Spartan Group led the investment, and the algorithmic stablecoin protocol TiTi Protocol completed a financing of 3.5 million US dollars

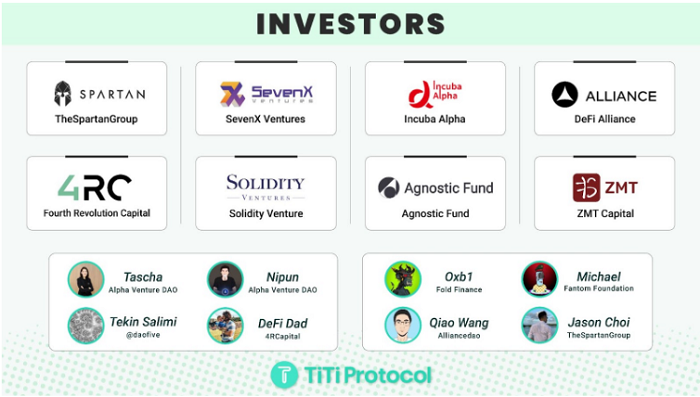

Algorithmic stablecoin protocol TiTi Protocol announced the completion of $3.5 million in financing, led by Spartan Group, and participating investors include SevenX Ventures, Incuba Alpha, DeFi Alliance, Agnostic Fund, Fourth Revolution Capital (4RCapital), Solidity Venture and other investment institutions, And independent investors such as 0xb1 (Fold Finance), Tascha and Nipun (Alpha Venture DAO), Michael (Fantom). TiTi Protocol stated that it will use this latest capital and cooperate with world-class investors to jointly create a new DeFi future.

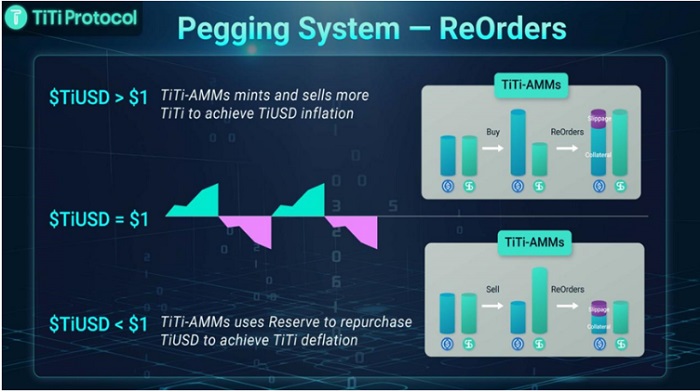

TiTi Protocol is a fully decentralized, algorithmic stablecoin protocol supported by multi-asset reserves and has a "Use-to-Earn" function. It combines a multi-asset reserve mechanism and the protocol itself will be constantly monitored Changes in the total value of reserves, calculate the average price of TiUSD in circulation, and adjust the market-making anchor price of TiUSD in the primary market through the ReOrders mechanism. The protocol provides diversified and decentralized financial services through an encrypted native stable currency system and autonomous monetary policy.

In fact, the TiTi Protocol design is very unique because it combines the "Multi-Assets-Reserve" mechanism and the "Reorders" algorithm mechanism, bringing a new paradigm of algorithmic stablecoin solutions to DeFi and Web 3.

It is undeniable that the most noteworthy of the TiTi Protocol solutions is the Use-to-Earn token economic model, which realizes the interoperability of algorithmic stablecoins and other DeFi projects, and greatly promotes the adoption of algorithmic stablecoins , and maximize the benefits for DeFi users. Frankly speaking, the reason why all of this can become a reality is entirely due to the unremitting efforts of the TiTi Protocol team in DeFi, especially their continuous tracking research and experiments on algorithmic stablecoins for several years.

More importantly, the ambition of the TiTi Protocol team goes far beyond this. The first Use-to-Earn algorithm stablecoin protocol may be just a test of the water. Their ultimate goal is to provide global Users bring more diversified DeFi services.

So, how does TiTi Protocol differ from other algorithmic stablecoin protocols?

text

1. The new stablecoin issuance model TiTi-AMM greatly improves the on-chain liquidity and capital efficiency of stablecoins, avoiding impermanent losses.

TiTi Protocol has built an automated market-making model "TiTi-AMM" for issuing and destroying TiUSD, which can effectively control the inflation and deflation of TiUSD. Thanks to the unique liquidity rebalancing algorithm, the TiTi-AMM model eliminates impermanent losses and provides investors with triple mining rewards. Stablecoin users no longer have to worry about their assets being liquidated, and can trade with peace of mind. In addition, if liquidity providers want to participate in liquidity mining, they do not need to open positions for TiUSD, they only need to provide one-way liquidity for TiTi-AMM, because the protocol will automatically calculate and mint equivalent TiUSD for them , these TiUSD stored in trading pairs will enhance liquidity.

Compared with ordinary automated market making, TiTi-AMM has greatly improved capital efficiency, thus improving the liquidity of TiUSD. Not only that, this model can also effectively suppress single-point risks, because no matter in the long-term or short-term, the stable currency issued by TiTi Protocol can always be guaranteed by the corresponding encrypted assets exceeding US$1, and the data is completely on-chain , transparent, so it is easy to gain the trust of users. In this case, this core stability mechanism allows users to exchange assets worth approximately $1 for stablecoins.

text

2. Use multi-asset reserves to ensure stability and increase the upper limit of the issuance scale.

text

3. Use the Reorders supply and demand algorithm to adjust liquidity to ensure that the value of TiUSD is always anchored at $1.

text

4. Use-to-Earn,The new stablecoin token design will greatly promote the adoption of algorithmic stablecoin users.

In fact, as more and more users start using algorithmic stablecoins, the market penetration will also increase, and this is the core of the organic market growth. TiTi Protocol invented the first Use-to-Earn mechanism, which aims to promote the organic adoption of algorithmic stablecoins, and will also significantly enhance TiUSD's market competitive advantage, and may even bring about a qualitative leap. Use-to-Earn is a brand-new concept of stable currency income, which is actually to use stable currency to passively or actively earn protocol fees.

Specifically, Use-to-Earn allows users to earn protocol fees by holding or using TiUSD. On the one hand, users can use TiUSD or other stablecoins and tokens to trade, transfer, mortgage or asset hedging as usual , the overall feeling does not seem to be much different. On the other hand, TiUSD is actually an interest-bearing algorithmic stablecoin, because TiUSD users or holders can claim additional rewards, that is, protocol fees, in a fully decentralized Merkle-proof manner.

text

5. Calibrate DAO governance.

TiTi Protocol has designed a more reasonable governance mechanism, and uses auction governance tokens or future reserve income to motivate the healthy development of the stablecoin TiUSD in the next few decades, or even longer term, rather than just focusing on short-term profits. TiTi Protocol provides incentives for governance, and does not use this approach as a last resort in a crisis. If the timing is right and the valuation of governance tokens is higher, governance participants will be incentivized to auction new tokens early to increase reserves.

It can be said that TiTi Protocol has carried the banner of promoting the accelerated development of the algorithmic stablecoin protocol, and also brought new solutions to the DeFi and Web 3 ecosystems.