Inventory of the top ten NFTs in 2021: Crypto's way out of the circle

NFT can be said to be full of glory in 2021, and no one thought that Crypto's way out of the circle in 2021 would start with NFT. From no one cares about it to everyone knows it, and was even selected as the 2021 vocabulary of the Collins Dictionary. According to statistics, in 2021, the usage rate of the term NFT has increased by 110,000%.

secondary title

NBA Top Shot

At the beginning of 2021, NBA Top Shot fired the first shot of NFT going out of the circle.

Although NBA Top Shot began testing in mid-2020, it did not fully explode until January 2021. These digital versions of star cards have attracted the attention and active participation of many NFT enthusiasts, NBA fans, and physical star card collectors. When NBA Top Shot is at its peak, the single-day transaction volume can reach 45 million US dollars. As of press time, the total transaction volume of the NBA Top Shot secondary market is as high as $811 million.

secondary title

Hashmasks

In February 2021, Hashmasks, the next project that will have a huge impact on the NFT field after NBA Top Shot, was born.

The emergence of Hashmasks made people exclaim that the blind box sale form can be used on NFT, and the joint curve of the sale price can make people have such a big FOMO emotion. Hashmasks also made people realize for the first time that they can participate in the process of co-creation by naming their own collections, and Name Change Token also made people realize for the first time that NFT collections can also be played with tokens economy combined.

secondary title

Everydays: The First 5000 Days

Immediately afterwards, in March 2021, artist Beeple's encrypted artwork "Everydays: The First 5000 Days" landed at Christie's, a top auction, and was sold at a sky-high price of US$69 million. At that time, this work also became the work of a living artist. The third highest-ranked artwork in .

This incident has caused a great sensation in many fields such as encrypted art circles, NFT circles, and traditional art circles. At that time, mainstream media reports on NFT were still focused on the wealth effect of NBA Top Shot and whether NFT was a new type of scam. Beeple and his works made people realize that NFT, as a new type of medium, is of great value to digital art. how important.

secondary title

Bored Ape Yacht Club

Then came early May and the Bored Ape Yacht Club (BAYC) was born. BAYC can definitely be said to be the best-performing NFT series in 2021. Whether it is price increase, popularity, social capital, etc., BAYC has led a collection of NFT avatars to previously unimaginable heights. Today, Stephen Curry, Post Malone and other celebrities from all walks of life have bought BAYC, which has also made BAYC continue to gain more popularity, and the floor price has also climbed to 51.9 ETH, which is about 210,000 US dollars.

At the end of the year, the confrontation between BAYC and CryptoPunks also attracted a lot of attention. BAYC gives the copyright to the collectors, and the collectors can use the image of the ape to make peripherals, derivatives, etc.; and Larva Labs, the production team of CryptoPunks, chose the opposite and did not give the copyright to the collectors. This also caused continuous debate between the two communities, and in the debate, some CryptoPunks collectors defected, which also caused the floor price of CryptoPunks to fall all the way.

In fact, if these avatars are simply regarded as "collections", it is completely understandable to retain copyright. However, in the Web3 era, these avatars have become the "digital identities" of collectors, and they cannot be held in their own hands. "Identity" is contrary to the purpose of Web3, not to mention that Larva Labs also directly authorizes some "digital identities" to film and television companies as movie characters. One of the main reasons for BAYC's explosion is that collectors use their own ape images to produce many peripheral products. This kind of spontaneous and large-scale publicity has also accumulated greater popularity for BAYC.

secondary title

Art Blocks

Art Blocks is a generative art platform that was launched in 2020 but didn't start to gain popularity until June 2021, and set a record monthly transaction volume of $627 million in August.

Generative art is a mainstream art category in the context of encrypted art. Different from oil paintings and sketches that we are familiar with, the creation of generative art depends on codes, and usually combines the randomness of computers. It can be regarded as human beings and computing, orderly Art born from the combination of randomness, sensibility and rationality. Many of the codes used in generative art are also open source. Anyone who uses the same code can generate the same work, and adding some artists' own thinking on the basis of open source code can produce a new set of art. Art work. The creative mode and concept of generative art also coincide with Crypto and Web3.

secondary title

Nouns

When the time comes to August 2021, the development of NFT has reached a new stage. From Hashmasks to BAYC to Nouns, we can find that for NFT series, people's pursuit of aesthetics is gradually decreasing, and social capital is getting more and more attention. The acquisition and value-added of social capital has less and less relationship with the appearance of NFT. The important thing is who is using the same series of avatars and who is in the community.

The issuance of Nouns NFT is different from our common one-time issuance of 10,000 pieces. Nouns adopts the form of auctioning one piece per day, and Nouns DAO is established. Nouns NFT is the only way to join DAO and participate in proposals and governance. All proceeds from the auction will also belong to the DAO treasury. Like BAYC, Nouns also encourages the creation of peripheral projects. The birth of Noadz, Nouns Vox, Noundles, HeadDAO and other projects has also brought more attention to Nouns.

secondary title

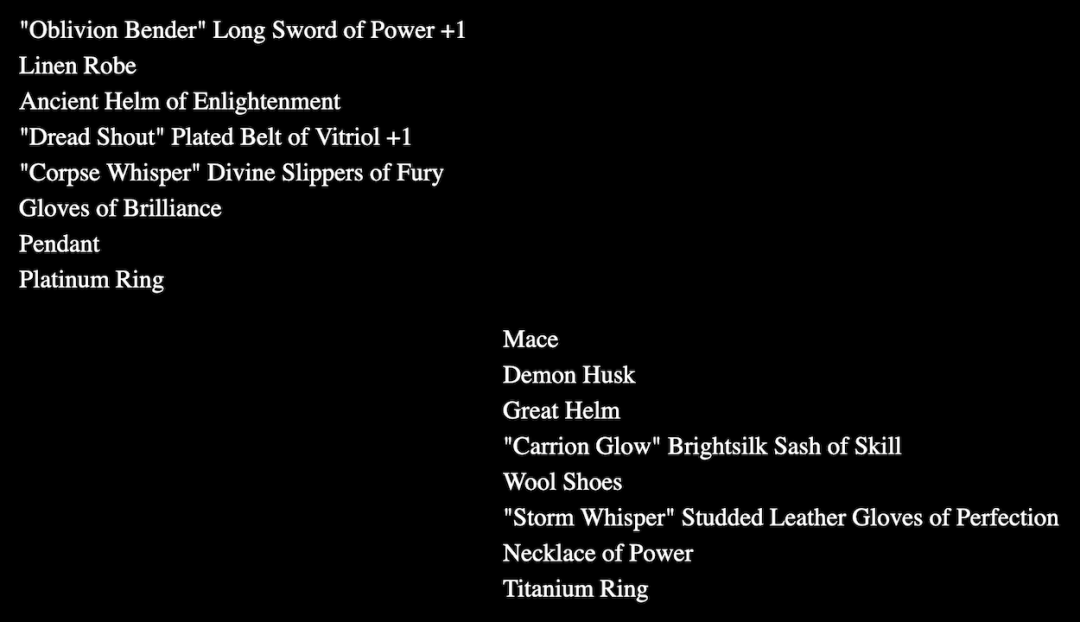

Loot (for Adventurers)

When the time comes to September, a project that will definitely be recorded in the history of NFT was born, it is Loot (for Adventurers).

The founder of Loot (for Adventurers) is the well-known Dom Hofmann, who launched the short video App Vine in 2012 and was acquired by Twitter for $30 million in 2016. Just born.

Loot took off because it broke the mold. The release model adopts free casting through contracts rather than official website sales, and the secondary market royalty rate is set to 0; in terms of community building, other NFTs first have a product and then attract people to join the community, while Loot first Attract people to join the community and then have the community members co-create a product.

Previously, people needed to accept the "image" given by the project party as their digital avatar in the original universe. Only after owning this digital avatar can they join the community of these projects, and then wait for the project party to decide which NFT to give Practicality or what benefits are issued to the holder. What Loot has done is to turn this model around, and create an image that everyone recognizes as a digital avatar by itself and the community, and decide together how to empower instead of simply obeying a certain project party. This paradigm shift also makes people extremely optimistic about the prospects of this project.

However, because Loot lacks a way to capture subsequent value, the current performance of the secondary market has not met people's expectations, but the paradigm shift brought about by Loot has given us a new understanding of NFT and the community.

secondary title

Merge

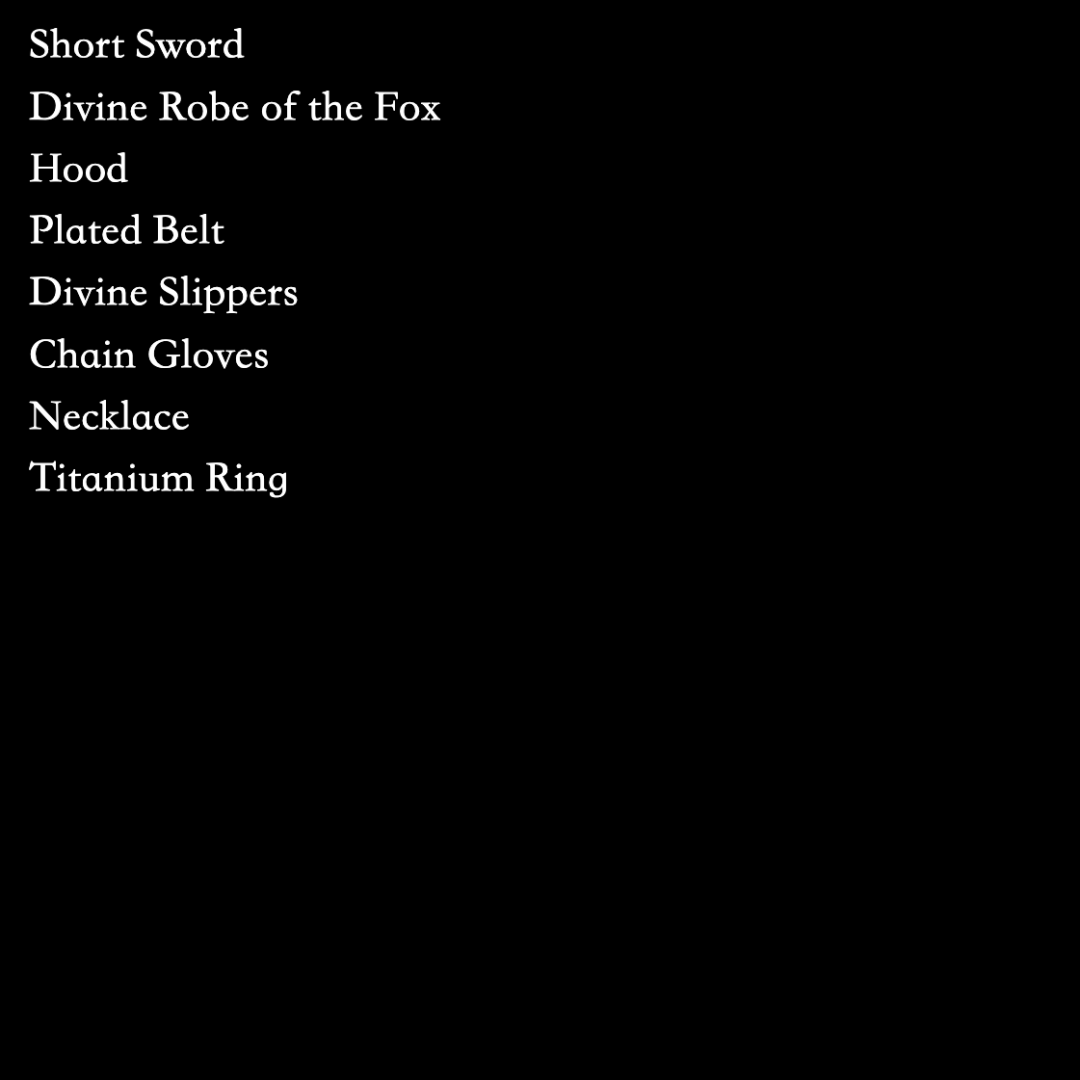

In December, encryption artist Pak's work Merge caught people's attention.

Just looking at the NFT itself, with a black background and a small circle, countless people questioned "Is this considered art?" In fact, people have always had such a "prejudice" against Pak.

The "small ball" released by Pak this time will be fused with the "small ball" originally owned by the collector with each transaction. The more the fusion, the "small ball" will become bigger, and after that, These "small balls" will be converted into ASH tokens issued by Pak according to the rules. And such a fusion mechanism can not only allow NFT to interact with collectors, but also play a deflationary role. And Merge also broke the original "buy first, then fragment" process, and became a "buy fragment first, then merge" gameplay. In addition, the link between Merge and ASH also allows artworks to have financial attributes, and tokens to have artistic attributes.

From the CUBE composed of small cubes to the LostPoets, which was originally a blank sheet of paper, people always think that these "can be done by themselves". Indeed, from the appearance of a single NFT, there is almost no production threshold, but Pak is not actually a "visual artist". Compared with the visual, the mechanism design of Pak's works is more attractive. The gameplay mechanism together constitutes "a work of art", and Pak is a "digital concept artist".

secondary title

RTFKT

Then came the shocking news that RTFKT, a digital fashion brand and Web3 unicorn company, was acquired by traditional industry giant Nike. As soon as this news came out, the price of the NFT collectibles of the CLONE X avatar series issued by RTFKT doubled directly.

The various 1/1 sneakers previously launched by RTFKT, the trendy toys co-branded with artists such as FEWOCIOUS, and the sneaker series launched for CryptoPunks holders have all been well received, and CLONE X, which collaborates with trendy artist Takashi Murakami, has also attracted much attention. So the news that RTFKT was acquired by Nike caused a sensation and heated discussions among people.

Some people think this is a good thing, proving that NFT has a growing influence around the world; some people also think that this is not as exciting as most people think, and Web3's unicorn companies are finally Was "recruited".

secondary title

adidas Originals Into the Metaverse

Also in December, Nike's competitor adidas also made a big move in the NFT field.

The clover brand of adidas may cooperate with BAYC, G-Money and PUNKS Comic to release the "Into the Metaverse" NFT in mid-December. A total of 29,620 NFTs were sold in this sale, with sales reaching 5924 ETH, or about 23 million US dollars .

Unlike many other traditional industry giants that sell NFT, adidas' cooperation with the NFT project has not been questioned, but has been well received. Adidas did not return to Web2 to do traditional business after making a lot of money from the sale, but chose to develop in the long-term on Web3. Adidas officials also said that this sale is just the beginning and will continue to empower NFT in the future. The benefits of NFT holders that have been announced so far are that they can receive 3 pieces of iconic physical clothing related to NFT for free in 2022.

As of press time, in less than a week, the transaction volume of adidas Originals Into the Metaverse NFT secondary market has reached 47.18 million US dollars, surpassing many veteran NFT projects such as CryptoKitties.

2021 is a year of rapid development of NFT. The development speed of Crypto is already faster than that of traditional industries. In addition, NFT has cultural attributes that are easier to get out of the circle than other tracks of Crypto. This makes people who have never paid attention to NFT or even People who pay attention to Crypto are flocking, which also allows NFT to undergo several changes in just one year.

As for what NFT will look like in the future, no one can make a conclusion, but it is foreseeable that the existing high-quality projects will continue to advance along the path opened by themselves and attract more people to join. More new projects will try to explore the boundaries of NFT and explore things that we have not yet imagined today.