iZUMi Research 4D Report: Current Status and Future Prospects of DeFi Liquidity

first level title

Preface - About Liquidity

In traditional financial concepts, the definition of liquidity is very simple, that is, an asset can be bought or sold in the market at a reasonable price for all required time scales. Its importance in the entire economic and financial system is self-evident. It can even be said that the modern financial transaction system, and even the entire monetary system, are constantly evolving and innovating to better improve the liquidity of market transactions.

"Cash" or fiat currency is generally considered the most liquid asset because it can be converted into other assets most quickly and easily. Other financial products and tangible assets, the most common investments such as stocks, bonds, art and real estate, declined across various places on the liquidity spectrum.

Therefore, we can say that the highly liquid "currency" is the value transmission mechanism of the entire financial system and the global trading system. The liquidity of a "currency" in the global trade market also often represents the status of the sovereign government that endorses it in international trade. In this respect, the U.S. dollar deserves to be the most liquid "asset" at present.

secondary title

Blockchain: Revolution of Trading System + Explosion of Liquidity

The blockchain marks value or represents various assets through freely circulated certificates, and regardless of the restrictions imposed by some sovereign governments in the world on various centralized trading platforms, any individual can participate in the transaction through a device connected to the Internet. In a blockchain trading system with no barriers to entry.

This change has revolutionized the problem of entry barriers for traders in traditional finance - bank or exchange accounts, trading qualifications, trading time limits, etc. do not exist in the on-chain trading system at all. (The issue of KYC of centralized exchange accounts is not discussed here)

The revolution of the trading system on the chain has brought users a lower or even almost zero entry threshold, which means more sufficient competition and more efficient market efficiency in the microeconomic market mechanism. In the blockchain market, it means explosive liquidity.

secondary title

AMM automatic market maker: the birth of the DeFi industry

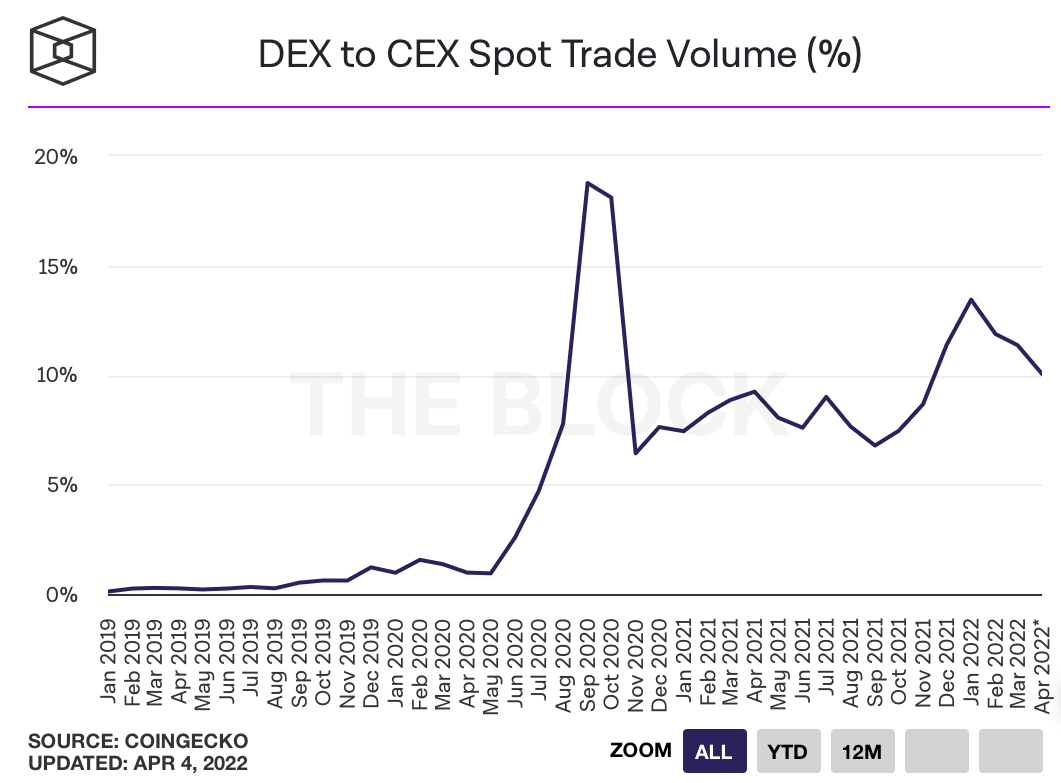

image description

(https://www.theblockcrypto.com/data/decentralized-finance/dex-non-custodial/dex-to-cex-spot-trade-volume)

While professional market makers provide exchanges with better trading depth, they can also provide cooperative project parties with better token liquidity, and real users will also have a better trading experience when trading. This seems to be a win-win situation for all parties, but in the digital currency market that is not regulated and has no market maker system, the relationship between the banker and the market maker is often not really conducive to the effective discovery of the token value by the market . In order to improve market liquidity, stabilize currency prices, and market value management, project parties, investment institutions and even large currency holders will also build a professional market maker team to participate in market making.

However, in CEX, a large amount of transaction data and transaction party information is not open and transparent. Therefore, ordinary traders often assume the role of a market maker’s profit source in disguise during the transaction process, and are also vulnerable to investment losses caused by market value management.

However, the emergence of the AMM automatic market maker trading mechanism on the chain, as well as the corresponding decentralized exchange platform and "liquidity provider", provide a solution from a new perspective to solve some liquidity problems. Any independent individual can act as a "market maker" by providing liquidity for the trading pair fund pool. Trading users no longer rely on order book quotations to match and trade with counterparties, but automatically price through algorithms, and directly exchange tokens with the fund pool in proportion to achieve the purpose of the transaction.

The emergence of the AMM mechanism marked the beginning of the DeFi industry, and at the same time officially divided the liquidity of blockchain tokens into two parts: 1. Off-chain liquidity of CEX centralized exchanges; 2. On-chain liquidity.

On-chain liquidity

On-chain liquidity

On-chain liquidity has experienced explosive growth in the past two years. Compared with off-chain liquidity on centralized exchanges, first, the automated market maker mechanism lowers the entry threshold for the role of market liquidity provider, without the need for a professional market-making team and a centralized trading platform, any Individuals can obtain direct fee income while providing liquidity for transactions.

At the same time, for trading users, the liquidity information on the chain is more transparent. Better on-chain liquidity can often bring more holding information to investors, because they can realize and operate more smoothly if necessary, without worrying about the liquidity exhaustion that is prone to occur in centralized exchanges large price fluctuations.

For project parties, better on-chain liquidity has always been their goal. According to the data, it can be found that the scale of on-chain liquidity is often directly proportional to the market value of the project.

However, the most basic AMM automatic market maker logic has a fatal flaw: while liquidity providers provide liquidity for mainstream tokens with a large trading volume to obtain transaction fee income, they have no incentive to provide liquidity for some emerging tokens. Tokens provide liquidity. The main reason is that when providing liquidity for emerging tokens, you need to hold the corresponding tokens first, so most of the liquidity providers need to consume funds to purchase, and after providing liquidity, they also need to bear the risk of impermanent losses. The project is not popular enough, and the transaction fees obtained by liquidity providers are relatively low. In this case, liquidity providers whose main purpose is to make profits do not have enough expected returns to bear the corresponding risks. However, if there is not sufficient liquidity for an emerging token, factors such as transaction slippage and currency price stability will become obstacles for ordinary users to participate in DeFi projects or invest in and trade their tokens, and if there are not enough users to trade, It is also impossible to generate higher transaction fee returns to motivate liquidity providers to ensure more sufficient liquidity. This is again the classic "chicken and the egg" problem.

first level title

secondary title

Yield Farming Token Incentive Model

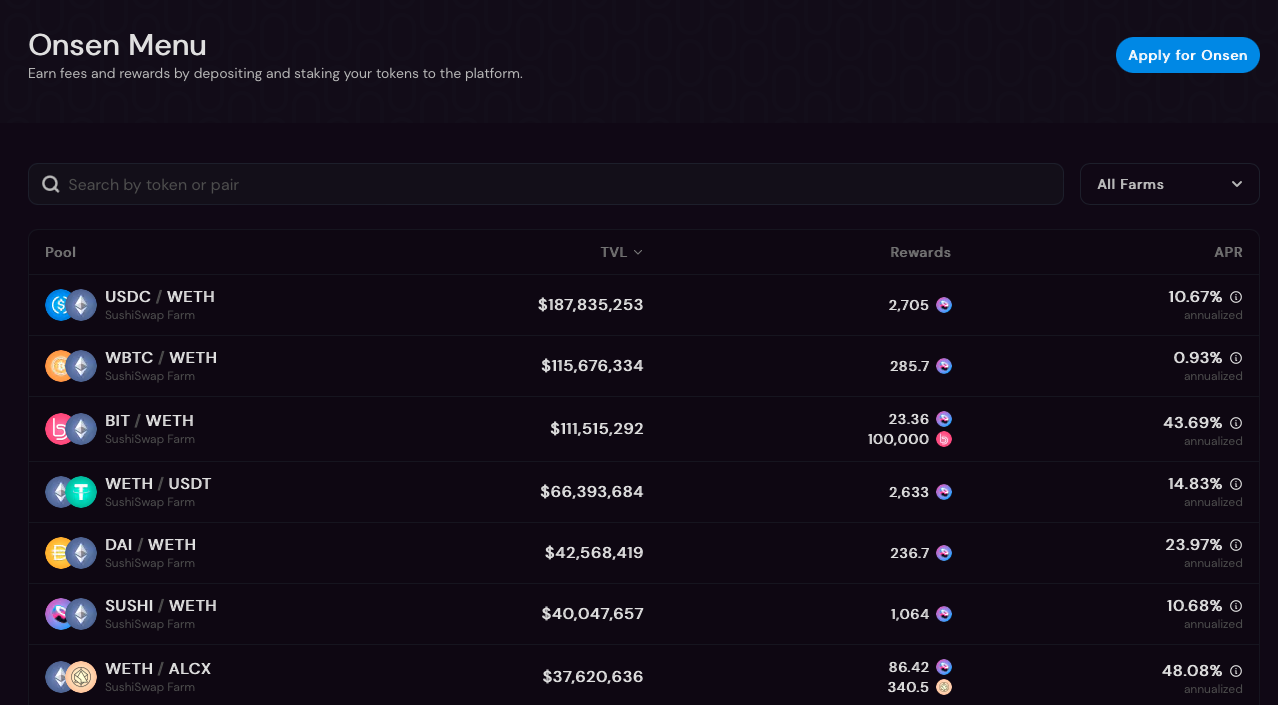

image description

(https://defillama.com/protocol/compound)

Uniswap, as one of the most mature AMM-mode decentralized exchange platforms at that time, users will obtain the corresponding LP Token (Liquidity Provider Token) after providing liquidity in the fund pool as a certificate for the user to provide liquidity, but the liquidity provider is in In this mode, only the fee incentives generated in the transaction can be obtained.

Sushiswap was inspired by the token incentive model of the Compound protocol. On the basis of forking the Uniswap platform code, it introduced the SUSHI platform token and opened the DEX liquidity mining mode, and successfully launched a "vampire attack" on Uniswap's liquidity. .

On the Sushiswap platform, after users provide liquidity to the fund pool, in addition to receiving a share of transaction fees, they will also be rewarded in the form of SUSHI tokens. SUSHI tokens also correspond to the governance rights and income rights of the platform. Even if the user no longer provides liquidity, the user can still earn a part of the transaction fees of the SUSHI protocol through only SUSHI tokens, which better motivates the early liquidity providers and enables them to continue to benefit from the long-term development of the platform. And achieve a deeper binding of the interests of the "liquidity provider" and the "decentralized exchange platform".

In addition to various DeFi platforms that can start liquidity mining to encourage users to provide liquidity for their own DeFi applications, the DEX + LP token mechanism also creates opportunities for other blockchain project parties to rely on their own tokens to motivate corresponding transactions. A new model for on-chain liquidity. After users provide liquidity for the trading pairs of project tokens and mainstream currencies on the DEX, they can stake the obtained LP tokens to obtain liquidity mining rewards provided by the project party.

secondary title

(https://app.sushi.com/farm)

Off-chain exchange liquidity mining

The liquidity mining of the trading platform did not actually start from DEX, but from one of the most popular projects in 2018 - the FCoin centralized exchange. After FCoin went online, it started the "transaction is mining" mode, which is also the main distribution mode of its FC tokens. As the originator of the "liquidity mining" mechanism, the "transaction is mining" model is designed to provide rewards of FC tokens (FCoin platform tokens) based on the user's transaction volume on the FCoin exchange. Hope to encourage greater trading volume to represent the sufficient liquidity of its exchange, and thereby attract more market users to choose FCoin for transactions and become long-term real users, but the result is not the case

Since the main cost of trading on a centralized exchange is only the transaction fee, a large number of "mining teams" participated in this activity. As long as the cost of transaction fees is lower than the income that can be obtained after the sale of the corresponding FC tokens, brush trading is the simplest and most direct means of profit. Therefore, during the time when FCoin carried out liquidity mining activities, an excessive amount of brushing transactions occurred. Its single-day transaction volume once reached 5.6 billion US dollars, making it the most liquid exchange in the world at that time in terms of transaction volume data. One of the ample exchanges. However, all users are well aware that the real transaction depth behind these false transaction volumes is actually not sufficient, and after obtaining FC tokens, most users will choose to sell them directly to make a profit, and have not become long-term loyal users of FCoin. Therefore, after the income of FC tokens is not enough to cover the transaction costs, the transaction volume of FCoin also continues to decline.

secondary title

Limitations of On-Chain Liquidity Mining 1.0

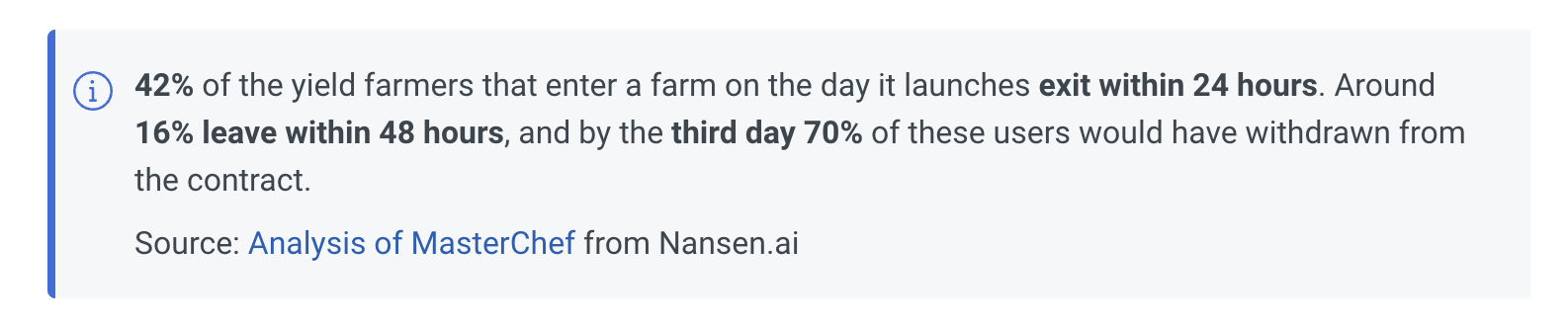

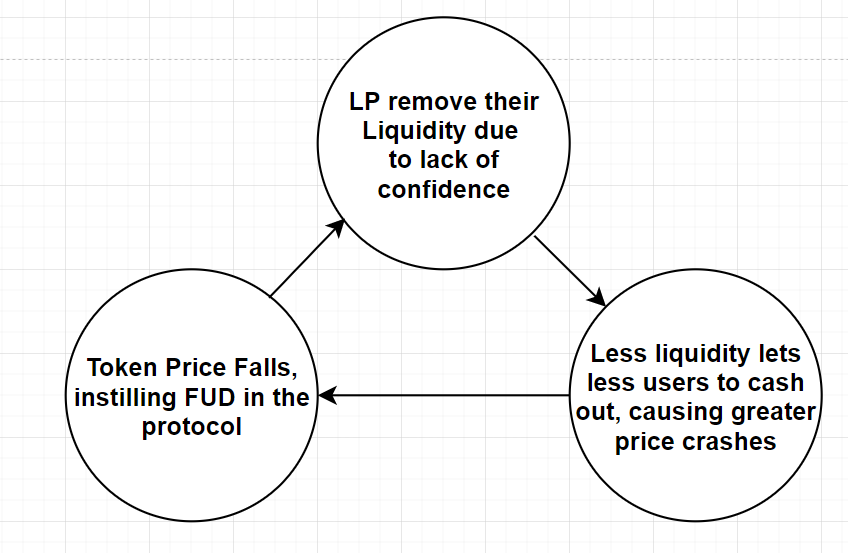

Just like the fatal problems encountered in liquidity mining of FCoin centralized exchange, liquidity mining on the chain also has many limitations.

First of all, for any profitable economic activity, the most direct purpose of attracting funds must be to obtain profits. Therefore, the mode of most liquidity mining participants is very succinctly summarized as "digging, withdrawing, and selling" - mining, withdrawing, and selling. The industry also calls this type of liquidity provider "locust miners". They cannot provide long-term effective liquidity for trading pairs or become long-term holders of project tokens. On the contrary, they will form a large selling order in the market, which is not conducive to the market mechanism to obtain a reasonable price for tokens.

image description

(https://www.nansen.ai/research/all-hail-masterchef-analysing-yield-farming-activity)

image description

(https://docs.olympusdao.finance/pro)

first level title

Improvement of liquidity efficiency by DEX - liquidity capital efficiency of underlying transactions

secondary title

Curve:Stable Assets,Ve-Tokenomics,and Convex

secondary title

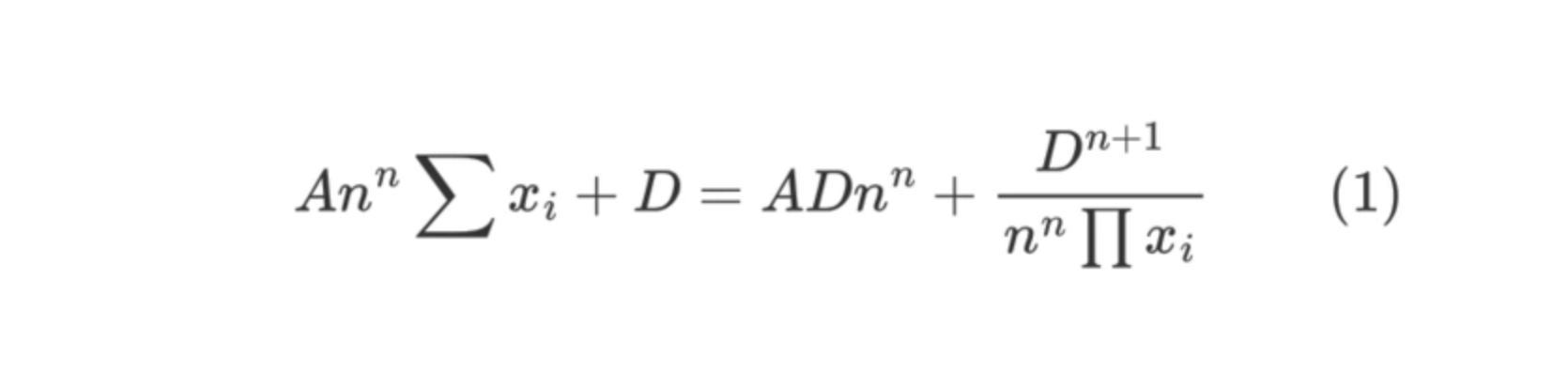

CFMM algorithm

image description

(https://www.odaily.news/post/5176601)

secondary title

(https://www.odaily.news/post/5176601)

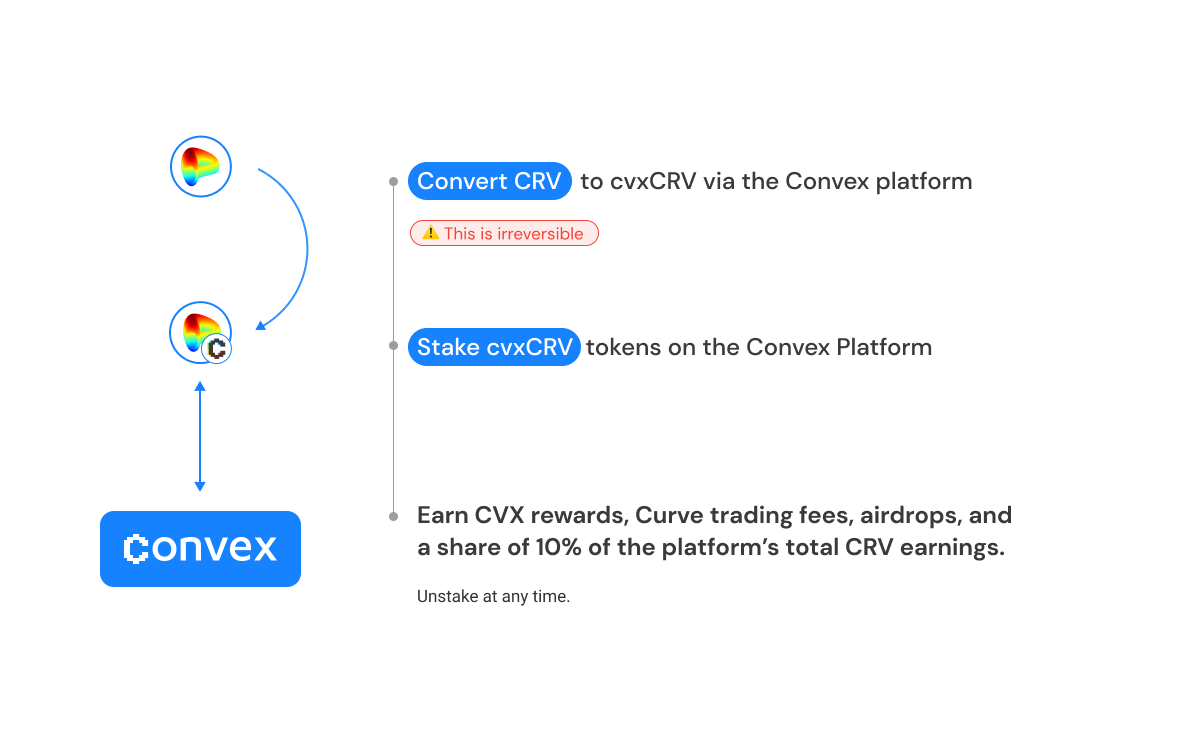

ve-Tokenomics

In addition to the innovation in the AMM automatic market maker algorithm, another biggest innovation of Curve is the opening of ve-Tokenomics. Curve launched in August 2020"vote lock"(Vote-Escrowed) function, which allows CRV Token holders to lock their Token for up to four years in exchange for veCRV (Vote-Escrowed CRV), and the number of veCRV is proportional to the remaining lock-up time, and veCRV Not transferable or tradeable. In terms of corresponding rights and interests, the voting rights corresponding to VeCRV can choose a specific liquidity pool to obtain CRV rewards for voting, and veCRV also represents Curve’s platform income right certificate, users can not only boost their own liquidity mining through veCRV Mining income, you can also directly obtain the share of the Curve platform income.

Based on the situation at the time, the choice for liquidity providers to maximize the rate of return is: lock CRV to obtain veCRV to boost their own liquidity mining income, and guide CRV liquidity mining rewards to their preferred mining pools through voting, So as to get more CRV rewards. The corresponding result is that the corresponding trading pairs can obtain more liquidity providers and their financial support, so the transaction depth increases and the slippage decreases, thus attracting more traders from the market to choose the Curve platform Make a transaction and achieve a positive cycle.

image description

(https://defillama.com/protocol/curve)

After being verified by the successful development of the Curve platform, ve-Tokenomics is also becoming an indispensable part of the token economy designed by many DeFi projects, such as Stargate, UDX, Curvance, Lendflare, etc. At the same time, many well-known old-fashioned DeFi projects have also launched or announced that they will integrate the ve token economic model, including Frax, Ribbon Finance, Yearn, etc. On this basis, some project parties even combine the ve model with NFT, including AC's Solidly ve (3, 3) and the veNFT (veiZi) launched by Uniswap V3 ecosystem iZUMi Finance.

secondary title

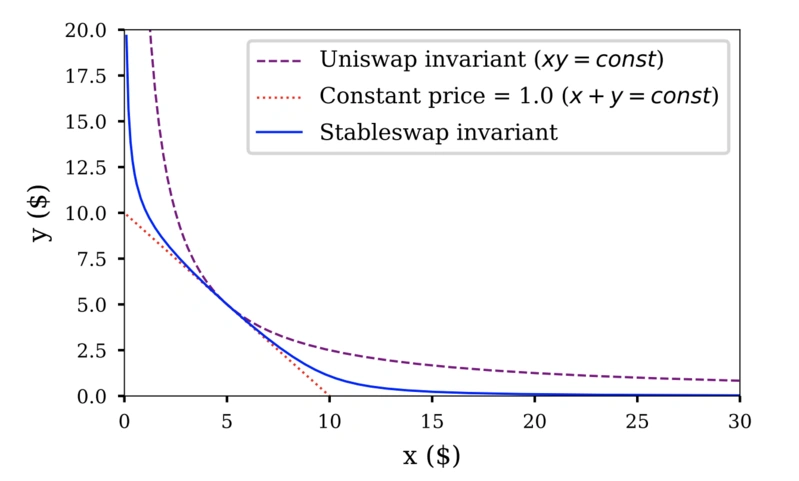

Convex - creating liquidity for Ve-tokenomics

One of the core mechanisms of Ve-tokenomics opened by Curve is that the veCRV tokens obtained by locking positions cannot be transferred or traded, so its asset liquidity is almost zero. But this is the most criticized mechanism by users, because retail players often cannot afford the capital cost of locking CRV tokens for four years, and cannot obtain the benefits of veCRV to boost their own liquidity funds or compete for CRV in the corresponding CRV through veCRV voting. Incentive rights in the pool of funds.

Therefore, in order to solve the problem of ve Token liquidity, Convex came into being. CRV holders can pledge CRV on Convex and obtain cvxCRV. The Convex platform will automatically lock the obtained CRV tokens on Curve to obtain the veCRV tokens mastered by the agreement. Therefore, cvxCRV tokens can also be called negotiable Tokenized veCRV. After staking cvxCRV tokens, users can obtain Curve governance rights, some $CRV liquidity mining rewards (10% of the total Convex mining rewards), 50% transaction fees ($3CRV), Convex native pass Proof $CVX rewards and airdrop rewards provided by Convex.

first level title

(https://dune.xyz/engineer/CRV-and-Convex)

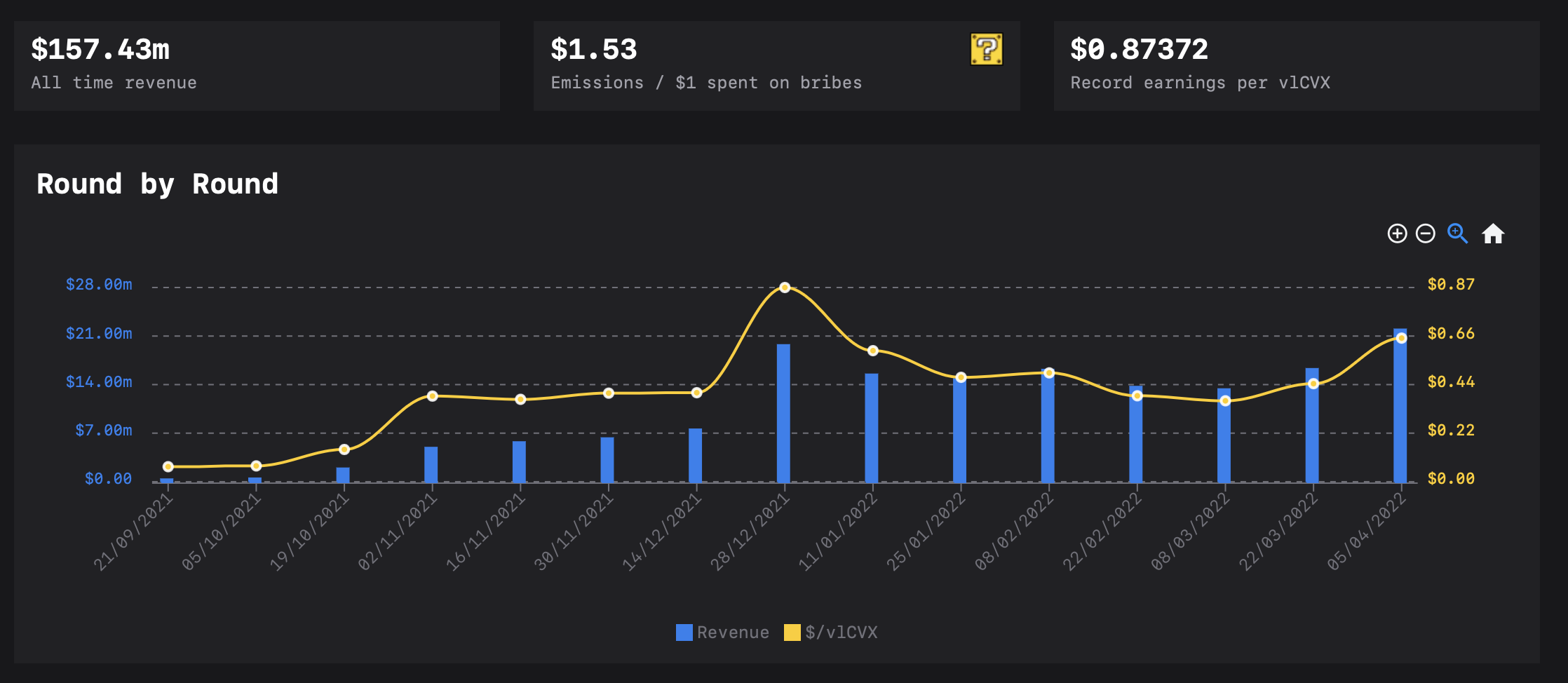

Bribery - Creating Liquidity for Governance Power

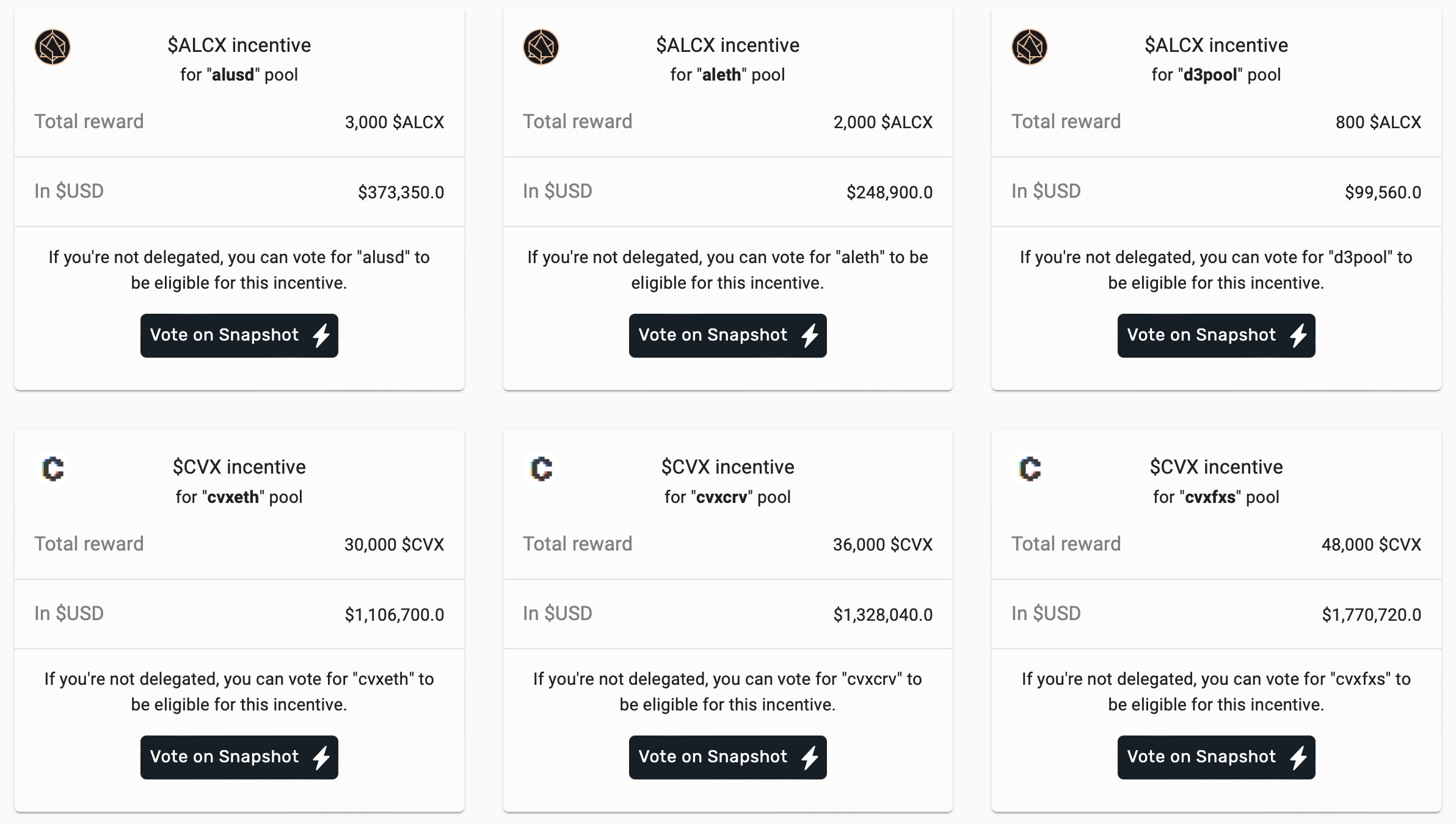

image description

(https://votium.app)

image description

(https://llama.airforce/#/votium/overview)

secondary title

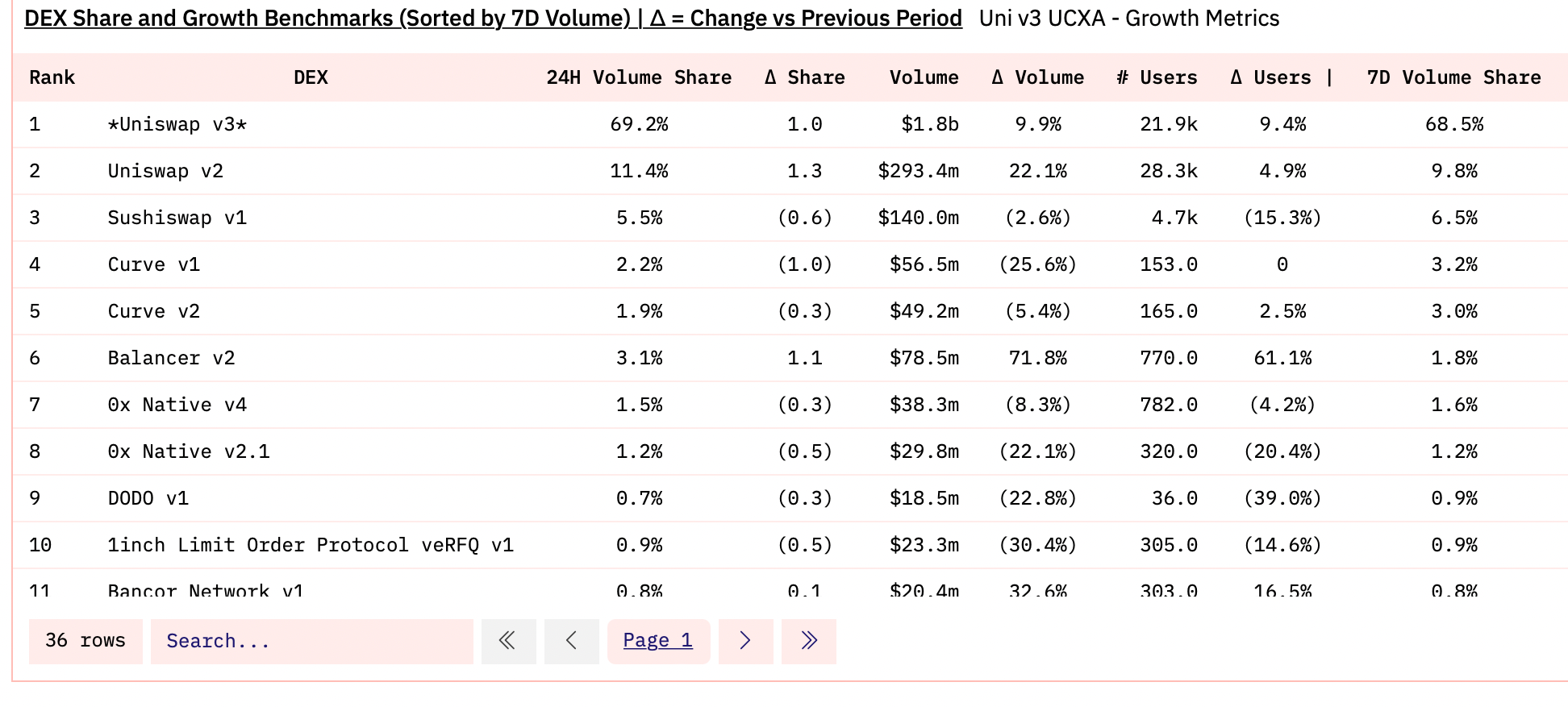

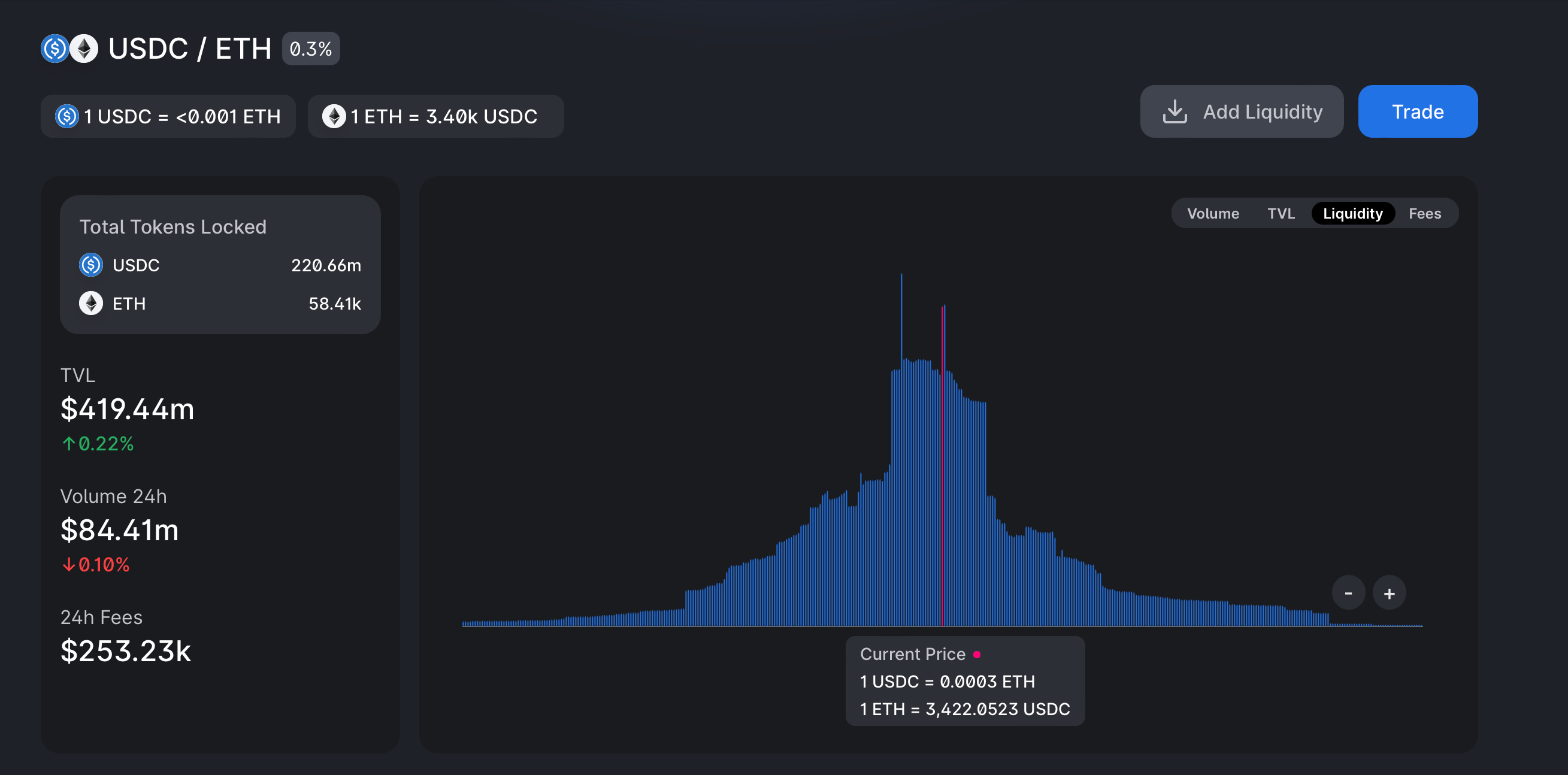

Centralized liquidity mechanism of Uniswap V3

image description

(https://dune.xyz/msilb7/Uniswap-v3-Competitive-Analysis?Time%20Period=24%20hours)

Uniswap v3 occupies about 70% of the market share in the current Ethereum chain transactions, and the transaction volume is 17 times that of Curve in the same period, but the TVL is less than 1/3 of Curve. If we take the ratio of trading volume to TVL as the capital efficiency of liquidity funds, the Uniswap V3 platform has a capital efficiency of up to 50 times that of Curve.

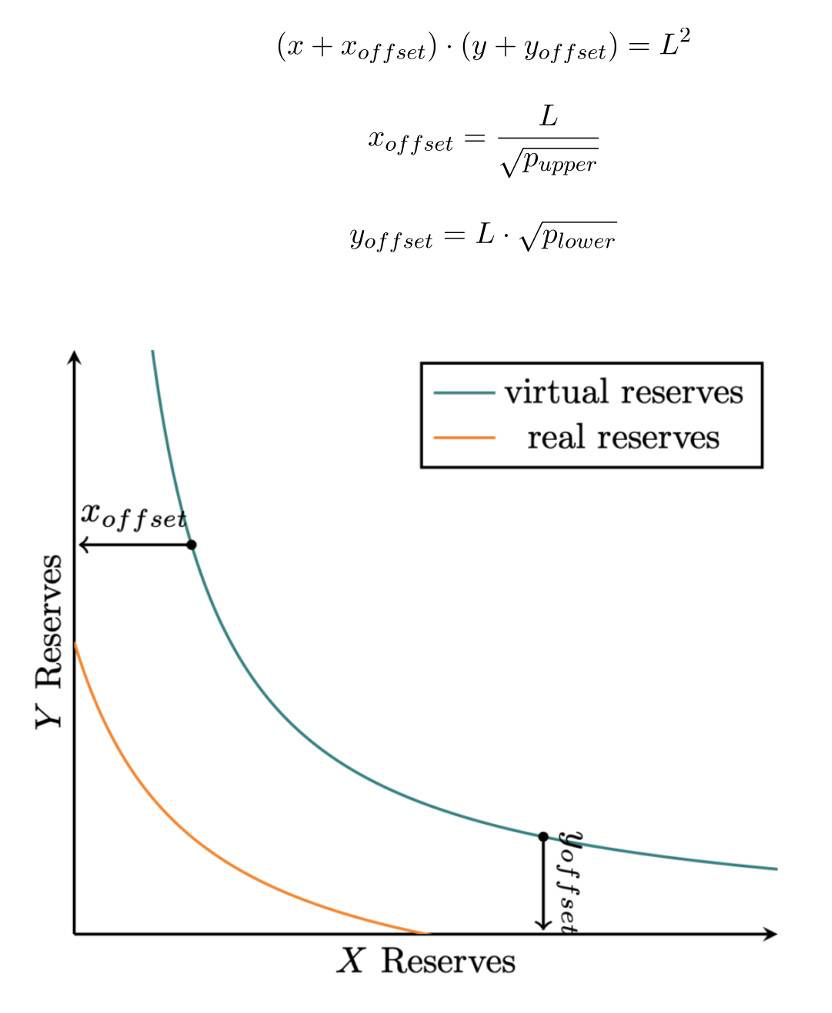

The core reason for such outstanding advantages lies in the innovative centralized liquidity mechanism of Uniswap V3. Users can choose a specified price range when providing liquidity, so as to achieve the functions of centralized liquidity and customized liquidity. Within the value range set by the user, AMM is still based on the constant product algorithm of V2. Compared with Uniswap V2's default full-range liquidity, Uniswap V3's "range liquidity provision" greatly improves the freedom of liquidity providers and the capital efficiency of providing funds. Therefore, liquidity is concentrated near market prices the concept of replacing"unlimited"image description

(https://news.huoxing24.com/20210704171101877495.html)

secondary title

(https://info.uniswap.org/#/)

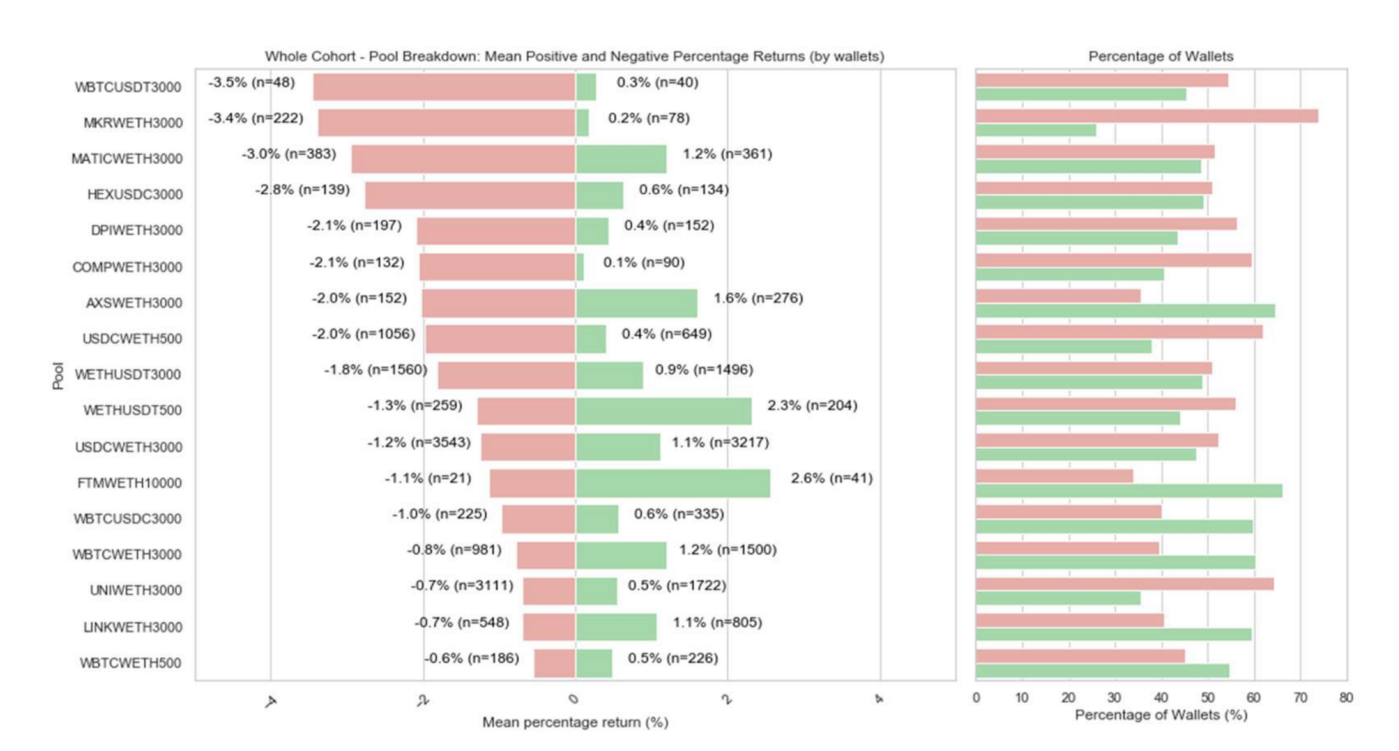

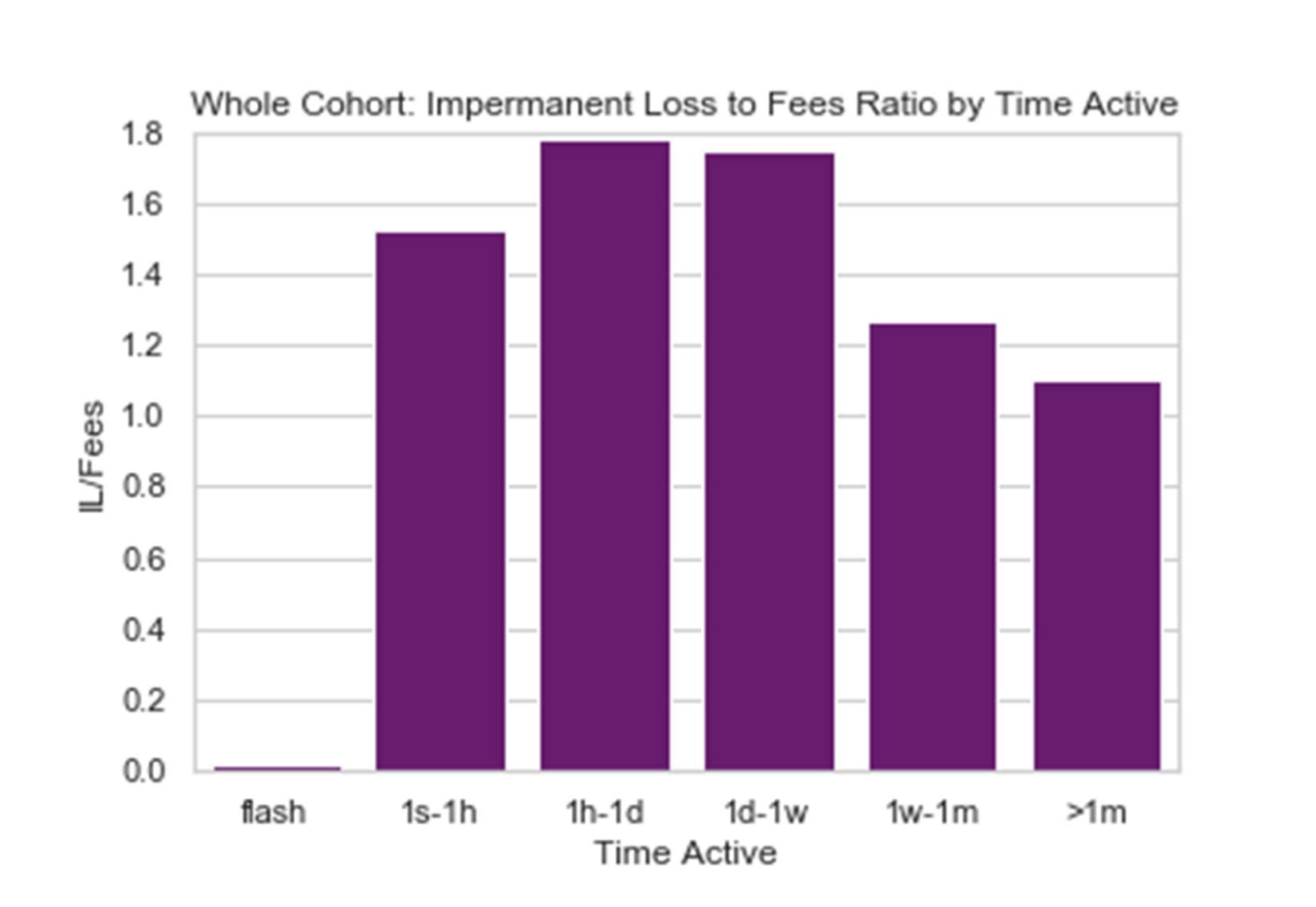

The Flipside of Concentrated Liquidity - Higher Unpaid Losses

Topaz Blue and Bancor agreement released in November 2021An in-depth study on Uniswap V3 benefitsimage description

(https://arxiv.org/ftp/arxiv/papers/2111/2111.09192.pdf)

image description

(https://arxiv.org/ftp/arxiv/papers/2111/2111.09192.pdf)

Among all liquidity providers, the only group that continues to make profits is the Flash LPs that only provide liquidity for one block, which is later called"Just-in-Time"secondary title

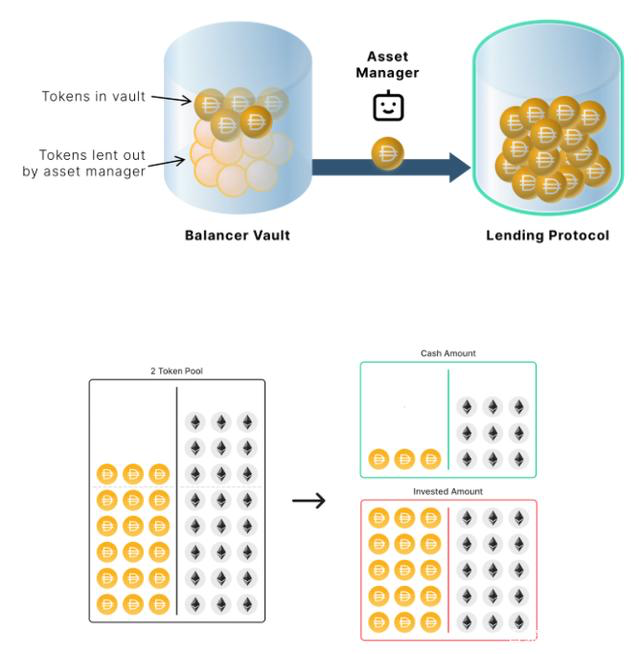

Balancer - Programmable Fund Pool AMM

Balancer is also a DEX platform based on the automatic market maker AMM protocol, but unlike other DEXs, Balancer's transaction fund pool can be composed of 2-8 tokens, and the initial share of each token in the fund pool can also be Freely set from 2% to 98%. This is different from the traditional AMM's 50%+50% token pool (such as Uniswap) that relies on the x*y=k equation, because it allows different tokens to be selected according to the specific token situation and the usage scenario of the AMM pool. , changing permanent loss scenarios and capital efficiencies.

And the transaction fee of the Balancer pool can also be freely selected, ranging from 0.00001% to 10%, to suit different transaction scenarios. For example, a fund pool with a fee rate close to 0 can be used to support the special needs of high-frequency trading and improve the capital utilization efficiency of corresponding operations.

Another model innovation of Balancer in the liquidity mechanism is the LBP that guides liquidity for emerging token assets. In the traditional AMM model, the emerging asset pool requires a token ratio of 50%+50%, so this model needs to deploy a large amount of funds from the founding team (50% of funds other than its own project tokens need to use mainstream tokens , such as ETH, USDT, etc.), once the initial liquidity funds are insufficient, it may lead to huge price fluctuations in the initial stage of listing, which is not conducive to reasonable value discovery. In LBP, the project side can dynamically change the short-term intelligent pool of token weight (for example, 2%/98% ETH/$ tokens are changed to 98%/2% ETH/$ tokens), so that the project side can use very little The funds can be used to create LBP, and at the same time it can be used as a tool for token sales: during the token sale process, users can purchase tokens from the fund pool at any time. If there is no purchase behavior for a period of time, the token price will decrease. Automatic downward adjustment until new purchases occur. When this token sale mechanism is combined with moderate purchase demand, it can achieve efficient price discovery. This also eliminates the phenomenon of robot panic buying that is easy to occur in other ways of token sale.

asset manager

secondary title

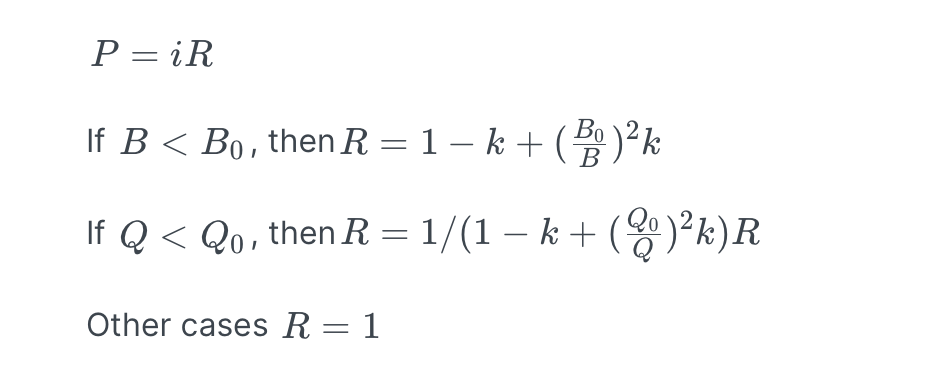

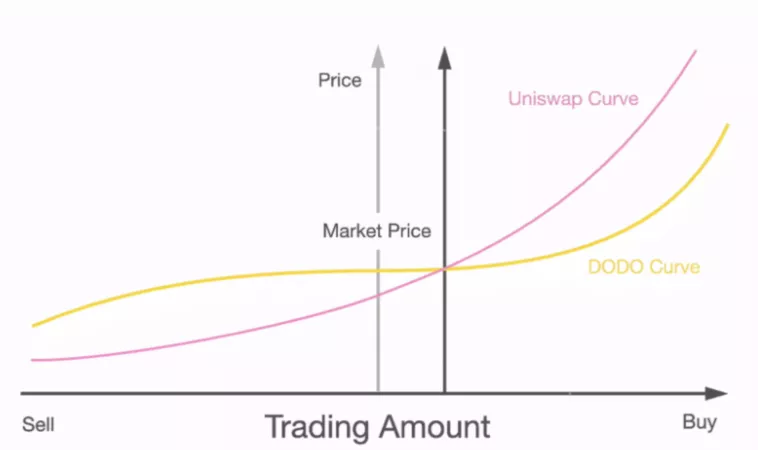

DODO——PMM Active Market Maker Mechanism

image description

(https://docs.dodoex.io/english/dodo-academy/pmm-overview/the-mathematical-principle-of-pmm)

image description

(https://blog.dodoex.io/the-evolution-attack-and-future-of-dex-53392064865d )

The traditional AMM algorithm DEX can be called"Inert fluidity"secondary title

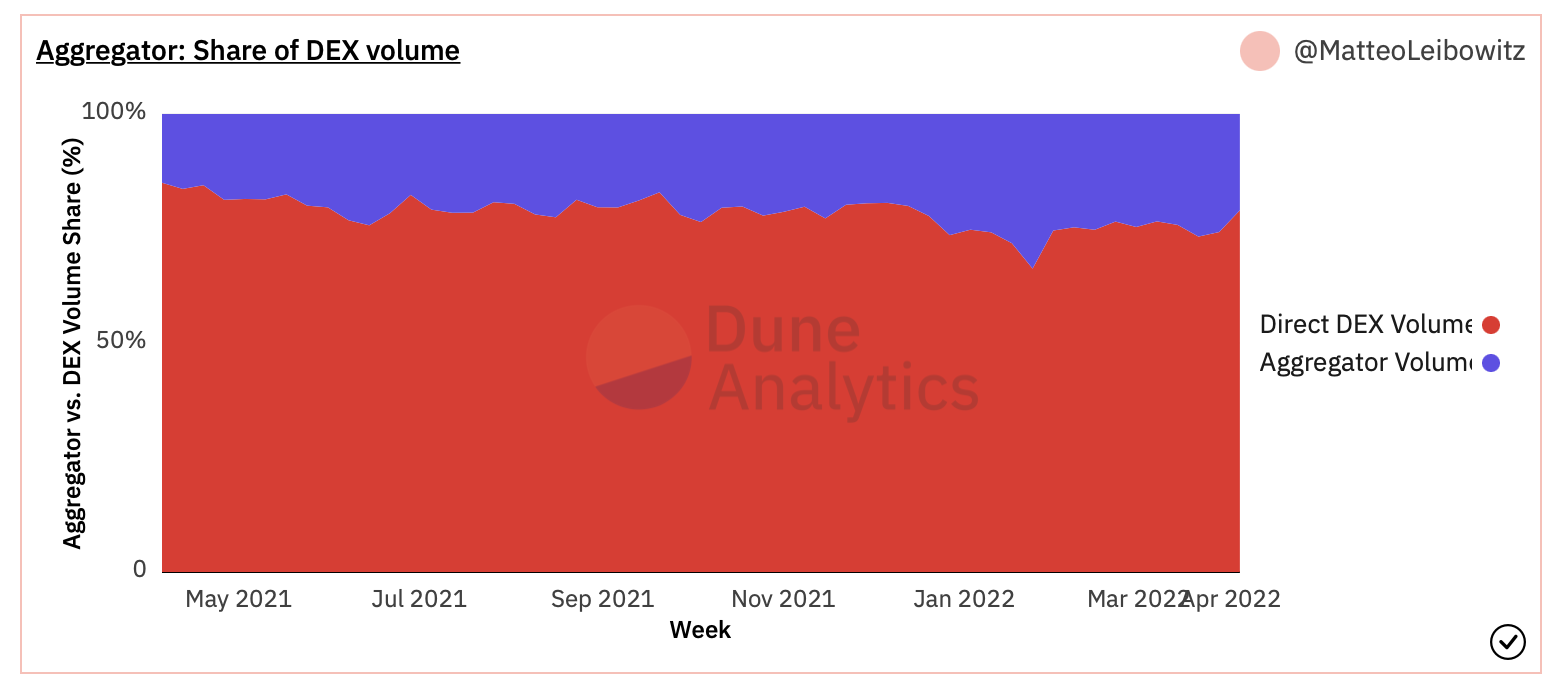

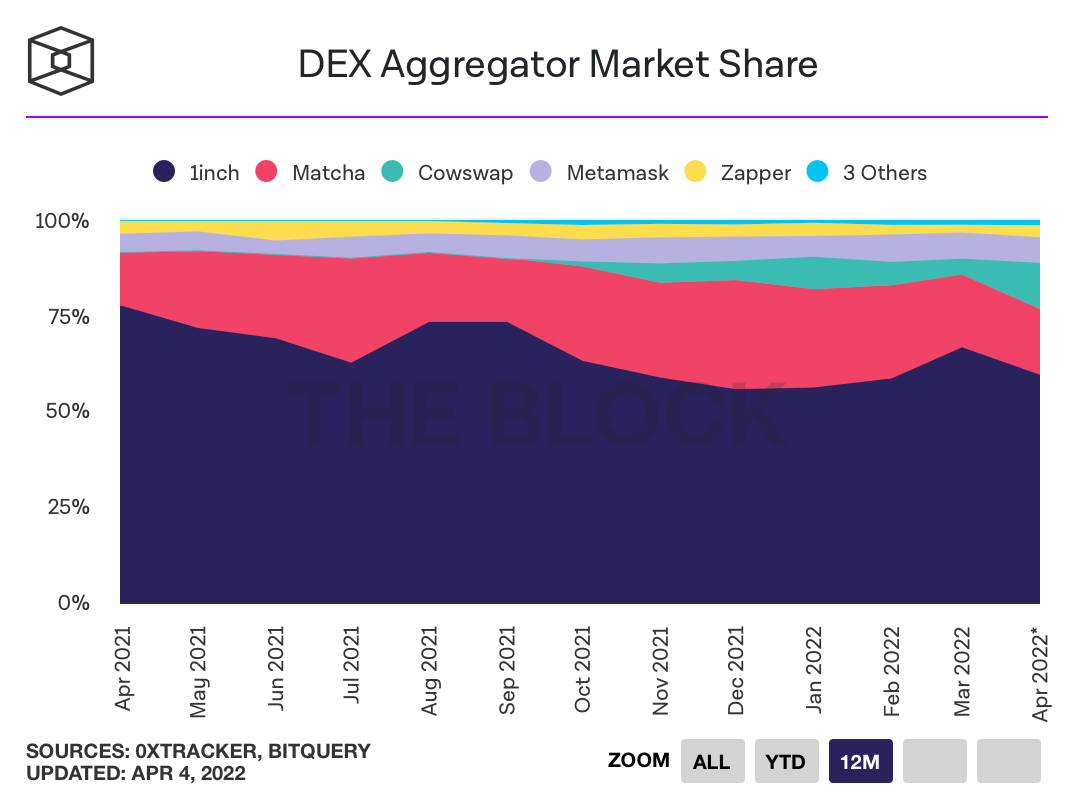

On-chain transaction aggregator based on DeFi Lego attributes

(https://dune.xyz/MatteoLeibowitz/Aggregator-Dashboard)

After introducing the innovative improvement of liquidity capital efficiency of various DEX platforms at the bottom of the transaction, another major feature of the DeFi industry - the Lego attribute, has also brought new improvements to the liquidity efficiency at the transaction level, that is An on-chain transaction aggregator built on many DEXs and capital pool APIs.

image description

(https://www.theblockcrypto.com/data/decentralized-finance/dex-non-custodial/dex-aggregator-market-share)

first level title

(https://dune.xyz/MatteoLeibowitz/Aggregator-Dashboard)

Improvement of the liquidity model of DeFi projects - the innovation of the top-level liquidity incentive and guidance mechanism

secondary title

Olympus DAO--POL protocol has liquidity+ (3, 3)

secondary title

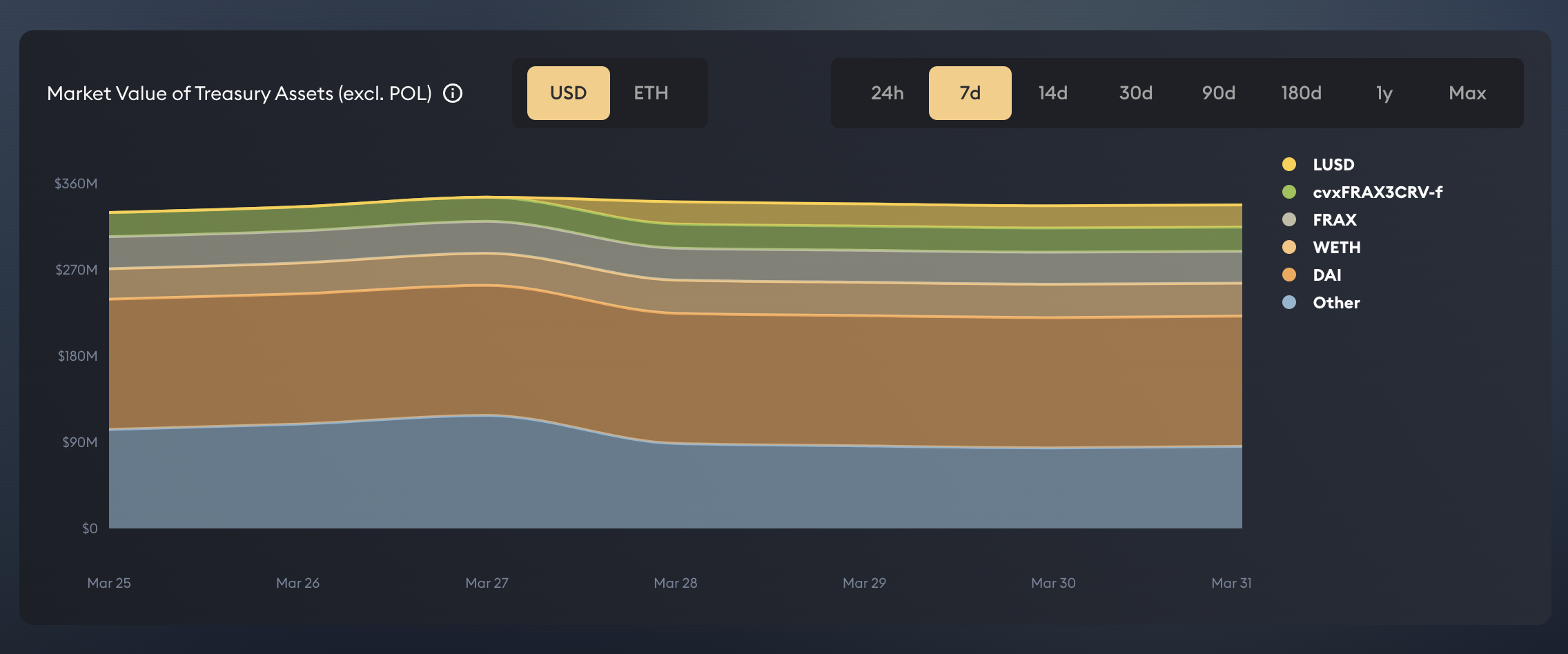

image description

(https://app.olympusdao.finance/#/dashboard)

image description

(https://app.olympusdao.finance/#/dashboard)

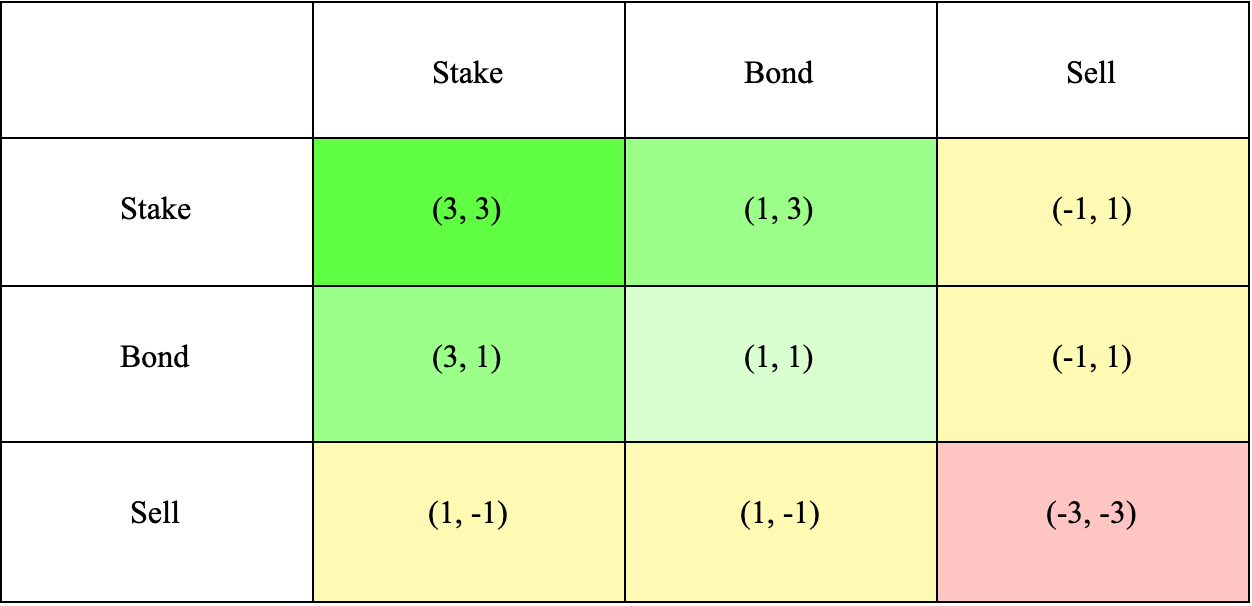

image description

(https://dune.xyz/shadow/Olympus-(OHM))

secondary title

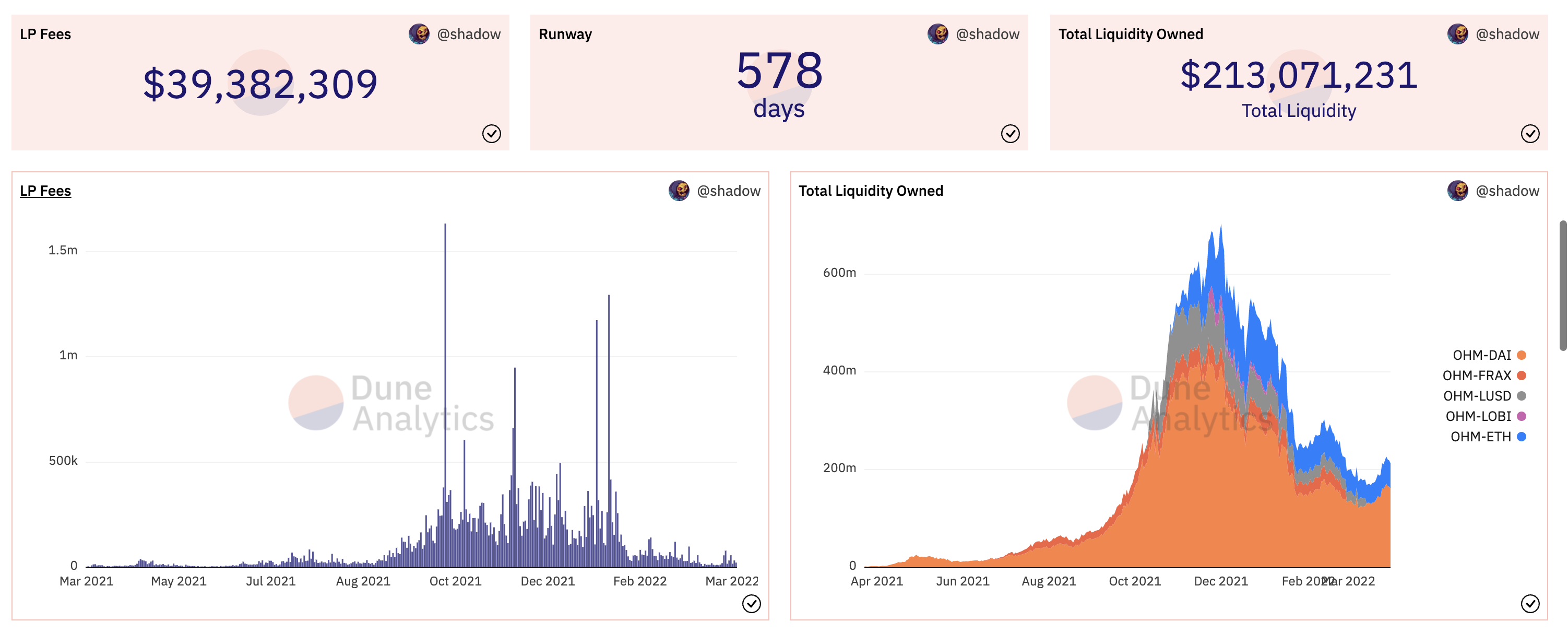

(3,3) Token model - innovation? Or a scam?

The reason why Olympus DAO has attracted a large number of users in a short period of time is mainly due to its fomo (3,3) economic model, which comes from the famous "Prisoner's Dilemma" model in game theory.

After users obtain OHM through bond purchases, the Olympus DAO treasury is supported by value assets. In addition to the OHM tokens sold to users, the contract will automatically generate OHM tokens, 10% of which will be transferred to the DAO treasury, and the other 90% will be transferred to the DAO treasury. Distributed to OHM stakers as Rebase rewards.

image description

(https://olympusdao.medium.com/the-game-theory-of-olympus-e4c5f19a77df)

Such a situation corresponds to the (3,3) state in the upper left corner of the figure above. When all users participate in the stake, a win-win effect can be achieved for both the user and the protocol, that is, the (3,3) state. This is also the main reason why Olympus DAO can form a super high rate of return in the initial stage of the agreement.

secondary title

(CoinmarketCap)

Olympus Pro — a bond market that accesses its own liquidity for DeFi protocols

Based on the bond purchase model of Olympus DAO, Olympus has launched a bond market that can help other DeFi projects obtain protocol-controlled liquidity - Olympus Pro. Other agreements can borrow the Bonding function of the Olympus platform to sell bonds belonging to their own projects, so as to obtain permanent liquidity directly controlled by their own agreement and obtain DEX transaction fees, instead of providing high-incentive liquidity mining activities to "rent" unavailable Continuous mobility.

Long-term holders do not need to speculate on price action in order to acquire more tokens. With bonds, they can offer LP tokens to the protocol of their choice in exchange for their original tokens at a discount. This is a win-win situation for token holders and the protocol itself.

With the accumulation of more liquidity, the capital pool can support larger transactions and ensure price stability, preventing a large amount of liquidity from exiting. This in turn creates a healthy liquidity regime that attracts long-term holders.

image description

(https://docs.olympusdao.finance/pro/)

secondary title

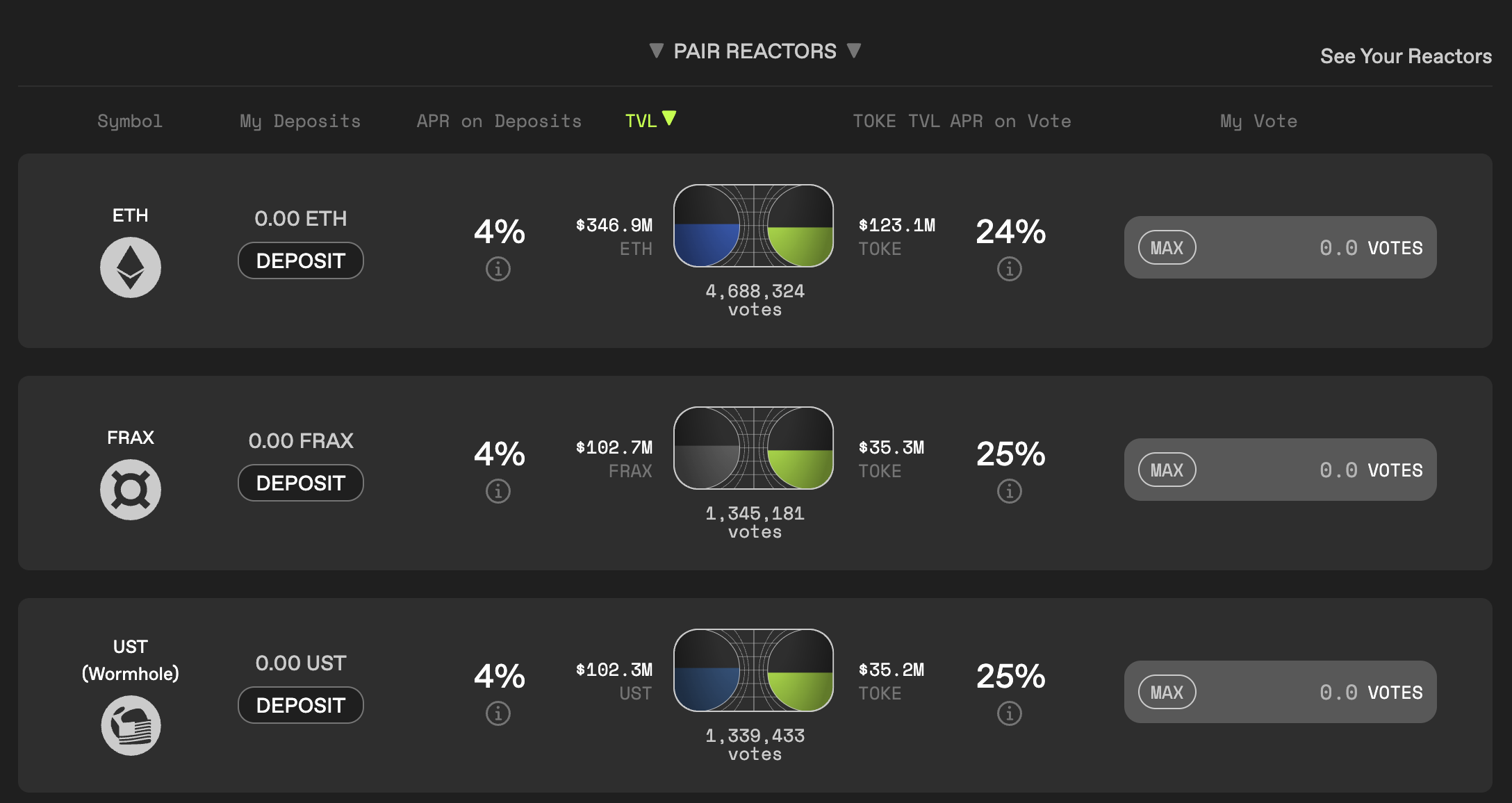

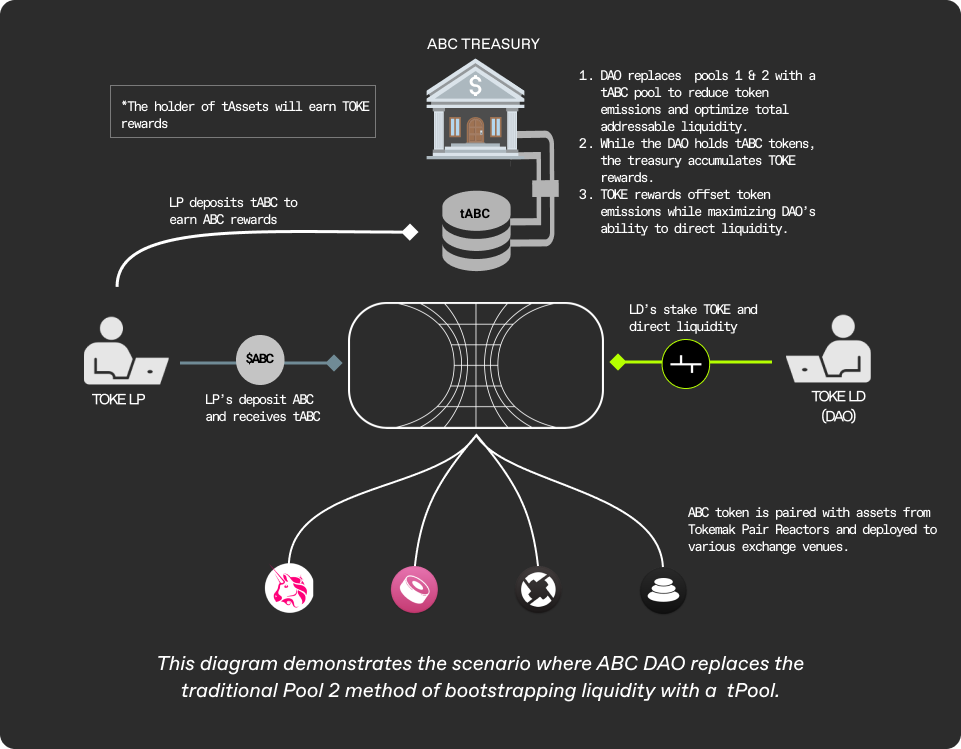

Tokemak--a decentralized liquidity market maker based on the DAO to DAO model

secondary title

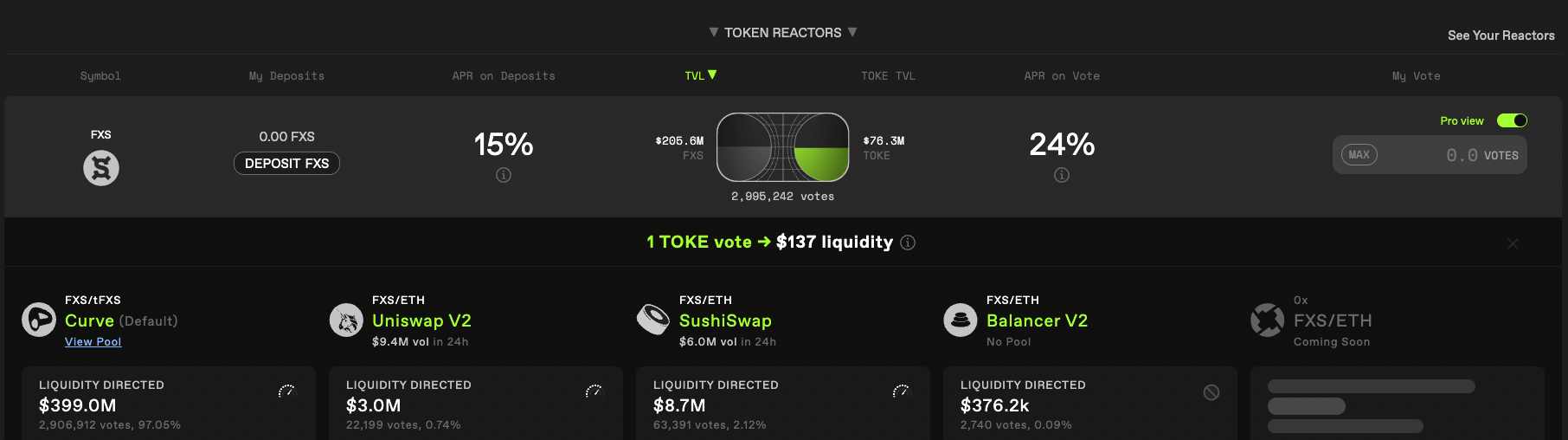

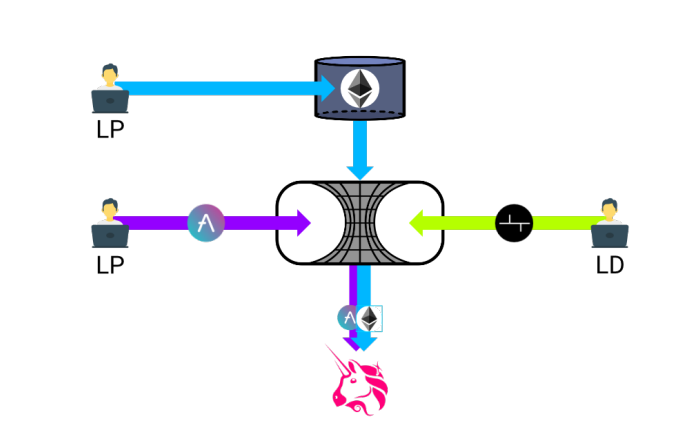

Tokemak's Liquidity Fund Container - Bilateral Reactor

image description

(https://www.Tokemak.xyz/)

image description

(https://www.Tokemak.xyz/)

image description

(https://docs.Tokemak.xyz/mechanics-and-functionality/general-overview)

On the other side of the bilateral reactor is the TOKE voting right pledged by the liquidity leader LD. LD obtains the voting rights of the corresponding asset reactor by staking TOKE, and guides the encrypted assets in the reactor to the DEX trading platform of their choice to obtain liquidity and provide benefits. Currently, the DEX platforms supported by Tokemak include Curve, Uniswap V2, SushiSwap, Balancer V2, and the 0x trading platform that is planned to be supported. LD participates in liquidity guidance by staking TOKE tokens, and will also receive %APR incentives in the form of TOKE.

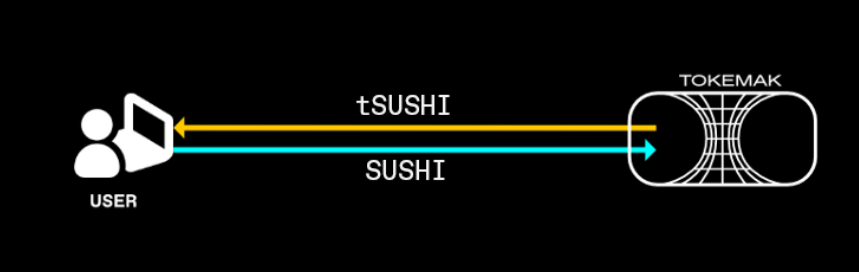

Based on the reactor mechanism, Tokemak has also designed many mechanisms to improve capital utilization efficiency and protect the income of liquidity providers, such as its free loss protection mechanism supported by reserve pools and LD collateral, and liquidity providers in tAssets obtained after depositing assets. Liquidity providers will receive corresponding tTokens when depositing tokens into the reactor (for example, depositing SUSHI to obtain tSUSHI tokens).

secondary title

(https://docs.Tokemak.xyz/Tokemak-for-dao-liquidity/benefits-of-a-token-reactor)

Dynamic yield balancing mechanism Dynamic yield balancing mechanism

Unlike DeFi platforms such as Curve, community voting is required to determine the income distribution mechanism for the incentives of different fund pools. Tokemak platform through the dynamics of reactor bilateral assets