Is it good to participate in the HECO node election? We did the math for you

The booming DeFi in 2020 has injected vitality into the encryption market and also opened the prelude to public chain competition.

In the past year, we have witnessed the growth of the Ethereum ecosystem and the resurgence of the old generation of public chains. In this battlefield, the most brave performer is the public chain of the head exchange. Huobi, Binance, and OKEx have come to an end. Relying on their own resources and technology, they are striving to build the exchange public chain, trying to capture developers and expand the ecological value of the exchange.

Nowadays, most of the market’s attention is focused on the longer-running Binance Smart Chain (BSC), so that the Huobi Ecological Chain (HECO), which was just launched at the end of last year, seems to be “small and transparent.”

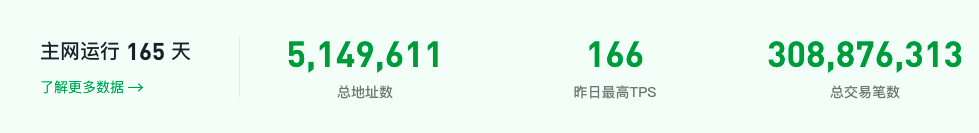

However, the reality is that HECO has far exceeded expectations. Less than half a year after its launch, the total number of HECO addresses exceeds 5.1 million, ranking first among the exchange public chains; the total lock-up volume is close to 10 billion US dollars, second only to BSC.

Recently, HECO announced the official launch of the global node election, and users become nodes to participate in network governance by staking HT. As soon as the news came out, the price of HT rose immediately, reaching as high as 39.9 US dollars, with a maximum increase of more than 65% within a week.

"HECO is an efficient and energy-saving public chain built for decentralized ecological applications. Although Huobi Group is the original sponsor, public chain governance must rely on community power. Realizing HECO's true decentralization is the goal of this node election. The core goal.” Liu Su, head of HECO, told Odaily.

In this article, we will introduce the HECO node election rules in detail, calculate the node income, and analyze the long-term impact of the node election on the future circulation and price of HT.

1. HECO opens a new era of decentralized governance

Half a year after its launch, HECO ushered in its first transformation.

On April 29, Beijing time, Du Jun, the co-founder of Huobi, revealed the news of the HECO node campaign in advance on Twitter, with the accompanying text "Hello, HECO Node!", and posted a picture of the HECO node campaign.

Due to the high entry threshold (10,000 BNB) for BSC node participation, many people have been hindered from entering. Therefore, for the HECO node, which is also the public chain of the leading exchange, those who are interested are eager to try and hoard coins in advance, just waiting for the rules to be announced.

"We bought some HT as soon as Du Jun posted the article. Even if we can't become a node in the end, the node election should drive HT up." A node service provider told Odaily.

However, some people believe that the HECO node election is destined to be far away, with great momentum and little rain. After all, the Huobi public chain in the past two years often bounced tickets. But this time, HECO proved itself with actions.

On May 7th, HECO officially announced the official launch of the global node election, which is also an important step in HECO's technology roadmap.

On December 21, 2020, the HECO mainnet was officially launched and the "fire seed" stage was simultaneously launched (HECO is divided into four stages: fire seed, spark, flame, and prairie fire). According to the plan, the node election will be launched in the "fire seed" stage. It was originally scheduled to start in the first quarter of this year. Later, due to the improvement of technical facilities and repair problems, it was slightly delayed by more than one month.

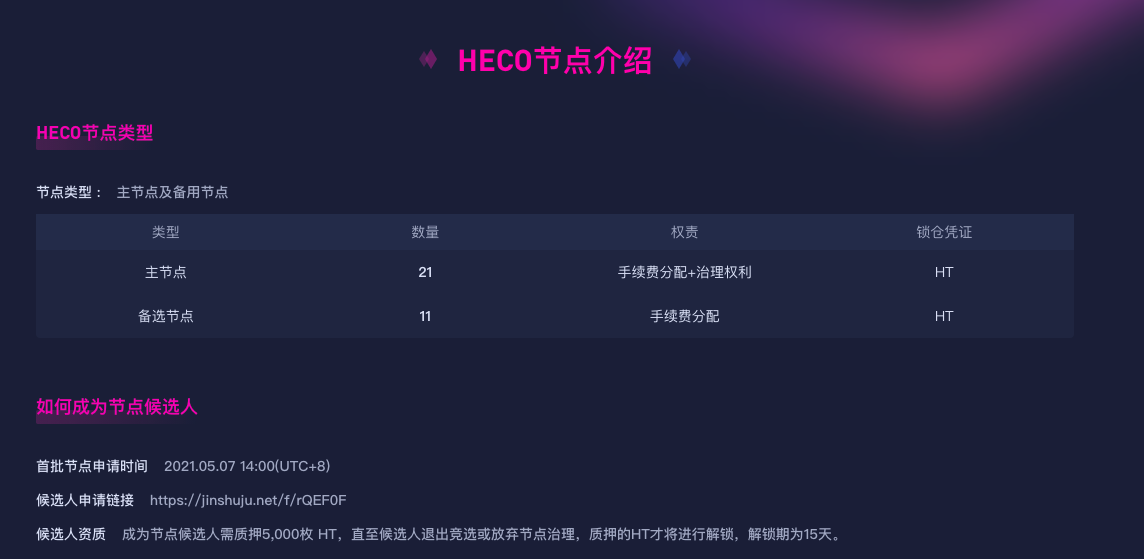

According to the official announcement, HECO has set up a total of 21 master nodes and 11 backup nodes. In this round, 11 master nodes and 11 candidate nodes are open to the public; users can vote for node candidates and pledge HT (minimum 5,000 HT) to the HECO address specified by the node; the top 11 candidates with HT pledged amount are the master nodes , the 12th-22nd are named as candidate nodes.

Regarding why only 11 masternodes are open, Liu Su, head of HECO, told Odaily that the HECO nodes have been operated by Huobi officials before. In order to maintain ecological stability, the node election can only be gradually released to the outside world to guide community participation. "In order to prevent governance chaos caused by all releases, the official will occupy a certain number of nodes in the early stage of the project, and will gradually hand them over to the community in the later stage."

The design of 21 master nodes is basically the same as the design of the current mainstream POS public chain, the difference is that there are more alternative nodes for other public chains. For example, EOS has 100 candidate nodes, and exchange public chains such as BSC also have more than 20 candidate nodes.

Governance, however, is a power only masternodes can enjoy. According to the announcement, 21 master nodes can participate in governance on the HECO chain (processing transactions, signing blocks, initiating proposals, etc.), and at the same time enjoy the share of transaction fees on the HECO chain; You can get transaction fee sharing.

For HECO, this node election has far-reaching significance.Node elections are conducive to gathering more power, contributing to the healthy development of HECO, and purifying the current ecological status of HECO.

In the past six months, the development of HECO has not been smooth sailing. When it was first launched, HECO did show a lot of vitality, attracting a large number of developers to enter. But for Huobi itself, it has limited energy and it is difficult to deal with tens of thousands of users and hundreds of project parties. Therefore, some "earth dog projects" have also begun to take root in HECO, and frequent thunderstorms have caused damage to the HECO brand.

For Huobi, decentralization and community autonomy are the best solutions. For example, if a project runs away in a thunderstorm, the community can initiate a proposal to freeze and return the funds involved. Through the decentralized autonomy of the community, it can not only avoid the burden of exclusive power on Huobi, but also expand Huobi's global influence.

"Node election is a key step to improve the stability and decentralization of the HECO system, so that more users in the HECO community can participate in the development of the HECO ecosystem, and give more rights and incentives to the community, thereby promoting the prosperity of the entire HECO ecosystem and sustainable development," Liusu added.

2. Node income and future trend of HT

Regarding the HECO node election, what everyone cares most about is the node income. As mentioned earlier, currently, nodes can only enjoy the share of transaction fees on the HECO chain. More rights and interests in the future will be generated based on node proposals.

Specifically, all node fees of HECO are allocated according to the following ratio:50% is distributed equally to each master node, 40% is distributed according to the number of HT locked by all 21 master nodes, and 10% is distributed to all candidate nodes corresponding to the locked HT.

(1) The annualized income is 15.3%, and the HECO node surpasses BSC&OEC

Odaily calculated the income of the master node and the backup node, as follows:

According to the data on the chain, the current average daily handling fee of HECO is 3947 HT. According to the minimum threshold of a single node is 5000 HT, the average daily handling fee of each master node is 169.15 HT, and the annualized income of the coin-based handling fee can reach 1234.8%; the average daily handling fee of the 11 candidate nodes is 35.88 HT, and the annualized income of currency-based handling fees can reach 261.9%.

Of course, the above situation is an idealized estimate. In fact, according to the previous POS node pledge situation, 5000 HT cannot eventually become a node. Considering that different public chains have different target groups, we choose to refer to BSC and OKEx Chain, both of which are exchange public chains, both of which are 21 commonly used nodes:

The 21st node on BSC pledged 313,608 BNB, accounting for 0.2% of the circulation; the first node pledged 520,173 BNB, accounting for 0.33% of the circulation;

The 21st node on OKT pledged 564,242 OKT, accounting for 1.3% of the circulating supply; the first node pledged 3,181,376 OKT, accounting for 7.5% of the circulating supply.

Since OKT has not achieved full circulation like HT and BNB at present, and the turnover is insufficient, the pledge situation on BSC is more valuable for HECO.

The current circulation of HT is 185.017 million, so the last masternode on HECO should need to pledge at least 370,000 HT, accounting for 3.9% of the total masternodes;From this, we can conclude that the daily handling fee share of the last node should be 155.54 HT, and the annualized income of the currency-based handling fee is 15.3%. This figure is much higher than the yield of the last node of OKEx Chain (OEC) (1.2%) and the yield of the last node of BSC (5%).

Of course, the more pledged, the higher the node ranking, and the corresponding income will also increase. Therefore, participating in the node election is actually very suitable for HECO project parties who hold a large amount of HT and large long-term holders of HT. After all, even the last master node earns far more than the wealth management products currently on the market.

More importantly, HECO's current transaction fee income has room for improvement dozens of times compared to Ethereum. As the HECO ecology continues to develop and the number of projects increases, the HT fee share is expected to continue to increase, thereby increasing the rate of return on the node pledge currency standard; if the price of HT rises, it will also drive the income of the legal currency standard to rise in a straight line.

(2) The impact of HECO node election on HT

We look at it from two perspectives:

One is to reduce circulation. The HECO node election will inevitably greatly stimulate the demand for HT and reduce the circulation of HT in the market.

Through the previous calculations, we have already concluded that the pledge amount of the last master node needs 370,000 HT, which accounts for 0.2% of the circulation; compared with BSC, through calculation, the proportion of circulation of the entire 21 master nodes of HCEO can reach 5.1% ;Considering the enthusiastic participation of users and the addition of 11 candidate nodes, it is estimated that the total lock-up accounted for 10% of HT circulation.

The second is to increase the price of HT. Node election is bound to become another important consumption scenario of HT after the means of destruction.

Taking the recent market performance as an example, in the past week, the price of HT once rose to 39.9 US dollars, with a maximum increase of more than 65%. Compared with the EOS super node election in 2018, the price of EOS once rose by more than 460% within a month, so the price trend of HT in the short term is still relatively good.

However, many people worry that HT will collapse after the end of the node election, just like EOS in 2018. From the current point of view, there is a high probability that this will not happen.

On the one hand, according to the official announcement, if a candidate withdraws from the election or gives up node governance, the pledged HT unlock period is 15 days; and when the node election is always in progress, the old HT is unlocked, but there will be new HT to participate in the pledged election .

On the other hand, today's HECO campaign is nothing like the EOS campaign. At that time, EOS had not yet launched the main network, nor did it have its own ecology and application scenarios. The node election was only a short-term hype. Once it was unprofitable, the participants scattered one after another.

But today's HECO has become a self-contained entity, has a complete ecological application, and can continuously generate transaction fees as incentives, and the participation of nodes has been significantly improved.

secondary title

text

text

text

text

text

text

text

text

text

Today's HECO is ambitiously marching towards the DeFi market, and has a strong impact on the public chain structure. We also look forward to HECO's future performance.