An article to understand the $40 billion NFT market: What are NFT enthusiasts actually buying?

Original translation: Block unicorn

Original translation: Block unicorn

However,

However,In 2021, people traded over $40 billion worth of NFTs.

Why is it so crazy? NFTs are actually nothing. When you buy an NFT, you get a unique encrypted token with no intrinsic value. Of course, NFTs often represent nominal "ownership" of digital artwork. But NFT owners generally don't "own" the works represented by NFTs in the traditional sense. NFTs rarely convey copyright, so most NFT owners don't really own anything other than their NFT and whatever meaning people give it.

NFTs are nonsense, why would anyone pay anything to own the equivalent of a cryptographic receipt for a digital work of art that is freely available to the public, let alone millions of dollars? Sure, a fool is born every minute, but fools expect To the Moon, not IOUs. After all, George C. Parker was selling the Brooklyn Bridge, not the Hess Triangle.

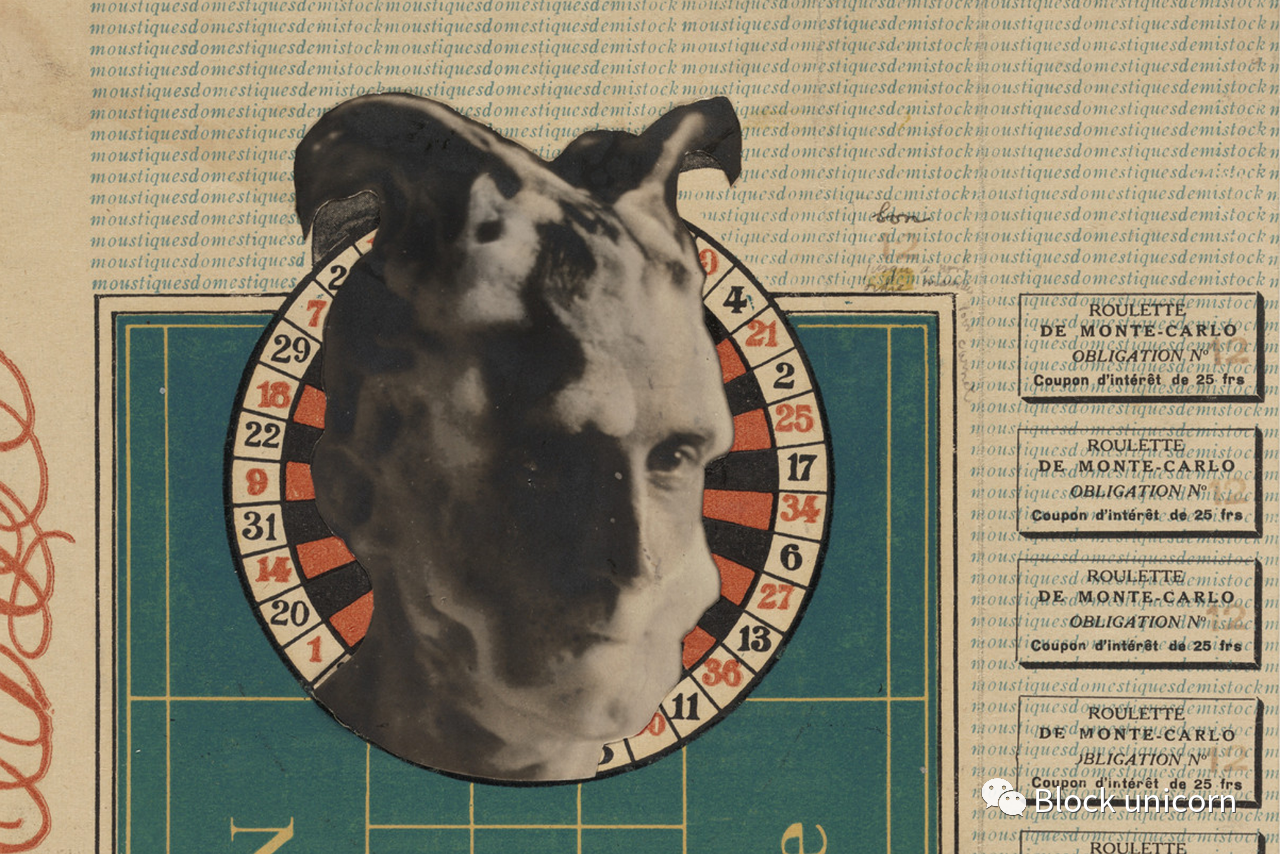

image description

Maurizio Cattelan, Comedian, 2019

Not sure why everyone is so surprised and confused by the emergence of the NFT market or its rapid growth, I don't feel that way. The NFT market is exactly like any other financial market, it just looks different because we haven't rationalized it yet. If the NFT market persists — and there’s no guarantee it will — everyone will end up taking it for granted, just as they have done with other financial markets. Unless, just maybe, get people asking what these NFT marketplaces are for, what these marketplaces are worth, and whether these marketplaces have value.

The NFT market is ridiculous, so what?The market doesn't have to be meaningful to be functional, after all, the NFT market is essentially the same as the traditional art market.The NFT of a work represents the ownership of the work, and the value of the NFT depends on how much people value the work. Or more precisely, the value of an NFT depends on how much people value "ownership" of a work, whatever that means.

The traditional art market works the same way, of course if you buy a painting or sculpture you get the painting or sculpture, but that doesn't matter.The art market doesn't value the objects you own, it values what the objects represent.What you're really buying is an entry in an artist's catalog, and from an art market perspective, a painting or sculpture is just a dirty canvas or lump of rock that represents a catalog entry. Paintings and sculptures have no intrinsic market value, their value is solely determined by the value of the catalog entry they represent. Of course, if a painting or sculpture is damaged or destroyed, it may affect the value of the catalog. But this is only a function of artistic metamorphosis, intangible catalog entries concretized into tangible marks.

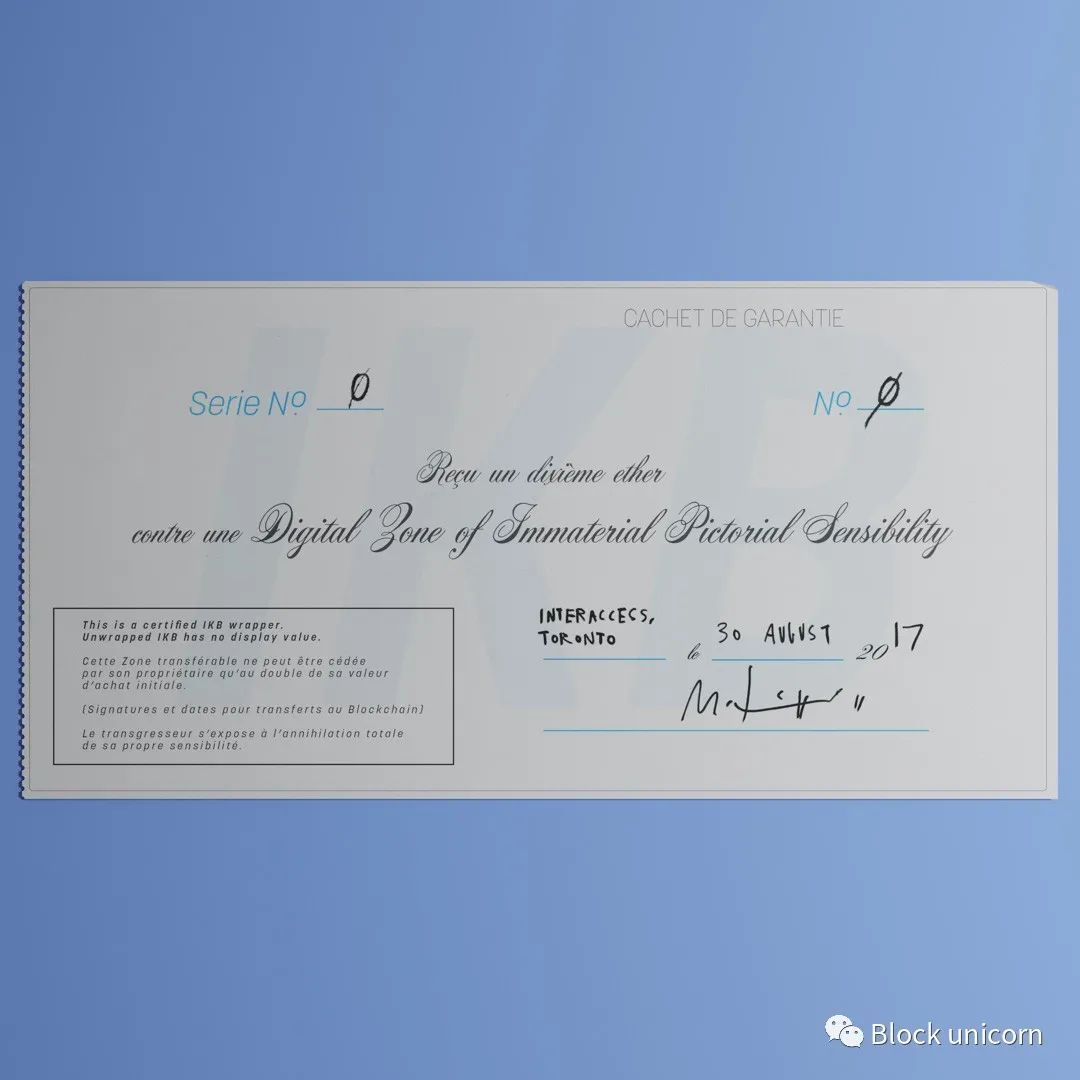

image description

Mitchell Chan, Digital Areas of Immaterial Painting Sensibility, 2017

So, is it unreasonable for NFT collectors to value encrypted tokens that represent ownership of artworks? Yes. But it is also unreasonable for art collectors to value paintings and sculptures that represent ownership of works of art. And it's unreasonable in exactly the same way. The problem is, art is worthless unless people agree that it has value. Problem solved, people do agree that art has value. In fact, sometimes they think it's worth it.

Often, valuable art comes in the form of painting and sculpture. But recently, it started to take the form of NFT, what's the difference? Not one is different.The NFT market looks ridiculous just because it's new, the traditional art market is just as ridiculous, we're just getting used to it.In fact, we often use the market price of an artwork as a heuristic for quality. Everyone wants to see the Mona Lisa because it is considered the most valuable painting in the world. But when we look at the Mona Lisa, we see an entry in Leonardo's complete catalog. It's a conundrum that by making art valuable, we keep people from seeing it even as we encourage people to create it.

NFTs are inevitable. After all, for decades,The art market has been trying to free itself from tangible objects, all it needs is a reasonable medium.

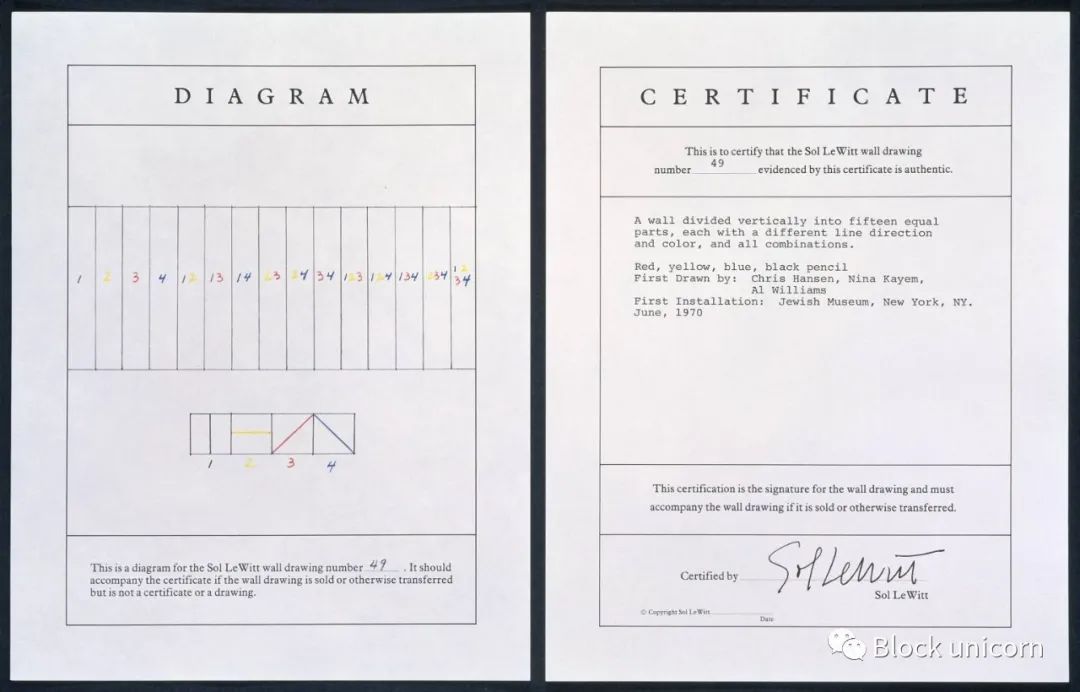

image description

Sol LeWitt, Mural #49, 1970

Unfortunately, the concept art fell through. The problem is that collectors still want to show off tangible items. Clients and guests are more impressed by a Warhol on a wall or a Picasso on a pedestal than a LeWitt in a drawer. Even conceptual artists have made concessions to the market, allowing collectors to create physical manifestations of what they call conceptual art. Does the painting on the wall ignore the concept it represents? Who knows, but it's definitely an easier sell.

NFT solves the conceptual art problem by creating a new market. First, they appeal to collectors who value digital art for its own sake and don't care (or even want) the physical object. Second, they gamify the art market by enabling people to buy and sell NFTs in a large, automated, and transparent online marketplace. Apparently, that's all there is to it. Before NFTs existed, could people sell ownership of digital artwork? certainly! In fact, they did, or at least they tried to. But almost no one was interested. NFTs don't change the nature of the market, they just lower transaction costs. But more often than not, it's the most important market innovations. You don't have to do something new, you just have to do it better.

OK, but wait a minute. Most NFTs don't look like works of art. After all, the art market trades Leonardo and Michelangelo, but the NFT market trades CryptoPunks and Bored Apes. Of course, you can't equate the two, or even compare them. why not? The art market doesn't care what people value, it will do anything. If collectors need old paintings by masters, the market will provide them. If they want giant balloon dogs, that's fine too. Christie's is more than happy to sell Beeple's NFT for $69 million. Who cares how it looks if people are willing to buy it. If collectors want NFTs, artists will make NFTs, galleries will sell them, no problem. If collectors wanted video game sprites and doodle-inspired cartoons, they got them. The art market doesn't care, what it's doing is selling, it doesn't really care what it's selling, as long as it convinces collectors to buy. Anyone who tells you otherwise is either a liar or a fool.

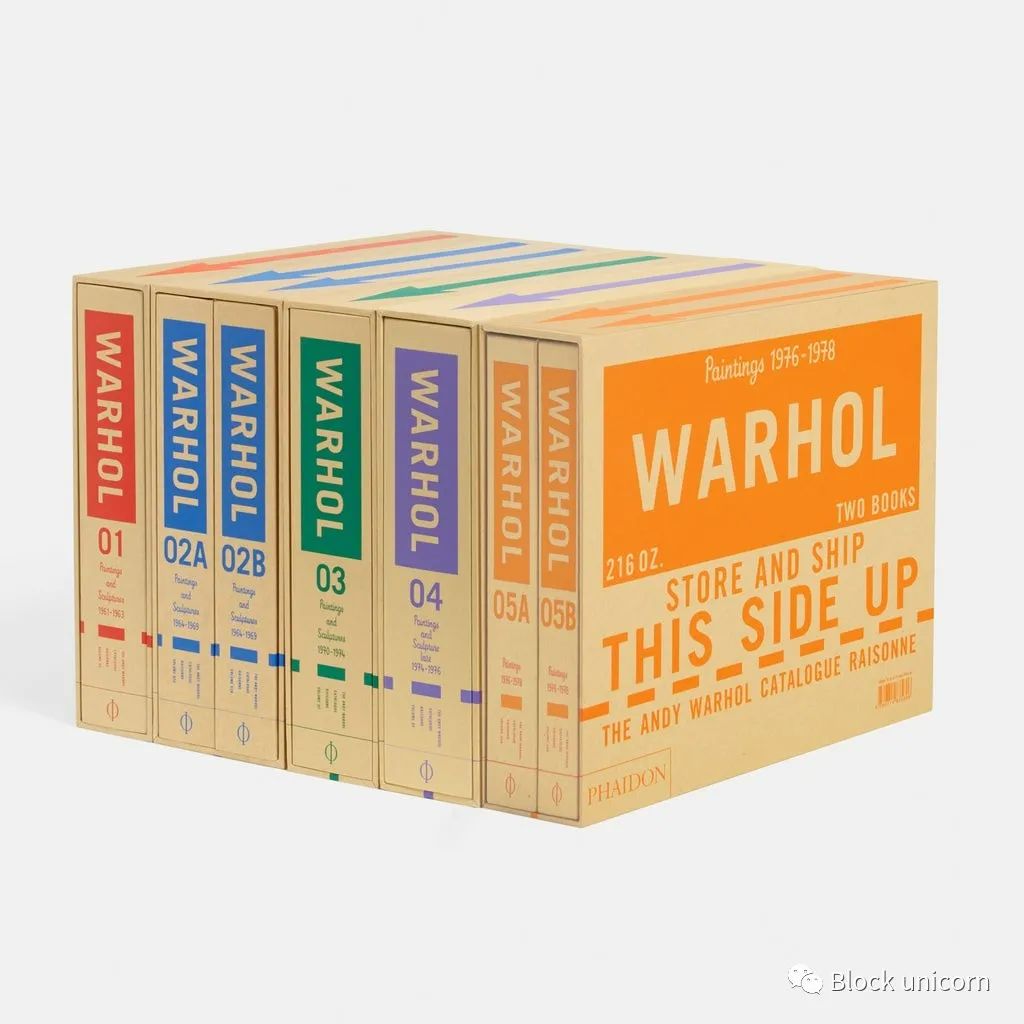

andy warhol

andy warhol

Maybe it's all a house of cards ready to collapse. I have no idea. The art market has been around for a while, and it looks good. In fact, most people seem to accept the face value that the art world places on artworks, even using it as a proxy for quality. So why not? If price information is communicated, then why shouldn't it be communicated about the value of art, or at least a consensus assessment of it, to the point where the public even cares.

Likewise, why wouldn't the price of Punks or Apes convey the same message? If the market says it has value because people like it, who am I to argue? Maybe that's the whole point of art having value, at least in the sense that the market cares.

Really, how is this different from any other abstract market? We assume that securities reflect the intrinsic value of the business. Thus, the stock market is like a computer that consumes all public information about businesses and produces prices that reflect the sum of this information. We've believed it for a long time. Is there any reason to think this is true? It's looking less and less believable.

Tell me, why is GameStop stock worth $140? It currently has no real business and no coherent plan for doing so in the future. Why is Trump's media SPAC worth hundreds of millions of dollars? It never does anything, nor does it explain what it will do. But these are simple examples. This incoherence is more pervasive. Why is Tesla stock worth over $1,000? It seems like a decent, if odd, company. But the stock price is ridiculous and has absolutely nothing to do with its actual business. Even more troubling, the same goes for companies like Google, Facebook, and Amazon. We can tell ourselves that the stock market is processing information. But what information? It doesn't appear to be information about the companies, but rather about what they are and what the future might mean. In other words, it looks very much like a semiotic market, adjacent to commercial reality, reflected only through glass, darkly. Maybe people are just investing in the future of the market,

If so, is the NFT market really that unreliable? People are investing in CryptoPunks and Boring Apes because everyone else is. Or Picasso and Warhol, or Koons and Basquiat, if you will. The point is, the market exists, the money is available, people want to invest in something, and maybe it doesn't matter how much the market is worth, as long as investors are willing to take whatever the market says. If you call some NFT a "blue chip" enough times, maybe it will. After all, it applies to painting and sculpture, and it seems to apply to securities as well.

Maybe the market is always looking for new products right now, maybe the growth of NFTs shows that it has found a market for explosive growth. For better or worse, we'll find out sooner or later.