Stablecoin FUD spreads, what caused USDT decoupling?

Article compilation: Block unicorn

Article compilation: Block unicorn

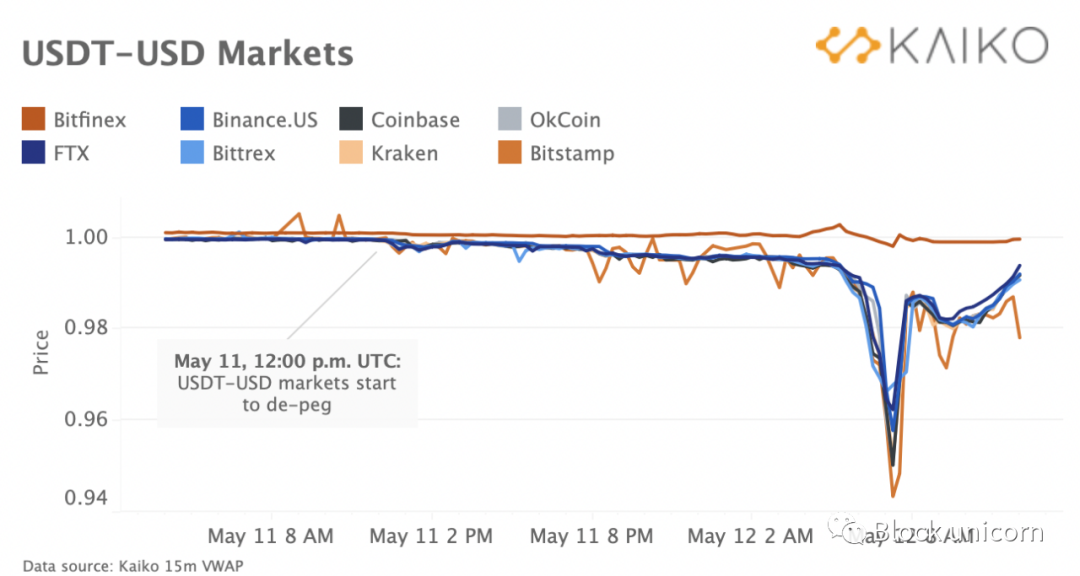

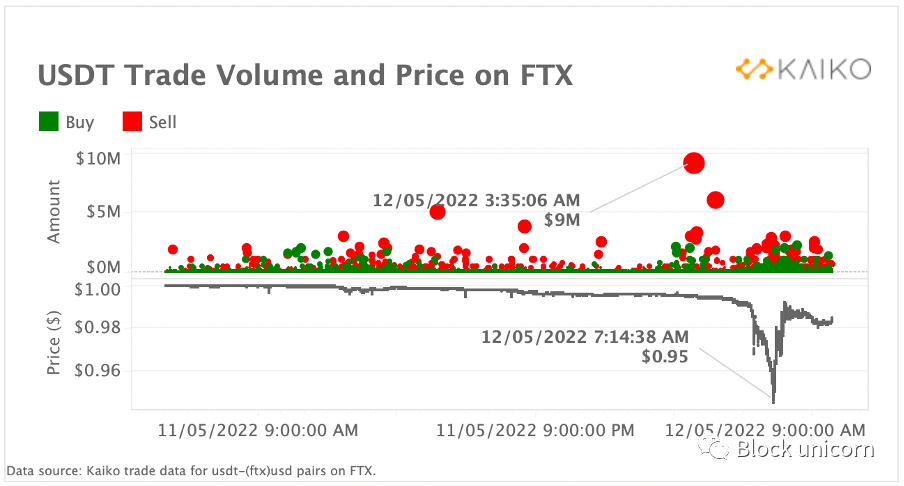

Less than a day after the UST and LUNA horror crashes, stablecoin FUD (panic) has spread to Tether, the largest and most systemically important cryptocurrency. Following the UST crash, Tether (USDT) began de-pegging around 12:00 PM UTC on May 11. At first it was only a small drop, from around $0.999 to $0.997, before falling sharply to $0.95 around 7 am this morning. At press time, USDT was trading back around $0.993 (now stable) USD, though concerns remained about the reasons for the decoupling and how long it would take for the stablecoin to fully re-peg.

For years, people have been speculating about Tether's reserves, which has sparked many predictions of an imminent crash, but the most likely explanation for this decline lies in the bearish market sentiment following the breakup of UST. However, never in recent market history has Tether seen such a dramatic price drop across all USDT markets.

Unlike UST, USDT is the most widely quoted asset on centralized exchanges. At present, there are more than 3,500 active instruments denominated in USDT, of which more than 75 instruments use USDT as the underlying asset. Therefore, the price discovery process is far more complex than for stablecoins with smaller market caps, which is why it is difficult to determine the source of the depeg event.

One way to understand Tether's price discovery, though, is to look at the real USDT-USD trading pairs that trade on 12 exchanges today (we're counting FTX's USDT-USD pairs, although exchanges technically use them own version of the stablecoin USD). The USDT-USD market provides a "true" rate for the stablecoin, whereas other markets such as USDT-DAI, USDT-USDC or BTC-USDT require traders to determine a midpoint rate for Tether's USD value.

image description

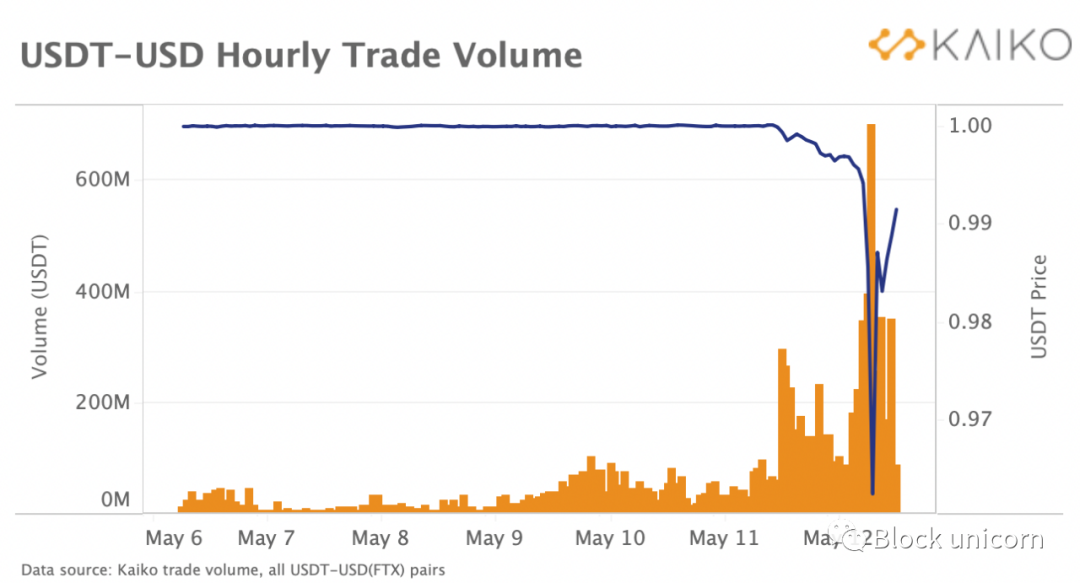

Hourly trading volume soars by about $650 million

image description

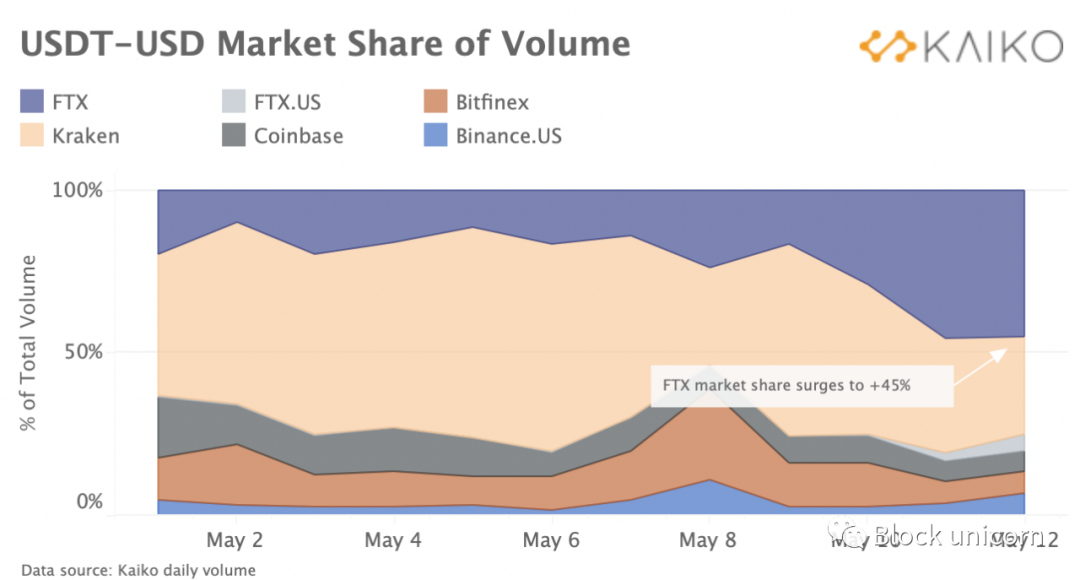

FTX's USDT-USD volume market share more than doubles in 2 days

Let's take a deeper look at some of the orders that occur on these exchanges.

Explore buy and sell orders

image description

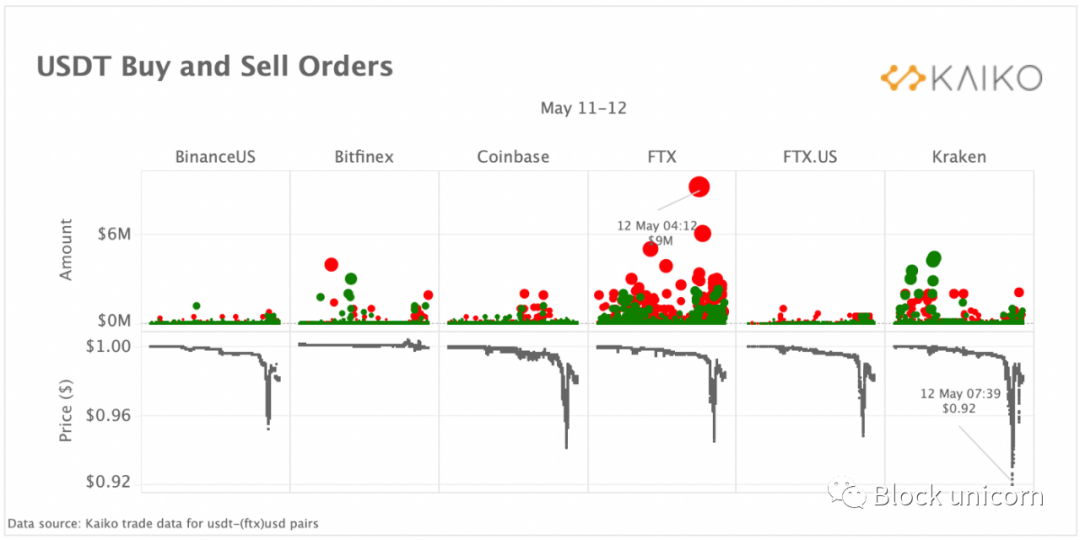

At the height of the decoupling, the largest sell order on FTX was $9 million

During the height of the decoupling, we could observe some massive sell orders on FTX. The most mysterious thing about the large FTX sell order is why traders would sell USDT at a loss when they could theoretically redeem USD at an exact 1:1 ratio from Tether Limited, which claims to be still processing redemptions normally.

However, the company only offers redemptions for "verified customers," delays are possible, and it's unclear how easy it is for ordinary traders to offload large amounts of USDT. Uncertainty about redemptions could spark panic during a decoupling that spilled over to the USDT-USD pair, where it remains unclear why traders are selling at such low prices despite millions of dollars at risk.

Another interesting trend is the large number of orders on Kraken to buy USDT at a discount, suggesting that whale traders may profit from this redemption mechanism by snapping up USDT at low prices. On Bitfinex (which owns Tether Limited), USDT is still trading above its 1:1 peg, so traders can also buy on Kraken and sell on Bitfinex for quick profits.

Zooming in on FTX, we can observe that a large number of sell orders started around the unpegging event and continued at a higher rate than the large number of buy orders.

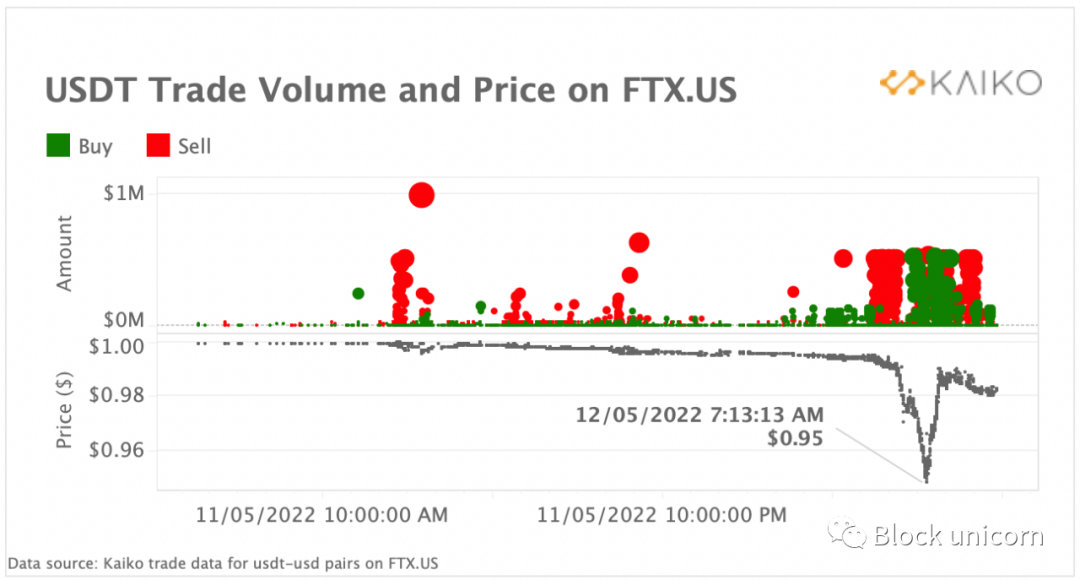

The same trend can be observed on FTX.US, albeit more extreme:

image description

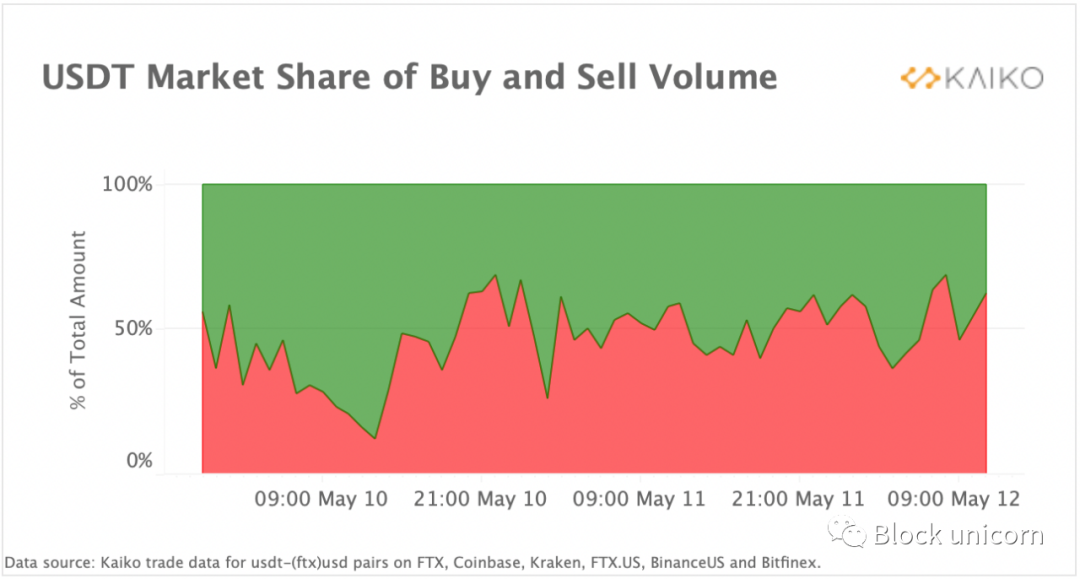

Biggest USDT market buy and sell volume

Stablecoin Pairs Price Discovery

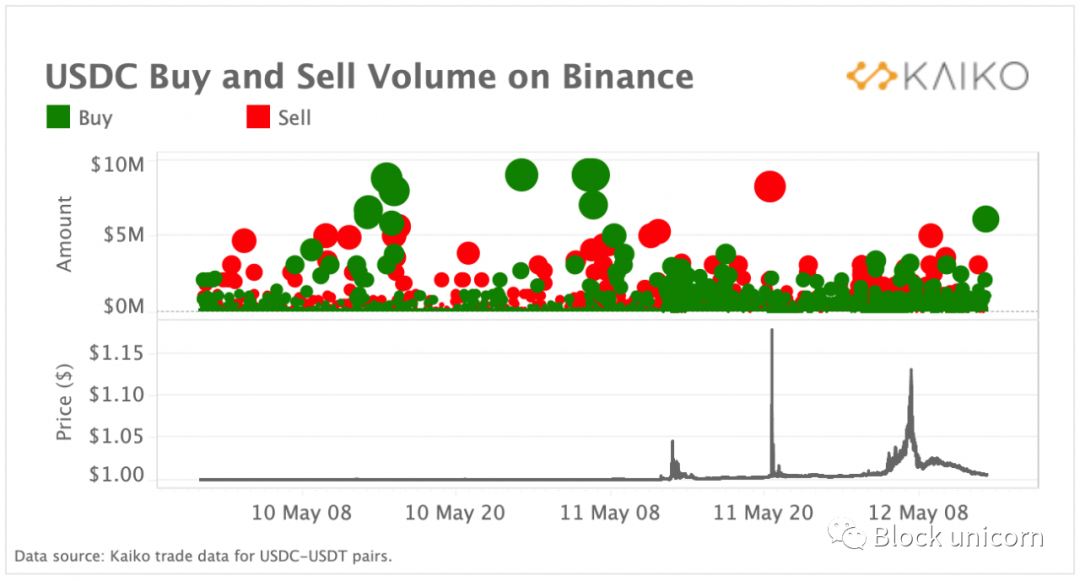

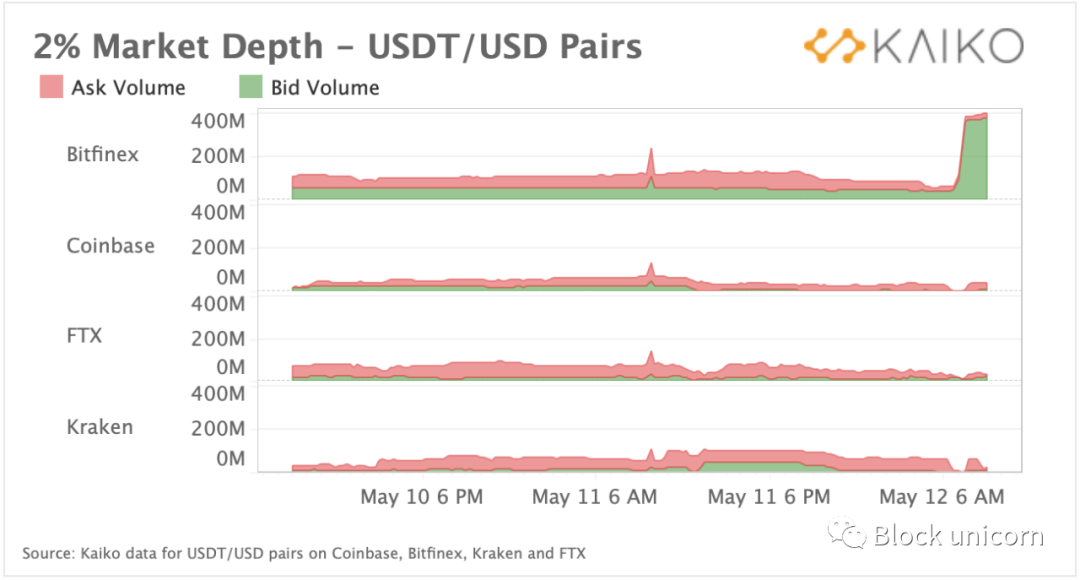

Stablecoin pairs also play an important role in USDT price discovery, especially on exchanges like Binance that do not offer USD trading pairs. Instead of cashing out USD, bearish traders can switch USDT to a "safer" stablecoin.

image description

Place a large buy order for USDC, sell USDT

Massive sell orders on BUSD to profit from difference in USDT price

Ultimately, if large market orders are able to remove liquidity from the order book, they can cause a rapid price drop. Let's take a look at these order books and see what's going on.

Order Book Data

Centralized exchanges are extremely important to stablecoin price discovery, and therefore critical to maintaining their peg. Order books can be a useful way to gain more insight into the efforts of market makers to defend these exchanges' pegs. This is usually done by providing liquidity, especially on the buy side of a bear market. Once the peg panic spreads, investors flee to fiat currencies and look to ditch their stablecoins via the stablecoin/USD pair.

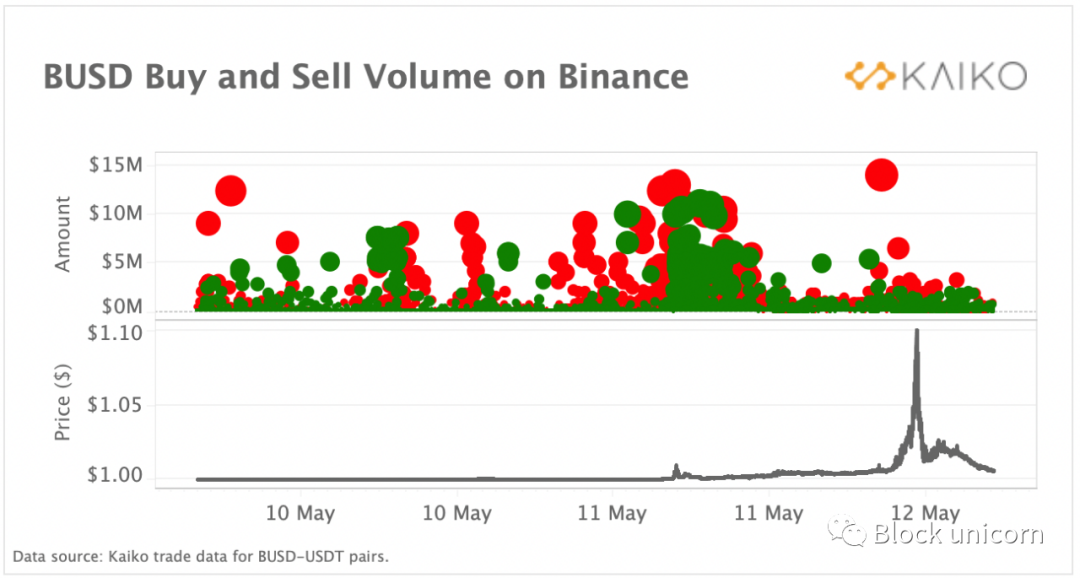

image description

Market depth has declined on most exchanges except Bitfinex, which seeks to defend USDT's price stability with bids

By looking at the data transactions of the exchanges, we can clearly see the efforts made to defend the USDT anchor in the early hours of this morning. Not surprisingly, Bitfinex, which is owned by the same parent company as Tether, is doing its best to defend the USDT peg by increasing bid depth.

That's why in our first USDT price chart we see no movement in Tether's price on Bitfinex. On the other hand, we could observe a sharp drop in liquidity on the other largest exchanges trading USDT/USD, which could lead to a decoupling.

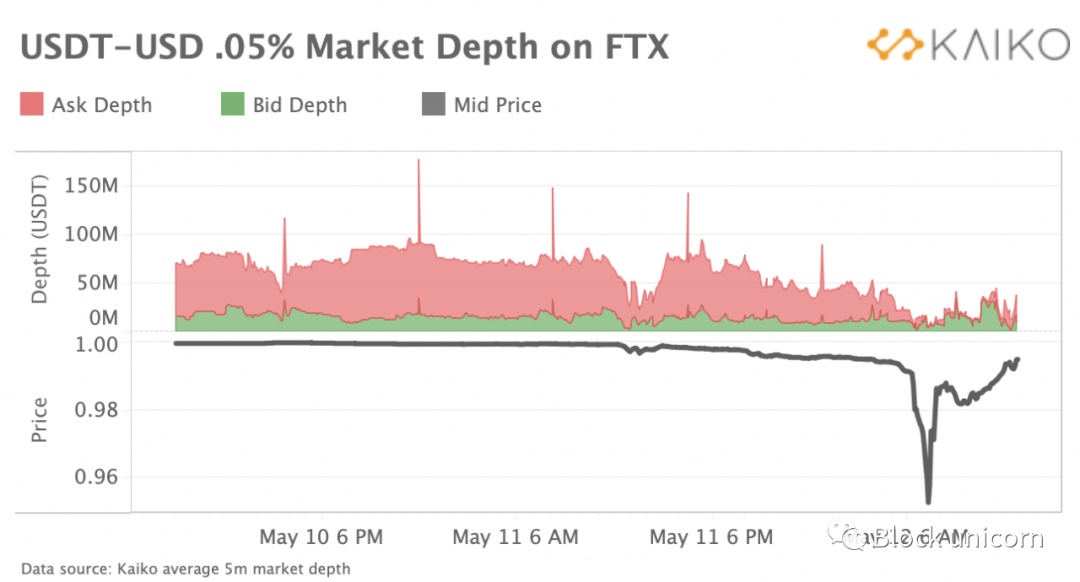

Zooming in on the 0.05% average market depth on FTX, we can observe that the depth of buying and selling decreased after the peg was removed, although it has since recovered.

text

in conclusion

Price discovery is complicated, especially for a large stablecoin like Tether, but from the data we can observe some interesting trends over the past two days. FTX’s market share skyrocketed with a flood of sell orders (although Tether’s redemption mechanism is said to still be working). Stablecoin pairs have also played an important role in Tether’s price discovery, with many traders rotating in and out during the decoupling. Ultimately, the USDT decoupling came as a shock to all cryptocurrency markets, especially given the uncertainty of why it happened. However, as of press time, the stablecoin has slowly shed its abnormal price, allowing it to be pegged to the exchange rate and avoiding the worst.