Coinbase report: The real "Ethereum killer" may be Ethereum itself

This article comes fromCoinbasesecondary title

Odaily Translator |

content overview

content overview

● Layer 1 (L1) alternatives are gaining popularity, mainly because high gas fees on the Ethereum network make DeFi-related transactions more and more expensive;

● Ethereum is trying to solve the network scalability problem through Layer 2 solutions, and turning to the proof-of-stake consensus model and sharding;

● Although this does not necessarily mean that L1 will become irrelevant, the value of L1 may depend on the time it takes for the Ethereum network to complete the expansion.Gas fees on the Ethereum network have been one of the biggest hurdles to mass adoption of ETH, and smart contract platforms in general, and this is where Layer 1 alternatives including Solana (SOL), Avalanche (AVAX) and Terra (LUNA) come in. 2021 is a major cause for concern. However, the majority of active application development on the L1 network still appears to be happening on the Ethereum blockchain, which currently has $156 billion in total lockup across 214 projects — nearly the top 10 in lockup. Twice the sum of the locked positions of the 2-11 blockchains. In this case, a question arises, namely:

If Ethereum 2.0 can replace the current Ethereum network with a faster, cheaper alternative, how much will those L1 replacements - the so-called "Ethereum killers" - be worth in the end?

In our opinion, there is still room for some L1 blockchains to exist in the crypto space, and to co-exist with Ethereum, for at least a few reasons. First of all, although the official implementation schedule of Ethereum 2.0 has been advanced to 2023 (sharding will be completed), during this transition period, the L1 network will still intervene in the network, aiming to solve the problem that the Ethereum transaction processing time is too long and the transaction cost is too high. high question. That said, at least for now, ETH-centric Layer 2 (L2) solutions can play a huge role in improving throughput and reducing transaction fees.

Second, scalability is only one issue affecting the Ethereum network. At present, users or investors may not be concerned about issues such as maximum extractable value (MEV), but as these ecosystems continue to develop, related issues may change the governance mechanism of the L1 blockchain. Also, more complex bridging algorithms and interoperability improvements may facilitate greater composability between different L1 networks in the future.

However, we do think that L2 scaling solutions, merging with the beacon chain, and sharding upgrades may limit the current development of the L1 network. For example, as the scalability of Ethereum improves, DApp users may stop looking for faster and cheaper alternatives to Ethereum. Nonetheless, we believe there is still room for multi-chain coexistence in the near term, driven by cross-chain interoperability and the possible need for alternative consensus mechanisms.

secondary title

Misunderstanding: Ethereum 2.0 Timeline

Essentially, Ethereum 2.0 is a "set of interconnected upgrades" on the Ethereum network that allows for network scalability without significantly sacrificing decentralization or security. Considering the speed of development of decentralized applications (dapps) on the Ethereum blockchain and the rapid growth of the entire ecosystem, we believe that if Ethereum 2.0 can provide lower fees and better network performance, it will definitely have the potential to disrupt L1 The potential of the network.

But many market participants tend to confuse the upcoming Ethereum mainnet merger with the beacon chain with the actual deployment of Ethereum 2.0 itself, which is an important misconception. The reality is that the merger of the Ethereum mainnet and the beacon chain will only change Ethereum from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism, but in itself, it is very important for achieving higher transaction processing speed and improving transaction efficiency. Throughput, and support for lower gas costs are negligible. In fact, Ethereum network fees are primarily driven by the demand for block space, so if activity on the network picks up after the Ethereum mainnet merges with the beacon chain, then the underlying network (i.e. Ethereum mainnet) fees will actually remain the same. It is possible to continue to rise.

Monetary Policy. Although there are some problems, the merger of the Ethereum mainnet and the beacon chain does not mean that the update is meaningless, because the change of the consensus mechanism may also bring about related efficiency improvements, especially in terms of monetary policy. As an example, the merger of the Ethereum mainnet with the beacon chain could mean more ETH is staked and less ETH is created (taking into account the shift from miners to validators), reducing supply on exchanges and thus From the perspective of supply and demand, prices can be driven upward.

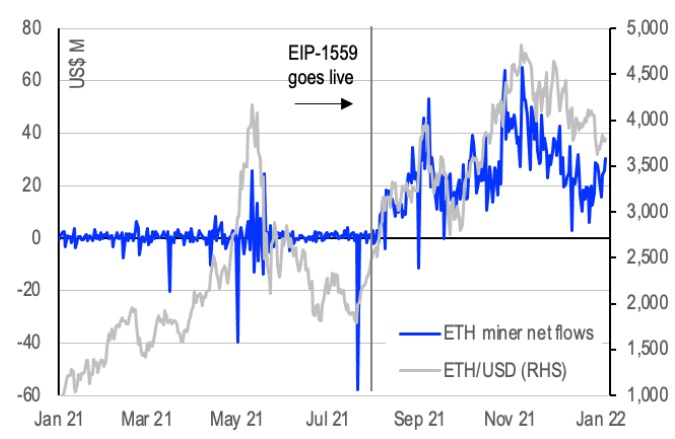

It should be noted that the speed of ETH issuance is also an important factor, because in the past miners often had to sell ETH to obtain funds to pay for their equipment operating costs. Thus, by our estimates, using (fewer) validators could reduce the issuance of ETH by as much as 90%, and also reduce the amount of ETH sold on exchanges by at least 30-50%, since the same as Proof-of-Work ( Compared with the PoW) mechanism, the Ethereum network after the merger of the Ethereum mainnet and the beacon chain requires less computing power (ie: lower operating expenses mean less mandatory ETH sales). This situation is particularly evident after the launch of EIP-1559 in early August. As can be seen from the figure below, the capital flow of Ethereum miners seems to be more directional.

However, while the merger of the Ethereum mainnet and the beacon chain could set a higher low price for ETH/USD, it is unlikely to have much improvement in performance metrics such as network transaction speed, scale or cost. So, how to solve these problems? The answer may be to fragment the beacon chain. Fragmentation is actually an upgrade planned by the Ethereum network before the merger of the Ethereum mainnet and the beacon chain, but it was eventually postponed to 2023 for various reasons. The L2 solution centered on Ethereum has achieved good results, but now, L2 has become the main focus of the Ethereum network expansion.

secondary title

L2: The Key to Ethereum Network Expansion

herehereto view.

to view.

Rollups can significantly reduce transaction fees, but if Ethereum implements a sharding upgrade in 2023, it may strengthen the impact on transaction execution speed by allowing Rollups to utilize more block space on Ethereum. In the long run, this is critical to the ethereum network's goal of scaling to billions of users and processing tens of thousands of transactions per second.

However, in our view, L2s are still in their early stages, and they may not be ready for prime time, which is why they, seen as "L1 replacements", continue to proliferate. For example, when transferring funds between Rollup and the base layer of Ethereum and scanning for fraud, users may wait a long time on Optimistic rollup, in some cases, it may even need to wait a week, for institutional investors Said that this situation may bring greater potential risks. On the other hand, ZK Rollups also has certain limitations in terms of supported transaction types.

secondary title

Living in a multi-chain world

As Ethereum's scalability challenges persist, we believe the attractiveness of L1 alternatives in the market will depend primarily on how quickly Ethereum 2.0 and L2 solutions emerge. That said, we may see continued growth in these so-called "L1 replacement networks" and cross-chain bridges in the first half of 2022. However, the window of opportunity for L1 alternatives may start to shrink significantly in the second half of 2022, as we expect ZK proof technology to improve and Rollups to gain wider use.

However, that doesn't mean L1 alternatives are going away anytime soon. The multi-chain world is a very real existence, because we believe that solving the scalability trilemma (scalability trilemma) is only the first step in the development of smart contract platform blockchain. First of all, in terms of the trilemma, users may pay more attention to transaction speed, security and decentralization, and choose L1 based on these factors.

Second, other issues in the crypto industry are beginning to emerge, such as maximum extractable value (MEV) and priority gas auction bots. MEV refers to the profit that miners and validators can extract from others due to their ability to include, exclude, order, and reorder transactions in blocks, which has the potential to create some problems for proof-of-work and proof-of-stake networks. Questions like this may favor blockchains using other consensus mechanisms, such as Proof of History (PoH), which do not rely on mempools and thus may be more insulated from MEV.