The "UST Defense War" started? Can Terra Cope with a New Crisis of Confidence?

Beginning on May 8,Rumors of "UST decoupling" have begun to ferment in the market. The severity of the situation can be seen from the UST stablecoin exchange pair on the centralized CEX:

The price of UST/USDT on Binance was once close to 0.98, and the UST on the borrowing market was even wiped out. With the spread of panic,UST and LUNA do seem to be facing a new test never before seen.

first level title

01

Double peg mechanism of Luna and UST

The core design idea of the Terra ecology is how to expand the usage scenarios and payment requirements of the stable currency UST, and the operation of UST adopts a dual Token design:

Luna, a Token for governance, pledge and verification; UST, a native dollar-pegged stablecoin.

A simple understanding is that every time a UST is minted, LUNA worth one dollar must be burned, and LUNA helps maintain the peg between UST and the US dollar through an arbitrage mechanism:

Whenever the UST exhange is higher than the peg, the user can send LUNA worth 1 USD to the system and receive 1 UST; conversely, when the UST exhange is lower than the peg, the user can send 1 USD of UST to the system to get 1 USD LUNA.

In both cases,Users are motivated to carry out arbitrage, thereby helping to maintain the peg between UST and the U.S. dollar. This dual-token arbitrage stablecoin design and typical over-collateralization requirements are prone to tragic large-scale liquidation events when the encryption market encounters violent fluctuations.

In the previous "5.19" crash in 2021, USTDue to the spiral liquidation, the price "unanchored" appeared, and even broke the anchor by more than 10% at one time, almost entering a collapse of confidence and a vicious circle.

Whether it is the stampede and liquidation of ETH in "3.12" in 2020 or the "queue shooting" of ETH in "5.19" in 2021, it has verified the worst possible huge destructiveness in this extreme situation.

This is also an almost inescapable test for algorithmic stablecoinsTherefore, under extreme market conditions, the stability of the price relative to the overall market is an inevitable and important growth test for a stable calculation like UST, and it is also a sign that the project is becoming mature and sufficiently anti-fragile.

Risks on the data surface: At least from the data level, UST has reached the most critical momentfirst level title

02

Inversion risk of UST market value and LUNA market value

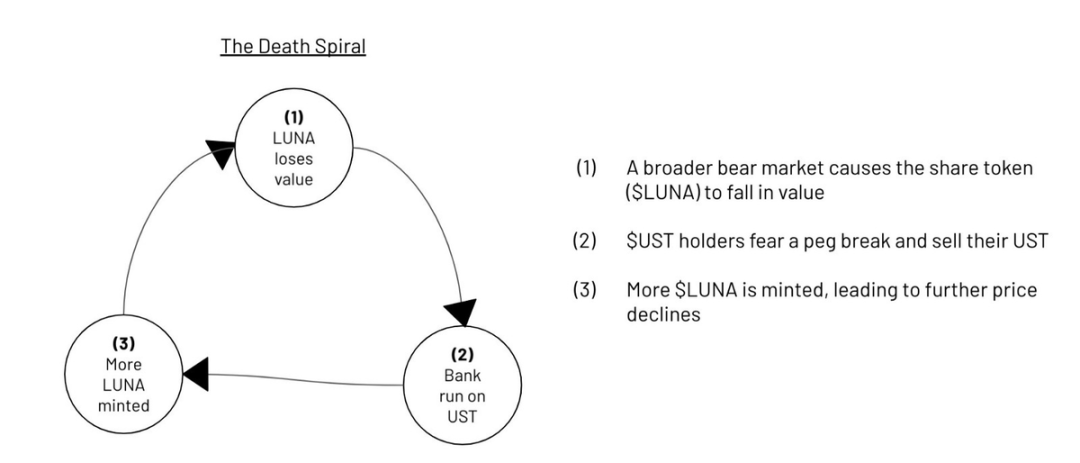

The main reason is the risk of inversion between UST market value and LUNA market value:Previously, the market value of LUNA had been much higher than that of UST, which resulted in that when LUNA fell, it generally reserved enough room for liquidation, so as not to appear in the extreme situation of insolvency, thus preventing the death stampede after the collapse of confidence.

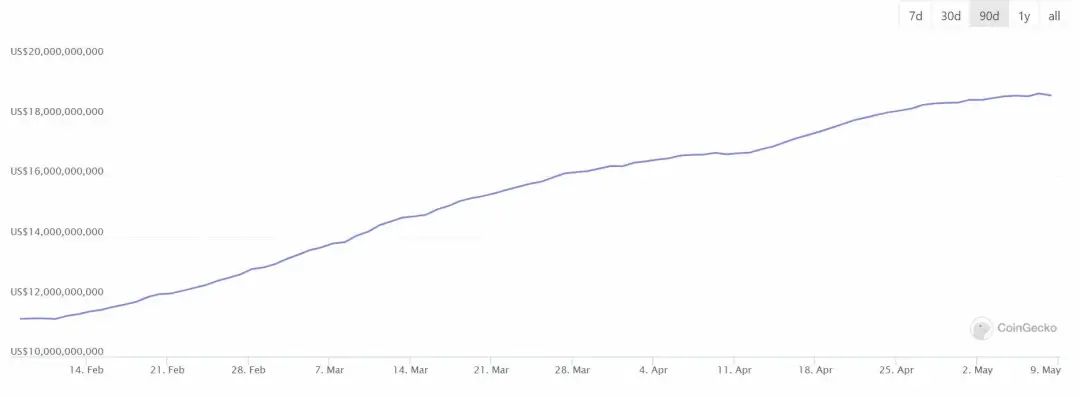

However, the circulation of UST has soared rapidly in the past six months. As of May 9, it has exceeded 18.7 billion US dollars, an increase of more than 11% in the past 30 days.

This is a delicate embarrassing situation - Luna's current market value is 22.4 billion U.S. dollars, and UST's circulation market value is 18.6 billion U.S. dollars.If the secondary market price of LUNA continues to fall, the market capitalization of UST may exceed that of Luna.

Calculated according to the corresponding price, that is, if Luna falls below $55, the market value of UST in circulation will exceed Luna, which will most likely bring about extreme panic in the market and a "death spiral".

UST's fleeing sentiment intensified "stomping".

Confidence is more critical than gold, especially for algorithmic stablecoins like UST that rely on ecology to grow.

However, UST in Anchor had a net outflow of about US$2.3 billion in the past two days, of which UST outflowed 1.3 billion on May 7, setting a new single-day high.

Compared with the peak value of 12.7 billion US dollars on May 5, the current UST deposits in Anchor have fallen by nearly 20%, which has caused investors to panic about UST's unanchor.The tide of redemption has further increased the risk of stampede.

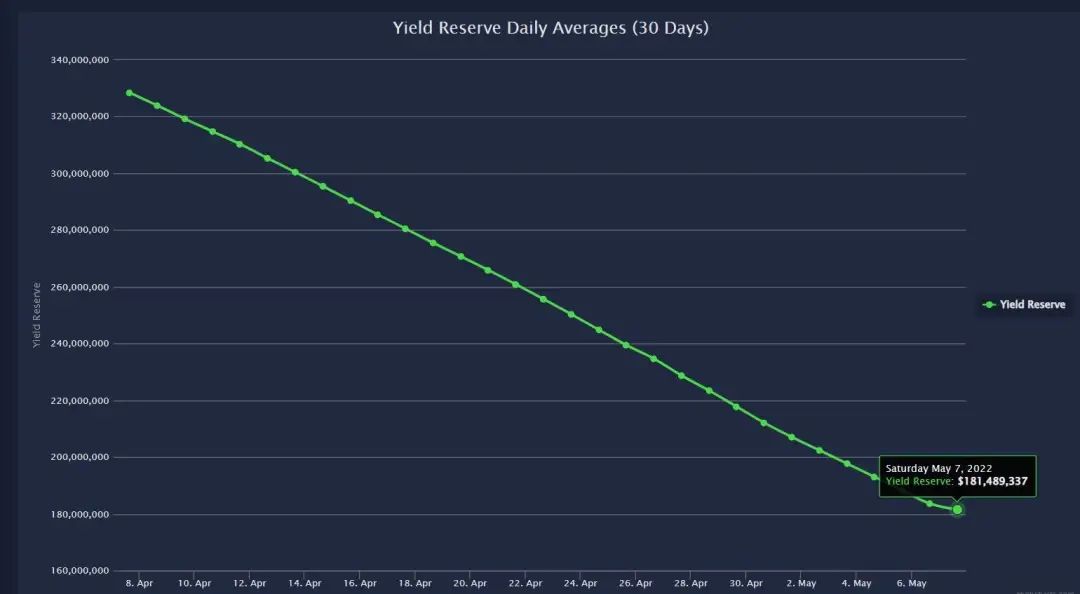

Anchor reserves are insufficient.

first level title

03

What are the toughness of UST

The development confidence of UST and Terra ecology is basically supported by the Anchor-based Luna-ust anchoring mechanism.

In the best case, it can maintain a scale of 1-2 billion, but the current problem is that the current circulation volume of UST has reached 19 billion.

Curve pool support

Therefore, LUNA has also set its sights on Curve in order to control the "minting power" of the encrypted world. The most direct is its 4pool solution-the new Curve liquidity pool composed of UST, FRAX, USDC, and USDT.

In this way, with the help of Curve, the minting power market, a peg guarantee is provided for extreme situations:

veCrv guarantees the stability of liquidity, and when a large amount of asset exchange actually occurs, there will be no liquidity escape; veCrv can be used as a governance tool for re-linking after unanchoring, With a few million dollars, billions of assets can be relinked, which is fundamentally impossible in uni.

However, this construction has only just begun, and it encountered this shock. UST only has a liquidity of about US$500 million on Curve, but has tens of billions of US dollars in deposits on Anchor.

Anchor Model Adjustment

UST deposits on Anchor,It is a double-edged sword of Terra's ecological life and death.

March 24,Anchor Protocol's proposal to "adjust the yield rate to a semi-dynamic rate based on the fluctuation of the yield reserve" was passed.

Its rate was cut from 19.5% to 18% starting this week in May. After that, the Anchor Earn interest rate will be adjusted dynamically up to 1.5% every month according to the appreciation or depreciation of the income reserve, the minimum APY is 15%, and the maximum APY is 20%.

At the same time, at the end of April, Terraform Labs protocol researchers issued a proposal suggesting that Anchor Protocol introduce the veANC model, and the latest news on May 7,The Anchor revenue and governance platform Helm Protocol will be launched soon, and users can deposit ANC into Helm to obtain veANC's derivative Token HELM.

In addition, Anchor has successively added AVAX, ATOM, and SOL as borrowing collateral. According to the general progress of Terra ecology, Anchor's efficiency is already self-extinguishing.

LFG's Bitcoin Reserve

As of now, the Luna Foundation Guard holds a total of about $3.5 billion worth of bitcoin reserves, which are designed for use in extreme situations-only for emergency bailouts,Only when the LUNA stability mechanism fails, the emergency reserve will be used:

It means that in the extreme situation where UST is sold in large quantities and the price of LUNA drops sharply,As a foreign exchange reserve that is not strongly correlated with Terra's economy, Bitcoin adds a policy tool to Terra's intervention in the exchange rate (maintaining the peg with the US dollar).

summary

04

summary

As a heterogeneous stablecoin that has grown rapidly in the past six months and whose market value is approaching 20 billion US dollars,UST’s “unanchor” test this time will far exceed “5.19” in terms of its own understanding and possible spillover influence.

Regardless of the final outcome, UST is destined to leave a strong mark in the battle for the holy grail of stablecoins this time.