The founder of dYdX personally recounted the 5-year entrepreneurial history: he was rejected by all VCs in Silicon Valley and was on the verge of bankruptcy

Author: Antonio Juliano

Original translation: Colin Wu Gary Ma

first level title

2015–2016

Working at Coinbase

Before joining Coinbase, I knew nothing about cryptocurrencies. Shortly after starting at Coinbase, I was very excited about the future of cryptocurrency. When I first started at Coinbase, basically the only legitimate cryptocurrency (that we knew of) was Bitcoin.

We all believe 100% that Bitcoin will be the only interesting thing in cryptocurrency, because if any other chain does something interesting, Bitcoin will integrate it and use its superior network effects to smash the other chain. Of course, this is ultimately wrong.

first level title

2017

Weipoint

Before founding dYdX, I had been working full-time on a search engine for decentralized applications. I've been working on this for 4-5 months, but no one is using it - I used to have about 10 users. This idea is too early. There were only a few dozen dApps in the world at the time. What's the point of a search engine if there's no searchable content?

secondary title

dYdX launched - July 27th

After Weipoint, I made up my mind to make something useful to the market. The main way cryptocurrencies were used back then (and to this day) was for trading and speculation. Around this time, the first decentralized exchanges (0x, Kyber) appeared. I looked at this and thought it was something really useful to build on top of Ethereum.

Given this, I think the next logical thing to build is decentralized margin trading and derivatives. This seemed logical, as margin trading (led by Bitfinex) was starting to take off in the crypto space at the time. Financial markets evolve over time from spot → margin → derivatives. It seems like cryptocurrencies should be no different.

secondary title

preliminary progress

secondary title

$2 million seed round

first level title

2018

the early days

$10 million in Series A funding

$10 million in Series A funding

We raised a $10 million Series A round at a $40 million valuation. The round was again led by Andreessen Horowitz and Polychain. This gives us 5x the capital and a longer runway (we're still not getting revenue).

V1 Margin Agreement

Brendan and I built the first version of the margin trading protocol. While it was impressive technology for its time (we invented flash loans and dex aggregators), it was overly complex and overly general. It took nearly a year from the establishment of dYdX to its launch.

Lesson learned: we should build some more special purpose/MVP and iterate

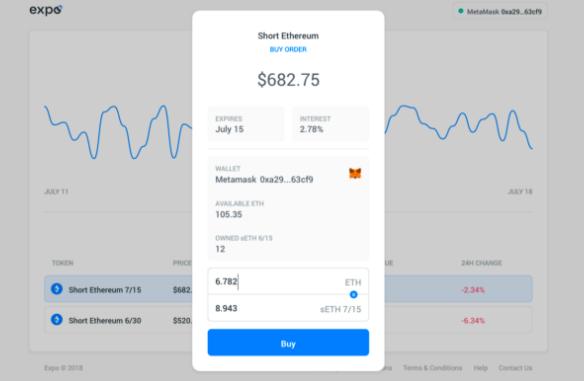

Expo

dYdX's first product, Expo, is built on top of the V1 margin protocol. This is a simple trading application that can be used to buy leveraged tokens. Leveraged tokens are tokenized versions of short/long margin positions on ETH.

The idea is that we will provide an easier way for users to trade on margin - just buy tokens and get leverage! We think this will expand the leveraged trading market and appeal to users who find exchanges such as Bitfinex too complex.

At its peak, Expo traded around $50 per day.

first level title

2019

Solo

We built and launched the second version of the dYdX margin trading protocol, codenamed "Solo". This version is more robust and it solves some problems of the original protocol.

Drawing lessons from Expo, we launched trading products aimed at more sophisticated traders. It went well and almost immediately increased our transaction volume to about $1 million per day.

dYdX Order Book

So far, dYdX has not built its own trading system. Instead, we integrate with a third-party DEX, 0x, to get buy and sell orders for ETH. Our users have experienced a number of issues with this, including high failure rates (e.g., users place a trade and then find out the trade has failed) and low liquidity.

So we decided to build our own order book based trading system. This allows us to build our own liquidity and solve some product issues. This worked well and allowed us to quickly become one of the most liquid DEXs at the time.

first level title

2020

In March, we turned on transaction fees and started making profits for the first time!

Perpetual contracts

In April, we launched BTC perpetual contracts. We will be launching perpetual contracts for ETH and LINK soon.

The decision to move into perpetual contracts was driven by a surge in perpetual contract volumes driven by Bitmex at the time. Driven by leveraged trading in perpetual contracts, Bitmex’s trading volume quickly surpassed that of Bitfinex and others. We (correctly) think this is an important emerging trend in crypto trading and think it's time to move to derivatives trading.

Before us, no one had built a perpetual transaction on a DEX. At the time, it was unclear whether we could successfully build perpetual contracts in a decentralized manner. Clearly, the bet paid off enormously for us in the long run.

Launching perpetual contracts also enables us to support the trading of cross-chain assets such as BTC. We initially thought that trading BTC on the DEX would be the killer use case, but it turned out to be wrong, our ETH perpetual contract ended up having more volume.

Initially, the trading volume of our perpetual contracts was lower than that of our margin trading products. One problem is that the V1 perps protocol only supports segregated deposits (users must deposit collateral separately for each market). This made it difficult for us to build liquidity and launch new markets. For this reason, our v1 perps only have 3 markets.

Lesson learned: jumping on trends early (not first, but early) and not being afraid to discard/de-prioritize everything we built earlier can pay huge dividends

The Rise of COMP & Uniswap

Most people don't remember this, but dYdX was the #1 DEX by trading volume in early 2020. Sometimes we are close to 50% market share. We were trading about $10 million per day at the time.

Compound’s launch of COMP, and the subsequent explosion of liquidity mining and DeFi, changed all that. The exponential success of COMP and its liquidity mining (leading to a 100x increase in Compound's TVL almost overnight) quickly spurred a flood of new DeFi Tokens.

People naturally want to trade these tokens. But many of them can only be traded on Uniswap (which makes it easy to add new tokens extremely quickly). This again led to a massive 100x increase in Uniswap's transaction volume and adoption almost overnight.

We were left in the dust and completely missed this trend. We can't add new tokens at all, there are only 3, while Uniswap has hundreds. Our market share dropped rapidly from about 50% → < 0.5%.

Lesson: It is important to anticipate, or at least be able to respond quickly to, drastic changes in market conditions

Overwhelmed by Gas

A major side effect of the rise of DeFi is that the gas cost of Ethereum has increased by 100-1000 times. At this point, we are subsidizing (paying) gas costs for our users. Right now, it costs over $100 in gas to execute a single transaction, and our transaction fees aren't nearly enough.

We started losing money at an alarming rate. We lose tens of thousands of dollars when people are trading on exchanges during the days with the highest volume,If we don't act, we will run out of money within 9 months.

$10 million in Series B financing

$10 million in Series B financing

We need to raise more money, or the company looks like it's going to fail.

At this point, our long-term plan is never to fully decentralize, but to always remain a profitable business with a central order book on top of the protocol. I don't believe it is possible to build a fully decentralized product with current technology to support the needs of professional traders (our core users).

This brings us to an existential question: If we are never fully decentralized, what is our competitive advantage over Binance and FTX? Can we do 10 times better than them? To be honest, I didn't have a good answer at the time.

As a result, we were basically rejected for this round by all the major crypto investors in Silicon Valley (a16z, Polychain, Paradigm, etc.).first level title

2021

new office

In the wake of COVID, we moved into a new office in San Francisco in March! We are still there today.

L2——Starkware

We needed to make major changes to our product because our business was hit by gas fees and we couldn't keep up with Uniswap, FTX, and others from a product standpoint. We decided it was time to move from Ethereum L1 to a more scalable chain.

After considering many different options (Starkware, Solana/Near, building our own optimistic rollup), we settled on Starkware. It gives us high throughput, low latency better than Ethereum, and is by far the best fit.

$65 million in Series C financing

$65 million in Series C financing

On June 21, we raised a $65M Series C round at a $215M valuation led by Paradigm. In addition to a great new lead investor, we've also brought in some high-quality investors.

dYdX Foundation issues $DYDX

In the summer of 21, the dYdX Foundation, an independent Swiss foundation, was established. The foundation released DYDX in August 21, the dYdX protocol token.

first level title

2022

We have opened our second headquarters in New York!

V4

Work on dYdX's fully decentralized version V4 begins in earnest. With V4, we have a clear mission and reason that dYdX can achieve its goal of becoming the largest cryptocurrency exchange - a fully decentralized and open source professional exchange that may be 10 times better than existing financial platforms. We published a blog post detailing our plans for V4. This remains the company's highest priority...