X to Earn: The Official Challenge to the Death Spiral

Author: Andy, IOSG Ventures

Original editor: Elaine, IOSG Ventures

written in front

written in front

Since the Axie Infinity fire, Axie-like Play to Earn games have sprung up one after another. However, after Axie performed a wonderful death spiral roller coaster for the currency circle and the game circle, it has not yet appeared. A P2E game that is truly comparable to Axie's wonderful story: the market value is not enough, the popularity is not enough, the creativity is not enough, or it is simply not done yet😛

The result is that Axie’s P2E not only taught other chain games a lesson, but also gave an inspiration to the equally smart non-chain game market: if Play to Earn can become popular like this, then is there another X to Earn (X2E)? Opportunity? So in the past two months, the market has finally seen the wonderful X2E product after Axie:STEPN。

For product introductions that have been reported many times by other research reports, I will summarize them in one sentence:STEPN is a Move to Earn game. Users buy running shoes NFT to run and earn tokens. Currently, STEPN has 1 million users and 300,000 DAU. The market value of governance tokens has grown from 8 million in IEO to less than two months. The time went straight to 20 billion.

Since STEPN is still on the rise when this article is published, many entrepreneurs who have entered or watched from the sidelines, and even other X2E entrepreneurs are paying close attention to a question: When will STEPN reach its peak and start to enter the death spiral? It is very understandable that under Ponzinomics (Ponzi economy), the death spiral is an inescapable topic in the market. However, when the market is trending towards X2E and continues to develop wildly, we should not only avoid talking about the death spiral, but should take the initiative to understand what the death spiral represents, and challenge how to make the project last for a long time under the shadow of the death spiral. Only with advanced operations and concepts can users, project parties and investors simultaneously maximize long-term value under the shadow of the death spiral. So at the time when STEPN is currently gaining great popularity and before more X2E products arrive, the author will borrow the cases of Axie and STEPN in this article to put forward a few hopes for the death spiral itself, which will help the market the opinion of.

Without further ado, let’s start with the conclusion:

Although death spirals are inevitable for Ponzinomics, this article would like to illustrate the following points:

First of all, the result of the death spiral is not death, nor does it represent the failure of the product, but the process of returning from the madness of X2E to the fair value of the product itself, and the incubation period before this process occurs can be long or short, the rate of decline when it occurs can be fast or slow, and the fair value returned after the process can be high or low.

As the first popular X2E project, Axie has gone through a lot of trials and errors, showing the possibilities, limitations, and challenges of X2E in long-term operation for the following products, so that we can see that such as STEPN The project takes the best out of the learning process and strives to innovate - X2E is evolving.

while we expectThe evolution of X2E is a more restrained crazy period, a slower fever-reducing period, and a higher fair value regression line- This is what I think STEPN has the potential to do.

In addition to this, what is more important is to be able to finally achieve,Let the users who recognize the fair value of the project itself become the mainstream, so that utility value investors rather than speculators can obtain most of the benefits. (Being able to educate the market to participate in such an X2E project is not simply investing 10 yuan to earn 20 yuan, but investing 10 yuan is not only worth the value of the utility brought by the project itself, but also returns an additional 3 yuan; and additional rewards for users who persist , can reach the possibility of returning 10 or even 20 yuan.)

in future storiesThe source of economy other than Ponzinomics is what I am looking forward to for X2E, because it has more stories and space than the current P2E of chain games:For example, we just recently talked about an early Bike to Earn project (MOTE by Sweetgum Labs, interested investors are welcome to communicate with each other) that mentioned the realization of carbon emissions back to the economy, so as an example, a person who originally drove 10 kilometers back and forth every day People who go to work instead of cycling every day can save 4 tons of carbon emissions a year, and a ton of carbon emissions can currently be worth 80 euros in Europe, which meansIn theory, a person can realize more than 300 euros a year to flow back into the economic systemfirst level title

secondary title

1. Sunk cost acceptance of investment losses

Let me start with an example: I believe everyone is familiar with the fitness card; and the story of practicing three times a week in the first month and once three weeks in the tenth month after applying for the card is probably not unfamiliar; finally, if you After a period of time after the expiration of the card, the fighting spirit is rekindled, and the above cycle is repeated, then you and I are a family. Why do we allow ourselves to invest a lot of money again and again, but surrender to low self-control over and over again, so that this cycle keeps happening? Do people who have failed in one cycle swear to "be sure next time" as if they have forgotten their lesson, and embark on this road again?

A key mindset isTolerance for sunk costs:Applying for a fitness card is originally an investment in one's body shape and health (utility), but after the excitement period, the spider web on the fitness card is the willpower to announce the failure of this investment and the reconciliation of the silent cost.

It may not sound like much, so let’s roughly quantify it: the original purchase purpose of the fitness annual card of more than 5,000 RMB is to urge you to run 5 kilometers each time three times a week, but you only lasted for the first two months in the end, so when you originally purchased it The recognized return on investment of 5,000 yuan is 13 kilograms, and the final return is 2.3 kilograms, which is 15% of the original ROI → Most people will react to this with a high probability of "sorry, dare to do it next time", and then apply for a card. However, just imagine if this is the ROI of investing in the stock market and blockchain, will you continue to "dare to do it next time"?secondary title

2. STEPN: Is it your financial investment software or utility investment (fitness) software?

Unexpected return for STEPN investors:To give an example that many Stepn players may resonate to some extent: A friend who has experienced Axie entered the game almost a month ago. The original purpose of entering the game is the same as playing Axie at the beginning, and the additional form of running is less than the game. It took a lot of brains, and there was less resistance like "playing games to waste time", so I chose Stepn at the same time cost; but as I ran downstairs on time every day to earn GST this month, I discovered the meaning that Stepn brought to me There has been a change from my original expectations: the most important thing is how long it takes to get back the money, and how much money I can earn by running once a day on average (financial return), but then I was shocked by the non-financial return that I didn’t care much about before: The change of mental state brought about by exercising for 40 minutes a day, the change of being lazy at home after work, the change of starting to go out to exercise with family members around you, the change of losing weight for many years but this time I lost 2 catties in January, and the change of my own health A more mindful change.

For this friend, Stepn is originally a running + money-making project. Of course, users will naturally expect both sides when they enter the market, but there is another key mentality change in the participation process at the micro level: from holding financial benefits to come with the best purpose,first level title

secondary title

1. First define three types of players:

Lucky A players, worried B players and wait-and-see C players:The friend mentioned in the above example entered a month ago and is about to pay back at this time - we might as well call this type of player who has paid back (or is about to pay back smoothly) luckyClass A players- Since the mechanism of the game does not set a life cycle for shoes, then A-type players will earn forever as long as they are willing to persist after paying back their capital. Then, after reading the cost-returning users of category A, there are two soul questions for Ponzinomic (Ponzinomics) products:

1) Can/how long will people who have bought shoes and haven’t paid back their money pay back? We call this type of playerWorried B-type players.

2) Friends who have not entered the venue to buy shoes but are waiting to see, can they still enter? We call this type of playerClass C players on the sidelines。

secondary title

2. What is the difference between STEPN's death spiral and Axie Infinity?

One point that cannot be justified is that Ponzinomics cannot avoid the death spiral, but I think it is the same death spiral, the experience and results of STEPN and Axie will have 3 interesting differences (again non-investment advice):1) The latent period of the death spiral of STEPN may be longer; 2) The chain reaction of the death spiral of STEPN may be slower; 3) The plateau period after the death spiral of STEPN may have greater prospects.Let's discuss it in detail below.

1) STEPN’s death spiral incubation period may be longer (Warning! Theoretical analysis is not investment advice):

Axie:

a. Axie who embraced the guild experienced crazy unnatural growth- Only 15% of the players are individual users, and 85% are guild users who do not need to own Axie to participate in SLP output. The guild provides step-by-step tutorials to attract newcomers to join. Players can quickly get started and start making gold in a short period of time. The guild management can directly arrange the optimal yield strategy so that a large number of guild players who join quickly can produce the largest amount of SLP. .

b. A large number of guilds and mercenaries maintain a far greater extraction efficiency than natural players on the economic system:At this time, guild players do not belong to the A, B, and C types of players mentioned in the previous STEPN analysis, but pure mercenaries, used to maximize the benefits of Axie infinity, and such extraction efficiency is more natural than the same number Growth in individual players is much higher. The rapid extraction speed allows guilds and mercenaries to taste the sweetness and continue to expand, and sky mavis, which enjoys rapid growth, has not interfered with such efficient value extraction, or the momentum of the guild (momentum) has not allowed sky Mavis stepped on the brakes, so high-efficiency value extraction and high-speed unnatural growth represent a shorter Ponzi product life cycle. In the end, what we saw was AXS, which started to work in early July 21, and in 11 after 4 months At the beginning of the month, I came to my highest point and officially entered the death spiral.

c. And guilds and mercenaries may be the slow poison that Axie must swallow:What if there was no guild at the beginning? Can Axie stretch those 4 months to 6 months with natural growth? Even 10 months? Or if there is no trade union, will Axie be unable to attract new blood because it is not growing fast enough, which will lead to an earlier abrupt stop? I don't have a definite conclusion, but I tend to believe that Axie can't rely on natural growth, and can only swallow the life-saving poison of the guild- traditional gamers are not willing to actively spend high prices to enter such a dry and simple game. The market suffers, and developing countries such as the Philippines lack the help of guilds, and the natural barriers of the complex encrypted token system will keep a large number of users with low learning ability and economic ability at a distance, so guilds are almost an inevitable choice for Axie. It may be clear that it may bring economic consequences, but it is still a slow poison that must be swallowed.

STEPN:

a. Resolutely maintain natural growth, combat cheating, reject guilds, and have no leases:When writing this article, the official has just announced that it has reached 300K DAU. The big difference from Axie is that these 300K DAU are basically real players with "one person, one machine, one number" - no union, no lease, and admission requirements To learn how to use encrypted tokens by yourself, you need to pay out of your own pocket, and it is difficult to cheat - it is extremely difficult to achieve unnatural growth under the strict monitoring and crackdown of STEPN officials. The two founders Jerry and Yawn have expressed their insistence on natural growth in many sharings, and the only lease function related to non-natural growth in the white paper, Jerry also confirmed in my special question that it will only be opened later, And confirmed that it will not be available within half a year.

b. The project party is also very restrained in the operation of the token economy:STEPN’s invitation code mechanism has alleviated the excessive speed of entering the market to a certain extent. The gems and unboxing games launched are consuming GST more and more. The demand points that have recently been added to the governance token GMT are also indirectly sharing the pressure of GST, and More functions will be given to GMT in the future. Project parties who can see the background of the game have borrowed and innovated multiple methods in traditional games and P2E cases to strive to maintain the stability of the token economy, so as to prolong the short path of Axie as much as possible.

c. Real players who are rich and love to learn, and high-quality new players outside the circle brought by breaking the circle:Such persistence and restraint lead to a two-layer screening of the user group: rich (the admission fee is indeed not cheap, and they have to pay out of pocket), and learning ability/knowledge (there is no lengthy new user in the STEPN software. The introduction of the gameplay requires players to learn by themselves to figure out the usage and logic of the wallet - Jerry mentioned that the survey shows that 30% of users are using decentralized wallets for the first time).

d. If the project side wants to, they can choose to open the valve of unnatural growth at any time to delay the death spiral (although not in the short term):Although we have seen the rapid growth of user data with the naked eye, such data is already a real user growth under the restraint of the project party, and the value extraction efficiency of the economic system is far inferior to that of the Axie guild. Even if it slowly begins to grow in the later stage, If STEPN wants to open the valve and lower the user screening threshold, I believe that the unnatural growth in the later stage can continue to delay the start of the death spiral to a certain extent.

2) The chain reaction of STEPN's death spiral may be slower:

Axie:

a. Although the death spiral is a chain reaction, the decline of Axie is not a cliff-like decline:In fact, when we look at the market value of AXS after the start of the death spiral, although it is a chain reaction, it is not a cliff-like decline. The original payback speed has been lengthened during the decline, but if users are willing, they can still stick to the liver (grind) to pay back slowly, but this is a painful process, because the game itself has an enjoyable gameplay (enjoyable gameplay) duration It is limited, and slowly recovering costs for financial returns in the later stage is torture and suffering.

b. Since the asset does not provide much utility other than financial investment, selling is a simple and clear choice:For most users, the game is of little significance except for the nature of playing metal. In other words, if you, as a real user, really invest your own money to play Axie, in addition to the purpose of getting back the money, the game itself brings If the enjoyment/utility is too low, you will only be left with the annoyance of reduced financial investment returns during the death spiral, then the most rational way is to run away early, and you will choose this rational way with a high probability. Because there are many people who think like you in the game, this is also the speed of the crash caused by the death spiral. Although it will not be a cliff, it will not be a gentle slope.

STEPN:

a. User's recognition of utility returns other than financial returns during the participation process:Looking back at the story of my friend at the beginning of the article - he participated in STEPN mainly for the purpose of financial investment, but gradually realized the return on investment in terms of utility (body shape/health/happiness) in the process. Then go back to the part I mentioned at the beginning of the article: it is also an investment loss. It is easy to see that everyone has a low tolerance for the sunk cost of financial investment in real life. Compared with it, the utility (body shape/health/ Happiness, etc.) investment sunk cost tolerance is much higher - so in the STEPN scene, how does this extra tolerance reflect? Let's analyze it in detail:

b. Unlike Axie, STEPN gives some users who recognize utility rewards a choice not to sell:So here comes a key question: Suppose you invested $1,000 at the peak of the death spiral, and after running every day for a month, you found that your previous goal of paying back your capital in 50 days had been stretched to a year or even longer. What would you do if you have obtained so many utility returns other than financial returns?

Quickly sell all property to stop loss, and return to the lazy life of staying at home and not exercising every day?

Affirming my persistence and utility returns during this period of time, and realizing that the desire to return the capital has gradually transformed from an investment expectation into a commitment to help myself persist, so I decided not to sell/sell less, and made the two-month return Stretch the front line for a year or more, and slowly recover the cost?

In other words, as long as you are willing to stay and keep exercising, you will become healthier and healthier, and sooner or later you will be able to pay back your capital, and sooner or later you will start to make a net profit; and choosing to sell will cause you to have direct financial losses, and without external driving force, you will slowly lose money. Give up a very good living habit.I think you have already started to consider your own choice after seeing this problem, instead of the single and fast choice of Axie users above, then the decline of STEPN's death spiral may be slower than that of Axie.

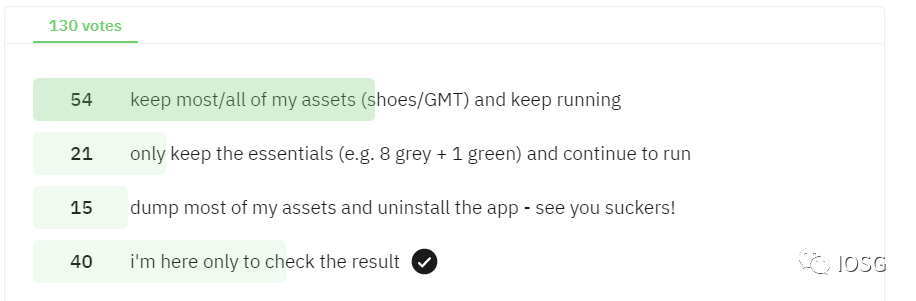

c. The questionnaire shows that 83% of users expect that they will not run away in the death spiral:Let's look at another example, which is a user survey I posted on STEPN reddit (as shown below): When STEPN enters a death spiral like Axie, what will you do to your property? I originally expected that most people would choose to sell all their property and leave, but the final result is that 60% chose not to sell GMT and shoes and are ready to continue running, and 23% chose to keep key shoes (such as 1 gray, or 1 green and 8 grays), and only 17% of people chose to sell all:

Of course, this set of questionnaires has no legal effect, so although in the end when the price starts to fall, it may still be sold when the price is not sold now, but I believe that such survey results are definitely not available on Axie. That is to say, I think that the selling pressure after the death spiral has a higher probability will be lower than that of Axie, and the downward slope will be slower. A certain change will be made to utility investment, resulting in less sensitivity to the original investment return, and more focus on the return of utility.

3) The flat period after STEPN's death spiral may have greater prospects:

Axie:

a. The result of the death spiral is not death, but slowly revealing the fair value of the product to the market:After experiencing a sharp decline in the death spiral, the market value of AXS has stabilized at 3 billion for nearly three months, and the price of Axie has dropped to around $50, which is more accessible to more people. At this time, the investment threshold for entry is low, but the payback period is still long. However, because the utility return (game fun) brought to players by the game itself is limited, players who aim to pay back and make a net profit will still feel tortured. And for the 85% of the guild mercenaries among the total players, the yield of Axie has been lower than that of real work, and the participation rate has dropped. On the contrary, the real players who were interested in trying Axie but thought the tickets were expensive, That is to say, "wait and see C-type players" have the opportunity to come in and try, which means that the death spiral allows Axie to pass the rapid expansion promotion period, and finally has the opportunity to welcome real players to enter. Guilds with prolonged payback cycles and mercenaries with reduced income are not happy, but the decline caused by the death spiral still brings opportunities to the majority of real players who most need to enjoy the fun of the game. My colleague Alex and I watched the game together believe that P2E is not the purpose, but the method of customer acquisition (UA) - Axie's story indirectly confirms this theory in an immature way: P2E carnival saved Axie from the cold start purchase Steps to quickly obtain a large amount of funds, users, and opportunities to polish products in the early stage. After experiencing the death spiral, the entry threshold has returned to the fair value of the game itself. Players who really want to play this game (rather than speculators) to participate and replace.

STEPN:

a. After the death spiral of STEPN, it will stabilize at a higher plateau value than Axie, and there will be more users and a larger market than the current one:When the price of the cheapest gray shoes drops from $1,000 to, for example, $100, although the payback period is very long (for example, one year), the investment of players who can’t persist becomes sunk costs to pay players who persist, but As long as you persevere, the system will reward you to pay back, because when the investment is reduced from 1000 dollars to 100 dollars, players will be more tolerant of their own sunk costs, resulting in more people who cannot persist and more sunk costs collected , then a relatively stable balance will be formed, which is similar to the current stabilized price of AXS above. At this time, STEPN has transformed from a money-making project into a gambling agreement: spend 100 dollars to buy a project that monitors your own running, and when you persist, you can not only get back the 100 dollars, but even continue to make money steadily, how does that sound?

b. The imitation market can last for a while but can’t achieve anything, and it will not affect the long-term value of STEPN:Summarize

Summarize

Although death spirals are inevitable for Ponzinomics, my purpose of writing this article is to illustrate the following points:

First of all, the result of the death spiral is not death, nor does it represent the failure of the product, but the process of returning from the madness of X2E to the fair value of the product itself, and the incubation period before this process can be long or short, and the decline rate can be fast when it occurs It may be slow, and the fair value returned after the occurrence may be high or low.

As the first popular XXX money-making project (or X2E), Axie has gone through a lot of trials and errors, showing the possibilities, limitations, and challenges of X2E for subsequent products, so that We've seen programs like STEPN take the best out of the learning process and strive to innovate - X2E is evolving.

while we expectThe evolution of X2E is a more restrained crazy period, a slower fever-reducing period, and a higher fair value regression line- This is what I think STEPN has the potential to do.

In addition to this, what is more important is to be able to finally achieve,Let the users who recognize the fair value of the project itself become the mainstream, so that utility value investors rather than speculators can obtain most of the benefits. (It is recognized that participating in such a project is not simply investing 10 yuan to earn 20 yuan, but investing 10 yuan is not only worth the value of the utility brought by the project itself, but also returns an additional 3 yuan; and additional rewards for users who persist can reach Possibility of $10 or even $20 back.)

In the future stories, economic sources other than Ponzinomics are what I am looking forward to for X2E, because it has more stories and space than P2E in current chain games: for example, I just talked about a Bike to Earn project recently (MOTE by Sweetgum Labs, Interested investors are welcome to communicate with each other) mentioned the realization of carbon emissions back to the economy, so for example, a person who used to drive 10 kilometers to and from work every day instead of cycling every day can save 4 tons of carbon emissions a year, And one ton of carbon emissions can currently be worth 80 euros in Europe, which meansA person can realize more than 300 euros a year to flow back into the economic systemtext

write at the end

Having said so much, I think STEPN has advantages over Axie, and I would like to emphasize again that this is not investment advice, because the operation of the project depends to a large extent on those in power and large players in addition to the fundamentals-STEPN can let The cooperation of the three major exchanges, as well as the generosity of Whale when pulling the market, have shown a lot of STEPN's strength beyond the fundamentals. In the end, the development direction of STEPN still depends on the balance of pros and cons among various important elements in the project and the turbulent market. The above analysis is based on the various information obtained so far to speculate on some nodes and potentials that STEPN may experience in the future. Let us wait and see what will happen in the end.

Disclaimer and Risks

Please review the Disclaimer, Terms and Risks to understand the legal notices of this document, its contents and its risk factors. In particular, you should do your own research (DYOR) before making any investment and be aware of the risks associated with forward-looking statements in this document.