A Comprehensive Interpretation of Axie Infinity (2): The Road to GameFi Community Revenue Reaching $15 Billion

Related Reading:

Related Reading:

Comprehensive Interpretation of Axie Infinity (1): How GameFi Breaks Tens of Millions of Players

Summary

Summary

This report explores GameFi with in-depth data analysis of Axie Infinity's reach, retention and revenue.

Using Covalent data, we analyzed over 686 million rows of on-chain Ronin data, giving you unique insights into Axie Infinity's player patterns and revenue metrics.

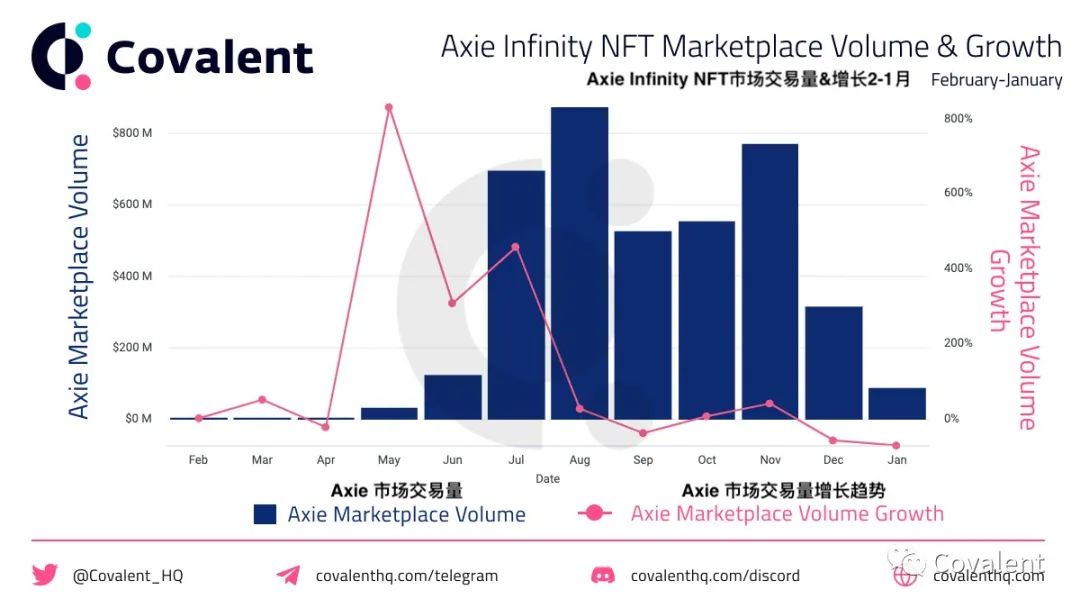

The NFT marketplace has facilitated over $4 billion in sales to over 1.5 million different wallets.

us

usThe previous report was"Axie Infinity - How GameFi will break the 10-million player mark"first level title

1. Why analyze Axie Infinity

Over the past 20 years, there have been three main phases in the way gaming has been monetized. First of all, it is represented by "Call of Duty", "Minecraft", "GTA", etc."paid game"type. followed by around"free game"earn while playing"earn while playing"(P2E), the popularity of this type of game brought about by Axie Infinity.

Despite innovations like this, the GameFi space will never reach its full potential without first understanding the data on user behavior. Deep, granular data on Ronin is extremely hard to find. However,Covalent APIProvides complete blockchain data for every transaction, game log, and value transfer on Ronin. Using this data, we looked at the 3 most important indicators of user behavior in the GameFi ecosystem.

Coverage - Growth of new players.

Retention rate - how many players the game retains over a period of time.

Revenue - How much money is captured by different parts of the ecosystem.

Quoting Covalent CEO Ganesh Swami:

"first level title

2. The internal balance of the Axie ecosystem

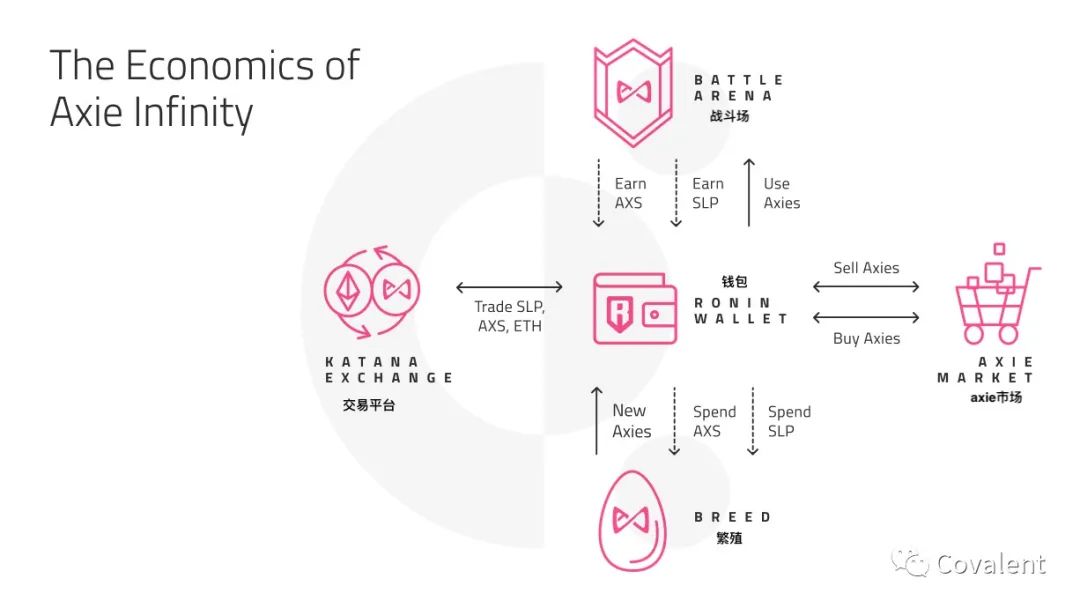

The view above gives a high-level breakdown of how Axie infinity maintains a value cycle within the ecosystem.

First, value must flow into the Ronin wallet (center in the image above), and this happens in two ways.

Bridge from Ethereum to Ronin (most common).

Ramp Network allows users to deposit directly to their Ronin wallet.

After users top up their wallets, they can buy and sell on the Axie marketplace. If a user wants to fight in the arena, they need to purchase at least 3 Axies. They can also trade or provide liquidity for SLP, AXS and WETH on Katana DEX.

Once players start fighting, they start earning SLP rewards which can only be redeemed every 2 weeks. During this time, if players demonstrate superior skills, they can rank up on the global leaderboard, earning AXS as a reward.

As shown above, these rewards (including SLP and AXS) are used to breed more Axies. SLPs (produced upon claiming) are burned during Axies breeding. AXS used during breeding is sent to the Axie treasury for future reward distribution.

first level title

3. Institutions' thirst for data on the chain

The data on the chain is"Penetrating noise"the best way to understand why institutional money chooses to allocate billions to"game to make money"The best way for this type of project.

Mark Weinstein (@warcmeinstein) from Mechanism Capital, the venture capital firm that recently raised a $100 million GameFi fund.

"With GameFi's real money, the importance of high-quality data analysis in gaming has never been more important. For example, we need high-quality player metrics so that guilds can better accommodate and compensate scholars. As an investor, it's also useful for us to assess the growth of real versus bot users. "

- Marc Weinstein, Mechanism Capital

Additionally, the Axie community is one of the most vibrant and interesting ecosystems on the market right now. The sad reality is that people cannot fully understand the ecosystems they love without granular analysis of blockchain data. Covalent's unique data architecture makes it the only product capable of creating this level of granularityRoninand the other 26 chains we index are required for analysis.

first level title

4. The median wallet has spent $867 on Axies

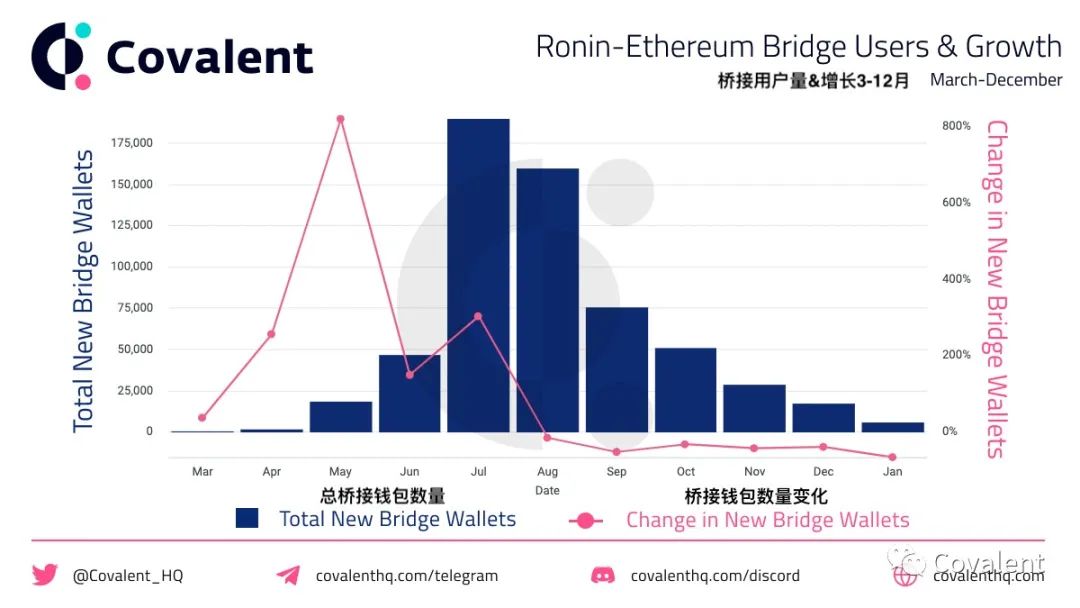

Before you can start playing, you have to fund a wallet and purchase three Axies. The most common way to fund a wallet is by using a Ronin-Ethereum bridge. As of now, 580,000 wallets have bridged over $9.8 billion worth of ETH, SLP, AXS, and USDC to Ronin. Instead, 300,000 different wallets have bridged $4.5 billion back to Ethereum. The average deposit transaction is $5k and the average withdrawal is $4.8k, but these figures are biased by whales and scholarship program managers. The median deposit is $820 and the median withdrawal is $137, which is more representative of the typical player.

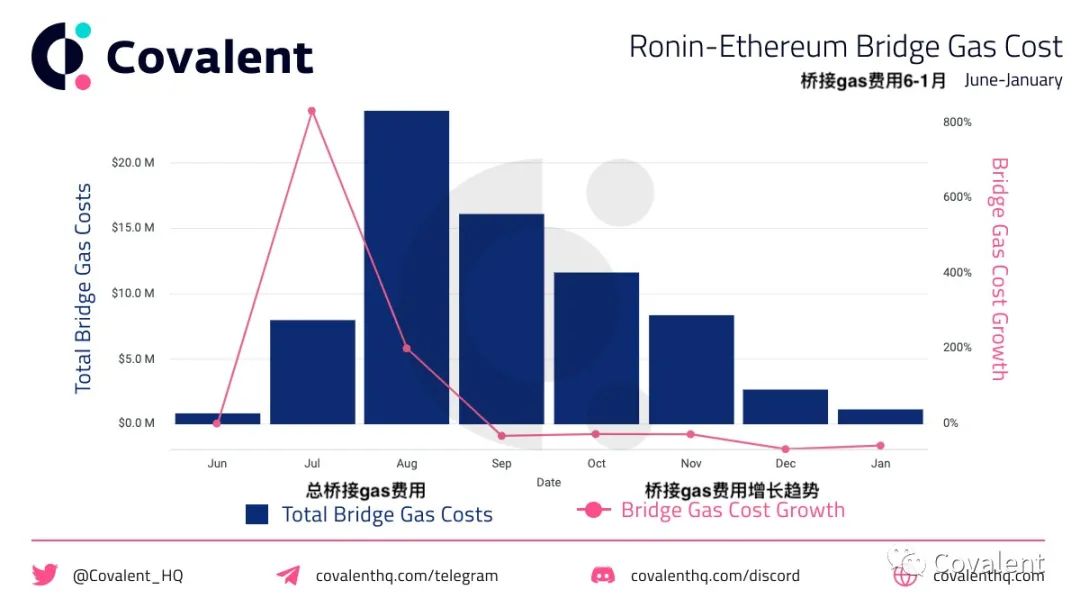

In addition to the money you need to invest in the bridge, you also need to pay gas fees on Ethereum. To date, more than $72 million has been spent on Ronin Bridge gas, averaging $25 per transaction. Gas generated due to bridging has been on a consistent decline since August, with December down 89% from its August high. This negative gas growth could indicate several things: positive growth of the scholarship program (which does not require you to bridge assets and buy Axies) or negative growth of new players - we discuss these possibilities in depth below.

Again, to play, you'll need to buy at least 3 Axies from the market. So far, over 7.3 million Axies have been bought/sold for a total of $39.9 billion. 1.45 million wallets bought Axie and 0.99 million wallets sold Axie. The highest value Axie sale so far was 300 ETH ($120k then, $950k now).

first level title

5. Players break even after 4-5 months

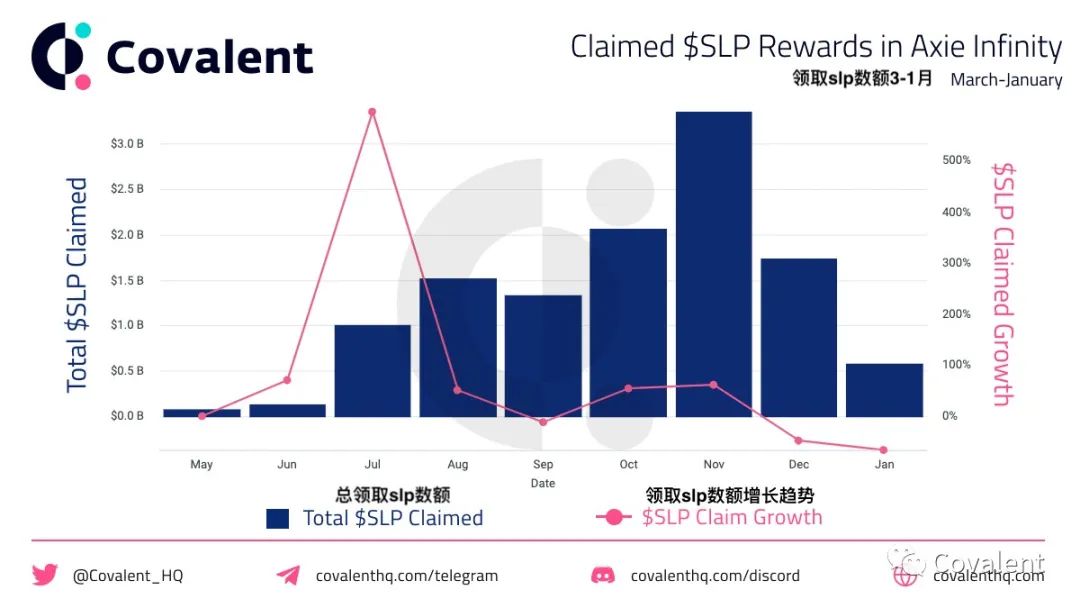

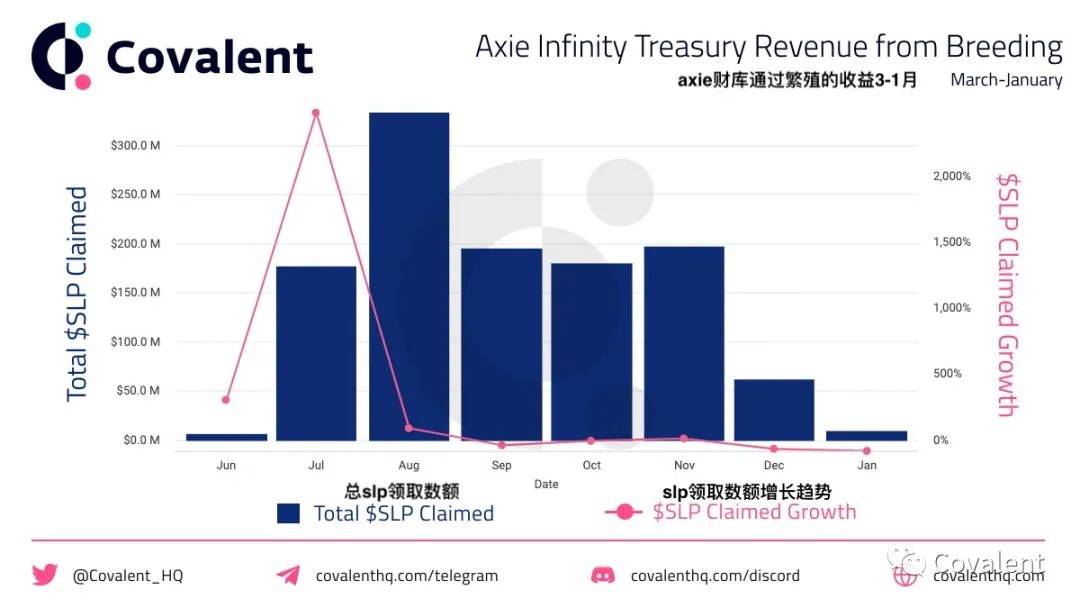

Let's take a look at how much money can be made by actually playing the game (excluding DeFi, NFT transactions and managing other players - this will be discussed in another article). Over the past 6 months, $11.3 billion in SLP has been claimed in 6.4 million wallets. That means about $192 per wallet per month. If we take the in-game cost of $867 per wallet from the previous section, the typical break-even time frame is about 4.5 months.

It is worth noting that the number of wallets is not necessarily directly proportional to the number of players, as one Ronin wallet can be linked to multiple Axie game accounts, so one Ronin wallet can support multiple players (this is how the scholarship program works) . That said, we'll still be able to see the total SLP displayed each month, and thus see the full picture of revenue being generated for players (even though we don't know exactly how many players there are).

To dig deeper into the contents of the scholarship program. We can look at Yield Guild Games (YGG) - one of the largest Axie Infinity scholarship programs. According to the YGG 2021 Year-End Review, by the end of 2021, YGG reached 10,000 scholars, generating $13.6 million in SLP revenue since the program started in April. According to the most recent YGG asset and funding update, they had 4,710 scholars in September, earning a total of $1.24 million through the game. That equates to $263 per user in September. According to some metrics we will discuss below, it is currently impossible for YGG academics to generate more income than this. Of this $263, 70% goes to academics, 20% to managers, and 10% to guilds. This means that the average academic earns about $184 per month, or $2,209 annualized. On the other hand, in September, the 20% share of 32 community managers equated to about $7,750 per leader!

first level title

6. Most of the bridged traffic is in the direction of Ronin

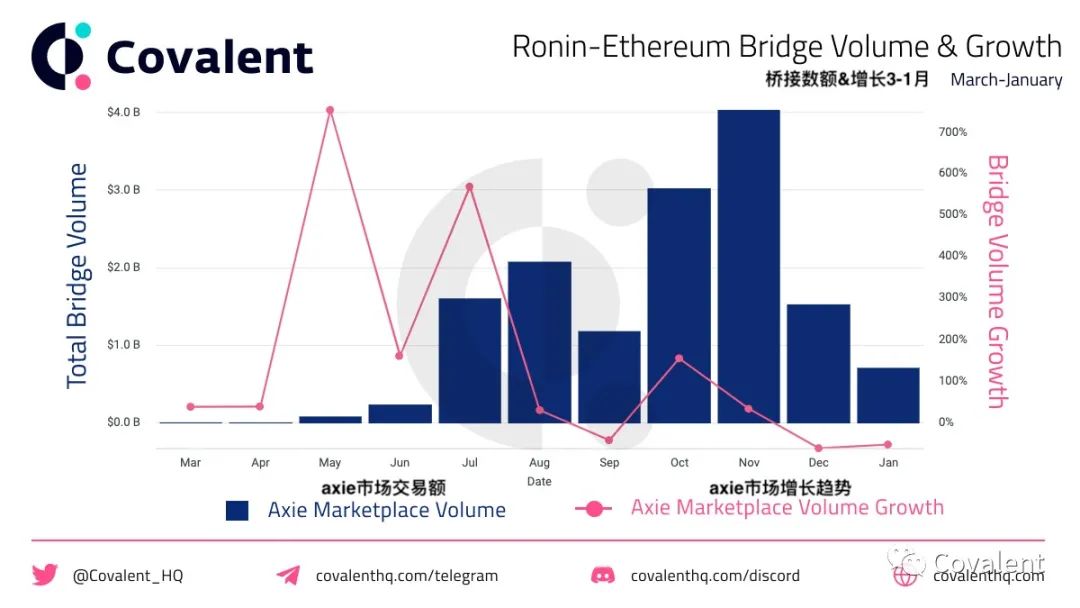

So is it too late to get in now? The short answer is no, it's not too late. In fact, now might be a better time than at the height of the hype. As mentioned above, the Ronin-Ethereum bridge is the main gateway into the ecosystem and points to new users bridging assets to Ronin or existing Ronin users profiting and transferring back to Ethereum.

Bridging volumes are currently in a decline phase, and bridging volumes (both into and from Ronin) have decreased significantly since their peak in November. Compared with November, December decreased by -59%. The peak daily volume was on November 5, 2021, at $38.6 million, and as of this writing, the average daily volume is down 90% from that high ($4.8 million). This shows that there is currently no major capital flow between Ronin and Ethereum - capital enters from July to November and mostly stays on Ronin.

first level title

7. Axie infinity maker earns $62 million in December amid changing farming fees

The final piece of the puzzle here is revenue for the game treasury and the developers of Sky Mavis. The treasury earns 0.5AXS per breeding and 0.05% of DEX transactions on Katana. That equates to the full $1.1 billion and December's $62 million. The value in December was 68% lower than the $196 million in the coffers in November. This decline in December was to be expected -- it doesn't indicate a 68% drop in nurturing fees. The cultivation fee was adjusted on December 7, and the AXS fee (about 80%) was cut in half. SLP fees have tripled, but still have not grown significantly in dollar terms due to low prices.

The team at Sky Mavis takes 4.5% of NFT sales on the market. The market charge equates to more than $180 million in revenue historically and $13.5 million in December. However, these incomes are very volatile, depending on how many players there are. As mentioned above, new user growth has declined significantly, and NFT revenue has also declined. Compared with the $35 million in revenue of the NFT market in November, Sky Mavis’s revenue in December fell by 59%.

first level title

Conclusions and implications

We look at the GameFi ecosystem through the lens of Axie Infinity, the largest blockchain game of 2021, and analyze over 686 million rows of on-chain Ronin data. Axie Infinity has nearly 6.5 million wallets claiming over $11.3 billion in SLP from the game in 2021. The NFT marketplace has facilitated over $4 billion in sales to over 1.5 million different wallets. And this transfer bridge has brought more than $5 billion in revenue to the Ronin ecosystem. The median wallet can break even after 4.5 months of play, earning $192 per month, and the total cost of building a team is $862.

While the overall numbers are staggering, the monthly numbers have dropped precipitously on all fronts since November. Since November, SLP claims are down 48%, NFT marketplace sales are down 59%, and bridge traffic is down 62%.

The Axie Infinity economy, like any economy, goes through cycles of growth and contraction, so short-term negative growth is understandable. The $11.3 billion in revenue earned by the community should exceed $15 billion by the end of March 2022, as long as the ecosystem recovers from its December slump. Axie demand is low, and Axie prices are correspondingly low, so now is a good time to build a team and learn what the game is all about.

To track your earnings, compare with others, or find some Axie strategies, check outCovalent API,it's hereQuery the Ronin chainany transaction or event.