Crypto funds have seen their principal halved after four years of investing in top-tier VCs. What's wrong with crypto funds?

- 核心观点:加密基金高费率与大规模难获超额回报。

- 关键要素:

- Pantera基金四年亏损44%,跑输比特币。

- “3/30”高费率结构引发行业争议。

- 基金规模过大导致投资分散化拖累收益。

- 市场影响:推动行业反思费率结构与基金规模合理性。

- 时效性标注:中期影响

Original author: PANews, Zen

Recently, Akshat Vaidya, co-founder and head of investment at Arthur Hayes' family office Maelstrom, publicly disclosed a dismal investment performance on X, sparking widespread discussion in the crypto community.

Vaidya said he invested $100,000 in Pantera Capital's early-stage token fund (Pantera Early-Stage Token Fund LP) four years ago, and now only has $56,000 left, losing almost half of his principal.

In contrast, Vaidya pointed out that during the same period, the price of Bitcoin roughly tripled, while many seed-round crypto projects saw returns soaring by 20–75 times. Vaidya lamented, “While the specific year an investment enters the market is important, losing 50% in any given period is considered the worst possible performance.” This sharp assessment directly questioned the fund’s performance, sparking heated debate within the industry regarding the performance and fee structures of large crypto funds.

The "3/30" of a market boom

The "3/30" fee structure that Vaidya specifically mentioned and criticized refers to a 3% annual management fee and a 30% performance fee on investment returns. This is significantly higher than the "2/20" model commonly used by traditional hedge funds and venture capital funds, which consists of a 2% management fee and a 20% performance fee.

At the height of the crypto market frenzy, some well-known institutional funds, leveraging their extensive project channels and past track records, charged investors fees higher than traditional standards, such as 2.5% or 3% management fees and 25% or even 30% of excess returns. Pantera, which Vaidya criticized, is a typical example of a fund with excessively high fees.

As the market has evolved, the fees charged by crypto funds have also been gradually changing in recent years. Having weathered bull and bear market cycles, and influenced by LP bargaining pressures and fundraising difficulties, crypto funds are generally shifting towards lower fees. Newly raised crypto funds in recent years have begun to make concessions on fees, such as reducing management fees to 1-1.5% or only charging higher performance fees on excess returns, attempting to align more closely with the interests of investors.

Currently, cryptocurrency hedge funds typically employ a classic "2% profit sharing and 20% performance fee" structure, but funding pressures have led to a decrease in average fees. Data released by Crypto Insights Group shows that current management fees are close to 1.5%, while performance fees tend to range from 15% to 17.5% depending on the strategy and liquidity conditions.

Crypto funds are difficult to scale

Vaidya's post also sparked a discussion about the size of crypto funds. Vaidya stated bluntly that, with a few exceptions, large cryptocurrency venture capital funds generally have poor returns and are harming their limited partners. He said the purpose of the tweet was to use data to remind/educate people that cryptocurrency venture capital cannot be scaled, even for well-known brands with top investors.

One viewpoint supports his opinion, arguing that the excessive fundraising size of early-stage crypto funds has actually become a drag on performance. Leading institutions like Pantera, a16z Crypto, and Paradigm have raised billions of dollars in crypto funds in recent years, but efficiently deploying such a large amount of capital in the relatively early stages of the crypto market is extremely difficult.

With a limited pool of projects, the National Integrated Circuit Industry Investment Fund (Big Fund) was forced to invest in numerous startups in a "wide net" manner. As a result, the investment in each project was not high and the quality varied. This excessive diversification made it difficult to obtain excess returns.

In contrast, smaller funds or family offices, with their moderate capital size, can more rigorously screen projects and concentrate their bets on high-quality investments. Some proponents believe that this "small but elite" strategy is more likely to outperform the market. Vaidya himself also commented that he agrees more with the view that "the problem is not with early-stage tokens, but with fund size" and that "ideal early-stage cryptocurrency funds must be small and flexible."

However, some voices have questioned this radical claim. Their argument is that while large funds may face diminishing marginal returns when pursuing early-stage projects, their value in the industry should not be completely negated by the poor performance of a single investment. Large crypto funds often possess abundant resources, professional teams, and extensive industry networks, enabling them to provide value-added services to projects after investment and drive the development of the entire ecosystem—something individual investors or small funds cannot match.

Furthermore, large funds are typically able to participate in larger funding rounds or infrastructure development, providing the industry with the necessary deep financial support. For example, some public blockchains and trading platforms that require hundreds of millions of dollars in funding rely heavily on the participation of large crypto funds. Therefore, large funds have their place, but it is crucial to control the match between fund size and market opportunities to avoid excessive expansion.

It's worth noting that, amidst this controversy, some commentators believe that Vaidya's public attack on his peers has a strong "marketing" element—as the head of Arthur Hayes' family office, he has recently been developing a differentiated strategy and raising funds for his own fund—Maelstrom is preparing a new fund of over $250 million, planning to acquire mid-sized crypto infrastructure and data companies.

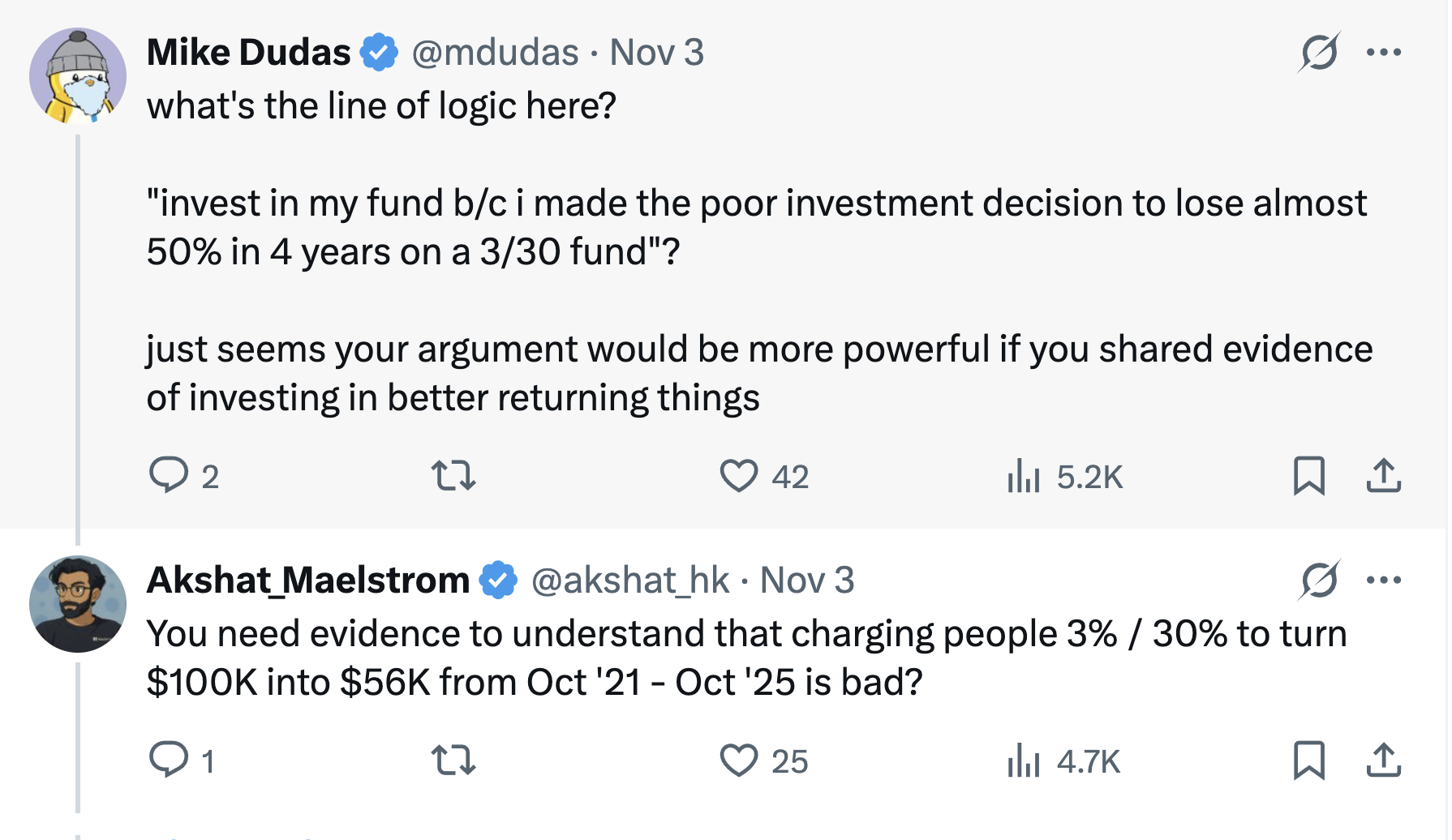

Therefore, Vaidya's criticism of competitors is suspected of highlighting Maelstrom's differentiated positioning based on value investing and cash flow. Mike Dudas, co-founder of 6th Man Ventures, stated that if he wanted to promote the performance of his family office's new fund, he should let his own achievements speak for themselves, rather than trying to attract attention by attacking others.

"No strategy is better than buying BTC."

Vaidya compared fund returns with a simple Bitcoin holding strategy based on her own experience, raising a well-worn question: for investors, is it better to just buy Bitcoin instead of entrusting money to a crypto fund?

This question may have different answers at different times.

In earlier bull market cycles, some top crypto funds significantly outperformed Bitcoin. For example, during the market frenzy of 2017 and 2020–2021, astute fund managers achieved returns far exceeding Bitcoin's gains by positioning themselves early in emerging projects or using leverage strategies.

Excellent funds can also provide professional risk management and downside protection: In a bear market, when the price of Bitcoin is halved or even falls further, some hedge funds have successfully avoided huge losses and even achieved positive returns by using short selling and quantitative hedging strategies, thereby relatively reducing volatility risk.

Secondly, for many institutions and high-net-worth investors, crypto funds offer diversified exposure and professional access. Funds can venture into areas that are difficult for individual investors to access, such as privately funded token projects, early-stage equity investments, and DeFi yields. Those seed projects mentioned by Vaidya that have seen 20-75x growth would be difficult for individual investors to participate in at early valuations without the channels and professional judgment of funds—provided that the fund managers truly possess exceptional project selection and execution capabilities.

From a long-term perspective, the crypto market is constantly changing, and professional investment and passive holding each have their own applicable scenarios.

For practitioners and investors in the crypto space, the turmoil surrounding the Pantera fund presents an opportunity—in the ever-changing crypto market, rationally assessing and choosing investment methods that suit one's own strategy is the key to maximizing wealth growth.