When we discuss DeFi (decentralized finance), we mostly focus on various ecosystems such as Ethereum, BSC, and Solana.

However, Bitcoin, the leading asset in the encryption market, is rarely mentioned. It seems that the Bitcoin network has been gradually marginalized in the technological iteration of the industry and has become a symbol. Behind this is the performance and technical limitations of the Bitcoin network itself, but it is also the inevitable result of the explosion of general-purpose chains and upper-layer applications represented by Ethereum.

Recently, Odaily has noticed a DeFi protocol called Portal Finance, which is dedicated to activating the original value of the Bitcoin network and introducing DeFi into the Bitcoin ecosystem.

Portal is a self-hosted Layer2 wallet and cross-chain DEX built on Bitcoin to achieve atomic swaps between Bitcoin and other encrypted assets; built on Fabric technology, Portal has privacy, high performance and security. In the future, Portal will also support derivatives businesses such as lending and options to build more complex DeFi application scenarios. Recently, Portal announced that it has received US$8.5 million in financing, led by Coinbase Ventures, and dozens of institutions including B21 Capital participated in the investment.

"By bringing fast, peer-to-peer Layer 2 transactions, Portal is delivering on the promise of self-sovereignty for everyone," said Portal CEO Eric Martindale. "Through Portal, DeFi becomes a service that anyone can provide."

secondary title

Absence of native DeFi on the Bitcoin network

Today, the market size of DeFi (decentralized finance) is getting bigger and bigger, and it is gradually breaking the circle, attracting the attention of mainstream society. However, the development of DeFi still has great limitations.

Judging from the data alone, although the current total lock-up value of DeFi is as high as 260 billion US dollars, which has undergone earth-shaking changes from more than a year ago, it is still not enough. A very important reason is that the current DeFi ecology does not fully include Bitcoin.

As the leading asset in the encryption market, Bitcoin has a market value of more than $1 trillion in just over 10 years of development, accounting for 40% of the entire encryption market value. Although it does not exceed the market value of gold by 10 trillion US dollars, the development potential of Bitcoin can be seen. Moreover, Bitcoin itself has a strong consensus and has a very strong value foundation. It has gradually become an emerging asset category recognized by traditional finance. Many listed companies and financial institutions, including Tesla and Microstrategy, use Bitcoin as an asset reserve.

It can be said that Bitcoin has become the most valuable asset in traditional finance and encrypted finance.However, in this wave of DeFi, Bitcoin has been suspended and gradually marginalized. The entire ecological DeFi application is seriously absent, and no representative leading project has been born at all.It was a fatal blow to an asset that occupies an important position in global financial markets.

At its root, the absence of Bitcoin DeFi applications is mainly due to its own defects. Bitcoin script is a simple, primitive and secure stack-based language. It is not Turing-complete and has no concept of state, which also makes application construction quite difficult. In addition, with the rise of new ecosystems such as Ethereum, the market will naturally turn its attention to new public chains. This further makes the lack of Bitcoin ecological basic development tools, which is not conducive to the construction of DeFi applications. In addition, the result of the vicious circle formed is that the DeFi applications of the new public chain have sprung up like mushrooms, while the native DeFi applications of the Bitcoin ecosystem are absent.

At present, the most popular Bitcoin DeFi solution on the market is "tokenized Bitcoin", and the more representative ones are WBTC and tBTC.

Taking WBTC as an example, users need to store their own BTC in the contract address of the custodian, so that they can obtain the ERC20 version of WBTC at 1:1. The doubts about this solution mainly focus on centralization: users need to pass the KYC process and trust the third-party custodian. The tBTC scheme is that the user deposits BTC to the custodian address, the custodian pledges ETH as a deposit, and the user obtains the ERC20 version of tBTC. Although this scheme has the characteristics of no need for trust, it requires the custodian to over-collateralize, and the capital utilization rate is not high.

Due to various limitations, the "tokenized bitcoin" scheme has not really been developed on a large scale. Taking WBTC as an example, the current circulation is only 253,000, which is less than 2% of the total bitcoin circulation. In other words, the vast majority of Bitcoins are excluded from DeFi, the liquidity of the original value is not high, and the DeFi needs of the vast majority of Bitcoin enthusiasts have not been met.

Today, centralized exchanges are facing more stringent regulatory policies, and DeFi has become an alternative with just needs. How to better meet the DeFi needs of Bitcoin enthusiasts is both a difficulty and an opportunity.

“Bitcoin has significant network effects, and a lot of people don’t realize how powerful Bitcoin is. Bitcoin is the most decentralized and secure system, we think of it as the currency layer. If you want to build functionality, financial contracts, etc., then It’s better to build it on the currency layer rather than other layers.” Eric Martindale, CEO of Portal, explained that the Bitcoin network itself is based on POW and has security unmatched by other ecosystems, and it is also the most ideal DeFi testing ground.

secondary title

Portal: Layer2+ cross-chain DEX, empowering Bitcoin DeFI

Portal is a decentralized financial platform that combines the advantages of Bitcoin and Layer2. With Portal, Bitcoin is compatible with the attributes of decentralized finance: uncensorable, peer-to-peer, and trust-minimized.

The first applications of Portal are self-custodial Layer2 wallets and cross-chain DEXs based on Bitcoin to achieve atomic swaps (Atomic Swaps) between Bitcoin and other encrypted assets. A prominent advantage of this scheme is the use of Bitcoin's"Hash Timelock Contract"function, which means that users can control their own account assets and conduct peer-to-peer transactions; instead of traditional DEX, funds may be stored in a public smart contract pool, thereby preventing counterparty risks and capital losses.

In fact, long before Portal, atomic swaps (Atomic Swaps) were an attempted solution for Bitcoin DeFi applications. Teams such as Summa, Liquality, SparkSwap, and Swap Online have all tried and gained attention. However, most of them have disappeared, or turned around.

The fundamental reason is that although the "atomic swap" scheme allows users to control their own assets, you need to know the bitcoin addresses of the participants before reaching an agreement, and cross-chain is also difficult, which also makes it impossible to establish liquidity on bitcoin Liquidity pool, which means no AMM (Automated Market Maker), liquidity providers need to be online 24/7 to allow participants to interact with any type of Bitcoin DeFi.

Portal has innovated on the basis of the former, constructing an order book model that aggregates liquidity in the trader network by homogenizing and matching orders in transactions, using a zero-knowledge system and proof of order book execution. At the same time, partial order execution and composability are introduced into cross-chain atomic swaps. It is important to emphasize that Portal transfers the provable execution of cross-chain contracts to Layer 2, resulting in faster speed, lower cost and higher liquidity.

According to Portal's plan, in the future, users can use Portal software to log in with one click to conduct decentralized transactions, and the system will find the best execution path (at the best price) on centralized and decentralized platforms such as Binance, Coinbase, and UniSwap. and liquidity transactions). "Portal will be the only app approved for atomic swaps in the Apple App Store."

In addition to cross-chain transactions, Portal also plans to launch derivative transactions such as loans and options to meet the many needs of Bitcoin enthusiasts.

To support these rich functions, Portal cannot do without the support behind the Fabric protocol.

Fabric itself is an open source protocol for the anti-censorship layer built on Bitcoin. It can be understood as Bitcoin's Layer 2 solution. Portal is built based on Fabric (Note: The founding team members of Portal are from Fabric). Because of this, Portal inherits Fabric's many advantages such as censorship resistance, high efficiency, credibility, de-financialization, and cross-chain interoperability. At the same time, Portal also inherits the security of Bitcoin Layer1.

However, from the perspective of the Portal team, the Lightning Network is the Layer 2 of Bitcoin, and Portal and Fabric are actually Layer 3 solutions. Both parties have the same network topology, but the latter focuses more on high-level computing. "L2 is the bottom layer, just the beginning; L3 is the computing layer and will be built, Fabric is designed as a third layer system, on top of Lightning/Payment Channels etc. We will see a new class of applications born. Our goal is to be compatible with Lightning Network, run a Portal node It also lets you connect directly to the Lightning Network.”

"Fabric, the underlying protocol used by Portal, extends the functionality of Bitcoin today without any BIP. Portal's Layer 2 and Layer 3 atomic swap technology can be used in a general market for data and computing. Our goal is to replace Bitcoin with a free data and computing market. A network server model that is easy to centralize through design and architecture." Portal stated on the official website.

secondary title

Professional background team, favored by top capital

"Current centralized exchanges, fake 'decentralized' DEXs, escrow wrapped tokens, and censorable ecosystems all threaten Bitcoin's promise of self-sovereignty. By bringing fast, secure, peer-to-peer Layer 2 transactions , Portal is delivering on the promise of self-sovereignty for everyone.” Eric Martindale concluded, “We are creating a portal for free trade and finance.”

Portal's novel design and ambitious blueprint have also won the favor of many investment institutions.

According to official news, Portal announced a financing of 8.5 million US dollars, oversubscribed more than 47 times, led by Coinbase Ventures, B21 Capital, ArringtonXRP Capital, OKEx Blockdream Ventures, Republic.co, Shima Ventures, LD Capital, ArkStream Capital, Monday Capital, GenBlock, Taureon, Autonomy Capital, Krypital, Kyl Armour, co-founder of Hedera Hashgraph, Craic Sellars, co-founder of Tether, and Danish Chaudhry, CEO of Bitcoin.com participated in the investment. In addition, Portal is about to go public in Republic.

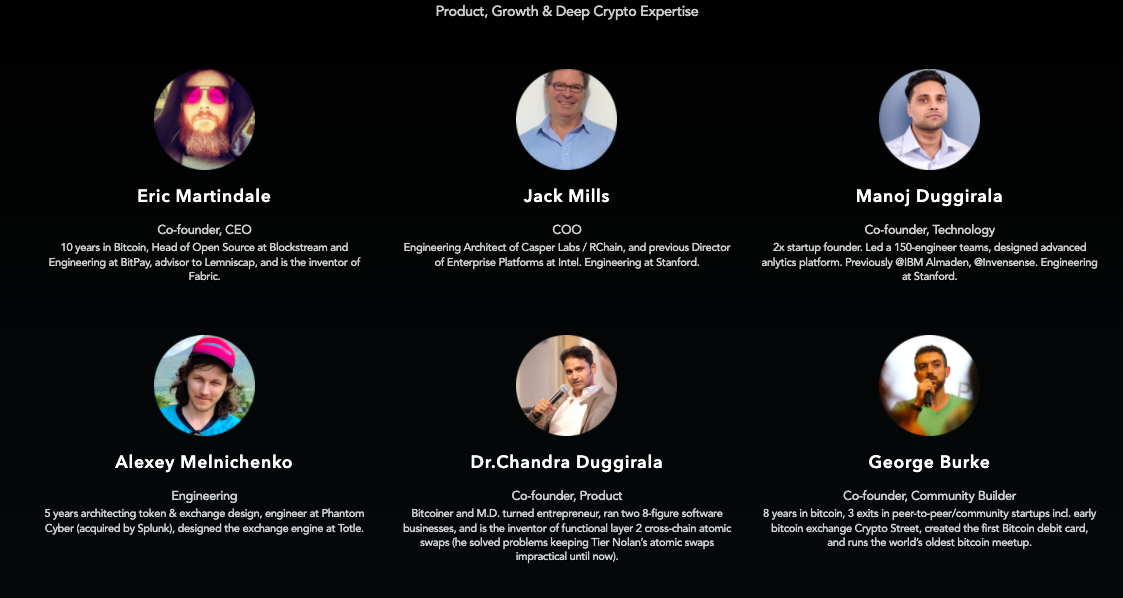

In terms of team, the Portal team has been working in the encryption field for many years and has extensive industry experience, which provides a resource base for Portal's future development.

For example, Eric Martindale, the co-founder and CEO, has been working on Bitcoin for 10 years. He is the open source director of Blockstream, the engineering director of BitPay, the consultant of Lemniscap, and the inventor of Fabric; the chief operating officer Jack Mills has worked in CasperLabs, Intel Corporation , Appgenesys and other well-known companies or projects, and served as the founder and CTO of Locke-Rand Institute, the vice president and founder of the board of directors of Salvus Group, the CEO and CEO of GoalWerks Inc., the vice president of Aditazz, etc. .

As the earliest blockchain ecology, Bitcoin has always been the leader in the encryption industry, building the strongest consensus and value barriers, but it has never been able to shine in the DeFi field.

Today, the entry of Portal has paved a new path for Bitcoin to enter DeFi, and at the same time, it has also allowed DeFi to obtain a more stable value support and promote DeFi to the traditional world. We also look forward to seeing new performances for Portal in the future.