Split venture capital through DAO: service DAO, incubation DAO, investment DAO

Article written by: Peter 'pet3rpan'

Article translation: Block unicorn

Service DAO, Incubation DAO, Investment DAO

There have been multiple attempts to disrupt venture capital in the past:

1. The proliferation of angel investors (AngelList, 2010).

2. Development and regulation of equity crowdfunding (Jobs Act, 2012).

3. Crypto crowdfunding ICO via token sale (2013)

While many of these efforts have succeeded in creating a greater supply of passive capital for founders, they have largely fallen short of adequately addressing founders' operational needs, which allow projects to get to market more quickly and throughout their lifecycles. Success in: people, design, product, marketing, research, economics, engineering, community building, business development, regulatory guidance and domain expertise.

Capital itself is abundant, but valuable services are not. Despite massive capital inflows into the tech and crypto ecosystem, high-value services remain scarce.

We believe this is based on the following factors:

Founders have no publicly verifiable data on the quality of service investors can provide, nor do many founders perform due diligence on investors. As a result, many founders fail to optimize their investors based on the services they provide.

The lack of high-quality data on investors has resulted in a sales-driven risk environment where investors overpromise and underreward. Unlike service providers who are bound by contractual obligations, or even founders who are bound by set timelines, investors will not be held to the same standards, although they will only be able to secure a few highly competitive funding rounds based on their proposed value proposition.

As a result, the funding landscape, both in crypto and in the broader venture capital space, is largely made up of passive capital.

While 1kx and a handful of other funds strive every day to be the exception to the norm, we have been unable to drive fundamental change in the broader investor landscape. Fortunately, we believe a shift is coming -- and we believe it started with Service Daos.

first level title

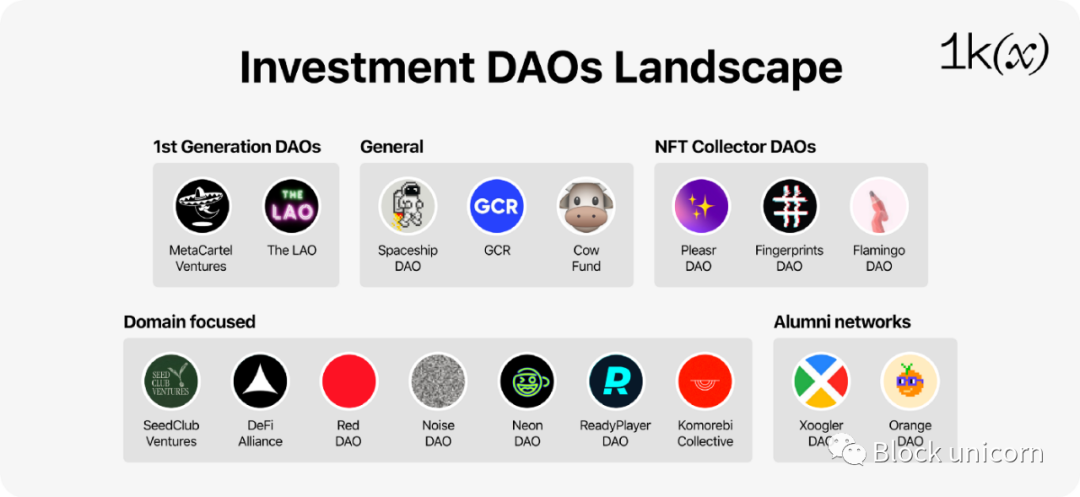

The Rise of Investing in DAOs (Generation 1)

The initial assumption of the first DAOs (MetaCartel Ventures and LAO) was an aggregated network and expertise of 60-100 DAO members (builders and investors) compared to a typical venture fund run by 2-3 partners Knowledge enables better evaluation of projects and provides added value to projects.

Despite this initial argument, many first-generation investment DAOs were largely unable to add value by providing access to the personal networks of the DAO members themselves and/or personal access to internal investment DAO transaction executives. This is because many DAOs are too focused on making investment decisions instead of other more helpful value-adding endeavors. We expect that Investing DAOs will expand their operational focus over time as more Investing DAOs enter the market, as they face increasing competition.

image description

first level title

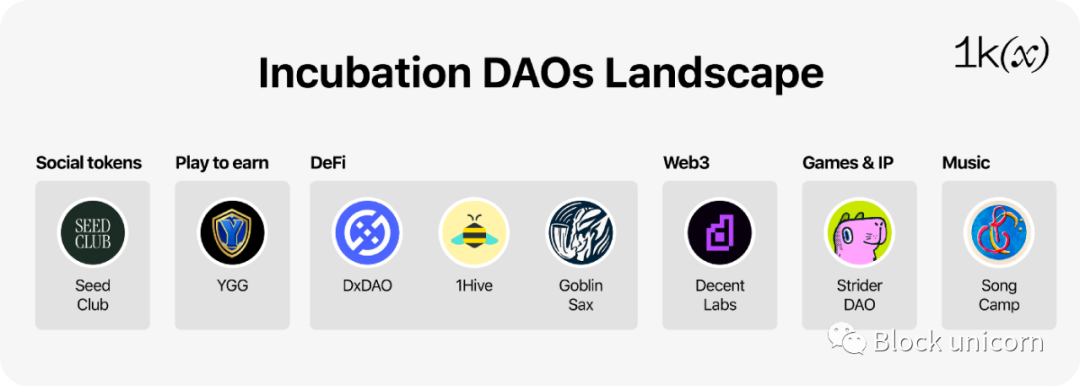

The Rise of the Incubating DAO (2nd Generation)

Incubation DAOs are communities that collectively help launch and launch new products and projects - while taking a small percentage of project ownership in exchange for providing initial incubation.

While these incubating DAOs often offer ideation programs or design sprints in which pre-launch projects are able to plan their product strategy behind the scenes, many incubators often apply to participate in the community signals these DAOs provide rather than the actual operational value-add.

image description

secondary title

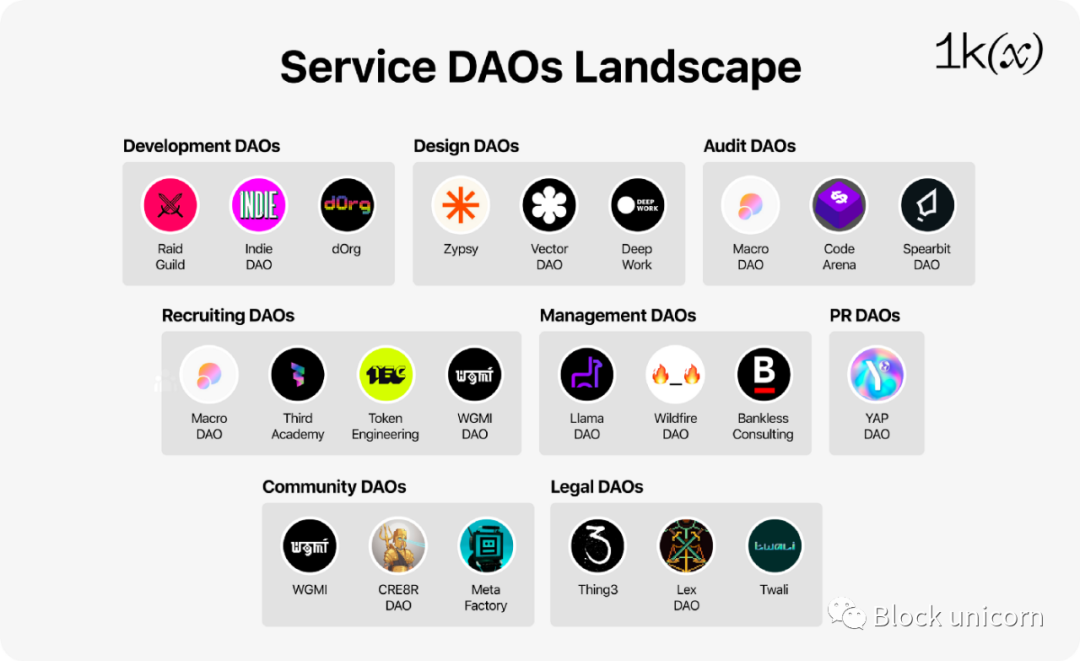

Next: The Rise of Service DAOs — Disrupting the Unit Economics of Venture Capital

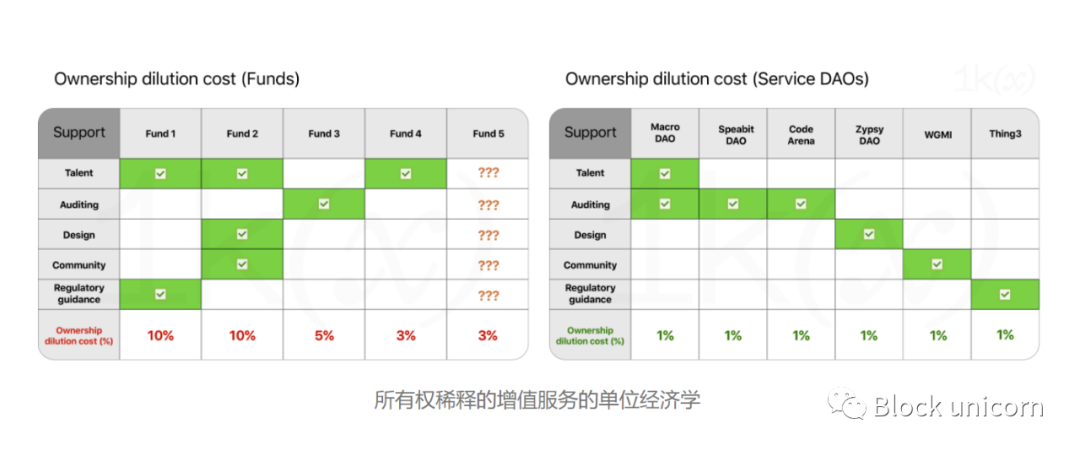

While most of the DAOs mentioned so far have only addressed ecosystem needs for high-value services, we believe that in order to develop the founders’ VC landscape, we need to evaluate VCs from a service perspective rather than a purely financial function :

Projects receive funding and value-added services from investors.

Projects pay a price in project ownership dilution.

(Sale % of its token supply or stake)

We expect more DAOs to focus less on investment and instead first as “service DAOs”—bringing together high-quality practitioners under one community to serve third parties (engineering, auditing, design, legal, research, financial management, etc.) organizations that provide services. In exchange for project ownership. As these service DAOs build demand for their services, they will be able to accumulate ownership of the protocols they use, further aligning incentives among them.

While some funds have traditionally offered a variety of services under the same umbrella, we may see services offered through service DAOs priced at much more granular levels and possibly with unit economics than those offering bundled services under their "platform" funds are much better.

Case 1:Given a team that most needs help with regulatory guidance, which of the following options might they choose?

A platform that provides funding, brand awareness, talent sourcing, and regulatory guidance, looking to earn 10% of a project's token supply.

Regulatory guidance service DAO, providing the same high-quality service in exchange for 1% of the token network.

It may make sense for a team to work with the fund if it needs the other available services that the fund offers, as well as regulatory guidance. But otherwise, the DAO-as-a-service model enables projects to address their needs directly without the significant dilution that traditional funding typically entails.

image description

secondary title

Why DAOs?

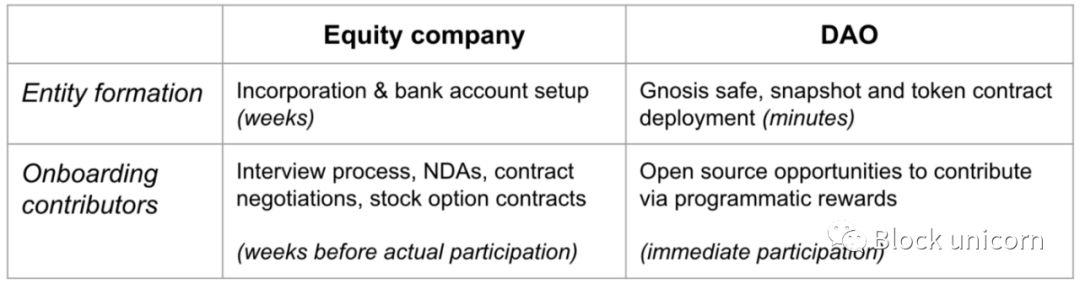

35% of U.S. employment is for building trust (legal contracts, enforcement, auditors) and this is reflected in the administrative processes required to set up and run an equity firm – via an organizational stack that supports smart contracts, which takes weeks, while No it might take a few minutes.

This is the fundamental advantage of today's encryption organizations over traditional equity organizations. However, despite this unique advantage, there are a few major measures of the DAO's success as a model of scale.

These measures include:

Ability to retain the best contributors.

(The best contributors to DAOS may face significant financial incentives to promote and join individual projects with greater capacity. How can a DAO provide an equivalent financial advantage for participation?).Solve the free-rider problem.

(The DAO needs to figure out how to balance community ownership and individual participants to ensure the most active contributors are rewarded for their work and have a long-term interest in the DAO while minimizing the influence of passive members).It is difficult to activate potential community talents.

(Even for a DAO with access to talent, getting talent in the network to contribute is difficult. How do we create scalable coordination processes that efficiently produce high-quality output?)

first level title

The Vision of a Homegrown DAO Entrepreneurial Industry

We are standing on the verge of a VC revolution and want to accelerate our vision of creating a DAO-native VC landscape.

Over the next 18-24 months we will continue to:

Investment service DAO, incubation DAO, investment DAO.

Help various DAOs cooperate with each other and form joint ventures.

Create a network of service DAOs to cross-disseminate operational insights.

Help determine how service DAOs can handle projects at different levels of maturity, from early-stage teams to large-scale token management vaults

So far we have seeded a vibrant DAO ecosystem under our portfolio:

Address their needs directly without incurring the severe dilution experienced by traditional funds.

Help early-stage teams launch token networks:

Design token economic model (distribution strategy, incentive plan, governance structure, value cycle).

Ecosystem construction (launch or guide market supply and demand DAO, community coordination, contributor coordination, governance participation).

Bootstrapping the infrastructure ecosystem (running validators, building open source infrastructure for portfolio projects, running liquidity provisioning and arbitrage bots).