Messari In-Depth Report: How will blockchain disrupt the game industry?

By Mason Nystrom & Jerry Sun, Messari Analysts

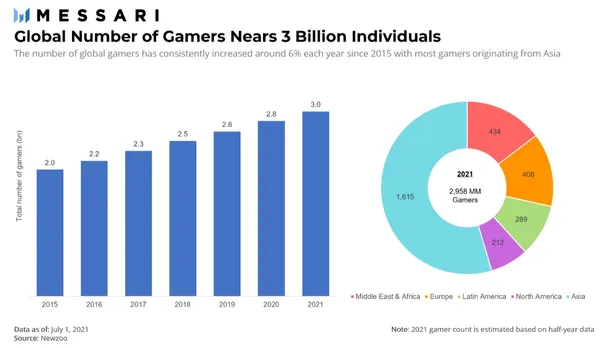

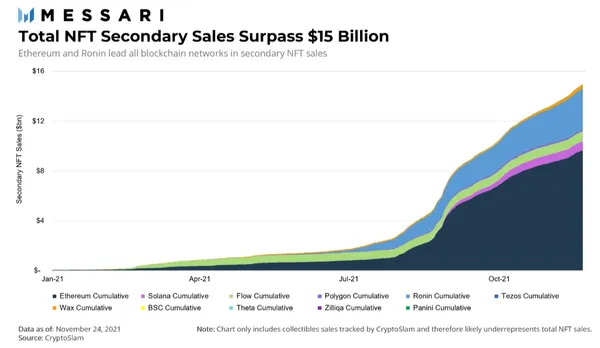

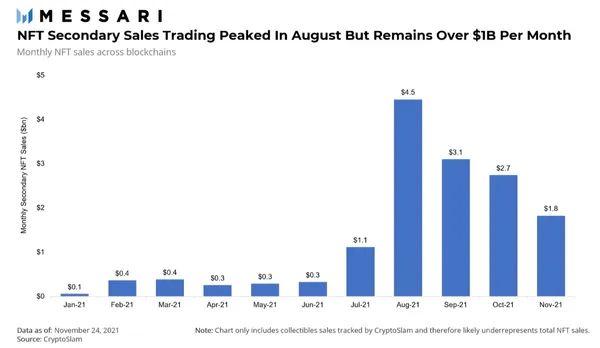

The rise in interest in video games and NFTs worldwide has been a huge catalyst over the past few years. Globally, the number of video game players is rapidly approaching 3 billion and is expected to grow at a compound annual growth rate of 5-7% over the next few years. Meanwhile, NFT sales surpassed $15 billion for the first time in 2021. In fact, secondary market sales of NFTs in blockchain games account for 20% of total NFT sales—many smaller games consistently generate tens or hundreds of millions of dollars in revenue.

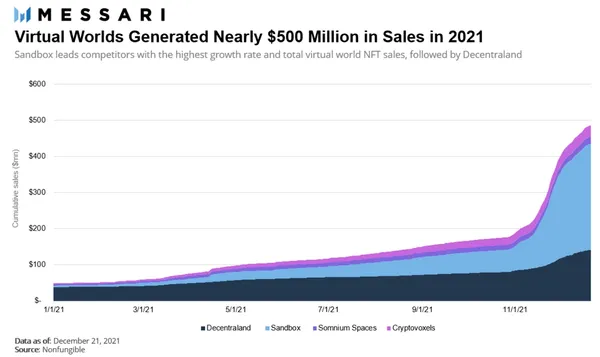

MetaverseMetaverseandDecentralandandThe SandboxVirtual world games such as Google have generated nearly $500 million in NFT sales (including virtual land and in-game assets). In 2021, NFT sales in the virtual world will grow the fastest, with a transaction value of more than 320 million US dollars. As people understand the Metaverse further, some parts of this new digital experience (i.e. the Metaverse) may utilize blockchain as a core part of the infrastructure—and as blockchain infrastructure continues to expand, This is more likely to happen to meet the needs of developers and consumers.

This report will delve into the growth of the three categories of the global game industry, NFT market and blockchain games. Although the blockchain gaming industry is still in its infancy, understanding these trends will give us insight into the future of gaming.

01. Introduction to blockchain games

Like its fictional characters, the gaming industry is constantly evolving. The industry is on the verge of disrupting traditional models, thereby adapting to changing market demands.

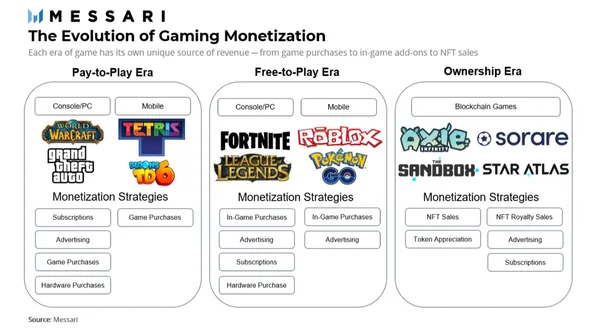

Take the evolution of game business models as an example. The first mainstream game to feature a Pay-to-Play system. In our memory, these games are mainly arcade games in the mall, CD disc games in the computer, or games downloaded directly to the machine later. The advantage of paid games is simple: you only pay once, and you can keep playing.

Following the payment model,"Freemium Model"(Freemium Model) came into being. In the era of this model, players no longer have to pay to start playing games. On the contrary,Game merchants make money by making players pay to unlock additional components of the game, or more commonly, by making in-game purchases such as expansion packs, platform subscriptions, and character skins.For many, freemium games have lowered the barrier to entry for gaming, and the shift to freemium games has helped grow player numbers around the world.

This brings us to today, where the next monetization revolution in the gaming industry is about to begin: blockchain gaming. The field of blockchain games has also gainedGameFiearn while playingearn while playing"(Play-to-Earn),image description

The development process of the profit revolution in the game industry: the era of paid games → the era of freemium games → the era of blockchain games (players have ownership of in-game assets)

At the heart of this revolution is the idea that players should have ownership over the content they earn (in-game assets), or at least more ownership in the digital world where they spend a lot of time and money. This creates two immediate advantages:(1) The life of in-game assets is extended as those assets continue to exist in the player's wallet, even after the game is closed; (2) The interoperability and composability of assets allows them to be integrated with other games, applications or Blockchain to interact.

Interoperability between different blockchains allows players to lend their in-game assets, transfer them to another application, or gain access to real-world events. Additionally, blockchain has the potential to provide players with the ability to safely and efficiently use fiat or cryptocurrency to buy, sell, trade, and create in-game assets, whereas the gray secondary markets of traditional games can be rife with fraud and many emerging The market lacks a payment infrastructure that allows players to conduct game-related transactions seamlessly.

While blockchain games can be a new source of revenue for game studios, it is important to be reminded that the blockchain world is not without its own flaws. For example, French video game publisher Ubisoft's recently launched in-game NFT marketplace Ubisoft Quartz has been questioned by fans, leading to the cancellation of Ubisoft's plans to include NFTs in its new game Tom Clancy Ghost Recon Breakpoint. Before that, popular gaming community Discord encountered similar resistance after hinting at an integration with ethereum.

The main reasons behind the community resistance are the sustainability of this game model, unclear user value proposition, and frequent "Rug Pulls" scams (that is, some cryptocurrency projects defraud users of investment by packaging themselves, and then immediately run away with money) ) wait. Many, if not all, of these concerns could be avoided or mitigated if projects launched their products more thoughtfully alongside market education, and Twitter recently introduced the ability to allow paying users to set NFTs as their profile pictures , and Adidas and others entering the NFT space, all show an encouraging path forward for platform and intellectual property owners.

02. Global game market

Gaming is one of the most popular sources of entertainment, and it's still expanding. Major franchises such as Fortnite and League of Legends now operate in the global pop culture arena. For example, "Fortnite" has collaborated with Marvel Studios, "Odaily Wars" and John Wick of the film industry, with Ariana Grande, Neymar and other influential celebrities, and with popular brands such as Balenciaga, Ferrari and Air Jordan. brand cooperation. On the other hand, the international sports league hosted by League of Legends attracts millions of fans.

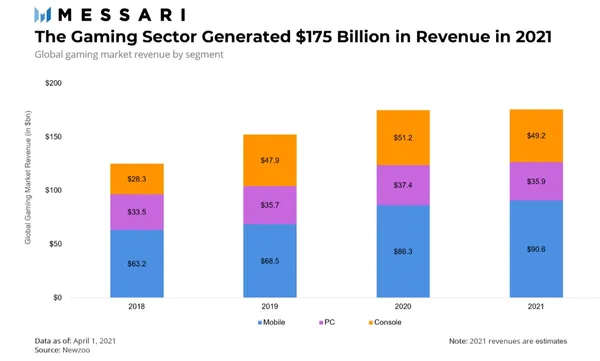

Anecdotes aside, it's impossible to assess the global games market without taking into account the past two years. In 2020, the lockdown caused by the Covid-19 outbreak acted as a strong catalyst for the industry. Those who have become gamers find themselves having more time to play their favorite games. Meanwhile, those who don't play games find themselves finding time to try new hobbies. therefore,Global gaming revenue up 15% in 2020. Mobile games, PC games, and console games all followed the development of mobile phones, with an annual growth rate of 26%.

Unfortunately,Businesses face a different situation in 2021.The long-term impact of the epidemic is beginning to highlight unexpected secondary effects in the global gaming market.Disruptions to manufacturing, shipping and logistics processes have hindered the launch of next-generation game consoles, and PC hardware has faced chip shortages and delays in other high-end components.image description

Above: Changes in annual revenue generated in the game field since 2018.

image description

Above: Growth in the number of global gamers since 2015 (unit: billions), with nearly 3 billion gamers worldwide in 2021.

Meanwhile, the total number of gamers worldwide is expected to approach 3 billion in 2021, 55% of which are in the Asia-Pacific region. The main factor driving the growing user base remains theExpanding Internet population, better network infrastructure, and easier access to smartphones.

The three drivers above remain solid in the short term, but as regions such as the Middle East, Africa, and Latin America move more users online, and user growth slows, exploring new avenues to add users will be of interest to many companies of.Blockchain games and their new token-based monetization models present a unique opportunity for game developers to generate more average revenue per user, expand their user base, and explore new revenue streams.

03. NFT: Game Changer

NFT serves as a core primitive of blockchain assets and serves as a key value proposition for various blockchain games.NFTs in blockchain games provide various benefits to games, including asset ownership, asset programmability, and open up new opportunities for incentives (players) and innovation.

1. Asset ownership

In traditional games, the internal assets of the game are controlled and owned by the game developer, and are actually rented out to players. In contrast,In blockchain games, players have real ownership of their in-game digital assets, whether it is in-game currency or unique assets such as skins, account names, in-game virtual land, or other assets.

2. Asset programmability

Because NFT is essentially software on the blockchain network, soThese assets can be programmed to have various properties, or built to have in-game utility. For example, NFTs can be designed as assets that can only be acquired when players reach a certain status, or programmed for many other unique use cases.

3. Motivation & Innovation

Game developers are already one of the most knowledgeable groups when it comes to incentives.NFTs provide an additional layer of economic incentives, allowing players to earn assets that can generate income, injecting real economic value into game assets,And build a stronger game economy through the in-game currency and NFT market.

Since blockchain networks are permissionless, this opens the door for developers to innovate. By using NFTs, a single asset class can be automatically licensed to other companies or used in other games. For example, the fantasy football NFT game Sorare has licensed other game developers such as Ubisoft to use its NFT.

In addition, NFT also opens up new forms of profit. For example, NFTs issued by game companies can earn royalties from all secondary sales, creating new revenue streams for digital asset distribution companies; game companies can choose to vertically integrate their own NFT markets and activities in games (such as the Axie Infinity game is own NFT market), or integrate with third-party platforms such as OpenSea.

04. The growth of NFT: Analyzing the secondary market

In 2021, the NFT secondary market sales of multiple blockchain networks will total more than $15 billion (see chart below), with Ethereum leading NFT transactions. However, the increase in transaction costs on the Ethereum network has paved the way for other new blockchains and L2 scalability solutions such as Solana, Ronin, ImmutableX, Polygon, etc.

Every blockchain network or L2 network has its own set of tradeoffs, including scalability, existing infrastructure, users, and security, among others. therefore,Different game developers choose to build games on different blockchains for different reasons: Games that require greater scalability may choose a blockchain platform such as Solana, while game developers who want to use Ethereum's existing network effects may choose a blockchain platform such as Polygon, ImmutableX or other Ethereum scalability solutions plan.

August 2021 is the peak monthly activity in 2021, with NFT secondary market sales exceeding $4.5 billion in that month. As shown below:

While the final months of 2021 still lag behind the August peak, it's important to realize that the NFT secondary market is still several times higher than it was at the beginning of 2021. As more apps and marketplaces integrate various forms of tokens, including NFTs, the NFT secondary market will be poised to retest the levels seen in August 2021.

Note that the graphs above represent secondary sales, sales from one person to another. Therefore, these figures exclude the initial sales of NFTs by game companies to the first buyer, which can generate meaningful income for game companies.Secondary sales of NFT assets within games is a useful indicator of the overall NFT market and the health of individual games.Growth in secondary sales could translate into a stronger game economy, and since each sale of an NFT collection typically provides a perpetual royalty to the company, a healthy secondary market also directly translates to increased revenue for NFT publishers.

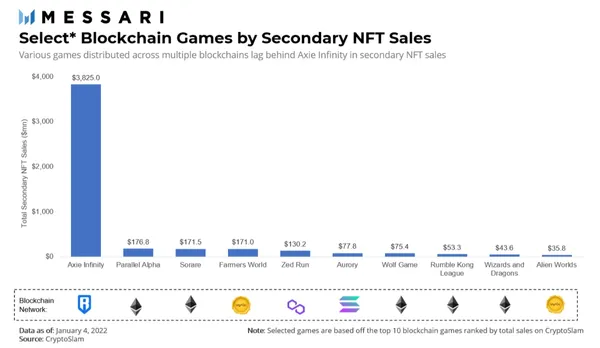

Data Display,Axie Infinityimage description

Above: NFT secondary sales of games on various blockchain networks, data as of January 4, 2022

It is also worth mentioning that,The Most Successful Blockchain Games Today Are Primarily Card Games, while the current game industry prefers sandbox games, massively multiplayer online games, and games with a stronger gaming experience.

At present, blockchain games have not reached the stage of development that can support complex gameplay and economic primitives (such as NFT) at the same time. However, over time, advancements in blockchain technology and user experience — including improvements released over the next year — will open the door to higher-functioning games running on blockchain networks.

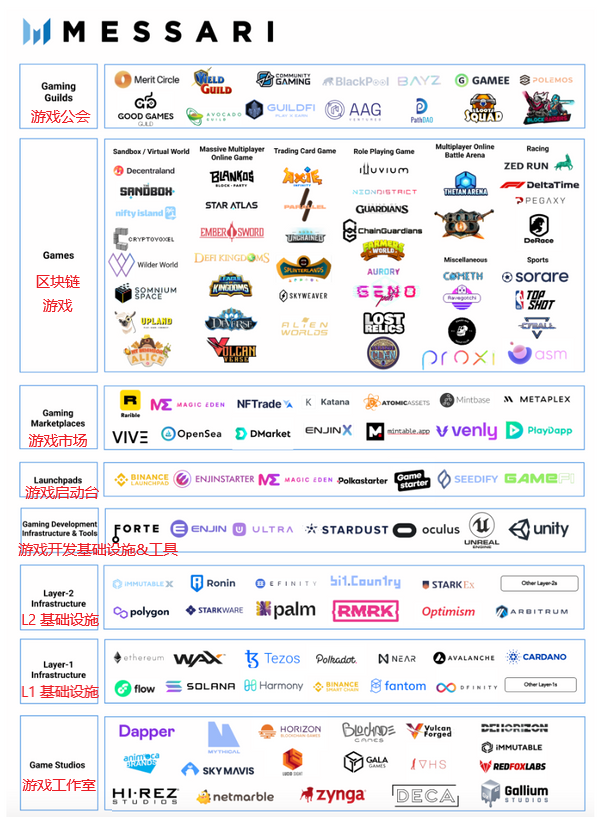

05. Blockchain game pattern

As the blockchain gaming industry has gained momentum, the gaming infrastructure stack has grown rapidly, becoming an ecosystem consisting of studios, games, and key infrastructure. As shown below:

Let’s analyze the various layers of the blockchain gaming space listed above.

1. Game Guild

Guilds are no strangers to blockchain games. However, by combining with DAO (Decentralized Autonomous Organization) and games,picturepictureYield Guild Games (YGG)Well-funded game guilds such as , GuildFi, and Merit Circle all get a portion of the game rewards by funding players of a large number of blockchain games (such as Axie Infinity).

2. Blockchain games

The biggest dimension of the blockchain gaming space is the game itself. So far, there are various game types. Some of the most successful categories include trading card games (such as Axie Infinity), massively multiplayer online role-playing games (such as DeFiKingdoms), virtual worlds (such as The Sandbox and Decentraland), and sports games (such as Sorare).

With the development of blockchain games, dominant games will emerge in various fields. However, many games are currently still in development and may take months or years to fully develop.

3. Market

As games issue assets in the form of NFTs, general NFT marketplaces like OpenSea, Rarible, etc., as well as blockchain-specific NFT marketplaces like Metaplex, VIVE, and Magic Eden, drive NFT transactions. In addition, some game infrastructures provide their own NFT market, such as Enjin provides an NFT market for games developed based on Enjin SDK.

4. Launch pad for blockchain games

Some launch pads (Launchpad) in the field of blockchain games can effectively help emerging game developers to raise funds for game development. Typically, these launchpads raise funds for specific gaming ecosystems (such as Polkastarter for the Polkadot ecosystem, and Magic Eden for the Solana ecosystem). Typically, these launch pads can be funded through Initial DEX Offerings (IDOs) or Liquidity Bootstrapping Pools (LBPs), each of which enables an initial token offering.

5. Game Development Infrastructure

Game development infrastructures like Forte and Enjin usually have APIs and SDKs that allow game developers to quickly integrate NFT or other encrypted economic activities. For game developers, building the entire blockchain infrastructure a game needs from scratch can be daunting and time-consuming. Just as blockchain developers leverage existing smart contract tools and wallet infrastructure, game developers can leverage blockchain game development software (such as Stardust, Enjin, and Forte) that supports modular components such as wallets , asset issuance, payment and other basic functions.

6. L2 Infrastructure

The NFT bull market in 2021 has led to increased L2 (second layer network) investment in the gaming ecosystem. For example, Axie Infinity chose vertical integration and developed its own Ethereum sidechain Ronin and decentralized exchange Katana. Other game development platforms have also opted for horizontal integration, such as Enjin, which won a parachain slot for its NFT-only chain, Efinity, in the recent Polkadot parachain auction.

Despite this, many existing games still aim to build on Ethereum's existing network effects, using Starkware (such as the NFT fantasy football game Sorare), ImmutableX (such as the NFT card game Gods Unchained), Polygon (such as the NFT horse racing game Zed Run ) and other Ethereum-based L2 solutions to meet the scalability requirements of these games.

7. L1 Infrastructure

L1 (first layer blockchain network) infrastructure is the core foundation of various protocols and applications. While some games are built on higher throughput L1 blockchains (such as Solana and Flow), most Ethereum games have migrated to L2 solutions. The importance of L1 comes from the fact that blockchain games will utilize other composable protocols on L1, including guilds,financialization agreement(such as NFTX), identity solutions (such as Ethereum Name ServiceENS), marketplaces and other applications or services.

8. Game Studio

Game studios are at the base layer, as they are usually game developers, as well as developers of L1 and L2 infrastructure. Dapper Labs (developed CryptoKitties and NBA Top Shot and other well-known NFT projects), Sky Mavis (developed Axie Infinity game) and Animoca Brands (its blockchain games include The Sandbox and Crazy Kings, etc.) Rich game developer. Ultimately, not all game studios survive. However, those companies developing the next blockbuster game have the potential to become the next Electronic Arts in the future.

06. Blockchain games gain widespread interest

The first blockchain games were created in late 2017, but it's only recently that NFTs have gained mainstream attention that has led to significant user engagement in the space. With the popularity of games like Axie Infinity and mainstream NFT collectibles like NBA Top Shot, blockchain-based games are now on the verge of widespread adoption.

1. User Metrics

While blockchain gamers are only a small fraction of the 3 billion gamers worldwide, recently released data from DappRadar shows that October 2021 is the first month with more than 1 million unique daily active wallets interacting with decentralized gaming apps . This is an increase of almost 300% compared to 4 months ago, when the same metric showed only 350,000 wallets interacting with these games.

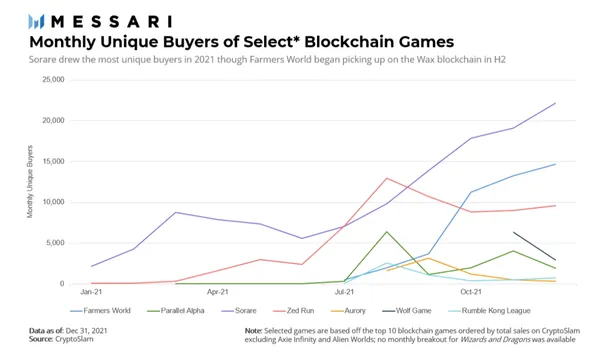

The number of monthly NFT buyers for blockchain games is also on the rise (see chart below). so far,Most Blockchain Games Require Players to Own NFTsimage description

Above: Changes in the number of monthly NFT buyers of several major blockchain games.

2. Follow the money

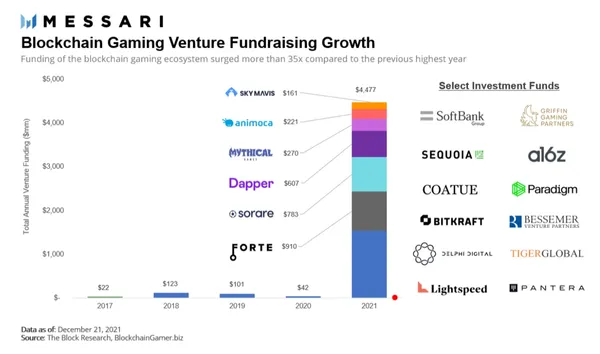

In addition to counting the number of wallets interacting with a blockchain game as an indicator of game adoption, another important metric to track is venture capital. Capital investment reflects many things: it reflects the interest of VC money in the industry; and to some extent, it reflects the ambitions of entrepreneurs in the field; existing resources. we need to analyzeChanges in the financing environment in the blockchain game field in the past year.

Not surprisingly, the VC funding metric further highlights the growth of the blockchain gaming space.image descriptionAs shown below:

Above: Growth in blockchain game venture funding since 2017.

The venture capital investment in the blockchain game field in 2021 is in stark contrast to previous years, with multiple companies raising more funds than previous years combined. Examples of this include Forte, a blockchain game development platform that works with numerous game studios. Perhaps notable in this data is the variety of products and services in this funding list: game studios, infrastructure/tools, and other components of the gaming stack, including NFT marketplaces and many L1 blockchains and L2 networks.

In addition to the amount raised, the source of funding has changed over the past year - VC funds focused on cryptocurrencies are no longer the only source of funding: over the past year, funds investing in this space include red Traditional tech funds like Sequoia Capital, Andreessen Horowitz (a16z) and Lightspeed Partners, as well as hedge funds with a proven track record in growth investing, notably Tiger Global and Coatue Management.

Going forward, these three VC funds (especially the latter two new entrants) should continue to bring new capital to the blockchain gaming ecosystem.

3. Developer Program

Additionally, a recent study of 157 developers in the US and UK found that 72% of respondents were considering integrating blockchain technology into their games, and 58% planned to do so within the next 12 months . At the same time, 47% of participants have already used NFTs in their games, which highlights the great interest on the part of game developers.

While game developers see new opportunities in it, it's important to reiterate that the technology behind these games is still in its infancy. Additionally, current challenges around blockchains, such as transaction costs, throughput speed, and scalability, limit the gameplay of blockchain games to turn-based, card-collecting games rather than AAA releases from high-budget studios Realistic and 3D graphics for level games.

07. Blockchain Game Case Study

In the following chapters, we will look at the development of three popular blockchain games, their models, and their impact on the blockchain gaming ecosystem.

1. Axie Infinity

As the most popular blockchain game to date, Axie Infinity has cumulatively generated more than $3.5 billion in its NFT marketplace. The game is similar to Pokemon: players own and breed NFT digital pets called Axies, which can be used to complete adventures (user versus environment) or fight other Axie pets in the Axie Infinity game ( user to user) and earn token rewards.

Successful battles will bring token rewards,These token rewards can be exchanged for real-world currency.Axie Infinity has catalyzed the global adoption of the "earn as you play" business model. An estimated 40% of the game's players are estimated to be in the Philippines alone, earning upwards of $500 a month from the game. The gameplay of Axie Infinity revolves around two crypto tokens: the Smooth Love Potions (SLP) token and the Axie Infinity Shard (AXS) token.

SLP tokens:SLP tokens are more widely used for practical purposes in the game and grant SLP holders the ability to breed new Axie pets. This breeding process involves using two existing Axie pets and burning SLP tokens to generate a new Axie pet. SLP tokens can be earned through regular gameplay, can be purchased on the secondary market, or can be obtained through promotions.

AXS tokens:AXS Token is the governance token of the Axie Infinity game. Those who own AXS tokens can stake them on the network to earn yield. AXS tokens are also the currency used in the game's NFT marketplace.

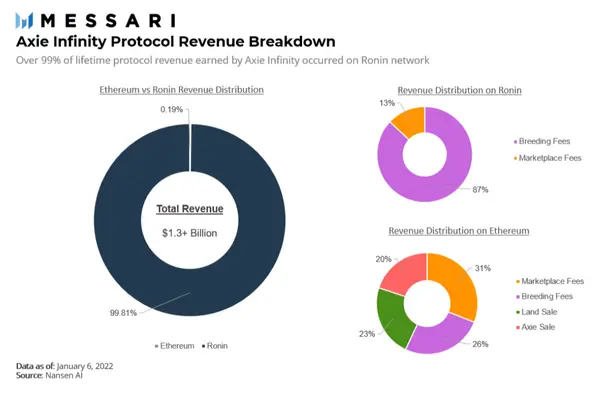

Axie Infinity’s protocol revenue comes from several fee mechanisms: the first fee mechanism is its NFT marketplace fee, this fee is a certain percentage of its NFT market transactions;Another major source of income is the breeding fee players pay when they breed new Axie pets in-game.There are also two smaller revenue streams including revenue from sales of in-game land and raw sales of first-generation Axie pets.

Overall, the protocol obtained from these four sourcesOver $1.3 billion in revenue, nearly all of which occurred after June 2021.The timing coincides with the launch of Sky Mavis, the studio behind the game, its own sidechain, Ronin, which should help reduce transaction costs for users and increase the game's popularity.

A breakdown of income seems to support this conclusion.More than 99% of cumulative revenue comes from activities on the Ronin Networkimage description

Above: Breakdown of Axie Infinity protocol revenue.

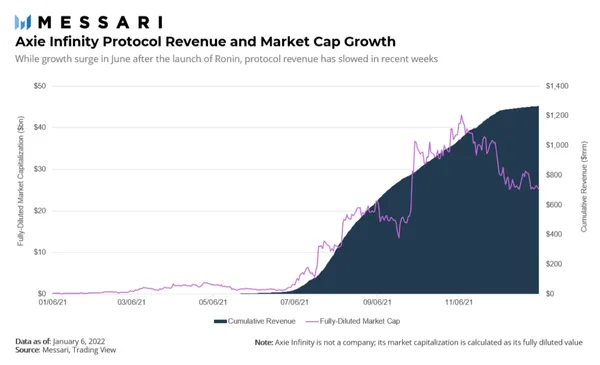

The chart below shows the agreement's revenue growth in the second half of 2021. Surprisingly, the protocol's revenue started to decline in the final weeks of 2021. Possible explanations include the recent devastation caused by Typhoon Rai in the Philippines (where 40% of users live), or shifting interest in other blockchain games with newer gameplay.

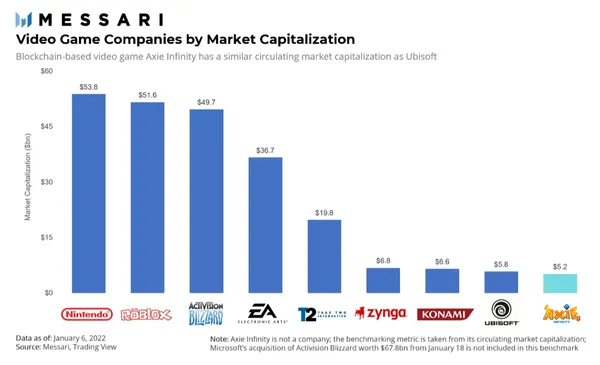

While Axie Infinity's floating market cap has fallen in recent weeks as revenue growth has slowed, rough benchmarks show the game is still comparable to many pure-play studios. It's worth noting that this approach compares a single game (i.e. Axie Infinity) to a game studio with multiple titles, further demonstrating just how big this game is.

image description

secondary title

2. Sorare

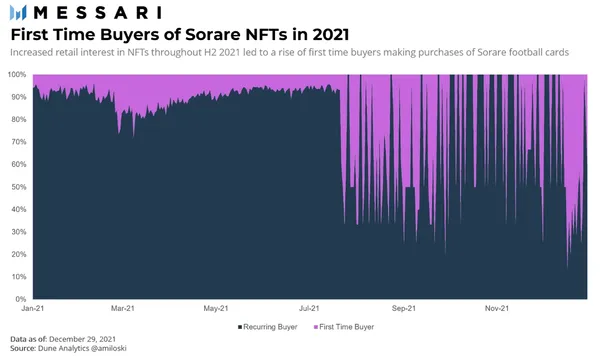

image description

Above: Sorare NFT's first-time buyers (purple part) and repeat buyers (black part) as a percentage of its total buyers since January 2021.

Sorare tracks real-world football statistics, rewarding players who hold NFT cards of high-level players. The nature of the game naturally appeals to a wide range of football fans. As the chart above shows, first-time buyers of Sorare NFTs will increase significantly in the second half of 2021.In December 2021, the monthly independent buyers of Sorare NFT exceeded 20,000 for the first time.What the data here needs to illustrate is that, unlike Axie Infinity, Sorare players do not need to purchase NFTs to start playing the game. This could mean that the total number of Sorare players exceeds the number of people making secondary NFT purchases.

secondary title

3. DeFi Kingdoms

Another blockchain game, DeFi Kingdoms, bears a resemblance to the popular web classic Runescape. Players of the latter may feel nostalgic for the game's virtual characters interacting with each other in a retro pixel art world. Unlike Axie Infinity or Sorare, the gameplay of DeFi Kingdoms does not revolve around collecting cards and using them to fight. on the contrary,The game incorporates heroes, quests, classes, and a wider range of actionable activities such as mining, gardening, farming, and fishing.The roadmap for this game is very ambitious. Its future gameplay will allow heroes to join guilds, engage in P2P battles, hatch pets, and more. Having heroes involved in these various quests increases the player's chances of amassing tradable resources on the blockchain marketplace.

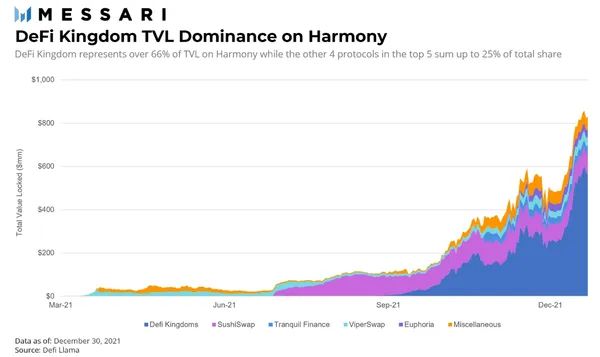

As its name suggests, DeFi Kingdoms incorporates gaming elements andDeFiimage description

Above: TVL (Total Locked Value) growth of the DeFi Kingdom protocol on the Harmony chain.

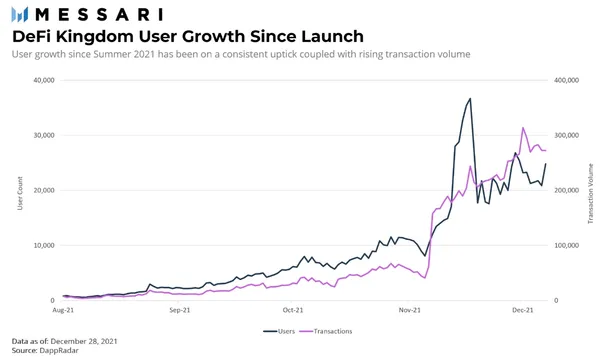

image description

Above: DeFi Kingdoms user growth since launch.

first level title

08. Metaverse

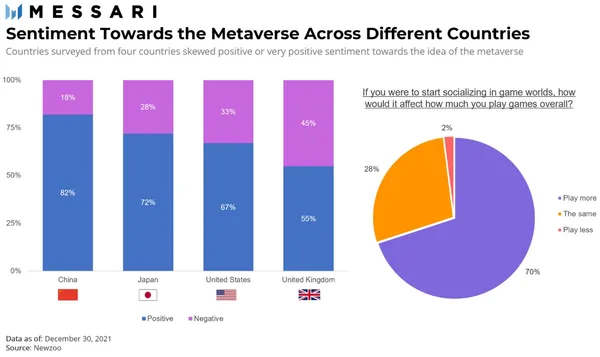

image description

The bar chart above shows the sentiment ratio of different countries towards the Metaverse (blue indicates positive sentiment, purple indicates negative sentiment)

The definition of the metaverse is still somewhat unclear, partly because the concept itself remains largely hypothetical. At its base, the Metaverse represents a collection of virtual worlds (including AR, VR, and 2D) in which we communicate with each other digitally. But as things stand, there are multiple virtual worlds co-existing, the ecosystem is fragmented, and the competition between these virtual worlds is fierce.

Whatever the ultimate form of the Metaverse, the opportunities for in-game integration are largely unexplored. The Metaverse broadens the scope of the game by unlocking new types of IP, experiences, and behaviors. An early example is Worldwide Webb, an interoperable massively multiplayer online role-playing game (MMORPG). Worldwide Webb allows users to import NFTs they own into the game as digital identities, whichsecondary title

dominance of the virtual world

Since Decentraland's ICO (Initial Coin Offering) in August 2017, virtual worlds have been considered a potential application of the Metaverse. These virtual worlds are designed as sandbox games (such as "Minecraft", "Roblox", etc.),Players can buy and build their own assets, and socialize with other players.

Currently, the top four metaverse virtual worlds areThe Sandbox, Decentraland, Somnium Spaces and Cryptovoxels, four virtual worlds that allow users to buy scarce digital land, many of which also use their own virtual currency (like the SAND token used by The Sandbox).

So far, some of these virtual worlds have gained fame for specific use cases. For example, Cryptovoxels users create 3D art studios, and Decentraland provides casinos and digital offices for various crypto companies.

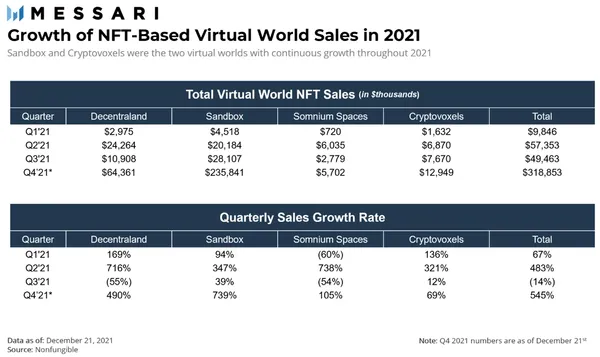

Virtual worlds have generated nearly $500 million in NFT sales to date(including NFT virtual land and in-game assets). In 2021, NFT sales in the virtual world will grow the fastest, generating more than $320 million in NFT sales. As shown below:

The Sandbox is far ahead of other virtual worlds with more than $235 million in NFT sales. Additionally, Decentraland and The Sandbox saw NFT sales increase by 490% and 739%, respectively, in Q4 2021.

As awareness of the Metaverse grows, virtual worlds experience increased speculation. At the end of the day, these apps are still in their infancy, still building content for players and trying to find their niche (eg social, gaming) among potential users.

first level title

09. Summary

Over the past year, it’s undeniable that blockchain gaming has experienced a watershed moment — a historic shift on which future development will depend. People’s perception of blockchain games has changed due to the success of games such as Axie Infinity, the explosion of NFT secondary sales, the broad growth of crypto users, and more specifically, the expansion of blockchain game users. In turn, this has facilitated further financing of various core infrastructures in the blockchain gaming space, as well as many new games and studios.

The metaverse tailwind also benefits the games industry, which accounts for a large portion of web activity today, and could be an important area of growth and user acquisition for companies established in the metaverse.

Blockchain ecosystems such as Ethereum are growing at an increasing pace, but scalability challenges and user experience issues remain. Still, there are many teams developing solutions for users and game developers to enhance the experience of building and playing blockchain games. While a common monetization model in blockchain games has yet to emerge, experiments around issuing NFTs, vertical marketplaces, in-game currencies, and other cryptoeconomic primitives still have a bright future.