Why am I short UST?

This article comes from MediumThis article comes from

, Original author: Hjalmar Peters, compiled by Odaily translator Katie Ku.

This morning, TerraUSD (UST) was severely de-anchored, falling as low as 0.609 USDT. The encryption market was "falling and falling", and by noon, UST had rebounded to 0.9 USDT.

Fiat-backed stablecoins, such as USDC or USDT, provide this incentive by promising a 1-to-1 redemption for real dollars, which they claim hold $1 in reserve for every token issued. Due to this mechanism, the peg of a fiat-backed stablecoin is related to the credibility of its redemption promise.

The algorithmic stablecoin represented by UST often relies on arbitrage incentives to maintain price anchoring. When the price is lower than the anchor price, the arbitrage incentive creates demand (push up the price), and when the price is higher than the anchor price, it will Create supply.

Specifically, the Terra protocol allows each UST it issues to be redeemed for $1 worth of Terra's other native token — LUNA. So, for example, if UST is trading at $0.99, an arbitrageur can redeem it by:

Buy 1 UST for $0.99;

Redeem 1 UST purchased for 1 USD of LUNA (for example, if LUNA trades for 100 USD, it will be 0.01 LUNA);

Because the redemption process is carried out by burning UST and minting new LUNA. As with fiat-backed stablecoins, if UST's redemption process fails, its peg will fail as well.

secondary title

Vulnerabilities of Terra's anchoring mechanism

For every $1 of UST that wants to be redeemed, someone must be willing to buy UST for $1 (or any other $1 worth of non-Terra assets), or, thanks to Terra's arbitrage mechanism, you can buy LUNA for any price. Otherwise, if more UST wants to leave Terra, UST will obviously not be able to trade at par.One might naively think that there should be enough dollars for any UST that might want to unpeg. However, this conclusion is incorrect. The definition of market value is market price × circulation supply.

Therefore, the entire circulating supply of the token must be sold at the prevailing market price to generate a yield commensurate with the market value of the token.

However, when a large number of tokens are sold, only the first few tokens will get the prevailing market price as the price will plummet very quickly. Therefore, only dollars worth a fraction of the token's market cap can be withdrawn from the market. This line of reasoning assumes that one cannot sell more than the circulating supply, and in the case of LUNA, it is also possible to oversell given the variable supply of LUNA. While the exact amount of USD that can be withdrawn from the LUNA marketplace is unknown, it is limited.("Net" means, minus the amount of USD you want to convert to UST.) This is why UST supply tightening poses a permanent threat to the peg (assuming they are due to UST leaving Terra rather than UST switching to LUNA) . Terra responds to this threat by stimulating supply expansion. However, this approach is not sustainable.

secondary title

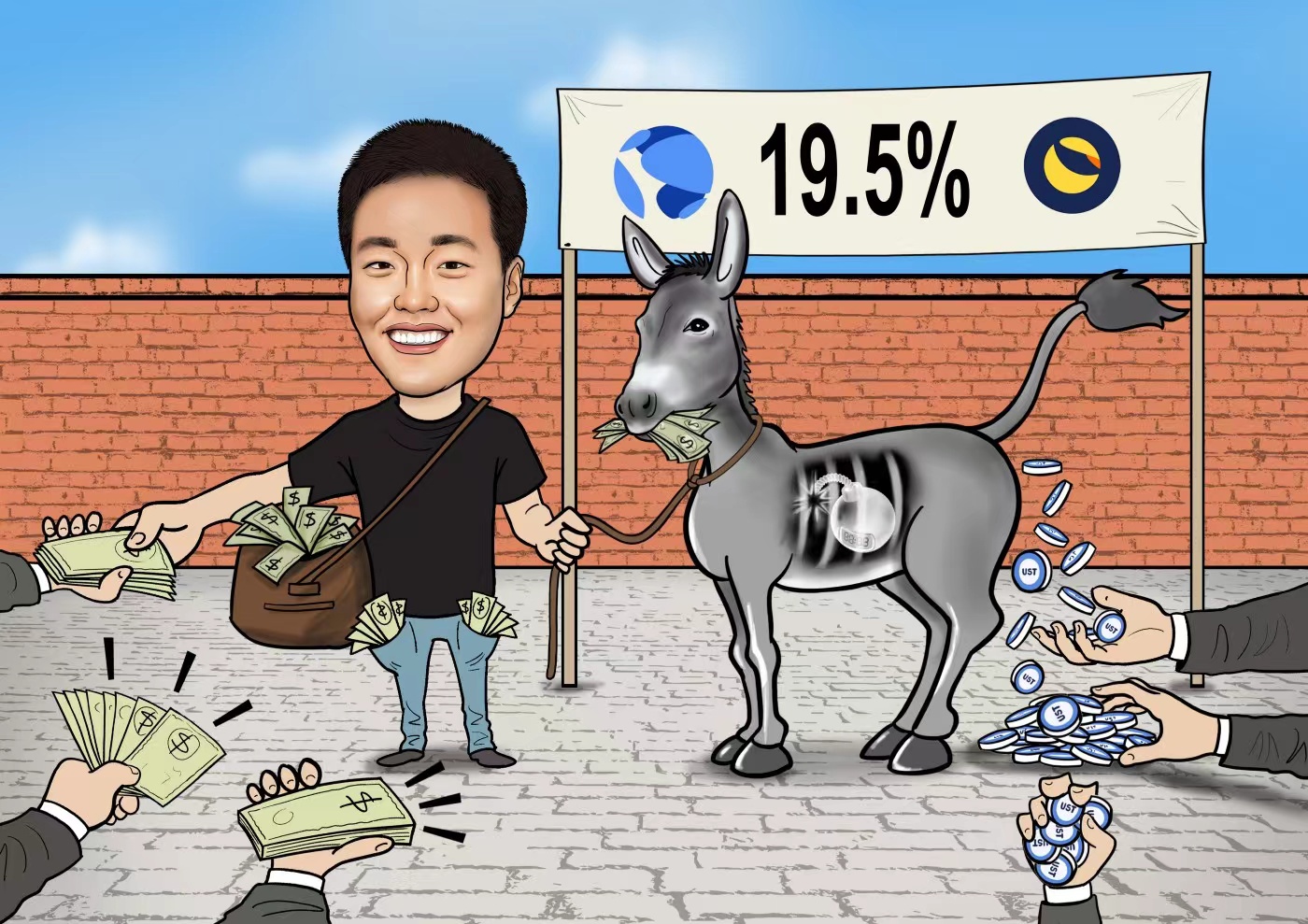

Terra Ponzi EconomyTerra is incentivizing UST supply expansion through its Anchor Protocol offering a staggering 19.5% interest rate.

This rate can be achieved through the following three steps:

1 USD redeems 1 UST;

Deposit 1 UST into Anchor Protocol for a period of time and receive x UST interest;

Convert 1+x UST to 1+x USD.

As mentioned in the previous section, step 3 requires "1+x USD" willingness to buy UST for $1 or LUNA for any price. During the expansion of UST supply, there are enough US dollars willing to buy UST at par, so the principal (1 USD) and interest (x USD) received in step 3 can be fully obtained from the redemption of UST from US dollars.With step 1 implemented, most of these USD were converted to UST, namely to profit from Terra's 19.5% interest rate. so,During the expansion of UST's supply, the principal and interest accumulated at Terra's 19.5% interest rate are all paid by new funds entering Terra to enjoy this interest rate. Of course, this Ponzi is not sustainable.

At some point in the future, the inflow of new funds attracted by Terra's special interest rate will no longer be sufficient to cover the outflow of principal and interest. At that point, Terra's resilience to UST supply contractions will be tested.

Finally, let's take a look at pegs and the 19.5% interest rate it offers for local UST. At the time of writing, there are 18.5 billion UST in total. 13.7 billion UST is deposited into Anchor, and the interest of 6.7 million UST is collected every day. Of these daily interest payments, only about 1.5 million UST comes from borrowers who, in addition, are subsidized by the ANC tokens distributed to them. The remaining UST of more than 5 million comes from the so-called yield reserve. Terra will automatically replenish whenever the Yield Reserve is low, the last time in February was 450 million UST. Terra does these fillings with funds it arbitrarily allocated to itself during its inception.

secondary title

UST sell-off death spiral

The UST supply contraction may eventually trigger a fatal blow to the supply contraction due to the following side effects.Selling pressure on UST means selling pressure on LUNA.

There are two reasons. First, once selling pressure pushes UST below $1, arbitrage occurs. UST, on the other hand, is the central pillar of the Terra ecosystem. The departure of many USTs from the ecosystem may indicate waning interest in Terra, which in turn prompts the exit of speculative LUNA holders.Selling pressure on LUNA implies selling pressure on UST.

LUNA plays a central role in the redemption process of UST. If the price of LUNA falls sharply or rapidly, holders of UST may worry about the possibility of future redemption and decide to sell UST while they can still get rewarded.These two causal relationships constitute aprice negative feedback loop

. Selling pressure on one token (eg UST) leads to selling pressure on another token (LUNA), which in turn causes more selling pressure on UST, etc. This vicious cycle will send UST and LUNA into a sell-off death spiral that will not stop until their respective prices go to zero. Most importantly, the impending death spiral itself can release selling pressure, thus starting the death spiral.The two charts below show what happened last year, a project similar to Terra (UST is equivalent to IRON, LUNA is equivalent to TITAN). Notably, IRON is backed by 75% of the USDC reserve. These reserves were not consumed in the death spiral, so IRON has an intrinsic value of $0.75. Note also that the death spiral that occurs on Terra will proceed slowly due to some provisions built into Terra's mechanics. Scenario 1 in the next section illustrates this slow "torture to death" zeroing process.

TITAN price plummets to $0 in June 2021 (nomics.com)

IRON price drops to around $0.75 in June 2021 (nomics.com)

secondary title

Terra Breakdown Scenario

In reality, the Terra protocol provides less and less LUNA worth 1 UST to trade more UST per minute. For example, with the current parameters (BasePool=50M SDR, PoolRecoveryPeriod=36 blocks), the Terra protocol only pays:

When the transaction volume per minute is 450,000 UST, the price of 1 UST is $0.95;

When the transaction volume per minute is 7 million UST, the price of 1 UST is $0.50.Therefore, whenever high arbitrage throughput is required to maintain the peg, the peg breaks down. The chart below shows the unanchoring event that occurred in May of last year. While in this case UST reinstated the peg after about a day, there is no guarantee it will be reinstated every time.

image description

UST price temporarily unanchored in May 2021

Let's assume that, over a certain time frame, there is a net 5 billion UST that wants to be converted into USD, but only 4 billion USD can be withdrawn from the LUNA market. As explained in the "vulnerability" above, the peg of UST must be broken under this assumption. Still, depending on the behavior of UST holders, the outcome could be "unreasonable". As shown in the following two examples:

Scenario 1 - Assume holders of 5 billion UST want to convert to USD as soon as possible, but they are unwilling to sell UST below $0.95. Under this assumption, the price of UST will drop to $0.95 and arbitrageurs will buy and burn UST to mint and sell LUNA. However, such arbitrage can only be profitable if the arbitrageur is able to mint more than $0.95 of LUNA for every 1 UST burned. Therefore, they must limit their arbitrage throughput to 450,000 UST per minute. As the arbitrage proceeds, $427,500 worth of newly minted LUNA is dumped into the market every minute, driving down the price of LUNA.

As the price drops, more LUNA need to be minted for every 1 UST burned in order to create the equivalent value of $0.95. After about a week of continuous arbitrage, 4.21 billion UST will be burned, a large amount of LUNA will be minted, and $4 billion will be purchased for these LUNA. At this point, according to our assumption, there are no more dollars willing to buy LUNA, so the price of LUNA eventually goes to zero. With LUNA becoming worthless, the arbitrage mechanism stopped working, UST going to zero is inevitable, and Terra is dead.

While the lucky first 4.21 billion UST was shaved off by 5%, the remaining 790 million UST (and all the 13.5 billion UST that was not intended to be redeemed for USD) went away empty-handed.

Scenario 2 - As just seen, when panicking, the patience of UST holders is dangerous.

Therefore, UST holders have an incentive to accelerate the conversion to USD by accepting a lower price. Let's assume that holders of 5 billion UST think that $0.50 per UST is better than nothing. Under this assumption, the price of UST would drop to $0.5 and prompt arbitrageurs to convert up to 7 million UST per minute into LUNA. After about 12 hours of continuous arbitrage, 5 billion UST will be burned and $2.5 billion will buy all newly minted LUNA tokens. Every UST holder who wanted to leave Terra did, albeit with a 50% loss. At this point, the unpegging storm is over and UST can be re-pegged to the USD.At first glance, Scenario 2 appears to be a temporary de-anchoring caused by over-frightened Terra holders foolishly selling Terra at half price. However,In reality, Terra price recovery comes at the expense of these Terra holders. If they were as patient as in scene 1, it would be zero death., Terra is better equipped to deal with bank runs and panics than to slowly die.

secondary title

Terra's Reinforcement: The Bitcoin Reserve

More recently, Terra has attempted to mitigate its weaknesses by partially backing UST with non-Terra assets, primarily Bitcoin. Over the past three months, Terra purchased 42,500 bitcoins (worth $1.6 billion at the time), as well as $300 million worth of USDC and USDT. In the future, Terra plans to change its UST minting process so that its reserves grow in sync with UST supply. In order to mint 1 UST, a user may need to add $0.4 of Bitcoin to Terra's reserves and burn $0.6 of LUNA (the exact ratio has not yet been determined). Instead, in addition to LUNA, UST also plans to be redeemable for Bitcoin. In the remainder of this article, I will assume that these plans have been realized.While the Bitcoin Reserve does make Terra more robust, its fundamental weaknesses remain. The peg is still inherently fragile as a sufficiently large UST supply contraction could easily deplete the reserve and then still break the peg as before.

Furthermore, the risk of a death spiral persists as the following negative feedback loop exists between UST's selling pressure and weakening reserves.

The drop in reserves put UST under selling pressure. Terra's Bitcoin reserves and LUNA guarantee that 1 UST can be redeemed for the equivalent of 1 USD. The weakening of this guarantee may encourage UST holders to sell their UST while they can still make a profit. To make matters worse, this is closely related to the cryptocurrency market. It is also possible that LUNA will struggle if the reserves are weakened due to a drop in the price of Bitcoin.

secondary title

Grab the life-saving straw of "Bitcoin appreciation"

secondary title

Summarize

SummarizeTerra's mechanism of pegging UST to USD is vulnerable to a significant contraction in UST supply. Furthermore, it has the property of amplifying pressure, and even a modest supply contraction can trigger a sell-off death spiral. To avoid these situations,recommended reading

recommended reading

Start the death spiral or the end of the stress test? Can UST be saved?