Taking Curve and Sushi as examples, talk about the DeFi pedestal theory

Compilation of the original text: The Way of DeFi

Compilation of the original text: The Way of DeFi

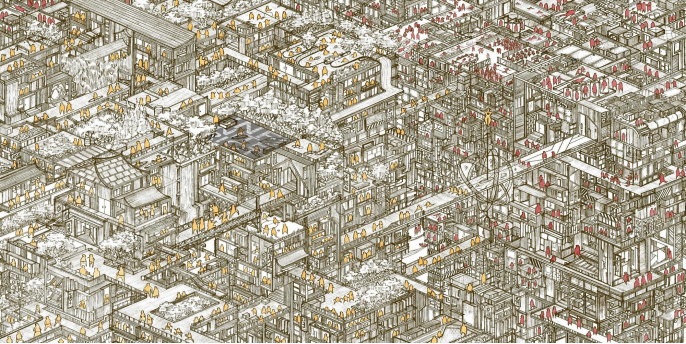

DeFi protocols focus too much on value capture and not enough on value creation. As an industry, we've taken the concept of money LEGO too seriously. I've been a believer in the fat protocol theory (not yet proven) since I entered the field, but as the industry has grown, I think I've started to see it from a different perspective.

While I like Sushi, I think their protocol has an inherent flaw that gives companies like Curve the upper hand as they focus on value capture rather than value creation. When I look at protocols like Sushi, and more specifically, xSushi, it's clear that what's missing from their model is their network incentives being in a closed loop within their ecosystem, which is very different from the "Money Lego" narrative on the contrary. It limits its own success and causes its own failure.

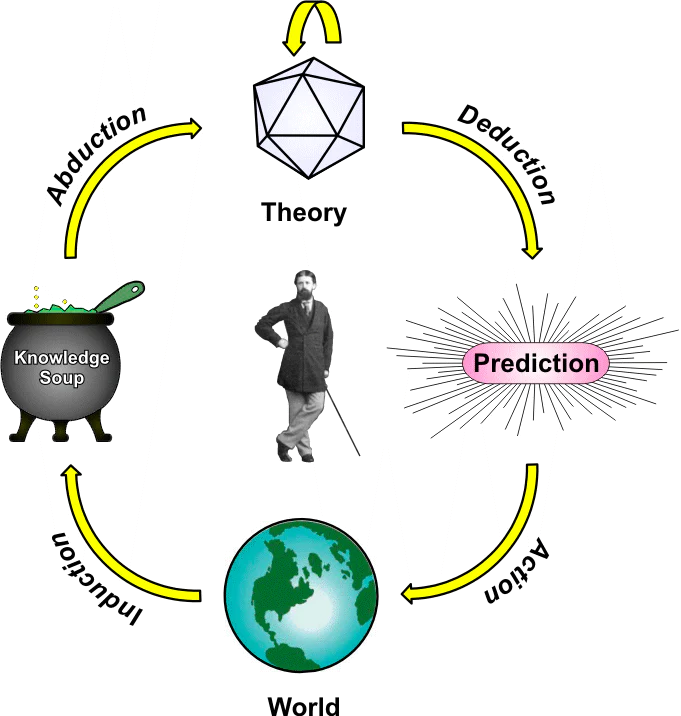

Curve has unknowingly become the main application in this article. Whether this was intentional or not doesn't really matter. The greatest innovations in finance are often made by mistake, or at least aspragmatic logicindirect results.

protocol"application"or"protocol"Any value capture of the layer is irrelevant. The concept of governance desirability refers to the value that network ownership creates across the ecosystem.

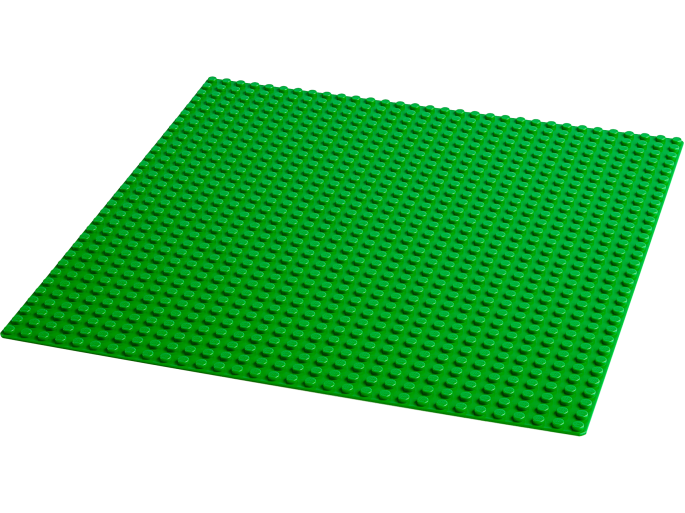

Baseplate theory

fat protocolfat protocol。

"fat protocol"protocol"protocol"(TCP/IP, HTTP, SMTP, etc.) generate immeasurable value, but most of it is captured and re-aggregated at the top of the application layer, mostly in the form of data (think Google, Facebook, etc.). In terms of how value is allocated, the internet stack is made up of"thin"agreement and"fat"composed of applications. As the market has evolved, we have learned that investing in applications yields high returns, while investing directly in protocol technology generally yields low returns. This relationship between protocols and applications is subverted in the blockchain application stack. The value is concentrated at the shared protocol layer, and only a small portion of the value is distributed at the application layer. This is a"fat"agreement and"thin"Application stack.

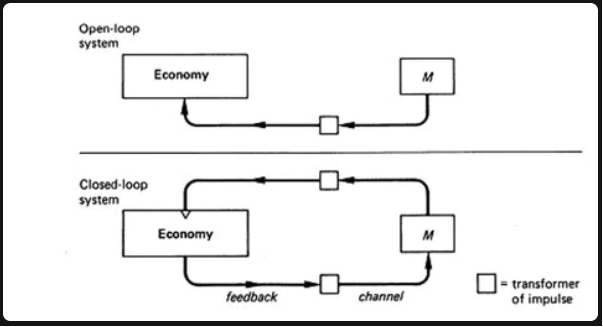

Closed vs. Open Feedback Loops

Should the supply of liquid assets follow an expansionary path unresponsive to cryptoeconomic events? Or should the money supply process include a feedback channel? As cryptoeconomic architects, we must choose between open-loop and closed-loop control systems. In the case of a flexible and evolving financial layer like DeFi, one has a larger expected value (EV) than the other, as in the case of Curve vs Sushi when combining elements of decentralized decision making and voting of belief as shown.

What did you do to yourself, or worse, buy back, when you shifted the incentives toward your own economy instead of someone else's? You are creating a closed-loop incentive structure, and if this theory ends up having any effect, it will be the death of many DeFi protocols. You are letting people who don't have the right motivational mindset run an economy that refuses to grow, and misdirect supply expansion in favor of their own growth mindset.

M = monetary policy

the feedback"the feedback", seeking direction directly from the economy offered by the release program.

All in all, Sushi operates in a closed loop system, and the path of market expansion is determined by elected officials on the team, who in theory should have Sushi's best interests in mind - although in practice that may not be the case.

In contrast to Curve, it gains a competitive advantage because its supply expansion is not dictated by those with Curve's best interests at heart. This somehow ultimately proves that their model works, they are not focused on getting everyone trading and liquidity through the Curve model, their reliance on external actors (like Yearn, Convex) dictates the direction of release , thus allowing Curve to develop from a simple and ordinary money Lego. This is"base"theory.

Since it is still in its infancy, some would argue that it is very similar to fat protocols in theory, and far from perfect in practice.

But I think it's somewhat proven in practice when you look at fat protocols from a value creation mentality rather than a value capture mentality.

In conclusion, outside of price action, the value flow within DeFi is in a bubble, and I think in many ways Curve is slowly proving the validation of fat protocols, but with some slight deviations from the original proposal.

What makes a project a protocol and not an application?

In the case of DeFi, what makes a project a pedestal rather than a Lego block?

I think Curve is a lot more similar to Ethereum than most people think. In the case of Pedestal, the distinction between protocol and application is less binary and more spectral, and Curve is closer to the protocol side of the spectrum. Using the previous open loop/closed loop example, Ethereum is an open loop system. Technical issues aside, Ethereum has no goals other than to operate a decentralized smart contract protocol and have a monetary policy that third parties (miners) compete for in their self-interest. In turn, this allows the economy (blockchain) to continue to grow. On the other hand, applications built on top of it (DeFi) simply cause network traffic to power the protocol beneath it, thus creating a perfect intersection of supply (ETH) and demand (hashrate).

Let's apply the same logic to Curve, another open loop system. Curve also has no goals other than to run a decentralized exchange and have a monetary policy that other people (DeFi) compete for in their self-interest. In turn, this keeps Curve's economy (liquidity) stable. The expansion path is an undominated monetary policy that releases $CRV to those projects (Yearn/Convex) that release the most energy on it - similar to the release of miners competing for Ethereum.

Like Curve, when you can not only integrate yourself into other projects' economies, but make their entire application revolve around you, then you have upgraded from an application to a protocol.

Likewise, ignoring price appreciation and looking only at impact, Curve has grown from a closed loop maintaining its network ownership to an open loop, which indirectly makes it a pedestal under Lego bricks. It creates value -- it doesn't struggle to capture value.

I think pedestal theory differs from fat protocol theory in several other ways. The main difference is that the micro-economy we build in DeFi requires you to focus on the desirability of governance to ensure your DApp exists as a protocol and not an application, rather than focusing on the value flow to fatten the protocol and make the application get thinner.

Cournot competitive mentality

Composability has proven to be a spectrum in DeFi's short lifespan. In my opinion, most protocols react and evolve based on the success of their competitors, rather than focusing on gaining the advantage of composability. A clear example of this is the governance of the industry from liquidity → illiquidity in the form of voting-storage tokens and belief staking.

In all practical cases, if you're trying to base our paradigm shift beyond simple money Lego, then your incentives should come from an open loop system, not a closed loop system. Embracing the PvP nature of DeFi, let’s compare our market to some slightly altered theories of economic competition and see how they relate to pedestal theory.

What is the Cournot Competition?

In dry TradFi terms, Cournot competition is an economic model describing the structure of an industry in which rival firms offering the same product compete independently for the amount of their output at the same time. In case anyone cares, it is named after its founder, the French mathematician Augustin Gounod. From the perspective of Degens, this sentence means that competitors of DEXes that provide nearly the same products, through their release, independently and simultaneously compete on the amount of liquidity they capture.

The basic elements of DeFi: DEXes, lending platforms, stablecoins, etc. operate in a market with limited competition, where most market leaders have 3-4 real competitors - oligopoly. They often compete by seeking to take market share from each other. One way to do this in DeFi is to change your monetary policy over the money supply process through feedback channels.

According to the law of supply and demand, a higher token output (release) drives the token price down, while a lower output makes it rise. Therefore, applications must consider how much liquidity supply competitors are likely to churn in order to have a better chance of profit maximization and liquidity retention.

In short, the effort to maximize profits is based on the decisions of competitors, and the output decisions of each DAO are believed to affect the market value of DApps. The idea that a DAO responds to what it thinks its opponent will produce forms part of the theory of perfect competition.

Unfortunately, it's a story we're all familiar with, of others trying to outdo each other, only to end up pushing themselves and their profits into the ground due to massive dilution. In the case of DeFi, this is something the application has to deal with. However, as far as the protocols that live under it are concerned, they are only on the side of beneficiaries, for example, the stablecoin market and Curve. The gameplay is relatively simple, instead of competing with other DEXs for liquidity, it is better to provide capacity for another competitive niche market (stable coins), by acquiring your tokens in the market"Cournot advantage", which is why Curve is a pedestal, not a Lego block. Looking forward to DeFi in 2022, my thesis is to only do what Curve does, create value for others to compete for, not compete for it.

Turn Lego into a pedestal

Let's pick a random token for a fair sale, BTRFLY. I think the goal should be to follow in the footsteps of the clear winners and seek to ignore the liquidity battles in the market and choose the path of value creation.

Like Curve and other projects trying to follow in their footsteps, the goal should be to create governance desirability, the competitive advantage of this token is the ~$100M or so meta-governance power held by treasury in the whole DeFi, if the new Market participants who want to grow their liquidity, they need these things to compete. So how do we turn our USP (independent selling point) into one that is more attractive to DAOs than to retail?

One approach is to migrate future releases and rewards into an illiquid governance token of the user's choice, the governance-locked (gl) or revenue-locked (rl) BTRFLY. Then, advertise that bonus items from planning have an extremely high APY, as is done in the regular (3,3) narrative. However, there is a problem that the rewards are issued in the form of illiquid and non-transferable BTRFLY, depending on the end goal of users and alignment of incentives, they will choose to mint gl or rl derivatives of BTRFLY. Use of the network, whether at the harberger tax level or the protocols built around the ecosystem (M&A, Hidden Hand, Racket), empowers the DAO with ownership rather than simple liquidity incentives. Incentives are better aligned this way, and where capital inflows come from long-term consistent capital, protocol ownership will be distributed to these same participants.

Holders of r/gl btrfly still share in the platform's fees, so users end up with liquidity rewards (rights to future income) as the platform grows. We could even take a cue from the ve(3,3) model and put a valve on the release relative to the percentage supply. Mimicking LooksRare's rewards program was a poor move that incentivized wash trading that ended up getting no attention from any projects. In this environment, you need to make bold moves to differentiate/take market share from protected competitors - adding a second layer of complexity through the two locked token mechanism makes the model more reflexive sex. In summary, a new open-loop economic model in DeFi that allows other projects to not only leverage the protocol's incentive structure (release) to their own best interest, but also tokenize their assets in DeFi from their treasury The basic impact item in is a pedestal worth building upon.