"Time": How to understand the virtual real estate gold rush?

Author: Raisa Bruner

Original source: "Time Magazine"

Chris Adamo believes that he has come too late when it comes to investing in NFTs. He only collected the first NFT in the summer of 2021. But when it came to buying virtual real estate in the metaverse, Adamo was early. Eight months ago, the Miami-based venture capitalist and a group of partners calling themselves MetaCollective DAO purchased 23 parcels in The Sandbox, a blockchain-based virtual world, through a virtual real estate agent, starting at $1 ETH (~$3000). Recently, a real estate in the virtual world even sold for a high price of 42 ETH, which is about 130,000 US dollars.

image description

Above: MetaCollective DAO tweeted that the 23 parcels they purchased at The Sandbox are near BYAC

"It's like New York City in The Sandbox. It's like the Lower East Side or SoHo right now," Adamo said.

If the Metaverse is meant to encompass everything that exists virtually, from digital art to virtual worlds, then the virtual real estate that is being snapped up, often presented as NFTs, can be seen as a Metaverse investment. Currently, includingThe Sanbox、Decentraland、Cryptovoxels、Earth2、Nifty Island、Superworld、Wilder WorldEach virtual world offers users something different: ultra-realistic graphics, game selection, a specific type of early user community, etc. For example, the famous American rapper Snoop Dogg (Snoop Dogg) has made a "home" for himself in The Sandbox; Paris Hilton (American actor) has an island in Roblox.

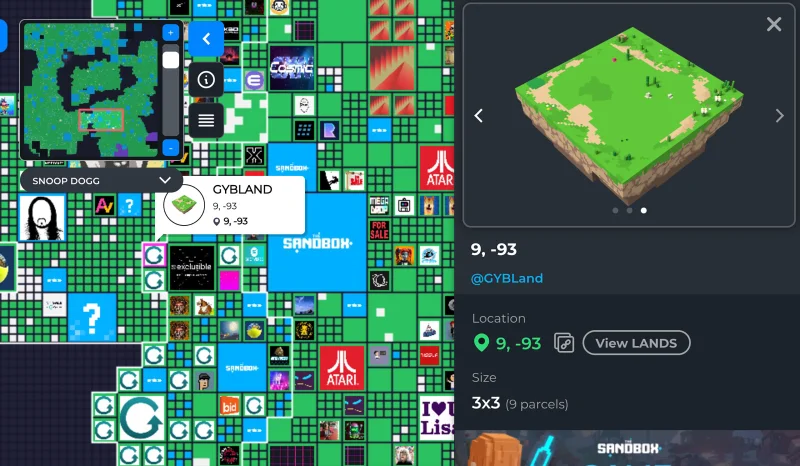

image description

Above: The plot of The Sanbox virtual world

MetaCollective has big plans for their blank lot. Drew Austin is managing partner of venture capital firm RedBeard Ventures and principal of MetaCollective. It's all about developing this futuristic corner of the internet into a virtual learning center or "university," he argues. He envisions virtual classrooms, dorms that users can rent, and a full social experience. “In this new digital world, we can recreate the educational digital experience,” he says. While none of these have yet been built or designed, real money has been invested.

One way to look at the act of buying virtual real estate is that it's like buying a domain name, or getting a head start on a good social media username. If email was our "home" in Web 1, and social platforms (like Facebook or Instagram pages) were our "home" in Web 2, then personal property in the form of virtual real estate may be our "home" in Web 2. "Home" in 3. The difference is that instead of relying on a provider or platform to design, manage and control the user experience, virtual estate in Web 3Something you - the end user - can build yourself. For brands, this could mean being more interactive and active than their current digital presence; for individuals, it could mean earning income by playing games or selling products.

Andrew Steinwold, managing partner of metaverse investment fund Sfermion, calls real estate in virtual worlds "infinite optionality", breaking the limits of our personal profiles and pages in Web2. A whole industry of virtual world developers has emerged. "One of the exciting and fascinating things about the Metaverse is that it's created by people, right?said MetaCollective member Jessica Peltz Zatulove.but,”

but,It's all speculation or speculation right now. The biggest winners, at least for now, are the platforms and developers launching these virtual worlds, who are raking in investments from early buyers.For example, Animoca Brands, the company behind The Sandbox, recently reported that the company is now valued at $5 billion, up from $2 billion in 2021. Roblox, on the other hand, is a more established gaming universe, listing on the New York Stock Exchange in March 2021 with a valuation of $42 billion. A research report predicts that virtual gaming worlds alone could be worth $400 billion by 2025, while the broader metaverse industry will be worth more than $1 trillion.

Many early buyers of virtual real estate were dual-investing — both investing in the platforms themselves and buying and developing new virtual land, so their bullishness was ultimately selfish. For example, Andrew Steinwold's fund Sfermion dabbles in both platform investing and virtual real estate; Drew Austin manages a fund that invests in five different virtual worlds.

The technology is also in its early stages, with Adamo being the first to admit that we’re still a decade away from easy mass adoption, and Austin points out that there’s still “a lot” to go with these virtual worlds, from the interface to the complex technical process of buying a property. room for improvement".

But enthusiasm among Web3 investors is running high. According to CNBC, the price of virtual real estate has increased by 500% since Facebook hyped its transition to Meta.image description

Above: The entrance to the virtual world Decentraland. Decentraland is a 3D virtual world platform. Users can purchase NFT virtual plots on the platform using its native token MANA. The platform, which opened to the public in February 2020, is overseen by the non-profit Decentraland Foundation.

While the average user experience leaves a lot to be desired, claims for virtual land, and plans for development of those properties, are expanding every day.Most recently, ONE Sotheby's just announced that they will be building a virtual replica of a real-world property in The Sandbox. Meanwhile, an anonymous buyer reportedly paid $450,000 for a Snoop Dogg property near The Sandbox, betting that having a famous neighbor nearby would add value, much like MetaCollective did in BAYC (Boring Ape Yacht Club) near the purchase of the same plot.

Meanwhile, in the virtual world of Cryptovoxels, a developer is planning to build a New York Stock Exchange (NYSE)-style trading center on their Frankfurt virtual estate, which they bought because it allowed for the construction of a larger virtual architecture. Their dream is for it to be the central hub of this universe, with real utility as we migrate to the virtual realm.

If this all sounds quixotic, some of the cynicism of the moment is justified. Even investors are taking a healthy dose of skepticism about the current iteration of virtual worlds. Steinwold has raised more than $100 million from investors for his fund, but he believes much of the virtual world speculation has been overvalued so far. In fact, he said that Web3’s overvaluation is “largely true” for everything from NFT artwork to crypto tokens. But that hasn't stopped him from investing at a "company-building level." That didn't stop him from backing the Frankfurt NYSE initiative in Cryptovoxels. He compares today's virtual world to the music-sharing platform Napster and its successors in the early 2000s. He said:

"We're kind of in a pre-Napster era right now. We don't have Napster yet. We don't have iTunes, we don't have Spotify. But we will, it's just going to take a long time."

For Zatulove, another investor in MetaCollective, the appeal of virtual real estate is its commercial potential. As a founding partner of venture capital firm Hannah Grey, Zatulove is focused on finding ways to build businesses in this new environment. “It’s about owning an office space in a prime location, but it’s really about: Can you lease the land?” she said. “Can you open a store? Can you host events?We're in a virtual real estate gold rush where people don't know what they're going to build or how they're going to build it, but they're acquiring land in the best possible location to create an interesting financial future.’ She imagined building office space on the MetaCollective campus.

“Maybe we’ll open a coffee shop, maybe we’ll open a cool hangout. Maybe we’ll have town hall meetings, maybe we’ll have office hours for founders, maybe we’ll have a museum that inspires creativity, in this Collaboration between different builders in the space,” she continued.

Moreover, the market is still untapped; Zatulove cites the example of the world's 3 billion gamers who are used to spending time in virtual environments. Even if The Sandbox hasn't caught their attention yet, the potential is there. She said: "The fun thing about virtual real estate right now is that people realize that there are opportunities ahead and you can create opportunities for yourself.”

Adamo already has children of his own, and like all fathers, he's thinking about their future—and what he can pass on to them. The virtual property he purchased might not be a physical property, but it was still purchased in their best interest. "Given the rate of growth this year, it really looks like a multi-generational planned purchase," he said. Maybe Sandbox Hill Road will disappear from the Internet in a few years, like Limewire and Kazaa, or maybe he bought is a future Spotify.

Meanwhile, the froth is only getting bigger.