VanEck year-end inventory: five bright moments and five trend forecasts in the encryption market

Originally written by John Patrick Lee, Product Manager, VanEck

Compilation of the original text: Bitui BitpushNews

Compilation of the original text: Bitui BitpushNews

(Note: VanEck was one of the first U.S. fund management companies to apply for a Bitcoin ETF, and its Bitcoin futures ETF was listed on the Chicago Board Options Exchange in mid-November.)

secondary title

Crypto market highlights in 2021: Disruption and the rise of crypto enablers

1. Fintech companies and traditional payment providers embrace blockchain and start adopting encryption solutions at the same time.

It is widely believed that the financial services industry is one of the main targets of blockchain technology. We believe that blockchain technology is deflationary in nature because it provides greater efficiency and transparency to the entire system, which greatly reduces transaction costs. In 2018, Square established itself as an early cryptocurrency adopter by allowing users to buy and sell bitcoin on the app. In 2021, PayPal, Venmo, Mastercard, and even Twitter will all begin allowing customers to transact with Bitcoin. Offering remittance solutions cheaply, as Mexican crypto remittance company Bitso puts it, could immediately grab more market share from incumbent financial firms such as Western Union.

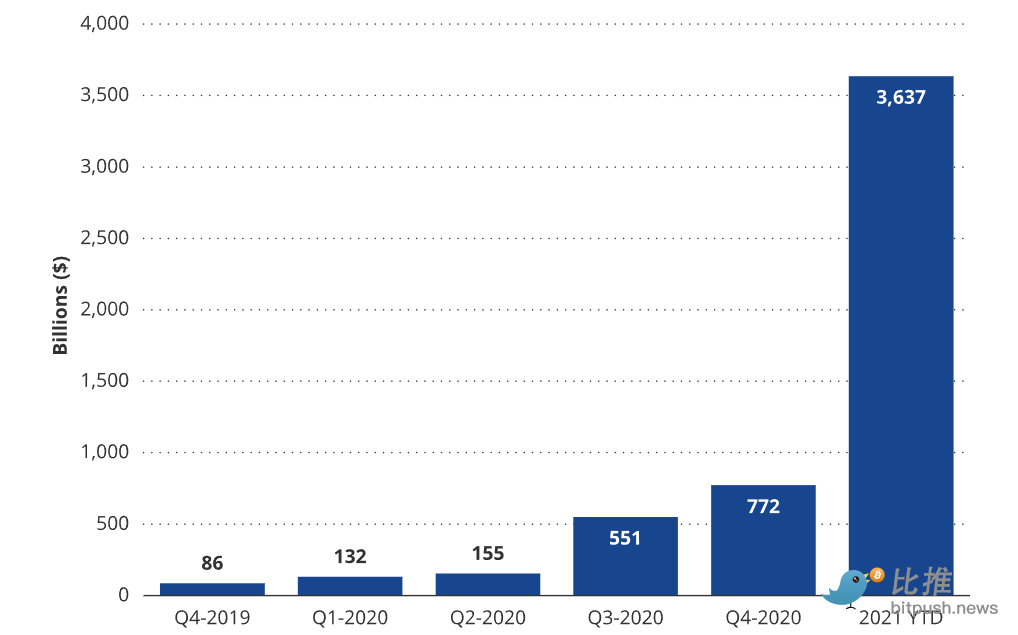

2. The use of blockchain transactions and the adoption of smart contracts has exploded, with the transaction volume on the Ethereum network reaching $3.5 trillion.

image description

The Explosive Growth of the Total Transaction Value of the Ethereum Network in 2021

3. Bitcoin begins to unleash its full potential as a fiat currency disruptor, especially for emerging market countries

Since Bitcoin's launch in 2009, many Bitcoin maximalists have tended to see Bitcoin as a safe haven that protects investors from the negative effects of monetary and fiscal policies implemented in both developed and emerging markets. Because Bitcoin is decentralized and has a fixed supply, it does not face the inflationary pressures that affect fiat currencies around the world. From a geopolitical standpoint, Bitcoin may offer emerging market countries a viable currency alternative to relying solely on IMF/World Bank loans, which sometimes exacerbates rather than solves problems.

In September 2021, El Salvador officially recognized Bitcoin as legal tender, the first country to do so.

4. China’s Crypto Ban Skews Global Mining Market Share to U.S. Miners

China's relationship with Bitcoin has been one since the digital currency was launched in 2009"love hate". On the one hand, miners in China control the vast majority of the world's computing power, and they are also one of the main producers of ASIC chips used in Bitcoin mining. On the other hand, the Chinese government has threatened to ban bitcoin mining and trading, and has escalated restrictions on cryptocurrencies, eventually banning cryptocurrency trading, mining and exchanging outright. While the long-term impact remains to be seen, the short-term impact is evident. Cryptocurrency miners fled the country, and the global mining market share immediately began to flow to miners in the United States and elsewhere. With Chinese exchanges and mining out of the way, U.S. and other miners face less competition and more opportunities to increase their share of global computing power.

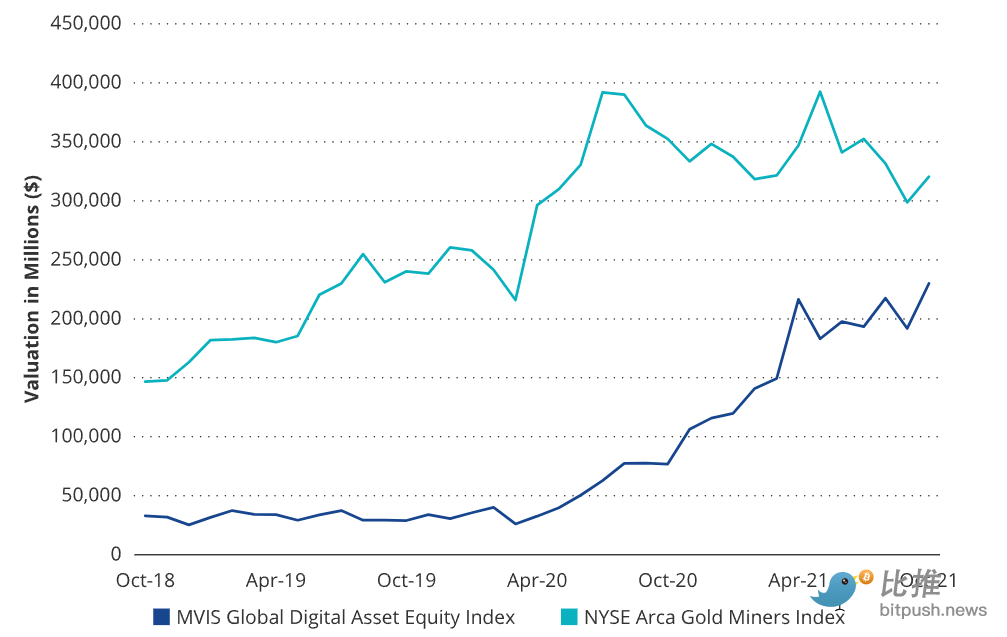

5. Encryption company IPOs highlight the massive growth of digital asset businesses, while the market capitalization of encryption pioneers is approaching traditional market companies

2021 will be a huge year for companies going public in the cryptocurrency space. Coinbase made history as the largest crypto company ever to go public, listing at a valuation twice that of Nasdaq and nearly the size of New York Stock Exchange parent Intercontinental Exchange (ICE). In addition to Coinbase, a number of miners and other cryptocurrency movers have also listed, including Coinshares, Bakkt and Stronghold Digital Mining.

image description

secondary title

Crypto Predictions for 2022: More IPOs, More Use Cases, Wider Adoption

1. In 2022, even more crypto-intensive businesses will go public

We believe that the number of crypto companies preparing to go public is still large, and 2022 will continue the trend of newly listed companies in 2021. And there is a wide range of businesses that crypto companies can participate in — from exchanges to digital asset miners to payment companies. As the cryptocurrency market continues to grow and develop, we expect the market to grow as new companies come to market and shift as companies gain and lose market share.

The above picture shows the possible fields of 7 major encrypted listed companies, including payment nodes (credit cards, digital payments, etc.), hardware (mining-related hardware manufacturers), digital mining, exchanges, participation in holding/trading cryptocurrencies (such as Microstrategy ), software services (digital infrastructure related to encryption), banking & asset management.

The above picture shows the possible fields of 7 major encrypted listed companies, including payment nodes (credit cards, digital payments, etc.), hardware (mining-related hardware manufacturers), digital mining, exchanges, participation in holding/trading cryptocurrencies (such as Microstrategy ), software services (digital infrastructure related to encryption), banking & asset management.

2. NFT (non-fungible token) went out of the circle and entered the mainstream culture, and millions of users flooded into the market. The next major use cases will be sports ticketing, loyalty points and e-sports

NFTs have a new lease of life in 2021, but we believe better things are yet to come. In our opinion, two things are holding NFTs back from wider adoption. The first is that the user interface (UI) of the NFT platform needs to become easier for non-crypto-native users to participate. The NBA's TopShot is a great example of an NFT project that makes it easy for non-crypto-native users to purchase NFTs. The second stumbling block preventing its widespread adoption is the current narrow use case for NFTs. While there are already some applications on the market, we think sports ticketing, loyalty points, and esports will be the next big areas where NFTs can make a big splash. The smart contract system provided by the NFT platform will attract people to participate. Once it can provide more functions, such as VIP draws, etc., it will greatly increase the participation and enthusiasm of fans.

3. Ethereum will undergo a major network upgrade to get rid of the energy-intensive proof-of-work mechanism and substantially increase network capacity.

Proof of employment"Proof of employment"Proof of employment"Proof of employment"proof of stake"proof of stake"(PoS), which will greatly change the pattern of miners centered on Ethereum. Rather than expending effort to solve computationally intensive problems (PoW), proof-of-stake will provide better energy efficiency, increase network capacity, lower barriers to entry, and provide greater centralization immunity to the Ethereum blockchain. One of the main downsides of the proposed upgrade is that Ethereum hardware mining will cease to exist, meaning that Ethereum-focused miners will have to look elsewhere.

4. Bitcoin continues to mature in wider institutional ownership and adoption as another emerging market country may declare Bitcoin legal tender (El Salvador 2.0)

As the broader digital asset market grows, we expect more companies to add Bitcoin to their balance sheet assets and expand mining operations to increase potential revenue streams. Certain emerging market countries may also find Bitcoin useful as a monetary tool, as El Salvador demonstrated, a potential solution to avoid merely relying too heavily on IMF/World Bank debt aid.

5. ESG investors finally find Bitcoin an accelerator for green energy adoption and financial inclusion (ESG: Environment, Social Responsibility, Corporate Governance)

Unfortunately, concerns from misguided and uninformed ESG investors continue to plague the cryptocurrency industry, particularly around the energy use required to mine Bitcoin. While the debate continues, we believe cryptocurrency miners will continue to play a prominent role in green energy adoption and financial inclusion. Leading U.S. bitcoin miner Riot Blockchain has been an advocate and supporter of the bitcoin mining industry and is a force for good in the conversation around sustainable energy use. Stronghold Digital Mining, which went public in the fourth quarter of 2021, is another ESG-focused bitcoin mining company that uses coal mining waste, a by-product of coal mining, to generate the electricity used to mine bitcoin. We expect sustainability-focused mining companies to continue to expand their market share.