Pocket network: The new power of the Web3 infrastructure layer

Research Institution: Mint Ventures

Researcher: Xu Xiaopeng

Researcher: Xu Xiaopeng

first level title

1. Highlights of the report

secondary title

1.1 Core investment logic

Pocket Network is in a highly deterministic high-speed growth track - blockchain data infrastructure, which will benefit from the evolution of the Web3 wave for a long time.

Its core competitiveness mainly comes from a more advanced product paradigm, providing services through agreements rather than centralized services, specifically:

● In addition to competition, Pocket Network and other nodes also have a cooperative relationship. When the network grows to a certain level, competitors of self-operated nodes also need to join it

● Owning a token system, in terms of growth, incentives and coordination of multi-party interests, there are advantages that non-currency organizations do not have

● Has an application main chain managed by DAO, and has a rich macro strategy toolbox at the currency level

secondary title

1.2 Major Risks

The main risks of Pocket Network include loss of competition, excessive concentration of nodes, and excessive inflation. For details, see "Risks" in the chapter [Business Analysis].

1.3 Valuation

Using the valuation of Alchemy, the leading project on the track, as the "anchor", the valuation of Pocket Network was calculated from the perspective of the GBF model. However, if the expansion speed of Pocket Network exceeds expectations and the market begins to accept "decentralized basic data services is the mainstream”, the valuation ceiling of Pocket Network may be further opened, see [Preliminary Value Evaluation] for details.

2. Basic information of the project

2.1 Project business scope

The core business of Pocket Network is to provide developers on various public chains with decentralized data relay services (or RPC services), compared to the centralized service model adopted by mainstream data service providers such as Infura and Alchemy Generally speaking, the core part of Pocket Network's data service is provided by the full-node operators in its network. In the long run, distributed node groups are more robust than centralized node operators such as Infura, avoiding the possibility of a single point of failure, but they save money and effort compared to developers running full nodes of the public chain by themselves.

As a middle-level service protocol that connects the underlying public chain and upper-level applications, Pocket Network is a typical Web3 infrastructure project.

2.2 Project History and Roadmap

Judging from the event flow of project development, we will find that the acceleration of Pocket Network’s project progress began after its mainnet was launched. In the early days (2017-early 2020), it has been in the stage of technical research, and there is basically not much publicity and news. Another point worth noting is that Pocket Network has not yet launched any mainstream trading platform, nor has it landed on DEX.

secondary title

2.3 Business Situation

text

2.3.1 Business Concept and Service Objects

business concept

Considering that many readers are not developers (and so is the author), before starting to introduce the business situation of Pocket Network, the author feels that it is necessary to explain several key business concepts of Pocket, so that readers can understand the content of subsequent research reports.

Concept 1: Node

What is a node?

Any device connected to the blockchain can be classified as a node, including: servers, computers, laptops, browsers or desktop wallets, and mobile phones. All nodes are somehow connected to the blockchain and are constantly updating each other, adding the latest information to the blockchain. Nodes are an important part of blockchain infrastructure. They validate distributed ledgers and allow anyone to transparently view transactions or data made or held on the network.

The goal of a node is to maintain the reliability of data stored on the blockchain, and the entire blockchain history can be stored by a full node running it. The more full nodes a blockchain has, the more decentralized it is, making it more antifragile to threats such as system failures, power outages, and ledger tampering. When a new block of data is added to the blockchain, a node communicates the block to other nodes on the network.

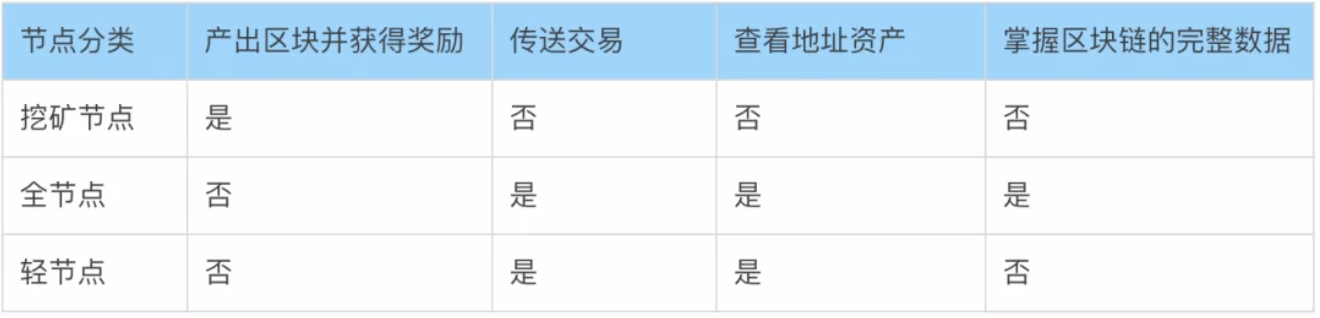

● The type of node

There are three types of nodes in the blockchain network: mining nodes, full nodes, and light nodes. Mining nodes are responsible for exchanging computing power for the right to create new blocks, while full nodes and light nodes have similar functions: they are responsible for disseminating and verifying block information to further consolidate network security.

The difference between them can be understood by the following table:

Mining nodes protect the network through computing power, and generally receive program rewards from the network, while full nodes and light nodes basically have no rewards in the network mechanism. Since there is no reward, full nodes are usually run by volunteers (such as many main chain officials) or stakeholders (service providers, such as Infura), and because light nodes (wallets) only store block headers, so light nodes All data validation depends on the full node it is connected to.

Concept 2: Relays and relay nodes

In the business scenario of this article, relay refers to the process in which the application (demand side) calls the data on the chain and performs data interaction. For example, a DeFi application retrieves and verifies the USDT balance data of an account address to confirm whether the user at the address has sufficient funds to deposit. In the business process of Pocket Network, the work of processing the relay request is completed by the active public chain full node operator in the network. These nodes are also called "relay nodes" in the business of Pocket Network .

Concept 3: API and RPC

API refers to the application program interface, which is usually a set of definitions, programs and protocols. Through the API interface, the mutual communication between applications can be realized, and the calling process is relatively simple. RPC refers to a remote procedure call, which is also a call. The RPC call method is often more complicated. It is a set of call requests, and it is more like a relationship to the API. The RPC interface is mainly used outside the chain. For example, if I log in to the Metamask wallet and the wallet needs to display the balance of my account, I need to use the RPC interface provided by the designated RPC node to call the asset data on the chain of my account to display. Those who provide the RPC interface run the main chain client (the main chain node), and open the port authority of the RPC node, allowing it to be called by RPC.

At present, there may be two types of nodes that provide RPC interfaces:

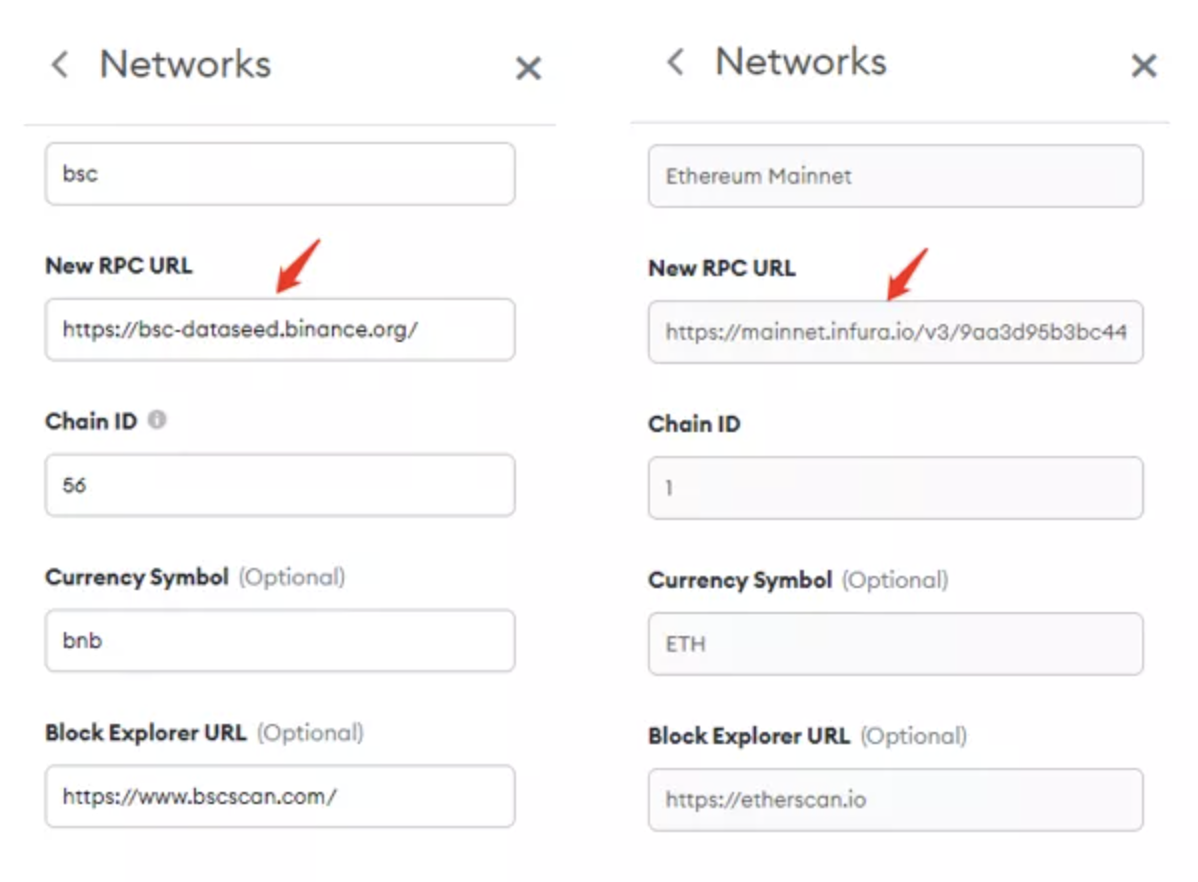

1. Officially provided by the public chain, such as the BSC mainnet configuration added by the author in the figure below, the selected RPC node is the official full node provided by Binance;

2. Provided by a third party, for example, most of Metamask’s Ethereum full nodes are provided by Infura (as shown in the figure below). The RPC service provided by Pocket Network also belongs to this category, but you need to pledge Pokt to obtain it.

Business objects: application side and public chain

for example:

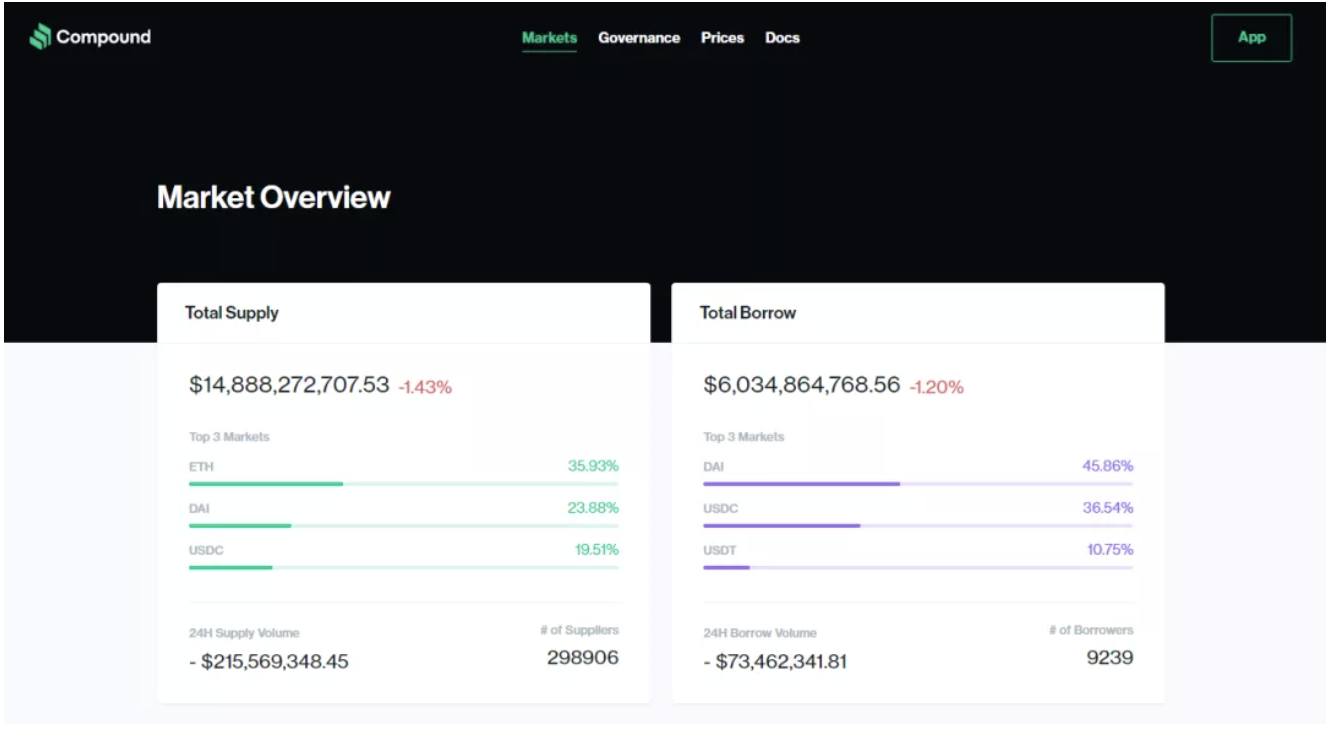

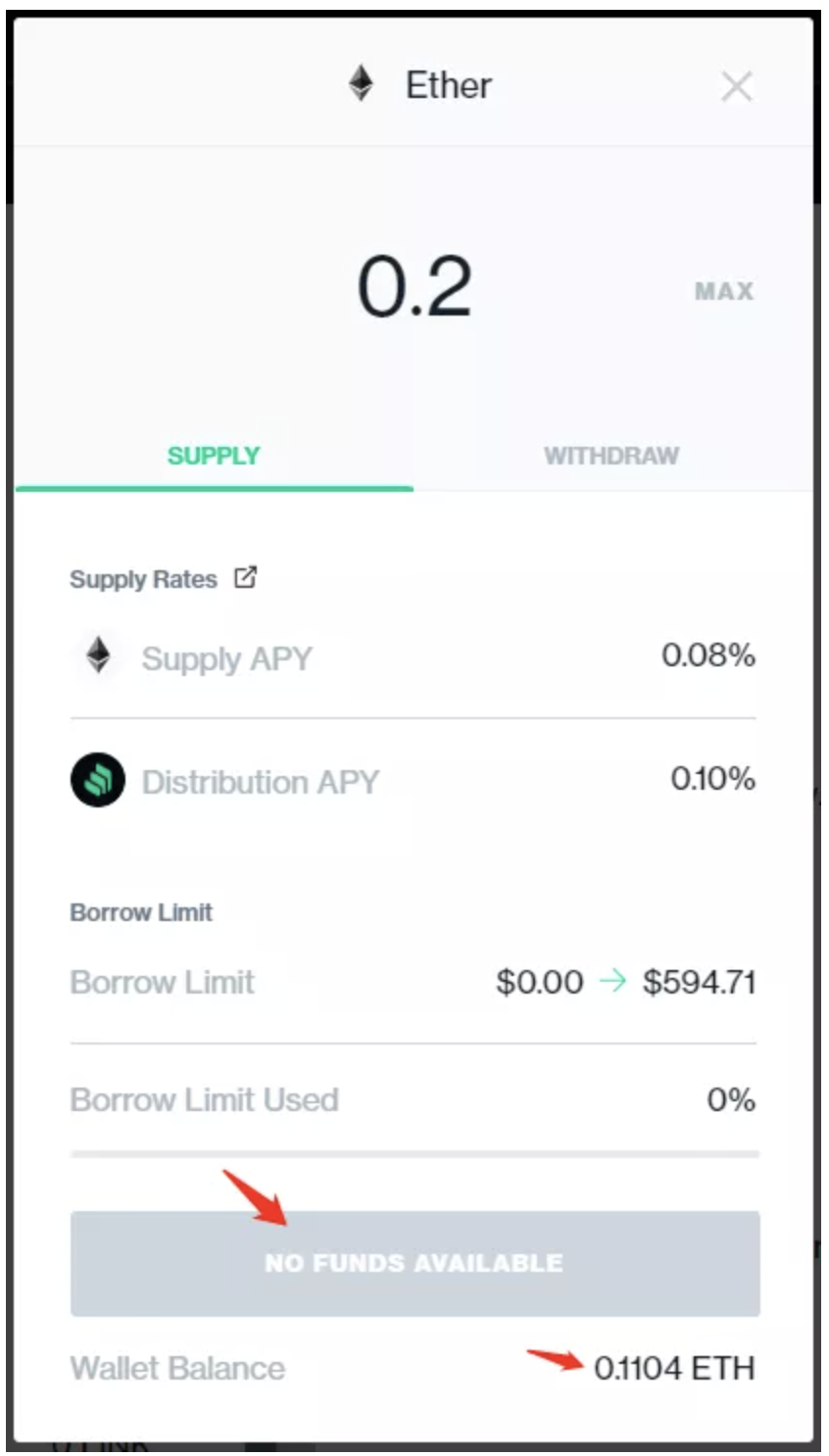

Whether it is a decentralized protocol based on smart contracts, such as lending projects such as Compound, or a centralized service provider such as a trading platform, market and data website, to ensure the operation of the business, they all need to continuously request the corresponding on-chain data.

image description

Image Source:https://app.compound.finance/

image description

image description

Image Source:https://app.compound.finance/

image description

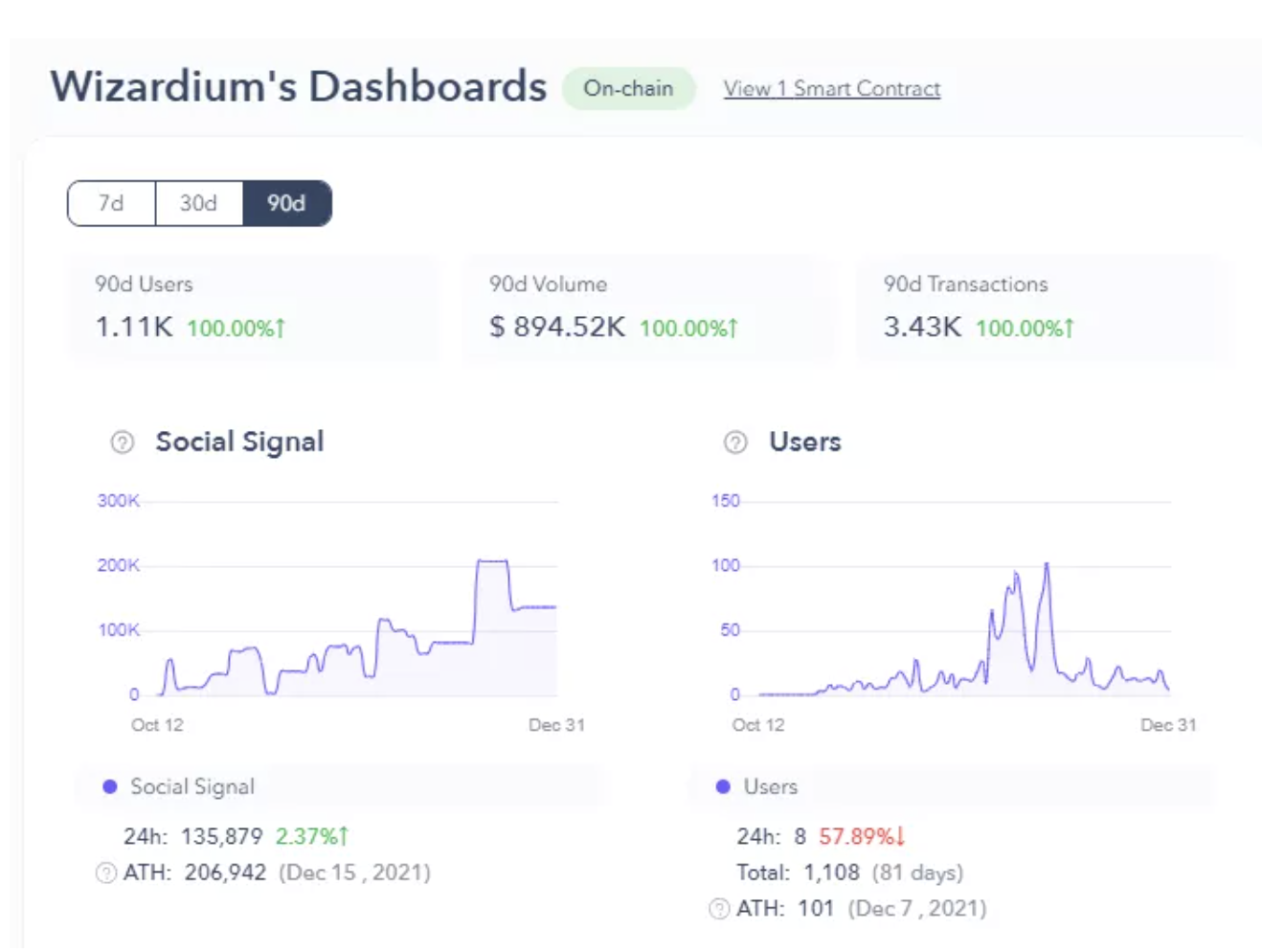

Image Source:https://www.dapp.com/app/wizardium

In addition to smart contracts, many centralized encryption service providers also have a large number of requests for data on the chain. For example, the well-known dApp data website dapp.com, which displays dApp multi-dimensional data for investors, comes from data on the chain. . For example, the business data of a chain game in the figure below.

image description

Chain game business data displayed on the dApp website, image source:

Asset deposits and withdrawals on centralized exchanges, data queries on blockchain browsers, and asset display and transfers on Metamask wallets all require data requests or interactions with the public chain through relay services. It can be said that the data relay service is a bridge and messenger between applications, users and the blockchain, and it is also one of the largest and busiest Web3 middleware services.

However, high adoption also creates centralization and single point risks for API services.

On November 11, 2020, because Infura was not running the latest version of the Geth client, some special transactions triggered a bug in the old version of the client, which eventually caused many applications using Infura to be down for more than 7 hours, including Binance Many exchanges have suspended the deposit and withdrawal of Ethereum.

Many people realized for the first time that the full-node service responsible for verifying data may also need to be distributed and decentralized just like mining nodes. The number and degree of dispersion of full nodes may determine the health of a public chain ecology just like miner nodes.

News reports that Infura's outage affects the operation of a large number of exchanges and encrypted applications, source: The block

Therefore, although the application side is the direct adopter of API services, for the public chain, the degree of decentralization of any infrastructure layer will greatly affect the upper limit of the load value of the entire network.

Therefore, the public chain party is also the indirect business object of the API data service, and the public chain party's demand for API services will also grow with the growth of its ecology, gradually from pure "stability" to "stability" + "decentralization". "over.

text

2.3.2 Business content

As mentioned above, Pocket Network provides applications with blockchain RPC node services, that is, through the full node to call the data on the blockchain for the application to ensure the normal operation of the application. Under normal circumstances, developers have two options to call data on the blockchain:

● Self-build a full node corresponding to the public chain and maintain it by yourself

● Use third-party full-node relay services. The third parties here include: volunteer nodes with open RPC interfaces (generally provided by public chain officials), centralized full-node service providers such as Infura, and decentralized node protocols such as Pocket Network .

After the Infura downtime incident in November 2020, many people pointed out that the application side should build a full node by itself to ensure the stability of the service. However, the cost of building a node by yourself is not low. There are costs and thresholds such as hardware cost, technical ability, and daily maintenance. In order to ensure the stability of the service, developers often need to ensure that 2-3 full nodes are online in case one of them The node goes offline due to failure. In 2021, when multi-chains are flourishing and multi-chain deployment of applications has gradually become a trend, the full-node deployment and operation and maintenance tasks of self-built node developers will greatly increase.

Self-built and maintained nodes may be more than enough for medium and large teams, but for those developers with relatively lean personnel or even individual combat, the overall cost of this option is too high.

Therefore, most developers tend to choose the RPC node services of third-party commercial organizations, among which Infura, alchemy, etc. occupy the mainstream.

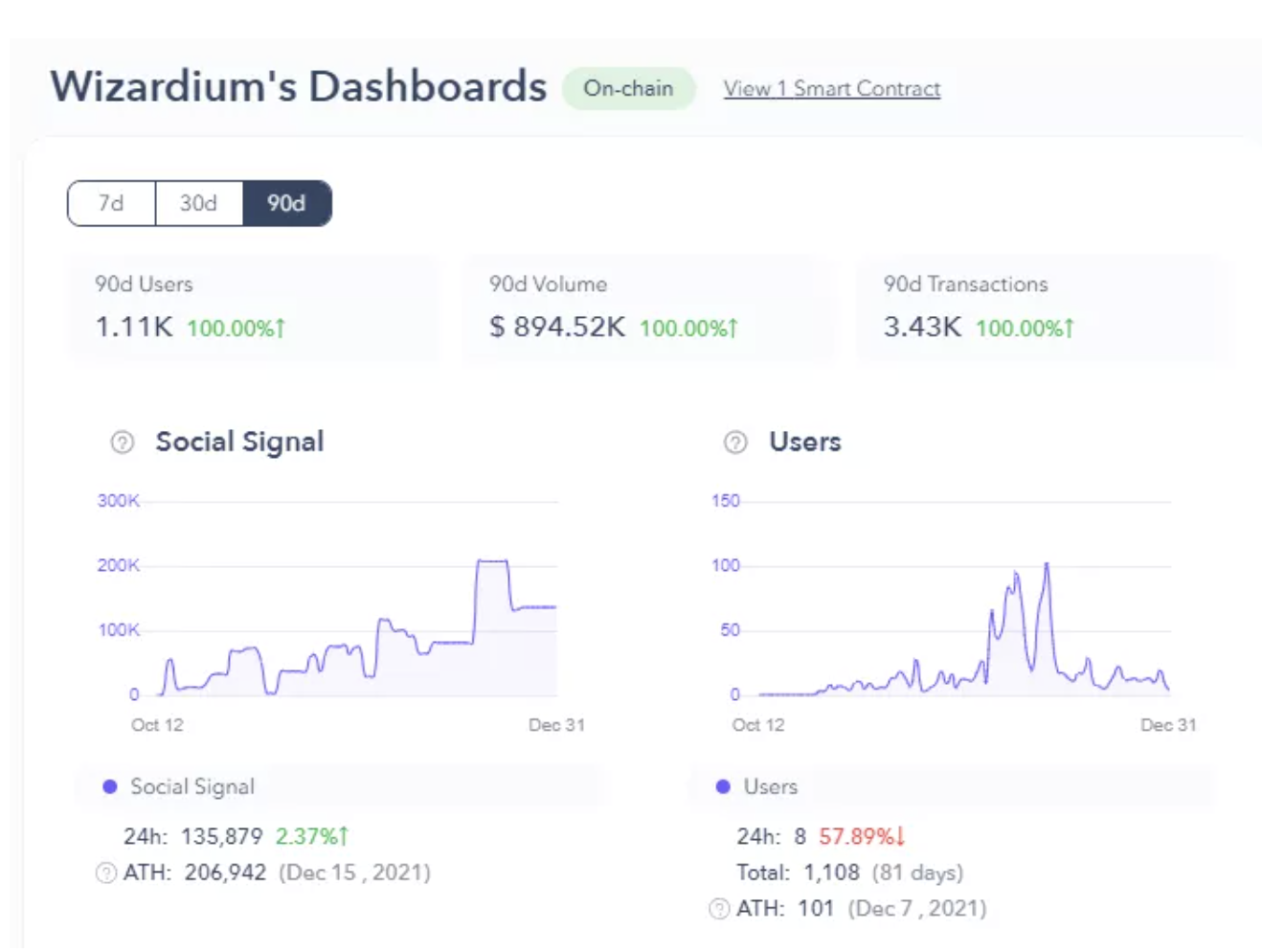

The business structure of Pocket Network consists of a main chain + node operator network.

The main chain of Pocket Network is a PoS network, and all operators involved in processing data relay tasks participate in the network in the form of Pocket Network nodes (one operator can run multiple Pocket Network nodes to maximize its income), the main function of the Pocket Network main network is mainly to run pledge, incentive and transfer systems, not to run smart contracts, so this is not a network born for high TPS.

Pocket Network itself does not directly provide data relay services for applications, but provides a two-sided market consisting of both supply and demand ends of full nodes: one end of the market is web3 applications that need to call full node data, and the other end is different full nodes Node clusters run by operators, who run full nodes including Ethereum, Bitcoin, Polygon, Solana, Harmony and other mainnets. Pocket Network provides full-node operators with their own Pokt token incentives (and punishes unqualified nodes) through its own application chain and related protocols, connecting the supply and demand sides.

image description

Service Structure Diagram of Pocket Network

Although it is consistent with the final service type provided by centralized API service agencies such as Infura, Pocket Network is actually different from Infura in many ways:

● Different degrees of decentralization: Infura provides a set of data relay services, while Pocket Network provides a protocol, or a data relay market, which means that Infura’s service sources are unified and centralized, while Pocket Network’s service sources are diverse and dispersed

● Different transparency: Infura’s business is relatively closed, while Pocket Network’s business flow and reward distribution are transparent and verifiable

The essence of the above differences comes from: Infura is an enterprise, while Pocket Network is an open protocol that everyone can participate in.

It is precisely because of this that in a sense, Pocket Network can avoid direct competition with some centralized node operators, but cooperate with them. For example, Quicknode itself is a very well-known node service provider, which provides node services to more than 20,000 developers every month, but it is also a partner of Pocket Network, playing the role of verifier and supplier in its network. Compared with direct competition from centralized node operators such as Infura and alchemy, for companies such as Quicknode, Pocket Network is more like a new channel worth exploring.

In the long run, if Pocket Network's network grows large enough, joining this network will eventually become an inevitable choice for most small and medium-sized operators. The author believes that this subtle inflection point may appear after the total business volume of Pocket Network exceeds the total business volume operated by a certain leading centralized node.

text

2.3.3 Business data

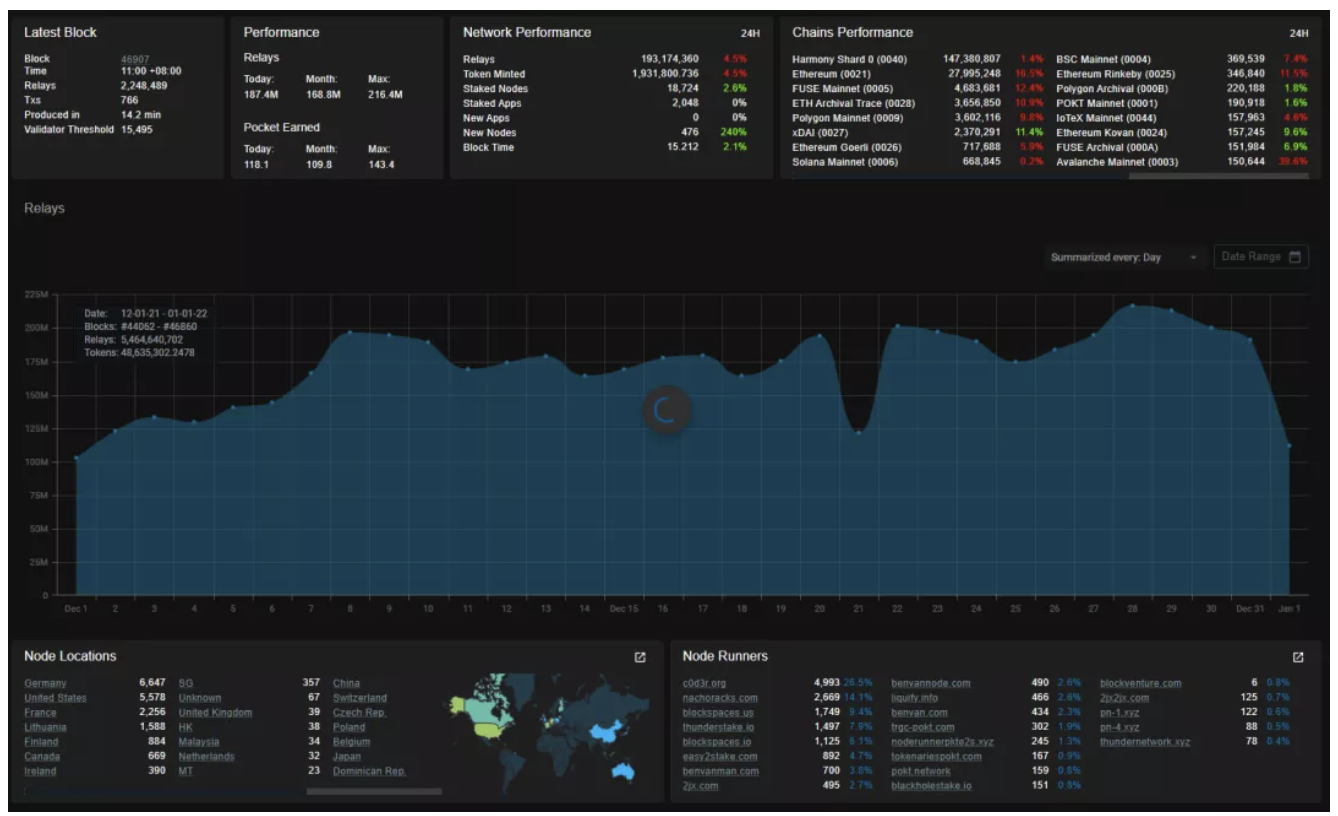

In the dimension of business data, the author focuses on two core indicators:

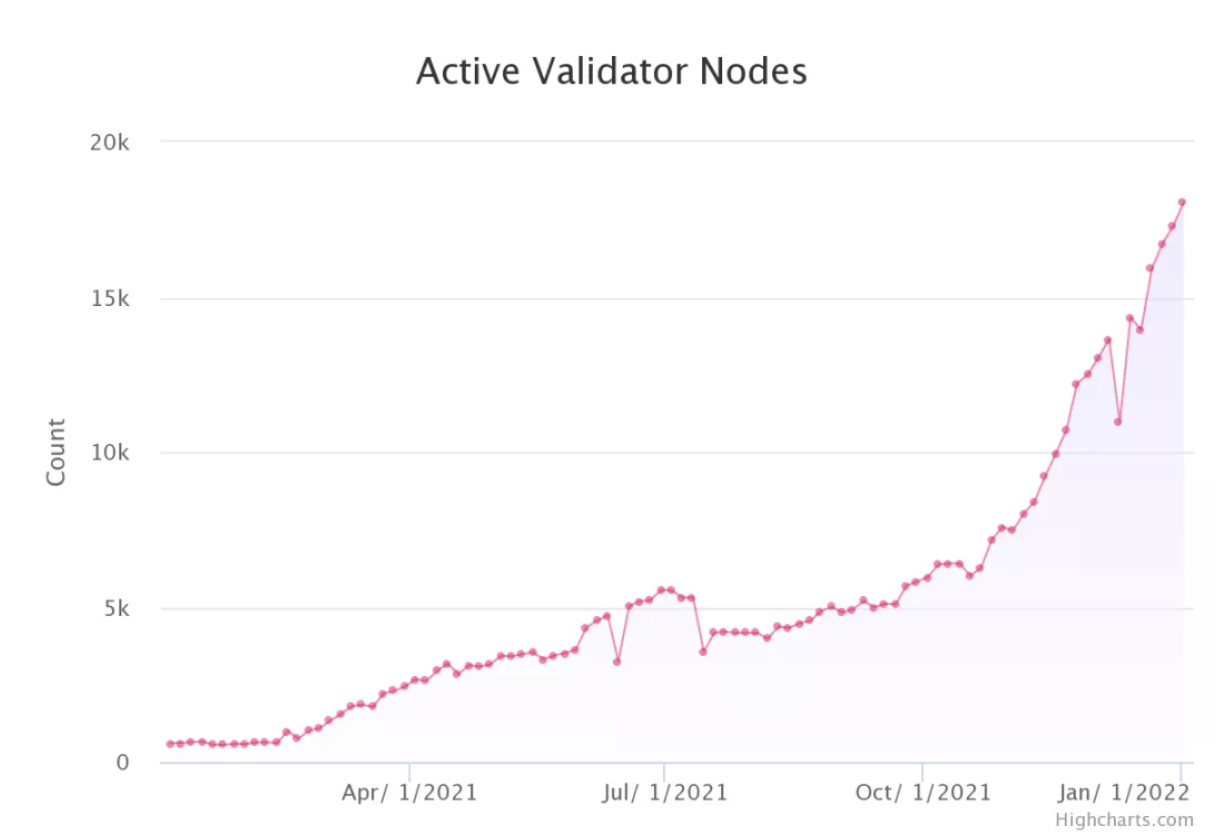

2. The number of active nodes of Pocket Network.

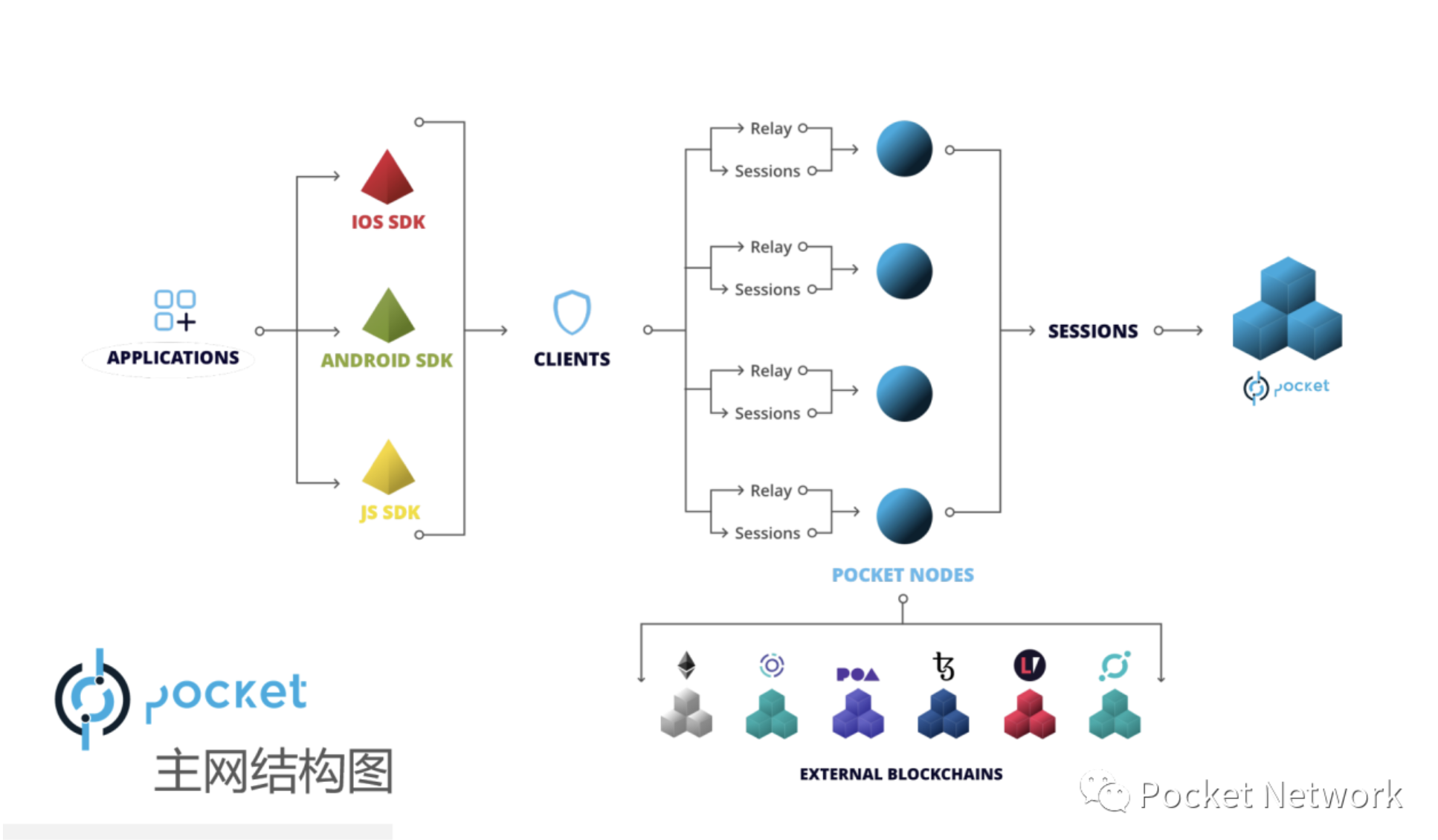

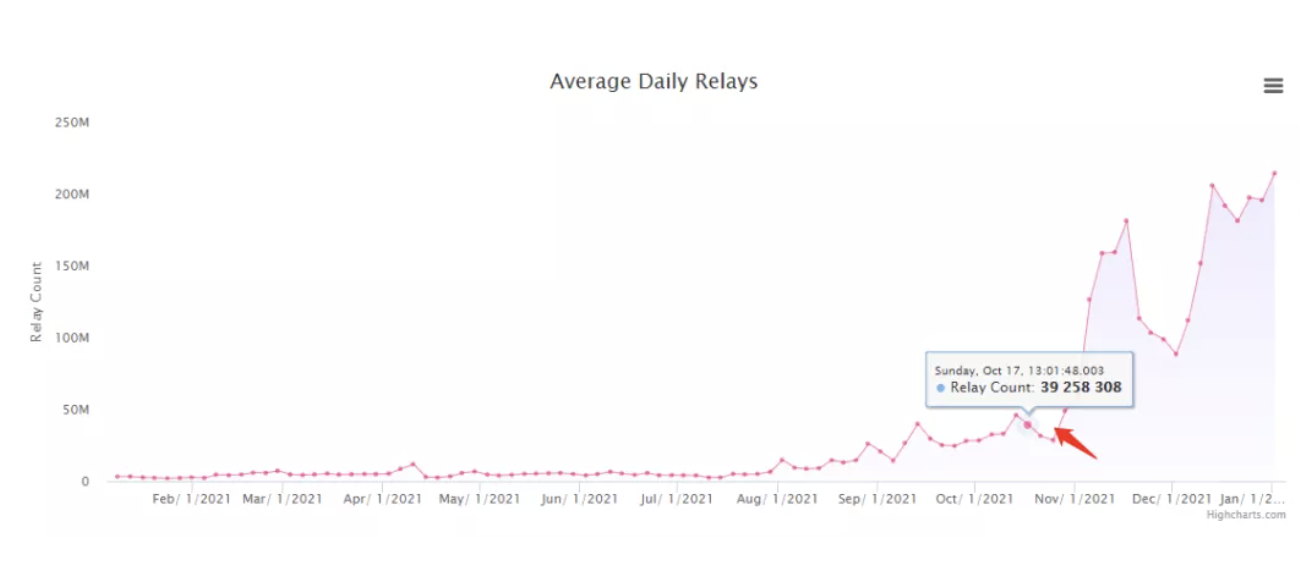

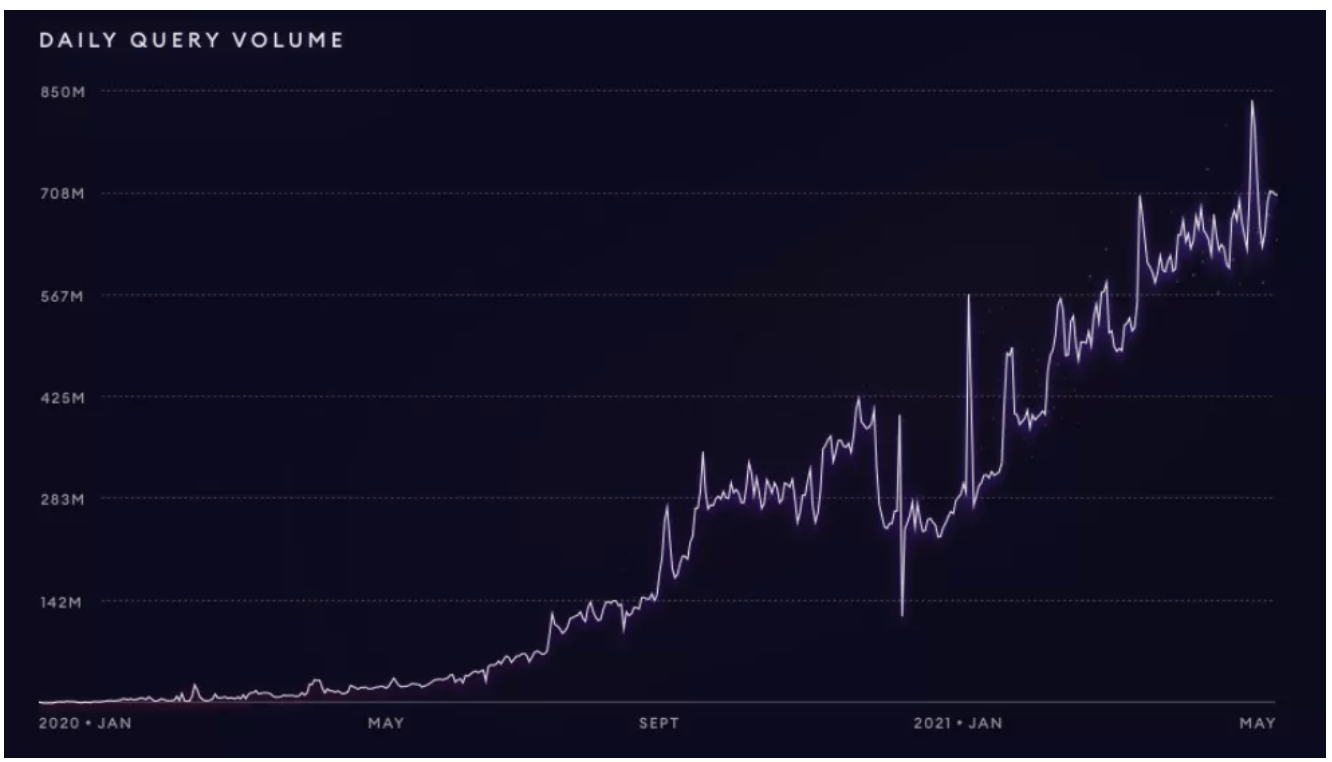

The year-on-year growth of these two indicators is very impressive:https://C0D3R.org/NetworkCharts

image description

The daily average relay processing number of Pocket Network, data source:

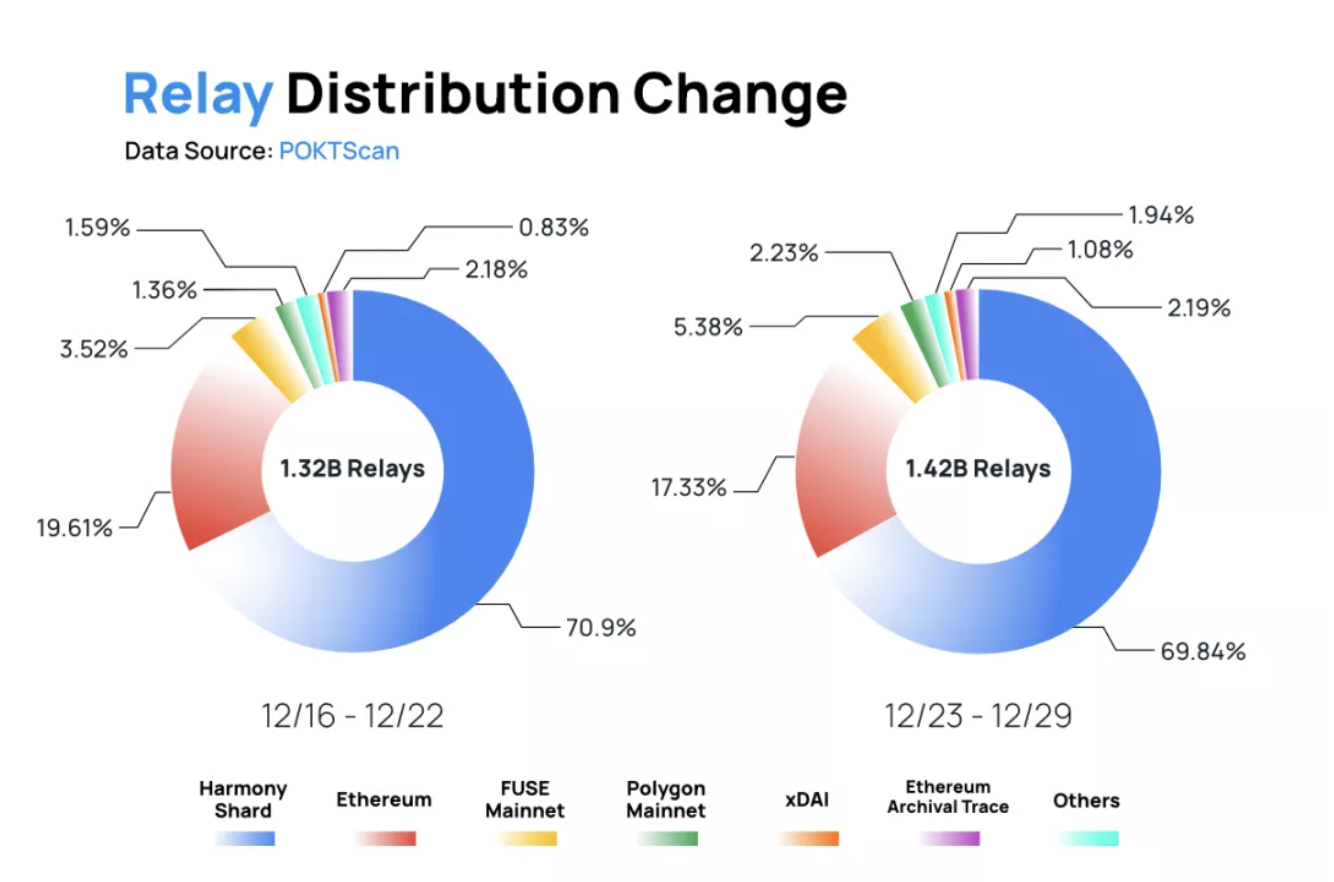

Judging from the distribution of the current relay business on each main chain, the majority of the relay business handled by Pocket Network is Harmony (accounting for 69.84% of the total), followed by Ethereum.

Data source: Pocket Network Weekly Relay Recap#51

Pocket Network's integration of Harmony's mainnet will take place in mid-October 2021. Since then, Pocket Network's data relay business volume has grown by leaps and bounds.https://C0D3R.org/NetworkCharts

image description

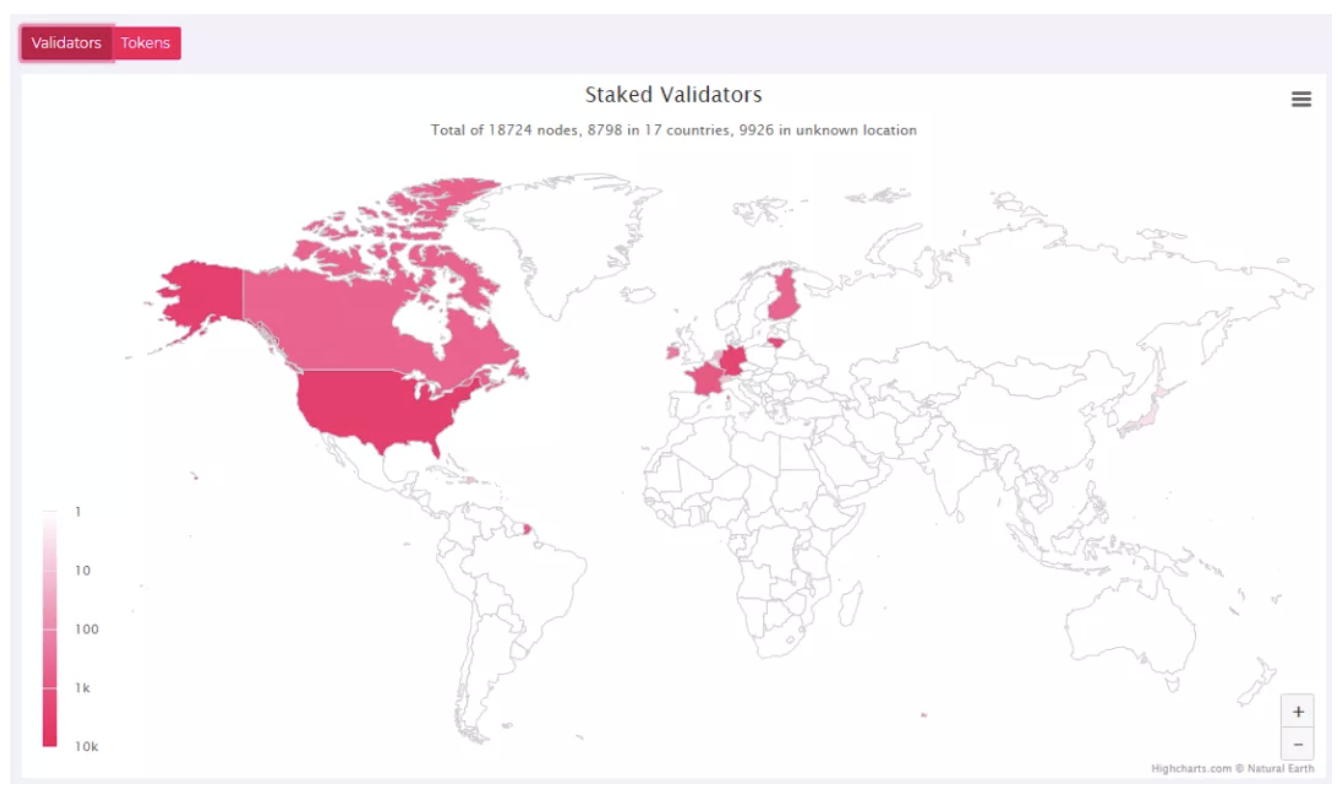

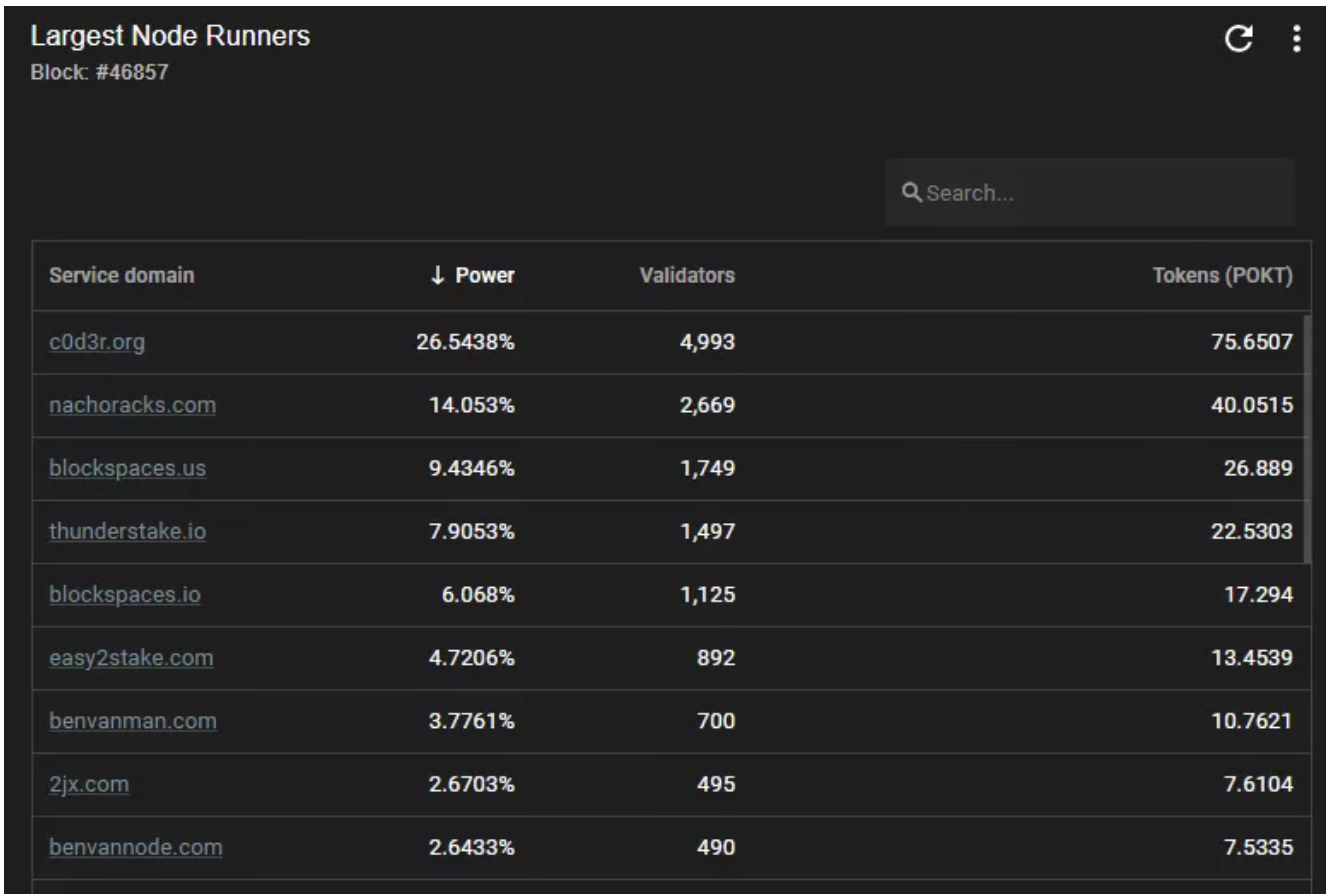

From the perspective of the distribution of nodes, the nodes of Pocket Network are mainly distributed in Germany, France and the United States in Europe. Among the many node operators, C0D3R.org has the largest number of nodes, and it operates nearly 5,000 Pocket Network nodes, accounting for 26.5% of the entire network.https://C0D3R.org/NetworkCharts

image descriptionhttps://www.poktscan.com/

Global distribution of Pocket Network nodes, data source:

The master node ranking of Pocket Network node operators, data source:

2.4 Team situation

Core member

text

image description

CTO:Luis C. de Leon

Michael P O'Rourke graduated from the University of South Florida with a major in International Affairs Studies. He was an active member in college and worked in a number of jobs related to customer relations, from XBOX customer service specialists, golf club receptionists to financial Customer service personnel for lending services. Michael is also a sports enthusiast. He joined basketball, Frisbee, and tennis clubs during school, and served as the vice chairman of the Tennis Association. After graduation, he has been engaged in IOS and mobile terminal development and product work in the early stage, and met many core entrepreneurial partners of Pocket Network during the period. Michael has been exposed to Bitcoin since 2013, but his first formal full-time job related to the blockchain was in 2017 when he founded the blockchain company NOUCE+1, and he also established Pocket Network in the same year.

image description

image description

Development Director: Alex Firmani

Alex graduated from the University of Florida with a major in journalism, but his first job after graduation was in front-end design at Amazon, and he has been engaged in development since then, serving as the development team leader of many companies. Alex joined Pocket Network at the end of 2019 and gradually became the development leader of the team.

image description

Graduated from the University of South Florida with a major in computer science in 2018. Although he is very young, he has rich experience in blockchain development. He started working as a blockchain engineer at Nonce+1 Labs in 2017, and then worked at BitcoinLatina Foundation/Artpiece.io respectively. A core development member and an early contributor to the Ethereum Android client.

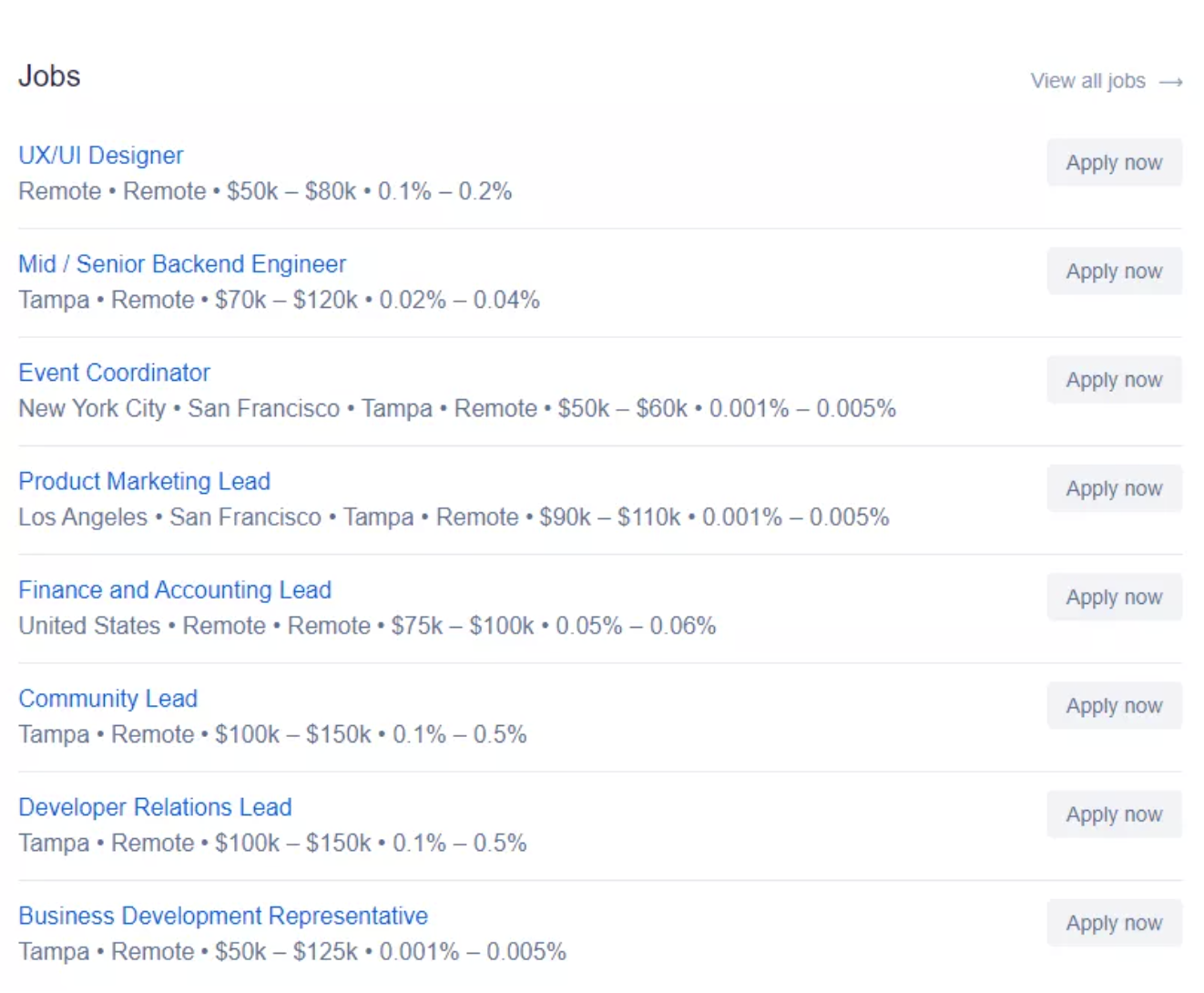

The overall situation of the teamhttps://angel.co/company/pocket-network

image description

Pocket Network's current recruitment information, source:https://www.poktscan.com/

Although Pocket Network is not that big in terms of community size (twitter was established in 2016, with 14,000+ followers; telegram English community has 3300+, Chinese community has 600+), but the community basic work of the project is very complete, such as project documentation, The community guides are very clear and detailed. In terms of data transparency of the project, both the project party and community volunteers have provided a wealth of data dashboards. The data dimensions are very detailed and real-time, which is impressive.

Pocket Network's data dashboard, data source:

The community staff of the project are also very conscientious. The various questions that the author asks in the community as a user will basically get accurate and clear replies within 5-10 minutes, no matter day or night or holidays.

Although all of the above are "details" of the project, they can reflect the actual working status, management level and self-requirements of the team. The actual experience of the project from the front line of the community is often more convincing than the exquisite publicity manuscript (of course, marketing and PR are equally important).

secondary title

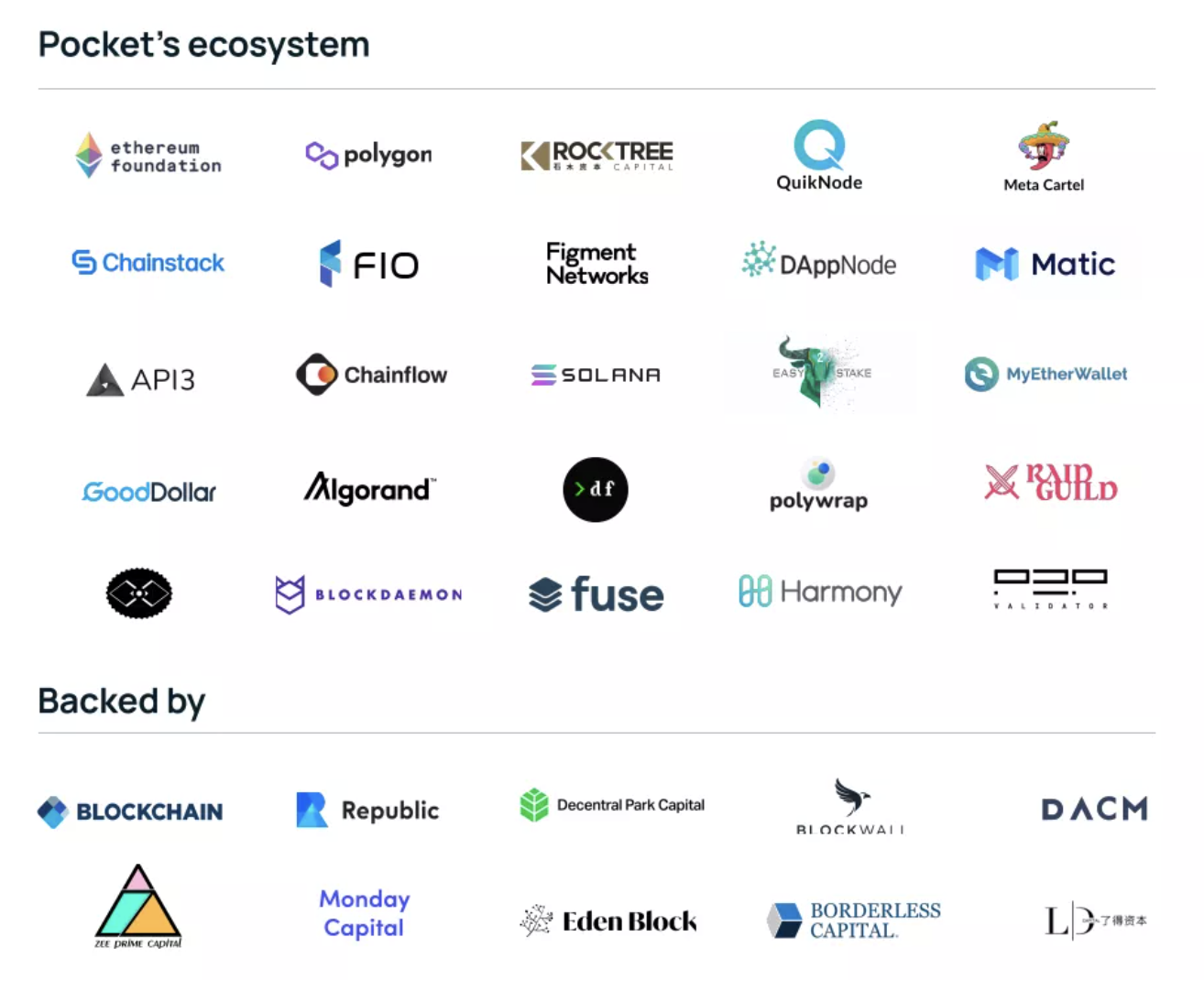

2.5. Partners and financing

Pocket Network has had multiple funding rounds, but the only round that was disclosed was the January 2021 round. According to the official disclosure in April 2021, the total amount of this round of financing is 9.3 million US dollars (the financing price is unknown), and the investment targets include more than 200 nodes in addition to Blockchain.com, Eden Block, DACM, LD, OKEX, FBG and other institutions operator. Prior to this, the project had also conducted two rounds of private placements, but the specific financing amount was unknown. According to public information, it was mainly individual investors.

Another important partner group of Pocket Network is the public chain.

image description

Data Sources:https://C0D3R.org/NetworkCharts

image description

It is conceivable that the progress of subsequent ecological cooperation with major public chains is the key to whether the core business of Pocket Network can continue to grow by leaps and bounds.

3. Business Analysis

secondary title

3.1 Track Overview

text

3.1.1 Track classification and development background

The big track where Pocket Network is located is data. Specifically, it belongs to the infrastructure part (Infrastructure) of the big data track, or the NaaS (Node as a service) subdivision of BaaS (Blockchain as a service) road.

In the big track of blockchain data, the infrastructure track is the bottom layer, which is the basis for other companies or projects to build their services.

Data display and data analysis: such as Dune Analytics, Nansen

Application building: various centralized services and dApps)

Data query and index: such as The Graph and Covalent

Infrastructure: such as Infura, Alchemy, Quicknode and Pocket Network

In recent years, with the prosperity of blockchain business and various Web3 applications, the data track has also developed rapidly, and the market's attention and value evaluation have also rapidly increased.

Among them, Nansen, a data analysis platform, raised US$75 million in the B round in December 2021, with a valuation of US$750 million. Dune Analytics on the same track is also raising funds recently, with a target valuation of US$1 billion. The leading project of data query and indexing track, The Graph, currently has a market value of 3.6 billion US dollars in circulation, and a market value of 6.9 billion US dollars in full circulation.

As the bottom layer of the data track, leading projects at the infrastructure layer are even more sought after by the market. The valuation of infrastructure Alchemy has soared 7 times in half a year. USD) at a valuation of USD 505 million, which increased to USD 3.5 billion in the C round of financing led by A16Z in October 2021.

Behind the large amount of financing in the infrastructure track is the background of the explosive development of blockchain business starting from 2020. In this context, there are five factors driving the explosion of the data market:

● The public chain ecology has grown from the dominance of Ethereum to the current multi-chain pattern, and the public chain data has doubled

● The increase of applications and users on each public chain

● Further enrichment of asset types on the chain, especially the explosion of NFT and its diffusion and sinking into the mass market

● User behavior is becoming more and more complex, which increases the dimension of data sources and analysis, and also increases the value of data analysis

It can be expected that the above factors will still exist in the next few years and will continue to develop in depth, and drive the business performance and valuation of the data infrastructure track to continue to grow.

Let's first take a look at the business growth of the blockchain data track in recent years.

Alchemy

text

3.1.1 Track growth rate

There is no reliable and complete industry-wide data disclosure for the specific business data of the blockchain data overall track and the data infrastructure subdivision track, but we can disclose it in interviews and announcements from some leading companies in the infrastructure track A peek at the current impressive growth rate of the track.

When disclosing its last Series B round in April 2021, the founders of infrastructure provider Alchemy revealed some numbers:

● The number of terminal addresses of the projects it serves has increased from 4 million last year to "tens of millions"

● Since opening the service to the public market (previously only for key enterprise customers), the number of customers has increased by 97 times in 8 months

● The number of enterprises served will double in the first quarter of 2021

● Since the beginning of the year, its business from NFT has increased by more than 13 times

In December 2021, when it received the C-round investment with a 7-fold valuation increase, its founder said that "Alchemy's business growth is much faster than the valuation growth rate."

Another very representative is Quicknode, which also disclosed some growth figures in the interview when it received $35 million in Series A financing in October 2021:

● From March 2021 to present, the revenue and number of customers have increased by 20 times, and the size of the team has increased by 6 times

● At present, the company processes more than 2 billion data requests for 20,000 developers every day, and the number of requests processed per month exceeds 70 billion

According to a report by market research firm Markets and Markets, the market size of blockchain infrastructure will grow at a compound annual growth rate of approximately 67%, and is expected to reach $40 billion by 2025.

Another thing worth mentioning is that whether it is Alchemy, IInfura or Quicknode, they have already passed the cash burning stage, and are currently profitable, with very good cash flow and capital reserves.https://thegraph.com/blog/20billion-queries

image description

secondary title

market share

3.2 Competitive Landscape

text

market share

The data infrastructure track in which Pocket Network is located has a considerable industry space and growth rate, and it is a blue ocean market that is still in its early stages. But the current competitive landscape is not friendly to Pocket Network. At present, most of the leading Web3 projects almost choose to cooperate with well-known centralized node operators, and the industry concentration is relatively high.

Infura is the basic service provider with the largest number of developers. As early as 2018, the number of data requests processed per day has reached 13 billion per day, and the number of full nodes it operates accounts for 10% of the total number of Ethereum full nodes. 5-10%. In The block's 2020 annual report on the blockchain data and infrastructure industry, Infura is also the company listed as the core competitor by the most peers. They believe that 70% of the top dApps in the Ethereum ecosystem are using Infura's services.

Enterprise node operators other than these two giants, such as Quicknode, Blockdaemon, and Bloq, also have their own core customers. For example, the well-known blockchain data platforms Dune Analytics, Nansen, etc. are Quicknode's customers.

Whether it is the number of customers, the number of data requests processed, or the influence, in the current infrastructure market of hundreds of billions of orders, Pocket Network's 200 million relays per day currently account for a very small business share.

text

Comparison of advantages and disadvantages

Compared with Pocket Network, the main advantages of these centralized node operators are:

● Advantages of attracting new users: With the endorsement of higher popularity, a large number of industry cases and huge business volume, the trust cost of new users is relatively low

● Industrial advantages: Backed by strong industrial capital, capital can provide direct assistance in customer expansion and resource integration. For example, Metamask under Infura’s parent company ConsenSys will use Infura’s services by default

● Enterprise market advantage: It has obvious advantages in the enterprise market. In addition to the endorsement of the brand and investors, the centralized node is easier to provide customized services for enterprise customers, and the migration cost of enterprise customers is also higher than that of ordinary developers.

● Product line advantages: In addition to basic node data request services, centralized enterprises have also built a wealth of value-added service systems and product series. For example, Alchemy provides a rich developer suite, which is beneficial to project profitability and customer retention and growth. very helpful

Nevertheless, in such a huge infrastructure market, Pocket Network, as an open protocol, still has differentiated competitive advantages:

● Pocket Network does not directly provide node services, but provides an organic and diverse node network. In addition to competition with other nodes, there is also a cooperative relationship, which can be joined by small and medium node operators. When the network grows to a certain level Finally, even competitors need to be on board

● As an agreement, it has stronger openness, composability and flexibility. For example, its tokens can be cross-chained to each main chain, and used as incentives and assets to interact with a wide range of Web3 financial settings

● Since the network contains a wealth of node sources, Pocket Network will randomly match the user's data needs to 24 nodes to process and rotate them. Each node cannot obtain the complete data of the application, so as to protect the user's privacy

● Using pledge instead of payment to obtain resources, the long-term cost of users is lower

● Owning a token system, in terms of growth, incentives and coordination of multi-party interests, there are advantages that non-currency organizations do not have

● Has an application main chain managed by DAO, and has a rich toolbox of macro strategies

● Centralized institutions have huge infrastructure, hardware, and operation and maintenance costs. Pocket Network does not need to consider these. It can focus on developing communities and coordinating the distribution of network benefits. It is a lighter and more flexible business model

In short, the advantages of centralized node service providers lie in the current brand, scale, product maturity, and resources at the industrial end. Pocket Network has only one underlying advantage: its product paradigm is more advanced and more in line with the concept of Web3 and development trends.

secondary title

3.3 Token Model Analysis

3.3.1 Introduction to Pocket Network mainnet

The main network of Pocket Network is a PoS network that adopts the Tendermint consensus (later gradually transitioning to the custom stack of Pocket 1.0), with blocks produced every 15 minutes. Unlike most public chains, the main network is mainly used to run Pocket Network's pledge, incentive and transfer systems, not to run smart contracts, so this is not a network born for high TPS.

text

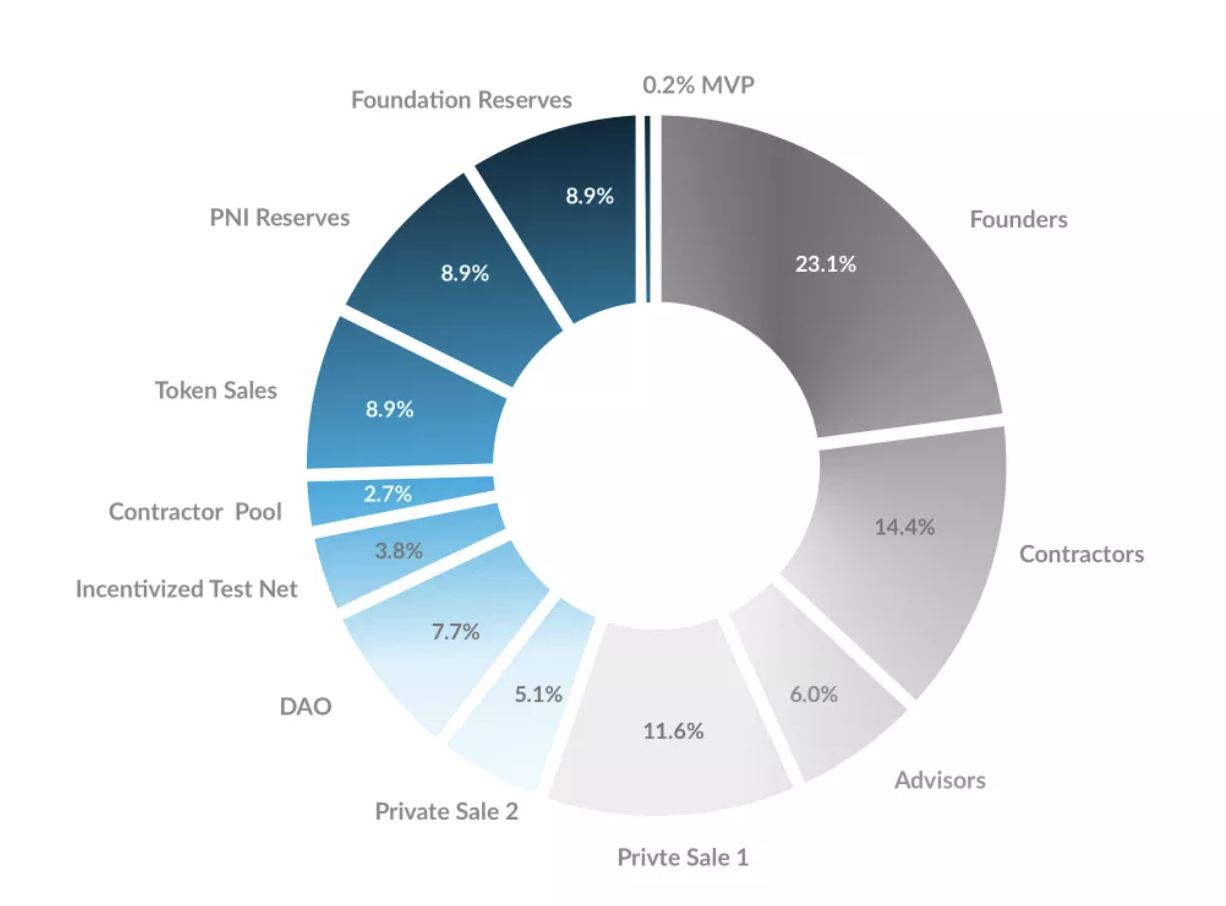

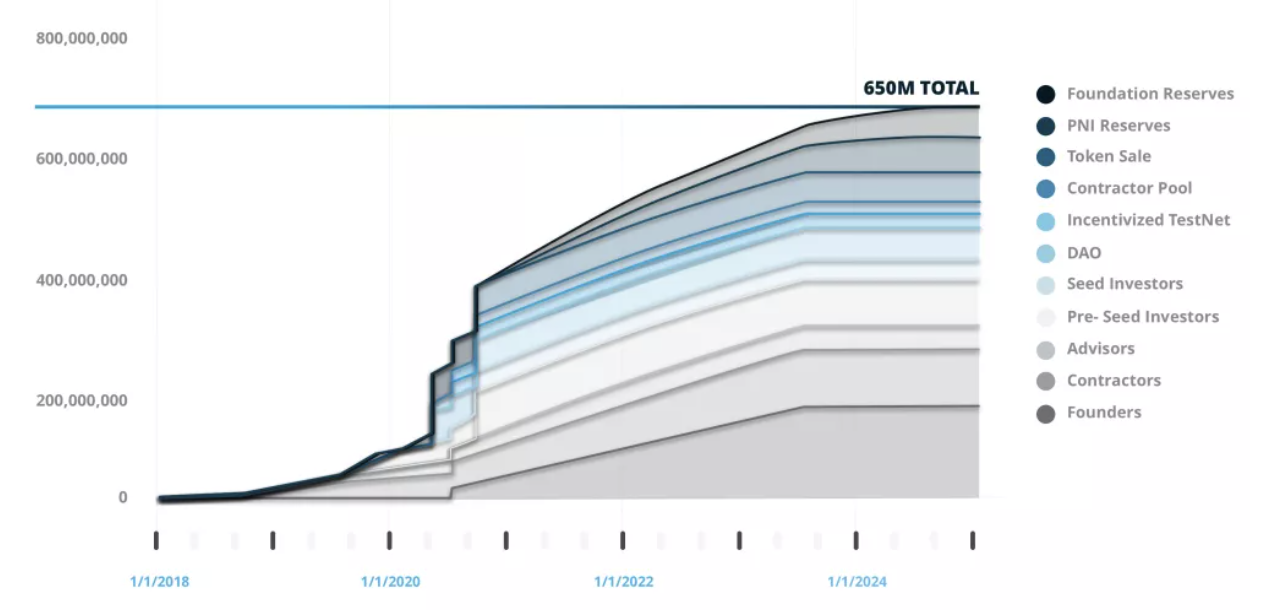

The initial circulation of Pokt tokens is 650 million, and the total amount has no upper limit. The allocation and release of the initial 650 million tokens are as follows:

image description

image description

The initial 650 million token unlock schedule, source: official documents

Overall, most of the initial tokens are owned by the founding team and the foundation. At present (January 2022), the peak period of unlocking has passed, and most of them have been unlocked.

text

3.3.3 Token output, destruction and balance

output mechanism

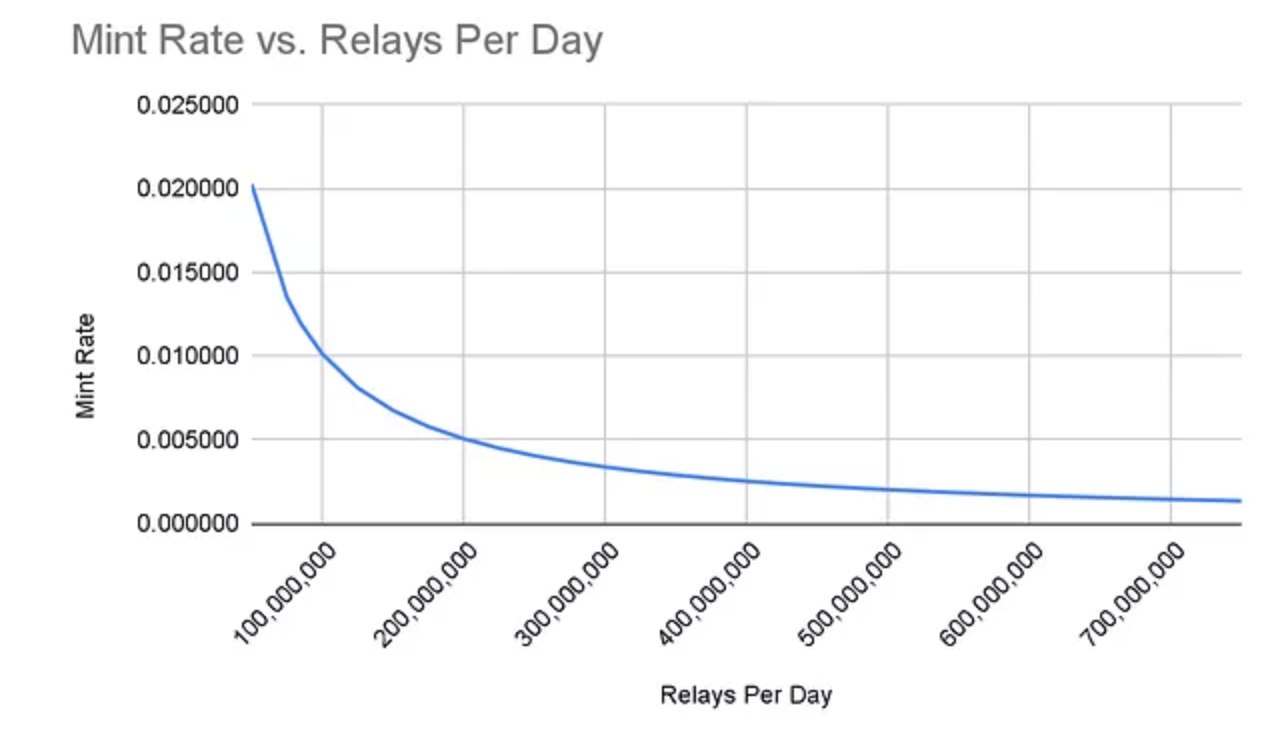

Unlike most main chain tokens that are produced with blocks, Pokt tokens are produced with actual business. Every time Pocket Network processes and verifies a relay data request, it will mint 0.01 Pokt tokens, of which 89% are used 10% is allocated to the DAO Foundation of Pocket Network, and the remaining 1% is rewarded to the verification nodes who pack blocks in the Pocket Network (the verification talents with the first 1000 pledged Eligible to participate in packaging, the higher the quantity, the greater the probability of participating in packaging).

The DAO of Pocket Network will adjust the output speed of Pokt according to the situation to balance the inflation of Pokt. According to official documents, DAO will initiate adjustments in two situations. The first is when the total supply of Pokt reaches a milestone number, such as reaching 1 billion (currently 700 million+), each relay output will be The Pokt is reduced from 0.01 to 0.001, and will be reduced to 0.0001 if it reaches 2 billion. Another way is dynamic adjustment, that is, to adjust the output of Pokt according to the actual situation to achieve a balanced state.

Image Source:https://forum.pokt.network/t/pup-11-wagmi-inflation/1369

In addition, Adam, a core member of the team, recently initiated a parameter adjustment proposal (PUP-11) in community governance. Considering that the number of relays has increased significantly recently, and the output of Pokt has reached 2-3 million per day, he suggested carefully considering this inflation rate and designing a "weighted annual maximum inflation rate (WAGMI)", according to this parameter , the minting rate of Pokt (that is, the number of Pokt minted by the network to process a relay request) will decrease as the number of daily relays increases, as follows:

image description

Through this proposal, firstly, the project will have more accurate inflation expectations, and secondly, it can control the current excessive inflation rate. Currently, this proposal is still under discussion within the community.

Under the superimposition of the dual factors of destruction and output rate attenuation, Pocket Network's system inflation will tend to balance or even deflation, so as to ensure that the interests of all parties will not be damaged, and maintain the intrinsic value of Pokt as a payment currency for system services.

Application Scenario

text

3.3.4 Token Demand Scenarios

Application Scenario

In the data relay market established by Pocket Network, there are two main roles, the demander of data relay service - web3 application, and the provider of data relay service - node service provider, both of which need Pokt to Get involved in the network.

For applications:

To obtain system services, you need to pledge at least 1 Pokt to obtain data relay services, and the number of relay processing that can be obtained for each pledged 1 Pokt is determined by the system parameter "BaseRelay Per POKT", which is currently 13.3684211 , which means that the application pledges a Pokt, and can use 13.3684211 relay services in a session period (according to the system definition, every 4 blocks is a session period, that is, one hour).

It should be noted that since the current Pocket Network is in its early stage, the official will provide subsidies for some applications and partners, and make Pokt pledges on behalf of the applications to complete the cold start of the network and enter the self-reinforcing stage of the growth flywheel as soon as possible.

For node operators who provide full nodes to handle relay requests:

In addition, whether it is an application or a node, the unlocking period of its pledged Pokt is 21 days.

MaxRelays=StabilityAdjustment+(ParticipationRate×BaseThroughput)

in:

There is another issue worthy of attention here. When the application side uses the service, they expect the price of the service to be stable and predictable. Using Pokt tokens as the purchase medium of resources, the price fluctuation of Pokt will also affect the cost of users to obtain services (albeit only for staking costs).

Therefore, Pocket Network designed a set of formulas to stabilize users' relay service prices, namely:

in:

● The StabilityAdjustment parameter is used to smooth pricing, which is at the discretion of DAO, so as to avoid frequent proposals

● ParticipationRate = total number of Pokt pledged by applications and nodes / total amount of Pokt

● BaseThroughput=The number of Pokt pledged by the application×BaseRelay Per POKT

● BaseRelay Per POKT is the X parameter mentioned above that "stake a Pokt, you can use X times relay service in a session cycle".

So we translate the above formula into Chinese, namely:

The maximum number of relays available to the application = price adjustment parameter + (Pokt pledge rate × number of Pokt pledged by users × BaseRelay Per POKT), through this formula, DAO can easily adjust the price of system services to keep it relatively stable.

Pokt is also an important medium for community governance. Proposals and participation in governance require Pokt. But if you want to really enter the governance decision-making layer of Pocket Network, you can directly vote on the proposal. In addition to having a sufficient amount of Pokt pledge, you also need to apply. There are four types of application roles: application developer, node operator, and community For shepherds and administrators, each role must meet certain conditions and tasks before it can be approved and selected.

In addition to the strict selection of governance core personnel, Pocket Network has also formulated a very detailed and operational "Governance Charter", which explains the boundaries of governance roles and rights, governance goals and principles, etc.

At present, the governance of the project is mainly completed through the governance tool outside the chain, that is, Snapshot.

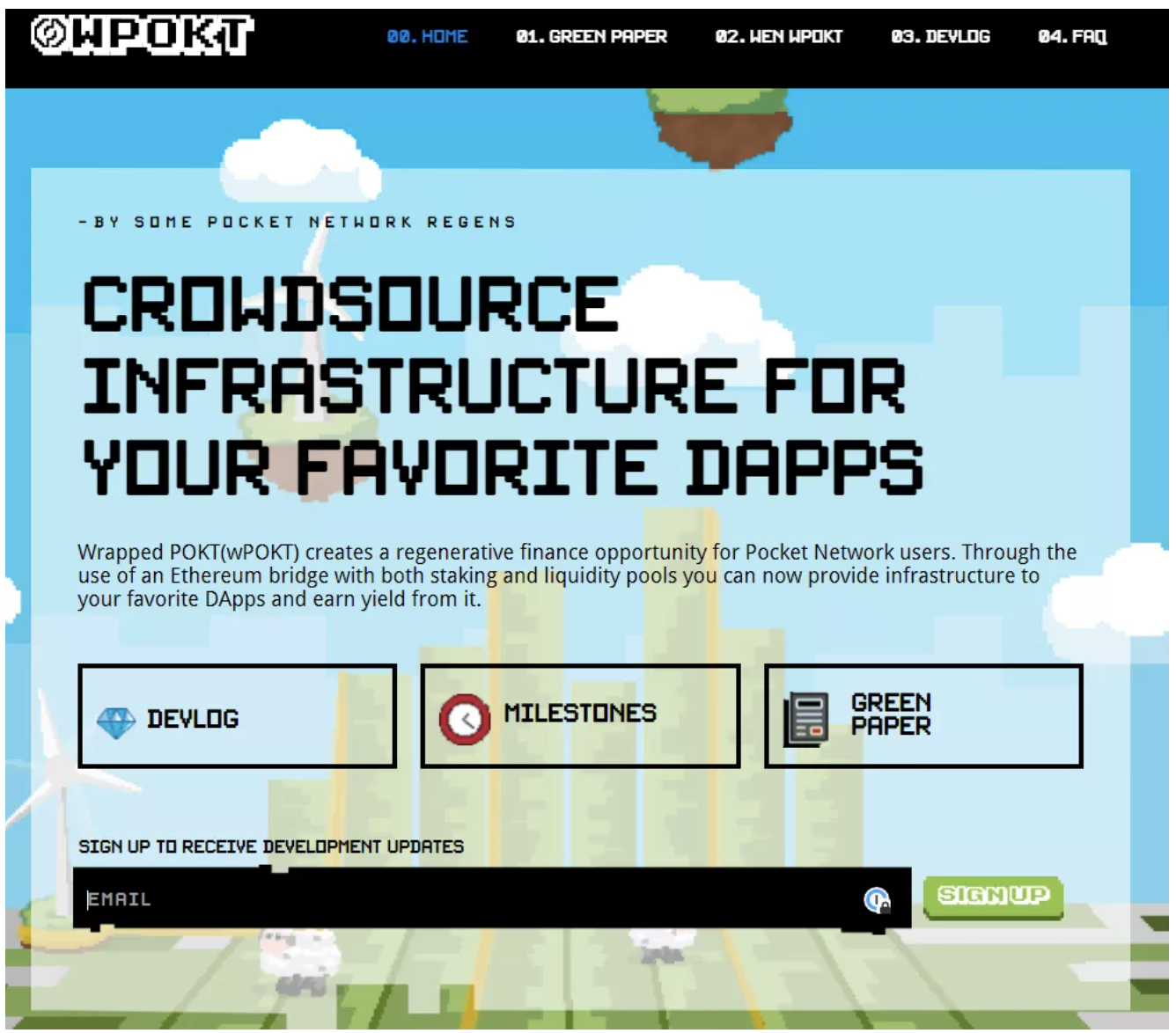

3.3.5wPokt: the key to access the Ethereum ecosystem

Since Pokt is a token running on the main network of Pocket Network, Pocket Network's exclusive wallet is required for use and transfer, which greatly limits the ability of Pokt to expand and combine as a value carrier of the project, resulting in Pocket Network and other The main chain, especially the isolation of the Ethereum ecosystem.https://wrapped.pokt.network/

Therefore, Pocket Network designed wPOKT. Wrapped POKT (wPOKT) is an ERC20-based token, which is the encapsulation asset of Pocket Network main network POKT in Ethereum, and its price corresponds to Pokt 1:1 equivalent.

image description

The official interface of wPokt, source:

The introduction of Wrapped POKT by Pocket Network may have the following purposes:

1. Standardize POKT to ERC20 format, which can open up the Ethereum ecology, so as to make great use of the various benefits brought by the rich smart contracts in its ecology, including the expansion of Pokt usage scenarios and the expansion of liquidity (access to various DEX )

2. Tokens in ERC20 format are cheaper for CEX to access, which is conducive to the listing of tokens on large trading platforms

3. In addition, the issuance and launch of wPOKT is the basic condition for Pocket Network’s network growth plan. With wPOK in Ethereum format as the token medium, Pocket Network can launch its long-planned Data Farming activity. The goal of this activity may be There are three:

● Encourage investors to pledge wPokt in the data farm, and the pledged wPokt will be used to provide basic relay bandwidth subsidies for new applications, so as to reduce the cost of developers switching from centralized API services such as Infura to Pocket Network, and realize Rapid Growth of Internet Users

PS: Balancer is a DEX on Ethereum, and its LBP is the abbreviation of Liquidity Bootstrapping Pool, which is an IDO scheme. Interested readers can learn more about it by querying Balancer's documentation.

3.4. Risks

secondary title

3.4. Risks

text

Competitive loss

text

excessive concentration of nodes

At present, 50% of Pocket Network’s verification nodes are in the hands of the top three node operators, which weakens the decentralization value and narrative of Pocket Network to a certain extent. This situation is worthy of vigilance.

The risk of hyperinflation

4. Preliminary value assessment

What operating cycle is the project in? Is it a mature stage, or an early and middle stage of development?

4.1 Five core issues

Does the project have a solid competitive advantage? Where does this competitive advantage come from?

Blockchain data infrastructure itself is a booming early market, and Pocket Network has established a new product paradigm of data infrastructure, which is in the early stage of exploration. Its future market space is huge, and of course it also faces uncertainties in terms of competition and path selection.

Is the long-term investment logic of the project clear? Is it in line with the general trend of the industry?

The competitive advantage of the project mainly comes from its new paradigm, which has obvious advantages in product structure, economic model, system privacy protection, composability and flexibility.

What are the main variables in the operation of the project? Is this factor easy to quantify and measure?

Pocket Network's medium and long-term investment logic is very clear, that is, the long-term growth of the blockchain infrastructure track and the explosion of data demand from multiple parties. This is a logic similar to that of cloud computing relative to the Web2 industry, and it fits well with the general trend of Web3 development.

How will the project be managed and governed? What is the level of DAO?

The main operational variable of the project is whether it can achieve a rapid start-up of business, let the two-sided markets promote each other as soon as possible, and let the growth flywheel enter the self-rotation stage. We can observe it from two angles. One is to directly look at its core business indicators: the number of relay services and the number of nodes. The second is to focus on the cooperation between each main chain and Pocket. In-depth cooperation with the main chain can quickly bring huge business growth.

How will the project be managed and governed? What is the level of DAO?

The project has launched the DAO governance method, has a complete governance constitution, a clear governance framework, and has also selected Aragon's governance tools. At present, there are many types of proposals in the governance forum, and the overall level of DAO is relatively good.

secondary title

4.2 Valuation level

The data infrastructure field of the blockchain has huge room for development, and the top players are in a good profit position. Whether it is the basic RPC node business or the horizontal expansion of new service categories, with the advancement of the Web3 wave, its growth limit will be very high. In the valuation of this kind of high-speed development and full of variables, the use of discounted cash flow for valuation does not have much practical significance.

And if the revenue multiple (PS\PE) is used, since the representative projects of this track such as Infura, Alchemy and Quicknode have not disclosed their actual revenue or profit data, it is difficult to make a horizontal comparison with Pocket Network, and Pocket Network The user payment method of the platform is pledge (disguised payment of service fees through network dilution), which is different from the monthly payment SaaS model of centralized projects, and the comparison of revenue multiples is also difficult to achieve.

Therefore, the author here only lists the current valuation and core business data of the top players on the track to compare with Pocket Network:

It can be seen that Alchemy represents the optimistic valuation upper limit of centralized companies in the infrastructure track, and its valuation even exceeds that of ConsenSys, which has two giant basic-level applications. The story Alchemy tells in the capital market is "AWS in the Web3 world", and its dominance in the enterprise market is gradually confirming this.

The logic that supports Alchemy's high valuation is the "high deterministic growth" of the Web3 track under the background of the overall sluggish growth rate of the global economy. Moreover, compared with unconstrained “Metaverse” projects, companies like Alchemy have a clearer profit model, growth trajectory, product array, and corresponding cash flow income, and institutions are more willing to place heavy bets.

If Alchemy's valuation is reasonable, we can refer to its valuation and use the "GBF model" to try to price Pocket Network.

GBF is the abbreviation of Get Big Fast, that is, "grow up fast". This valuation method is very simple. It is to find a possible future target as a benchmark, and then calculate the market ceiling that a start-up project may reach. Then assume that the start-up company at hand has smooth financing and rapid growth, and then calculates an ideal situation in the future. Then use this "ideal situation" to discount to judge how much the project is worth now.

To give a cross-border example of valuation using the "GBF model": This year, many catering companies in China have obtained a valuation of over US$150 million, including the cutting-edge brand "Momo Dim Sum", which was valued at the last round of financing in 2021. Worth nearly 500 million US dollars. Its core valuation logic comes from the fact that similar catering giants Hollyland (with a market value of 500 million U.S. dollars) and Yuanzu Cake (with a market value of 700 million U.S. dollars) provided it with valuation benchmarks. Now, due to China’s digital marketing and supply chain system Greatly improved, a cutting-edge catering company can grow rapidly with the help of the above two forces, and the success rate is greatly improved. This investment logic of "redoing a good track" has also won the favor of investment institutions.

Of course, the application of the GBF valuation model has a special scope, and generally speaking, several conditions need to be met:

● The growth of the track is relatively certain, the path is clear, and there are clear benchmarks for the same track

● Huge room for growth, with sufficient potential profit to hedge risks

Undoubtedly, the track that Pocket Network is in meets the above GBF valuation conditions, and Alchemy, which is worth US$3.5 billion, is the benchmark for Pocket Network. valuation range. However, if Pocket Network's expansion rate exceeds expectations, and the market begins to accept the view that "decentralized basic data services are the mainstream", Pocket Network's valuation ceiling will be further opened.

Of course, GBF is undoubtedly a relatively vague valuation method, which can only be used as an approximate "anchor". Alchemy is more certain than Pocket Network, and Pocket Network has a better product paradigm and has already issued tokens. Compared with Alchemy's equity valuation, its tokens will enjoy a higher liquidity premium. Under the influence of a combination of factors, we don’t need to be too surprised if Pocket Network’s valuation is lower or higher than Alchemy’s in the future.

secondary title

4.3 Summary of Value Evaluation

Pocket Network is in a highly deterministic high-speed growth track. As an infrastructure-level application of Web3, it will benefit from the evolution of the Web3 wave for a long time.

Its core competitiveness mainly comes from a more advanced product paradigm, providing services through agreements rather than centralized services, specifically:

● In addition to competition, Pocket Network and other nodes also have a cooperative relationship. When the network grows to a certain level, competitors of self-operated nodes also need to join it

● With stronger openness, composability and flexibility, it does not need to consider the huge infrastructure, hardware and operation and maintenance costs of the centralized organization, and can focus on developing the community and coordinating the distribution of network benefits

● Owning a token system, in terms of growth, incentives and coordination of multi-party interests, there are advantages that non-currency organizations do not have

● Has an application main chain managed by DAO, and has a rich toolbox of macro strategies

● Based on the concept design of Web3 openness and value sharing, it is easier to get the respect and recognition of influential developers, opinion leaders and public chains

In terms of valuation, you can consider using the GBP model to set an "anchor" for the valuation of Pocket Network—that is, the latest round of valuation of the industry-specific Alchemy. The US$2.5-3 billion may be short-term rational and optimistic for Pocket Network valuation range.

*Interest related and risk warning

first level title

research report

The Block:The State of the Digital Assets Data and Infrastructure Landscape (2020、2021)

HashKeySpecial thanks to Pocket Network Chinese Community Manager @Bruce Yin for his help in checking project information and consulting.

SEBA BANK:Classification and importance of nodes in a blockchain network

Cryp2Gem:Pocket Network Research

Eden block:Pocket Network Investment Thesis

project information

research reporthttps://docs.pokt.network/

: "In-depth interpretation of the blockchain data industry: how to generate and capture value?" "https://C0D3R.org/NetworkCharts;https://www.poktscan.com/

project informationhttps://github.com/pokt-foundation/governance/blob/master/constitution/constitution.md

Network data:https://forum.pokt.network/