4D Prediction: What Will Bitcoin Look Like in Twenty Years?

Author: Daniel Jeffries

Original translation: Jocy & Zhou Xiaotong & Kerouac

first level title

core feed

This article is a recharge belief article. Daniel wrote this article a year ago and made a prediction for the bitcoin world in twenty years. He successfully predicted the bursting of the bubble at the end of 2017.

1. 10% of the projects that pass the baptism of the market will become tomorrow’s Amazon, Google and Facebook, and maybe even JPMorgan Chase and Goldman Sachs, not to mention even the future government, such as digital democracy or liquid democracy.In the next 10 or 20 years, expect a very powerful government cryptocurrency to emerge and dictate the flow of money for many people in the world.

2. The killer application of the blockchain is not the browser. Blockchains are just the beginning of decentralized consensus. In the future, the application of blockchain will be easier to use and will be generated in areas where there is currently no application demand.

3. The protocol layer of the public chain will be separated from the cryptocurrency settlement layer.There are only four major cryptocurrencies in the future, fifty to a hundred minor cryptocurrencies and variants and state-dominated cryptocurrencies.

4. 99% of the projects currently in operation do not understand economics at all,In the next five years, there will be a DAO that will become the world's top 500text

text

Forecasting is a tricky business, and it's hard to get it right. But what I'm going to do is make bold predictions, and with the 10th anniversary of the Bitcoin white paper approaching, I'm going to try to see what Bitcoin and other cryptocurrencies, blockchains, and decentralization will look like 20 years from now.

When I'm old and gray, I'll look back at this post and it'll either feel downright stupid or incredibly brilliant.

I don't care what the end result will be. Anyway, I'm working on this.

It's easy to predict that "Bitcoin will go to zero" or "Bitcoin will become a reserve currency and be worth a million dollars," but I'm going to go a little deeper and look at how technology will shift and society will How will it be transformed.

I have successfully predicted future trends and technology changes. Arthur C. Clarke, one of the greatest science fiction writers of all time, predicted the arrival of satellites, GPS, cloud computing, the Internet, and telecommuting. But he admits he overestimated the importance of the rocket and overlooked the importance of a prototype laptop that a company sent him to use to write his next novel.

Chaos theory tells us that predicting the future is impossible. But that's not quite true.

We'll never predict black swan events or completely unexpected technologies (like trying to explain computers and the internet to 18th century farmers), but we can do something like Monte Carlo analysis of the future Then predict the main path of future development.

Very few people can predict well.

image description

Magnum Chaos represented by Lorenzo Lotto, photographed at the Basilica di Santa Maria Maggiore in Bergamo

image description

Homer’s brain

It's like a primitive lizard brain, completely incapable of understanding anything novel. It's only good at attacking, defending, finding food and shelter, and avoiding boredom. Its brain is nothing more than a survival machine.

Unfortunately, many people spend almost their entire lives at this level, and their opinions are worthless when they say they see new trends and directions.

The second major reason people fail to see the future is that the future develops against everything they understand about the world.

Like Kodak, they refused to see the power of digital film because they had a hundred-year business built on the back of chemical film. They have all kinds of advantages, and they sneer at digital movies. They mistook the past for the future and paid dearly as the market roared. To see the future, you have to be able to look beyond yourself, unlearn past successes, and look beyond your current understanding of the world.

The third major reason people fail to see the future is that the future challenges their positions of power

That's why JP Morgan, as well as the prince of a country that only allowed women to drive last month, has dismissed bitcoin and cryptocurrencies as a "fraud" or "scam."They cannot see the future clearly because they are the main beneficiaries of the current system. They don't want to see future changes, and even unconsciously launch a series of information wars, which are just their mental defense mechanism. The rise of new ways of governing the world meant their status was threatened and made them fearful. Asking these people about Bitcoin is like asking a taxi driver what he thinks of Uber or a carriage builder what he thinks of cars, and their opinions are worthless.

The fourth main reason people screw up forecasts is because they mistake their opinion for reality

image description

Clifford Stoll: I see nothing but the shadow of my opinions in Plato’s cave.

In 1995, US Newsweek's Clifford Stoll published an infamous article declaring that the Internet was about to collapse, facing failure. Stoll wrote:

"Visionaries see the future of telecommuting, interactive libraries and multimedia classrooms. They speak of electronic conferencing and virtual communities. Commerce and commerce will move from offices and malls to networks and modems. The freedom of the digital network will make government more democratic .It's just ridiculous!"

It is impossible to read this quote without laughing at the overwhelming sense of superiority.

I bet just about everyone is laughing at the poor guy for not seeing the internet coming, and they probably don't even know what the internet is. They certainly don't see a working Wikipedia, the rise of telecommuting, and buying anything from books to groceries through Amazon.

Actually, the most striking thing about the quote above is not how inaccurate it is, but how accurate it is on multiple levels.

Read that article, and you'll see that he's incredibly accurate in a huge number of his predictions!

If you go back to that article and strip out all of Stoll's points, it's a pretty clear picture of the Internet in the next two decades. Look at this sentence:

"Nicholas Negroponte, director of the MIT Media Lab, predicts that we will soon be buying books and newspapers over the Internet."

Stoll sees the future, he just refuses to understand it. If he manages to get out of his own way of understanding and just observe instead of interpreting and filtering what he sees. Then that article would go down as one of the most forward-thinking and accurately predictive future articles in history.

This phenomenon leads us to the next reason why it is difficult to predict the future.

The fifth reason people predict the future wrong is sheer impatience

To start with Stoll's article:

"After two decades of living on the Internet, I'm confused."

Stoll has lived on the Internet for two decades, but the Internet wasn't mature enough for him. It's easy to think that the Internet will still not mature over time.

Waiting is the hardest part. It takes patience to let things develop naturally.

The real creative process involves setbacks, failures, and persistence. Once you expose your thinking to a reality full of rust and friction, things tend to fall apart. None of the plans survive contacting the enemy. Reality is a whetstone that either crushes your thoughts or sharpens them.

How long does it take to turn an idea into reality?

George de Mestral, inventor of Velcro.

his story is aA classic example of the real creative process and the time it takes to create it。

In 1941, he was walking in the woods with his dog and found a bunch of small wooden spines stuck to his skin, so he had the idea to invent Velcro. But the idea didn't quite take root in his mind,Seven years later, in 1948, he began reinventing the small hook, and it took him another decade to realize the idea and mass-produce the product.When he started his company in the late 1950s, he predicted that Velcro would be in high demand, but nothing happened.

In the 1960s, he spent another five years improving Velcro to solve the problem of astronauts getting in and out of large and bulky spacesuits.Most people in the world are only concerned that Velcro can solve a problem for them but not the ideology behind the problem. Soon the ski industry took notice and applied Velcro to ski boots.

All in all, from an initial idea to running a profitable business?

It took about twenty-five years.

Finally, before I get into crypto predictions, there is a lesson we can take from Stoll.

Stoll's biggest mistake was turning a blind eye to the future. Based on current human inventions, he imagines current inventions and creations as solutions to future problems, which is obviously wrong!

Current inventions and creations can only solve current problems, and there will be new solutions to future problems.

In Stoll's article, it is mentioned that CD books will never replace real books. He's right, reading books on CD with a clunky CRT monitor is a retina-ripening miserable experience. But understanding this interesting history can help us understand the necessary characteristics of new solutions in the future.

It is almost impossible to know what the solution to a future problem will look like, but we can figure out what characteristics those solutions have so that we can recognize it when it arises.

Let's take a look at how e-reading has evolved:

CDs are awkward to use. The monitors back then were blurry, hard to read and a pain in the eyes. Computers are bulky and inconvenient to carry. A laptop is a leg-burning brick, and no one wants to read anything on it.

But Stoll also ignores the shortcomings of books.

Books are also heavy. Made of wood and easily lost or damaged, you can only carry books that you can bear the weight of.

From the above analysis, we can see that a good solution is:

Lightweight and ultra-portable

Has a clear display

User-unaware data storage

Easy to use like a book, open and read

Data is protected and if lost or damaged, it can be recovered without having to purchase it again

Allows for a large number of books to be carried at once

The Kindle enhances the reading experience, and it's even waterproof compared to traditional books. New solutions must be able to provide the original feature set as well as have new and improved features in order to really catch on.

Now we know the answer: Kindles and iPads.

Both are easy to use and protect your eyes while protecting your data with backups.

image description

The Kindle improved reading and now it’s even waterproof which makes it better than traditional books. New solutions must offer the same feature set plus new and improved features to really take off.

As can be seen above, there are three principles that can help us predict the future:

1. Patience.

2、 Observe,don't interpret. Keep watching.

3. Don't graft today's solutions onto tomorrow's problems. Don't graft today's solutions onto tomorrow's problems.

Well, let's open the crystal ball and see the future fate of Bitcoin and blockchain.

We start with a few simple predictions, move on to some more complex and far-reaching predictions, and end with some controversial issues.

secondary title

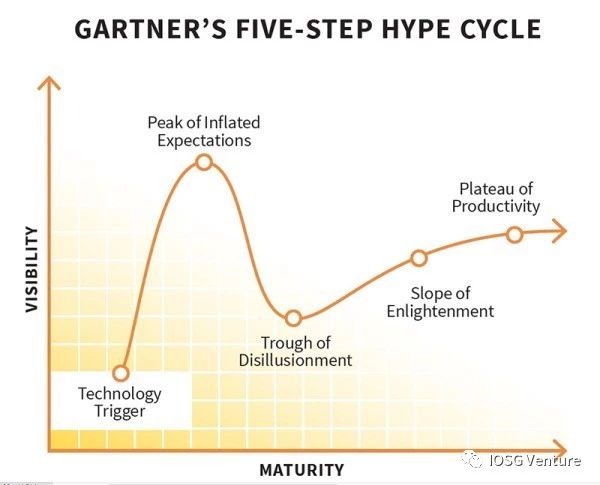

1) Bubble burst

Those in and out of the cryptocurrency market see it as a bubble that is about to burst, causing prices to plummet.

They are right, but so what? This is not the end of the story, it's just the beginning.

We are in a state of extreme excitement and there is tremendous potential in this area. We can almost experience a decentralized future. It's around the corner, any day now!

There is no doubt that the bursting of the bubble will not solve the problem. Vitalik is right, 90% of tokens will fail.

After the bubble bursts, the real future will emerge.

After eight years of running the cryptocurrency experiment, everyone is researching the future direction of the crypto world, but apart from speculative trading and smart contracts, there is not much to show.The current applications in the encrypted world are imaginative but practically unusable. It can be a headache when you press "send" and send someone $5,000 online. If you get the address wrong, your money will disappear!

When the Internet bubble burst that year, many of today's giant companies lost 85% of their stock prices. But they survived and waited for the best of times, Amazon and Google dominate the current world.

The same will happen in the crypto world.

10% of the projects will become tomorrow's Amazon, Google and Facebook through the baptism of the market, it may also be JPMorgan Chase and Goldman Sachs, and even the future government, such as the era of digital democracy.

Innovation is hard work.

Because you're trying to create something that exists in theory but doesn't!

Innovation has no guidelines, no templates, and no business logic to clone. nothing. Only you! Only with you and your imagination, of course 90% of people and companies will fail!

But that's not a problem.

Encryption algorithms, blockchains, and triple-entry bookkeeping are probably the most important inventions of the past 500 years, so they don't go into that good night gently.

Bursting the bubble is the next step.

secondary title

2) Government-led cryptocurrencies will prosper

The crypto community won't like this, but it's undeniable.

The government will not sit idly by and lose control of the money supply without a vicious fight. Anyone working on this should anticipate future attacks on the protocol level of block cryptography and design defenses against them.

Gladius, a distributed and decentralized DDoS defense grid is a great start, but there is still a lot to do to get there. We’ll discuss some additional defenses that the crypto world can survive in future protocol changes.

In the long run, the government will lose the race, maybe 30 to 100 years (maybe sooner, depending on how many times wars or financial crises break out), we will survive the race, and in the future Within 10 or 20 years of 2020, very powerful government cryptocurrencies are expected to emerge and dictate the flow of money for many people in the world.

"But no one will accept them!"A cry from a true believer in encryption technology!

Of course, people will eventually adopt government cryptocurrencies.

Ordinary people don't understand the real importance of cryptocurrencies, and they have absolutely no need for privacy and security. Until extreme circumstances arise, like war depriving their bodies. When soldiers invade their house and take everything from them, that momentary need for privacy becomes very real.

Remember Snowden's interview on John Oliver's talk show about government surveillance?

Looking at Snowden's expression, he realizes that ordinary people on the street don't care about their own privacy at all! They only care about whether their private photos are stored on the government's hard drive.

People won’t hesitate to adopt government cryptocurrencies like good little sheep. Even they think it's definitely the right thing to do. They are even willing to kill for defending government cryptocurrency if they are told that using it is absolutely true!

Governments will say that cryptocurrencies are ridiculous in many ways, as Naval Ravikant pointed out in an epic blockchain tweetstorm:

Blockchains are meaningless because the purpose of blockchains is to redistribute power across the system. Without allowing a single organization to arbitrarily control or change the rules, decentralized cryptography and applications provide a strong set of checks and balances to prevent damage to the system.

When five different banks own a blockchain, it's not a blockchain, it's just a database. A blockchain is only true when the bank, regulators, shareholders and the bank's customers simultaneously hold the keys to the blockchain and are able to neutralize each other's power.

Checks and balances of power are the key!

The idea of a government cryptocurrency is downright corrupt.

But none of that matters. The government will stop at nothing to achieve this.

In fact, rather than decentralizing power, they look more like centralizing power further, giving themselves the ability to effortlessly track every citizen's spending and automatically collect taxes from wages and sales of goods and services. That's why authoritarian governments are racing to establish an official cryptocurrency, and they can't wait to see the panorama (get all your payment details and processes) in your pocket as soon as possible.

They are absolutely going to outlaw physical cash and they are going to do it under the guise of the following three excuses:

prevent money laundering

prevent terrorist attacks

crime prevention

Of course you spend half your salary on Amazon, groceries and rent has nothing to do with any of these things. But if any of the above excuses are thrown around, more than half the population can easily be persuaded to do anything, and they'll even believe it outright.

Remember the conversation American psychologist Gustav Gilbert had with Nazi Hermann Göring during the Nuremberg trials? Goering told him,Whether it's a democracy or a fascist dictatorship, most people will agree to what their leaders ask them to do。

Gilber replied naively: “I don’t agree. In democracies, the people have a say in this issue through their elected representatives. In America only Congress can declare war.”

But Goering just laughed and said: "Oh, that's fine. But whether the people can have a voice or not, the people will always follow the orders of the leadership. It's easy, just tell them that we are under attack and condemn the lack of patriotism of the pacifists doctrine and put the country at risk, any country operates in the same way."

Government-issued cryptocurrencies will be a very painful process for those who believe in the future of cryptocurrencies. But these people will eventually try to get used to this existence.

secondary title

3) Decentralized cryptocurrency will become a parallel running economic system on the planet

Centralized cryptocurrencies have outstanding advantages, but it does not mean that decentralized cryptocurrencies are about to disappear. Many governments will try, but ultimately cannot remove them from the economic system.

the reason is simple.

It is difficult for people to reach consensus on various issues of the blockchain, and it is also difficult for governments around the world to agree on anything. They can't do it, some governments love decentralization, others hate it.

Even if some countries are openly opposed to accepting decentralized cryptocurrencies, others will, especially those that were heavily dominated by the euro and dollar in the last century.

I see countries in Latin America and Singapore, such unrestrained globalists. Even historical banker Switzerland and many Asian and African countries welcome decentralized cryptocurrencies with open arms.

Even if all countries do not accept decentralized cryptocurrencies and centralized cryptocurrencies come to power, decentralized cryptocurrencies will never disappear.

To remain relevant to the world, decentralized cryptocurrencies need to grow fast and need killer apps. Cryptocurrencies are currently vulnerable to attack.To really take root requires a killer app that can spread across the globe. The app has to be something people can't live without, people can't imagine life without it. This would allow players with power in the real world to enter, who would then use that power to fend off attacks from outside.

secondary title

4) The killer app of the blockchain is not the browser

This is a classic example of porting an old invention to a new system. Brave is a great browser, and I would really like BAT (Note: Basic Attention Token) as a companion product or a general payment system that automatically exchanges cryptocurrencies instead of manually. But I don't think this is the final interface to the blockchain, it's just a potential transition tool.

What does a killer app look like?

I don't know, but I know that the app needs to have these characteristics:

Ubiquitous

Easy to use

Platform (Acts as a platform for everything from changing money to getting tickets to protecting privacy and information)

Open source

It is also a new, original and scalable application.

Extends the best features of the blockchain while minimizing its greatest weaknesses.

secondary title

5) Blockchain is only the beginning of decentralized consensus

People have invented new technologies like IOTA's Tangle and HashGraph.

It doesn't matter if these techniques prove to fail over time. Because there must be other projects that will be recreated in another way.

In the next 20 years, I expect there will be dozens or even hundreds of experimental distributed consensus protocols, assisted by artificial intelligence, that will greatly exceed the transaction level of VISA processing.

There is also a good chance that these systems were not designed by humans.

Artificial intelligence will quickly iterate various ideas and complete systems that humans cannot complete in a hundred years. AI can draw inspiration from insects, roots, or other biological systems such as proteins.

secondary title

6) Blockchain applications will be easier to use

The current user experience of blockchain applications is very poor.

If I copy and paste wrong, the software malfunctions, or someone hacks my computer and phone, my property is gone forever. See what the actual user experience looks like? Once you make a mistake, you lose completely. It's like riding a mountain bike on a ridge with no roads.

Full node wallets are slow, ugly and hard to use. During the last Ethereum upgrade, I forgot to keep the private key, so I had to restore the wallet. Earlier this year I had a bitcoin stuck in the 2013 version of Multibit, the software mistook me for sending a transaction that was never actually broadcast, and it took me a week to get the transaction released.

image description

If grandma can’t do it, forget it. Everyone is not an IT person who can bang away at the Linux terminal.

The average person cannot solve the various problems that occur in the wallet. Twenty years of experience in IT has taught me that people will screw up their systems in ways that technologists can't even imagine, like Murphy's Law.

To make matters worse, there is no way for one to reverse any transaction, and there is no guarantee that the transaction will not go wrong. I foresee many algorithms to freeze, rollback and secure transactions as well as provide self-custody of funds and recovery of stolen funds.

If the new system wants to be applied on a large scale, it must be compatible with the old system and provide brand new functions.

Think of CD-ROM e-books in the 80s. They have new features like charts and colors that you can easily carry around. But that's not enough, because CDs are fatally flawed.

In his book The Singularity Is Coming, Ray Kurzweil refers to the evolution of CD-based e-books as the "pretender" phase. New technologies have some advantages, but too many disadvantages to really integrate with the wider world to replace older technologies.

Until the emergence of Kindle and iPad, e-readers have all the old functions of reading books, such as portability and ease of use, and new functions, such as being able to carry a thousand books with you, have the conditions for large-scale application.

The development of the crypto world must follow a similar path,From an early stage with many fatal flaws to endless new powers for people and businesses to achieve world domination。

I also see many applications that we really need, such as passing digital assets to our children. To this end, it is necessary to set up an algorithm bank, bulletproof (bullet proof) multi-signature wallet, and use decentralized cloud services for final arbitration.

Simply sharding your private keys and handing them over to a trusted friend or loved one is not enough. This is only an initial solution. When friends stop being friends, people get divorced or die, or worse, we need fully automated solutions.

Think how hard it is to pass bitcoins to loved ones these days. What if you die tomorrow or forget your password? If you are currently trying to do this, you will find that the actual situation is very bad.

You start by creating a will, locking up a backup of your private keys and wallet in a safe, giving the passphrase to a lawyer and hoping he doesn't steal the assets, and keeping the USB storage or Trezor/Nano from malfunctioning. You can also create a multi-signature wallet with friends and family and hope that no one leaves a back door or submits a different version to Github and causes a bug. These programs are not mature at all, and ordinary users will not accept them.

I foresee a future where smart contracts can be deployed via drag and drop, AI can be used to generate wills, and self-custody of funds can take place. In essence, the blockchain itself is the customer service department of the bank and the bank, through your biometric token, third-party POS (proof-of-stake) group or decentralized artificial intelligence, to verify your loved ones and others. Trigger the corresponding event on the day you die.

secondary title

7) The protocol layer of the future public chain will be separated from the cryptocurrency settlement layer

Now all cryptocurrencies running public chains are inseparable from the protocol layer.

I hope that in the future theThe protocol layer and the settlement layer of the cryptocurrency are separated, so that the cryptocurrency can be better protected and stored. Just like the evolution process of the server, the server has experienced the evolution from bare metal to virtualization, to container to serverless (SaaS).

Most public chains are facing a scalability dilemma, and we cannot perform Visa-level transaction processing on public chains. This is a subject that any public chain must face and continue to debate. At peak Bitcoin can only process 7 transactions per second. Some see this as an advantage of cryptocurrencies, as it encourages people to store it rather than send it.

This is simply ridiculous!

We should be able to move cryptocurrencies as fast and as much as possible.

Let's face it, the 1 MB block limit is nothing more than to prevent hacking. Originally Bitcoin had no block size limit, then Satoshi sneaked in to add this limit and didn't mention it, nor explain it in the source code. Most likely it's just a way to prevent DDoS attacks.

We will come up with better protections.

Are you a 1MB block stickler?

How about 2MB for SegWit2X?

Maybe you'd go for Bitcoin Cash's 8MB blocks?

Wrong, all of this is wrong and nonsensical.

According to the Lightning developers, if we had 7 billion people transacting every day, with each person making two transactions, it would take:

With 24 GB blocks, the data volume is 3.5 TB/day, 1.27 PB/year.

We need to think differently and design real solutions. Bitcoin and the entire crypto world must constantly change in order to survive. Before the advent of quantum computing, we need to integrate new defenses at a faster rate, update encryption algorithms and continue to innovate.

We can't just stop at Satoshi's vision and assume he thought of everything that might happen in the future.

He didn't.

Frankly, who cares what Satoshi thinks? He left the project. If he really wants to bootstrap Bitcoin, it should be like Linus did to Linux. But he didn't, and he left Bitcoin for others to figure out later.

Let's really get down to it, the encrypted world has not yet set standards, unlike the real world where it is monopolized by giants.

One method is to strip the protocol layer, run the original cryptocurrency into a virtual machine or container, and separate the protocol rules from the cryptocurrency liquidation.

This is just a precautionary measure, and to be groundbreaking requires real innovation.

Either way, quick thinking and decision-making is required. Otherwise we will still be arguing about 1MB or 2MB, rather than when the encrypted ruble and encrypted yuan will surpass us.

In the future, there will also be a need to defend against hostile behavior, APT (advanced persistent threat) protocol-level attacks, and relay service attacks. The architecture of NEM is a good start as it has node protection measures including firewalls etc.

The encryption world needs to further prevent more insidious and destructive attacks, and the future does not allow us to spend four years upgrading or a hard fork to deploy solutions.

The best solution is to download the chain of external security rules to all nodes in the network, and perform security countermeasures such as intrusion detection, firewalls, protocol checkers, and AI-based automatic rule sets in these nodes.

secondary title

8) Only four major cryptocurrencies in the future, fifty to one hundred minor cryptocurrencies and their variants and state-led cryptocurrencies

Right now we are making cryptocurrencies for every use case.

Are you building an identity platform like Civic? Then issue a cryptocurrency.

Want to create a decentralized DNS? Issue a cryptocurrency and conduct an ICO!

Want to build a boring app on the blockchain? My friend, you need a cryptocurrency!

Actually you don't need a cryptocurrency.

Cryptocurrencies are starting to emerge in various categories. I see four types of cryptocurrencies that we can seamlessly exchange for technical services as needed:

1. Deflationary Saver Coin (deflationary cryptocurrency)

2. Inflationary Spender Coin (inflationary cryptocurrency)

3. Action Token (resource usage token)

4. Reward Token (reward/governance token)

Deflationary cryptocurrencies are good for hoarding investments. The price of cryptocurrencies rises over time and benefits hoarders, everyone needs this investment, which is why Bitcoin came into being in the first place.

An inflationary cryptocurrency is like the dollar today. Nobody likes paying for TV with Bitcoin because they might realize in a few years that they paid $175,000 for it, as the price of Bitcoin keeps skyrocketing. We need stable, spendable cryptocurrencies to buy and sell everyday goods.

The method of paying for resource usage through Token should be changed to always free, such as voting or sending text messages, these operations are not transactions. Resetting a password should not cost the equivalent of two pennies Token, as people in the EOS ecosystem say: "If you go to Amazon to shop and find that it costs 3 cents to load a page, no one will load the page."

Reward tokens are designed to be a reward and punishment tool that flows around the system as a way to incentivize good behavior and punish bad behavior.

secondary title

9) We will know that we don’t know economics

Are you a Keynesian planner or an Austrian free market advocate?

The answer is no one cares?

All current economic theory is based on research based on limited data that was once recorded using paper and ink. When new economic systems emerge in the future, all current economic theories will prove to be as old as cave paintings.

This is what the new cryptocurrency is about: a microeconomic system at war.

Darwinian economics.

Some basic economic theories are right, but many of them will fall by the wayside. Because in the future under the blockchain-led system, we will get real-time economic data around the world, instead of a bunch of guesses made with pencil and paper a hundred years ago.

secondary title

10) A DAO will become the world's top 500

The most likely DAO (Decentralized Autonomous Organization) to reach this milestone would be a Visa-like version of the DAO that would potentially collect fees from transactions and miners sent on the network and fund future development and governance of the network.

Instead of hoarding all funds, DAO acts as a link, sending funds through smart contracts to other businesses and DAOs as well as local governments and other non-government entities that contribute to the entire network.

To achieve this, DAO must continue to develop. We currently think that DAO is just a smart contract, which is far from what we imagined.

DAOs need AI to help manage rule sets and be able to automatically generate templated governance models. Governance is everything in DAO. As the main direction of open source elite work, there is currently no good scalable model to support DAO to manage a large company. Early DAOs failed because of what I call the brave new world problem.

“How beauteous mankind is! O brave new world, / That has such people in ‘t!”

Everyone imagines themselves to be the leader, no one wants to bend down and pick up the trash.

It's hard for us to even order a paper clip when everyone is the leader of a DAO.

To function effectively, a team needs people to fill various roles. Even as people continue to accumulate experience and establish prestige, DAO can also have the ability to replace people.

In a real business environment, management is hard enough. How do you fire someone for not being able to work in a DAO? How do you ensure that the person in charge of ICO security is qualified and not elected because everyone likes him? You can't risk losing $45 million in Bitcoin Bob was elected simply because Bob could tell the amazing story of Burning Man.

secondary title

11) The gig economy will grow dramatically

People in World War II had only one or two jobs in their lives.

Today we have five or six jobs.

People of tomorrow will have five or six jobs at a time.

Half of the income will be passive income earned automatically. We will also see the rise of AI job matching services. Machines will learn about your abilities and skills and match you with short-term jobs.

Imagine a software project in the future requiring approximately 10 trillion lines of code. Software projects are becoming more and more complex. AI will write and test half of it, and people will write the other half. The project would be fed into a distributed system that could split the work, much like a project manager, to deliver work to programmers spread across the globe based on reputation and skill.

The Hong Kong subway AI system may be the first prototype of such a network, even if it is not a perfect analogy. The AI system will predict what is about to break down on the subway and let engineers maintain it in advance. This makes the world's busiest subway an uptime of 99%.

This system will be governed by a blockchain powered reputation bank and will be the credit foundation of the future society.

image description

Black Mirror's Social Credit. British TV series "Black Mirror"

The evil side, such as the credit system in today's society, is like "Black Mirror" today. Things could not get any worse as democracies use reputation banks to stuff ideology into people's brains.

Publicly managed reputation banks can also help us find people we can trust in business and in life.

This is a double-edged sword.

secondary title

12) Blockchain will enable all sorts of nefarious things to happen

Enthusiasts in the crypto world have to come to terms with the fact that blockchain brings as much evil as it does good.

Good and evil come together, you can kill with a gun, and you can hunt to support your family. Water can sustain life, or it can drown a person.

If you are currently designing a system by "breaking the old and building the new" at a rapid pace, you have to know that if algorithms control our living systems, it may bring disaster.

Instead, you should move slowly and consider ways to not destroy old things.

At the same time you should think about all the possible ways to destroy your system, if you don't imagine the various ways that a hostile party will use the power of blockchain to destroy your system, then you will not be able to protect it.

I'm writing an article called "What If Hitler Had a Blockchain?" and frankly I don't want to post it because I don't want to give the bad guys any fresh ideas. Maybe I'm overthinking, their dark minds are already trying to imagine how blockchain can be used as a tool of control and repression.

Think of your life filled with all kinds of digital information, from where you go and what you do, to statistical predictions of your behavior, to finally unbreakable digital identity management and outright genocide.

Genocide?

Yeah, don't forget that IBM helped the Nazis manage the Holocaust by providing punch cards to track victims.

What will they use the blockchain for? A: Many more horrific atrocities that we are only now beginning to imagine.

Maybe you think open systems always prevent abuse?

mistake.

If the internet has taught us anything, it's that open systems favor centralization. And given enough time, central powers can disrupt any system to their advantage.

secondary title

13) Bitcoin has only half the probability of surviving

Most Bitcoin believers won't like me saying this, but honestly 50% is pretty high.

I know, you must have heard Buy Forever and HODLz before!

Let me explain my point further.

First of all, I will support Bitcoin until the dying day, but let's take a few minutes to objectively judge why Bitcoin may decline, which may not be the same as your thinking.

Bitcoin has a first-mover advantage. It still holds the largest market share, but has some major flaws.

It is the Model T of the blockchain revolution.

How many other Model T cars can you see on the street today?

Can you modify a Model T to burn tires like a Lamborghini?

Can you add complex electronics and make it a self-driving Tesla?

No, it's not possible at all.

First, Bitcoin has no built-in governance.

This is an important flaw. There are several ways to go about it.

The first is to submit a proposal that almost everyone agrees on, which is very difficult as we have seen with SegWit, the SegWit reform took four years to be adopted.

The second is to hard fork and start a new project. This may be the only option that can be effectively implemented. A team might fork Bitcoin and establish governance, but that's a long process.

Well-designed cryptocurrencies with built-in governance protocols have significant advantages over Bitcoin and can easily replace Bitcoin because new cryptocurrencies can upgrade seamlessly and smoothly. Simultaneously, upgrades in the face of attacks by well-funded adversaries would need to be rapidly deployed across the network in hours or days, not the years it now takes.

How to expand?

We have already talked about this issue. Changing the block size doesn't do much and requires a more aggressive approach.

What if some countries deploy firewalls?

Are there relay servers and anti-jamming codes that can be upgraded into the system?

What if the government decides to spend $1 billion building data centers and secretly designs ASICs to run the system? Are there still miners able to compete?

What if the enemy decides to round up all core developers? Considering the huge shortage of talents in the crypto world, it is difficult to expect someone to replace them?

These are some almost insurmountable problems. I point out these questions not so that people can nip them in the bud, but to make people think. If we find the real problem, we can find a solution to it. But if we're just dealing with fake issues like block size limits, we'll end up going nowhere.

Bitcoin is a beautiful and wonderful idea that has changed the world. If Bitcoin fails one day, it may be because of its own coding rules, infighting and lack of governance.

Of course, Bitcoin will not fail in the end. We can now start thinking about how to protect it.

As I mentioned earlier, as servers become virtualized, containerized. Bitcoin can be migrated as the settlement layer of the public chain while establishing an abstract protocol layer and a defense mechanism to adapt to constant changes. This ensures that it will not only survive but thrive.

I'm working on this. I bet if you're reading this, you are too.

The best way to ensure it survives is to understand all the reasons why it might fail and start designing real solutions to those problems. That way we'll be ready when problems do arise.

final frontier

Cryptocurrencies represent a fundamental upgrade to the world's economic system. Once they are fully activated and integrated into global networks, the world as we understand it will be very different.

Looking back hundreds of years later, today's economy looks like the feudal economy of yesteryear.

Cyrptocurrencies, decentralized applications and DAOs could even lead us to a Star Trek-like post-scarcity economy, but it will take time.

The crypto world, like life, is full of good and evil.

If you're in it, you're building tomorrow's world, but don't expect it to come next week.

appendix:

appendix:

Daniel's 2016 predictions about AI Video Game Accelerator Cards

Arthur C. Clarke Predicted GPS and Satellite TV in 1956

Tech Time Warp of the Week: Arthur C. Clarke Predicts the Internet, 1974

What is a black swan event

Monte Carlo analysis

Your Lizard Brain

The Limbic System and Brain Functioning

How Kodak Squandered Every Single Digital Opportunity It Had

JPMorgan CEO Jamie Dimon says bitcoin is a 'fraud' that will eventually blow up

Saudi Prince Alwaleed suggests Bitcoin is a 'fraud'

Newsweek in 1995: Why the Internet will Fail.

George de Mestral

Vitalik Buterin: 90% of ICOs Will Fail

Why Everyone Missed the Most Important Invention in the Last 500 Years

Gladius

Government Surveillance: Last Week Tonight with John Oliver (HBO)

Gustave Gilbert’s talk with Nazi Herman Goring during the Nuremberg trials?

Gamifying the Delivery of Money

Brave Browser

BAT

What is an Atomic Swap?

IOTA’s Tangle

HashGraph

The Multi-sig Hack: A Postmortem

Lightning Network

ATP

NEM architecture

Keynesian planner

Austrian free market

Hong Kong subway AI

Reputation Banks

IBM helped the Nazis manage the holocaust with punch cards for tracking victims