Life Is Unbearable: UST-Luna Investors Are Taking a Double Whammy of Faith and Finance

Original Source: Old Yuppie

Original Source: Old Yuppie

Author: Edward Ongweso Jr

The cryptocurrency market is in the midst of a massive meltdown, causing severe financial pain for investors, with no clear way out for everyone."The most notable drop so far has been the collapse of the $30 billion Terra ecosystem: its token Luna, its algorithmic stablecoin TerraUSD (UST) — which should remain pegged 1:1 to the U.S. dollar — and associated loans Protocol Anchor. The implosion caused unimaginable pain to would-be investors and exacerbated the ongoing sell-off across the cryptocurrency market. UST is currently trading at $0.18, while Luna has dropped from over $100 in April to $0.0004 today, in crypto industry parlance, actually"return to zero

up. Luna’s biggest drop occurred last week, with the token down 99.99% from its $80 price a week earlier. Anchor’s token price also dropped sharply, from $2 to $0.09."Do Kwon, the founder of Terraform Labs, the South Korean company behind Terra-Luna, is a tweeter who often replies critics as"the poor", and said in an interview:"95% of (Tokens) will die, but it's also fun to watch companies die.

Now, he hasn't tweeted in days and appears to have applied for emergency habeas corpus with the police.

Terra is not an accidental cryptocurrency project. It's backed by venture capitalists, who pumped $150 million into the ecosystem last year, likely giving investors confidence in the project. Investors include major players such as Pantera Capital, Arrington Capital, Coinbase Ventures, and Galaxy Digital.Most found themselves drowning in blood, with some investors saying they had lost their life savings, sharing their desperation or suicidal thoughts on online forums.

secondary title

Investors 'all hope is lost'

Motherboard interviewed several investors in Terra-Luna, some of whom described financial pain and a loss of faith in a project they once believed in (Motherboard could not independently verify their losses)."A trader from Colombia told Motherboard:"To be a trader it is important to keep your mind still and act 'robotically' but for the past two days my emotions have been broken and I am trying to accept them and let them run their course. I lost all my savings."

As you can read in my text, frustration and regret are unbearable. My digital assets have shrunk a few times before, and they were all drizzle, but this time I returned to zero, and there was nothing left."One investor said in a private message on Twitter:"

I am not rich. I have 27 Lunas. I lost thousands of dollars. I am disabled and only get a fixed allowance of $197 a month. So this breaks my heart. I want to expose the story of Terra and the influencers who helped drive this Ponzi scheme."He added:"。

I have a degree in television broadcasting. A big V needs a technician. I would also love to do an internship. set foot on a road of no return"According to this investor, they were"。

A faithful follower of Terra"Another Redditor told Motherboard that he lost $10,000, but after auditing his finances, he discovered it was actually more than $20,000. He said:"。

I lost all my savings. From a loss of $20k, to around $50k as Luna's exponential plunge

"Another investor posted about losing $20,000 in Terra-Luna, saying: They now believe the project is a Ponzi scheme. He also warned risk-takers not to look for big gains at Luna's current price."。

"So I'm invested in multiple ecosystems, and the main reason I like Terra is that it pays out staking rewards in stablecoins. Honestly, I should have done more research and realized that this is Ponzi Economics"

The main reason I tell investors not to buy is because they think the risk reward is great because the price is so low. One guy left me a message thinking he would retire if the price came back. That's simply not possible, Luna is now an irreparable dead item."Another investor tweeted:"

The LUNA token is the only investment I've ever made that lost 99% in less than 24 hours. I've never lost money so quickly before."Another investor told Motherboard in a Twitter exchange:"。"I would not advise anyone to invest large sums of money in $LUNA. If they want to take the risk like I do, I suggest they spend a small amount of money on it."

secondary title

UST is called"Algorithmic Stablecoins", a relatively new invention in cryptocurrencies that aims to use financial incentives to produce a stable $1 peg, rather than holding actual dollars and other assets in 1:1 reserves. The plan is essentially that 1 UST can always be burned to mint $1 worth of Luna, and Luna (regardless of its price) can always be burned to mint an equal amount of UST. This delicate balance of supply and demand worked for a while, but has now resulted in a"death spiral"death spiral

, as UST withdrew to Luna, ballooning the circulating supply to billions and crashing its price completely."The other part of the equation is Anchor, a Terra-based lending protocol that incentivizes users to"pledge

Their UST earns almost 20% interest return. All those pieces came together last Saturday when Anchor’s total deposits fell from $14 billion to $11.2 billion, sparking panic selling of UST by popular investors."LUNAtics "Terra's founder, Do Kwon, was undisturbed at the time and posted a strange poem addressing

The companions ensure that everything works.

Sadly, many people can only watch this tragedy happen. For years, high-profile bitcoin believers have warned investors of the dangers of flimsy so-called algorithmic stablecoins. In January of this year, we got a taste of it all. DeFi protocol Abracadabra began unwinding its massive Anchor positions, not only temporarily depriving UST, but also crashing Luna. One Reddit user even predicted a doomsday scenario in late January of this year, where a loss of confidence in Anchor could lead to a drop in deposits, UST being converted to Luna and a massive supply expansion, and a massive downward pressure that would destroy both cryptocurrencies. This, they reasoned, would spell doom for the ecosystem, as devaluation would quickly be followed by a death spiral.

After the panic in January of this year, Terraform Labs created the Luna Foundation Guard, which will sit on a reserve of Bitcoin (worth $3.5 billion) that could be used to help stabilize UST should it depeg again. Sure enough, when it was depegged over the weekend, LFG announced that it would be lending $1.5 billion worth of Bitcoin and UST to repeg the stablecoin.

While the value of UST did climb back to $1, it did not restore investor confidence in the ecosystem and investors started fleeing. Anchor's deposits plummeted to $8.7 billion, the platform's token fell 35%, and soon UST collapsed, and Luna collapsed further, falling from $100 to $1, and even into a fraction of a penny one.

Many commentators, such as cryptocurrency critic David Gerard and American University law professor Hilary J. Allen, pointed out that this is all similar to the 2008 financial crisis. The Federal Reserve and Treasury Secretary also went out of their way to identify too many worrying parallels between stablecoins and various money market funds of the magnitude of the 2008 financial crisis.

For the most part, it seems unlikely that projects will do much for those wiped out by the collapse of the third largest stablecoin. So far, all talk of bailouts has largely been limited to: talk."Larry Cermak, vice president of research at The Block, tweeted,"Rumor has it that Jump, Alameda, etc. offered another $2 billion to 'bailout' UST,

But so far, this has not become a reality. Bloomberg reported that backers had difficulty finding bailout funds, even after offering Luna tokens to investors at a steep discount."One Redditor who only put $100 into the project told Motherboard:"

The Luna thing is a pity, but that project really wasn't as innovative as everyone said it was, and finally people heard about the 20% yield and the stable coin, and people jumped in. But investing in cryptocurrencies is the best opportunity I've had in 35 years. I anticipate that at some point I may be in the red, which is fine. I'll at least keep buying bitcoin, and I'll keep an eye out for new projects and new Ponzi schemes.

Other hurt investors interviewed by Motherboard are also looking forward to the project party's recovery."The investor who lost $20,000 said:"

Of course, I think it's a big blow to most people who aren't in the top 0.1%. However, life goes on and we will have the chance to accumulate more, we can only hope we are luckier next time. You never look back, you plan out what your next step is.

Either way, UST and Luna have put many cryptocurrency enthusiasts in a bind. Trading of these tokens has ceased on multiple exchanges, which means that some people may be completely unusable for the few remaining tokens for the foreseeable future.

DeFi, and cryptocurrencies in general, have been lying in the grave of zeroing projects. Coindesk has just revealed that Kwon himself ran a failed algorithmic stablecoin called Basis Cash before launching UST. Its total value briefly peaked at $174 million in February 2021, while Terra hit $30 billion before its spectacular demise.

The average investor stuck in Terra-Luna is unlikely to see bailout news. Instead, things will continue as they always have. Backers and financiers will do what they can, and ordinary investors will take what they have to take and try to find some kind of fix.

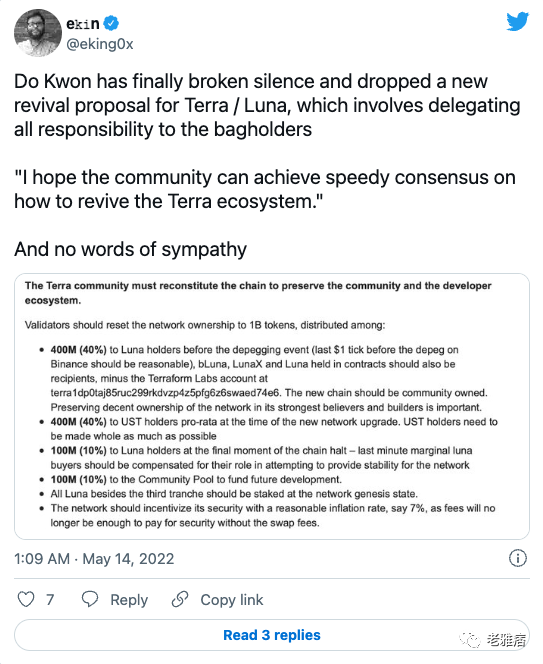

On Friday afternoon, Kwon broke his silence to post a brief proposal on the Terra forums, essentially asking the developer and investor community to wind up the blockchain clock and save the Terra ecosystem. The post acknowledged that the project is all but dead."Kwon wrote:"。

Even if the peg is eventually restored after the last fringe buyers and sellers capitulate, Luna holders will be severely liquidated and diluted, and we lack an ecosystem to rebuild from the ashes. While a decentralized economy does need decentralized money, UST has lost too much trust among users to be useful"Kwon's post presents a"Restructuring the chain to protect the community and developer ecosystem

Plan to reset Luna’s token supply from 6.5 trillion tokens to 1 billion tokens and distribute among Luna holders, UST holders, and community holders. It's not quite clear how all of this will actually happen."Kwon hopes"

The community was able to quickly reach a consensus on how to revitalize the Terra ecosystem."further reading"

further reading

secondary title

Do Kwon claims not to have profited from luna debacle

Terra co-founder Do Kwon insisted that he did not profit from the collapse of the network’s LUNA cryptocurrency and UST stablecoin.

Do Kwon is known for his aggressive social media tactics, but the Terra co-creator has been uncharacteristically silent over the past few days as the web spiraled into disaster."Presented to the network's research forum today, Do Kwon"Terra Ecosystem Revitalization Program

"Hours later, he took to Twitter for the first time in two days to express his sadness at how things had turned out."My heart aches for the pain my invention has caused you all,"He tweeted that he spends most of his time with those"Hit by UST deprivation

people talking on the phone.

UST, an undercollateralized stablecoin designed to maintain parity with the U.S. dollar through a burn mechanism with Terra’s LUNA governance token, slipped from its peg over the weekend.

Although Terra mobilized $1.5 billion in loans from its reserve fund when the entire cryptocurrency market started to crumble, it wasn’t enough to keep UST at $1. The price continued to drop, taking LUNA with it. The stablecoin is now trading below $0.20, with LUNA worth only a fraction of a cent. Meanwhile, the Terra blockchain is also on hold as the community decides how to move forward.

Do Kwon took today’s Twitter thread as an opportunity to revisit his proposals, which include rebuilding the Terra blockchain without the UST stablecoin, and redistribution of LUNA tokens."A lot of people lost money in Terra's decline, and while Do Kwon didn't detail his own losses, he did assert:"

Neither I nor any agency I am affiliated with profited in any way from this incident. During the crisis, I did not sell Luna or UST."Anon,secondary title

secondary title

Tether CTO: Tether has reduced its holdings of commercial paper backing stablecoins by 50%

In a twitter space event, Tether CTO Paolo Ardoino revealed that Tether has reduced its commercial paper holdings by 50%.

"During a recent twitter space event discussing stablecoins and recent cryptocurrency volatility, Tether CTO Paolo Ardoino said the stablecoin provider had halved the amount of commercial paper backing its stablecoin. Ardoino is also the CTO of cryptocurrency exchange Bitfinex."In the past six months, [Tether] has reduced the size of commercial paper by 50%. Everything that was reduced from commercial paper was rolled into U.S. Treasuries,"He said,"

In the coming weeks, we will have fresh evidence that these commercial papers are shrinking further.

Commercial paper is a type of security issued by large companies to pay for short-term debt obligations such as inventory or payroll.

The Spaces event featured other members of the cryptocurrency industry, including Jan3's Samson Mow and Blockstream's Adam Back, among others. U.S. Senate candidate Michael Soetaert, representing Kansas, was also in attendance.

Tether (USDT) is the largest stablecoin in the industry by market cap and is said to be backed by various financial assets.

According to Tether’s transparency report, USDT’s backing includes cryptocurrencies, loans, corporate bonds, precious metals, cash and cash equivalents.

Tether’s latest official proof shows that cash, cash equivalents, short-term deposits, and commercial paper account for 83.74% of all Tethers in circulation in the market.

Of that number, nearly 37 percent was made up of commercial paper and certificates of deposit. Treasury bills account for about 52%. The 37% figure is for December, so given Ardoino's comments about a 50% reduction in six months, it's unclear whether Tether's commercial paper holdings are now around 18.5% or something else.

"In addition to outlining what has changed with the stablecoin’s support, Ardoino also highlighted how the ecosystem should move forward in the light of the recent debacle of Terra’s UST stablecoin."In my opinion, what we'd like to see is clear guidance on the type of disclosures we need,"He said,"

Everyone was pointing at us and saying 'well, guys, you've got to give everything to the public. Well, that's a fair requirement of society. At the same time, this will need to be true for everyone. Everyone needs to be held to the same standard."Tether is no longer on the market, Ardooin continues"The only stablecoin

, hinting at the rapid growth of its recent rival stablecoin Circle’s USDC.

Both USDC and USDT stand in stark contrast to decentralized and algorithmic stablecoins whose stablecoins are fully backed by other cryptocurrencies or self-executing smart contracts.

MakerDAO’s DAI is an example of an over-collateralized algorithmic stablecoin, while Terra’s UST is an example of an algorithmic stablecoin with no backing beyond a few lines of code.