Verse protocol, a wonderful idea to optimize NFT liquidity

Original Author: Kiran

Original compilation: H. Forest Ventures, Jason

Recommended reason

Recommended reasonSummary

Summary:The ability of digital objects to serve as their own medium of exchange has enabled a paradigm shift in media, culture, infrastructure and identity on the Internet.

Over the past few months, I've become obsessed with the concept of NFTs as digitized items, and how this framework enables a whole new paradigm in the way internet-native objects are exchanged.

Let's first consider the limitations of physical entities. You could say that literally anything made of atoms is"object (entity)", but it is useless to attempt to specify a specific definition here. But we can focus on an important feature of physical entities (as opposed to digital ones) that will help us understand"digital object"real potential: ownership.

Blockchain, the core innovation of the public ledger, separates the concept of digital ownership from physical ownership, which lacks any decentralized consensus mechanism. However, while we have created this powerful infrastructure to redefine the nature of ownership of digital items, we still rely on the transaction systems built for physical entities.

In the physical world, any form of physical exchange requires a market. In this market, entities temporarily exist within the confines of their owners. As we know, traditional markets require both supply-side and demand-side liquidity in order to succeed. For Uber,"liquidity provider"Riders and drivers; for Airbnb, guests and hosts; for StockX, sneaker buyers and resellers. For any of the above-mentioned markets, if the quantity of one party is exhausted, the other party will soon be exhausted, until the entire market is paralyzed.

Over the past year, we’ve seen the explosion of NFTs as the first market for truly ownable digital objects. NFTs have many form factors. For example, the functions conferred by digital objects can include: membership card, access token, interactive game, status symbol, artwork, certificate and so on.

Echoing the rapid development of NFT is the rise of the NFT market, although all current market structures are very similar to the market for physical entities and services.

For example, at Opensea, the structure and design of the marketplace is what you'd expect from a typical brick-and-mortar goods giant like eBay. This traditional market structure creates a winner-take-all environment where success is binary:If you have the most buy-side and sell-side liquidity, you probably win. If not, you may suffer a painful demise.

Not surprisingly, both OpenSea and Magic Eden have consistently enjoyed over 90% market share of NFT transaction volume, despite their higher fees and downtime than many of their competitors. Of course, there is much more to discuss about Aggregation Theory and its nuances in cryptocurrencies, but I will leave it for now.

It is not difficult to imagine that over time, today's large aggregators will gradually disintegrate in the ecosystem of the NFT market. We’ve already seen a proliferation of niche markets like Catalog Works designed specifically for niche NFT transactions. There is no doubt that specialty markets will be the place to trade some particular types of unique collectibles.

In all cases, however, virtually all NFTs are traded using some form of auction model and are economically linked to third-party marketplaces. No matter the size of the market, we have to go to the market to trade and still do a price search. The economic outcome is still a scramble for locked liquidity.Ultimately, even though we have these new, internet-native digital items, we still exchange them as if they were physical entities and subject them to the same centralization, dependencies, liquidity, and inefficient pricing.

first level title

Introducing Verse: Super Exchange Protocol

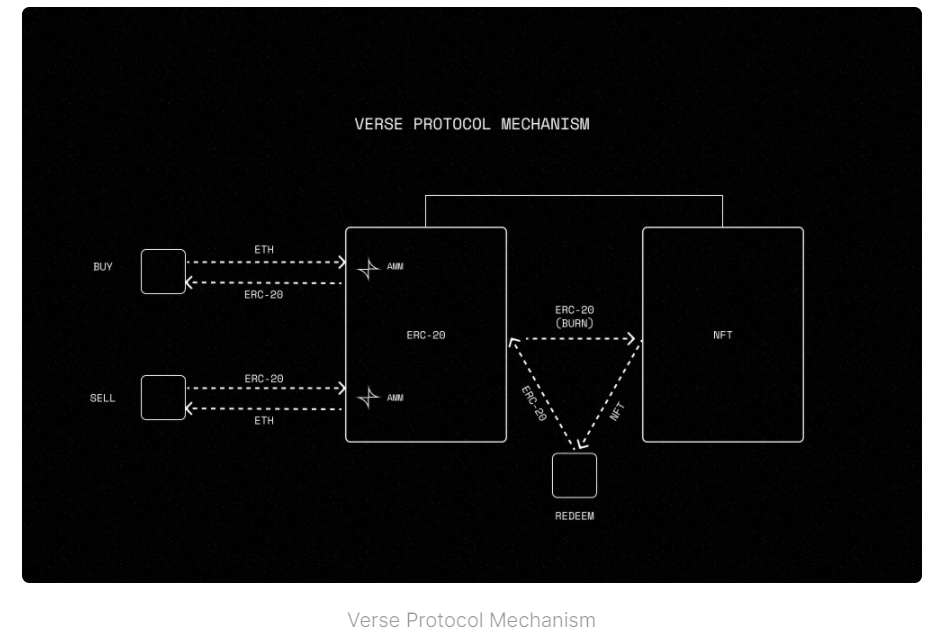

The Verse Protocol enables every digital item to have an embedded, autonomous exchange. Structurally, this means that every ERC-721 NFT created through Verse is backed by a basic ERC-20 marketplace. Let's take a closer look at how it works.

Through this protocol, the creator deploys a contract pair consisting of an ERC-20 transaction contract and an ERC-721 super object contract. The dynamic price and supply of ERC-20 tokens is managed by a bonding curve that acts as an AMM. Simply put, this means that anyone can buy and sell tokens at any time with instant liquidity, and the contract will programmatically adjust the price based on the circulating supply. Those who hold at least 1 atomic unit of ERC-20 tokens can redeem their tokens. Redeeming a token transfers the holder's ERC-20 to the paired HyperObject contract, which mints a new NFT and transfers it to the redeemer in exchange.

Example: Let's say I'm a creator creating a digital basketball court NFT called "Swich Court" via Verse. On Verse, I deployed a contract pair consisting of an ERC-20 SWISH contract and an ERC-721 SwichCourt NFT contract. Anyone can then buy and sell SWISH tokens instantly. Those who hold at least 1 SWISH can redeem their tokens and then receive a SwishCourt NFT for 1 SWISH in return.

Therefore, digital items, as their own medium of exchange, have an autonomous market. Since the item essentially provides its own liquidity, it can be exchanged without the jurisdiction of a middleman.

This new exchange structure yields many benefits for both NFT creators and consumers.

consumeralso,

also,CreatorHave absolute control over how the NFT is priced throughout its lifecycle. Creators can specify the base reserve ratio and the initial slope of the ERC-20 price curve, tweaking slightly how they want their NFTs to be priced as demand changes. In this way, creators can set a practical limit on the supply of NFTs and guarantee a certain level of scarcity.

Perhaps most importantly, Verse enables digital items to live autonomously anywhere on the internet, without needing to be connected to a marketplace. Imagine that you casually browse information on a certain website, see an NFT created by Verse, and be able to trade it at that moment and at that location. It's like walking down the street, seeing a pair of Nike Dunks, and being able to put them on your feet at the snap of your fingers, rather than having to track down the lowest prices, go to a store, and buy them. As such, the protocol catalyzes new forms of discovery that enable the instant exchange of items where they are consumed.

What I'm most excited about is the new utility that will emerge when ERC-20 mechanisms can be combined with NFTs. Compared with physical entities, digital objects have three core characteristics that open up a world of possibilities. digital items arestateful、as well asas well asnetworked. Digital items can represent anything you can encode, and having an exchange built into items does more than just facilitate better forms of exchange.

For example, consider a Web3 media network like Mad Reality. Imagine a future with a Mad Realities created by Verse"Episode Idea NFT", the owner of the NFT can set the tokenURI to their idea of a new episode. Owners of all the underlying ERC-20s can then stake their tokens to different NFTs, effectively curating their favorite ideas and choosing which ones make it into the show. As the show becomes more popular and more people stake their ideas on the associated NFT, the price of the token rises and coiners are rewarded for their curation efforts.

Or consider the digital Kith hoodie, which was a blank NFT at the time of the minting. Rather than minting a random pattern (similar to the pattern of a traditional 10k PFP project), you can customize the pattern of your digital hoodie and "build your own NFT" based on a limited selection of attributes in the contract. Then, assuming each owner's designs are available on the virtual marketplace, you can use the underlying ERC-20 as an NFT-specific currency to buy other creators' graphics to display on your hoodie. Such a system would incentivize building an economy around NFTs and create value for token holders without needing to be separate from the asset.

Suddenly, you have a graph of items, marketplaces, and social interactions all wrapped up in it. Each object becomes its own micro-economy, and has a native incentive mechanism, allowing investment builders to develop space and systems for the ecology of the object. With recent projects such as OKPC, we have seen innovative experiments in treating NFTs as items with their own state and operating system. Verse is designed to enhance these concepts at the protocol level.

rarity"rarity"NFT of digital items. Long term, I think the protocol will incentivize the creation of NFTs, making them feel more like usable items than collectibles. While it's cliché to say "we're still in the early days," I do believe we haven't touched the level of what digital items can really achieve. By introducing a better way to trade digital items, I firmly believe that Verse will expand the usage scenarios of NFT and promote the overall development of NFT.

Today, I'm excited to open Verse beta and begin working with NFT creators and builders to explore the best projects Verse can help bring to life. (If you are a creator interested in building a new NFT paradigm, please feel free to communicate. If you are an elite full-stack engineer, Solidity developer, or community leader, please email me.)

translator notes

translator notesOfficial account: H Forest

Follow us:

Our twitter:@Forest_Ventures

Our mirrors:H.Forest

Official account: H Forest