At the end of March, DDDX, the DEX2.0 protocol on BNB Chain, announced the second round of project partners. 12 well-known projects on BNB Chain, including Beefy, Autofarm and dForce, successively announced their participation in the veNFT governance of the DDDX protocol.

DDDX.io project partners will participate in its governance plan and launch plan by obtaining veNFT and voting governance rights. According to its start-up plan, the DDDX emission plan will start at 8 am on April 7, starting the first week of the DDDX mining cycle.

first level title

1. What is DEX 2.0?

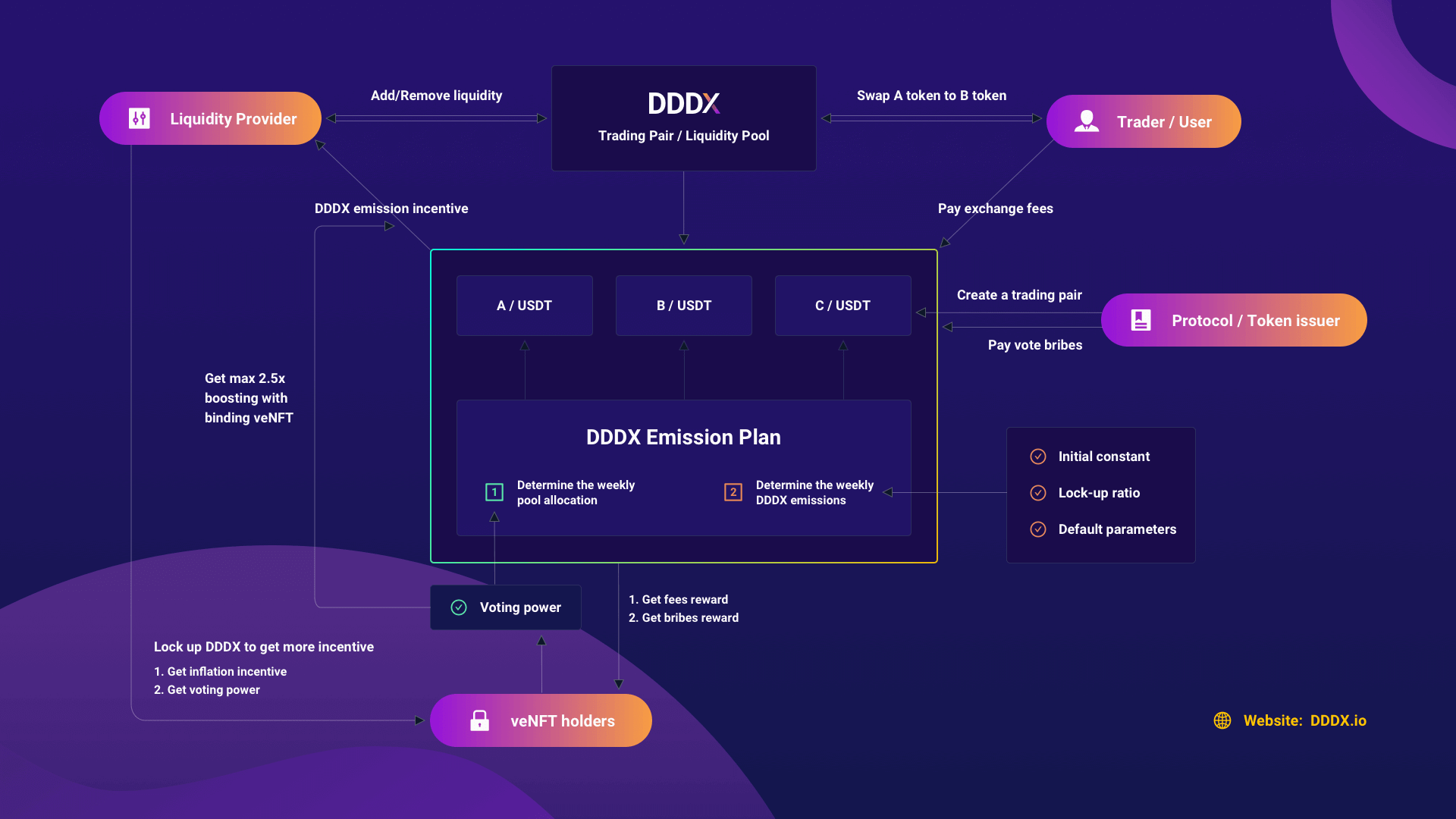

The concept of DEX2.0 is close to the concept of DeFi 2.0. It advocates that the agreement itself controls the income of the agreement fee, and then returns all the income of the agreement to the users who hold Token. The protocol operation process is shown in the figure below.

Let’s compare the DEX 2.0 mechanism of DDDX with DEX 1.0 representative and DEX 2.0’s DDDX token economic model:

1. Token-subsidized DEX 1.0 economic model——taking SUSHI as an example

Liquidity providers share the transaction fee of this trading pair through LP tokens, and pledge LP to obtain SUSHI token subsidies. The main role of SUSHI tokens in this economic model is to subsidize the rate of return of trading pairs. Under the subsidized token economic model, SUSHI tokens continue to be in a state of inflation, and as the circulation increases, the value of the tokens continues to be diluted.

2. Token Governance DEX 2.0 Economic Model—Taking DDDX as an Example

DDDX's DEX 2.0 economic model refers to Curve's veToken governance mechanism and OlympusDAO's (3,3) mechanism.

1. All the transaction fees of the transaction pair will be returned to the governance users who voted for the transaction pair with veNFT.

2. For users who lock DDDX and obtain veNFT to participate in protocol governance, the proportion of DDDX tokens held by them will not be diluted after each inflation. This solves the problem that the proportion of veCRV holders is continuously diluted by the newly produced CRV tokens, so that the long-term rights and interests of users participating in governance can be better protected. Relying on the (3,3) directional inflation and non-diluted algorithm, the DDDX token becomes a share token of the DDDX protocol's revenue or a similar interest-bearing token.

3. The inflation algorithm is upgraded, and the number of DDDX inflation tokens every 7 days changes according to the lock-up rate. Compared with the infinite continuous inflation algorithm of the dex1.0 protocol, this algorithm will lock the consensus and bind the token inflation rate, and the algorithm is more scientific. In addition to a fixed 2% weekly production reduction, if the lock-up rate increases, the number of token inflation will decrease and the value will continue to increase.

first level title

2. Vote to earn gameplay introduction

To understand how Vote to earn works, you need to understand the various participant roles of the protocol and how they participate and profit.

1. Analysis of the best profit strategy as a liquidity provider

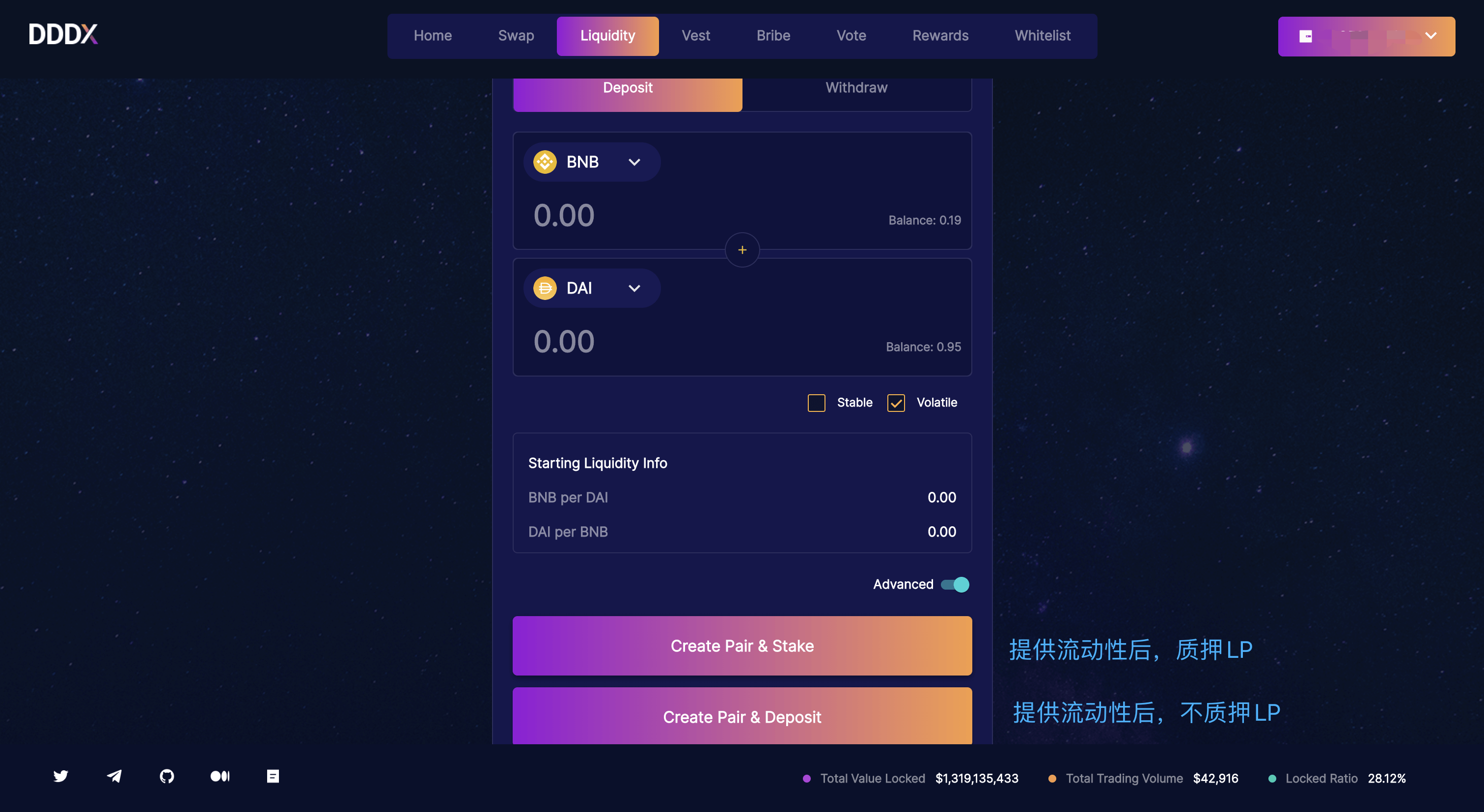

After depositing liquidity, unstaked LP token——Role A

After depositing liquidity, pledge the LP token into the Gauge contract—role B

Voting Power is the counting unit. veNFT holders can choose to vote for and against. The support votes of all voters are accumulated and all negative votes are subtracted, which is the valid votes for the trading pair.

All trading pairs will allocate the next week's DDDX output according to their valid votes (Voting Power).

Glossary

According to the holding ratio of its LP token, it will share the corresponding proportion of transaction fees generated by the transaction pair, but it will not be rewarded by DDDX for LP providers.

Role B can obtain token incentives for sharing DDDX to the LP provider for this transaction. When character B obtains the DDDX token, he can lock it into veNFT and vote for the trading pair that provides LP, and he will get the transaction fee reward of this trading pair.

In addition, after owning veNFT, you can bind veNFT to accelerate the mining rate of DDDX when providing LP token pledge.

for example:

for example:

Assume that a total of 10 LP tokens have been minted for the current BTC/USDT transaction pair, of which 60% are being pledged, and 40% are held by the address of role A and have not been pledged. If the transaction pair generates a transaction fee of 1,000 USD within a specific period of time.

Then role A participates in the distribution of 400 USD handling fee, role B distributes all DDDX output rewards, and veNFT holders, namely voters, distribute 600 USD handling fee.

The best profit strategy for liquidity providers is to deposit liquidity, pledge LP, lock the position as veNFT after obtaining dddx, and then vote for trading pairs that provide liquidity to obtain transaction fees and bribery income.

2. How to Vote To EARN?

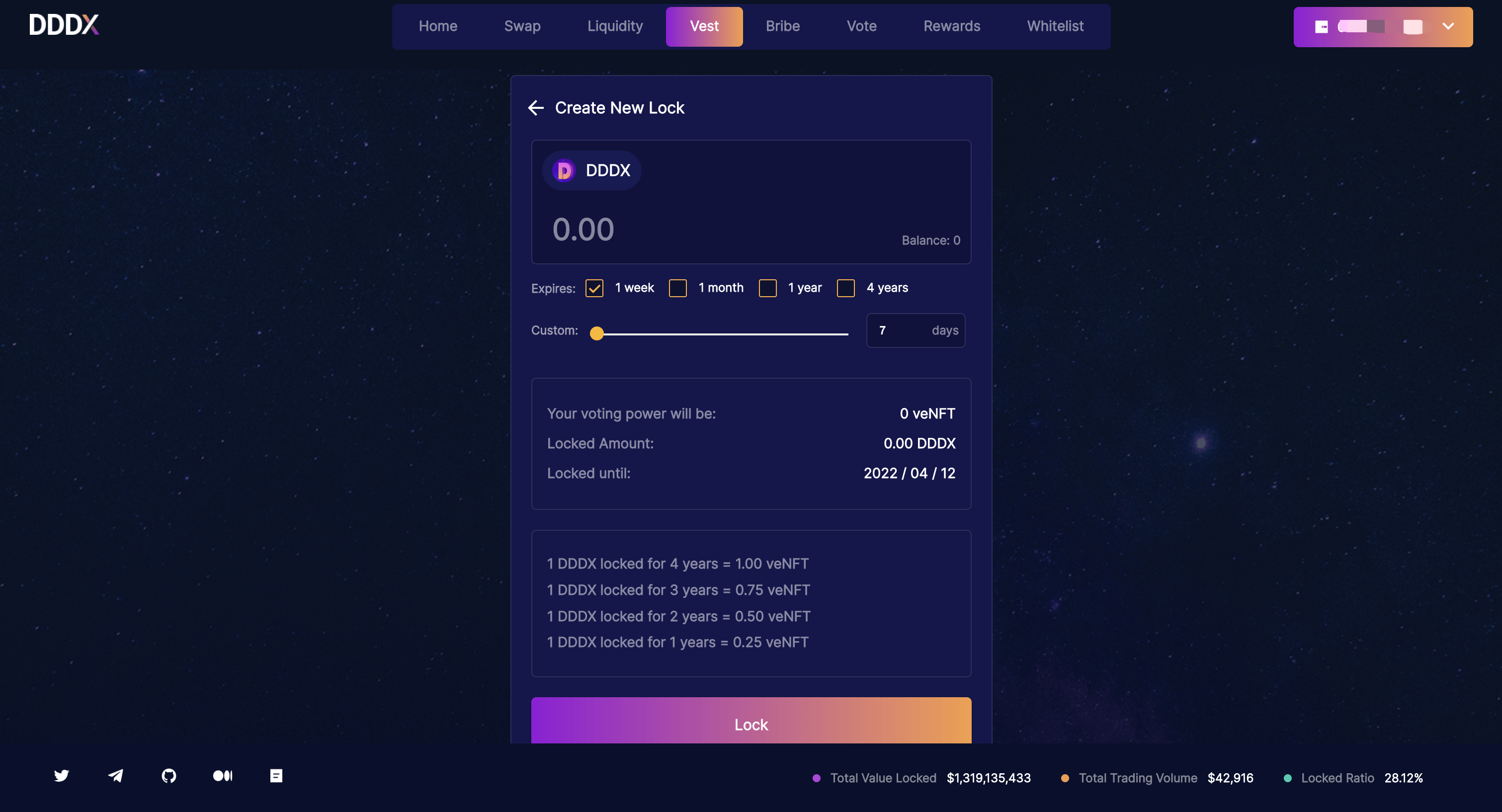

1. After locking DDDX to obtain veNFT, participate in Vote to make profits

After locking DDDX into veNFT, users will receive DDDX lockup inflation rewards every 7 days. According to the protocol algorithm, it will ensure that the ratio of locked tokens of DDDX locked users to the circulating supply remains unchanged and will never be diluted, so as to protect the long-term rights and interests of locked users.

Using veNFT to participate in voting for a trading pair will increase the DDDX inflation reward for this trading pair. Voting users can share the transaction fee and Bribe rewards of this transaction pair.

Participate in DDDX lock-up method:

Currently, the lock-up period is supported between 1 week and 4 years. In the case of the same amount of DDDX tokens, the longer the lock-up time, the more voting rights (Voting Power) veNFT holders will get.

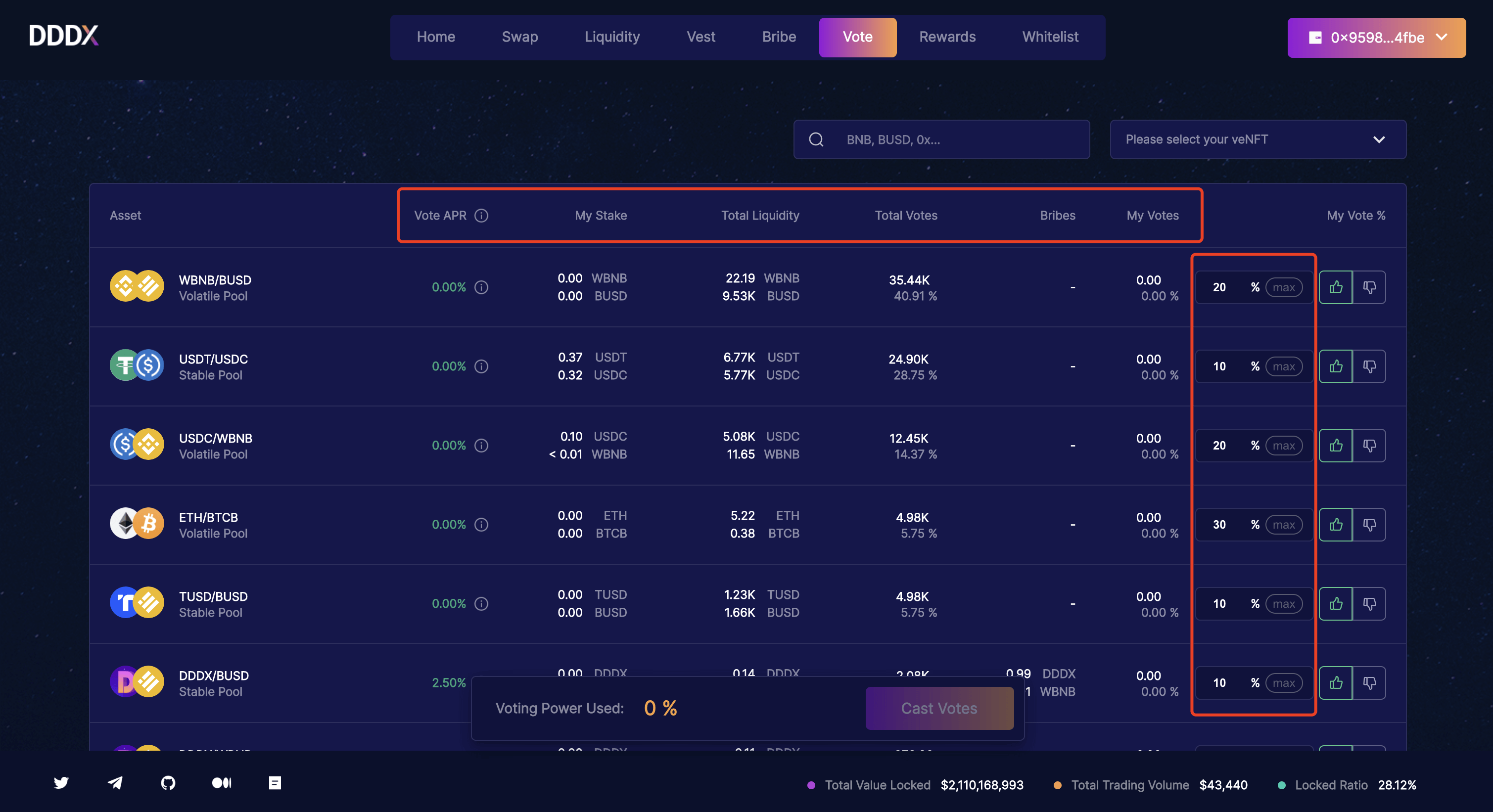

2. How do veNFT holders participate in voting?

Glossary

Vote APR: Pledge DDDX now and lock up the rate of return for voting on this trading pair for 4 years.

My Stake: After providing liquidity for this trading pair, the amount of assets represented by the LP token in my pledge.

Total Liquidity: The amount of the two token assets in the transaction pair

Total Votes: The amount of Voting Power currently obtained by the trading pair.

Bribes: Participate in the trading pair voting, the number of tokens that can participate in the distribution of various bribery rewards.

My Votes: The number of Voting Power I voted for this trading pair.

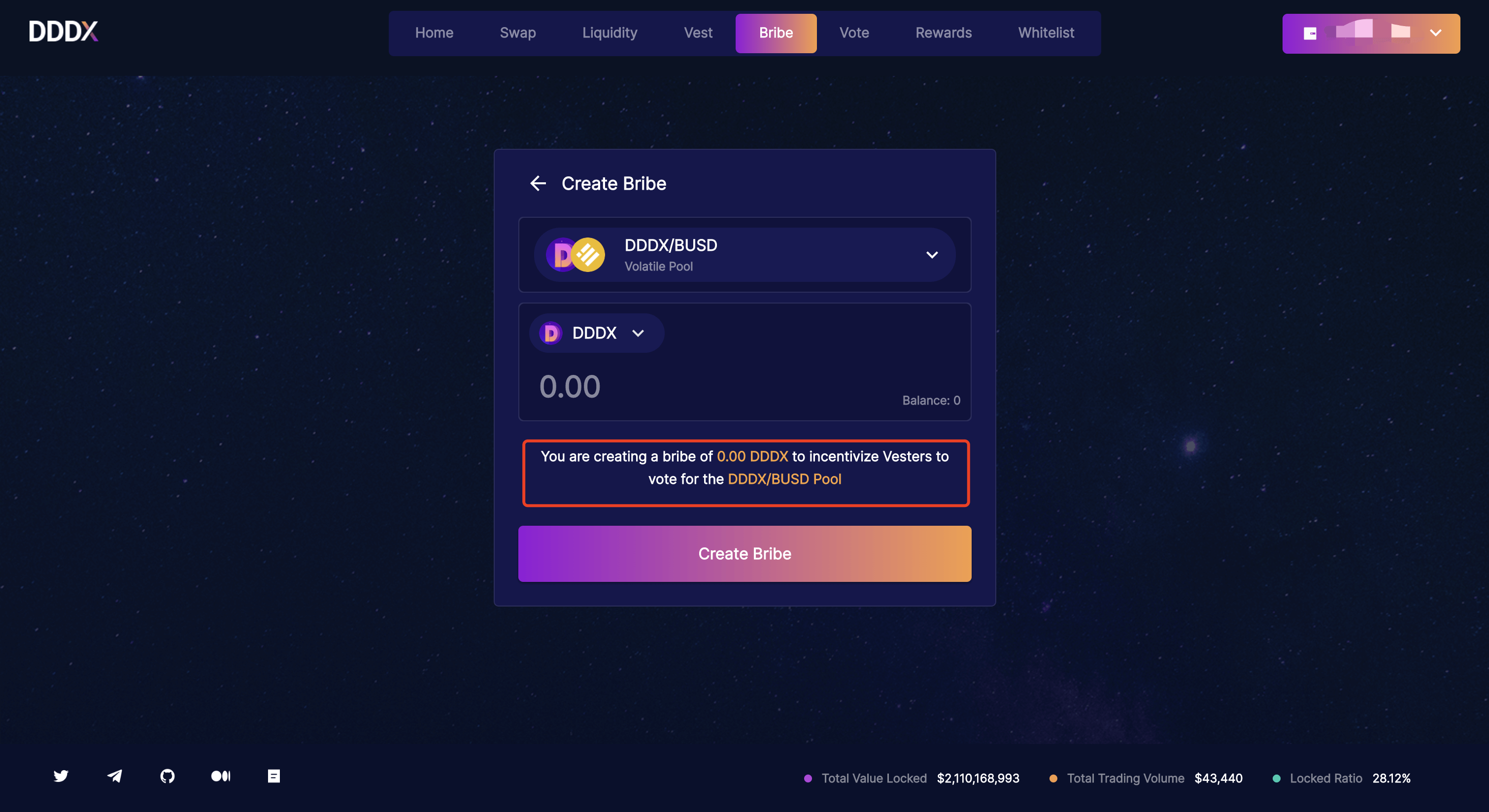

3. Bribe function introduction - a bribery and canvassing tool for token issuers

DDDX.io is a bribery tool provided by project parties/token issuers. The project party initiates canvassing by creating a bribery plan, hoping to obtain more veNFT votes for its token trading pairs, and then obtain more DDDX distribution shares and outputs.

DDDX.io is a bribery tool provided by project parties/token issuers. The project party initiates canvassing by creating a bribery plan, hoping to obtain more veNFT votes for its token trading pairs, and then obtain more DDDX distribution shares and outputs.

Summarize

Summarize

As a DEX2.0 product, DDDX.io is not only a safe and low-cost decentralized trading platform for trading users, but also a liquidity control and management platform for protocol project parties or token issuers.

The value support of DDDX tokens includes not only the transaction fee income of the AMM protocol, but also the entire budget prepared by the token issuer for liquidity mining in the DEX 1.0 era.

Among all the announced governance partners of DDDX.io, the DoubleClub platform is a revenue optimizer protocol customized for DDDX.io, which is similar to the way Convex is compared to Curve. We are looking forward to the launch of DoubleClub and will continue to share in future articles.