Analysis on whether the combination of DAO and NFT can accelerate the popularity of Web3

Original Author: Anjali Jain

Original translation: Translator detective

This article is from the WeChat public account Laoyupi (ID: laoyapi), reprinted and edited by Odaily with authorization.

Imagine a world no longer controlled by closed-door board meetings and behind-the-scenes lobbying, but instead run by distributed governance on an open-source network. This vision is exactly what blockchain-based decentralized autonomous organizations (DAOs) hope to achieve by creating platforms that replace traditional hierarchies and are governed by token holders.

Essentially, DAOs are purely internet-native organizations that lack central leadership. Instead, they operate through on-chain rules solidified in smart contracts. This allows for a bottom-up decision-making process, with consensus reached through voting. This is partly where cryptocurrencies step in, as governance tokens that allow holders to participate in all major decisions.

While it might sound like a buzzword spawned by the Web3 mania, DAOs have actually been around for years. During this time, they have managed to capture significant market share in the cryptocurrency industry, and many popular DeFi projects, such as UniSwap, are actually managed by DAOs.

first level title

The Creation of a Creator Economy

The DAO's vision for an ownership-based economy was also embraced by non-fungible tokens (NFTs), which preceded the DAO as the "next big thing" in cryptocurrencies this year. This is evidenced by its breaking Google Trends records and becoming Collins Dictionary's word of the year.

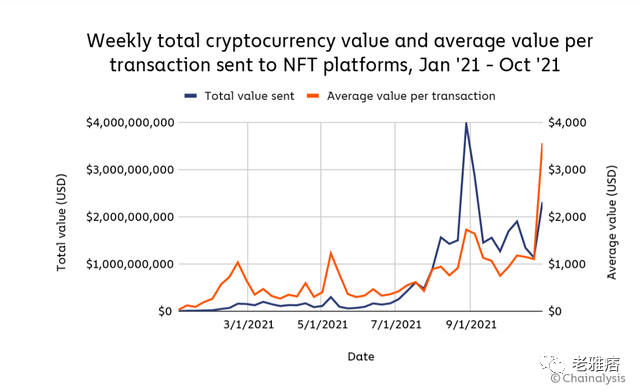

While NFT sales soared to $2.5 billion in the first half of 2021, by early December, users had sent at least $26.9 billion worth of cryptocurrencies to Ethereum contracts related to NFT marketplaces and collectibles. Archives, digital animals, music, memes, and even tweets have been tokenized and sold for millions of dollars, while also providing virtual marketplaces for artists and creators as the world steadily migrates to digital.

first level title

text

Recently, some DAOs were created with the sole purpose of buying NFTs, amassing large sums to make high-profile purchases, such as buying a rare Wu-Tang Clan CD for $4 million. Another DAO even tried unsuccessfully to buy a rare U.S. Constitution by raising $20 million in ETH.

While it’s hard to debate who’s behind the rise of which, NFTs and DAOs have now evolved into a symbiotic relationship that’s sparking growth in both industries. But how does DAO help the management and development of NFT? And, can both gain a place on Web3?

To answer this question, we must examine the relationship of these two entities and how their ecosystems have evolved together.

first level title

Promote the development of public ownership

In order for this to happen, creators would have to sell their NFTs to the DAO, which would then mine a currency and exchange it for collective or fractional ownership in exchange for NFTs. While NFTs will serve as the backing asset for the DAO currency and provide value to it, token ownership will ensure that DAO members have a voice in governance.

They will then be able to vote on the fate of the NFT and profit from the possible price appreciation of the token. Due to the uniqueness, non-fungibility, and subsequent scarcity of NFTs, both the NFT and the token it will serve as collateral may grow in value.

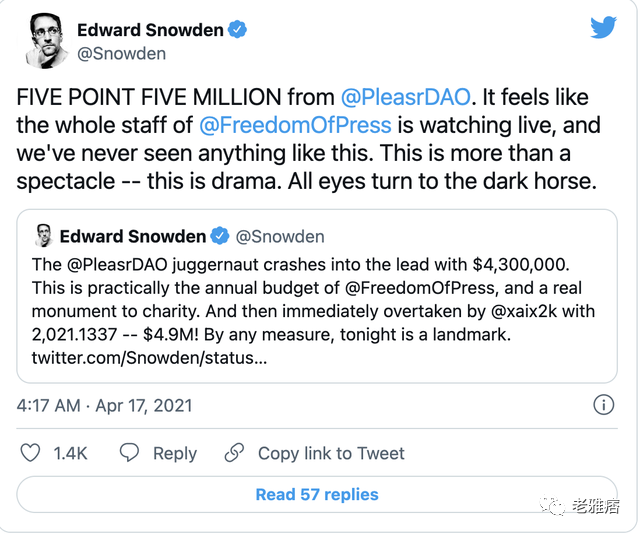

In addition to helping smaller artists, DAOs could provide access to invest in blue-chip NFT projects that would otherwise cost millions. One such project operating on this model is PleasrDAO, one such project that claims to be a collective of "DeFi leaders, early NFT collectors, and digital artists" who are raising capital to buy high-value non-functional These NFTs are jointly paid and owned by DAO members or token holders.

5.5 million from @PleasrDAO. Felt like the entire @FreedomOfPress staff was watching live, we've never seen anything like it. It's not just a spectacle -- it's a drama. All eyes turned to the black horse.

— Edward Snowden (@Snowden) April 16, 2021

Similar to this is FlamingoDAO, which "aims to explore emerging investment opportunities for ownable, blockchain-based assets," allowing members to develop and deploy NFT-focused investment strategies. To further boost NFT’s foothold in DeFi, the protocol also allows members to vote for splitting NFT assets for lending or use as collateral on other DeFi platforms.

Another DAO even tried to buy the Chicago Bulls. The DAO sells NFTs as tickets to its Discord server and governance tokens. The goal of the project is to transfer ownership of sports teams from billionaires to passionate fans. Krause House closed its NFT sale last month after collecting 1,000 ETH worth over $4 million.

Like sports, another major area of the NFT space is music, with many artists large and small translating their melodies into unique digital assets. MODA DAO takes this goal a step further by making these digital tokens an administrative tool for artists and their managers to control copyright contracts.

first level title

collective gain = collective loss

While increased awareness and aggressive regulatory efforts around DAOs have certainly led to a surge in their acceptance, security threats remain a major hurdle. This is also outlined in the recent attack on the BadgerDAO protocol. It cost investors about $120 million.

In fact, one of the first DAOs, simply called The DAO, was meant to operate as a venture capital fund for the cryptocurrency and decentralized space. Instead, it was hacked for a whopping $70 million, equivalent to 15% of the entire ETH supply at the time, while also powering a major hard fork for the ethereum network.

first level title

text

Putting these shortcomings aside, the DAO-NFT duo has undoubtedly contributed to the birth of a new creator economy. It will be built on unique and collective ownership, allowing creators and owners to participate and interact more, while eliminating the need for centralized middlemen who eat up profits.

As the world accelerates its transition to a new phase of the Internet, this ownership structure will ensure that investors at all levels can participate in the creation and operation of the Internet.

In order to protect their coding and technical needs from being a barrier to adoption, projects such as the UpStream Collective have also emerged to simplify the creation of DAOs and ensure that the vision of Web3 does not fail.