Comprehensive Interpretation of Axie Infinity (1): How GameFi Breaks Tens of Millions of Players

Related Reading:

Related Reading:

Axie Infinity is about to reach 10 million players, arguably one of the hottest blockchain applications today. We're going to be writing a 4-part series around the explosive growth of Axie Infinity. This first part is a cohort analysis focusing on Axie Infinity's massive player growth and retention, in contrast to the low usage of some features in the game such as breeding. All analyzes are derived fromCovalentIntroduction

Introduction

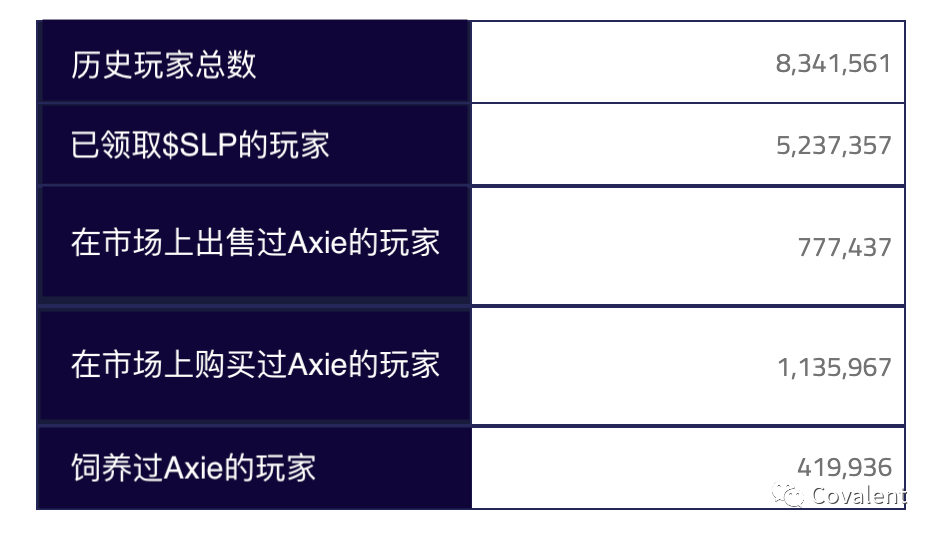

Axie Infinity is by far the most popular blockchain game with over 8.3 million historical players and over 1 million daily active players. The game started on the Ethereum blockchain and was later moved to a gas-free chain made specifically for the game calledRonin. With Covalent, we can analyze the data of both chains and see the full evolution of Axie Infinity, but let’s focus our analysis on the recent history and the explosive growth of games driven by the Ronin chain.

This analysis will revolve around players in each of the five categories shown in the table below. We'll look at the pace of growth, compare new versus existing users, and examine month-to-month player retention in each category.

Here are some facts that can serve as a foreshadowing.

If it continues to grow at the three-month average, Axie infinity will surpass 10 million historical players in December.

Player retention is very high, with almost 75% of players returning within the second month of joining the game (in the past 3 months).

More than 62% of players have claimed rewards from the game.

Only 14% of players have ever bought an Axie, and 9% have sold it.

Less than 5% of players have ever raised Axies.

first level title

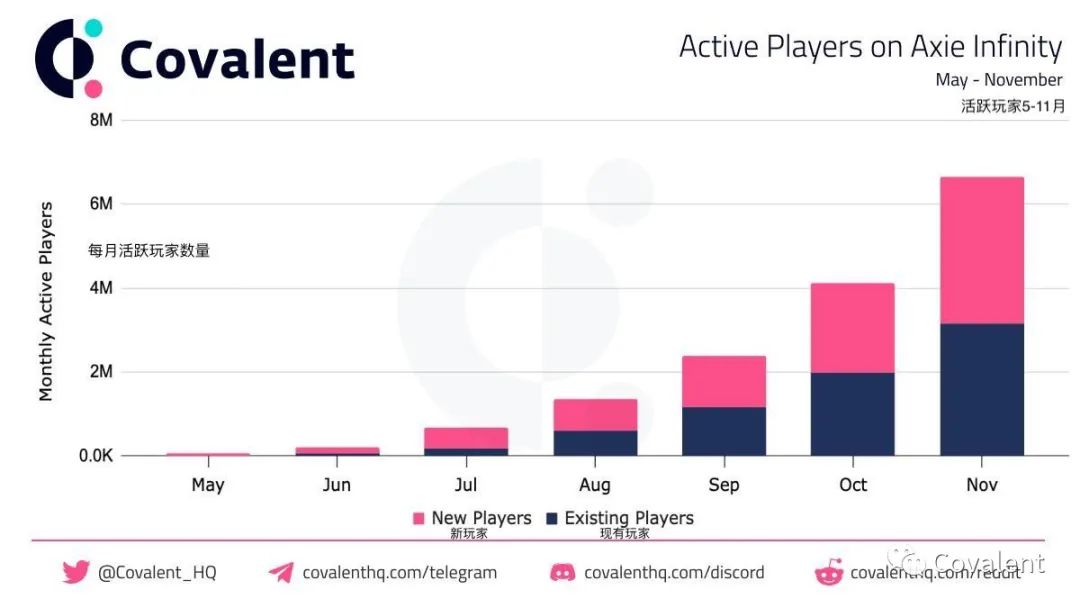

1. Active Players

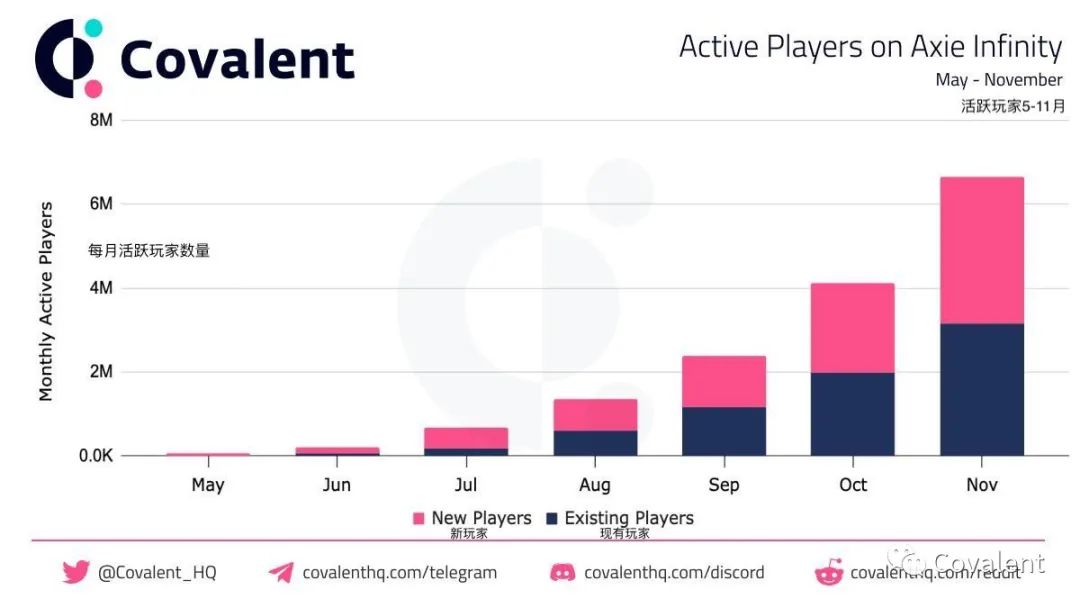

On November 13, 2021, Axie's daily active players exceeded 1 million for the first time, and its monthly active players also exceeded 5 million. This makes Axie infinity similar in size to popular sports games like FIFA 22 and Madden 22.

November ended with 6.6 million players, and if growth continues at the three-month average, December will well pass the 10 million player mark. The table below shows the total number of players and the number of new players, and their respective growth rates since the launch of the Ronin Chain.

The average new player growth rate over the past 3 months is 74%, and if this continues through December, we will see over 6.5 million new players this month. Total player growth over the past 3 months is 70%, and if this month continues, Axie will have 11.3 million players per month.

The chart below shows a visual representation of exponential growth. More than 50% of monthly users are new users, while existing users are also growing month-on-month. Let's move on to the next section and explore player retention.

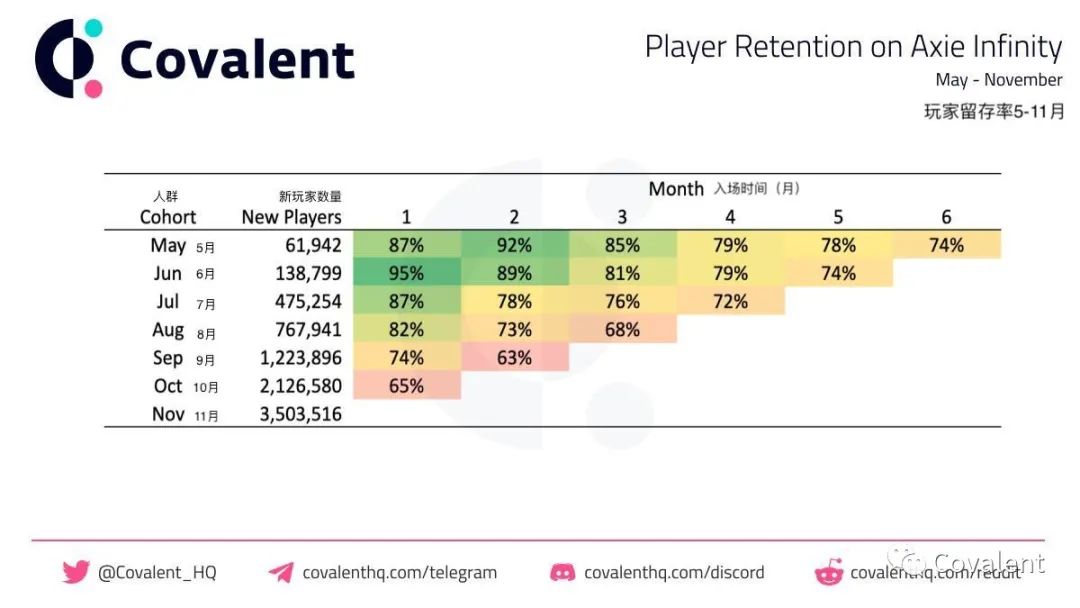

Explosive growth is not sustainable without an equally high player retention rate. The table below divides new users into cohorts based on when they first join the game, and tracks their cohorts over the course of a few months after they start the game.

With an average retention rate of 82% in the first month, nearly 80% of new users in May, June and July were still playing in October -- and more than 65% of them continued to play in November. The fact that the monthly retention rate is relatively stable means that Axie has been successful in acquiring new users while also keeping existing users active and engaged - suggesting that the game has a lot of potential for future growth.

first level title

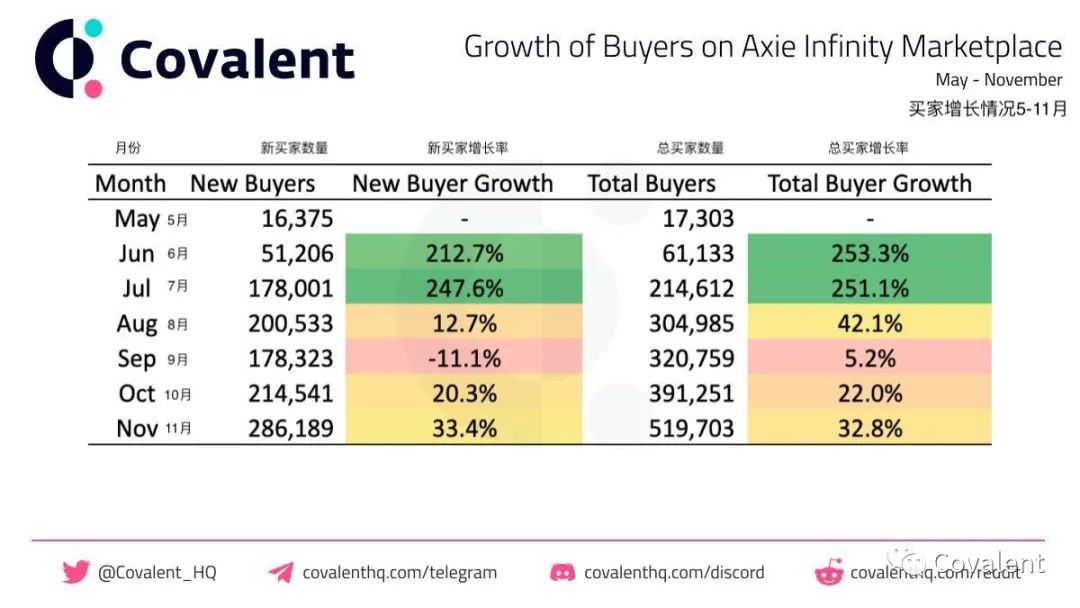

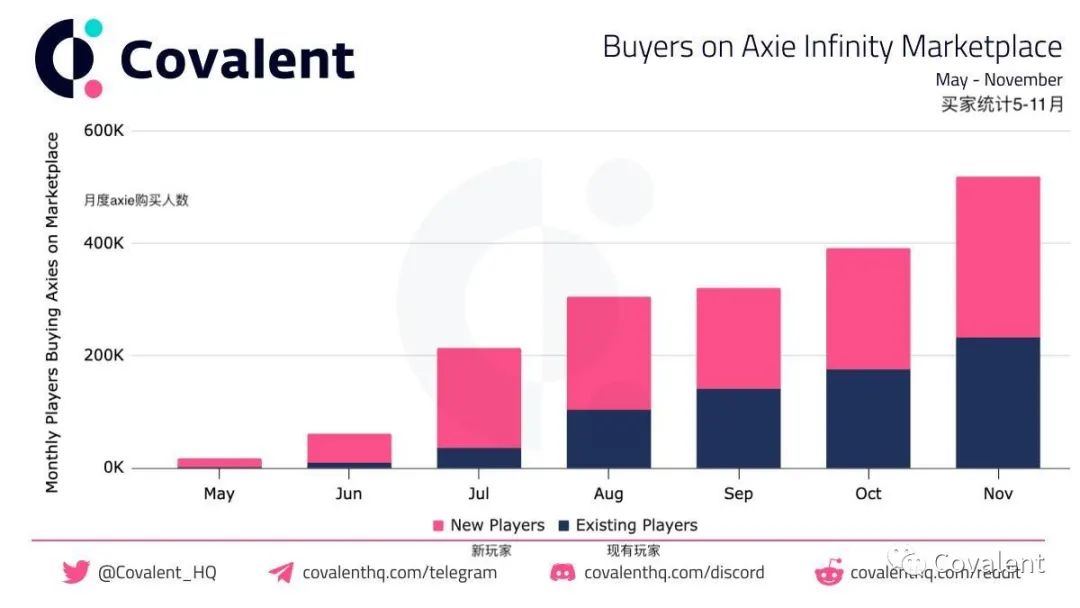

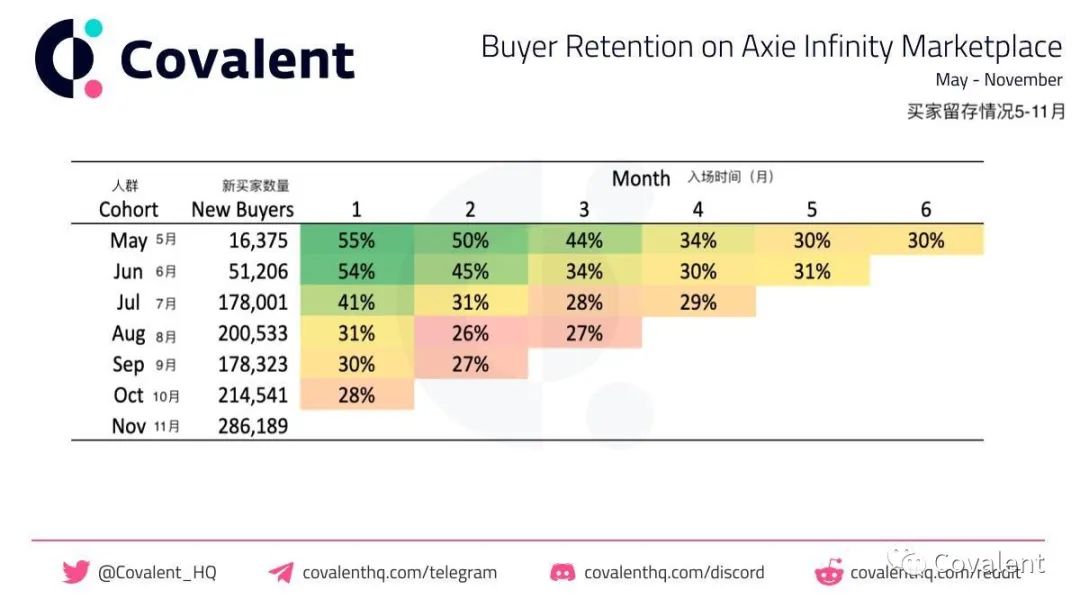

2. Players who have purchased Axie in the market

To play this game, you need to buy (or borrow) 3 Axies. Buying can be a financial strain for some, so it's always been popular to have scholarship schemes where you'll share the proceeds with players who loan you your Axie. The table below shows that the number of total buyers is low and the growth rate is erratic (sometimes negative).

Notable in the table above is the negative growth in new Axie buyers in September. That's in stark contrast to the game's more than 1 million new players in September. But in November, the game appeared to break through the buyer stagnation of previous months, with a strong recovery in both new and existing Axie buyer growth.

However, about 50% of traffic in November was from previous buyers in each month since September. This also means that the churn rate of new users is high. Let’s dig into the buyer retention analysis below.

Looking at the first batch of players in May, among the same players, the buyer churn rate in the first month is higher than the churn rate in the sixth month. That said, the first wave of players still has the highest Axie buyer retention.

The growing number of players and small number of buyers suggests that demand for Axies may be stagnant due to the amount available through the scholarship scheme. This suggests that an early batch may have purchased a large amount of Axies, which they are now lending to other players for $SLP.

first level title

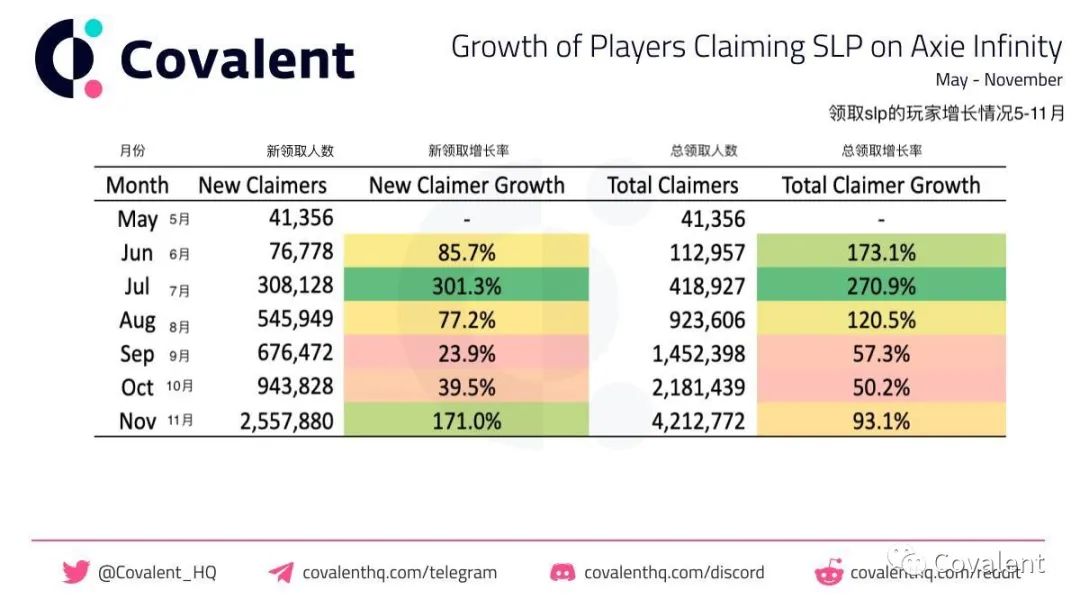

3. Players who have received $SLP

The main feature of Axie infinity is the money-making nature of its games, and in this section we'll explore how many players are making money. In another report we'll dig into who's earning money and how much each earns, but for now we're going to explore how many people are making money for the first time and how many continue after a few months make money.

Growth in players applying for $SLP had been slowing since July -- until November broke the trend in spectacular fashion. The previous drop was troubling, as player growth has remained more or less steady over the past few months. This means that the number of players has increased, but the number of players applying for SLP has not increased proportionally - so a smaller percentage of the total number of players claiming rewards each month. November reversed that trend, with a 171% increase in players applying for SLP - a good sign for the P2E side of the game.

In previous months, more than 50% of players who applied for SLP were existing players - November also broke this trend.

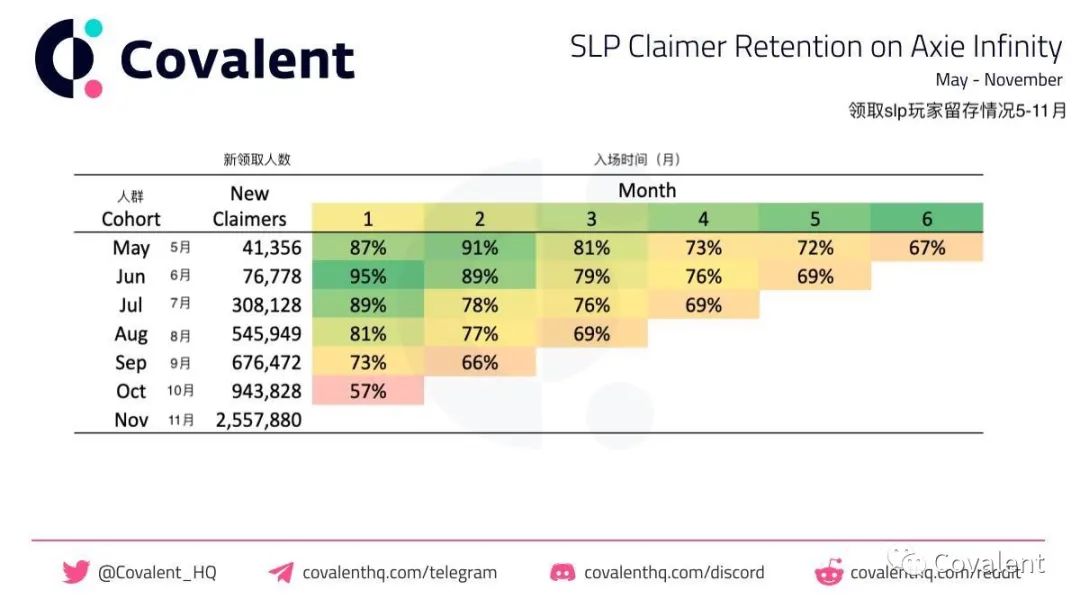

If the first few months continue, we'll start to see the"rich get richer"Phenomenon. A breakout increase in new players applying for $SLP in November is a promising sign of reversing this trend. But we need to look at the retention of this new batch of players again next month.

For example, players in October had the lowest claim retention rate among players of any time period - meaning that only 57% of players who claimed $SLP in October also claimed $SLP in November.

The table below groups players who claim $SLP by the month they first claim $SLP, and tracks whether they continue to claim rewards in subsequent months.

Players in November broke the trend of new users claiming $SLP, but players in October also broke the trend of retention rates above 70%. Due to explosive growth, a drop in retention is to be expected, but it’s not ideal. We will dig into the distribution of wealth related to this retention rate in the next article.

success"success"first level title

4. Players who have raised Axie

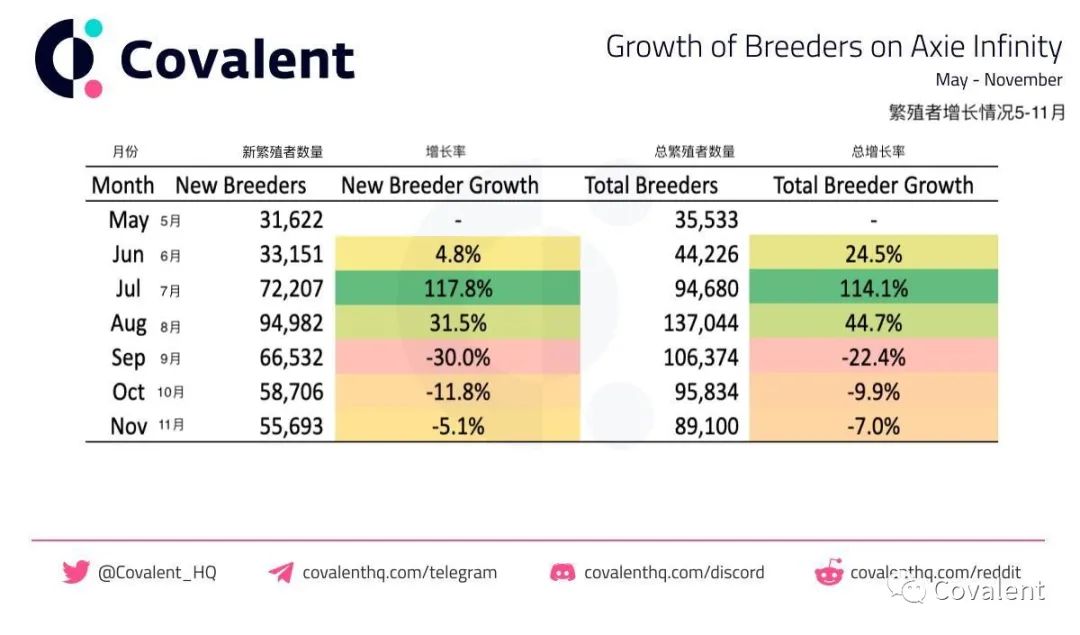

Another way to get more Axies is through breeding. This requires two Axies, and spends an increasing amount of $SLP based on how many times each Axie has been bred before, and one $AXS token. The benefits of breeding are maximized when the prices of $SLP and $AXS are low and the prices of Axies are high. Currently, the price of Axies is high, $SLP is low, and $AXS is high. This is reflected in the decrease in breeders since August and the negative growth shown in the table below.

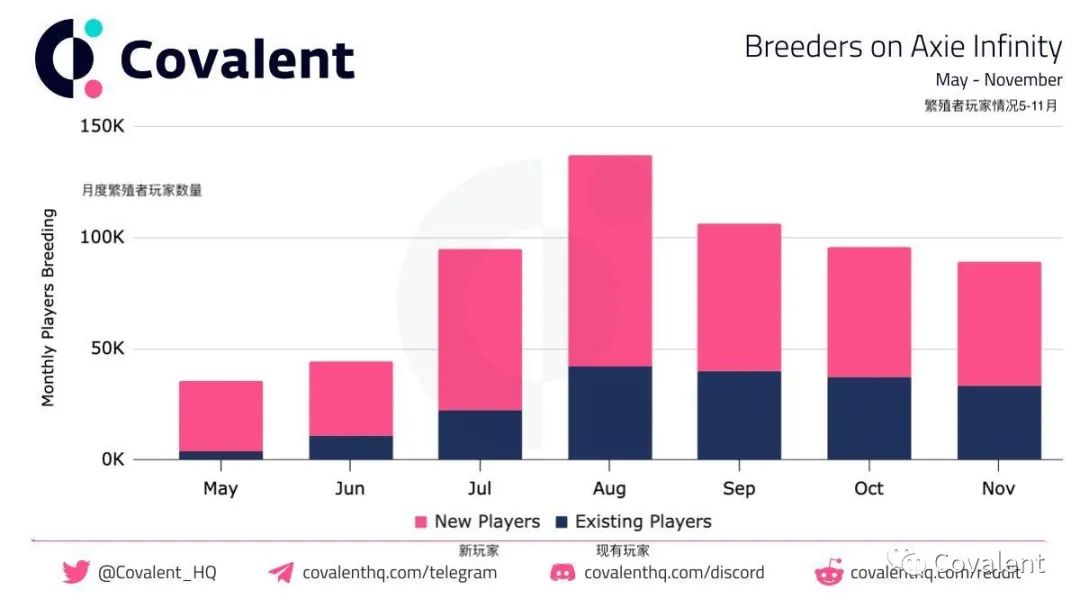

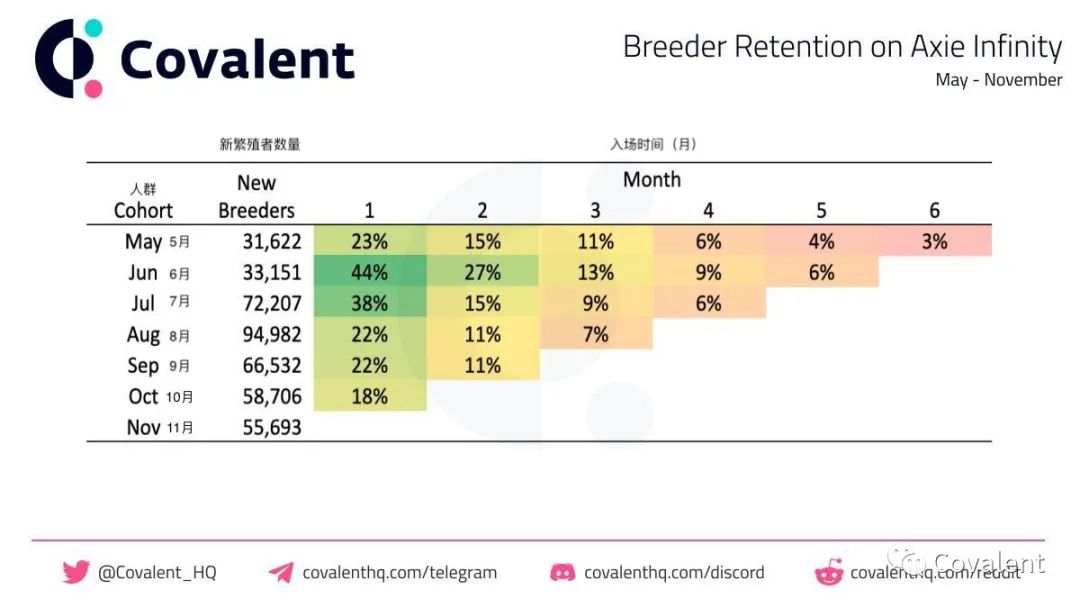

Not only is the total number of breeders shrinking month by month, but the number of existing breeders is also shrinking - meaning that no matter what level of experience anyone has at the moment, there is no way to make a profit. With declining growth rates and fewer existing breeders, the retention rates shown in the next section are necessarily low.

Breeders had the lowest retention rates of all activities. Only 4% of players in May were breeders who bred Axies in October, although 78% of players in that demographic were still playing in October.

Conclusions and implications

Conclusions and implications

Players are joining Axie infinity at an incredible rate and the number continues to increase every month. The game has averaged 65% more new players than it did last month, and about 81% of those players will stay into the second month, and about 70% will continue indefinitely. If this continues, Axie Infinity will surpass 11 million players in December.

But digging deeper, we found that not many players were buying or breeding Axies, which raised concerns about sustainability. This means that new players may be joining through scholarship programs that are controlled by existing players. Without ownership, we should see churn start to rise and the price of Axies may start to drop as a result. If this leads to an increase in first-time Axie owners, then growth and retention should continue, but if this decline is bought up by existing players and we don't see new buyers entering the market, then the game has the potential to be high net worth players dominate and slow growth.

While the game is played to make money, it seems to be very orderly. Over 75% of players have earned monthly since joining the game, which means that if a player reaches the point where they collect $SLP, then they are likely to keep playing and keep making money. However, given the negative growth and high churn rates of these campaigns, it seems unprofitable to make money by breeding and selling Axies.