"Black Tuesday" for US retail investors: Speculative stocks and cryptocurrencies plummet under the combined pressure of earnings reports and short selling.

- 核心观点:美股暴跌引发全球市场连锁反应。

- 关键要素:

- 纳指标普创月内最大跌幅。

- 比特币跌破10万美元关键位。

- 散户重仓股指数暴跌3.6%。

- 市场影响:风险资产遭抛售,避险情绪升温。

- 时效性标注:短期影响

Original author: Bao Yilong

Original source: Wall Street News

U.S. stocks experienced a "Black Tuesday," with CEOs of several major Wall Street banks publicly warning of a potential market correction , igniting investor anxiety.

The Nasdaq and S&P 500 indexes recorded their biggest single-day declines in nearly a month, with technology stocks and high-valuation stocks being the hardest hit. Six of the seven tech giants fell, and the Philadelphia Semiconductor Index plunged 4%.

Cryptocurrencies have suffered consecutive days of sharp declines amid dampened risk sentiment. Bitcoin fell below the $100,000 mark for the first time since June, while Ethereum plummeted by 10%. According to Coinglass, 342,000 people were liquidated in the past 24 hours, with liquidations exceeding $1.3 billion, of which long positions accounted for 85% of the losses.

For retail investors who are keen to chase hot stocks, the overnight U.S. stock market saw its worst trading day since April.

On Tuesday, stocks and assets previously favored by retail investors suffered a sharp sell-off, impacted by Palantir's earnings report, bearish bets from prominent short sellers, and volatility in the cryptocurrency market.

Goldman Sachs' index of U.S. retail-heavy stocks plunged 3.6%, roughly three times the drop in the S&P 500, marking its biggest single-day decline since April 10.

The "Black Tuesday" in US stocks spread to Asian markets, as investor concerns about overvalued tech stocks dampened market risk appetite.

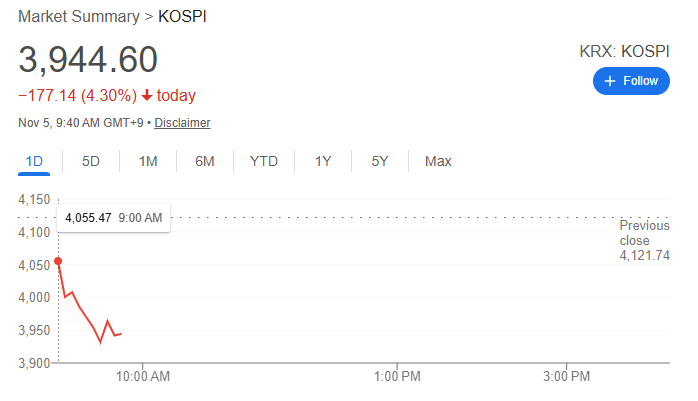

U.S. stock index futures fell further in early Asian trading on Wednesday, with Asian stock markets generally opening lower. South Korean stocks led the decline with a drop of more than 4%, and the South Korean Kospi 200 index futures fell more than 5% during the session. South Korea triggered the "Sidecar" mechanism at 9:46 a.m. local time, suspending algorithmic selling orders for 5 minutes.

Black Tuesday: US stocks plummet, retail investors stunned.

U.S. stocks plunged on Tuesday, with the Nasdaq Technology Index falling more than 2.5% and the Semiconductor Index dropping 4%. Six of the seven major tech companies declined, with the Philadelphia Semiconductor Index plunging 4%. Palantir fell 7.94%. Metsera surged 20% after Novo Nordisk raised its acquisition offer for the company.

According to Goldman Sachs' index of retail investor holdings, the index plummeted 3.6% that day, about three times the drop in the S&P 500, marking its biggest single-day decline since April 10.

Retail investors' enthusiasm for trading did not immediately subside when U.S. stocks opened on Tuesday. According to data compiled by JPMorgan Chase, as of 11 a.m. New York time on Tuesday, retail investors were still making net purchases of $560 million worth of individual stocks and ETFs.

This may be one of the reasons why the market rebounded in the early morning and the S&P 500 narrowed its losses, but the rally failed to hold, and the market subsequently turned downwards again. Melissa Armo, CEO of the trader education platform Stock Swoosh, described Tuesday's US stock market performance as follows:

This happens when people start to panic and sell off their shares.

Specifically, two major events directly triggered a sell-off in popular retail stocks. First, Palantir's financial report raised concerns about its growth prospects.

As reported by Wall Street Insights, Palantir's financial report showed excellent performance in the third quarter, but the market has doubts about the sustainability of its high valuation. This retail investor "darling" that has soared by more than 150% this year suffered a sharp decline yesterday, closing down nearly 8% and continuing its downward trend in after-hours trading.

Palantir's stock price plummeted

The cryptocurrency market is once again in bloodshed! Bitcoin has fallen below the $100,000 mark for the first time since June, while Ethereum has plummeted by 10%.

In addition to the direct impact on the stock market, the turmoil in the cryptocurrency sector has exacerbated the pressure on retail investors and dragged down cryptocurrency-related stocks.

Cryptocurrencies have suffered consecutive days of heavy losses, with Bitcoin falling below $100,000 intraday for the first time in more than four months, and Ethereum dropping by more than 10% intraday.

Analysts believe the selling pressure stems from the hawkish comments made by Federal Reserve Chairman Jerome Powell last week. He downplayed market expectations for a December rate cut and reiterated the narrative that interest rates will remain high for an extended period. This shift has strengthened the dollar, putting direct pressure on non-interest-bearing assets such as Bitcoin.

Meanwhile, data shows that investors have withdrawn more than $1.8 billion from Bitcoin and Ethereum-related ETFs in the past four trading days, further exacerbating market liquidity tensions.

Analysts warn that a deeper pullback could be imminent if the current level cannot be held, with traders closely watching the key support area of $96,000.

The current decline in the cryptocurrency market is not far removed from the historic liquidity crisis three weeks ago, when the market turmoil led to the forced liquidation of billions of dollars in leveraged cryptocurrency positions.

Looking ahead, market sentiment remains tense. Melissa Armo stated that she is preparing for another potential drop on Wednesday . She advised:

If a trader can tolerate some pain, they can start preparing a list of potential stock buys. If not, then I suggest selling.

Asian markets were also affected.

After a strong rally in global stock markets driven by the artificial intelligence boom and expectations of interest rate cuts, investor concerns about high valuations are rapidly intensifying, triggering a widespread market correction. Technology stocks have been hit hardest by this sell-off, and risk warnings from Wall Street executives have further fueled risk aversion, with funds flowing into traditional safe-haven assets.

This sell-off is spreading from Wall Street to Asia. Following Tuesday's decline in U.S. stocks, U.S. stock index futures continued to fall in early Asian trading, with the Nasdaq 100 futures, dominated by technology stocks, leading the decline.

As a result, Asian stock markets opened lower, with the South Korean stock market falling by more than 4% at one point. Previously, the MSCI World Equity Index had recorded its biggest single-day drop in nearly a month.

As investors reduced their risk exposure, risk aversion in the market intensified significantly. US Treasury prices rose across all ends of the yield curve.

The Japanese yen, a traditional safe-haven asset, strengthened against the US dollar for the second consecutive day, while the Bloomberg Dollar Spot Index also hit its highest point since May.