. Therefore, there has been an exploration of algorithmic stablecoins in the industry.

image description

Chart source: Footprint Analytics

The development process of algorithmic stablecoins is actually very bumpy. From AMPL, ESD to BAC, and then to Frax, Fei, OHM, these algorithmic stablecoins once gained some attention in the circle, but they all inevitably ended hastily. It is UST that has really achieved a leap in market value, with a peak of more than 18 billion US dollars, and once surpassed BUSD to become the third largest stable currency in the world.

UST(TerraUSD)

UST is an algorithmic stablecoin launched by Terra. Terra launched the Terra public chain and its native token LUNA in 2018, and later designed a dual-currency system-two-way destruction and casting between LUNA and UST, using an arbitrage mechanism to maintain UST at $1.

The casting and destruction logic of UST:

When 1 LUNA = 100 U, destroying 1 LUNA can mint 100 UST; destroying 1 UST can mint 0.01 LUNA.

Mechanism for UST to maintain stability:

UST achieves stability through an arbitrage mechanism. When UST>$1, users can mint 1 UST by burning LUNA worth $1, and then sell UST in the secondary market to make a profit; when USTExample:

Example:

When 1 UST = 1.5 US dollars, the user can mint 1 UST by destroying 1 US dollar of LUNA, and then sell it at a price of 1.5 US dollars in the secondary market, thereby making a profit of 0.5 US dollars. The price will approach $1;

When 1 UST = 0.5 USD, the user can buy UST at a price of 0.5 USD from the secondary market, then destroy 1 UST to mint LUNA worth 1 USD, and then sell LUNA in the secondary market to make a profit of 0.5 USD, through The arbitrage action pulled the price of UST back to $1.

Why can UST develop to a market size of 18 billion US dollars?

At its peak, UST reached a market size of 18 billion U.S. dollars, and the native token LUNA of the Terra public chain rose to a circulation market value of more than 40 billion U.S. dollars. In addition to the cyclical premium of the bull market, it also relies on the DEFI development of its public chain ecology.

First, Terra launched the algorithmic stablecoin UST based on the public chain native token LUNA. And through the endorsement of South Korea's second largest payment group investment, UST has designed usage scenarios - consumption, payment, e-commerce, etc. For example, Terra has partnered with mobile payment app Chai, which has 2.3 million users to allow businesses to easily settle transactions.

Secondly, Terra also launched Mirror, a synthetic asset protocol, to increase the financial application of UST. In the Mirror agreement, UST can be over-mortgaged to generate synthetic assets (for example: stocks of leading technology companies such as Google, Apple, Amazon, and Tesla) to meet the investment needs of users who cannot directly invest in these assets (US stocks) .

Finally, the craziest thing about Terra is the launch of Anchor, a savings agreement with an annualized rate of return of up to 20%. Users only need to store UST in the Anchor protocol, and they can get nearly 20% annualized current income and ANC token incentives.

Based on the above payment, investment, savings and other usage scenarios, Terra has established a highly leveraged ecosystem. In just two years, LUNA has developed to a market value of more than 40 billion US dollars, minted and issued 18 billion US dollars of UST.

This seems to be developing very well, but in fact, UST's casting logic and UST's stability maintenance logic have already doomed today's collapse.

Charlie Munger famously said: Tell me your motives, and I'll tell you your fate.

Many people in the community have already suspected that the collapse of Terra may be the result of the project's high-level cash-out. Why do you feel this way? The community mainly raised four questions:

1. Fund direction. Who cast LUNA and UST, and who took over?

Mainly the project party was casting, and many LUNA holders and UST holders took over when the crash occurred.

2. Why does stablecoin storage give an annualized rate of return as high as 20%?

In order to attract more people and more funds to take over. Investors must hold UST and use it for Staking to obtain an annualized rate of return of 20%. What can the borrowers of the Anchor agreement do with these funds to guarantee an annualized return of more than 20%?

3. Where did more than 80,000 bitcoins go?

This issue should be the most concerned issue at present, including Binance's CZ who also publicly shouted on Twitter: When Terra was in trouble, where did Terra's bitcoin reserves go?

When UST began to fall on May 9, LFG announced that it would start disposing of more than 80,000 bitcoin reserves to stabilize UST's peg to the US dollar. The next day, LFG's bitcoin reserves were emptied.

image description

Source: Elliptic

On the morning of May 9th, LFG announced that it would “mortgage BTC loans of USD 750 million to over-the-counter trading companies to help UST re-peg”. At the same time, 22189 BTC (worth about USD 750 million at the time) was transferred from the LFG address. Later on May 9, another transfer of 30,000 BTC was made to the same address. In the following hours, the 52,189 BTC were transferred to the Gemini exchange, and it was impossible to determine whether these bitcoins were sold to support the UST price or transferred to other wallets.

Similarly, after the remaining 28205.5 BTC of the LFG Foundation were transferred to the Binance exchange on May 10, it was impossible to determine whether these BTC were sold to support UST or transferred to other wallets.

In the face of doubts from the community, the LFG Foundation has not disclosed the details of the disposal of the over 80,000 BTC.

4. Regardless of whether LUNA crashes or UST is unanchored or not, why does the Terra team mint a lot of extra LUNA?

In addition to the unknown whereabouts of 80,000 bitcoins, the Terra team issued more than 6 trillion LUNAs between May 10th and 13th. This is completely unreasonable and violates the spirit of the blockchain.

Summarize

Summarize

The lessons learned from the UST crash should arouse the vigilance of other stablecoin projects with similar algorithms, such as Waves’ USDN. In the Vires lending agreement in the Waves public chain ecology, the annualized loan interest rate of the USDT and USDC stablecoins has been as high as 40% for a period of time. challenged by the community.

Each type of stablecoin has its advantages and disadvantages. Fiat currency-anchored stablecoins have defects such as centralization, opacity, and supervision, but they also have advantages such as high capital efficiency and guaranteed anchoring; over-collateralized stablecoins have good stability, decentralization, and anti-censorship, but their capital efficiency Low. Although algorithmic stablecoins have experienced several generations of development and evolution, there is indeed no successful case of "too big to fail".

In the design of the core mechanism of algorithmic stable coins, a lot of practical exploration may be needed. At least the following aspects need to be considered:

First, the underlying asset selection of algorithmic stablecoins. Taking UST as an example, it uses LUNA as the underlying asset for minting and burning, but is the consensus of LUNA itself big enough? This may be a consensus in the Terra ecology, but the destruction of the UST minted by LUNA is actually not strong enough in the larger encryption community, in the traditional Korean consumer market, and in the global financial field. The degree of dispersion of LUNA token itself is too low and highly concentrated. It is difficult not to make people feel that the project party cannot sell goods in the secondary market when the price of LUNA is high, so it is minted into UST to achieve high cashout. This is different from UST's For subsequent holders and users, it is undoubtedly a high-risk event.

Second, what kind of mortgage (destruction) parameters can take into account both security and capital efficiency. Still taking UST as an example, 1 UST can be minted by destroying LUNA worth 1 US dollar. Compared with over-collateralized stablecoins such as DAI, the capital efficiency of UST, an algorithmic stablecoin, is much higher. It did not choose to have a global consensus The BTC and ETH are used as the underlying casting assets, and there is no mortgage rate higher than 100%. The setting of mortgage (destruction) parameters needs to consider the situation that insolvency cannot be triggered when the underlying asset price fluctuates.

Third, the demand for the use of stablecoins and who will mint them first, and how to regulate them. Because it is a stable currency, it has no investment value in theory. If it does not have sufficient use value and use scenarios, it is difficult to maintain its consensus. overall risk. It is not a false use requirement set up to lock its circulation, but a real general equivalent.

We cannot kill the development prospects of algorithmic stablecoins just because of the failure of algorithmic stablecoin projects at the current stage. Economist Friedrich August von Hayek wrote in The Denationalization of Money: "I believe that humanity can do better than historical gold."

In the encrypted world, there may be an algorithmic stable currency that can get a large enough consensus, just like the scope and recognition of Bitcoin today. Maybe like Bitcoin, consensus just happens, who knows.