Image source: Internet

Author: Chen Zou

Author: Chen Zou

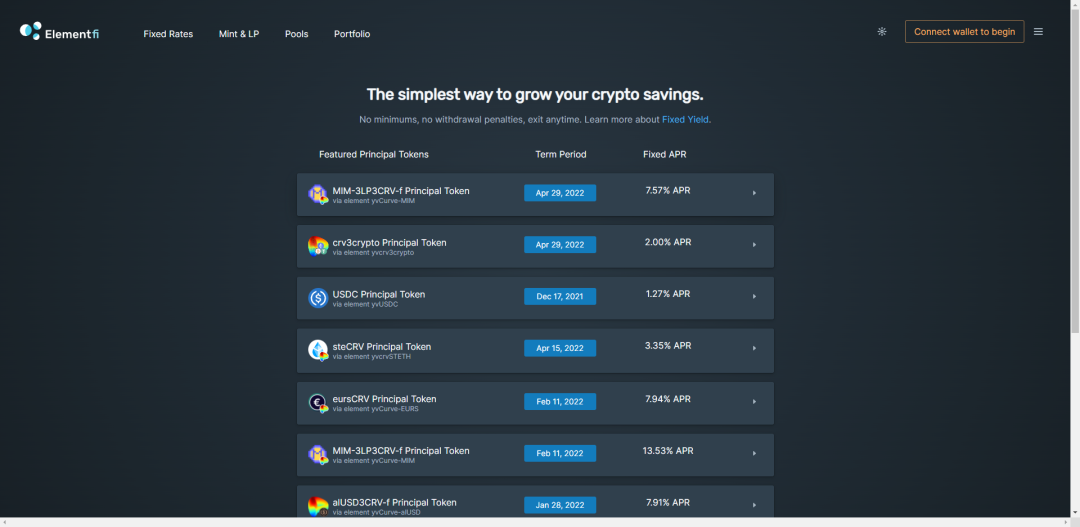

1. Element Finance

Bankless has recently sorted out 25 projects worthy of attention in the future that may issue airdrops, a total of 25, this article will introduce 5 of them, and follow-up projects will continue to be released~"first level title"。

Introduction: Element Finance is a

Open source protocol for fixed and variable income markets

Official website: https://app.element.fi/fixedrates/

How to win: Element Finance’s flagship products are its Earning App and Savings App; using either may qualify you for future airdrops.

Element is live on Ethereum Mainnet!

How to Access Fixed APR on USD, ETH, and BTC in 4 minutes

2. Hop Protocol

Learn more about portals:

first level title

Introduction: Hop Protocol is a token bridging protocol (cross-chain track) for easily sending ETH and ERC-20 between blockchain and Rollup; it currently supports between Ethereum, Arbitrum, Optimism, Polygon and xDai bridging assets."Official website: https://hop.exchange/"。

Reason for the list: Regarding the Hop token, the project team has previously stated that,

Any official announcements about the protocol will come directly from the official Hop channel of the Hop team

If Hop is not going to launch a token, they will most likely say so directly like ParaSwap did.

Sweeping method: check hop.exchange,

1) Use its cross-chain function to bridge assets from one chain to another

Learn more about portals:

3. DeFi Saver

How to use the Hop protocol (Youtube video, bring your own ladder)"first level title"。

Introduction: DeFi Saver is a

One-stop Defi console to create, manage and track your DeFi assets

Official website: https://defisaver.com/

Why it's on the list: DeFi Saver has been silent on the issue of native tokens so far. However, the possibility of issuing governance tokens and using them to vote and prioritize new protocol integrations is still very much possible.

Learn more about portals:

4. Ondo Finance

Introduction to DeFi Saver"first level title"Introduction: Ondo Finance is a support

Defi's Risk Market

agreement."Official website: https://ondo.finance/"Ondo currently has no tokens"at present"。

. Focus on:

at present

Learn more about portals:

5. Saddle Finance

Introduction to Ondo Finance"first level title"。

Introduction: Saddle Finance is a decentralized exchange,

Optimized for pegged types of cryptoassets such as stablecoins and wBTC

Official website: https://saddle.finance/

Sweeping method: conduct token trading operations through exchanges, or act as liquidity providers.

Low Slippage Trades Across Pools via Virtual Swaps

6. Charm

Learn more about portals:

first level title

Introduction: Charm is an agreement that provides a set of DeFi products, including Alpha Vaults (flagship product), Cube Tokens, etc."Official website: https://charm.fi/"Why it's on the list: From day one, the Charm team's stated goal was to build a"Anyone can research, build and manage protocols in Charm". Reading between the lines, their ultimate goal is to

management agreement

, so launching its governance token is an inevitable trend.

How to do it: Deposit funds in Charm's flagship products, such as Alpha Vaults.

Charm Options and Cube Tokens

7. Slingshot

Introducing Alpha Vaults

first level title

Introduction: Slingshot is a Web3 trading platform, which is currently launched on Polygon and will support Arbitrum next.

Official website: https://slingshot.finance/

Why it's on the list: Slingshot is likely to follow the same path as other DEXs and eventually release its own native token.

Learn more about portals:

8. TokenSets

Slingshot - Next Generation Decentralized Trading Platform

first level title

Introduction: TokenSets is a DeFi asset management platform built on the Set protocol. (Set Protocol is based on the Ethereum ERC20 standard. It is an infrastructure service that abstracts a package of tokens that are realized by smart contracts, fully mortgaged, convertible, and combinable into a collection of tokens. The usage scenarios include digital currency index funds, exchanges Trading funds, and payment services with multiple tokens. Do your own research, DYOR.)

Official website: https://www.tokensets.com/

Reason for listing: The project is developing towards a completely decentralized governance direction, and native tokens are just needed.

Learn more about portals:

9. Gro Protocol

Introduction to TokenSets

first level title

Introduction: Gro Protocol is a yield aggregation protocol."Official website: https://www.gro.xyz/about#about-contributors"Reason for listing: The Gro team plans to make the project

Fully decentralized in the near future

, and plans to let early supporters participate in governance (translation: wait for us to smash the airdrop!).

Learn more about portals:

10.Cowswap

Introducing the Gro protocol

first level title

Brief: Cowswap is a MEV-resistant DEX aggregator built on top of Gnosis Protocol (DEX) v2.

Official website: https://cowswap.exchange/#/swap

Sweeping method: Do some transactions through exchanges.

Cowswap FAQ

11. Cozy Finance

Learn more about portals:

first level title

Introduction: Cozy Finance is a protocol (Defi Insurance) that creates a trust-minimized protection market for DeFi.

Official website: https://www.cozy.finance/

Why it's on the list: So far, most DeFi insurance projects have launched their own native tokens, and Cozy Finance will not be an exception.

Learn more about portals:

12. Zapper

Cozy Finance Overview

first level title

Introduction: Zapper is a Web3 wallet application for DeFi and NFT users.

Official website: https://zapper.fi/dashboard

Why it's on the list: Zapper hasn't dismissed the possibility of a token launch.

Learn more about portals:

13. Zerion

Getting started with Zapper

first level title

Brief: Zerion is another popular Web3 wallet management app for DeFi and NFT users.

Official website: https://zerion.io/

Why it's on the list: Like Zapper, we'll likely see Zerion launching a native token for community governance at some point in the future.

Learn more about portals:

14. Kwenta & Lyra

first level title

Official website:

https://kwenta.io/

https://www.lyra.finance/

Introduction: These are two different protocols, but what they have in common is that they are both derivative projects built on Synthetix, which have been deployed on Optimism L2. Based on these commonalities, I have highlighted them together here accordingly.

Official website:

Why they made the list: These projects have publicly confirmed that they will be doing token airdrops (respectively).

Sweeping method: pledge SNX on Optimism, and then use any of the relevant protocols.

The Ultimate Guide to Kwenta Futures Trading

15. Mirror

Options Guide on Lyra

first level title

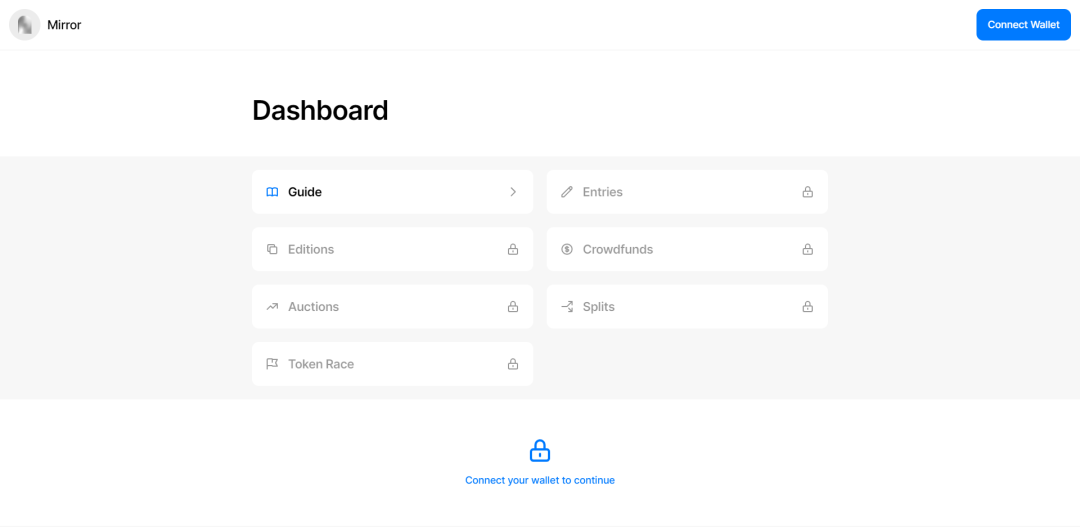

What it is: Mirror is a decentralized publishing platform and content creator platform.

Official website: https://mirror.xyz/

Reason for the list: Although Mirror has launched the WRITE token, strictly speaking, it only completes the interaction with the platform, but so far, the usage scenarios of the token are quite limited. Perhaps in the future, Mirror has the opportunity to airdrop more tokens to its early users and encourage experimentation with new use cases.

Learn more about portals:

This article is from Bitpush.News, reproduced with authorization.