Talking about the trade-off between decentralization and centralization: an interesting gray area

Article translation: Block unicorn

Article translation: Block unicorn

I've been thinking about gray areas lately, and as someone who divides my time between macroeconomics, cryptocurrencies, the stock market, and politics, I've noticed more and more that...it doesn't make sense (hell :) yep). Like things make sense but they don't either? This is mostly because of trade-offs — our lives don't exist in a vacuum, they exist in experimental petri dishes. This section breaks down as follows:

trade off:The trolley problem and second order effects and life is a gray area

centralization trade-off

The Fed's trade-off(Wow, they never get it right)

Apple weighs(Or is the stock market really only 6 stocks?)

Cybersecurity Tradeoffs(dependency on legacy systems)

True Decentralization-Centralization Tradeoff(a story as old as time)

energy tradeoff(Why can't we stop destroying the planet)

Encryption Tradeoffs(Narrative Creation, Resistance and Destruction)

dollar trade off(dollar elastic)

balance of happinessfirst level title

final thoughts

trade off

For every action, there is an equal and opposite reaction. For every option A, there is an option B, and sometimes an option C, an option D, and an option Z. Life is a function of evaluating those choices, of making weighted probability decisions around the different choices we face (most of the time).

Are you selling or buying? Do you pick up trash or throw trash? Are you moving or staying? Life is a series of small decisions that are then packaged into several larger decisions, some harder than others.

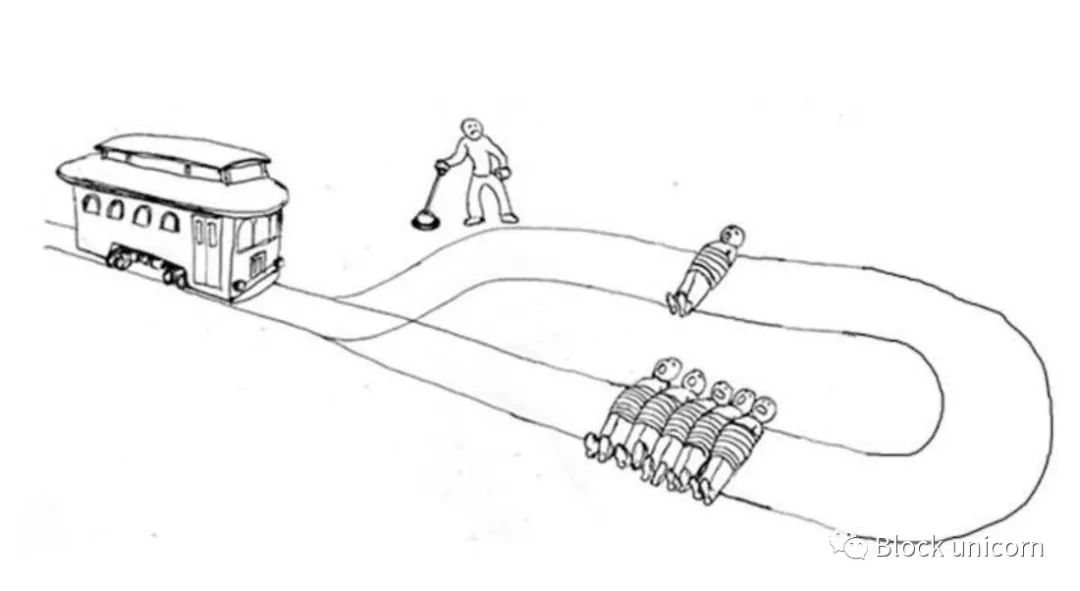

It's a wheelbarrow problem, scaled, do you pull or don't you pull the lever?

But of course, outcomes aren't limited - it's not true that every decision we make has consequences, levers pulled or not.

(A) Pull the lever.

(B) Don't pull the lever.

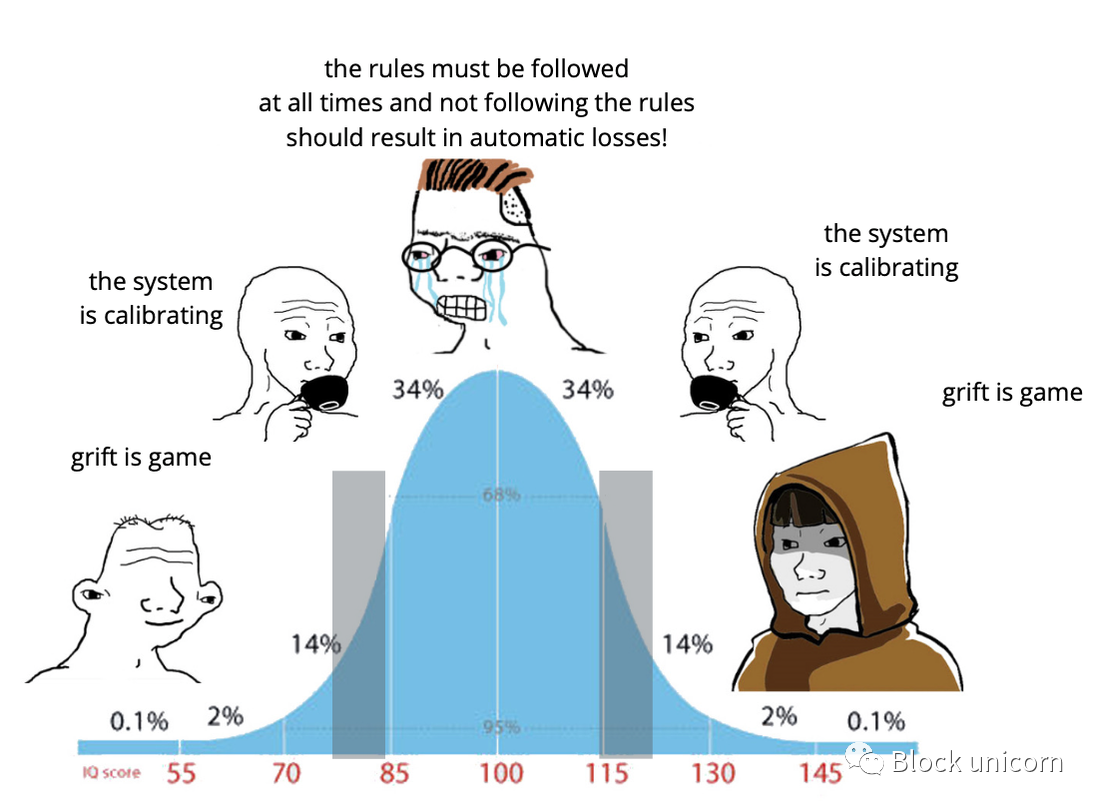

There are a lot of gray areas - who is affected by A, what carnage B leaves behind, if the cart loses a wheel, A turns into B, etc.second order effectimage description

Image Credit: The New Republic

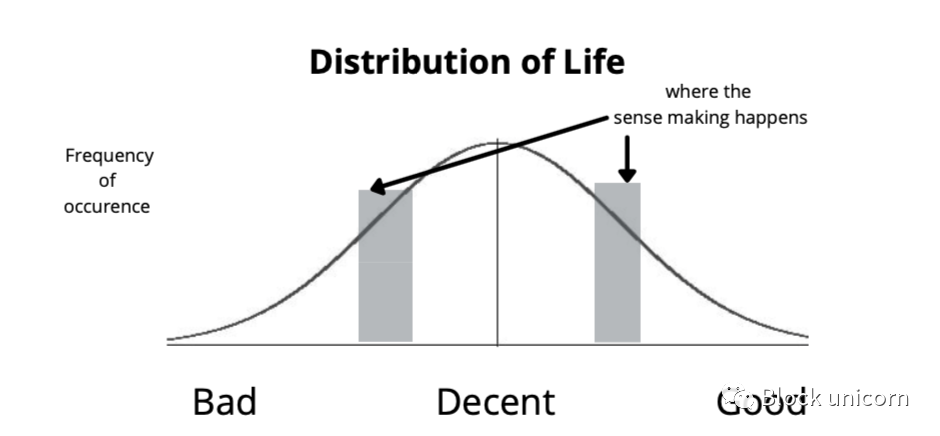

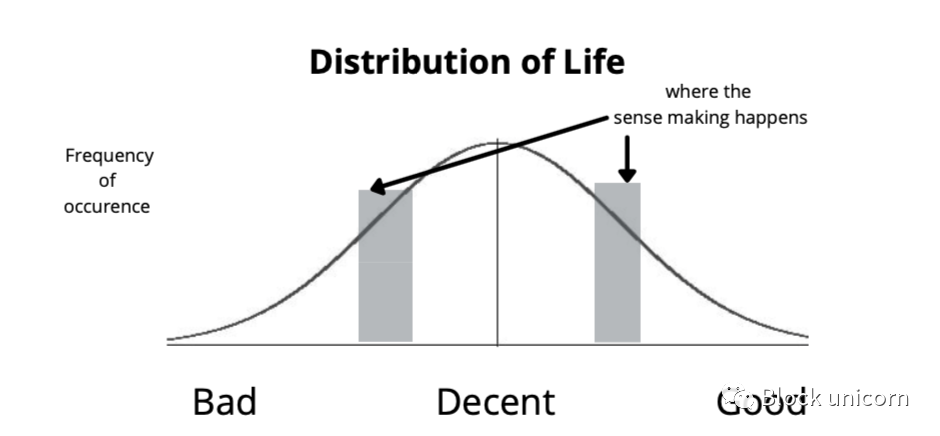

That's why this gray area makes up so much of our lives—a key part of the distribution. In life (on the most macro scale):

we have good stuff

we have good stuff

we have very bad things

Of course, there are a lot of gray areas, and this gray area is the most interesting part, what is the edge of good and bad, what makes something decent and good, and what makes something terrible and wonderful.

Life is a distribution, but those tails are fuzzy, right? - Defining what is "good" and what is "bad" is something philosophers have been banging their heads against the wall for thousands of years, and bad/good gets blurred due to trade-offs.

centralization trade-off

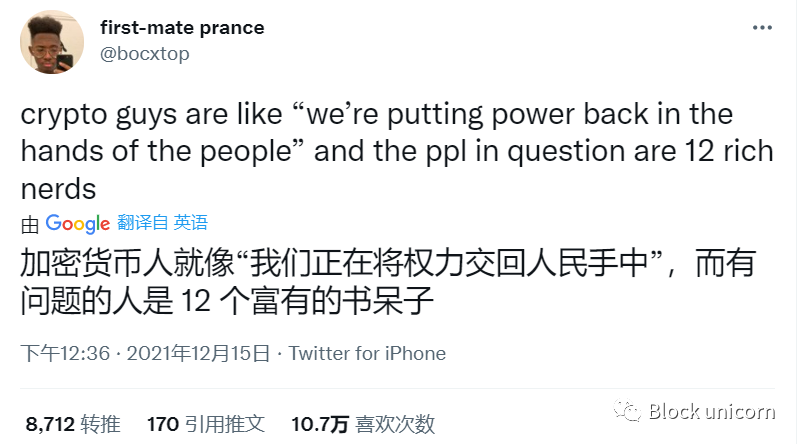

Centralization is a core part of our lives - and sometimes worrisome. One of the main goals of crypto/web3 is to revise centralization into decentralization - so that everyone has access to opportunities, and key decisions are not made by 5-person derivatives in a board room deciding the outcome.

As Vitalik writes in his excellent book Bulldozers and the Political Axis of the Veto:

Cryptocurrency proponents often cite Citadel's meddling in the Gamestop deal as an example of the opaque, centralized (and bulldozing) manipulation they're fighting against. Web2 developers often complain that centralized platforms suddenly change their APIs to destroy startups built around their platforms.

Vitalik goes on to describe a series of trade-offs between the bulldozer and the veto (as opposed to the authoritarian-liberal axis, not necessarily centralization-versus-decentralization, but these ideas can apply here as well):

The physical world has too many vetoes, but the digital world has too many bulldozers with no real effective shelter from bulldozers (hence: why do we need blockchain?).

The process of creating lasting change requires overthrowing the status quo, but protecting that change requires a veto. These processes should happen at some optimal rate; too much, and chaos ensues; not enough, and stagnation ensues.

A strong veto should protect key institutions that exist both for the bulldozers need to bring about positive change and to give people something they can rely on that won't be destroyed by the bulldozers.

In particular, the bottom layer of the blockchain should be vetoed by one vote, but the application layer governance should leave more room for bulldozers.

Better economic mechanisms (quadratic voting? Harberger taxes?) could get us many of the benefits of vetoes and bulldozers without much of the cost.

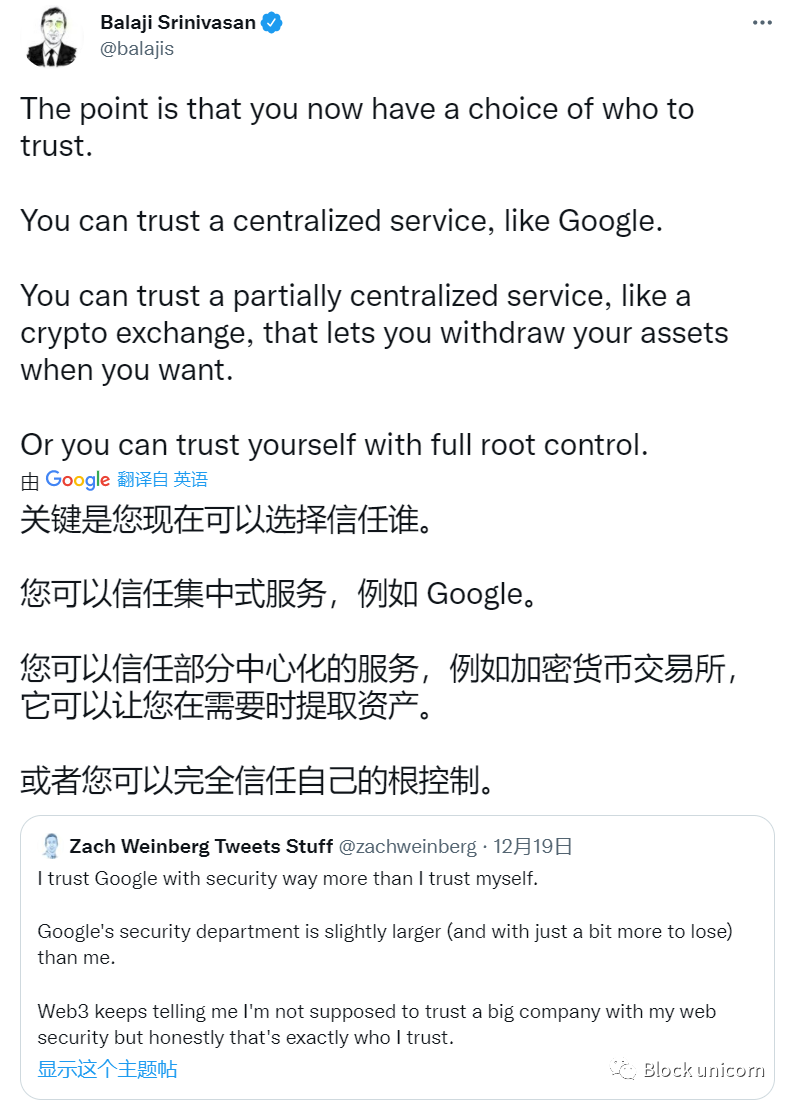

image description

Source: Balaji Srinivasan (tweet on Dec 19)

Decentralization offers options: ownership, information flow, understanding narratives, controlling your own data, and having an element of privacy are important.

But centralization also has benefits—such as stability, reliability, efficiency, and more.

This is the ~trade off~.

As Henry Mintzberg said in The Structuring of Organizations (written in 1979, we do live in a cycle):

“The words centralization and decentralization have been talked about for as long as anyone has been willing to write about organizations.”

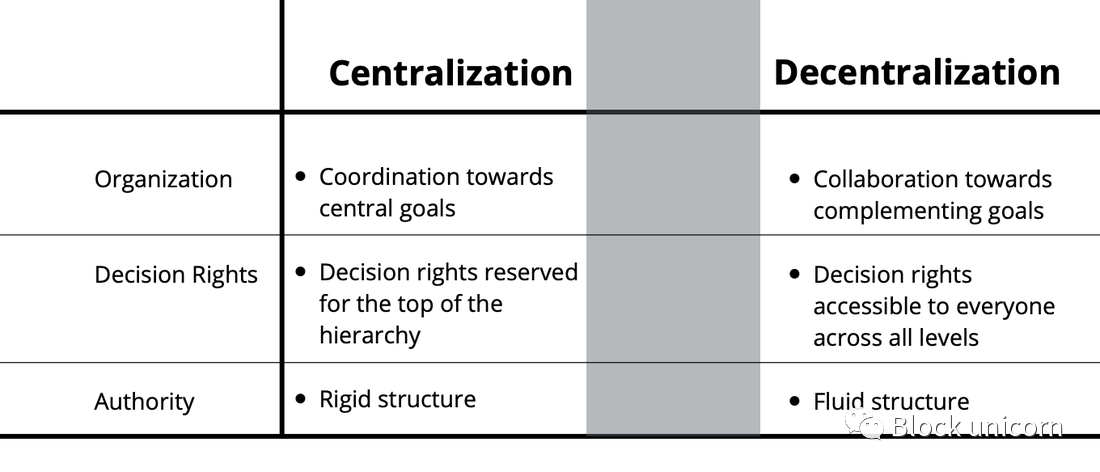

So the crash ends up looking like this - concentrated and scattered, with gray in between.

Centralization has pros and cons (tradeoffs):

Good: having core decision makers is more efficient (in the current system)

Bad: because of overhead (erosion of efficiency)

Decentralization has both advantages and disadvantages:

Benefits: Everyone has the right to vote, equal and fair.

Disadvantages: factions are easy to form, and the cost of reconciliation is high (after all, everyone has different opinions).

andandimage description

Inspired by decentralized organizations, graph text mining

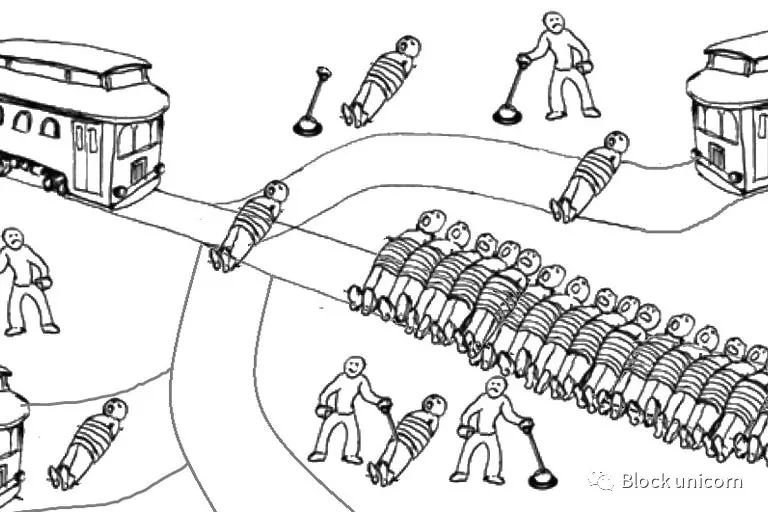

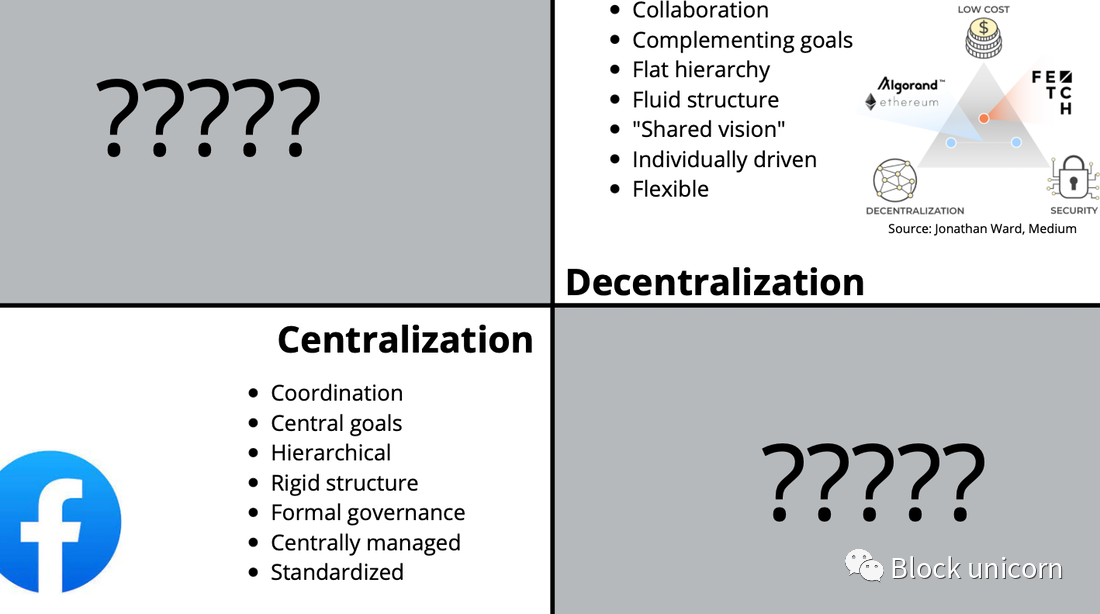

But like the trolley problem, it's really not (A) centralized or (B) decentralized - it's more like (A) centralized with contextual trust and some optional elements or (B) with full ownership But there is access to the support system.

Decentralization: In a DAO (Decentralized Autonomous Organization), there are ultimately quasi-leaders who direct most of the operations and make capital D decisions.

image description

first level title

The Fed's trade-off (Hi Jerome Powell)

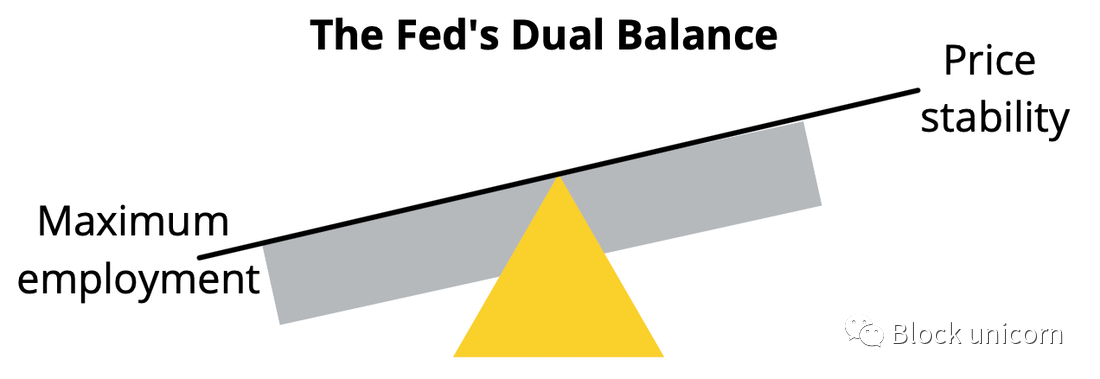

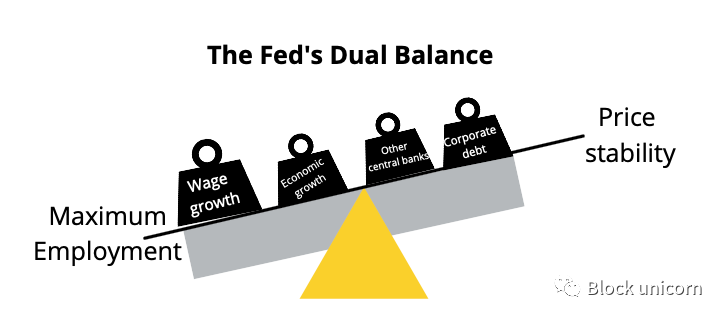

So where is this narrative of decentralization versus centralization? The Fed is a centralized policymaker (Jerome Powell drives the car). They have a huge tradeoff - one of the hardest because of the impact it has, and the sheer difficulty of getting the balance right.

The Fed must optimize both maximum employment and price stability - this is their dual mandate, better described as their dual balance:

Employment:They need people to be employed, but not too employed.

Price Stability:They need prices to rise, but not too quickly (inflation is increasingly a political tool with uneven effects - it's important to get this right).

Then it all boils down to:

Economic Growth:They have to make sure of this (otherwise! wrath from politicians!), not let the economy grow too fast, while making sure it doesn't stagnate. Of course, there are other factors that affect the Fed's dual balance.

Other central banks:They also have to balance the international monetary policies of other central banks (notably a surprise rate hike by the Bank of England).

Corporate Debt:At historically high levels, it will be squeezed with higher interest rates.

supply chain mess, the raw materials are quite expensive, and the labor market is also strange.

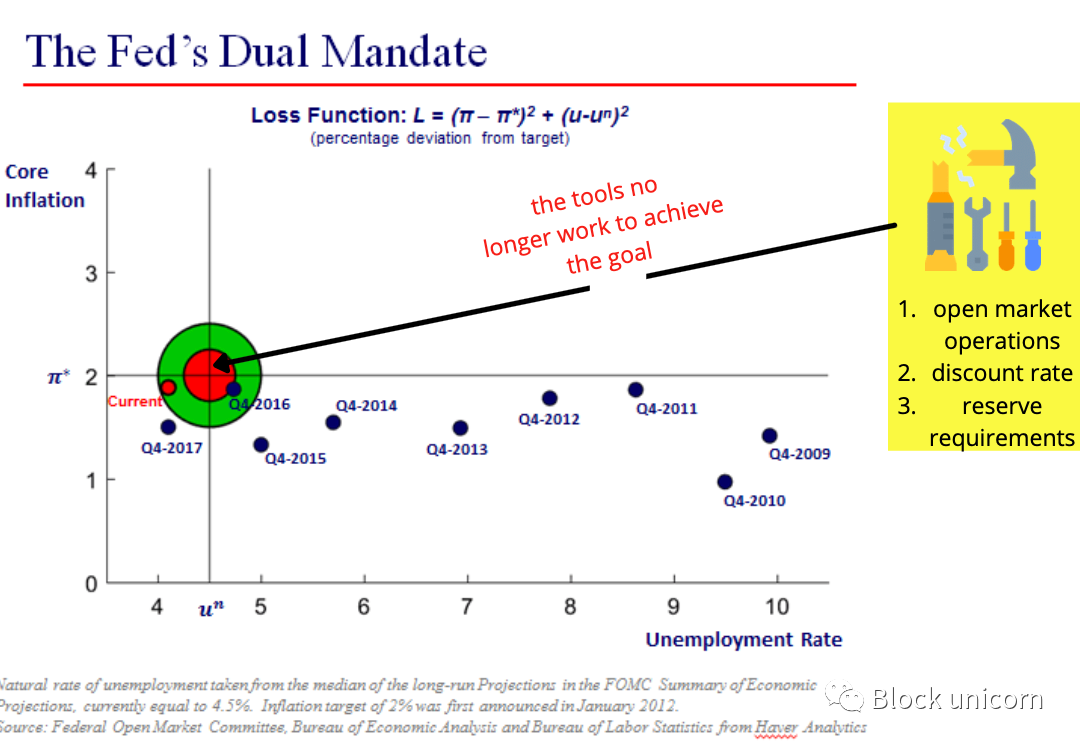

The worst part - and what the decentralization/centralization tradeoff doesn't really solve -Yes the Fed's tools may not work, as Harley Basman writes:

"The Fed may well have broken the correlation between interest rates and inflation.

Unfortunately, decentralization doesn't matter if the link between process and outcome is broken. The Fed must now apply potentially damaging tools to:

How do you increase the rate and slow/speed up the taper to get into the red dot in the image below?

image description

Source: Chicago Fed

first level title

The Manchin Nuke and Key Man Risk

image description

image description

Manchin: Manchin is an important political figure in the Democratic Party of the United States.

first level title

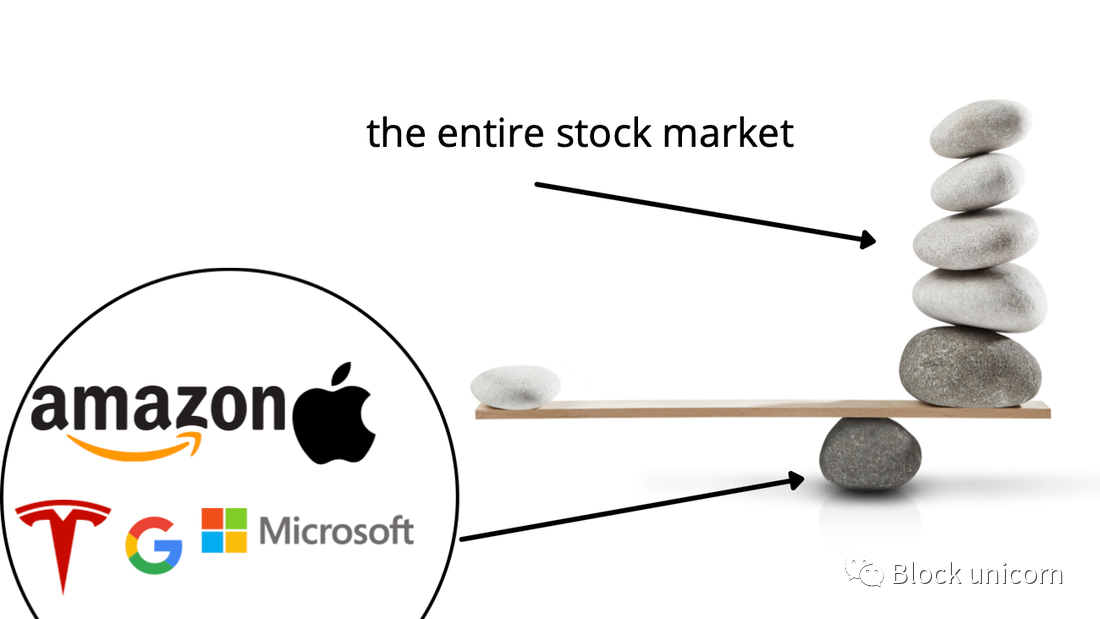

Apple Tradeoff (6 Stocks = Stock Market)

Apple is a core part of the S&P 500 (heh) and has been piggybacking on technology, it's really like 6 companies carrying the market - Apple, Google, Microsoft, Tesla and Amazon. The rest of the market is just a bit of a drag.

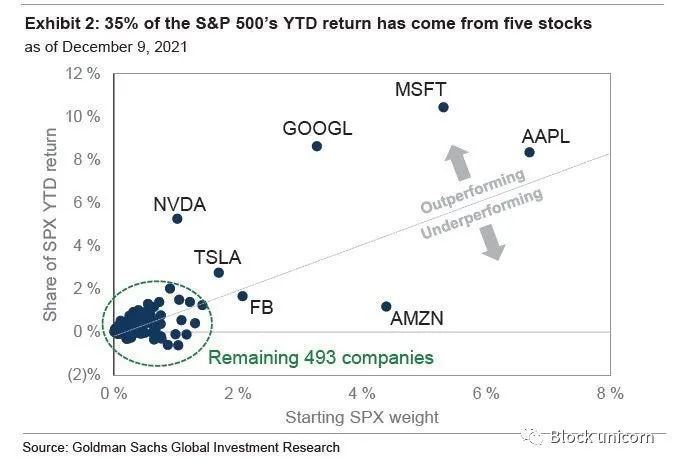

This chart from Goldman Sachs does an interesting job detailing - 35% of the S&P 500's return came from these 5 major stocks.

This creates an interesting environment when the five big boys fall - affecting the performance of the S&P 500 - while the rest of the market keeps rising. As Gunjan detailed following Thursday's post-FOMC (Fed Open Market Committee) sell-off - the S&P 500 fell despite eight out of 11 sectors gaining ground.

Then another question becomes - what is the stock market? (Ha ha)

Is it really only 6 stocks that are driving the performance of the index, thus dragging it down?

What is ~centralization~ risk?

Is it the S&P 500 or the S&P 5?

What are its weaknesses? Does the manager only match 5 stocks, and if so, what does this mean for concentration risk in the market? Where are the gray areas?

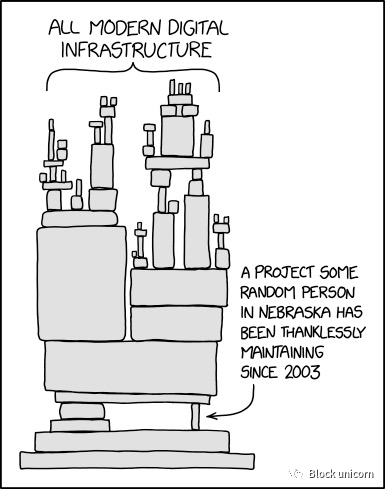

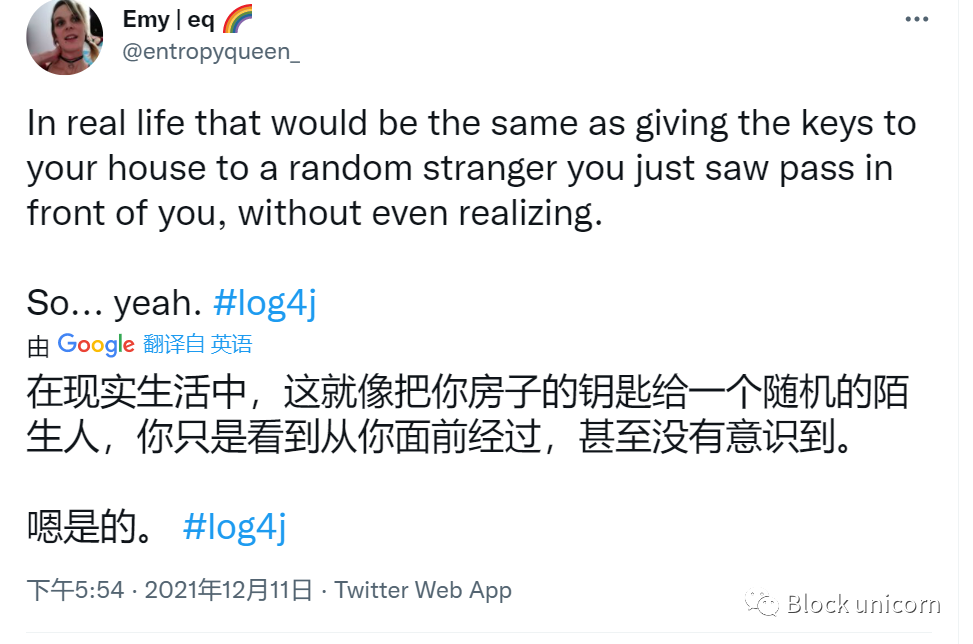

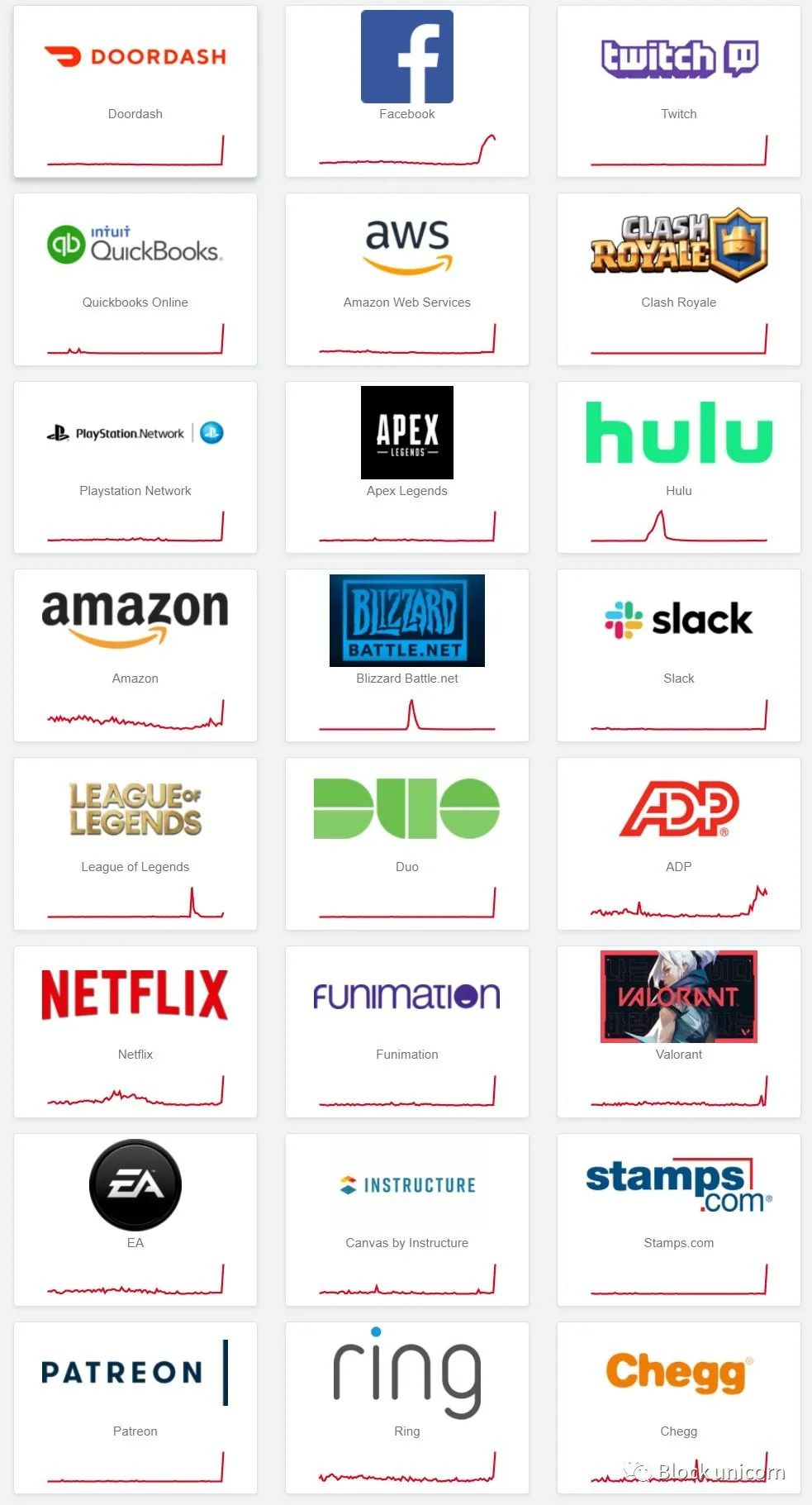

Network Security Tradeoffs (Internet jenga)

log4j vulnerabilities (more here) are another centralization tradeoff:

It shows us that we can't rely on small under-resourced and low-acceptance teams to maintain *the entire* Internet. It also shows us how fragile the systems we have are -- how fragile they can become if we don't take care of them.

It's a huge software bug and bug -- it's the foundation of open source, volunteers, and people who want to build a better Internet.

But better ones require investment (and stay away from constant patching, small fixes to branches, rather than solving the root cause!!!

And AWS, no matter what happens there - the risk of cloud centralization is real.

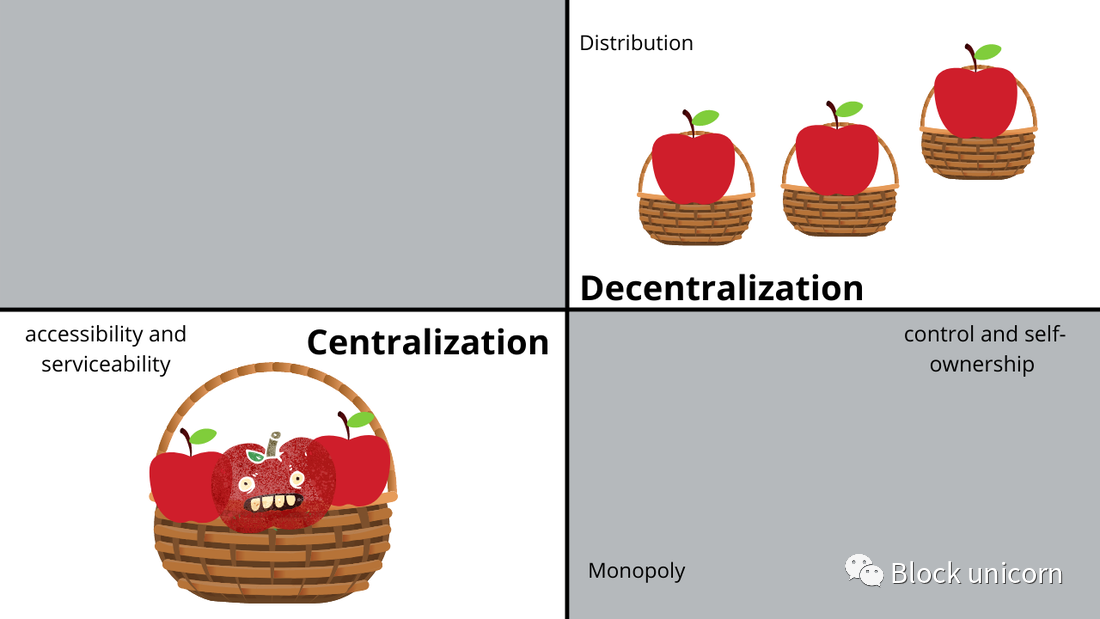

real trade off

Decentralization

Decentralization

Allocation - All apples are in separate baskets under control and self ownership - you can take them at any time.

centralization

centralization

Monopoly - all apples are in one basket - one bad one can ruin the whole lot.

Accessibility and serviceability - a centralized party can handle almost everything and is usually easy to use

Again, trade off

Centralization: One party controls everything, one bad apple ruins the batch, but is easy to use and access.

first level title

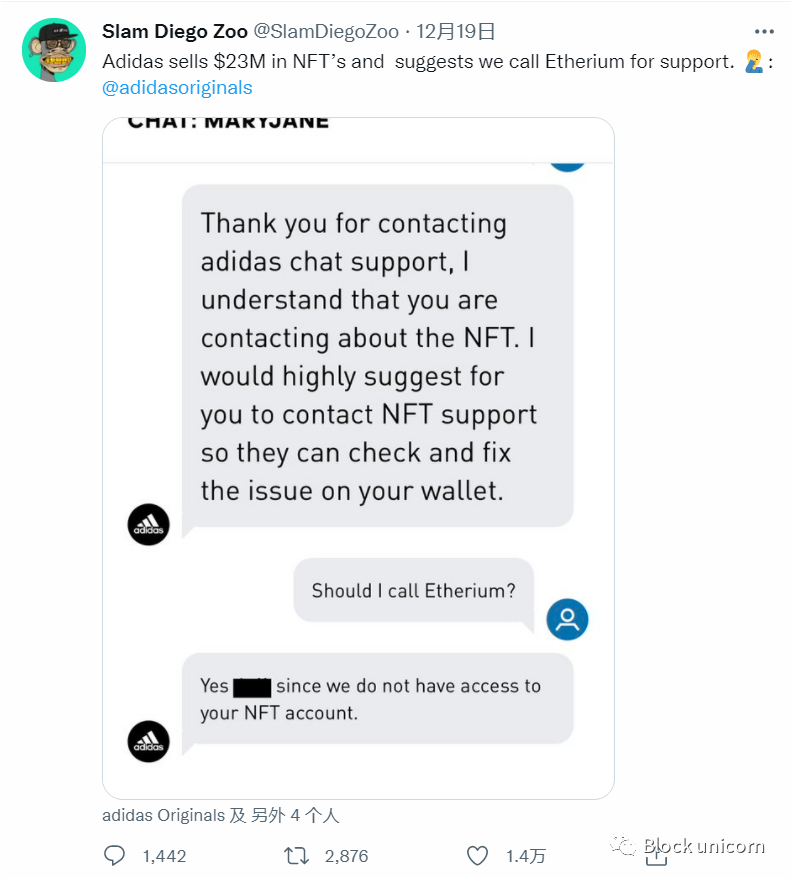

people need someone to call i think

Part of the problem is that people base it on their comfort level, so we expect maintenance or repairs to be called when something goes wrong, people love customer service.

This doesn't happen in web3 (decentralized presumably), it's very evident with adidas' foray into NFTs - you can't call anyone for support (especially "Ethereum") because there's literally no one to call Phone, it's a huge narrative shift.

This doesn't happen in web3 (decentralized presumably), it's very evident with adidas' foray into NFTs - you can't call anyone for support (especially "Ethereum") because there's literally no one to call Phone, it's a huge narrative shift.

As Mondo says on AWS: "Their prices are low, their service is top-notch, and they usually guarantee extremely high reliability. However, since they serve most websites in the cloud service space when they encounter errors or problems,So it feels like the whole internet is paralyzed。”

It's a gray area again, someone calling or having your information - a trade-off between the two (eventually, there will be some kind of reconciliation, but for now, the gray is pretty solid if you know what I mean).

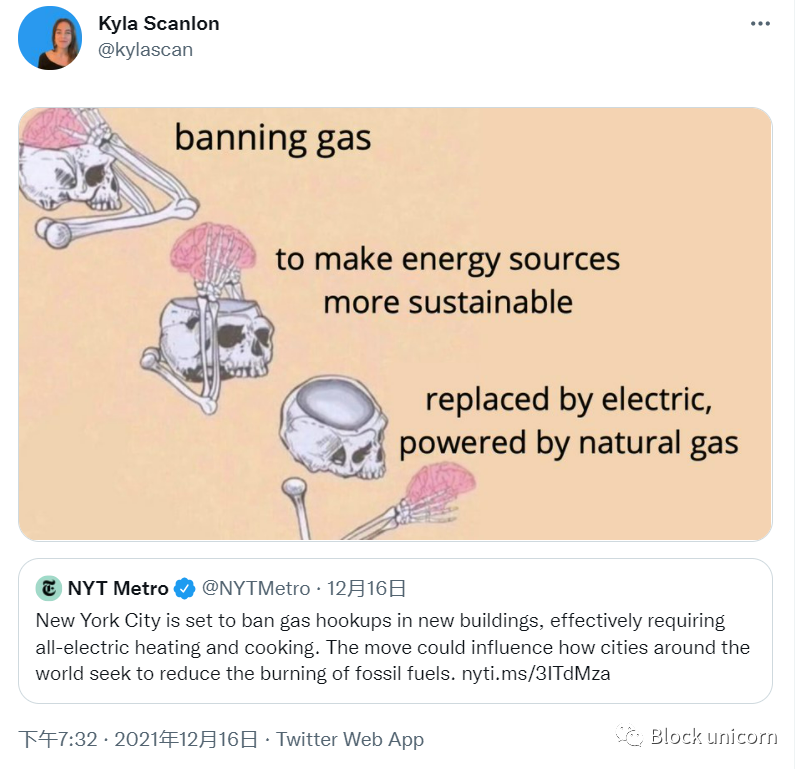

Energy Tradeoffs (How to Save the Planet)

This really gets into the tradeoff and balance between low price and reliability - a huge tradeoff with our future at Odaily.

The main arguments here:Incremental, deliberate progress is better than no progress at all. New York City just enacted a mandatory requirement for new homes to have all-electric heating and cooking, which is good! It's good that we're making progress in this direction, but the impact of legacy systems in the energy world is undeniable -- and they're sure to be hard to shake off.

Warning to my tweet above - there are many reasons why NYC made this decision important and beneficial - including clearing smog from homes, shifting to electricity that will soon be produced with clean energy instead of natural gas, and thermal efficiency pumps.

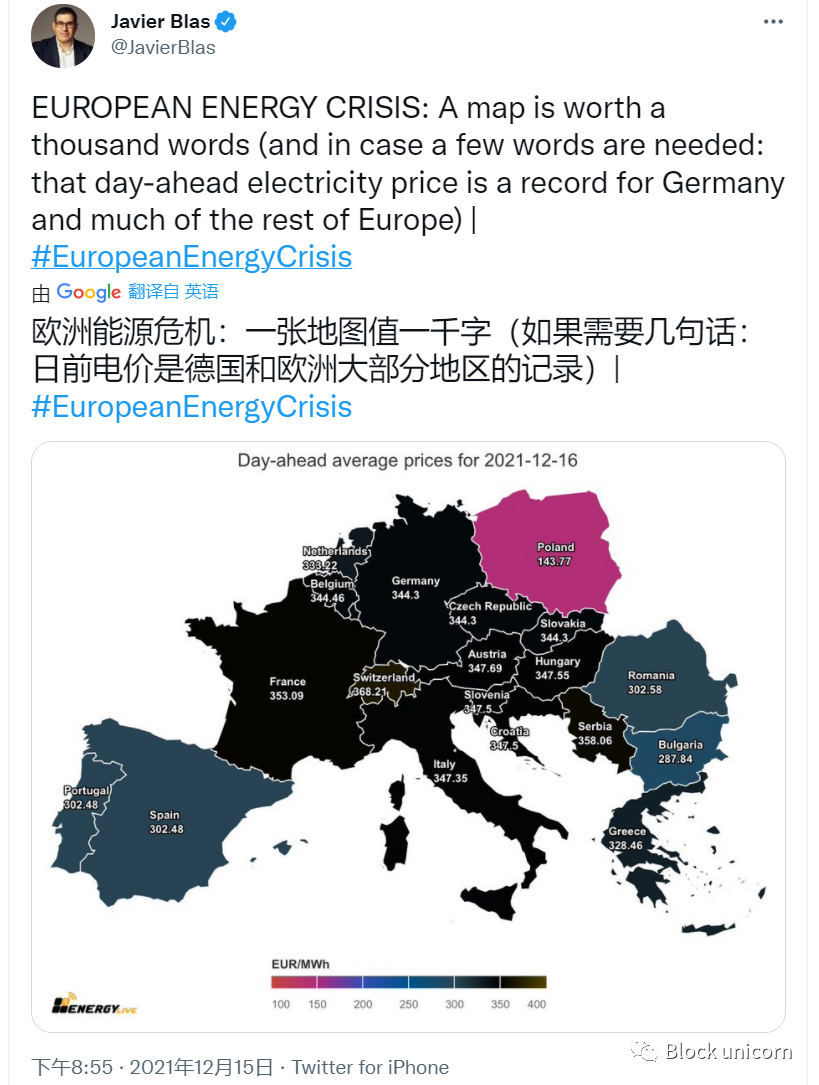

We all know this! We have to breathe. But with Diablo Canyon closing and Sweden having to restore oil-fired capacity due to Europe's energy crisis, I worry about the gray areas here. The Secretary of Energy just told the oil rigs to increase production - of course, because we are still overly reliant on oil.

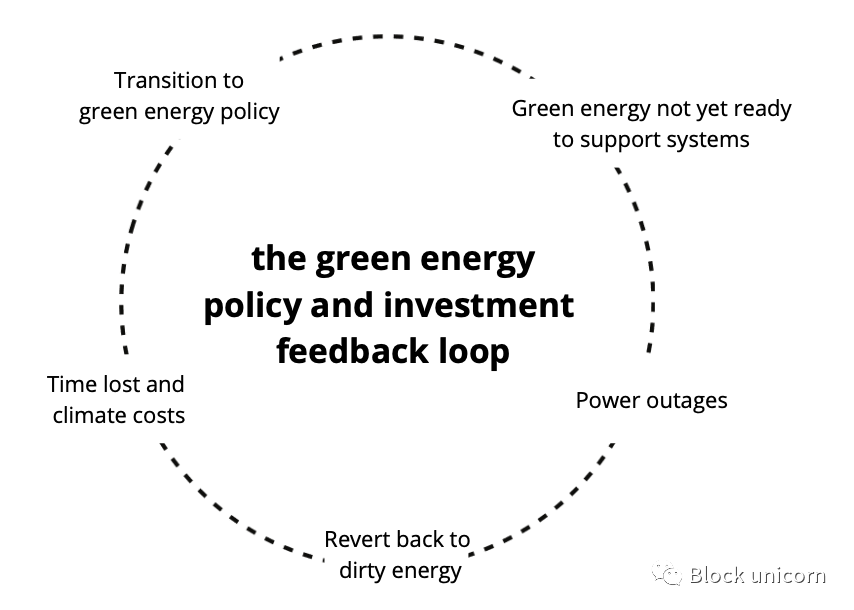

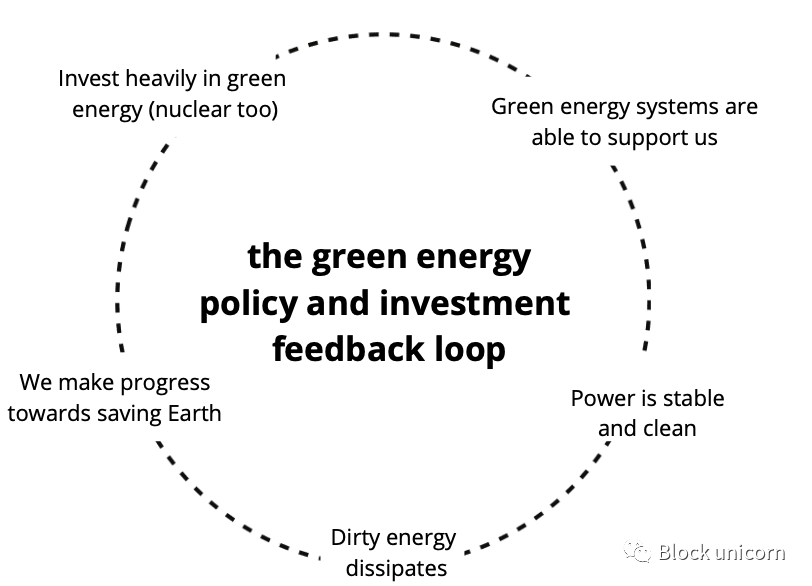

Here are the trade-offs of the energy transition:

1. We make a green energy transition: OK! :)

2. But it's not ready for us due to underinvestment :(

3. There was a power outage: not good :(

4. We ended up having to revert to dirty energy :(

5. We lose more time and money on earth: really bad :(

As Europe has shown, it's expensive.

The question then becomes - what is the cost of incremental progress? What is the reality of moving forward, how much should the transition cost, and how should we calculate the trade-offs from relying on a legacy system (with its own fatal flaws) to switching to a new system? Ideally (note I said ideally) it would look like this.

image description

it's a tradeoff

Encryption Tradeoffs (Narrative)

Encryption is a great example of transitioning from an old system to a new one. For anything to be made, it has to have some narrative element to be adopted. For encryption, the path looks like this:

1.narrative creation

2.narrative resistance

3.narrative break

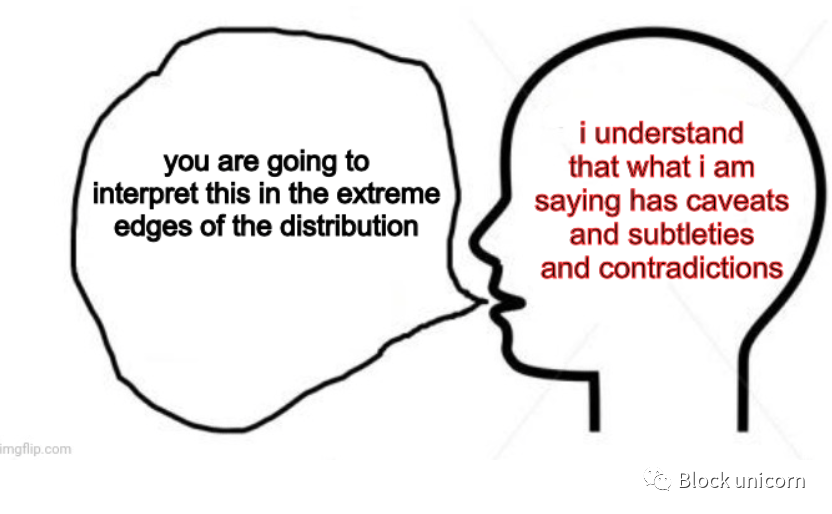

I want to warn the whole section with the following - people's intentions are usually gray, but we think they are either white or black (we think people say the most extreme meaning they mean) - so this leads to narrative interruption.

narrative creation

I love encryption. I'm fascinated by its capabilities, and there are a lot of builders in this space doing amazing things. But the grift economy is still alive and well (certainly in the crypto market as well as in the regular market), and watching it unfold has a certain level of frustration.

New markets bring calibration—and stimulation is a central part of it. In order to find out what is not fraud, the market has to adjust. As Jack Raines writes in his book Grift's Golden Age:

We're in the trillion dollar game of musical chairs, except some people think their chairs can't go away, others sit on chairs before the music actually stops, a couple of players just pick up their chairs and leave the room together, the only The losers are those who actually play by the rules.

This is an important point "losers are those who play by the rules". The old adage "rules are made to be broken" is powerful in *all* aspects of life.

Rules (in most cases, please go to speed limits, etc.) play in a gray space.

Those who test gray the most, especially in new markets, will benefit the most.

It's really just an unfortunate aspect of life because we have human-based systems that are going to be vulnerable to human-based attacks.

Humans love to play games—the Darwinian triumph of survival.

Survival is a function of tribal games -- namely, insider trading and psychological counseling.

As in all new markets, in crypto there is a lot of pull, a lot of money grabbing, a lot of behind-the-scenes information gathering - what we often see (or maybe notice) is a pull project due to extreme interpretations of information problems , which makes most of the people who play the game eventually become withdrawn from liquidity.

If we have to zoom out all the time,It's not a bad thing or a good thing (gray) it's just a thing.It's a calibrated system (traditional finance is just as bad, if not worse). Let's be honest, crypto/web3 is building some incredible things for the world - but greyed out.

text

narrative resistance

But there is huge resistance to crypto, mostly because of marketing issues. Having an anchor of hope is important, but most of us know that the world is gray — neither good nor bad, just usually more decent. I also think the reason there is resistance to encryption is because it *feels* that the world isn't built for everyone.

Open source for whom? Who do you work with? Decentralized by whom?

Things have to have a meaningful narrative, for everyone (I know that's a tall order, and it's totally unfair to ask for anything, but alas).

For that we have to go back to the decentralized framework - is ownership the most valuable thing web3/crypto can offer? Probably not, given what society really needs (access and opportunity, which encryption also offers, but it's marketed differently). Because of this - the narrative needs to shift.

And a few more tweets (although this drew backlash over the narrative issue):

I think that's really the main problem with cryptocurrency, it has a huge narrative problem, it's kind of confusing as to what it all means (mind you, there's very important stuff going on in this space). A lot of resistance does come from utopianism - and the feeling that crypto/web3 is trying to give up on the world (which they are not on average).

Crypto/web3 can incrementally improve the world - and it already does.

text

narrative break

image description

Source: CNBC

text

However, the narrative is packaged differently

At the end of the day, crypto is really a reimagining of how the world works - it takes things from the web2, it takes things from the financial world, etc., and ties them all together.

Almost everyone wants the world to be a better place - and social reprints are happening everywhere. If you turn around, the anti-job movement (covered brilliantly by Odd lot) has much of the same tone.

We want to keep working. Just on our terms.

We want to overhaul the existing system so that *people* in it benefit more.

We want to rewrite the way we think about the structure of the economy.

So as crypto/web3 calibrates, the same sentiment emerges in other areas of society. The most interesting part will be whether they can be combined - that is, the world frame in our head definitely needs to be deformed, but there is a lot of resistance.

However, as Tracy Alloway sums it up:

A friendly gray area can definitely solve a lot of the problems we have.

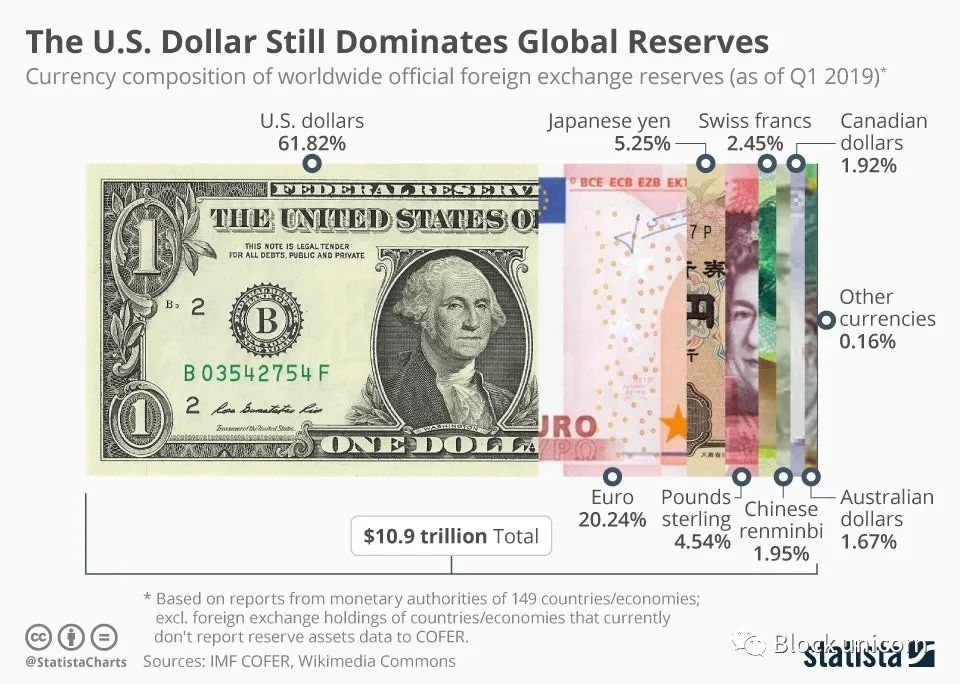

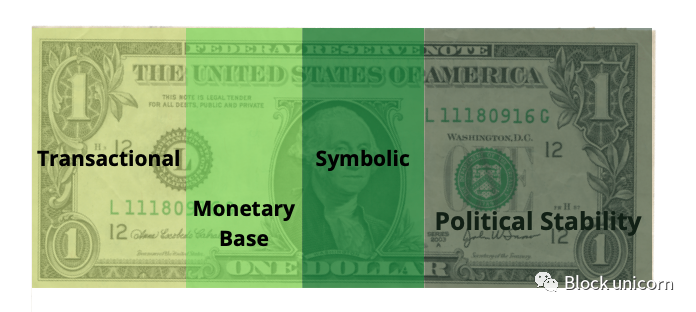

USD trade-off (USD is greater than USD)

However, the world is built on systems—And the system sometimes makes it hard for us to be good people. System calibration is what the dollar depends on - it's a very delicate balance, and reserve currencies are an age-old dance of geopolitics and monetary foundations.

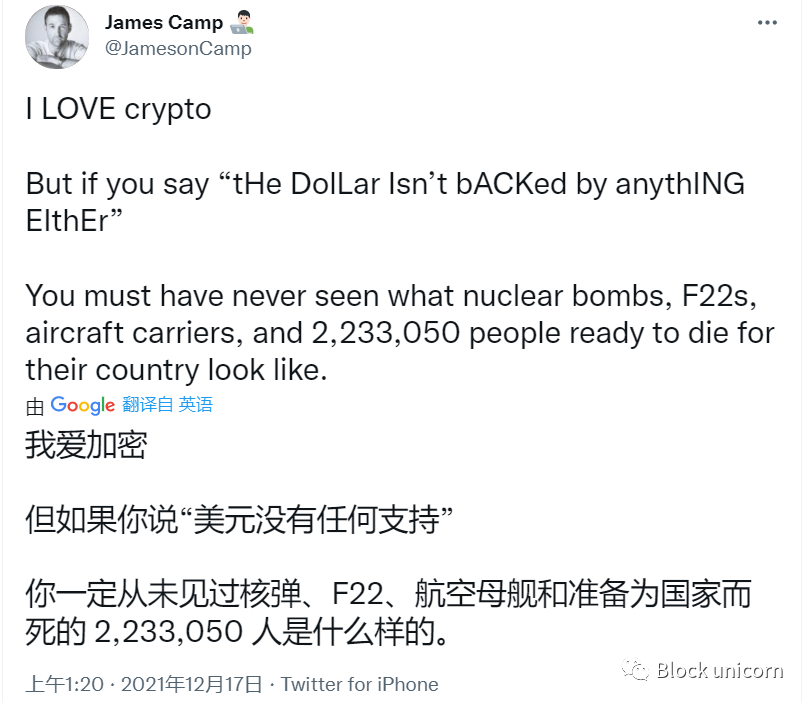

There are arguments against the dollar maintaining its reserve currency status, and you will often hear:

“We will have hyperinflation (meaning infinite dollars) and the purchasing power of the dollar will become zero (meaning zero value)”.

You see it from those advocating that Bitcoin replace the dollar as money, but you also see it from those who think that the dollar will implode because of "printing" (if we know anything about it, This is actually driven by the Fed and the banks).

The dollar is actually backed - not gold, no - but backed by guns and taxes. After all, taxes and death are the only two certainties in life.

The dollar (as a reserve currency) is more than just dollars.

It is an instrument of exchange, a monetary base, a token, a form of political stability.

When people talk about the dollar being forgotten, it's important to note that the dollar is symbolic as well as transactional.

Of course, this is how we buy things.

But it's also how we maintain trade agreements and conduct international negotiations.

It's also the US military, in paper form.

The dollar is both currency and money, and interestingly, it is also an instrument. Can it be replaced? perhaps? But the military is the end state of all civilization - which creates a trendy valuation model.

balance of happiness

There's no great transition here, but one of the interesting things about humans is that we live in feedback loops, both positive and negative. Our entire lives are governed by external influences, as annoying as it can be to admit.

It's a function of the environment -- you have to respond and respond to stimuli.

Of course, the nature of the response is the really interesting part.

We may not be able to choose, *if* we respond, but we can choose *how* we respond (to an extent).

When we respond, we are creating an action. Things acquire value relative to their opposites, every force has an opposite and equal response, and so on. Our responses are calibrated to nature and nurture, our current environment, and the experiences that shape us.

Fyodor Dostoevsky was a man who existed on all fringes of the distribution of good and bad. For Dostoevsky, this pain is not something to be avoided, it stains the fringes of our lives and makes our experience more intense—for if there is no color of unhappiness, the beauty of pleasure is What?

I think this is one of the hardest parts of being "literally" human, being grey! In truth, we don't exist in a vacuum, our emotions are uncontrolled entities in our blood that chase thoughts and wreak havoc (honestly, rudely!).

we also have oneinstant culturefinal thoughts

final thoughts

Thanks for getting this far. I'm about to draw the worst conclusions, but here's the best I think we can draw from all these tradeoffs:

I think my biggest takeaway from the past few weeks has been the lack of meaning, and that's okay (yes, subscribe to kyla's newsletter for incredible nothingness). What an unnecessarily long conclusion! !

But everything is relative—meaningmaking is just a puzzle of what doesn’t make sense with what makes sense—but the puzzle is never complete.

Alan Watts has a story about a mind exercise in condensing life—a dream world where you choose what happens.

"Let's assume you can dream whatever you want every night. For example, you could have the ability to dream for 75 years in one night. Or any length of time you want. When you start this dreaming adventure, You'll have all your wishes come true naturally. You'll have every kind of pleasure you can think of. After a couple of nights that everyone's been enjoying for 75 years, you're like "Well, that was awesome. ’ But now let’s have a surprise. Let’s have an uncontrolled dream. I don’t know what’s going to happen. Then you’ll dig it out and say, ‘Whoa, that’s clean shaved, isn’t it? "Then you'll get more and more adventurous, and at the end, you'll dream about ... where you are now. You'll dream about living the life you're actually living today."

You can design the most perfect, most beautiful life, and soon you'll be adding changes to your dreams, things that amaze us - and even bad things. Soon we don't want it to know it's a dream - it becomes our life, a dream state of imperfect change and understanding - because perfection is imperfection.

Dostoevsky wrote in The Idiot:

"What matters is life, and only life—the process of discovery, the eternal process, not discovery itself at all."

The gray area is where we spend the most time because it's subjective, because of our infused differences, because of our own humanity, the system is just a series of decisions, gray for less gray one day, and grayer for another:it's all a trade off。