ETH Weekly | Ethereum 2.0 merged developer testnet 4 online; Twitter reward function added support for Ethereum wallet address (2.14~2.20)

Author | Qin Xiaofeng

Editor | Hao Fangzhou

Produced | Odaily

1. Overall overview

Author | Qin Xiaofeng

secondary title

Second, the secondary market

1. Spot market

Twitter announced last Wednesday that Twitter mobile users will be able to add ethereum addresses to their list of potential tips. The company rolled out NFT avatar verification for paid Twitter Blue subscribers last month. A Twitter spokesperson said that all users who agree to the company's tipping policy can use the Ethereum wallet, but the new feature does not yet support ENS domains. The company confirmed that it will support tipping in ETH and ERC-20 tokens, including ethereum-based stablecoins. Twitter also said it has rolled out tipping in Nigeria, Ghana and India.

In terms of the secondary market, the current ETH price may pull back slightly in the short term, with a support level of $2,500 and a resistance level of $3,000.

According to OKX market data, the price of ETH once fell to around US$2,600 last week, and closed at US$2,652 during the week, a month-on-month decrease of 9.1%.

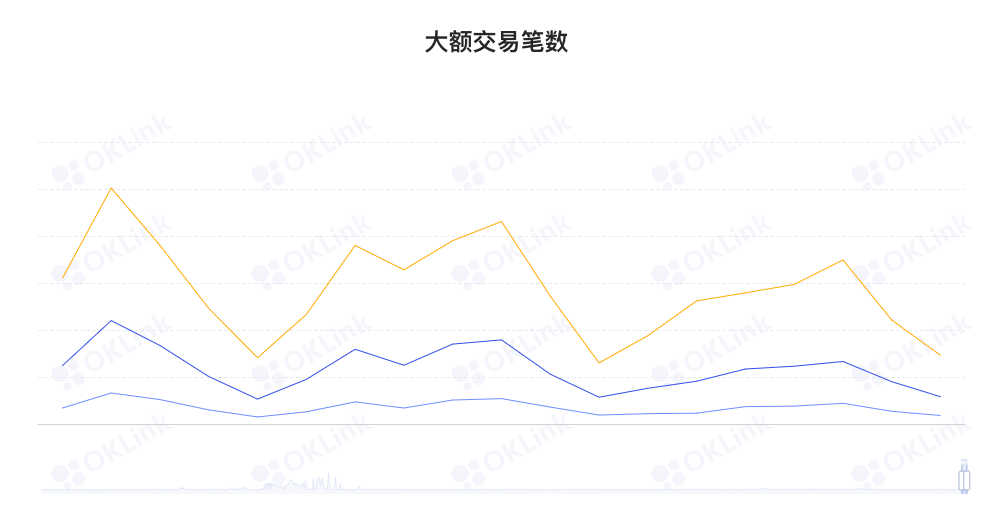

2. Large transaction

OKlink dataThe daily chart shows that the price is currently on the lower track of the Bollinger Band, and the price may continue to test the $2,500 mark in the short term; the lower support levels are $2,550 (the lower track of the Bollinger Band), $2,250 (the previous low), and the upper resistance level It's $2950 and $3000.

3. Rich list address

OKlink dataIt shows that the number of on-chain transfers dropped sharply last week, with "above 1,000 ETH", "above 2,000 ETH" and "above 5,000 ETH" decreasing by 19.5%, 22.7%, and 21.7% month-on-month respectively.

3. Ecology and technology

1. Technological progress

OKlink data

3. Ecology and technology

1. Technological progress

(1) Ethereum 2.0 merged developer testnet 4 online

(2) Over 75% of Byzantine behaviors in the Ethereum beacon chain have not been punished by slash

2. Voice of the Community

On February 16, Zhiguo He from the University of Chicago and Jiasun Li from George Mason University published the paper "Contract Enforcement and Decentralized Consensus: The Case of Slashing". Many new blockchain applications rely on "stake and slash" mechanisms to align incentives, the paper says. The paper points out that the design of this "contract" problem cannot be separated from the details of the decentralized consensus formation process. The paper conducts empirical research on Ethereum 2.0 and finds that more than 75% of Byzantine behaviors escape punishment (Slashing), highlighting that slashing may not be as effective as commonly believed.

It is reported that Slash collects fines from the 32 ETH pledged in the nodes. No amount of Slash can be replaced, and if a node drops below 16 ETH due to accumulated Slash penalties, the node is automatically withdrawn from the network.

3. Project trends

2. Voice of the Community

Ethereum founder Vitalik Buterin commented on Canadian police blacklisting bitcoin addresses related to truck driver protests in an interview with the ETHDenver conference. He said that the Canadian government’s attempt to cut off the flow of funds to protest truck drivers in Canada explains why cryptocurrencies exist. He said the government's response has been hawkish, and cryptocurrencies are a potential check on such excesses. "It's not about lawlessness, in some ways it's about bringing back the rule of law." He said the government and police could still act legally and go after suspects "as they always have" without needing to commandeer financial middlemen. This week, the government of Canadian Prime Minister Justin Trudeau invoked rarely used emergency powers in an effort to quell the protests. Banks and other financial service providers are authorized to freeze or suspend accounts related to trucker fleets without a court order and are shielded from civil liability to do so. Previously, supporters of Truckers tried to circumvent the Covid lockdown by raising donations in cryptocurrency. Currently, the government has blacklisted the cryptocurrency addresses in question, and a court injunction has ordered the freezing of funds pending the outcome of civil legal proceedings. (CoinDesk)

(1) The pledge pool provider Moonstake has reached a cooperation with the cross-chain project deBridge

(2) Curve Finance has launched the smart contract platform Moonbeam Network

(3) DeFi asset management protocol Enzyme announced the launch of V4 product Sulu on the Ethereum mainnet

Enzyme, a DeFi asset management protocol, announced that it will launch the V4 product Sulu on the Ethereum mainnet, and it will also be launched on Polygon in the next few weeks. The features of Enzyme v4 include independent setting of the treasury code, transferable treasury share, allowing the redemption of specific assets, introducing exit fees, and borrowing assets.

Sushiswap officially tweeted that Sushiswap has launched a free limit order function on Ethereum and Polygon, allowing users to buy or sell at a specific price point without continuously monitoring the market.

(5) Livepeer announced the migration of all functions from the Ethereum mainnet to Arbitrum

The decentralized streaming media transmission protocol Livepeer announced the completion of the network upgrade, disabled protocol operations on the Ethereum mainnet, and migrated all functions to the Arbitrum network. Livepeer said that with the rise of Gas fees on the Ethereum mainnet, the high-fee environment makes it difficult for network participants to operate efficiently and profitably. It is reported that any LPT tokens on the Ethereum mainnet need to be bridged to the L2 network in order to interact with the protocol.

Additionally, starting today, Livepeer Orchestrators will not receive revenue or inflation rewards on the Ethereum mainnet, the latter will be paid on Arbitrum. All coordinators have until February 21st to migrate their stake to Arbitrum. LPT token pledgers (delegators) can claim their LPT tokens and earnings on the Arbitrum network after February 21.

(6) Sushiswap launched a free limit order function

Sushiswap officially tweeted that Sushiswap has launched a free limit order function on Ethereum and Polygon, allowing users to buy or sell at a specific price point without continuously monitoring the market.

(7) Etherscan has added the functions of "View NFT" and "Contact Holder"

According to previous reports, in January this year, Blockscan, the team that created the Etherscan blockchain browser, released the beta version of Blockscan Chat. The information disclosed on the website’s homepage shows that Blockscan Chat is a messaging platform where users can easily and instantly message each other through wallet-to-wallet.

4. Borrowing

Defipulse(8) The liquidity market agreement xBank will launch the Ethereum expansion plan StarkNet in March

4. Borrowing

5. Mining

(data from etherchain.org)

etherchain.orgThe data shows that the value of locked-up collateral on the chain fell from US$83.8 billion to US$70.83 billion last week, a week-to-week decrease of 15.4%; a net decrease of US$856 million in the previous week and a net decrease of US$12.97 billion last week, a month-on-month decrease of 1415%. Specifically, the amount of ETH mortgages dropped from 8.25 million to 7.517 million last week, a drop of 8.8%; the amount of BTC mortgages dropped from 216,977 to 205,975, a drop of 5%.

image description

4. News

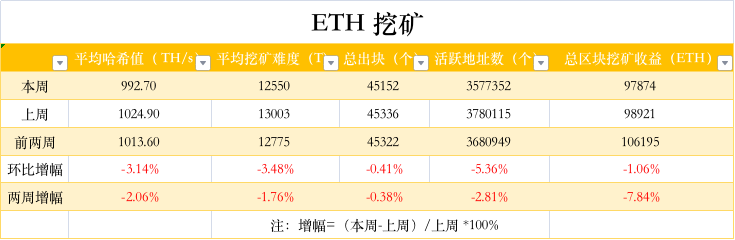

The data shows that the average computing power last week decreased by 3.1% month-on-month, temporarily reporting 992TH/s; the average mining difficulty decreased by 3.5% month-on-month, temporarily reporting 12550T; the activity on the chain decreased by 5.3% month-on-month, and the total mining revenue decreased by 1% month-on-month.

secondary title

4. News

(1) Canadian listed company Ether Capital announced an additional pledge of 10,240 ETH

Canadian listed company Ether Capital announced an additional pledge of 10,240 ETH, worth about $38 million. Ether Capital currently has 20,512 ETH staked, and hopes to stake at least 30,000 ETH before the Ethereum merger, accounting for more than 65% of its total ether balance. (Business Wire)

(2) Data: 18.36 million non-zero addresses will be added to the Ethereum network in 2021

IntoTheBlock data shows that the number of non-zero addresses on the Ethereum network will increase by 18.36 million in 2021. This means 1.53 million new addresses are being added every month, but at the same time the competition for market share is becoming more and more intense.

Although the price of ETH hit a new all-time high in 2021, the rate of growth of new addresses has not been particularly correlated with the price surge. The network has added about 10 million addresses since last October.

While the overall number is increasing, the percentage of active addresses in the network is decreasing. Overall, active addresses accounted for 1.05% of all addresses on January 1, 2021, peaking at 1.66% on April 25, but since then, as of February 15, the percentage of active addresses has dropped to 0.86%.

The number of whale addresses with more than 1000 ETH has also declined since the beginning of 2021. On-chain analytics firm Glassnode reported on Feb. 13 that the number of whale wallet addresses had reached a four-year low of 6,226. (Cointelegraph)