Weekly Editors' Picks Weekly Editors' Picks (0409-0415)

"Weekly Editor's Picks" is a "functional" column of Odaily.On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Now, come and read with us:

Now, come and read with us:

invest

invest

Multicoin Partner: How to find the optimal solution for investment?

A very short article, just in line with the author's "simple > complex".

The first part of the Multicoin Investment Memorandum is called the "Summary", and this part is only allowed to be summarized within three sentences. If you cannot accurately explain the reasons for investing in the project in three sentences, then we will not into the next step of the discussion. You can also try to use this method to summarize the projects you are optimistic about or are currently researching.

How to dig deep into a crypto project?

The first step is to understand what the project does, how it makes money, and whether it is at the protocol or chain level. You can also enter the community to discuss and ask the team for advice, as well as find data and observe the movements of giant whales.

For chains, non-major chains should generally be viewed as short-to-medium-term trades, not long-term holdings. Chain usage can be looked at in terms of number of transactions, total value locked (essentially an indicator of how much capital is being put to work on the chain) and the number of users on any given chain to see if people like to use it . Best also as users feel it, find reasons for data and data growth, track smart money, observe supply distribution. The author uses SRM and NEAR as examples to explain the chain evaluation in terms of data.

The goal of research is to establish your own beliefs, not the beliefs of others. If you don't have confidence in an investment, when it goes down 50% (which it almost certainly will), you need to have the confidence to stay invested or buy more chips at a cheaper price. Most losers are stuck comparing their tokens only to the market cap of the next market leader. "I usually look for low starting valuations (usually $150-500 million market cap), I think they're building something special, they can go to $1-2 billion. I don't look at plagiarized projects because if the project can easily fork, then its competitive advantage is very, very low.”

DeFi

How to Use Twitter to Find More Crypto Alpha?

Use Twitter lists, Tweetdeck, IFTTT, put key individuals and accounts in the notification bar, monitor Chad_follows, favorite tweets.

Messari: Review Uniswap's market performance and progress in the first quarter

As the market's interest in cryptocurrencies and NFTs wanes, Uniswap's total transaction volume and corresponding liquidity provider fees have declined in Q1 2022, with transaction volume down 53.5% from the previous quarter.

As the latest blockchain supported by Uniswap V3, the transaction volume on Polygon has become the market with the largest transaction volume in Uniswap V3 besides Ethereum (even in the absence of liquidity mining incentives); the next quarter Additional liquidity mining incentives should continue to help drive continued growth.

Detailed explanation of Redacted Cartel: Is the Curve ecology a clever combination of nesting dolls or DeFi Lego?

Because a large part of CRV's voting rights is controlled by Convex, the projects participating in Curve War are all carried out around Convex. In order to solve users' voting-related problems and help users maximize their voting benefits, a new so-called "voting aggregator" - Redacted Carted, appeared. Redacted is a Fork of OHM, and its native token is BTRFLY. It combines the mechanisms of OHM and Convex, and is committed to building a trading market with governance/voting/bribery as a target. After Redacted acquires Votemak (where Tokemak governance votes), it will integrate and re-launch Hidden Hand, a Bribe trading market. Hidden Hand will be the core venue of VaaS (Voting as a Service), while supporting Redacted to expand other protocols besides Convex.

NFT, GameFi and Metaverse

NFT, GameFi and MetaverseDismantling top NFT projects: exploring the profit model of 10K projects

(Note: The 10K project refers to a total of 10,000 PFP-like NFTs with common structures and elemental differences.)

Trading timing is one of the most important indicators. "The price development stage of most projects is divided into four parts, namely the incubation period/explosion period, the frenzy period, the cooling-off period/precipitation period and the development period. Each stage has representative events." Market heat, buyers and sellers The current ratio can be used to guide the timing of transactions. For high-quality projects, the longer the holding time, the more profits will be reaped. If you are not a HODLer, you can choose to leave when the hype peaks and the market heat reaches its peak, but if you firmly believe that the project can continue to create heat, HODL. At present, the NFT market is still driven by speculation and expectations. You can choose to follow the meme trend, or choose the style you like.

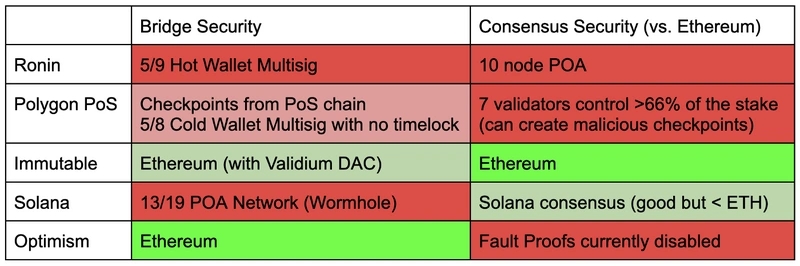

Text from Immutable X (you know). But security is indeed a problem that NFT projects should pay attention to and face at this stage of development. This article mainly compares the consensus and bridge security of the five underlying platforms of Ronin, Polygon, Immutable, Solana and Optimism. See the figure below for the core. At the end, the author also brought up other security factors that the project party should consider besides the bottom layer: wallet, metadata, project, funds and market.NFT, typical and atypical in Pond's New Paradisestory from "

PAK new project ASH2 farce: GAS WAR is triggered, the transaction is locked

", discuss the "Ponzi" (non-derogatory) of NFT, and explain it through Pak and BAYC.

The utility of the Pak universe may exist more in the imagination of the holders themselves. Judging from the market reaction, Pak's universe seems to have fallen into a 4-step "death spiral": From the perspective of Ponzi structure and utility, Pak has indeed ruined a good hand. But there is a good chance that the Pak universe will eventually rise from the phoenix. The art NFT universe is fundamentally different from other NFT universes, and utility may not be needed.

Web 3.0

secondary title

IOSG Ventures: Is the golden age of oracles coming?

In DeFi, there are two main types of oracles that are widely adopted. One is a general-purpose oracle represented by Chainlink, and the other is DEX itself, which can be used as a source of Price Feed. Another basic condition for a publicly recognized oracle is decentralization, i.e. whether it allows a single point of failure.

Successful replication, bringing the Web2 growth framework to Web3 products

Ethereum and scaling

Ethereum and scaling

Comparing Lido and Rocket Pool in all directions: Who is the better investment choice?

The impact of the merger of Ethereum will also be reflected in the application layer. For example, the merger will promote the growth of Ethereum's liquid staking services. These staking protocols eliminate the opportunity cost for users to participate in staking, and may grow to tens of billions in the next few years. The two biggest players in this rapidly growing industry right now are Lido and Rocket Pool.

a16z Protocol Expert: What new opportunities will there be in the iteration of Staking?

New ecology and cross-chain

New ecology and cross-chain

JZL Capital Cosmos Topic 1: The final form of the multi-chain pattern?

A small research report with a complete structure around Cosmos. The final conclusion is that the Cosmos ecosystem has strong traffic acquisition capabilities and low thresholds.

Learn about the Avalanche expansion solution in one article: What are the advantages of the subnet solution?

The author of this article believes that the disadvantages of monolithic designs outweigh the advantages, but affirms the appeal of subnetting. Subnets allow Avalanche to scale by allowing large numbers of validators to actively participate in consensus. Assets can move freely between subnetworks due to a high level of interoperability; this means no beacons or relay chains. Subnets are also free to choose which virtual machines to run on. Subnets also present a very lucrative proposition for validators. In addition to briefly reviewing the two subnet use cases of DeFi Kingdoms and Crabada, the author also expressed his expectation for the arrival of the high-performance computing ecosystem DeepSquare.

TVL breaks through $4 billion, will Stargate become the new cross-chain bridge leader?

The most outstanding point of Stargate is that it uses LayerZero's ability to transmit information to connect the capital liquidity islands of various public chains, thereby improving the capital efficiency of the system. The rapid rise of TVL is also inseparable from the liquidity weapon Delta Bridge.

DAO

secondary title

Talking about the valuation framework of DAO

Communities are inherently valuable. It brings together members' resources, skills, knowledge and experience to create value for members and other stakeholders with whom they interact. Today, the financial value created by Internet-based communities is ultimately captured by community "leaders" or hosting platforms such as Reddit.

If DAO is regarded as a country, the calculation method of GDP (the total currency or market value of all finished products and services produced in a country within a certain period of time) provides a reference for the valuation of DAO. The moat of the community may include network economy, switching costs, brand, monopoly resources.

CultDAO has brought the decentralized ideology to the extreme with its provocative manifesto, decentralized proposal and voting model, destruction of private keys and irreversible contracts. Existing problems include: lack of resources, potential bribery and monopoly risks, limited investment scope, and inefficient voting process for proposals.

Safety

SafetyCosine, Founder of SlowMist Technology: Blockchain Dark Forest Self-help ManualAn original text with 37,000 words

secondary title

hot spots of the week

In the past week,hot spots of the weekIn the past week,Central Committee of the Communist Party of ChinaPublished the "Opinions on Accelerating the Construction of a National Unified Market", mentioning the improvement of the standard system in areas such as blockchain,Director of the Payment and Settlement Department of the Central BankSaid to strengthen risk prevention in new fields such as virtual currency,Ministry of Public SecurityIt is said that telecommunications and network fraud crimes use a lot of running points platform and digital currency to launder money, and the use of USDT is the most harmful.China Mutual Finance Association and other three major financial associationsIssued an initiative on preventing NFT-related financial risks,

Beijing Arbitration CommissionIndicates that Bitcoin is a virtual property and is protected by law;Uniswap, Paradigm, a16z, etc.Grayscale is working with the SECMuskConvert GBTC to Spot Bitcoin ETF, Says Twitter CEOMuskDecided not to join Twitter's board, later fined for not disclosing shares affecting stock priceSued by Twitter shareholders, Musk proposedAcquired Twitter for $54.20 per share in cash, the acquisition is valued at about US$41.4 billion, with a premium of about 18%, and the "Taking Twitter private should be up to shareholders, not the board" votes,Wikimedia Foundationannounced that it will stop accepting cryptocurrency donations,

Brazilian SenateAnnouncing the imminent ratification of the Bitcoin Act;Former SoftBank CEO Marcelo Claure、4130 piecesBTC,Founder of BitMEX2508.95 piecesCoinbaseFounder of BitMEXSaid that the encryption market will fall in tandem with Nasdaq, Bitcoin will fall to $30,000, and Ethereum will fall to $2,500. Crypto big V Cobie tweeted that there is an address inBuy a large number of related currencies before publishing the list of currencies considered for listing in Q2,

Binance invests 100 million euros in France, and reached a cooperation with the start-up incubator Station F;Ethereum's first mainnet shadow forkis online,MetaMask SnapsEthereum merger expected to be completed within the yearSwap Widget, MetaMask launchesUniswap Labs, Will Support Bitcoin and More Blockchain Networks, Uniswap Labs LaunchesAave, allowing users to seamlessly exchange tokens on any network,Established a venture capital department to focus on investing in Web3 projects,;

Aave Ventures will be launched, Crypto Pragmatist founder Jack Niewold revealed,One of Arbitrum, Optimism, zkSync and Starknet may issue tokens next monthLINE's NFT marketplace LINE NFTofficially launched,ERC721R released, A trustless refund function is added to the smart contract of NFT, allowing minters to freely "return" within a specific period,

With "Editor's Picks of the Week" series

With "Editor's Picks of the Week" seriesPortal。

See you next time~