复制成功,把Web2的增长框架带到Web3的产品中来

原文作者:Matias Honorato

原文标题:Growth Frameworks from Web2 to Web3

这是一系列文章,DAOrayaki将探讨 Web3 创始人和建设者如何使用一些 Web2 增长框架来扩展成功的产品。

1. Web3 的增长模型

2. 为 Web3 制定持久的增长战略

3. 建立你的 Web3 增长团队

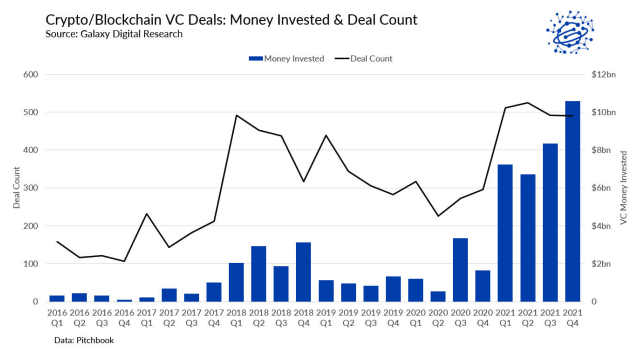

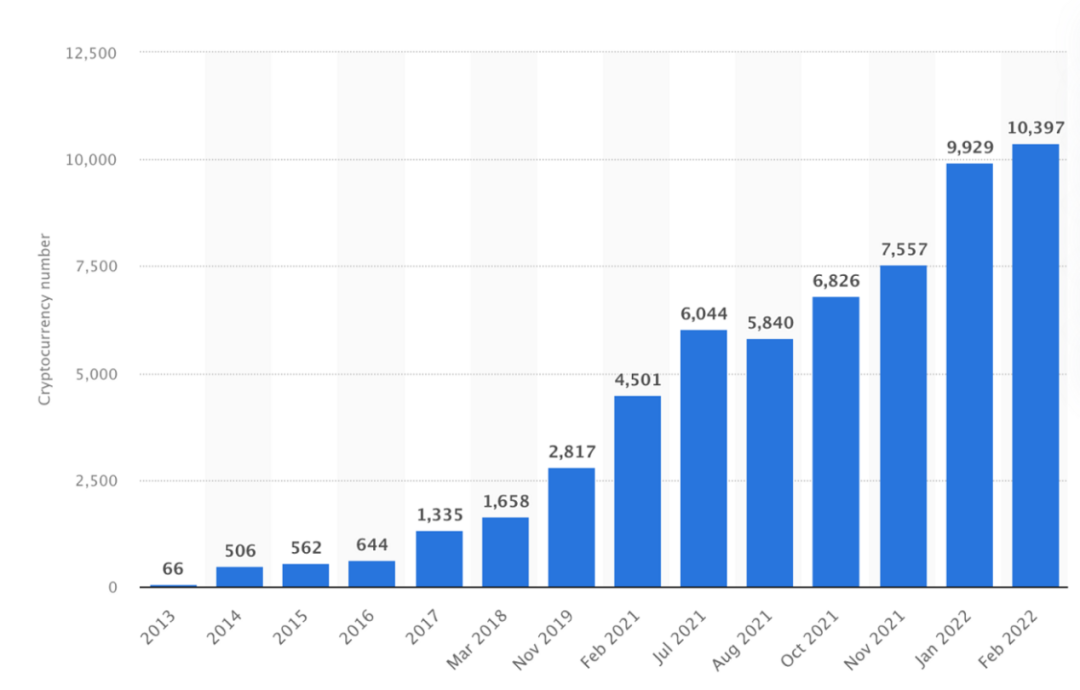

2021年是加密货币和区块链公司的创纪录一年。我们看到大量的交易和资金涌入该领域;2021 年第四季度,全球 VC 投资超过 105 亿美元,是去年所有季度中最多的,也超过了 2020 年全年的总和。首先,让我们看看与 Web3 相关的加密货币的发展。

我并不认为 2022 年会放缓,因为我们已经看到投资基金筹集了大量资金,准备部署到该领域。今年最重要的公告包括:Paradigm 的 25 亿美元基金、Andreessen Horowitz 的 22 亿美元基金、FTX 2B 美元投资基金和 Crypto.com 最近刚刚宣布了一个 500MM 的基金。

随着投资者为生态系统投入大量资金,期望值也将会变高,Web3 公司将不得不全力以赴实现增长。与十年前 Web2 领域发生的情况类似,我们应该期待看到大量公司涌入加密领域,并争相招聘增长角色(已经发生),并争先恐后地组建可以扩展成功增长模式的团队。

看到它的发展将是令人兴奋的,因为我相信Web3能够在各个层面上实现完全不同的增长方式——从收购渠道和策略、用户体验和入职体验,到留存和参与杠杆(更多信息请参见 以后的文章)。但当分散、匿名、协议所有权和用户拥有的数据成为新规范时,Web3也在为领域增加了一系列不同的挑战。

随着我们“说话”,新的 Web3 增长框架和剧本正在被创建。但是,我们可以将 Web2 中将哪些原则和系统带入这个蓬勃发展的新生态系统?

Web2发展的简述

在深入探讨增长对 Web3 重大意义之前,让我们对十年来围绕 Web2 公司增长框架的内容做一个高级概述。

安迪·约翰斯(Andy Johns)有一句很好的名言,有助于解释增长在最基本的层面上意味着什么:“如果财务拥有进出公司的现金流。那么增长拥有进出产品的客户流量”。

正如你之前可能听说过的那样,增长不能由一组特定的策略、灵丹妙药或公司内的确切角色来定义。这一点适用于 Web2 和 Web3 产品。

增长是一个介于公司使命、价值观和商业模式之间的系统,可帮助你定义以下方面:

1.我们的产品如何增长?

Brian Balfour 和 Reforge 团队在将这个问题进一步分解为基本部分方面做得非常出色。

分解为以下:

我们如何获取?

我们如何保留?

我们如何货币化(Monetize)?

我们如何防守?

通过你业务中特定增长循环的背景来查看这些问题,这将帮助你为你的公司建立一个整体增长模型。

2.四个基本契合

不仅仅是产品-市场契合,一个结构良好的增长模型需要找到四个基本契合:市场产品契合、产品渠道契合、渠道模型契合、模型市场契合。

3.增长策略

一旦你了解了我们的产品如何发展并适合你的社区/市场、渠道和业务模式,你就可以定义一个可持续和可扩展的上市或增长战略。

4.建立增长团队

随着越来越多的公司组建团队以推动上市和增长战略,在增长中取胜将要求你不仅拥有最佳方法,而且拥有最佳团队结构,以尽快部署该战略。

Casey Winters(Pinterest/Grubhub 的前增长主管)在他对增长的定义中将这些领域分开:增长的目的是扩大具有产品市场契合度的产品的使用范围。你可以通过构建一本关于如何扩展产品使用的剧本来做到这一点。剧本也可以称为增长模型或循环。

大多数产品团队的建立是为了创造或提高提供给客户的核心价值。增长正在将更多人与现有价值联系起来。

我们可能会持续数小时尝试缩小增长的确切含义以及如何将其应用于不同类型的产品、业务和团队,并且已经有优秀的内容供你深入研究这个主题。

所以,现在我们已经基本了解了作为一个系统的增长可以为你的产品解决什么问题,让我们专门为Web3公司进行细分。

Web3 公司的增长

你的 Web3 产品如何扩展?

你可以将此问题陈述分解为你需要回答的四个核心问题,这样你就可以奠定我们增长模型的基础部分:

我们如何获得?

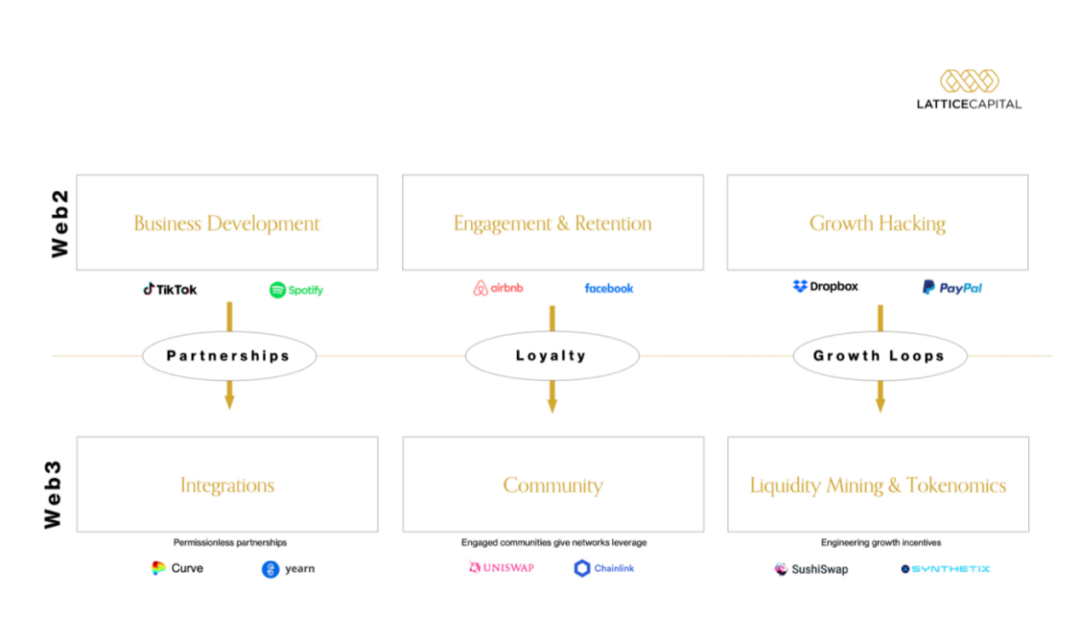

Lattice Capital 对目前Web3公司制定收购战略的行之有效的方法进行了详细分析———合作伙伴关系、用户所有权和代币驱动的增长池是 Web3 增长战略的支柱。

但是,上面概述的策略依赖于这样一种假设,即他们的目标用户已经熟悉或进入了Web3生态系统,而不一定关注如何或谁将帮助下一个10亿用户。

加密公司当前的收购策略仍然非常混乱,充满了未知因素,特别是考虑到新手在开始使用 Web3 时必须经历的固有分歧,从加入 Discord,到建立 Metamask,购买 NFT,寻找公开赏金等等。该系统仍然充满了分歧和障碍,使得“规范”轻松加入并参与该领域,我们看到公司之间的竞争正在迅速加剧,以追逐目前受过加密教育的消费者。

Web3 领域的赢家将是那些能够明确定义的人:

1.该产品在中心化与去中心化的范围内处于什么位置?

2. 这是否是网络效应驱动的业务?

3. 成功是什么样的?(用户增长、TLV、开发者活动、交易量、连接的钱包等)

我们如何留存?

留存是任何增长战略的基础。对于 Web2 公司来说,留存率是衡量产品与市场契合度的基础,而积极的留存率通常有助于为公司带来更多的收购和收入。

我在 Web2 和 Web3 增长之间看到的最大挑战之一是用户留存率以及我们如何看待它。为什么?Web2 中的用户或客户留存是由我们通过电子邮件、推送、应用程序内(基本上是生命周期营销)吸引和“复活”特定用户的能力驱动的。但在 Web3 中,没有“用户”作为可识别个体的概念,我们无法通过传统的生命周期策略来定位他们。

例如,你只能依靠钱包地址作为唯一的“用户”标识符,而不是电子邮件。问题是个人用户可以使用多个钱包访问你的 dApp,这可能会降低你的数据准确性。

定义 Web3 中“身份”的含义是未来几年该领域最具挑战性和最有趣的领域之一。事实证明,用户所有权和治理、链上活动、社区参与是影响 Web3 公司忠诚度/留存计划未来的一些基本机制。

我的猜测是,今年这些问题中的许多将开始得到回答。过去两年新兴的垂直行业,如 NFT、DeFi 和 DAO,将不得不在如何解决客户流失和用户留存问题上快速迭代和创新,以便在宏观经济条件可能与加密市场当前的乐观情绪相反的情况下,维持其当前的“向上”轨道。

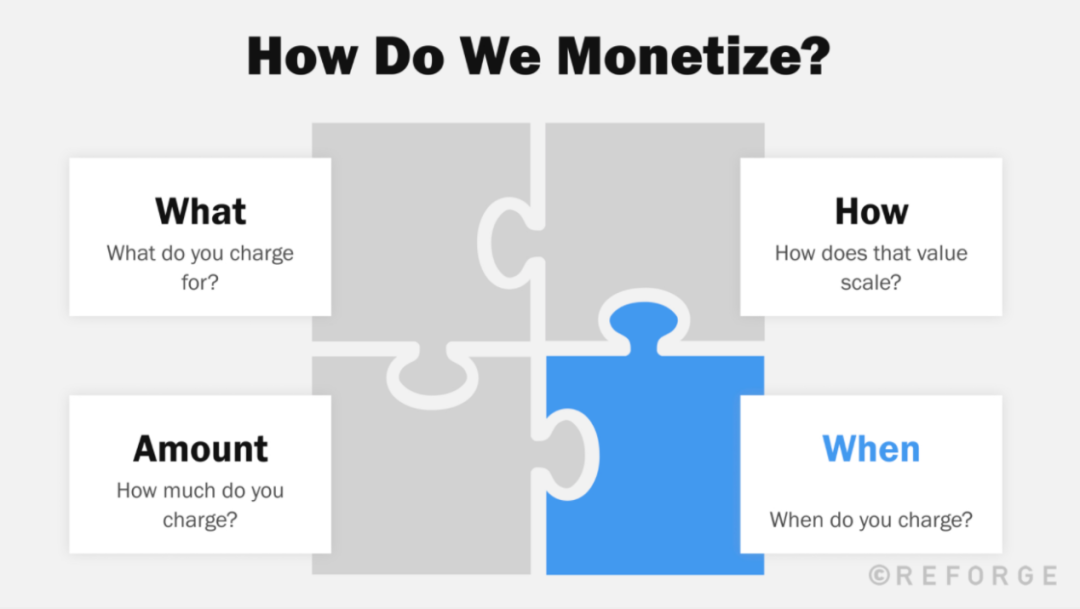

我们如何获利?

对于 Web2 和 Web3 公司来说,“货币化不仅仅是价格”,正如 Reforge 的实验 + 测试计划所述,他们有一个很好的框架来解决这个问题。

当我们思考货币化战略的所有要素时,我们需要意识到,我们围绕每一个具体要素所做的决定都会或多或少地给成为付费客户或产品用户的人带来分歧,这与Web2和Web3公司都有关。

“如果用户对我们收费的内容非常熟悉,也非常了解,那就是低分歧,但是如果我们收费的内容在市场上是全新的,而且不太了解,一个未知的,那会产生高分歧”。--Reforge

到目前为止,Opensea或Coinbase等大型集中式Web3公司已经使用了“众所周知且非常容易理解的”货币化策略,如交易费或上市/销售费,这减少了新用户加入和使用其平台的分歧。

但就新的收入来源而言,Web3 为去中心化组织提供了更广泛的可能性。例如,看看“free-to-X”DAO、游戏、Web3社交网络等如何通过DeFi策略将他们的资金转化为货币,打破“如果你不为产品付费,你就是产品”的普遍观念,这将是一件有趣的事情。

我们如何防守?

这张来自 Statista 的图表显示了过去几年新的 Web3 和加密公司出现的速度有多快,而且没有迹象表明这种趋势会很快放缓。

尽管 Web3 和 Crypto 仍然是非常新兴的行业,但其强竞争性已经得到证明。例如,LooksRare 在发布当天推动了 1 亿美元的 NFT 销售额,目前是 Opensea 的重要竞争对手。

“增长=速度,速度是当今市场的竞争优势”。--Matt Bivons

随着更多竞争进入该领域,当前的分销渠道将变得不那么有效。

我们看到用户所有权、网络参与、代币经济等方面发生了一些非常有趣的事情。但是 Web3 生态系统中的防御墙将与我们看到的一些最成功的 Web2 公司的增长具有非常相似的基础;网络效应、强大的社区和有机增长循环。

构建我们的增长模式

简而言之,你的增长模型是一个系统或循环,它代表了为你的产品增长提供信息的定性或定量杠杆。

回答我们在这篇文章中遇到的问题,将为贵公司明确定义和沟通战略、目标、指标、优先事项和团队,以为实现可持续和快速的规模奠定基础。

“当我问“你的产品是如何发展的?”时,这是创始人最常犯的错误之一。答案通常是一长串线性策略。这通常是因为问题中没有关于增长引擎是什么的假设,因此,他们尝试通过拼凑很多小东西来进行补偿。” — Brian Balfour

传统的 Web2 增长框架可以作为入门的实用指南,并提供一个成功产品如何增长的代理。产品使命和目的、激励机制和蓬勃发展的社区似乎是当前 Web3 增长模式的支柱,但随着越来越多的主流用户加入这个领域,还有很多东西需要发现、测试和学习。

“在 Web3 增长专家社区 Safary中,我们正在定义 web3 中的增长情况。”

在下一篇文章中,我们将使用一个框架分解这些当前模型,并定义可持续和可扩展增长战略的原则。