In-Depth Report: Everything You Need to Know About Solana

This article comes fromGrayscale, Odaily translator | Moni

overview

This article comes from

, Odaily translator | Moni

secondary title

overview

Solana is a next-generation Internet platform (Web 3.0), whose structure is a blockchain-based publicly traded encrypted network. Solana's network of open source software orchestrates the world's dispersed computers into a fully unified, user-owned and operated cloud platform. Solana supports high-speed and low-cost transactions on a single-layer blockchain, alleviating the need for additional scaling solutions typically required by other networks.

SOL is the native token of the Solana network and represents a piece of ownership in the ecosystem. At this stage, SOL tokens mainly have the following five functions:

(i) Provide support for decentralized applications (dApps)

(iii) Payment of Network Fees

(iv) Network Security through Staking

(v) Promote network governance.

Figure 1: SOLANA blockchain-related data, data as of November 29, 2021

secondary title

Solana's Blockchain Solutions

The Solana network aims to provide developers with a high-performance Web 3.0 cloud platform that provides scalability on a Layer 1 blockchain. This approach aims to optimize speed, cost, and improve network decentralization, removing the complexity of Ethereum's Layer 2 solutions. Specifically, these features can be quantified as:

• Speed: 400ms block time

• Cost: 0.000005 SOL (~$0.001) per transaction.

• Decentralization: 2,242 global nodes.

Utilizing a unique architectural approach with eight core innovations and optimizing for different technical trade-offs, Solana culminates in a level of high-performance networking. However, these "trade-offs" also bring some problems, such as the relatively low degree of decentralization of the network (compared to networks such as Ethereum), and the result is that the network is at risk of disruption, such as the DDoS attack that occurred on September 14, 2021 , which once caused all the functions of the Solana network to be shut down for about 24 hours. Nonetheless, Solana is still attracting users who like this type of network design, and they are currently expanding the size of the Web 3.0 blockchain cloud computing market by enabling the following features:

• New Users: Solana enables previously underserved, cost-sensitive users to access existing crypto applications such as Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), and other Web 3.0 DApps.

• Increased usage: Solana enables more active user adoption of Web 3.0 applications by reducing transaction costs and increasing transaction speed.

Technology trends often come in cycles, and Solana's impact on the Web 3.0 cloud computing market has similarities to previous computing platform innovations that drove overall Internet adoption: • Mainframe to PC: In the mainframe era, computers were bulky and expensive , which limits their access to academic researchers at selected universities. The advent of the personal computer (PC) changed that by reducing costs and opening access to a new wave of consumers, and Solana's lower fees have a similar effect today.

• From local to cloud: In the era of local networks, any organization had to own and manage its own servers, or rely on other computer infrastructure to access software, but with the advent of cloud computing, people no longer need to involve locally hosted processes while dramatically increasing application agility. Solana has had a similar impact by giving developers a single platform powerful enough to run Web 3.0 DApps while removing the complexities of Layer 2 scaling solutions.

• From desktop to mobile: In the desktop era, the dominant applications are basically designed for a fixed computing platform, so the range of applications that can be supported is also very limited. But now, our main life is carried out on mobile devices, and it also provides developers with a mobile computing platform, which changes the situation of desktop applications in the past, and also makes it possible to develop new applications based on mobile terminals, such as Uber. Solana, which designed DApps by improving Web 3.0 cloud scalability and providing developers with a new infrastructure medium, is having a similar impact today.

For networks such as Solana and Ethereum, the Web 3.0 cloud computing market is a huge and fast-growing opportunity. Many Web 2.0 cloud providers—including AWS, Google Cloud, Microsoft Azure, Alibaba Cloud, and Tencent Cloud—have found success by serving diverse customer needs, and the Web 3.0 cloud market is following a similar path, with networks such as Ethereum and Solana is becoming a major contender in this field.

secondary title

practical application

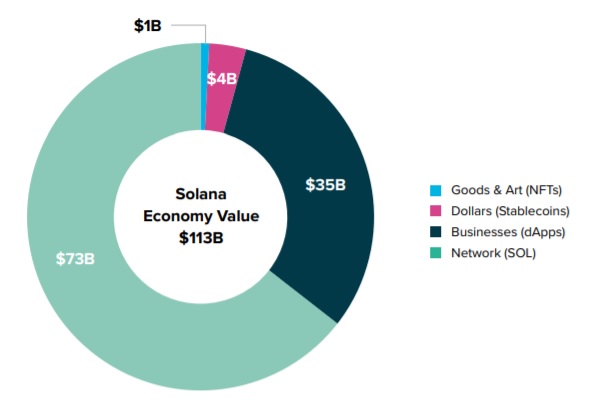

The Solana cloud economy has grown rapidly in the past year, driving the total value of the ecosystem to more than $110 billion. Currently, the entire ecosystem is mainly composed of the Solana network (SOL) and assets issued on the network. The SOL community has jurisdiction over the ecosystem . These include assets such as digital businesses (smart contract DApps), digital dollars (USD-backed stablecoins), or digital goods and artworks (i.e. NFTs) issued on the Solana network. Here is an overview of the value distribution between these categories:

• Solana Network (SOL) captures most of the value of the digital economy with a $73 billion market cap and currently accounts for approximately 65% of the total ecosystem value.

• The digital business (DApp) on the Solana network accounts for about 1/3 of the value of the entire ecosystem, and the specific data is about 35 billion US dollars, accounting for about 30%.

• The value of digital dollars (stablecoins) circulating in the Solana economy is approximately $4 billion, accounting for approximately 3% of the entire ecosystem's economic value.

• The value of Solana-based digital goods and art (NFT) is about $1 billion, which is about 1% of the total economic value of the entire ecosystem.

Figure 2: Market Value Distribution of SOLANA Cryptocurrency Economy

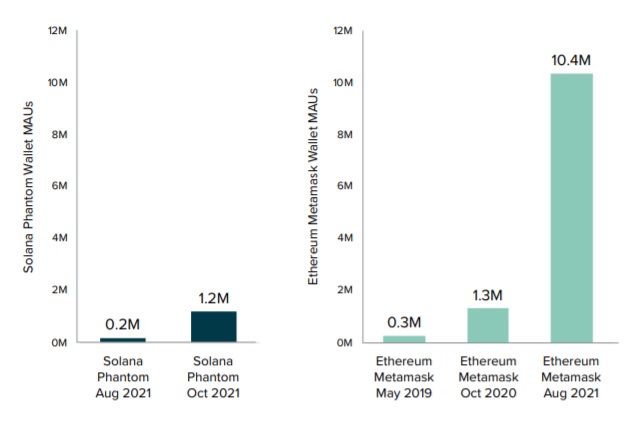

Solana has managed to build a large and rapidly growing user community. The number of monthly active users (MAU) of the most popular Solana wallet Phantom and its growth from 200,000 in August 2021 to 1.2 million in October 2021, if you compare Phantom with Metamask, the most popular Ethereum wallet, Solana User growth is roughly the same as Ethereum in October 2020.

Figure 3: Comparison of monthly active users of SOLANA PHANTOM and ETHEREUM METAMASK wallets

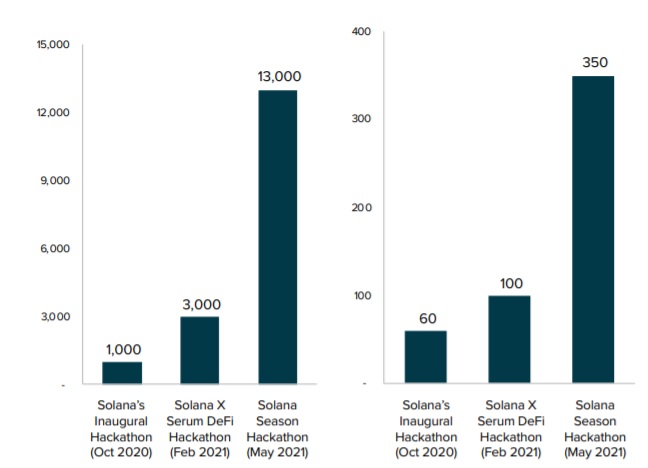

Developer interest in Solana has skyrocketed over the past year since the network launched. The interest of open source developers is a key indicator of the development of Web 3.0 cloud networks, because it is these BUIDLers who create the application ecosystem that will ultimately attract users to the Solana network. To this end, Solana has been actively promoting hackathon activities to attract more and more developers to register and submit projects, further promoting the development of the DApp ecosystem.

Figure 4: Solana Hackathon registrations (left) and project submissions (right)

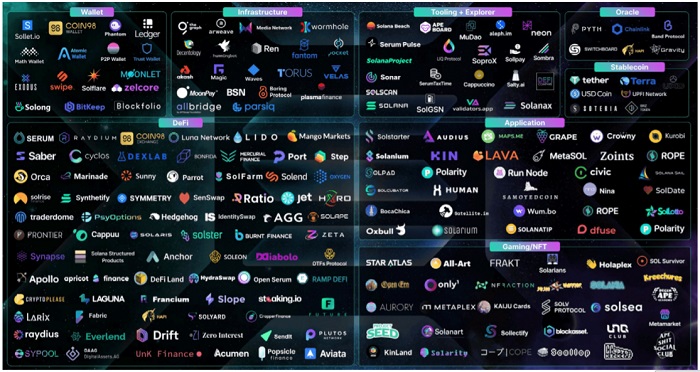

Solana is a smart contract platform or a general-purpose encrypted cloud platform for developing DApps. The Solana community has built a large ecosystem of more than 500 DApps within a short period of time after the network was launched. The fields designed by Solana DApp mainly include DeFi, Web 3.0 and NFT, including:

• DeFi: Use cases include open order book exchanges, automated market makers, lending platforms, asset management software, and payments.

• Web 3.0: Use cases include Solana name service, data privacy web browser, and off-chain data oracles.

• NFT: Use cases include minting platforms, marketplaces, gaming, music streaming, social media, and distributed autonomous organizations (DAOs).

.Figure 5: Decentralized Application (DAPP) Ecosystem on SOLANA Chain

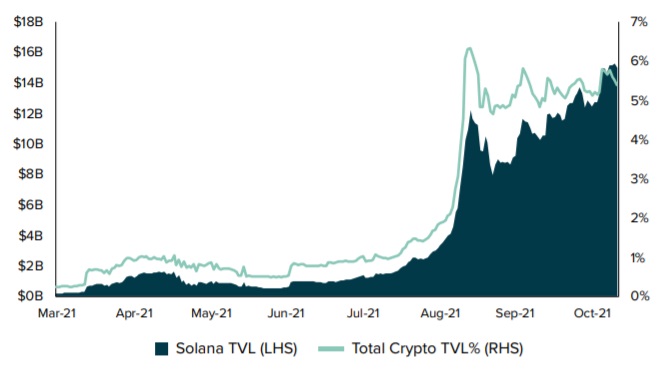

In the past year, the total locked volume (TVL) of the Solana DeFi protocol has increased, and now accounts for about 6% of the total locked volume (TVL) of all encrypted projects. This achievement is mainly due to the growing user interest in Solana interest, growing applications, strong SOL network performance, and increased issuance of digital dollars on the Solana chain (the total market capitalization of stablecoins on the Solana network has reached ~$4 billion).

In the past year, the total locked volume (TVL) of the Solana DeFi protocol has increased, and now accounts for about 6% of the total locked volume (TVL) of all encrypted projects. This achievement is mainly due to the growing user interest in Solana interest, growing applications, strong SOL network performance, and increased issuance of digital dollars on the Solana chain (the total market capitalization of stablecoins on the Solana network has reached ~$4 billion).

Figure 6: The total lock-up volume on the SOLANA chain, and the trend of the proportion of SOLANA lock-up volume in the total lock-up volume of cryptocurrencies

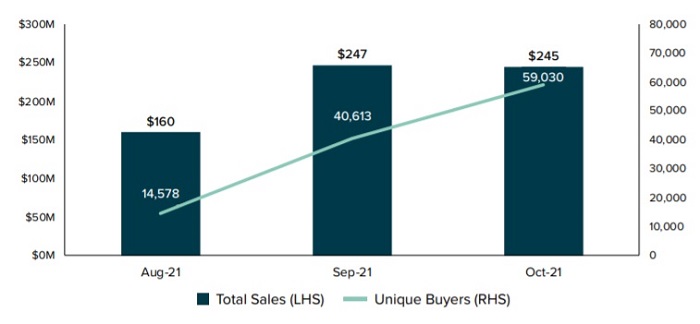

Finance isn’t the only area of growth in Solana’s digital economy — Solana’s on-chain performance is equally strong when it comes to consumption. Non-fungible tokens (NFTs) that represent ownership of digital property, such as artwork, consumer goods, or other assets, have also grown on the Solana chain in recent months. The total market capitalization of NFTs based on the Solana blockchain has risen to over $1 billion, monthly sales of Solana NFTs have increased to approximately $250 million, and the number of unique buyers has increased approximately 4-fold in the past three months to approximately 60,000 people.

Figure 7: SOLANA NFT secondary sales volume and number of independent buyers

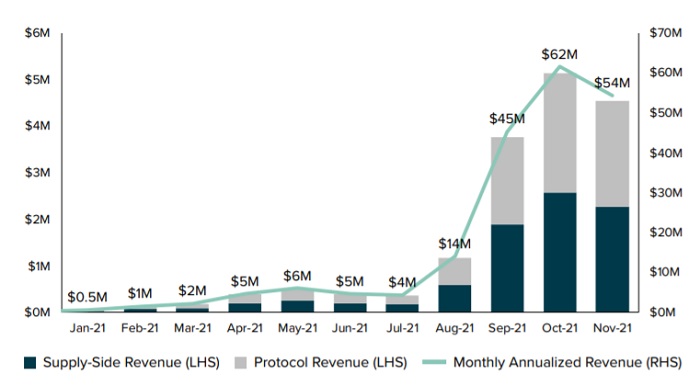

Solana's network revenue has increased over the past year as users, applications and usage continue to grow. By November 2021, total fees paid by Solana users for transactions such as sending payments, running smart contract programs, issuing new assets, and voting on network consensus reached approximately $4.5 billion, an increase of more than 100 times since the beginning of the year.

Solana's network revenue has increased over the past year as users, applications and usage continue to grow. By November 2021, total fees paid by Solana users for transactions such as sending payments, running smart contract programs, issuing new assets, and voting on network consensus reached approximately $4.5 billion, an increase of more than 100 times since the beginning of the year.

The Solana protocol reduces the supply of SOL by eliminating 50% of the total transaction fees, while the remaining 50% will be paid to the network's computing infrastructure provider (validator), and staking SOL tokens can be incentivized.

Figure 8: Monthly income on the SOLANA chain, and annual income trends calculated by month

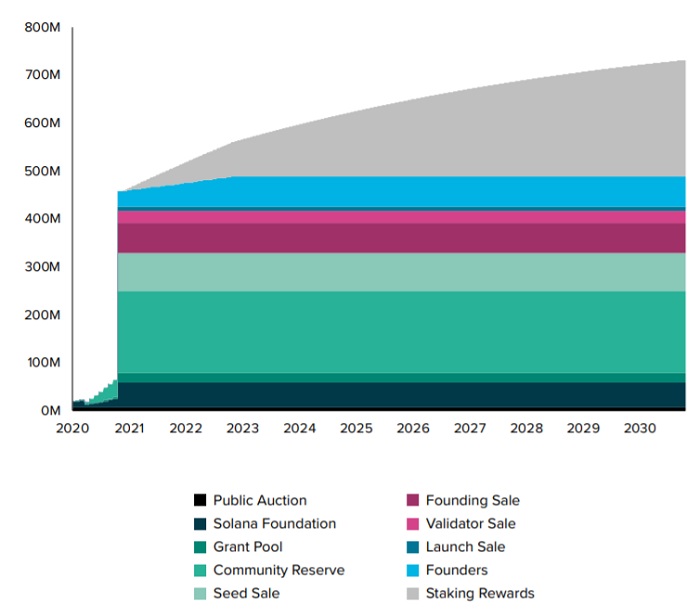

Due to the supply deflation mechanism adopted by Solana, the total supply of SOL in the future will not be determined. While the total SOL supply will vary based on network revenue, the rate at which new tokens are issued is written into the Solana protocol.

The Solana mainnet beta was launched in March 2021 with a supply of 500 million SOL. During February 2021, the SOL supply inflation rate was adjusted from 0.1% to an initial inflation rate of 8%, after which the initial inflation rate of 8% was reduced at an annualized dis-inflation rate of 15% until reaching 1.5 % long-term inflation rate. As of November 2021, the Solana network token circulation is approximately 509 billion SOL, and the total inflation rate is estimated to be approximately 7.3%.

Figure 9: SOL token supply release schedule

Solana was founded by Anatoly Yakovenko, who first conceived key elements of the project and its technical approach in late 2017. The Solana network's internal testnet and official whitepaper were released in early 2018, and the Solana software protocol mainnet beta was launched in March 2020.

Competitive Advantage

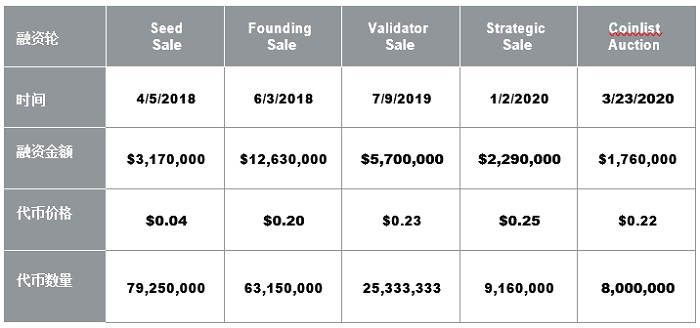

Between 2018 and early 2020, Solana Labs, the development company behind Solana, made a series of funding deals.

Figure 10: SOLANA Financing History

secondary title

Competitive Advantage

• Technology: Solana has a novel technology blockchain solution that offers high scalability and low transaction fees, which sets it apart from other networks.

potential risks

• Community: Solana has a strong and active community of users, developers, industry partners and investors.

• Ecosystem: Solana has built a large and rapidly growing DApp ecosystem with new use cases emerging.

secondary title

potential risks

At the network level, Solana also faces some potential risks, as well as pressure from competitors in the encryption industry and external factors, including:

• Degree of centralization: If one day, one or a group of entities control a majority of the SOL token supply, the Solana network may become overly centralized. In addition, users may need more specialized equipment to increase support if they want to participate in the Solana network, which means that the network cannot attract a large number of users, and in turn may not be able to achieve a high degree of decentralization.

Summarize

• Regulatory uncertainty: Solana could face scrutiny from various regulators, who have so far generally only identified Bitcoin and Ethereum as assets that are not securities.

• Network Security: Solana utilizes several new technology approaches with both advantages and disadvantages. First, the Solana consensus mechanism uses a new blockchain technology that is not widely used and may not function as intended; second, there may be flaws in the cryptography underlying the network, including flaws that affect the functionality of the Solana network or make the network vulnerable to attack. Finally, Solana's economic incentives may not work as intended, which may result in an unsafe or underperforming network.

secondary title