Footprint: Looking at the unique ecology of the public chain Terra, TVL will return to the top three?

Written by Footprint Analyst Simon (simon@footprint.network)

Written by Footprint Analyst Simon (simon@footprint.network)

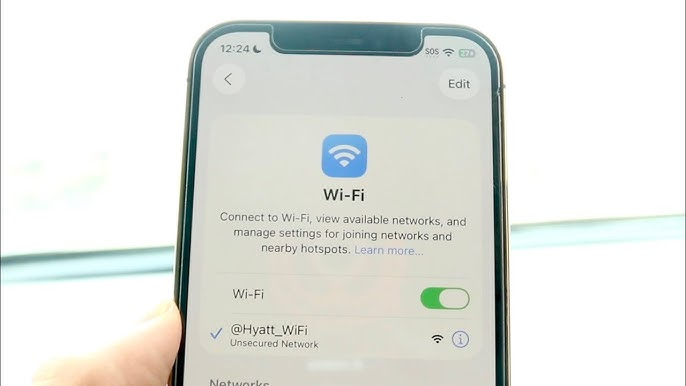

In the past quarter, all public chains have blossomed. Polygon, which rose in May, has been weak in development three months later. In the past January, the TVL has not increased but decreased. However, taking advantage of Polygon’s lack of stamina, the public chains Terra and Solana overtook Polygon in mid-August and early September respectively. Avalanche has also been gaining momentum recently and has a tendency to surpass Polygon. Polygon was second only to Ethereum and BSC. The public chain of the three major TVLs may drop to No. 6. Footprint Analytics has been on the public chain last monthSolanaandAvalancheAfter an in-depth analysis (click the link for details), this time we will continue to use the DeFi data on Footprint Analytics to explore the unique model of the public chain Terra.

image description

TVL of each public chain (from January 2021) Data source: Footprint Analytics

Focus on finance, get through the chain

Terra launched the project in January 2018 and launched the main network in April 2019, behind which is operated by Terraform Labs in Seoul, South Korea. Terra has raised three times from 2018 to 2021, with a cumulative financing of more than 200 million US dollars. The latest financing was 150 million US dollars on July 16, 2021. This financing is mainly used to fund the construction of ecological projects on the Terra chain.

The most sudden feature of Terra and other public chains is that its founding team has rich business background and resources. Its two payment programs CHAI and MemePay have opened up the offline payment scenarios in South Korea and Mongolia respectively, which makes Terra not only An intangible encrypted world, but a blockchain that can be linked to real life.

Unlike other public chains that only have one public chain token, in addition to the chain’s token Luna, Terra has restored its stablecoin UST, which is anchored to the US dollar. At the same time, there are stablecoins anchored to the Korean won and anchored to KRT. Mongolian Grik’s stablecoin MNT, and the IMF’s Special Drawing Rights SDR stablecoin SDT.

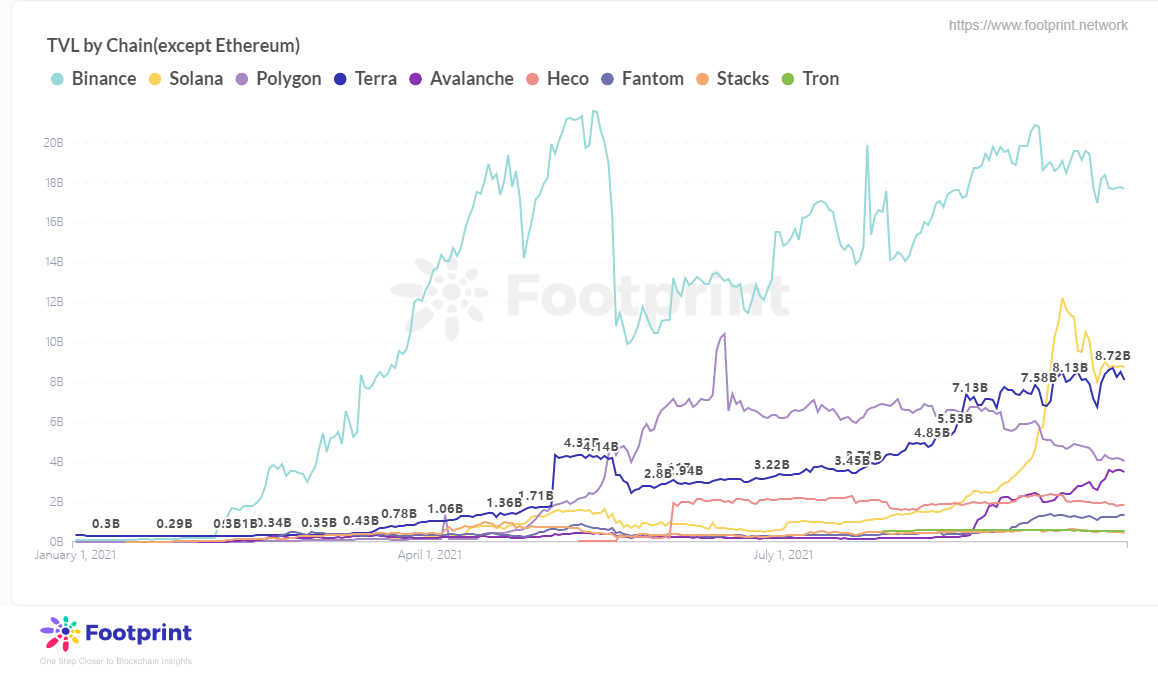

In the dual-token model, UST has ranked fourth in market capitalization among stablecoins

Compared with other public chains with many protocols, the entire protocol on the Terra chain is established around its original stable currency UST. The protocol on Terra has its own transaction scene of UST since its birth, and UST can Linked to offline payment.

image description

Stablecoin market value (end of September 2021) Data source: Footprint Analytics

According to the data of Footprint Analytics, among the common stablecoins in the market, the market value of UST has ranked fourth (2.673 billion US dollars), while the first and second USDT and USTC are centralized stablecoins, and the third place Dai cannot be regarded as a completely decentralized stablecoin. The decentralized stablecoin UST can be regarded as the top one. This is inseparable from Terra's opening up of offline scenarios. Compared with other stablecoins, it can be said to be the most "useful" stablecoin. , it loads real usage scenarios to the "illusory" blockchain world, and thus feeds back its own market value.

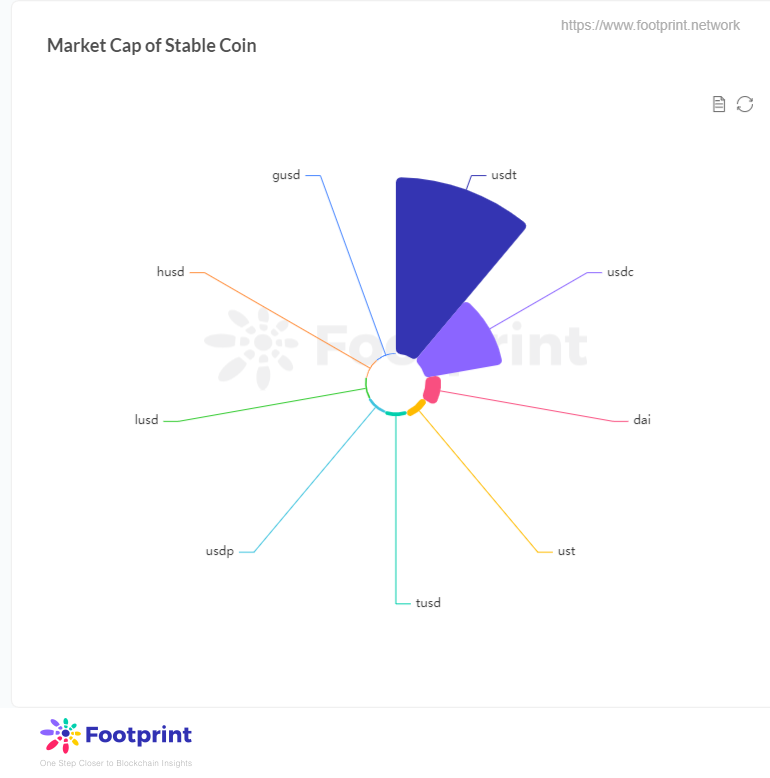

Token Luna increased by 416% in four months, ranking among the top five public chain tokens

Since Terra launched its mainnet in April this year, its token Luna has experienced a small wave of rise. After falling due to the "519" incident, it gradually rose again in July and rose sharply in August. It has risen by about 416%, but from the data of Footprint Analytics, it can be seen that Luna is currently the fifth most expensive token among public chain tokens. Although its price is half that of AVAX, which ranks 4th, its transaction volume is already comparable to that of AXAX. Comparable and even far superior to MATIC, it can be seen that this kind of public chain with strong currency attributes that connects online and offline has more transaction attributes.

Luna price (from January 2021) Source: Footprint Analytics

image description

Daily transaction volume of each public chain token (since January 2021) Data source: Footprint Analytics

However, given that UST is anchored by USD 1 Luna as a stable currency, the violent fluctuation of Luna will also cause UST to break away from the USD 1 anchor. However, it is believed that with the gradual increase in the number of users of Terra and the increase in transaction volume, the stability of the chain will be improved. will gradually strengthen.

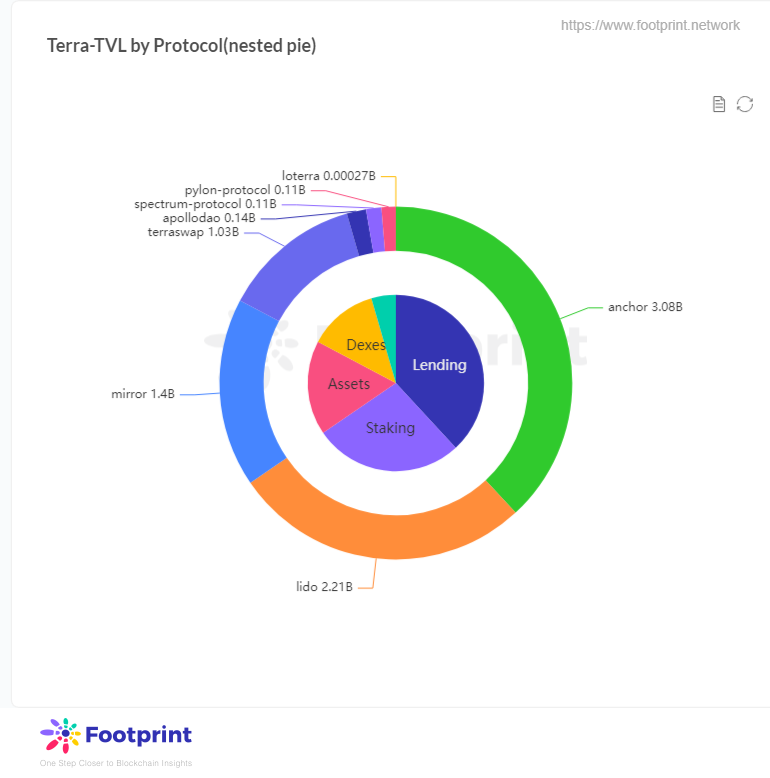

Compared with the rich and varied ecological protocols of other public chains, Terra seems to be "simplified" a lot. The protocols in its ecology are all closely centered around UST, among which Mirror (synthetic asset protocol) and Anchor (fixed APY savings product) are to create immediate use cases and demand for its stablecoins. Although Footprint Analytics currently only includes 8 protocols in the Terra chain, it can also be seen that the founding team is closely focused on the goal of financial scenarios.

image description

Terra chain protocol TVL ratio (at the end of September 2021) Data source: Footprint Analytics

Through the TVL of each protocol in the Terra chain in Footprint Analytics, we can see that the four protocols of Anchor, Lido, Mirror, and Terraswap on Terra currently account for about 95% of the TVL, but this alone almost surpasses Solana’s TVL , Compared with Solana's explosive growth, Terra's growth is more steady.

Similar to Synthetix, Mirror is a synthetic asset agreement, but the current TVL of Mirror in Terra and Ethereum is comparable to that of Synthetix. Mirror currently covers US stocks, BTC, ETH and other synthetic assets. It provides a powerful application scenario for UST, and at the same time increases the income of miners, making Terra's system develop more stably.

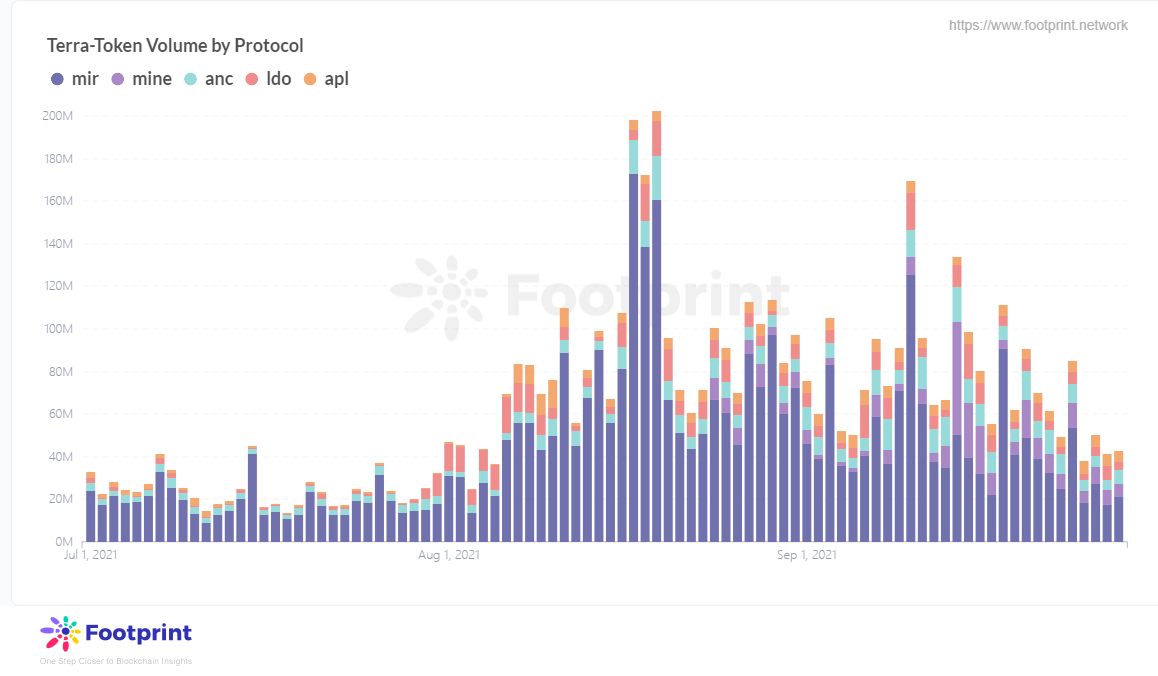

image description

From the trading situation of each protocol token, Mirror’s token MIR has the highest trading volume in the past 90 days. Although its token price is only 2.76 US dollars as of the press date, it can be seen that its trading volume is relatively higher than that of other protocols on the chain. Active, which is inseparable from Terra bringing cryptocurrency into the real world. Mirror is currently an industry leader in the field of synthetic US stock trading.

Summarize

Summarize

Although Terra is far from the recent skyrocketing SOL and AVAX in terms of token price, its steadily growing TVL almost surpasses Solana again. Terra will also upgrade Columbus-5 at block height 4460000 on September 30. Whether Terra after this upgrade can surpass Solana is worth looking forward to.