拆解头部NFT项目:探索10K项目的盈利模式

在 NFT 市场获利往往与很多因素相关。当你考虑是否要购买一个10K项目时,除了项目本身,交易行为,交易时机,以及交易金额都至关重要。通过NFTGo.io的指标以及以一些有名的 NFT 为例,我们将探究以下几个问题:

交易者

为什么要关注持有者分布?

交易曲线

市场炒作和热度曲线是怎样的?

交易时机

何时发现交易信号?持有期与利润之间呈现出何种关系?

交易成本

Top 10 的交易成本支出与地板价有几倍差异?

交易利润

纵观蓝筹项目,哪些平均利润最高?

交易者

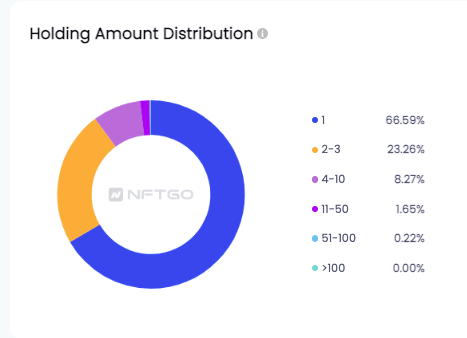

持有数量分布

项目的持有集中度是否过高是购买项目前需要考量的指标之一。如果大户或者项目方持有很多项目中的 NFT,集中卖出将会影响价格,进而对项目产生不利影响。你可以通过NFTGo.io查看任何项目的持有数量分布,尤其是需要观察项目中“51-100”持有者地址占比数量。

frankfrank持有数量分布;数据来源NFTGo.io

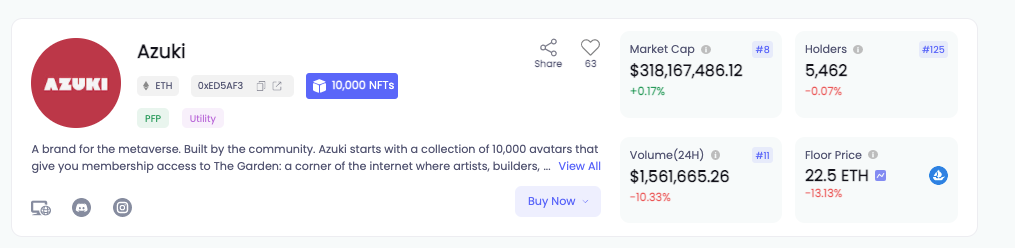

独立持有者数

Unique Holder 也是很重要的指标,你可以在 NFTGo.io 中查看每个项目的独立持有者数量。试想,当NFT项目发展很好的时候,没有人愿意出售他们的最后一个NFT,而且每个持有者都是潜在的活跃社区成员,能够更大范围地推广项目。

Azuki的Unique Holders数量为5462位;数据来源NFTGo.io

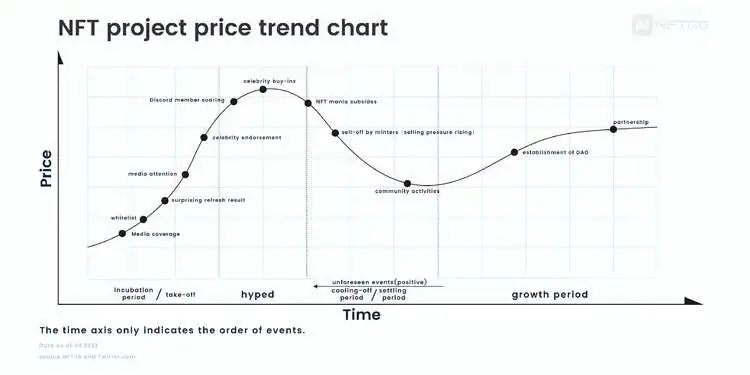

交易曲线

在正式讨论时机前,我们可以将大部分项目的价格发展阶段分为四个部分,分别是潜伏期/爆发期、狂热期、冷静期/沉淀期和发展期,每个阶段都有代表性的事件,我们在上图中只列举了一部分。

多数项目方通过制造话题,公售前白名单,Discord社群闭门式饥饿营销、日常社群活动举办、热度项目官推合作Raffle等一系列方式让项目几乎跳过第一阶段达到接近顶峰,一些项目则会拟合这条曲线的某部分阶段。第一阶段的增长速度取决于很多因素,包括:

当前市场总交易量环境、Discord社群成员在频道和语音中的互动热度、官方Twitter非合作伙伴内容的互动热度、项目方原住民Crypto Native指数,这其中又分为画师过往功绩、社群MODS过往经历、AMA频率与发言者质量、路线图创新与新颖性、想象力上限空间,开图效果、名人带货等等,但是在炒作达到顶峰之后,Flipper、Paperhand 会进行抛售,短期持有者也会选择出售,这是正常现象。等到炒作阶段褪去之后,便是项目方和社区共识展现的时候。如何让价值曲线重新正向增长,考验着项目方的能力和未来的路线图规划落实情况。

交易时机

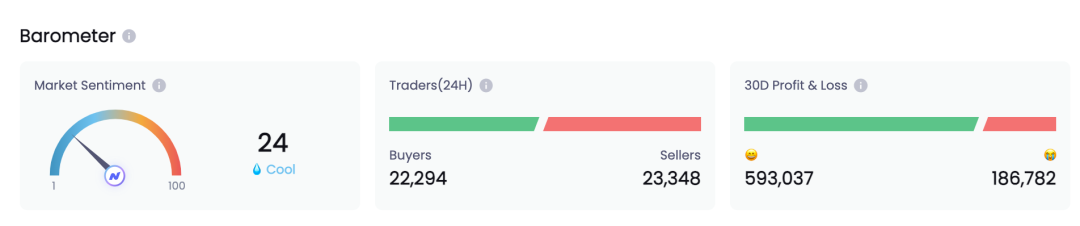

市场热度=买入卖出信号?

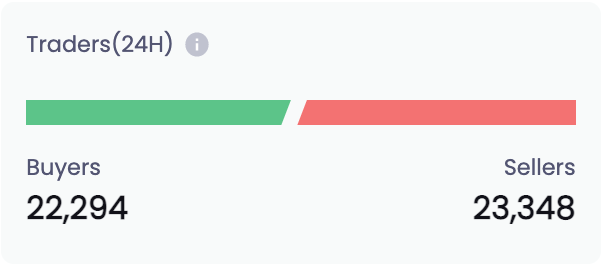

市场热度部分反映了当前市场对 NFT 的情绪,你可以看到过去 24 小时内的买卖双方的数量,以及盈利和亏损的地址数量。NFT 市场热度根据波动性、交易量、社交媒体和谷歌趋势计算得出,分数越高,表明市场热度越高。

数据来源NFTGo.io

除了市场热度,买卖双方的当前比率也能指导交易时机,在外汇和股市里,我们经常见到投机情绪指数 (SSI) ,这一直是实时交易最重要的指标之一。

普遍来说,大约 95-99% 的交易者在市场上会亏本。或许,与大多数交易者反向交易将会获益。绿色代表买家的百分比,而红色条代表卖家的百分比。如果大多数交易者做多,市场热度空前高涨,或许可以暂时观望一下。如果大多数人预计资产价格会下跌,市场热度下降,这时候或许可以考虑买入。当比例向某一方极度偏斜时,双方账户比例趋近于最大值,这也意味着行情或将转折。

数据来源NFTGo.io

最佳离场时机

持有时期分布

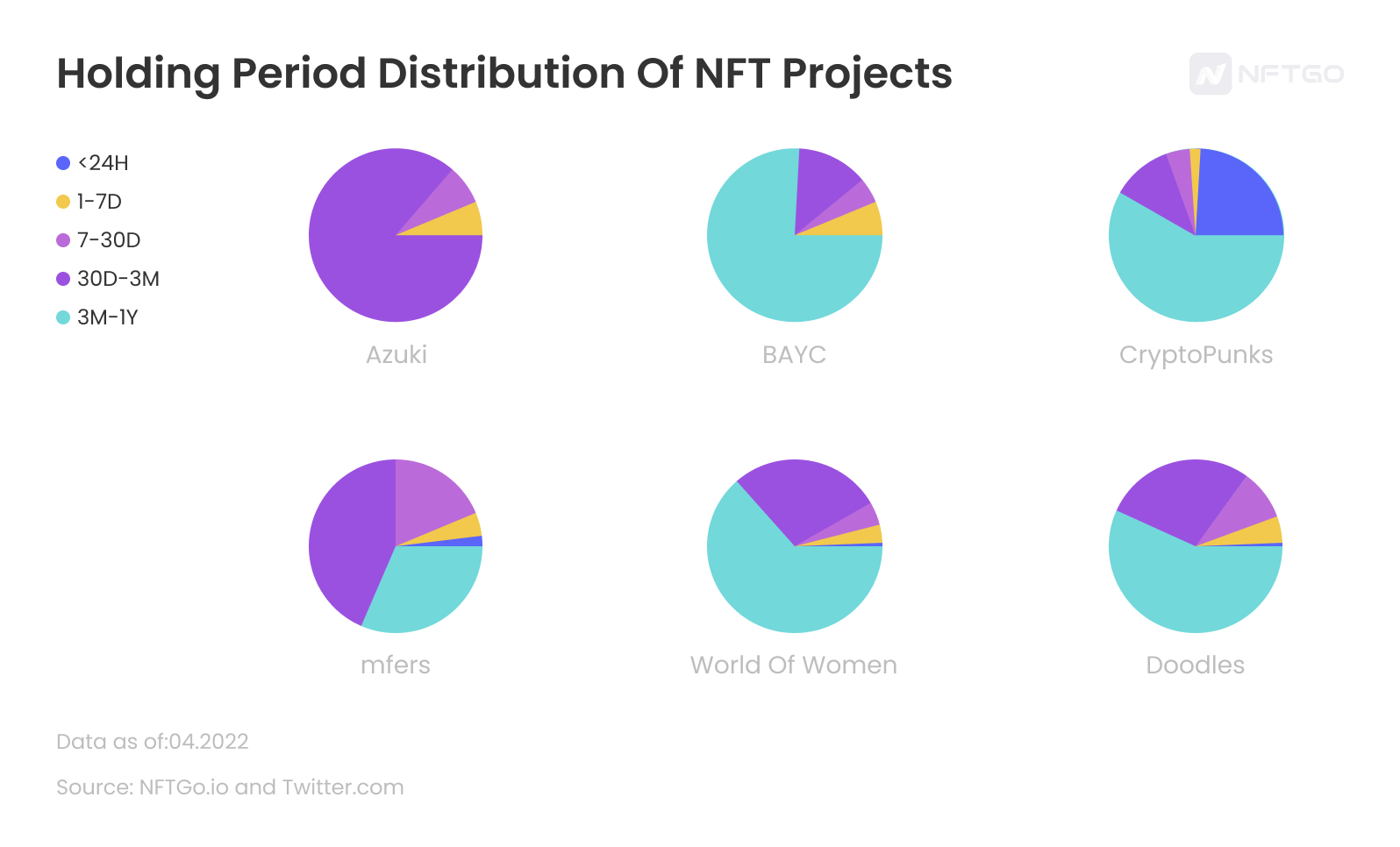

应该持有多长时间?其实,这个问题是无解的。在买入项目前你需要思考项目本身的价值,团队,画风等各种因素。但我们可以通过查看各种类型的顶级项目纵览持有期对ROI有何影响,下图展示了在六个项目中NFT持有者的持有期分布情况。

NFT项目的持有期分布统计图;数据来源:NFTGo.io

数据表明,除mfers项目外,其他生命周期超过五个月的项目都拥有很大比例的长期持有者(即持有时间在三个月至一年间)。通常情况下,在铸造NFT后,由于市场上的FOMO情绪加上项目发展,优质项目的二级市场的地板价格会比最初的铸造价格高出很多,这可能会促使大批早期购买者出售铸造的NFT,落袋为安后再购买其他的 NFT。三个月的时间,NFT 市场其实经历了很大的波动,从1月底的高峰到慢慢缓和,但好的项目中钻石手会占据一定的比例。

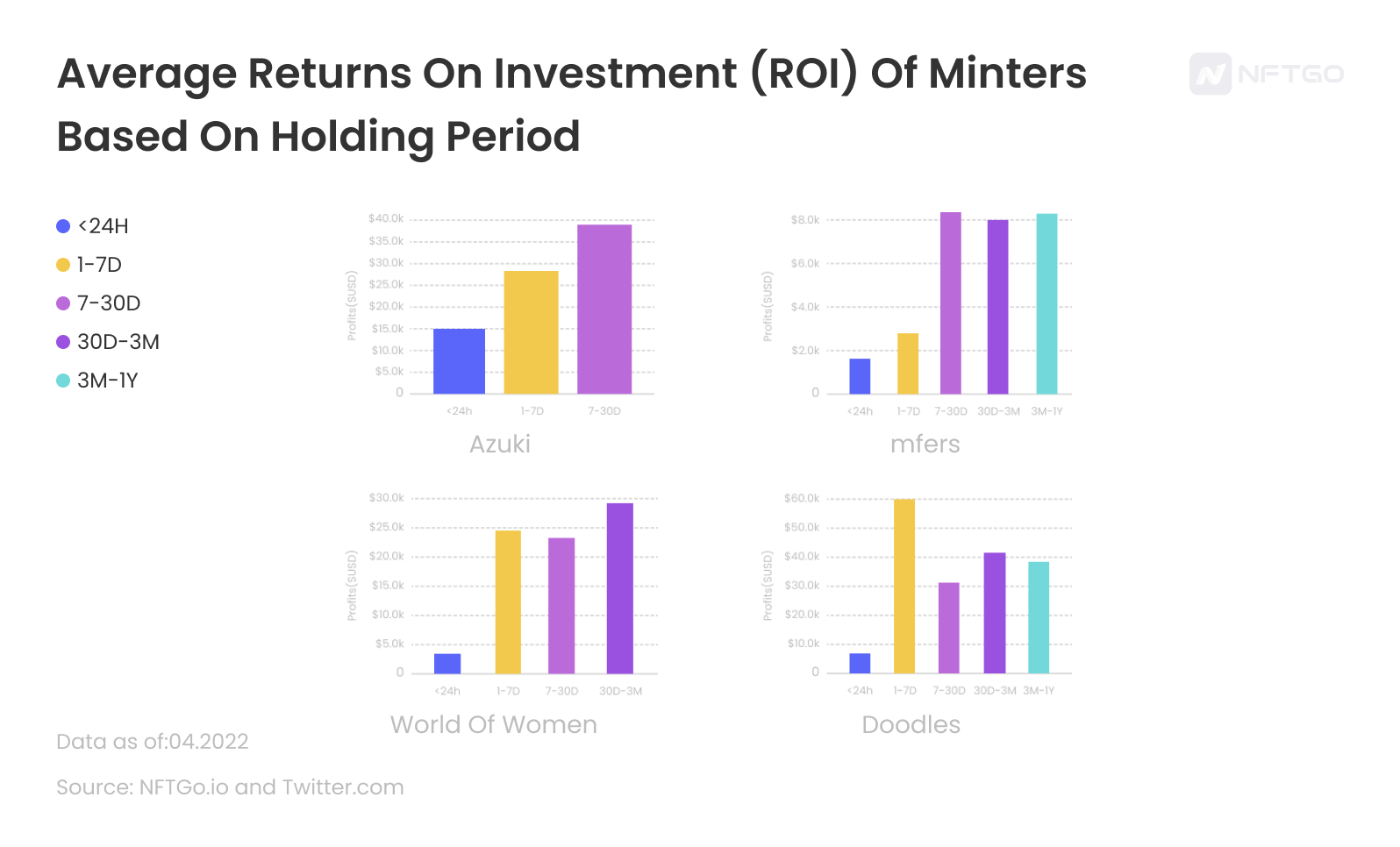

基于持有期的 ROI 分布

我们依据出售者的持有期对各项交易进行了分组,并统计了各组的平均利润。下图阐释了持有期对Minter收益的影响。

基于持有期的平均投资回报(ROI)汇总图;数据来源:NFTGo.io

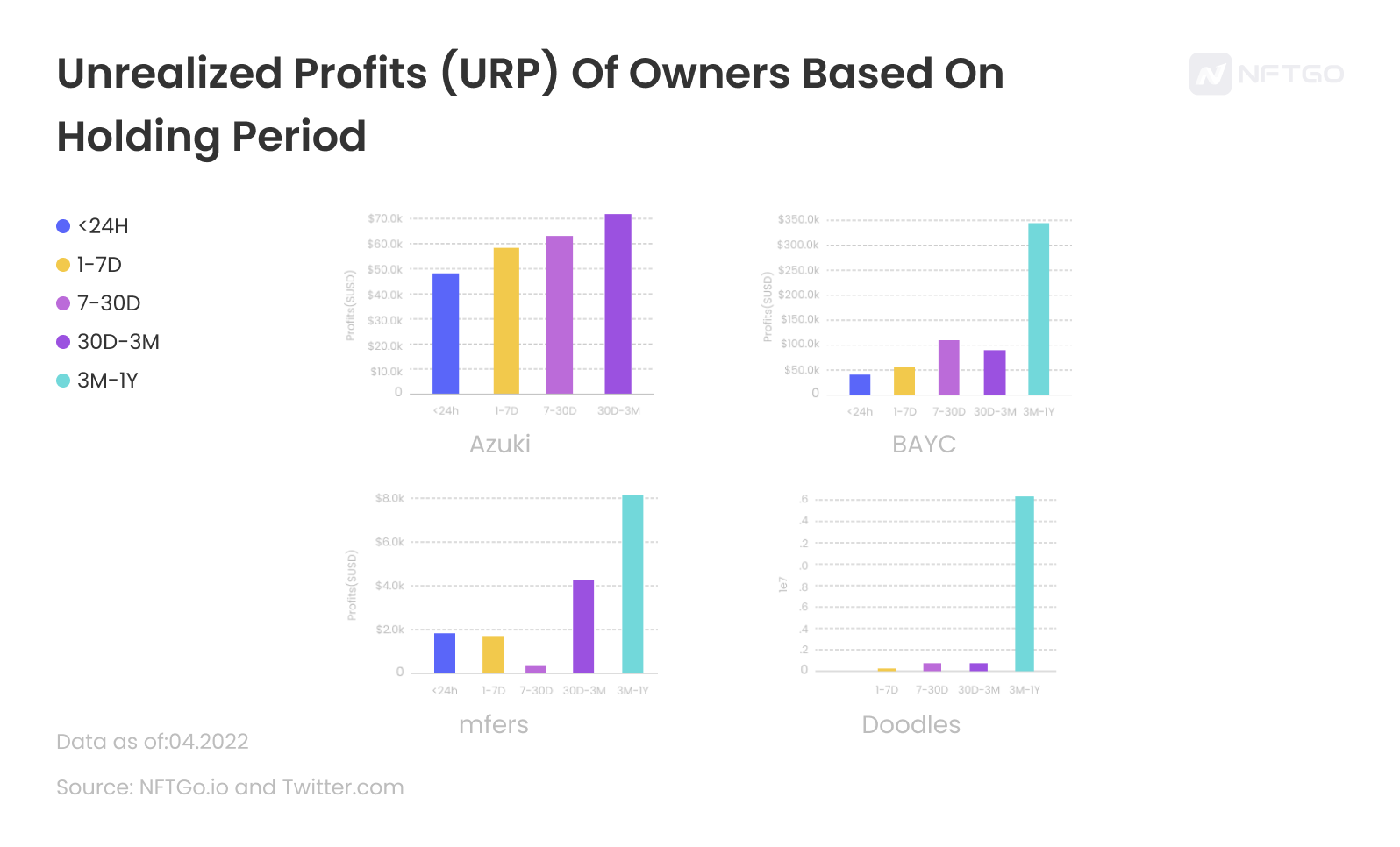

基于持有期的 URP 分布

我们采用未实现利润(Unrealized Profits, URP)指标比较minter出售NFT所获得的利润和持有者在一段时间内持有NFT所获得的利润。(*未实现利润 = 最大值(平均价格,地板价格) - 买入价格)

和前文类似,我们同样依据持有期对NFT持有者进行分类。下图展示了各类别未实现利润的统计数据。

基于持有期的Holder平均未实现利润(URP)统计图;数据来源:NFTGo.io

由图表可知,对于优质项目来说,持有时间越长,所收获的利润也将会更多。如果你不是一个HODLer,可以选择在炒作顶峰、市场热度达到顶点时期离场,但如果你坚信项目能持续的制造热度,HODL。

交易成本

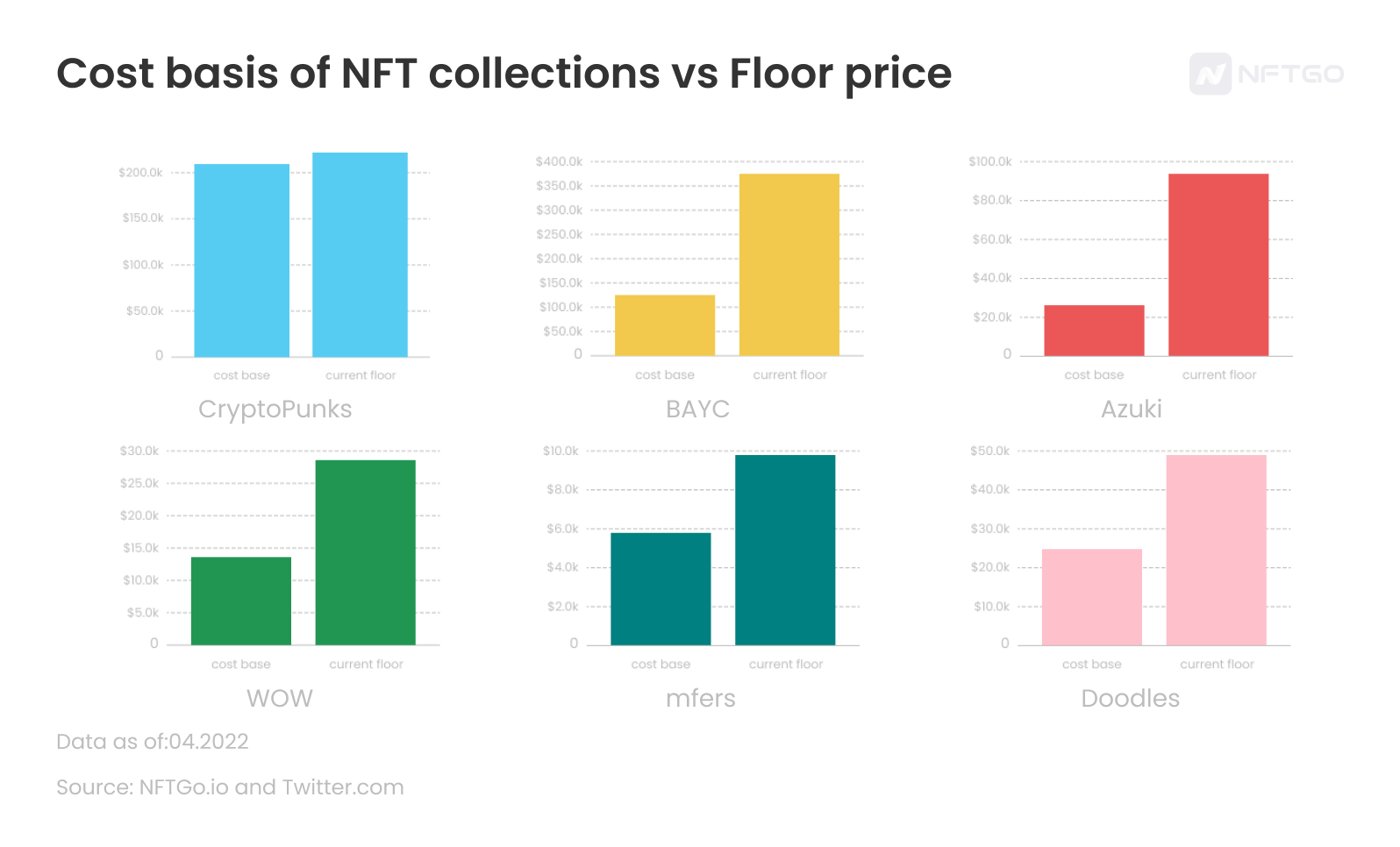

我们看到,交易时机是最重要指标之一。从持有价值和持有期限与利润的相关性来看,我们观察到多个蓝筹或潜在蓝筹 NFT Collection的重复性趋势。购买成本是另一个我们需要考量的因素。由于一些人倾向于买自己喜欢的或是稀有度较高的 NFT,多数 Top 10 NFT 的平均价格会超过地板价3-8倍。通过比较平均买入价格和地板价,我们可以得知每个Collection内的持有者筹码分布情况。对于一些Collection来说,项目中已很少有低价的买入持有者,内部已经历了一轮洗盘。但对于另外一些Collection来说,多数人的持有成本依旧很低,那么,对于下跌时的心理价位或许也会更低。

地板价 VS 平均买入价;数据来源:NFTGo.io

交易利润

一级与二级市场收益

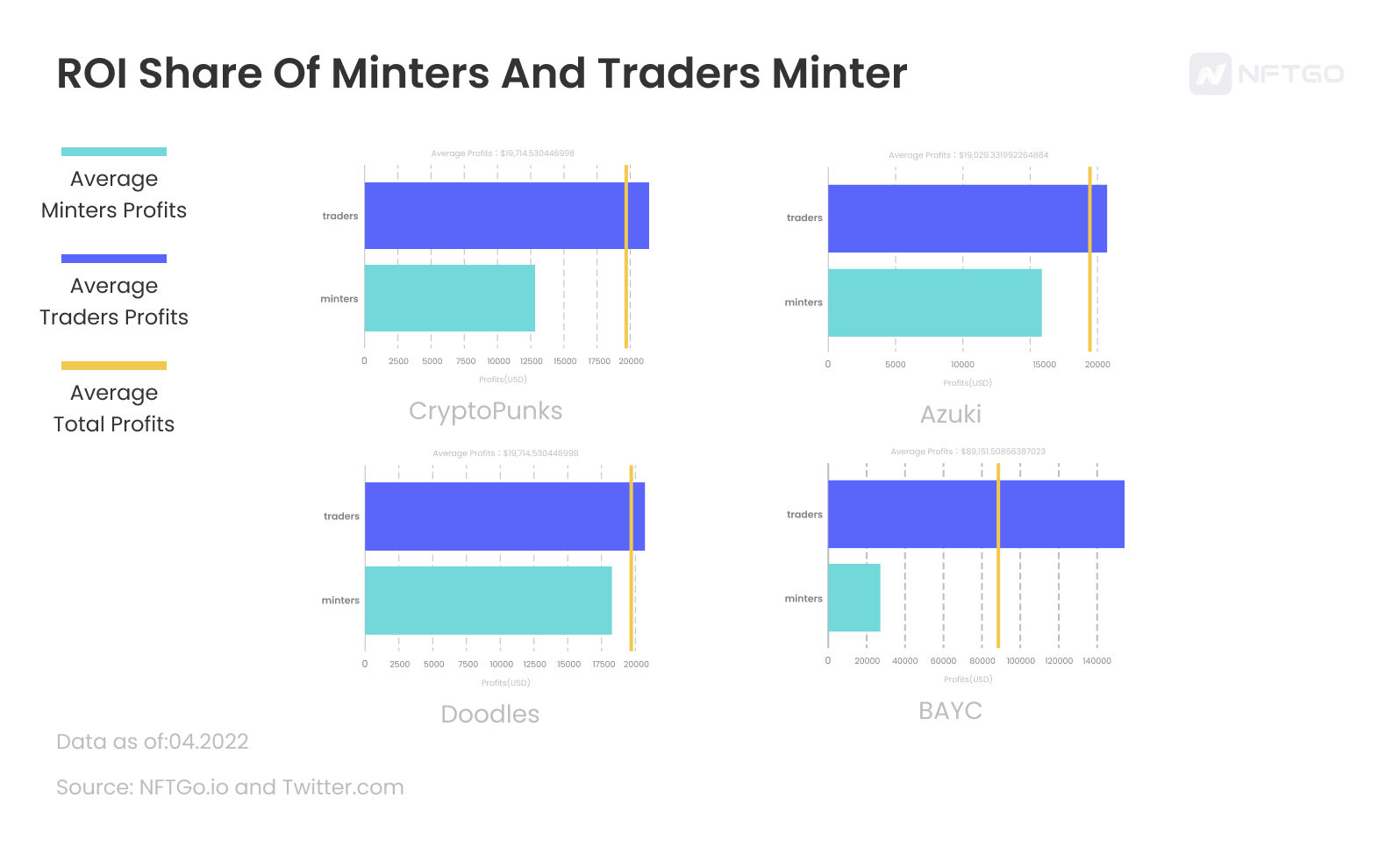

得益于较低的成本,成为“早期购买者”或是“Flipper”往往被视作投资获益的主要途径,这一观念广泛存在于包括NFT在内的所有投资领域。然而,早期购买者恰恰也冒着最大的风险将资金押注于全新的NFT项目之上。我们对比了NFT一级市场与二级市场交易的盈利能力,同时计算了蓝筹项目Minter和Trader获得的利润。

蓝筹项目中Minter与Trader的投资回报份额统计图;数据来源:NFTGo.io

随着项目越来越成熟,二级市场交易者也会获得越来越多的利润。因此,错过mint其实也无可厚非,更重要的是把握蓝筹项目的节奏。尽管交易者并未以最低价格购入NFT,但他们依旧可以享有较多的盈利空间。而且,随着项目越来越成熟,Trader的市场份额将会越来越大。

ROI 排行

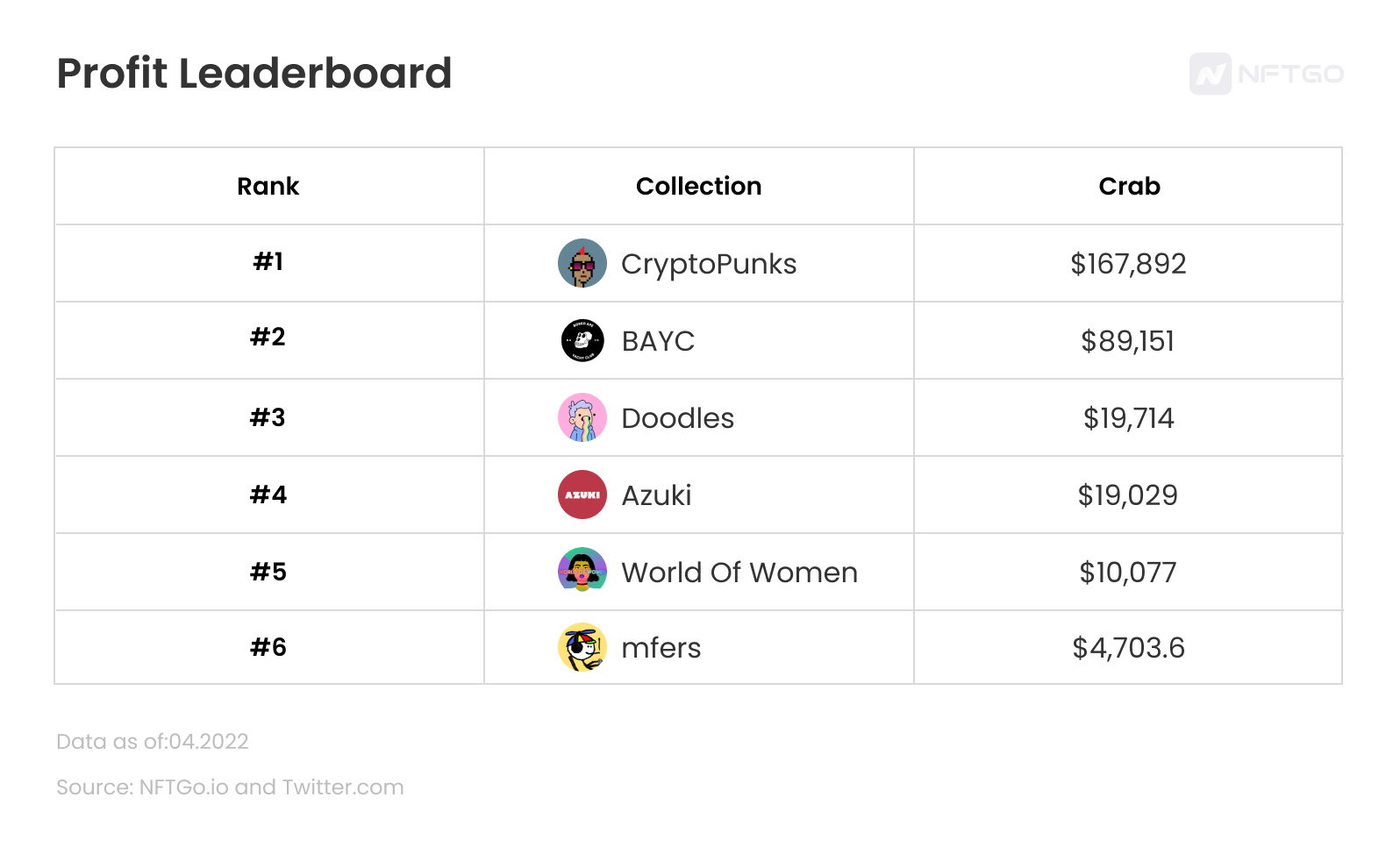

利用过去的销售数据和每个系列的当前价格表现,我们研究了每个系列的平均盈利能力。根据前面讨论的指标,已实现和未实现的利润都已考虑在内。下表是所列举的六个项目利润最高到最低的 Collection的排行榜。

基于平均 ROI 的六个 NFT Collection 的利润排行榜

结果表明,CryptoPunks 的平均盈利能力很高。Azuki 和 Doodles 的平均投资回报率非常接近,而 mfers 的平均投资回报率是第五名 World Of Women 的一半。

结语

很多人都会觉得,NFT 市场的最大利润似乎已经被蓝筹股的早期购买者收割了,想当初,大家用不到 100 美元就能购到一个Punk。尽早铸造发展前景良好的NFT项目有助于投资,但同时也要承担风险成本,只有经受住一定的风险,才能获得高于平均水平的投资回报。但无论采取哪种策略,交易时机都很重要。除了上述的几点外,交易特性,比如稀有度的选择也需纳入其中,如果希望保持较高的流动性,可以更多选择持有地板价附近的NFT,其对增长的响应速度会更快。

目前,NFT市场仍是由投机和预期驱动的,你可以选择紧跟meme潮流,抑或是选择喜欢的画风。NFT市场正在不断发展,但真正带来具有内生价值的数字产品,可能还需要经历时间的考验。根据NFTGo的数据,投资NFT不只有一种方式,一个时机,根据你的风险偏好,还有多种路径可供选择。