LUNA: A Feast for Arbitrageurs

Original Author: Knight Zhang

Original Source: Uncertain Thinking

Original Author: Knight Zhang

Original Source: Uncertain Thinking

I won’t say much about the previous situation of UST’s unanchoring. There have been many analysis articles on this topic, and the essential problems have been analyzed thoroughly.

It is also the first time I have seen a token that fell by 95%+ on the first day, and can continue to fall by 99% on the second day. In this case, the exchange has not yet been removed from the shelves, and the lending agreement has not suspended lending.

A lot can be analyzed from here, and I strive to pass this incident so that I can learn more risk management knowledge, arbitrage strategies and risk avoidance actions.

The watershed of the whole incident should be DK's speech. Before that, everyone is mainly concerned about what measures can be taken to re-anchor UST.

And DK's statement clearly shows that they don't have any external solutions. It can be seen from the tweet that he first talked about the principle of UST stability, and quoted a detailed description of DEPEG:

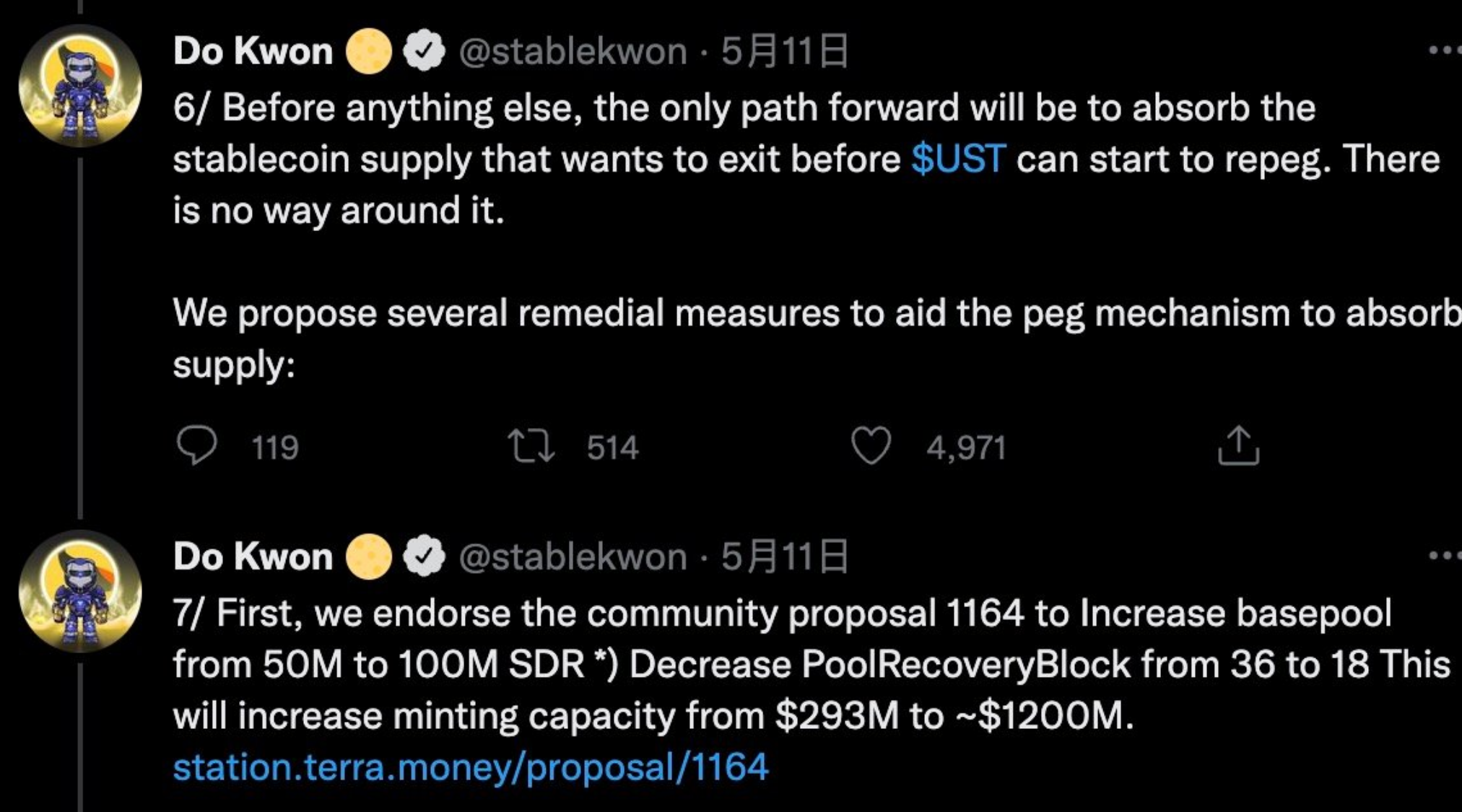

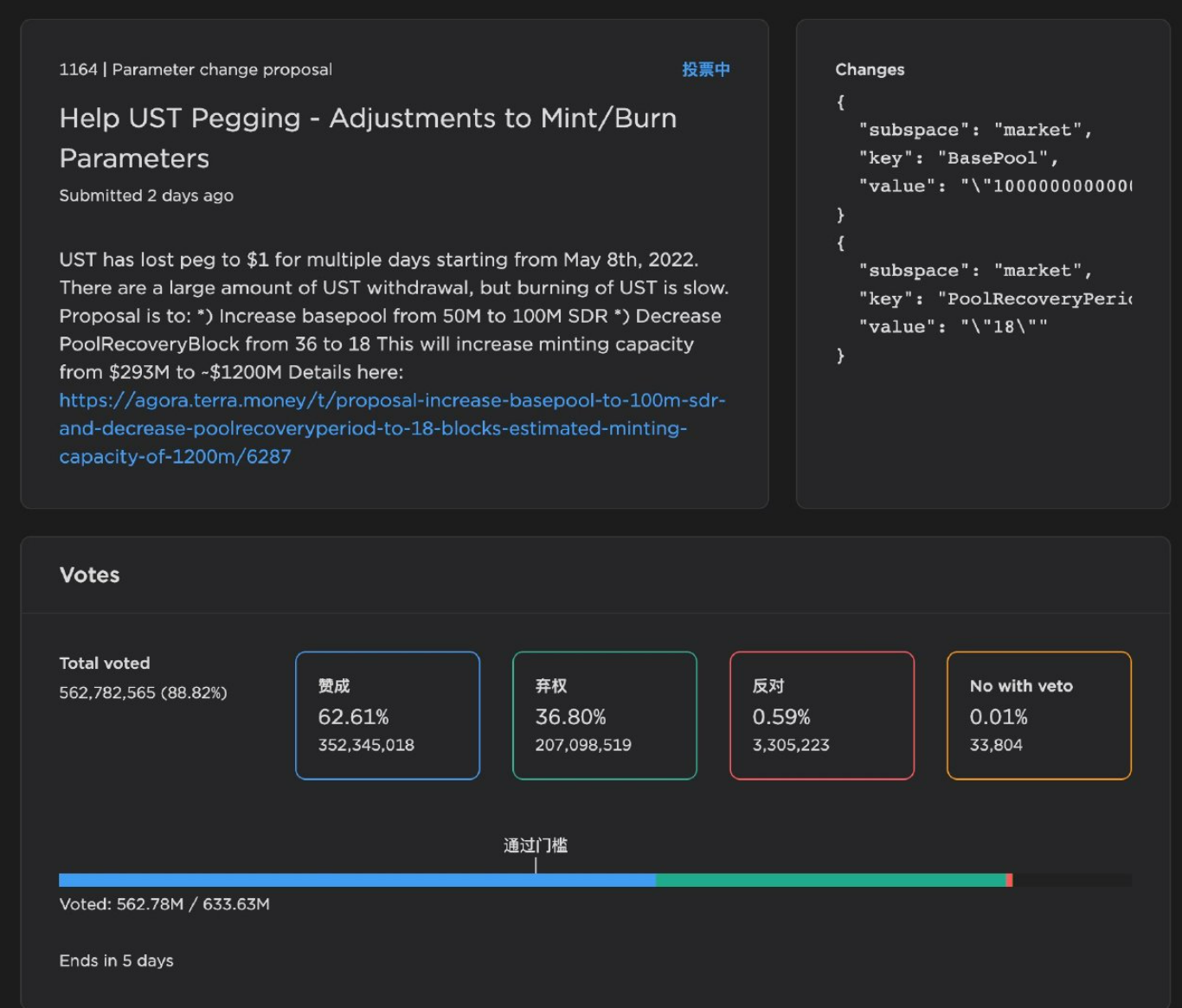

The following two are the key points. He clearly can only rely on the DEPEG mechanism to continuously burn UST, issue additional LUNA, and bring UST back to 1 through arbitrage. To add to this process, the community is also voting on a proposal to increase burning efficiency in order to speed up UST arbitrage.

When I saw these two pieces of news, my first reaction was that the project was over. If it burned like this, the market value of LUNA at that time would basically return to zero soon.

The first opportunity point is to go short on the news side. The risk is that the exchange closes the deposit and withdrawal, killing short positions.

After DK spoke in the afternoon, the price of LUNA on the exchange quickly reached around 0.7. But at this time, the exchange closed the deposit and withdrawal, and the price of LUNA was pulled to 7.

Since then, it has probably entered the trading hours of the US region, and the price of LUNA has entered the market game, and has not plummeted again, and has stabilized around 1.

On May 11, everyone mainly focused on the prices of LUNA and UST, and most of the news concerned the recovery of anchoring measures and the fight between long and short positions on exchanges.

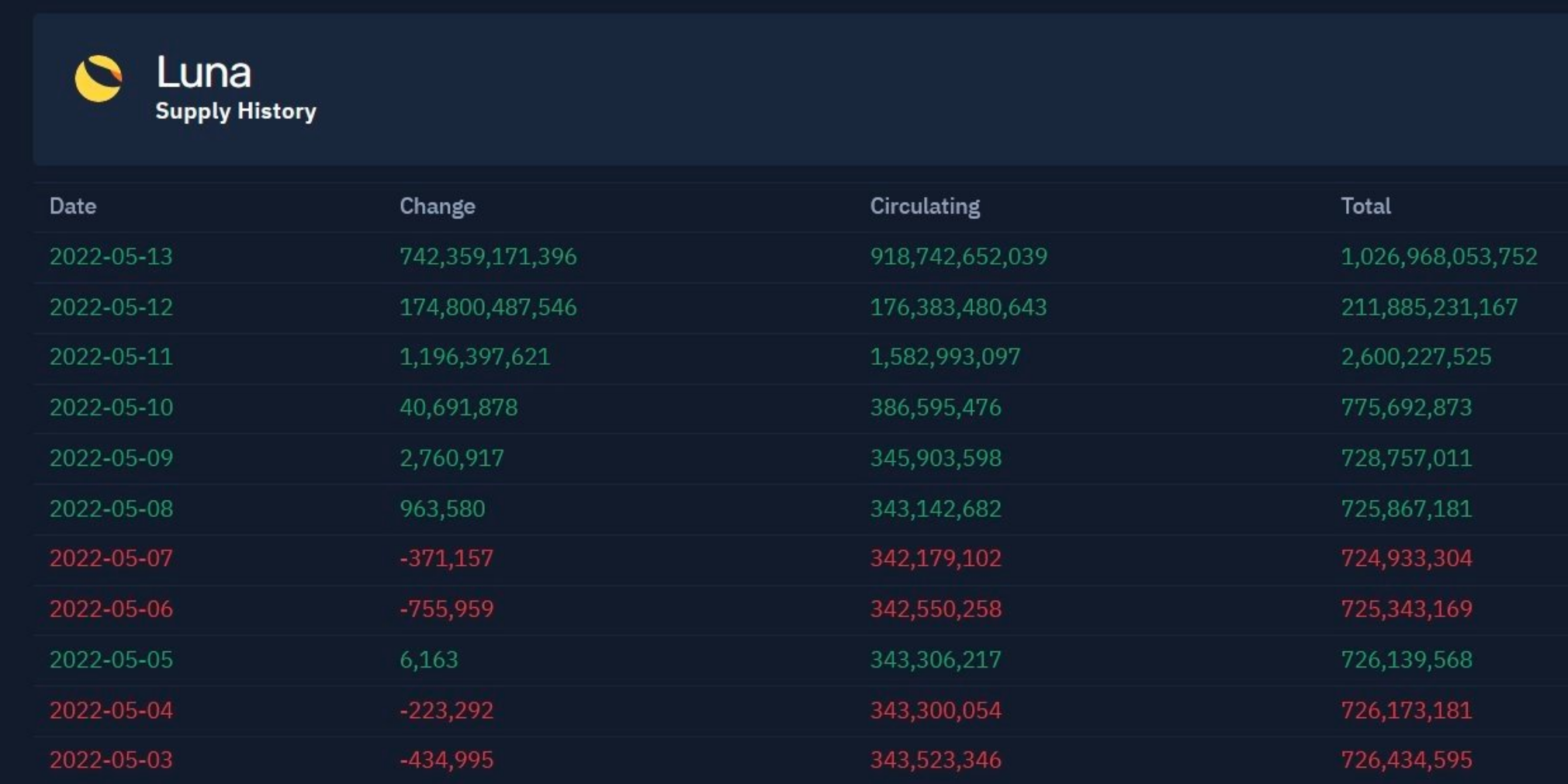

Judging from the additional issuance volume of LUNA, the additional issuance volume on May 11 did not exceed the cognitive range, and the price and additional issuance volume can basically be aligned.

If the exchange directly removes the trading pairs after May 11, the subsequent 512 drama will not be staged. There is not such a large pool on the chain that can accommodate this huge amount of additional issuance arbitrage.

The key point is that the big exchange did not close the trading pairs throughout the day on 512, allowing the entire arbitrage chain to run completely.

Also, people who do not understand this mechanism cannot imagine such a huge amount of additional issuance. The trading volume is so large because there is a huge information gap here. Some people think that it has fallen by 99%. With such a large ecology, you can buy the bottom and take a chance.

The huge information gap has formed a huge trading volume, so that while luna issued a large number of additional issuances, the price did not fall as fast as the additional issuance.

The price of LUNA has huge deviations in different markets, and there are two main breakthroughs. One is the official exchange channel, where the oracle price is priced at $1, and the other is the exchange channel, which has a huge trading volume.

The main arbitrage path here becomes: buy UST on the exchange -> refer to terra station to exchange for LUNA -> recharge to the exchange and sell into USDT -> buy into UST again

Among them, there will be a discount of about 4% when exchanging at the station. However, compared to the discount of UST and USDT, this space is still huge. If UST/USDT is 0.5, 96% - 50% = 46% arbitrage in turn will have a profit close to 46%. When UST reaches 0.7, there is also a 26% profit.

This process also requires two price protections, one when purchasing UST and the other when exchanging LUNA.

In DK’s tweet, there is a proposal from the community to increase the burning efficiency of UST. I checked the status of this proposal and it is still being voted on. In other words, even without increasing efficiency, the market's actions have fully exerted their effects.

In fact, consider it from a rational point of view. When DK said to allow UST to restore the anchor through the DEPEG mechanism, as long as anyone has an understanding of Suanwen, he must know that this is an announcement of death. This process is too fast.

However, LUNA did not die immediately. The exchange here has not been removed from the shelves for more than a day.

From the perspective of arbitrage, when the market price does not reflect the actual situation of the project, there is room for arbitrage. To be able to do it, you may need to understand the principle, know the relevant operations, find specific data, do a good job of risk avoidance, and finally have a little courage, or the muscle memory you have already practiced.

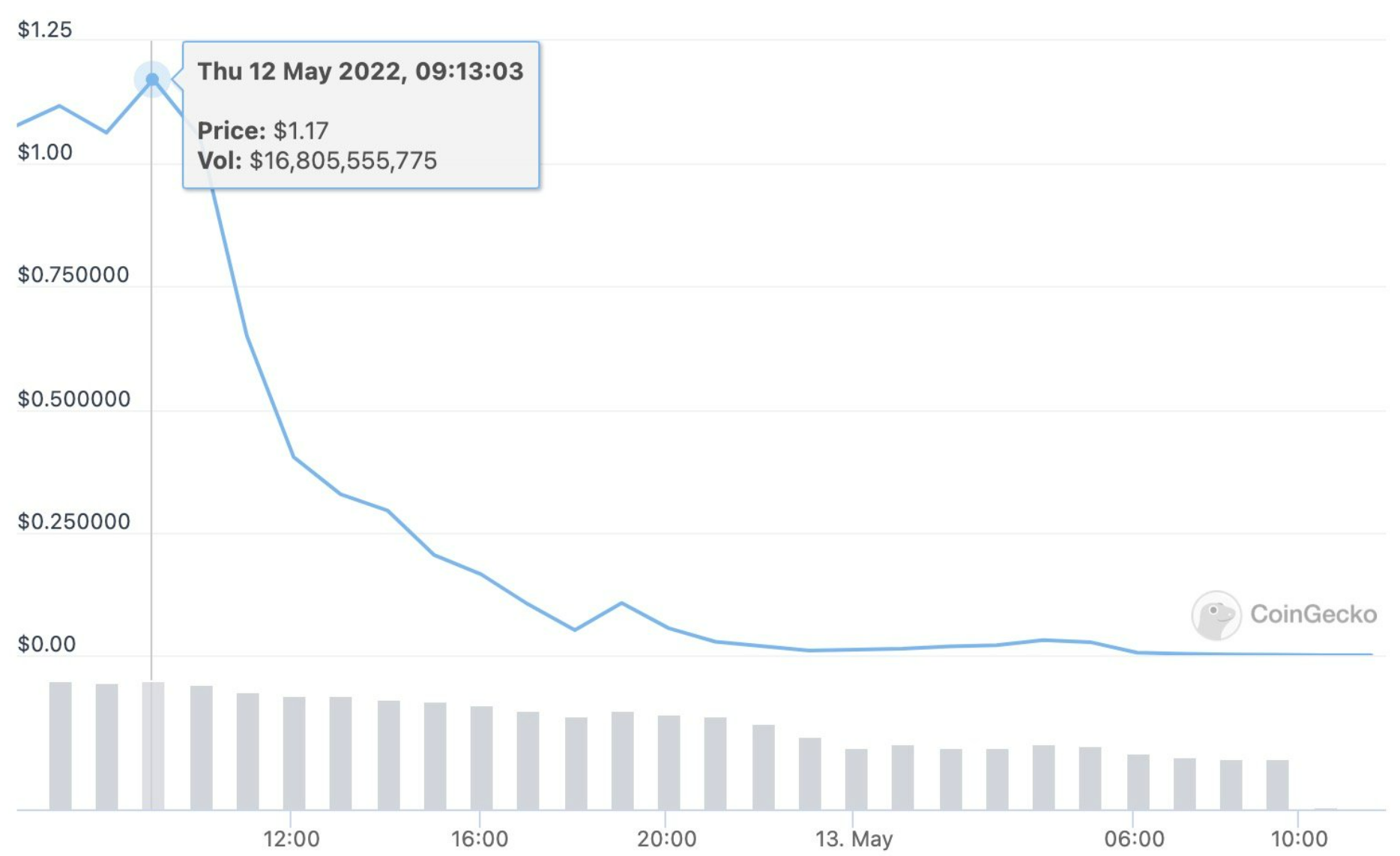

Judging from the amount of additional issuance and market price trends, 512 a day LUNA was issued steadily according to the upper limit of each block, and the price basically continued to decline, and continued to fall by 99%.

On 513, the exchange delisted LUNA and UST, and the drama came to an end.

In fact, it can be seen from the price trend of UST that the core of supporting this drama is that there are these two currency trading pairs on the exchange, because there are many opaque factors in centralization, so there is information gap.

At 9:00 a.m. on 512, the price of UST reached a 3d high on the exchange, and then fell all the way down, as did the price of LUNA.

From 7:00 pm on 511 to 9:00 am on 512, the price of UST recovered from 0.35 to 0.8. Those who do not understand the mechanism may think that the market is recovering confidence and healing itself.

According to the additional issue data, LUNA increased by about 3 times during this period, and the UST price rebound was actually purchased by arbitrageurs.

It all started with DK’s tweet, its 14 tweets actually have the same meaning, you guys go to arbitrage. Normally, the founder said so, and there is a high probability that he will go straight to the end. For the arbitrage mechanism to be effective, it needs to be supported by opponents. If it is an on-chain project, the one-time pool is dry. With the existence of the exchange, this feast can last for more than a day.

timeline:

It's a bit scattered, so briefly summarize:

timeline:

• DK tweeted, announcing lying flat

• Market feedback price from 3.5-0.7

• The exchange closes deposits and withdrawals, and the price reaches 7

• 511 late - 512 early 9, market price game, no big fluctuations

• During this period of time, LUNA will increase by about 3 times, and arbitrageurs will act secretly

• 512 early 9, UST recovered to 0.8, the arbitrage effect is more obvious

• After 9 am on 512, East 8th District time, panicked again after a large number of additional issuances were found

• From then on, it is estimated that it will be arbitrage for the whole people, and there will be a lot of random rushes, as opponents

• LUNA was delisted from the 513 exchange, and the drama came to an end

• UST price 0.1

• LUNA supply trillion+

Required knowledge and information:

• Mechanism of UST

• Relationship between UST and LUNA

• How to mint and burn UST

• Operation method of hedging

• Spreads across exchanges and on-chain

• Additional data issued by LUNA

• Difference between oracle price and actual price

• How responsive the market is to current realities

Possible risks:

• The exchange closed deposit and withdrawal

• The insurance policy was exploded

• Various unknown centralization risks