Introduction to Web3.0 Application Token Engineering

On December 1, 2021, Liu Yi, founder of Octopus Network, was invited by BeWater Community to share on the theme of "Web 3.0 Application Token Project". The outline of the content is as follows:

first level title

1. Background

1. Background

Hello everyone, today I will talk to you about token engineering. This ppt is what I made for Lesson 4 of Octopus Network Accelerator. The Octopus Accelerator of Octopus Network has a series of courses on Web3.0 entrepreneurship. The first lesson is the introduction of the basic concepts of web3.0, the second lesson is the product design of web3.0, and the third lesson is the community building of web3.0. Lesson 4 is Token Engineering, Lesson 5 is about Encryption Project Compliance, and Lesson 6 is Encryption Project Financing.

Back to the topic of token engineering, it can be said that every important progress in the blockchain industry is due to an important innovation in the token economic model, and every important innovation can create a new field. The most typical examples are PoW and PoS. In addition, we have seen that DeFi has been popular from last summer to this year, and the main reason is Liquidity Mining for more than a year. Liquidity mining is a very important innovation in the token economic model, which triggered the defi summer. In addition, like the current gamefi/play-to-earn, it is a new achievement of the token economy token project, which has driven a number of projects.

secondary title

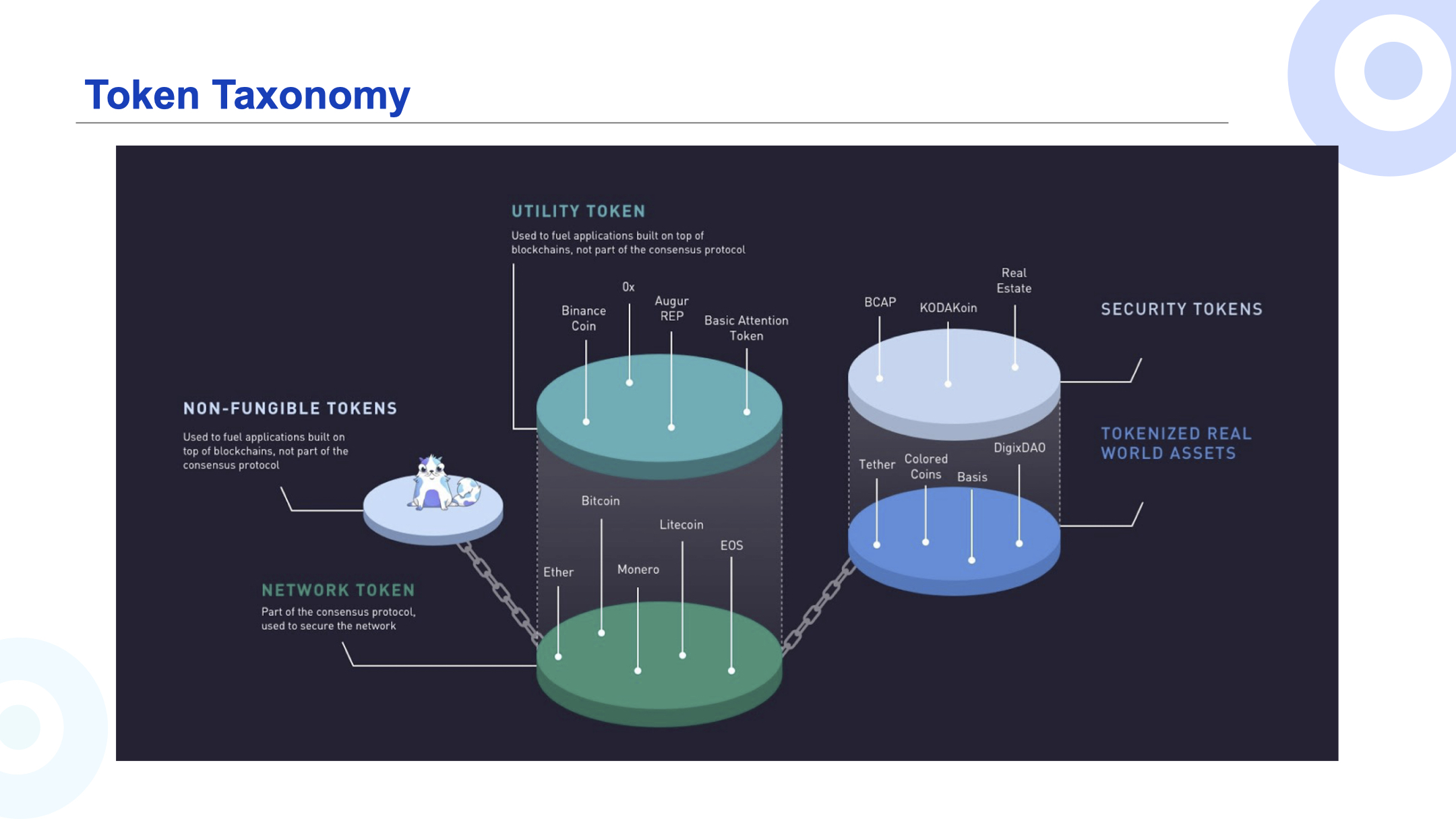

2. Token classification

secondary title

3. Main contributors

secondary title

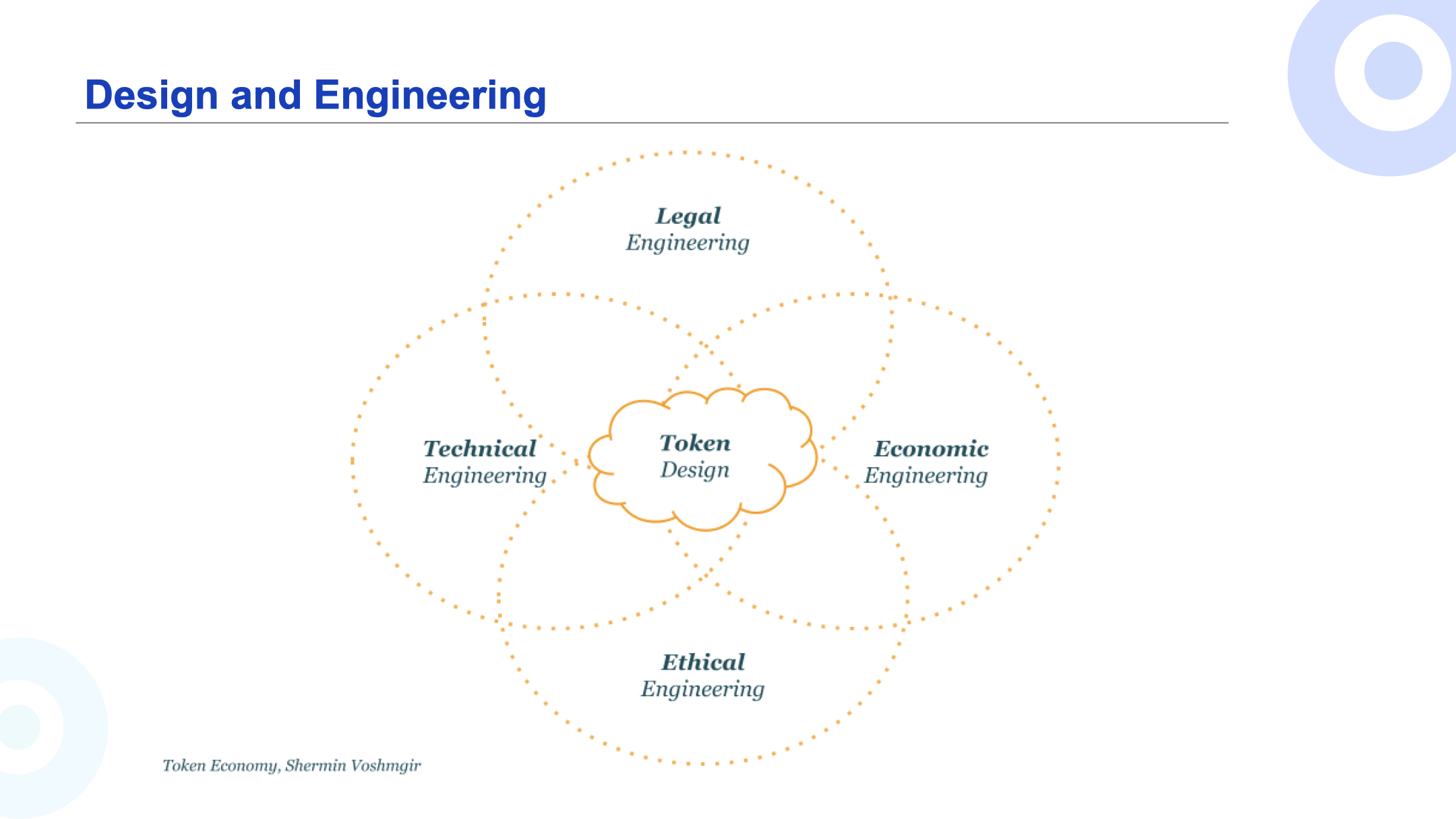

4. Design and Engineering

We say design and engineering. Why on earth do we call it a token project now? It and design are two fields with a high degree of overlap, but compared with design, engineering emphasizes more on science and reality, that is to say, design can design something out of any value orientation, but engineering Emphasize that what you design is a structure that can operate in the real world, and this structure must create certain utility and certain benefits for people.

first level title

secondary title

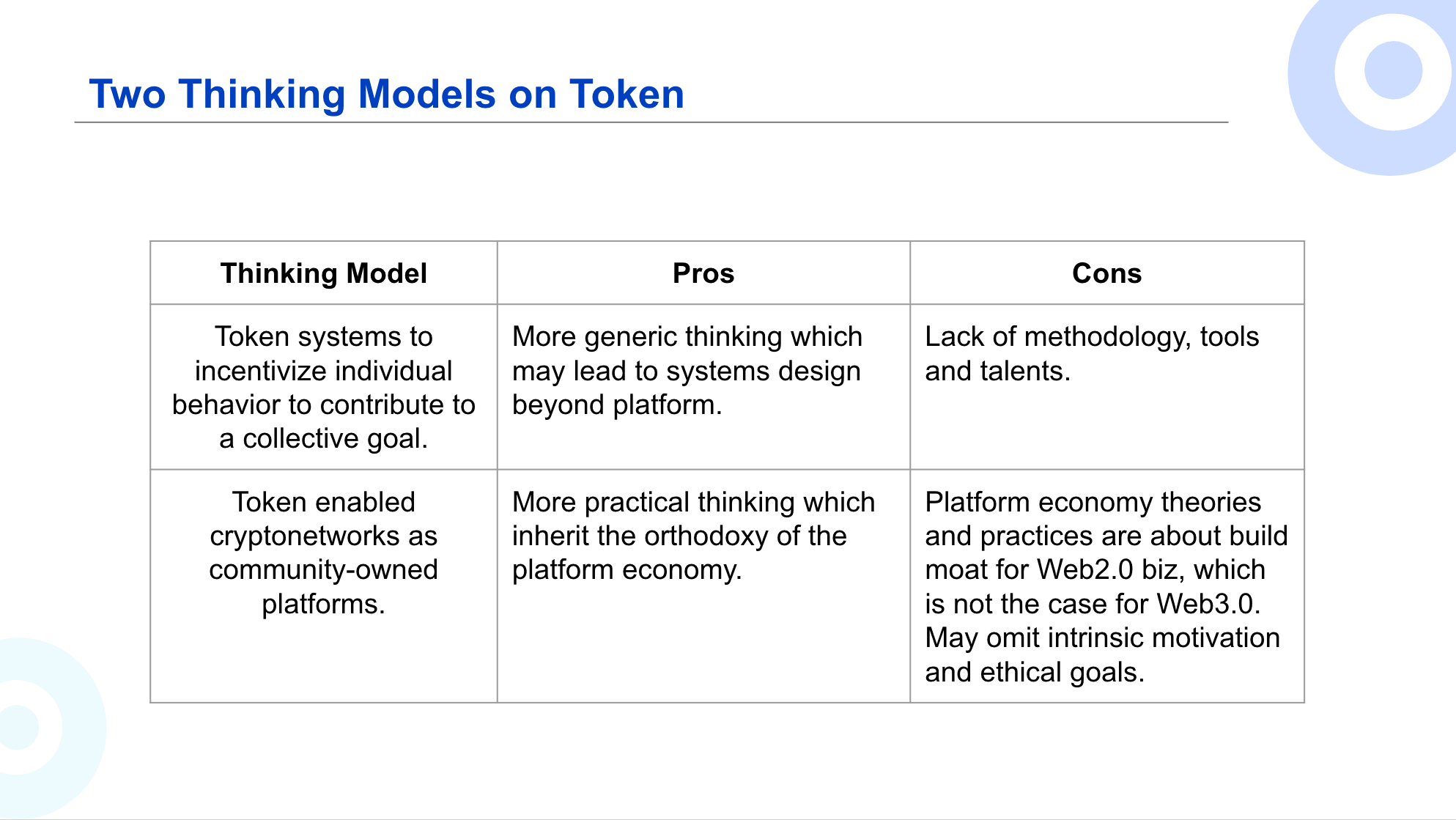

1. Two Thinking Models

Let's talk about two models about the design of the general economy. The first one is the upper line in the table, which is the token system to motivate individual behaviors, allowing these individual behaviors to form different contributions, and finally achieve a common goal. The advantage of this model is that it is very versatile. It covers all the potentials of what the token system or encrypted network can do. The token-related practice that many people are doing now is not limited to the Internet, or even the economic field, it can be extended to the field of social governance.

But its bad, from this point of view is a very new thing. From the perspective of economics, it can be considered as an extension of the new institutional economics, and some practice can be done with the methods of papers and mechanism design. I have also tried to learn, and I feel that this road is at least difficult, or it is relatively long. Because it is too abstract, and there are too many things to learn, and there are no actual cases. For example, when we talk about pow now, many scholars are studying Bitcoin after it started running, and then from the perspective of mechanism design, what kind of thing is it and how does it achieve equilibrium. But these are actually some retrospective studies. First, there is a Bitcoin network, and then everyone will analyze why it is feasible, its advantages, why it can be balanced, and so on. But can this method get the target first, and then use the mechanism design method to get a system. Currently I don't see such an avenue.

The second thinking model was mentioned by me, which narrowed down the scope. Let's not think that the token can do this or that, let's just say that the token can enable the encrypted network. What is an encrypted network? It's a community-owned platform, so web 3.0 is a natural evolution of the web 2.0 platform economy. It turns out that the core role of the platform economy is the Internet platform owned by the company. What is web3.0? We evolved the core role into a decentralized platform owned by the community. The advantage of this thinking model is that it can obtain nutrition from the platform economy. Because the economic characteristics of web2.0 have been studied for 10 years, there are many research results, including talents. These knowledge and talents can basically be inherited in the web3.0 era, that is, how to analyze the platform, how to analyze the bilateral market and the multilateral market, how to analyze the network effect, how to activate the network effect, etc. can be inherited.

What is the problem with the second mental model? That is, our original platform Economy was studying how to build a moat for the platform. web3.0 does not talk about the moat, the idea of web3.0 is just the opposite. The higher the commission in a certain platform economic field, the greater the opportunity for web3.0. Because web3.0 is to return the created value to the participants as much as possible. For example, for a taxi platform, it is drivers and passengers, and for a music platform, it is musicians and music fans. We want the economic value-added of the platform economy to be returned to these people, rather than staying on the platform itself to create profits for shareholders. But at the same time, we also hope to be able to create defensibility, that is to say, to be able to maintain these factors that exist in the encrypted network, because the essence is to hope that this network will become bigger and bigger.

So the values and goals of Web3.0 and Web2.0 are different. But the actual method is very similar to web2.0. Is there any essential difference here? Does motivation matter? I think it's still very important. If we want to succeed in web3.0, the values of the project founders are very important. From a practical point of view, if your project is to be recognized by the crypto market, what do you rely on to make everyone agree?

I think there are two most powerful forces in this market. One is the speculative force. If you can let others see that your model is very tense, and a large amount of funds will pour in, your currency will rise, and your Goals can also be achieved. In fact, there is a stronger force. Many of our practitioners ignore how the crypto market came about. The first wave of participants in the establishment of the market may be some liberals or some anarchists. These people do not enter the market purely for profit, and precisely because they are not purely for profit, these people On the contrary, they are more able to obtain huge profits and experience many market fluctuations because they have faith. Those who can get BTC from 2011 or 2012 to the present have increased their wealth tens of thousands of times. After they have money, at least a considerable number of people say that I will support those things that I think are pleasing to the eye.

If your project can resonate or resonate with some of them in terms of values, there is a great possibility of success in the crypto market. We now have no recognized valuation standards for crypto projects, and most of them are guessing at other people's opinions. But some people don’t guess, they are based on their own values: I think your project is good, I think your project is interesting, or I think your project promotes the direction of society, which is what I want to see Direction, I will support you. After these people make their own choices, others will guess based on their logic, and a consensus will be formed further.

secondary title

2. Network effect analysis

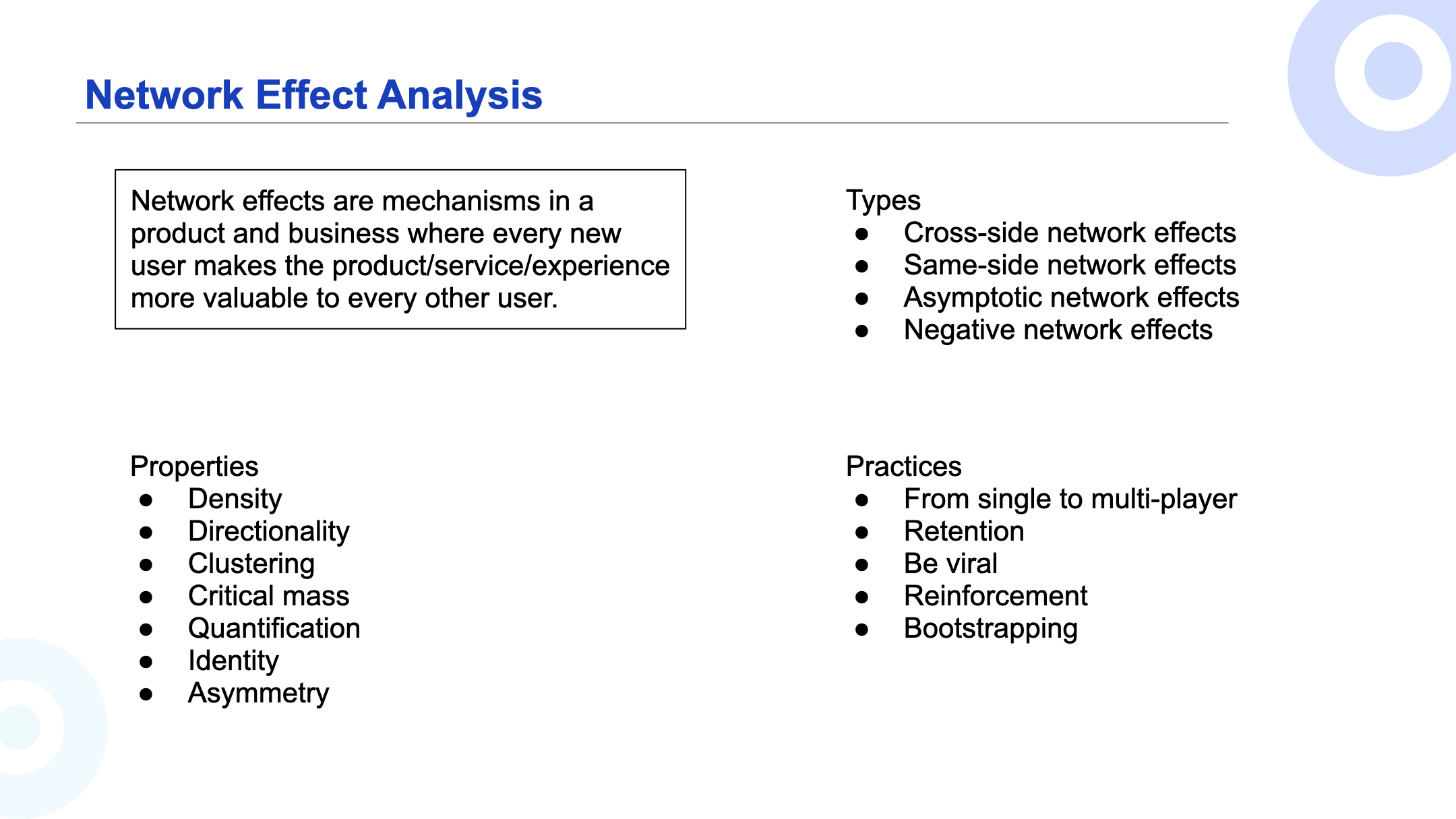

The network effect is the core of the platform operation, and we have now narrowed the scope of the discussion to the fact that the token economy is a decentralized platform. If the platform has no network effect or the network effect is weak, it is not worth doing.

So you have to analyze what kind of network you want to build, what kind of network effect is it, whether you can create enough network density, can create enough value, and then break through the critical scale and enter a stage of spontaneous development. And it will not encounter anti-network effects prematurely in the development process. The anti-network effect simply means that the more users there are, the worse the service will be. There are usually two situations. One is network congestion. This is seen in Ethereum. Because of the technical architecture, the more people use it, the higher the cost. The other is network pollution. After users come in, the platform will be hydrated.

first level title

secondary title

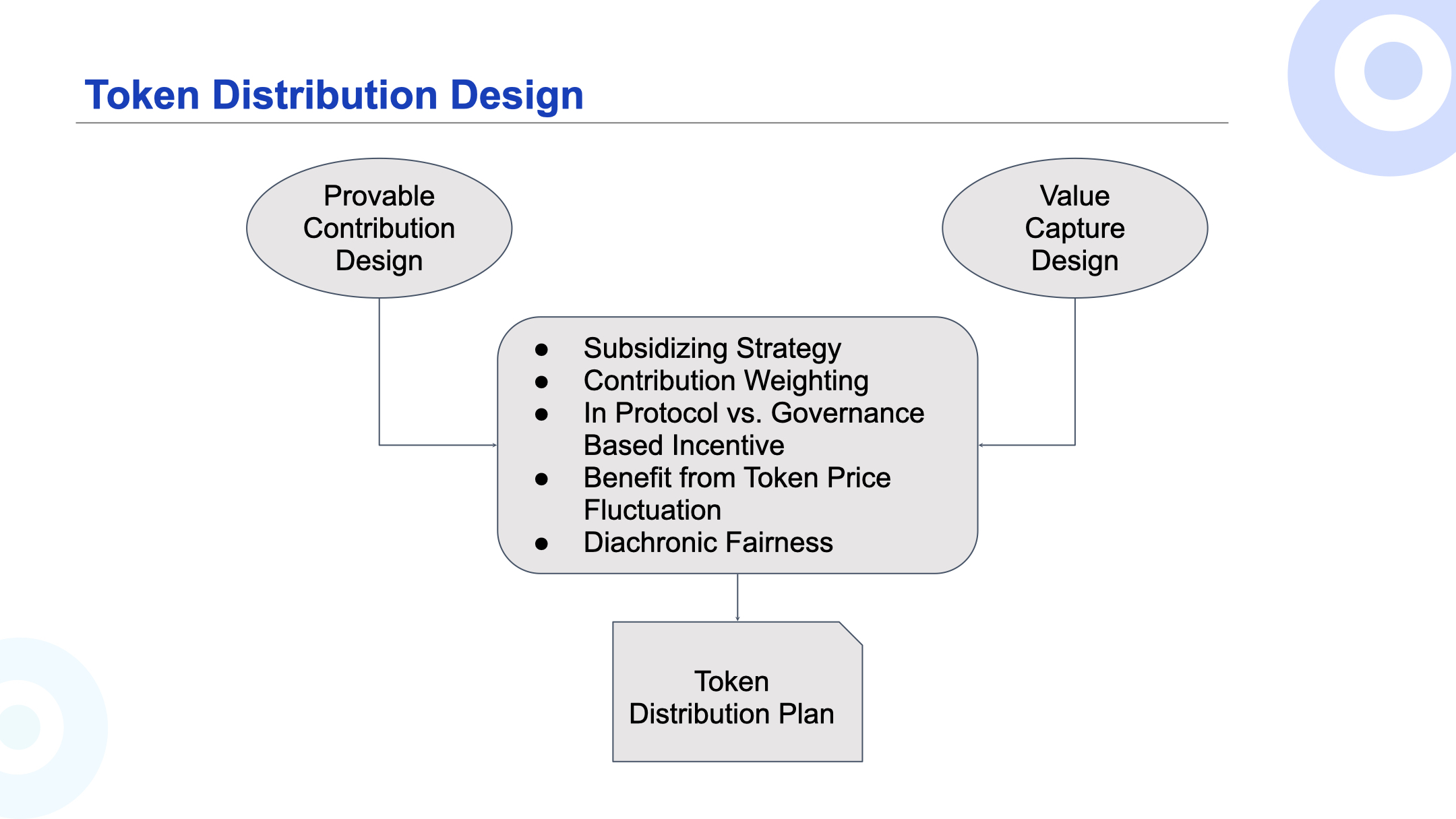

1. Token distribution design

Below we will focus on tokens. To design a token distribution model, there are two prerequisites. One is that participants have to contribute to the operation and development of the network. In the best case, these contributions can be verified and quantified on the chain, and corresponding contribution rewards can be allocated in the protocol. The operation of a network may require various contributions. For example, the simplest bitcoin, bitcoin needs someone to run a node, and someone to do software development, all of which are indispensable. However, there is no way to verify the software development contribution on the chain, that is to say, the contribution cannot be proved, but the pow can be proved. Therefore, the Bitcoin network can only reward contributions that can be verified on the chain within the protocol. Some contributions cannot be rewarded within the protocol.

So what to do? Use the governance based incentive. Generally speaking, if the agreement cannot be stabilized quickly at one time, you should not quickly hand over governance rights to the community. Instead, the efficiency of core team decision-making should be maintained. How much the core team decides to spend on marketing, or how much to pay themselves, is actually a governance based incentive.

But governance based has limitations. Routine incentives should not use governance based. If it is necessary to decide who is rewarded every day or who is rewarded every week through governance, this network is not established, why? Because the efficiency of community governance is always lower than that of corporate decision-making. Many things should be done in the way of enterprises and solved by enterprise management systems, rather than encrypted networks.

We say that the protocol has a transaction cost advantage in this field because the aspect of verifying the rewards of the contribution is completely automated, open and transparent, so it is established. If there is no transaction cost advantage over enterprises or platforms owned by enterprises, then there is no need to do web3.0.

Provable contribution design

Therefore, provable contribution design is a prerequisite. You have to think about the most important contribution to the daily operation of the network. How to achieve on-chain verification? The liquidity that defi needs most is on the chain itself, so the contributions of provide liquidity can be verified and quantified.

value capture design

Another prerequisite is value capture design. We say that tokens must have value. The most common indicator of value is the market value of circulation, which is the measure of token value given by the market. But the unit price of the pass is also very important, because the use of all tokens is based on the willingness to hold the token. Therefore, if the growth rate of the value of tokens is far behind the speed of additional issuance, all market participants will have no incentive to hold tokens, and this model must not work. Therefore, in the long run, the growth rate of the value of the pass will exceed the speed of the issuance of the pass.

How does the value of the token increase? There are 4 methods, the first one is the cash flow that the token can be entitled to share or the assets are increasing. The second is the ability to create purchases of tokens. The third is to be able to eliminate tokens from circulation. The fourth is that the rights attached to the certificate are increasing. These 4 are not mutually exclusive and can be used in combination. To design the mechanism of value capture, it is based on one or more of the four types. Only after these two conditions are met can token distribution design be done.

Subsidizing strategy

The first step is called subsidizing strategy, which is the subsidizing strategy. Why subsidize? It is because the encrypted network is a platform economy with network effects. Generally speaking, in such an economy, if it is a two-sided market, one side is usually more difficult to obtain. We call those difficult-to-obtain service providers a seller’s market, that is to say, as long as you find a seller, buyers will follow naturally. For example, the taxi-hailing mentioned just now, such as Didi, subsidizes drivers from the beginning. Then as long as the driver comes up, the passengers will follow. For example, Dianping and Meituan group buying, for example, subsidized merchants in the early days. If there is supply, demand will naturally follow.

Of course, there is also a buyer's market, that is, people on the demand side are more difficult to obtain. For example, task-like websites or websites are more difficult to obtain on the demand side. You need to find a strategy first to find the demand side. In the platform economy, it means that I provide subsidies to the seller, or the buyer provides subsidies. In Web3.0, you reward the token to the person who provides the service, or to the consumer service. people. This is a subsidized strategy. Determine which side to subsidize with tokens through network effect analysis.

contribution weighting

The second is contribution weighting. For example, maintaining a network requires different types of contributions. These contributions are necessary for the operation of the network. How to determine the relative weight between them? This matter seems a bit difficult. For example, maintaining life requires air, water, and food. Which one do you think is more important? It seems difficult. I found a relatively simple method: in a decentralized platform economy, it is usually possible to indentify the role of an owner, that is, who is the owner of the platform. Generally speaking, he should be those who provide services. For example, the owner of the taxi chain should be the driver. If it is a music platform, the owner should be the musician. You can regard the incentives obtained by other roles besides the owner as is the cost necessary to maintain the network. If you think of it as cost, the lower the better, with this set of rules, you can see that in order to attract these people to join the network in the market, for example, he is a validator to maintain the operation of the network and run the machine How expensive is it to run this node? How much is his expertise worth? What is a reasonable profit margin for him? How much profit will similar services give him? Offer a competitive price on it. So in this way, that is to say, other than the owner, you can use the method of cost analysis or horizontal comparison to determine the incentive level. On the premise that the growth rate of the token value is lower than the growth rate of the circulation, the rest should be sent to the owner, because they are the owners of the platform.

benefit from token price fluctuation

Then benefit from token price fluctuation, that is, the token economic model must withstand the fluctuation of the token price. Price fluctuations are endogenous, and all cryptocurrencies have a very high corelation with the big market. The entire cryptocurrency market is fluctuating violently, and a single token fluctuates on this basis, so skyrocketing and plummeting is the norm. Your token economic model should at least not be harmed if token prices skyrocket or plummet. That is to say, if token prices skyrocket, do not affect the cost of using the platform.

Another direction is that if token prices continue to fall, will it become a death spiral? That is, everyone scrambled to sell, and finally the coin returned to zero. Then it is difficult to restart the network effect, this is something to consider.

That is to say, will anyone buy when the currency price drops sharply? If your user wants to buy coins by using the necessary services, not just for investment speculation. Even if the currency falls, there is still utility for users, and the price of fiat currency may not change, users will still buy it to use this currency.

For the service provider, besides the token issued to him by the network, the incentive he gets has other cash flows. The token can usually be designed as the working capital of the Service provider. That means holding more coins, it can gain greater market share or service opportunities. When the price of the currency drops sharply, those who are in good business conditions, have good financial conditions, and want to expand their business will go to buy at the bottom. Those whose financial situation is not good and whose service is unpopular will naturally exit the market. Price fluctuations enable the platform economy to achieve survival of the fittest, which is a good thing.

diachronic fairness

The other is diachronic fairness, which is the fairness between old users and new users. This is very difficult. To be fair, it is theoretically easy. That is to say, the incentive of the newly issued tokens according to the current market price, that is, the marginal value, should be equal to the growth of the intrinsic value of the network in the current period.

If this equation can be maintained at all times, it will be fair to old users and new users, but this is very difficult, because there is no way to accurately calculate the value of the network.

Generally speaking, the token economic model will favor old users. It is the person who entered the network first, because it needs to be started, so it is not biased against him. If no one pays attention to you, the start-up will be very slow, and even cause the network to fail. But if fortunately the network gets better, he will feel unfair when new users come in. Even old users monopolize their interests, so that new users have no incentive to come in again. This situation has happened in many encrypted networks. That is to say, the long-term nature of the mechanism allows fresh blood to continue to come in.

token ditribution plan

secondary title

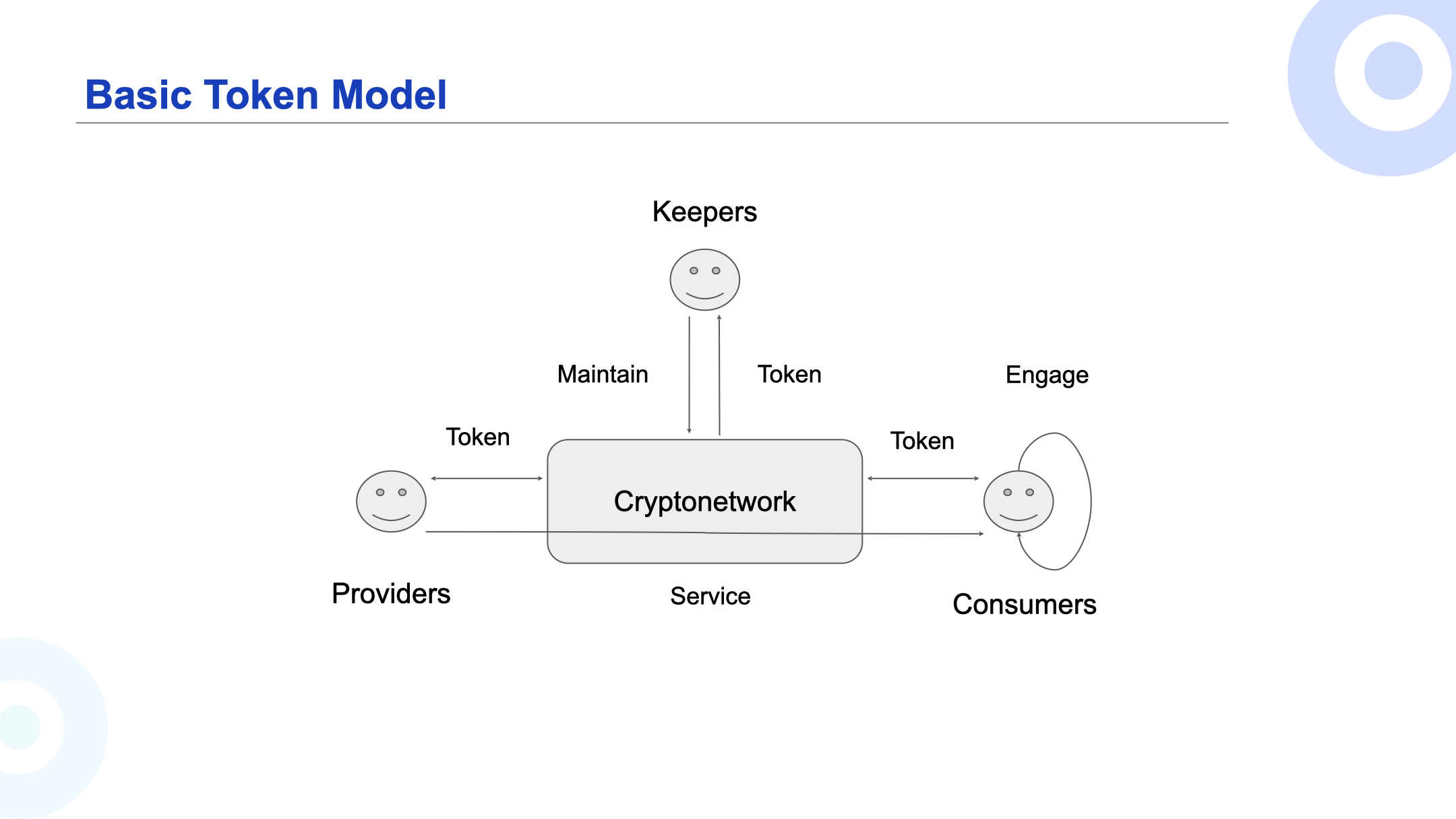

2. Basic Token Model

We propose a basic model where encrypted networks have three types of participants: Keepers, Providers, and Consumers. An encrypted network may have more than one type of keepers. Keepers allow the network to operate normally according to the design state, and are guaranteed to be safe. The service provider provides services to the service consumer through the network. There should be engagement between consumers. For example, consumers can promote virally, or through a kind of contribution, the experience of the service can be better or the value can be higher. All three types of participants get tokens according to their contributions.

secondary title

3. Token engineering process

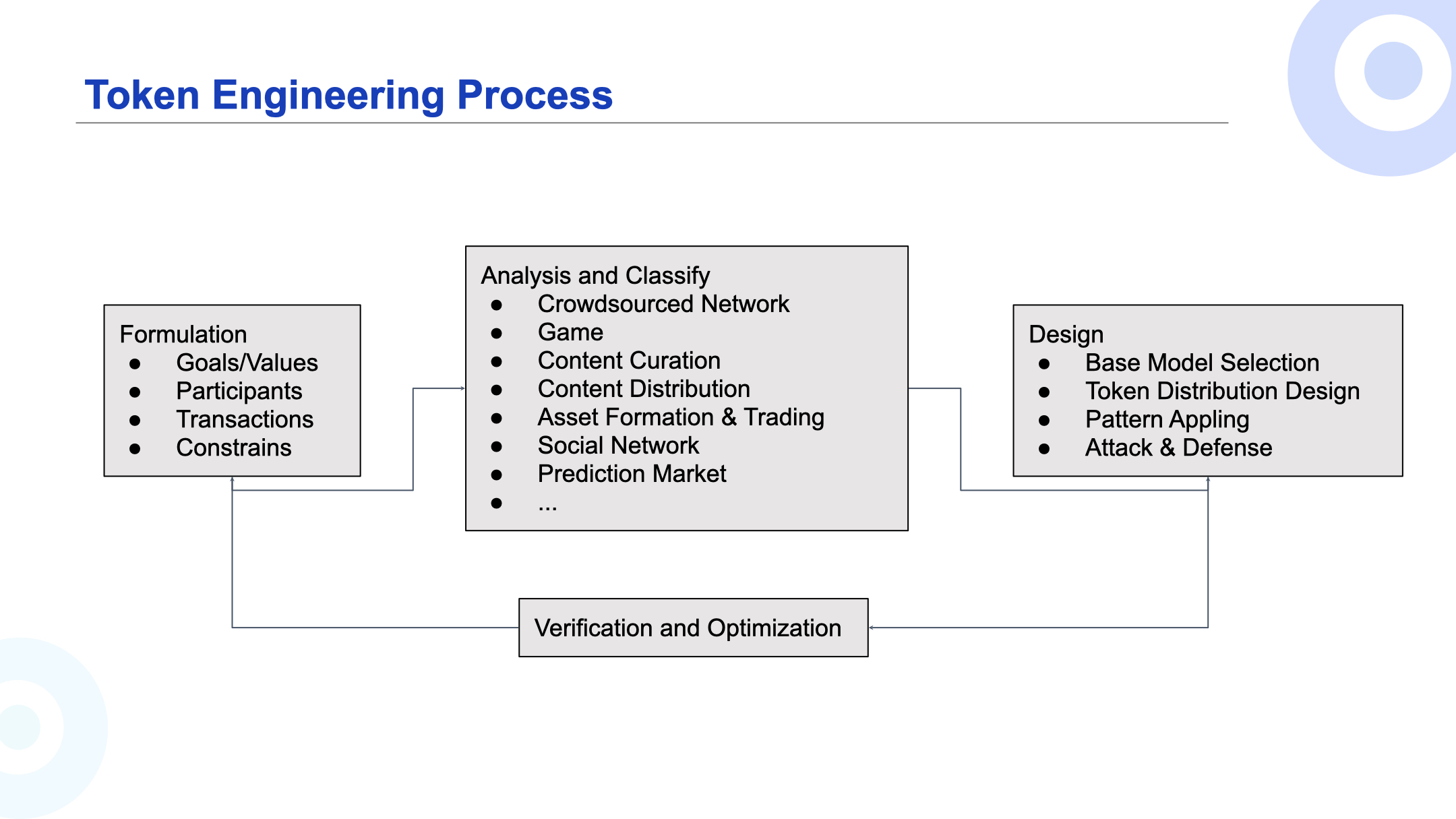

Token engineering process, the first step is to analyze the problem, what kind of platform do you want to build? What is the value of the platform? Who are its participants? What deal happened between them? What are the limitations of the platform? With the basic analysis, you can do network effect analysis. Then you have to classify the encrypted network, there are different categories in it, probably the name can explain it. After the classification, you have to find all the main projects of this category, and then study their white papers. Find research reports in this field. Know enough about this industry and this field, otherwise it will be difficult for you to convince investors, and it will also waste a shortcut, which is to find the best design so far. You go through all the existing designs, which saves time because each project spends a lot of time getting its own mockups.

Once you have this foundation, you can start designing. First of all, you need to choose a basic model. This basic model can be the model that you admire the most or that you think is the most desirable in similar projects. If not, you can start with the general base model I just introduced. Then do token distribution design, which is the process we mentioned earlier. Then some specific problems can be solved with the token design model. After solving these problems and getting a basic model, we need to do attack & defense. That is to find some knowledgeable friends, assuming various attack methods, the most important thing is to contribute to the coin, but it does not really contribute value to the grid. You need to adjust the model or add new constraints to solve these problems.

secondary title

4. Token design pattern

Every engineering field has its own basic component library, and we hope that the field of token engineering also has it, which is the token design pattern. There are quite a few token design patterns that have been identified, but their maturity is definitely far behind that of other fields. And I personally doubt whether every encrypted network designer should master all token design patterns. Because after all, most people will not have more than one chance to design a token economic model. Perhaps a better way is to turn to foreign aid.

Foreign aid actually already exists because there are some people, such as researchers from investment institutions. They have to see a lot of projects, see a lot, think a lot, and help these projects after they have invested. They have enough motivation and resources to invest in researching token design patterns. Learning has a scale effect, and after investment is converted into professional knowledge, it can help many projects. There is also an ecosystem like ours. There will be many projects in the ecosystem. We can also spend time sorting out these things, and then help many projects reduce their investment in this area and avoid detours. I'm running out of time a lot today, and that's all I want to talk about.