Guide for NFT players to avoid pitfalls: How to determine whether an NFT is worth investing in

image description

first level title

NFT Security Checklist

Whether you're new to the NFT space or a seasoned veteran, a framework for filtering great NFTs is an essential tool in any investor's toolbox.

image description

secondary title

Obvious NFT red flags

Let's start with the obvious red flags:

Anonymous creator with no experience, credibility, or success in the field.

Anonymity is common in the NFT space. Some want to be anonymous buyers, others want to be anonymous creators. Anonymity itself is not a red flag. Popping out with no prior experience, no proof of work, and no one to vouch for your credibility is a risk. Red light here.

tedious art

Do you like this work? Don't like it? So why buy it? If you don't like the painting, what are the chances you'll resell it for money because someone else found it interesting? Either way, if you don't like it, don't buy it.

Fiverr/Outsourced Art

Have you been into NFTs for over a week? If yes, then you are almost certainly aware of the epidemic sweeping the NFT ecosystem. Countless projects have outsourced their art to freelancers. The result is always the same; uninspired, cookie-cutter, flat, generative profile picture. These nightmares usually exist on Solana, Cardano, Harmony One or Tezos.

Celebrity endorsements

If a celebrity is the number one person or influencer behind a project, it probably doesn't bode well. Some celebrities have tacitly allowed their projects to stall. Still others performed Rug pulls. Projects with celebrities at the helm need more scrutiny, not less.

High prices for minted NFTs

Few projects can justify a minting price above 1ETH. Of course, this doesn't apply to 1/1 items, which can reasonably do this. Generative projects may one day justify this price, but so far the truth is that high-priced minting is not a guarantee of high-priced returns. As for chains other than Ethereum, the price of that cryptocurrency can be compared to the ETH price to make sure you are not overpaying.

Unoriginal knockoffs of popular items

Spinoffs of popular projects abound. Many people have been duped for slight alterations to popular collectibles. Unless it adds real value, new utility, or originality to the original item, it's unlikely to gain traction as a unique collection.

I know that OpenSea doesn't have such a graph. Sue me. I'm trying to save you from losing money technically on crap NFTs and you're telling me I shouldn't get a little creative license?

Unfulfilled or unrealistic roadmap

Intentionally or not, too many project roadmaps fall into this category. Maybe the project creators were too naive. Maybe the innovation they promised in their roadmap is beyond their capabilities. Perhaps the promise is based on sold-out coinage, or continued revenue from secondary sales.

When reviewing roadmaps, you should ask yourself whether the promises they make are realistic. Be wary if a commitment seems ambitious and the project seems to be breaking new ground. You should review the team to see if they can deliver on those promises. If they seem to be doing something beyond their competence, it's time to start asking questions on Discord and/or Twitter.

weak roadmap

On the other hand, a roadmap that lacks newness, innovation, and excitement is almost as much a mistake. If holders have nothing to look forward to, expect a sell-off. Under-promising, maintaining enthusiasm, and then over-delivering is a delicate art that few projects master. Projects that abandon the roadmap do not fall into this category.

"finished product" utility

Some projects promise to run at any time before minting an NFT. Sometimes this commitment comes in the form of staking to early lifecycle projects or other reasonable milestones for early lifecycle projects. Other times, it emerges as tamper evidence that a video game has been created and will be ready for deployment as soon as the minting is complete.

Don't take it for granted. This is a huge red flag and usually indicates a scam. Video games can take a long time to complete. If video games aren't the only focus (like Axie Infinity or Crabada), but are mentioned as a post-mint reward, don't take it too seriously. As contradictory as this may seem, the better the game is at this stage, the more likely it is that the project is a hoax. Stay tuned for other types of "finished" utility in the future as the scam evolves.

too much minting

Giving 10,000 tokens to a given project was commonplace a few months ago. Now, with the high saturation of the NFT market, many good projects are seeing that their minting cannot be completed. If a project is launching with 10k (or more) tokens, they better have a good reason for doing so. Only projects with the highest demand should really consider launching with this many tokens. While this is almost certain to change, the current gold mintage appears to be between 3,500 and 8,888 coins. Anything too much can add to the oversaturation of the market.

If minting started weeks or months ago and it still hasn't sold out or passed the 75% mark, that's a red flag. That doesn't mean the project won't bounce back at some point, but it's worrisome. However, keep in mind that some programs take some time to run. Doge Pound, for example, takes about a week to complete its minting.

too few coins

Scarcity for scarcity's sake is unlikely to reap the benefits NFT creators perceive. This of course refers to generativeness rather than 1/1 items, which usually derive value from their singularity. Projects that cap their mintage below 3,500, or reduce their mintage prematurely in order to reinvigorate the community, are killing themselves. Both behaviors are bad signs for the future development and sustainability of the project.

duality problem

A particular NFT's uniqueness within a series is equated to the aesthetics of the art itself. If a generative NFT collection has too few properties, cloning and lookalikes can occur. I call this"duality problem"(Doppelgӓnger Problem). To address this, some projects have begun generating batches of NFTs prior to minting and then combing the collection to ensure no two NFTs are the same.

Many NFT collectors are wary of this question. People don't want to have a profile picture with duality. To this day, projects that still fall into this trap are either ignorant or indifferent to the mature perception of NFT collectors on what defines a good project.

image description

The three Spidermen point at each other, their faces photoshopped into identical mekverse avatars.

Take these MekaVerse NFTs, for example. Can you spot the difference? Yes, I didn't see that either.

Asking admin/creator questions will silence you

Decentralized systems, by their very nature, should generate more scrutiny of authority, not less. If you're an asshole, your ban may be justified; but if you're asking real questions about a project and you get banned or stifled, that's a serious red flag.

Hostile Discord, Moderator or Creator

Maybe the admins haven't silenced you, but the overall feeling within the community is one of hostility. Whether this is directly attributable to the actions of the admins or because they are not enforcing healthy community guidelines, the admins are to blame. A hostile community cannot thrive if it is alienating users.

poor coinage

If you’ve been in the NFT space for a while and participated in some minting, chances are you’re a survivor of a failed mint. Despite good intentions, minting quickly failed due to technical difficulties. This is not necessarily an irreversible red flag. However, some projects have yet to recover from botched minting.

fake follower count

Paying for Twitter followers is nothing new. It should come as no surprise that scam NFT projects are buying their Twitter followers.

An easy way to keep an eye out for fake followers is to check how reactive and active their community is on Twitter. Do their posts get a lot of engagement? Are these engagements from users who appear to be real people? If not, then their follower count might not be real. Another way is to use a tool like Follower Audit, where you can check if your followers are real or not by entering a Twitter handle.

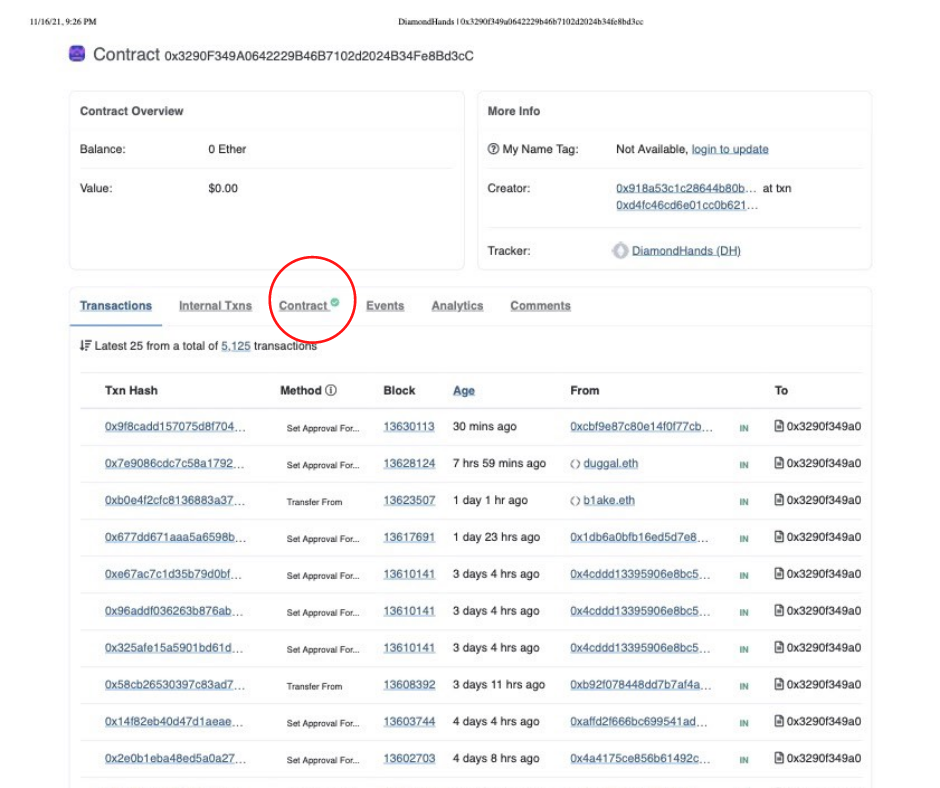

Smart contract not verified on Etherscan

Some minters may prefer to mint directly from the Etherscan contract. If you do this, you should make sure that the contract is actually verified with Etherscan, the Ethereum block explorer. There, you should check that the contract has a verified check mark next to it, like the contract below. If there is no checkmark in that place, proceed with caution!

Unverified NFT Artist

This is a red flag. We have to give artists a chance to showcase themselves, right? Now, if the artist is proven to be an established NFT artist? That’s safer. This isn't necessarily the case 100 percent of the time, but for generative works, it's an advantage.

If the artist is featured on SuperRare, Foundation, Rarible, or other reputable NFT marketplaces, this can add significant credibility to the project. It might give you some insight into what kind of artwork you can expect from the collection before minting.

It will also give you an idea of what to expect from any airdropped NFTs promised on the series' roadmap. Just make sure to check the artist's personal social networking sites to verify that they are indeed related to the project. On more than one occasion an artist has been incorrectly reported as the artist behind a project.

Sales in DM (DM your liar project)

I get it, you want to market your project and stand out from the hordes of other dog or ape NFTs. Give you some advice? Stop promoting your projects in my DMs! If you do this, you guarantee that I will never buy an NFT in your project.

For optimistic investors wondering if these projects are legit, understand that at worst, this is a scam that will empty your entire NFT collection the instant you click on the link. Tell me, is it worth risking this optimism?

Unlimited Minting

If a project allows unlimited minting, or if it arbitrarily decides to expand the minting amount, this is a big red flag. Also, if they don't limit the minting amount of whitelisted users, it's not advisable. If they allow more than 10 coins per person, that's a red flag. If each person has less than 5 coins, the project is relatively safe.

Why is this so important?

Allowing a small group of people to mint a disproportionately large majority of collectibles is a blatant challenge to community members who are not on the whitelist. This is especially true for those who have invested from the beginning and want to have a fair chance to participate in minting.

Second, it stands in stark contrast to the idea of decentralization in the crypto community.

Third, the more communication among stakeholders of the project, the better.

Fourth, minting means they can change the max supply, devaluing any NFTs you mint in the future.

Commitment to a fixed floor price or ROI

If a project promises to stay above a specific floor price, or guarantees a specific return on investment, that's a big red flag. This suggests that their priority is not the potential utility of the artwork or project, but profit. This is not a good sign. Worse, silencing holders who sell NFTs below a fixed reserve price.

Typos on website and marketing

That's not to say there aren't legit-looking scams out there, but if there are plenty of typos and incorrect grammar enough to make your gut go red-flagged, you might want to trust the feeling. Despite this, many projects from non-native English speakers have spelling mistakes, but these projects have proved to be successful and long-standing.

Claims that NFTs will be the next blue chip

image description

He was identified as an NFT project, claiming to be the "next blue chip" collection. Meanwhile, the rest of his rivals have authentic NFT blue-chip logos plastered on their faces and judge him for his unearned celebrations.

It's like when someone said to you in high school, "I'm going to set you free financially, just like the Ponzi scheme did to me".

% of holders

If there are a small number of people who hold the majority of NFTs, then it is best to avoid them. Projects with more than 50% independent holders are innocent. Projects with less than 30% independent holders may be at risk. Even though it's a legitimate item, it doesn't look like the healthiest thing.

Sweepstakes Fraud

Is the sweepstakes held on Twitter or Discord? Do a search on social media to see if it's real and if the winner actually received the prize.

bad error handling

In NFT projects, mistakes happen from time to time; how they are handled is very telling. If those involved in NFTs, no matter what their role, are not treating their community well, especially when they have made mistakes themselves, that is a big red flag. Even if there are short-term gains, the project is unlikely to become a blue chip stock right away. Unless the community can forgive and forget these mistakes.

Fake NFT

Fake NFTs abound. If you think an NFT might be counterfeit, use Tiny Eye reverse image search to see if the seller has ownership of the image.

reduced activity

Is creator activity on Discord or Twitter declining? Check their activity on both platforms to see if they are slowing down. This could indicate that they are looking for another cash grab, or that they will disappear with any profits they make, ending any further roadmap development.

well-designed whitelist

If projects are picking behind the scenes who they want to be part of the whitelist, that's a form of nepotism. It should have no place in a community that advocates for decentralized and trustless systems. Some projects will bluntly make this point, while others will not. In any case, this is a red flag.

stored off-chain

Unless it's stored on IFPS, or preferably on-chain, it's at risk of being tampered with or stolen by whatever centralized authority the NFT resides in. On-chain is king.

sellers and buyers

If buying used, is the number of sellers higher compared to the number of items in the collection? If yes, people may not have confidence in the project and may be looking for a way out.

leaked metadata

in conclusion

in conclusion

Now that you have the tools and knowledge to avoid common scams, you can explore the wonderful world of NFT if you are interested, but remember, never take other people's advice as your investment strategy.