From TORN to MKR to COMP, the DeFi faucet finally rolled up to the economic model

In the past two days, two events have quietly happened in the DeFi field, which may have a major impact on the future development of the two leading projects, Maker and Compound.

On March 14th and 15th, Maker and Compound successively submitted governance proposals in their respective forums, aiming to completely revolutionize the token economic models of these two projects.

Maker: From MKR to stkMKR

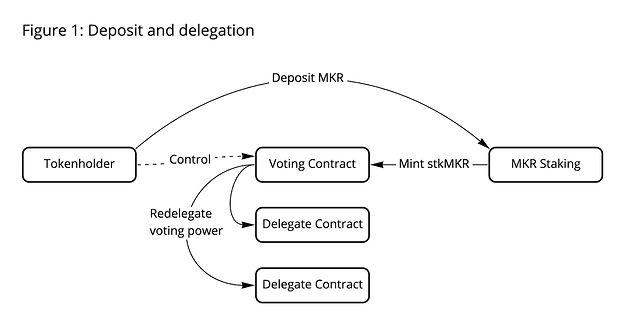

Let’s talk about Maker first. This proposal was proposed by monetsupply.eth, a member of the risk control team. It borrowed some design logic from Cosmos, stkAAVE, and xSUSHI. The core content is toReplace MKR with stkMKR as Maker's direct governance token. Specifically:

First, users can pledge MKR in the governance agreement to obtain stkMKR. stkMKR is non-transferable and represents the user's voting rights and the right to redeem pledged MKR shares.

Second, abandon the previous MKR repurchase and destruction mechanism, the MKR from the repurchase will no longer be destroyed, but will flow linearly into a revenue pool as the income of pledged MKR, which means that the number of MKR corresponding to each unit of stkMKR will be Gradually growing, logically similar to xSUSHI's automatic compound interest mechanism.

Third, similar to Cosmos and stkAAVE, users will need to wait for a fixed-time lockup period when unstaking MKR. During this period, stkMKR will be destroyed, and the corresponding MKR will be transferred to the escrow contract, which means that users will not enjoy any income and voting rights during this period. Users can redeem their own MKR only after the lock-up period is over. Of course, users can also change their minds during the lock-up period and immediately re-stake their MKR in exchange for stkMKR.

monetsupply.eth explains,Changes in the details of these economic models are expected to achieve the following effects:

One, it can incentivize participation in governance. Although this mechanism will not directly incentivize users to vote, the potential benefits of staking MKR are expected to increase the overall participation rate of the community.

Second, improve the value-added narrative of MKR. Compared to the buyback and burn model, more specific APR numbers and circulating supply reductions can help improve overall market sentiment. monetsupply.eth also roughly calculated the income figures. When 50% of MKR is pledged, the yield of stkMKR is about 3.25%, and when 20% of MKR is pledged, the yield of stkMKR is about 5.5%.

Third, improve governance security. Staking income objectively reduces the attractiveness of lending MKR, and the existence of the lock-up period can effectively prevent governance attacks and make them more costly to execute. At the same time, it can also inhibit CEX and other centralized service providers that may damage MakerDAO's decentralization effect Get involved.

Fourth, improve the resistance to the lack of agreement credit. During a market crash or restructuring, the existence of a lock-up period can keep some MKR out of the market, which prevents some MKR holders from front-running debt auctions.

Compound: Goodbye, Liquidity Mining

The Compound improvement proposal was proposed by community contributor tylerether.eth, the core content of which isGradually stop the current liquidity token incentives and switch to an interest rate incentive model。

Friends who are familiar with the history of DeFi development may remember that in the summer of 2020, Compound innovatively launched a liquidity mining plan. The unexpected effect triggered countless projects to follow suit, and since then this round of DeFi storm has been set off .

However, in the view of tylerether.eth, the liquidity incentives that Compound relies on currently attract more "speculative" liquidity, and these liquidity funds often choose to sell immediately after receiving the corresponding COMP incentives. This runs counter to the original intention of Compound - "distribute COMP to real users", and it also dilutes the COMP benefits that real users deserve, and damages the interests of the community.

However, for the lending market, the lack of incentives is also not advisable, because it may cause the market to lack sufficient liquidity, thereby inhibiting the operation of the entire market, especially after the launch of a new market (that is, a new currency) hour.

To this end, tylerether.eth developed its own improvement plan. details as follows:

First, shut down the current COMP incentive in two steps, first cut the on-chain incentive to 50% on March 18, and then completely cut the incentive to zero on April 15.

Secondly, further improve the interest rate model, because although the existing jump rate model and parameters can be well applied to the stable currency market, they are not necessarily applicable to the non-stable currency market. Under the current suboptimal interest rate model, it is difficult to balance the interests of both borrowers and lenders, thus limiting the scale of market liquidity.

Third, introduce an alternative incentive plan. After the upgrade of the interest rate model is completed, Compound needs to use a new incentive plan to start the lending market for new tokens. Of course, this incentive can also be used in some existing markets with insufficient liquidity. tylerether.eth mentioned some design ideas of this new incentive plan - incentive a new market with an annual interest rate of Y% for a period of n months, but limit the incentive to a target size of X , For example, an 8% annual interest rate is used to motivate the COMP deposit pool for one year, but this 8% will only take effect on the liquidity of 10 million US dollars in the pool, and the interest rate of the remaining liquidity is still determined by market supply and demand.

Weak business innovation, optimize the economic model?

One thing to emphasize is that,The two proposals proposed by monetsupply.eth and tylerether.eth are still in the governance process for the time being, and it is unknown whether they can be passed and take effect, especially the latter, although I personally affirm its attempt, but still find it difficult to implement in the short term.

Relatively speaking, monetsupply.eth's proposal in the Maker community is clearer, and there are sufficient previous cases for reference. In contrast to Compound, the proposal of tylerether.eth is still not detailed enough in aspects such as the improvement of the interest rate model and the parameter setting of the new incentive plan. In addition, the move to stop liquidity incentives is too radical, which will undoubtedly touch the interests of multiple roles in the ecosystem. For the agreement The impact of future development still needs to be carefully evaluated.

Objectively speaking, compared to Curve, the economic models of Maker and Compound are indeed a bit simpler, which also gives the two leading protocols room for improvement, through the adjustment of economic models to improve the investment sentiment and market conditions of their tokens. Reminiscent of the case of Tornado.cash quickly realizing the "take-off" of the secondary market after upgrading TORN's economic model, for the protocol itself, Maker and Compound's attempt is definitely not wrong.

But as far as my personal perception is concerned, it is somewhat embarrassing to watch one after another old-fashioned DeFi projects shift their focus to the economic model. Although the design of the economic model is also very important for the comprehensive development of a project, I personally still recognize the innovations in business logic and product functions. These innovations determine the fundamentals of the project business and the ability to expand outwards. In contrast, changes in the economic model are more like an optimization within the system.

Admittedly, DeFi is not at its best now, and we haven’t seen enough amazing new ideas for a while. Looking back at these leading DeFi projects on the market, most of them were actually born in the last cycle. Although we still firmly believe in the future of DeFi, perhaps the market needs some time to breed new seeds.